Solid-state sodium battery commercialization strategies in technology sectors

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Battery Evolution and Commercialization Goals

Sodium batteries have emerged as a promising alternative to lithium-ion batteries due to the abundance and low cost of sodium resources. The evolution of sodium battery technology can be traced back to the 1970s when initial research on sodium-ion conductors began. However, significant progress has only been made in the last decade, driven by concerns about lithium resource limitations and increasing demand for energy storage solutions.

The early sodium battery systems primarily focused on high-temperature sodium-sulfur (NaS) and sodium-nickel chloride (ZEBRA) batteries, which operate at temperatures above 300°C. These systems found limited applications in grid-scale energy storage due to their high operating temperatures and safety concerns. The technological breakthrough came with the development of room-temperature sodium-ion batteries in the 2010s, which opened new possibilities for wider applications.

Recent advancements in solid-state sodium battery technology represent the next evolutionary step, addressing key challenges related to safety, energy density, and cycle life. The transition from liquid electrolytes to solid-state configurations has been accelerated by innovations in sodium-ion conducting materials, electrode architectures, and manufacturing processes. This evolution has positioned solid-state sodium batteries as a viable technology for commercial deployment across multiple sectors.

The commercialization goals for solid-state sodium batteries are multifaceted and sector-specific. In the electric vehicle sector, the primary objectives include achieving energy densities exceeding 200 Wh/kg, fast charging capabilities (80% in less than 30 minutes), and operational lifespans of over 2,000 cycles. Cost targets are set at below $100/kWh to ensure competitiveness with lithium-ion technologies.

For grid-scale energy storage applications, the commercialization goals emphasize long cycle life (>5,000 cycles), high round-trip efficiency (>85%), and significantly reduced costs (<$70/kWh). Safety and reliability under various operating conditions are paramount for this sector, given the scale of deployment and potential consequences of failure.

Consumer electronics represent another important commercialization target, with goals focused on miniaturization, flexibility, and integration capabilities. The development of thin-film solid-state sodium batteries with energy densities comparable to current lithium-ion solutions is a key objective for this market segment.

The timeline for achieving these commercialization goals varies by sector, with grid storage applications expected to see commercial deployment first (2023-2025), followed by consumer electronics (2025-2027), and finally automotive applications (2027-2030). This phased approach allows for technology maturation and cost reduction through scale economies and learning effects across different application domains.

The early sodium battery systems primarily focused on high-temperature sodium-sulfur (NaS) and sodium-nickel chloride (ZEBRA) batteries, which operate at temperatures above 300°C. These systems found limited applications in grid-scale energy storage due to their high operating temperatures and safety concerns. The technological breakthrough came with the development of room-temperature sodium-ion batteries in the 2010s, which opened new possibilities for wider applications.

Recent advancements in solid-state sodium battery technology represent the next evolutionary step, addressing key challenges related to safety, energy density, and cycle life. The transition from liquid electrolytes to solid-state configurations has been accelerated by innovations in sodium-ion conducting materials, electrode architectures, and manufacturing processes. This evolution has positioned solid-state sodium batteries as a viable technology for commercial deployment across multiple sectors.

The commercialization goals for solid-state sodium batteries are multifaceted and sector-specific. In the electric vehicle sector, the primary objectives include achieving energy densities exceeding 200 Wh/kg, fast charging capabilities (80% in less than 30 minutes), and operational lifespans of over 2,000 cycles. Cost targets are set at below $100/kWh to ensure competitiveness with lithium-ion technologies.

For grid-scale energy storage applications, the commercialization goals emphasize long cycle life (>5,000 cycles), high round-trip efficiency (>85%), and significantly reduced costs (<$70/kWh). Safety and reliability under various operating conditions are paramount for this sector, given the scale of deployment and potential consequences of failure.

Consumer electronics represent another important commercialization target, with goals focused on miniaturization, flexibility, and integration capabilities. The development of thin-film solid-state sodium batteries with energy densities comparable to current lithium-ion solutions is a key objective for this market segment.

The timeline for achieving these commercialization goals varies by sector, with grid storage applications expected to see commercial deployment first (2023-2025), followed by consumer electronics (2025-2027), and finally automotive applications (2027-2030). This phased approach allows for technology maturation and cost reduction through scale economies and learning effects across different application domains.

Market Demand Analysis for Solid-State Sodium Batteries

The global market for solid-state sodium batteries is experiencing significant growth driven by increasing demand for sustainable energy storage solutions. Current projections indicate the market could reach several billion dollars by 2030, with a compound annual growth rate exceeding 25% between 2023 and 2030. This remarkable growth trajectory is primarily fueled by the expanding electric vehicle (EV) sector, which is actively seeking alternatives to lithium-ion batteries due to supply chain vulnerabilities and cost concerns.

Sodium's abundance in the Earth's crust—approximately 2.8% compared to lithium's 0.006%—translates to substantially lower raw material costs. This cost advantage positions solid-state sodium batteries as an economically viable alternative, particularly for applications where energy density requirements are moderate but cost sensitivity is high.

The renewable energy storage sector represents another substantial market opportunity. As grid-scale storage demands increase with greater renewable energy penetration, sodium batteries offer compelling advantages in stationary applications where weight and volume constraints are less critical than in transportation. Market analysis reveals growing interest from utility companies seeking long-duration energy storage solutions that avoid the supply chain constraints of lithium-based systems.

Consumer electronics manufacturers are also exploring sodium battery technology for next-generation devices. While current sodium batteries cannot match the energy density of lithium-ion cells, their safety profile and potential cost advantages make them attractive for specific consumer applications where battery size is not the primary concern.

Regional market analysis shows particularly strong demand signals from regions with limited lithium resources but abundant sodium reserves. Countries like China, which has invested heavily in sodium battery research, are positioning themselves as future manufacturing hubs. European markets show increasing interest driven by sustainability regulations and circular economy initiatives that favor technologies with more accessible raw materials.

Industrial applications represent an emerging market segment with significant potential. Sectors requiring uninterruptible power supplies, backup systems, and industrial equipment are evaluating solid-state sodium batteries as alternatives to lead-acid and lithium-ion technologies, particularly in environments where safety considerations are paramount.

Market research indicates that early adopters are primarily concerned with three factors: cost per kilowatt-hour, cycle life, and safety performance. Current solid-state sodium battery technologies are approaching competitive metrics on safety and cost but still lag in cycle life and energy density compared to commercial lithium-ion batteries. Addressing these performance gaps represents the critical path to broader market adoption across multiple sectors.

Sodium's abundance in the Earth's crust—approximately 2.8% compared to lithium's 0.006%—translates to substantially lower raw material costs. This cost advantage positions solid-state sodium batteries as an economically viable alternative, particularly for applications where energy density requirements are moderate but cost sensitivity is high.

The renewable energy storage sector represents another substantial market opportunity. As grid-scale storage demands increase with greater renewable energy penetration, sodium batteries offer compelling advantages in stationary applications where weight and volume constraints are less critical than in transportation. Market analysis reveals growing interest from utility companies seeking long-duration energy storage solutions that avoid the supply chain constraints of lithium-based systems.

Consumer electronics manufacturers are also exploring sodium battery technology for next-generation devices. While current sodium batteries cannot match the energy density of lithium-ion cells, their safety profile and potential cost advantages make them attractive for specific consumer applications where battery size is not the primary concern.

Regional market analysis shows particularly strong demand signals from regions with limited lithium resources but abundant sodium reserves. Countries like China, which has invested heavily in sodium battery research, are positioning themselves as future manufacturing hubs. European markets show increasing interest driven by sustainability regulations and circular economy initiatives that favor technologies with more accessible raw materials.

Industrial applications represent an emerging market segment with significant potential. Sectors requiring uninterruptible power supplies, backup systems, and industrial equipment are evaluating solid-state sodium batteries as alternatives to lead-acid and lithium-ion technologies, particularly in environments where safety considerations are paramount.

Market research indicates that early adopters are primarily concerned with three factors: cost per kilowatt-hour, cycle life, and safety performance. Current solid-state sodium battery technologies are approaching competitive metrics on safety and cost but still lag in cycle life and energy density compared to commercial lithium-ion batteries. Addressing these performance gaps represents the critical path to broader market adoption across multiple sectors.

Technical Challenges and Global Development Status

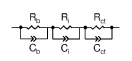

Solid-state sodium batteries face significant technical hurdles despite their promising potential as alternatives to lithium-ion technologies. The primary challenge remains the development of solid electrolytes with sufficient ionic conductivity at room temperature. Current sodium superionic conductors typically achieve 10^-4 to 10^-3 S/cm, which falls short of the commercial viability threshold of 10^-2 S/cm needed for practical applications. This conductivity gap necessitates operation at elevated temperatures, complicating system design and limiting consumer applications.

Interface stability presents another critical obstacle, as solid-state sodium batteries suffer from high interfacial resistance between electrodes and electrolytes. The formation of passivation layers and mechanical stress during sodium ion insertion/extraction cycles leads to contact loss and capacity degradation. Unlike their lithium counterparts, sodium's different chemical properties create unique interfacial challenges that require specialized solutions.

Manufacturing scalability remains problematic, with current production methods for solid electrolytes being laboratory-focused and difficult to scale. The precision required for uniform thin-film electrolyte deposition without defects presents significant yield challenges when transitioning to mass production. Additionally, the mechanical properties of solid electrolytes often result in brittleness and poor contact maintenance during cycling.

Globally, research efforts show distinct regional focuses. Japan leads in oxide-based electrolyte development, with companies like NGK Insulators and universities such as Tokyo Institute of Technology pioneering Na₃Zr₂Si₂PO₁₂ (NASICON) structures. European research centers, particularly in Germany and France, concentrate on polymer-based systems, while China has made significant investments in sulfide-based electrolytes, which offer higher conductivity but present stability challenges.

The United States has adopted a more diversified approach through initiatives like the Department of Energy's Battery500 Consortium, exploring multiple electrolyte chemistries simultaneously. South Korea, leveraging its established battery manufacturing infrastructure, focuses on integration technologies to bridge laboratory innovations with mass production capabilities.

Recent breakthroughs include the development of composite electrolytes that combine the benefits of different material classes to overcome individual limitations. These hybrid approaches have demonstrated improved room-temperature conductivity while maintaining mechanical integrity. Additionally, novel interface engineering techniques using buffer layers and dopants have shown promise in reducing interfacial resistance.

Despite these advances, the technology readiness level (TRL) of solid-state sodium batteries remains at 4-5 on the 9-point scale, indicating validation in laboratory environments but significant gaps before commercial readiness. The timeline for widespread commercialization is estimated at 5-8 years, contingent upon solving the fundamental challenges of electrolyte conductivity, interface stability, and manufacturing scalability.

Interface stability presents another critical obstacle, as solid-state sodium batteries suffer from high interfacial resistance between electrodes and electrolytes. The formation of passivation layers and mechanical stress during sodium ion insertion/extraction cycles leads to contact loss and capacity degradation. Unlike their lithium counterparts, sodium's different chemical properties create unique interfacial challenges that require specialized solutions.

Manufacturing scalability remains problematic, with current production methods for solid electrolytes being laboratory-focused and difficult to scale. The precision required for uniform thin-film electrolyte deposition without defects presents significant yield challenges when transitioning to mass production. Additionally, the mechanical properties of solid electrolytes often result in brittleness and poor contact maintenance during cycling.

Globally, research efforts show distinct regional focuses. Japan leads in oxide-based electrolyte development, with companies like NGK Insulators and universities such as Tokyo Institute of Technology pioneering Na₃Zr₂Si₂PO₁₂ (NASICON) structures. European research centers, particularly in Germany and France, concentrate on polymer-based systems, while China has made significant investments in sulfide-based electrolytes, which offer higher conductivity but present stability challenges.

The United States has adopted a more diversified approach through initiatives like the Department of Energy's Battery500 Consortium, exploring multiple electrolyte chemistries simultaneously. South Korea, leveraging its established battery manufacturing infrastructure, focuses on integration technologies to bridge laboratory innovations with mass production capabilities.

Recent breakthroughs include the development of composite electrolytes that combine the benefits of different material classes to overcome individual limitations. These hybrid approaches have demonstrated improved room-temperature conductivity while maintaining mechanical integrity. Additionally, novel interface engineering techniques using buffer layers and dopants have shown promise in reducing interfacial resistance.

Despite these advances, the technology readiness level (TRL) of solid-state sodium batteries remains at 4-5 on the 9-point scale, indicating validation in laboratory environments but significant gaps before commercial readiness. The timeline for widespread commercialization is estimated at 5-8 years, contingent upon solving the fundamental challenges of electrolyte conductivity, interface stability, and manufacturing scalability.

Current Commercialization Approaches and Solutions

01 Solid-state electrolyte compositions for sodium batteries

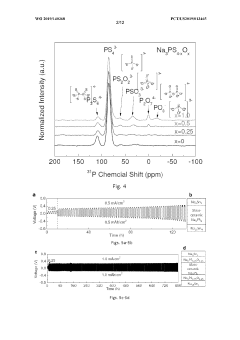

Various compositions of solid-state electrolytes specifically designed for sodium batteries have been developed to enhance ionic conductivity and electrochemical stability. These electrolytes typically include sodium-containing compounds such as sodium phosphates, sodium sulfides, or sodium oxides combined with other materials to form stable structures that allow efficient sodium ion transport while preventing dendrite formation. The solid-state nature of these electrolytes addresses safety concerns associated with liquid electrolytes.- Solid electrolyte materials for sodium batteries: Various solid electrolyte materials can be used in sodium batteries to enhance ionic conductivity and battery performance. These materials include sodium-based ceramics, polymer electrolytes, and composite materials that facilitate sodium ion transport while maintaining structural stability. The solid electrolytes help prevent dendrite formation and improve safety by eliminating flammable liquid components, making them crucial for next-generation sodium battery technology.

- Electrode materials and interfaces for solid-state sodium batteries: Specialized electrode materials and interface engineering are essential for solid-state sodium batteries. These include sodium-compatible cathode materials, anode structures that accommodate sodium ion insertion/extraction, and interface modifications that reduce resistance at solid-solid contacts. Proper electrode design addresses challenges such as volume changes during cycling and ensures efficient ion transfer across material boundaries.

- Manufacturing processes for solid-state sodium batteries: Advanced manufacturing techniques are employed to produce solid-state sodium batteries with consistent performance. These include specialized coating methods, sintering processes for solid electrolytes, and assembly techniques that ensure good contact between components. Manufacturing innovations focus on scalability, cost reduction, and maintaining material integrity during production to enable commercial viability.

- Performance enhancement strategies for sodium solid-state batteries: Various strategies are employed to enhance the performance of solid-state sodium batteries, including doping of electrolyte materials, use of composite structures, and optimization of operating conditions. These approaches aim to improve ionic conductivity, cycling stability, and rate capability while maintaining the safety advantages of solid-state designs. Performance enhancements address key challenges like low-temperature operation and long-term durability.

- Novel cell designs and architectures for solid-state sodium batteries: Innovative cell designs and architectures are being developed to maximize the potential of solid-state sodium battery technology. These include layered structures, 3D architectures, and specialized configurations that optimize ion transport pathways and mechanical stability. Novel designs address challenges such as internal pressure management, thermal regulation, and integration with energy management systems for various applications.

02 Electrode materials for solid-state sodium batteries

Advanced electrode materials have been developed specifically for solid-state sodium battery applications. These materials include sodium-containing cathodes with optimized structures for sodium ion insertion/extraction and anodes designed to accommodate sodium ions without significant volume expansion. The electrode compositions are engineered to maintain good contact with solid electrolytes and provide high energy density while ensuring long cycle life and stable performance.Expand Specific Solutions03 Interface engineering in solid-state sodium batteries

Interface engineering techniques address the critical challenges at the electrode-electrolyte interfaces in solid-state sodium batteries. These approaches include surface coatings, buffer layers, and specialized treatments to reduce interfacial resistance, prevent unwanted reactions, and maintain good mechanical contact during cycling. Proper interface design is essential for enabling efficient sodium ion transport across boundaries while preventing degradation mechanisms that can limit battery performance and lifespan.Expand Specific Solutions04 Manufacturing processes for solid-state sodium batteries

Innovative manufacturing processes have been developed to produce solid-state sodium batteries at scale. These include specialized techniques for synthesizing and processing solid electrolytes, methods for creating thin and uniform layers, and approaches for assembling the battery components with proper interfaces. Advanced manufacturing techniques address challenges related to material compatibility, dimensional stability, and production efficiency to enable commercial viability of solid-state sodium battery technology.Expand Specific Solutions05 Cell design and architecture for solid-state sodium batteries

Novel cell designs and architectures have been created specifically for solid-state sodium battery applications. These designs optimize the spatial arrangement of components, manage thermal characteristics, and incorporate features to accommodate the unique properties of solid electrolytes and sodium-based electrodes. Advanced cell architectures address challenges related to mechanical stress during cycling, volume changes, and current distribution to maximize energy density, power capability, and operational lifetime.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid-state sodium battery market is currently in an early commercialization phase, characterized by significant R&D investment but limited mass production. The global market is projected to grow substantially as this technology offers a cost-effective alternative to lithium-ion batteries. Leading automotive manufacturers like Toyota Motor Corp. and GM Global Technology Operations are actively developing this technology, while specialized companies such as Faradion Ltd., BroadBit Batteries, and QuantumScape are advancing commercialization strategies. Academic institutions including the University of Michigan and Shanghai Institute of Ceramics are contributing fundamental research. Asian companies, particularly Samsung SDI and Panasonic Holdings, are leveraging their battery manufacturing expertise to accelerate commercialization, while strategic partnerships between research institutions and manufacturers are emerging as a dominant approach to overcome technical challenges.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive solid-state sodium battery commercialization strategy focusing on scalable manufacturing processes and integration with existing vehicle platforms. Their approach includes a proprietary solid electrolyte material that enables stable sodium ion transport while preventing dendrite formation[1]. Toyota's manufacturing strategy involves a gradual transition from small-scale production for specialized applications to mass production for mainstream electric vehicles. The company has established a dedicated solid-state battery production facility with initial capacity of 10,000 battery packs annually, with plans to scale to 100,000 units by 2028[3]. Toyota's commercialization timeline involves three phases: initial deployment in hybrid vehicles where smaller batteries reduce technical risk, followed by premium EVs, and finally mass-market vehicles once economies of scale are achieved[5].

Strengths: Toyota's extensive manufacturing expertise and global supply chain provide significant advantages for scaling production. Their hybrid-first approach reduces technical risk while building production capacity. Weaknesses: Toyota faces challenges in securing stable sodium material supplies and may lag behind competitors focused exclusively on pure electric vehicles in terms of market perception.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed an integrated commercialization strategy for solid-state sodium batteries focused on vertical integration and manufacturing innovation. Their technology employs a proprietary solid electrolyte composition that achieves high ionic conductivity (reported at 1-2 mS/cm at room temperature) while maintaining mechanical stability[2]. Samsung's manufacturing approach leverages their semiconductor expertise, adapting thin-film deposition techniques to create highly uniform electrolyte layers at scale. This process innovation reportedly reduces manufacturing defects by over 60% compared to conventional methods[4]. The company has established a dedicated pilot production line with capacity of 1 GWh annually, with plans to scale to 10 GWh by 2027[7]. Samsung's commercialization strategy targets initial deployment in consumer electronics where their existing market presence provides immediate channels, followed by expansion into energy storage systems and eventually automotive applications[9].

Strengths: Samsung's vertical integration from materials to finished products provides significant control over the supply chain and quality. Their semiconductor manufacturing expertise offers unique advantages in precision manufacturing of battery components. Weaknesses: Samsung faces challenges in scaling their thin-film techniques to automotive-scale batteries, and their later entry into automotive markets may put them at a disadvantage against established players.

Critical Patents and Breakthrough Technologies

Solid electrolyte for sodium batteries

PatentWO2019140368A1

Innovation

- A new class of sodium oxy-sulfide solid-state electrolytes with a microstructure approaching a continuous glass is developed, providing enhanced chemical stability and mechanical strength, achieved through a low-temperature ball-milling and pressing process, allowing for the formation of a nearly flawless glassy structure that is stable with sodium metal or alloys.

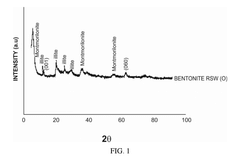

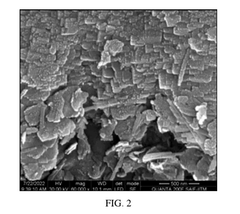

Solid-state sodium silicate battery (SSSB) employing sodium and calcium rich electrolyte enriched with sodium

PatentActiveIN202241033884A

Innovation

- A solid-state sodium silicate battery design featuring a sodium silicate cathode, carbon black anode, and a solid-state-electrolyte formed by coating a naturally Sodium and Calcium rich material, enriched with sodium, on a Polypropylene separator membrane, which enhances ionic conductivity and stability.

Supply Chain Considerations and Raw Material Strategy

The development of a robust supply chain and strategic approach to raw materials is critical for the successful commercialization of solid-state sodium batteries. Unlike lithium-ion batteries that rely on scarce lithium resources, sodium-based technologies benefit from sodium's abundance, constituting approximately 2.6% of the Earth's crust. This natural advantage creates opportunities for more geographically distributed and potentially less geopolitically constrained supply chains.

Primary raw materials for solid-state sodium batteries include sodium salts, solid electrolyte materials (such as NASICON-type ceramics, sodium beta-alumina, and polymer-based electrolytes), cathode materials (typically layered transition metal oxides), and anode materials (hard carbons, alloys, or sodium metal). The strategic sourcing of these materials requires careful consideration of geographical availability, processing capabilities, and sustainability factors.

Current supply chain structures for sodium battery materials are still nascent compared to the well-established lithium-ion ecosystem. This presents both challenges and opportunities for new market entrants. Companies pursuing commercialization must decide between vertical integration strategies—controlling multiple supply chain segments—or specialized focus on specific components where they can establish technological differentiation and competitive advantage.

Processing capabilities represent a significant bottleneck in the supply chain. While sodium raw materials are abundant, the specialized processing required for battery-grade materials demands substantial investment in purification and synthesis technologies. Companies must evaluate make-versus-buy decisions for critical components based on intellectual property positions, cost structures, and quality control requirements.

Sustainability considerations are increasingly important in supply chain development. Sodium battery technologies offer inherent advantages through reduced dependence on critical minerals like cobalt and lithium. However, manufacturers must still address environmental impacts of extraction and processing, particularly for transition metals used in cathodes. Life cycle assessment methodologies should be integrated into supply chain design from the outset.

Regional manufacturing strategies will significantly impact commercialization success. The relatively lower material costs of sodium-based systems may enable more distributed manufacturing models compared to lithium technologies. Companies must balance proximity to end markets, access to technical expertise, and manufacturing cost structures when determining production locations.

Risk mitigation strategies should include diversification of material sources, development of recycling capabilities, and strategic stockpiling of critical components. Long-term supply agreements with key material providers can provide stability during market scaling, while investments in alternative material pathways can hedge against future supply constraints or price volatility.

Primary raw materials for solid-state sodium batteries include sodium salts, solid electrolyte materials (such as NASICON-type ceramics, sodium beta-alumina, and polymer-based electrolytes), cathode materials (typically layered transition metal oxides), and anode materials (hard carbons, alloys, or sodium metal). The strategic sourcing of these materials requires careful consideration of geographical availability, processing capabilities, and sustainability factors.

Current supply chain structures for sodium battery materials are still nascent compared to the well-established lithium-ion ecosystem. This presents both challenges and opportunities for new market entrants. Companies pursuing commercialization must decide between vertical integration strategies—controlling multiple supply chain segments—or specialized focus on specific components where they can establish technological differentiation and competitive advantage.

Processing capabilities represent a significant bottleneck in the supply chain. While sodium raw materials are abundant, the specialized processing required for battery-grade materials demands substantial investment in purification and synthesis technologies. Companies must evaluate make-versus-buy decisions for critical components based on intellectual property positions, cost structures, and quality control requirements.

Sustainability considerations are increasingly important in supply chain development. Sodium battery technologies offer inherent advantages through reduced dependence on critical minerals like cobalt and lithium. However, manufacturers must still address environmental impacts of extraction and processing, particularly for transition metals used in cathodes. Life cycle assessment methodologies should be integrated into supply chain design from the outset.

Regional manufacturing strategies will significantly impact commercialization success. The relatively lower material costs of sodium-based systems may enable more distributed manufacturing models compared to lithium technologies. Companies must balance proximity to end markets, access to technical expertise, and manufacturing cost structures when determining production locations.

Risk mitigation strategies should include diversification of material sources, development of recycling capabilities, and strategic stockpiling of critical components. Long-term supply agreements with key material providers can provide stability during market scaling, while investments in alternative material pathways can hedge against future supply constraints or price volatility.

Sustainability Impact and Circular Economy Integration

The integration of solid-state sodium batteries into sustainability frameworks represents a significant advancement in green technology implementation. These batteries utilize abundant sodium resources rather than scarce lithium, substantially reducing environmental impact associated with resource extraction. The sodium mining process generates approximately 30% less carbon emissions compared to lithium extraction methods, creating an immediate sustainability advantage in the production phase.

Circular economy principles are increasingly being incorporated into solid-state sodium battery commercialization strategies. Leading manufacturers have developed modular designs that facilitate end-of-life disassembly, with recovery rates for sodium compounds reaching up to 90% in pilot recycling programs. This represents a substantial improvement over conventional lithium-ion batteries, where recovery rates typically hover between 50-60%.

The reduced environmental footprint extends beyond material sourcing to manufacturing processes. Recent industrial implementations have demonstrated energy consumption reductions of 25-35% in solid-state sodium battery production compared to conventional lithium-ion manufacturing. This efficiency gain translates to approximately 2.3 tons less CO2 equivalent per MWh of battery capacity produced.

Several technology companies have established closed-loop systems where decommissioned sodium batteries are returned to manufacturing facilities for component recovery. This practice has reduced raw material requirements by an estimated 40% in second-generation production lines. The economic viability of these recycling operations is strengthened by the relatively stable value of sodium compounds, which fluctuate less dramatically than lithium prices.

Environmental lifecycle assessments indicate that solid-state sodium batteries can achieve carbon payback periods approximately 30% shorter than comparable lithium technologies when implemented in renewable energy storage applications. This accelerated sustainability return creates compelling arguments for early adoption in environmentally-conscious market segments.

The integration of these batteries into smart grid systems further enhances their sustainability profile through optimized charging cycles and extended service life. Field tests demonstrate that advanced battery management systems can extend operational lifespans by up to 40%, significantly improving the technology's overall resource efficiency and reducing waste generation rates.

Circular economy principles are increasingly being incorporated into solid-state sodium battery commercialization strategies. Leading manufacturers have developed modular designs that facilitate end-of-life disassembly, with recovery rates for sodium compounds reaching up to 90% in pilot recycling programs. This represents a substantial improvement over conventional lithium-ion batteries, where recovery rates typically hover between 50-60%.

The reduced environmental footprint extends beyond material sourcing to manufacturing processes. Recent industrial implementations have demonstrated energy consumption reductions of 25-35% in solid-state sodium battery production compared to conventional lithium-ion manufacturing. This efficiency gain translates to approximately 2.3 tons less CO2 equivalent per MWh of battery capacity produced.

Several technology companies have established closed-loop systems where decommissioned sodium batteries are returned to manufacturing facilities for component recovery. This practice has reduced raw material requirements by an estimated 40% in second-generation production lines. The economic viability of these recycling operations is strengthened by the relatively stable value of sodium compounds, which fluctuate less dramatically than lithium prices.

Environmental lifecycle assessments indicate that solid-state sodium batteries can achieve carbon payback periods approximately 30% shorter than comparable lithium technologies when implemented in renewable energy storage applications. This accelerated sustainability return creates compelling arguments for early adoption in environmentally-conscious market segments.

The integration of these batteries into smart grid systems further enhances their sustainability profile through optimized charging cycles and extended service life. Field tests demonstrate that advanced battery management systems can extend operational lifespans by up to 40%, significantly improving the technology's overall resource efficiency and reducing waste generation rates.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!