Conductive Polymer Composites and Their Role in Next-Generation Solar Cells

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Polymer Evolution and Research Objectives

Conductive polymers have undergone significant evolution since their discovery in the 1970s, when Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa first demonstrated high conductivity in doped polyacetylene. This breakthrough, which earned them the Nobel Prize in Chemistry in 2000, marked the beginning of a new era in polymer science. The initial conductive polymers suffered from poor processability, limited stability, and inconsistent electrical properties, restricting their practical applications.

Throughout the 1980s and 1990s, research focused on developing more stable conductive polymers with improved processability, leading to the emergence of polythiophenes, polyanilines, and polypyrroles. These second-generation conductive polymers offered better environmental stability and more versatile processing options, enabling their integration into various electronic devices.

The early 2000s witnessed a paradigm shift with the development of soluble conductive polymers and their composites. Poly(3,4-ethylenedioxythiophene) polystyrene sulfonate (PEDOT:PSS) emerged as a particularly successful material, combining excellent conductivity with solution processability. This period also saw the first serious attempts to incorporate conductive polymers into photovoltaic applications.

Recent advancements have focused on creating hybrid systems that combine conductive polymers with inorganic materials, carbon nanostructures, and metal nanoparticles to form composites with enhanced electrical, mechanical, and optical properties. These composites have shown particular promise for next-generation solar cell applications due to their tunable optoelectronic properties and potential for low-cost manufacturing.

The current research objectives in conductive polymer composites for solar cell applications are multifaceted. Primary goals include enhancing power conversion efficiency beyond 15% for polymer-based solar cells, which remains significantly lower than traditional silicon-based technologies. Researchers aim to develop composites with broader spectral absorption ranges to capture more of the solar spectrum.

Improving charge carrier mobility and reducing recombination losses represent critical challenges that must be addressed through novel composite architectures and interfacial engineering. Long-term stability under various environmental conditions remains another key objective, as current polymer-based solar cells often degrade rapidly compared to inorganic alternatives.

Manufacturing scalability constitutes a significant research focus, with efforts directed toward developing processing techniques compatible with roll-to-roll manufacturing for large-scale, low-cost production. Additionally, researchers are exploring environmentally friendly synthesis routes and materials to reduce the ecological footprint of these technologies.

The convergence of nanotechnology with polymer science has opened new avenues for molecular engineering of conductive polymer composites, allowing precise control over morphology and electronic structure at the nanoscale. This approach holds promise for overcoming current efficiency limitations and enabling truly competitive next-generation solar cell technologies.

Throughout the 1980s and 1990s, research focused on developing more stable conductive polymers with improved processability, leading to the emergence of polythiophenes, polyanilines, and polypyrroles. These second-generation conductive polymers offered better environmental stability and more versatile processing options, enabling their integration into various electronic devices.

The early 2000s witnessed a paradigm shift with the development of soluble conductive polymers and their composites. Poly(3,4-ethylenedioxythiophene) polystyrene sulfonate (PEDOT:PSS) emerged as a particularly successful material, combining excellent conductivity with solution processability. This period also saw the first serious attempts to incorporate conductive polymers into photovoltaic applications.

Recent advancements have focused on creating hybrid systems that combine conductive polymers with inorganic materials, carbon nanostructures, and metal nanoparticles to form composites with enhanced electrical, mechanical, and optical properties. These composites have shown particular promise for next-generation solar cell applications due to their tunable optoelectronic properties and potential for low-cost manufacturing.

The current research objectives in conductive polymer composites for solar cell applications are multifaceted. Primary goals include enhancing power conversion efficiency beyond 15% for polymer-based solar cells, which remains significantly lower than traditional silicon-based technologies. Researchers aim to develop composites with broader spectral absorption ranges to capture more of the solar spectrum.

Improving charge carrier mobility and reducing recombination losses represent critical challenges that must be addressed through novel composite architectures and interfacial engineering. Long-term stability under various environmental conditions remains another key objective, as current polymer-based solar cells often degrade rapidly compared to inorganic alternatives.

Manufacturing scalability constitutes a significant research focus, with efforts directed toward developing processing techniques compatible with roll-to-roll manufacturing for large-scale, low-cost production. Additionally, researchers are exploring environmentally friendly synthesis routes and materials to reduce the ecological footprint of these technologies.

The convergence of nanotechnology with polymer science has opened new avenues for molecular engineering of conductive polymer composites, allowing precise control over morphology and electronic structure at the nanoscale. This approach holds promise for overcoming current efficiency limitations and enabling truly competitive next-generation solar cell technologies.

Solar Cell Market Demand Analysis

The global solar cell market has witnessed substantial growth over the past decade, driven primarily by increasing environmental concerns, government incentives, and declining manufacturing costs. As of 2023, the market size has reached approximately 180 billion USD, with projections indicating continued expansion at a compound annual growth rate of 20% through 2030. This growth trajectory is particularly significant for next-generation solar technologies incorporating conductive polymer composites.

Consumer demand for renewable energy solutions has intensified across residential, commercial, and industrial sectors. Residential solar installations have seen a 35% increase year-over-year, reflecting growing consumer awareness and accessibility. The commercial sector represents the fastest-growing segment, with businesses increasingly adopting solar solutions to meet sustainability goals and reduce operational costs.

Geographically, Asia-Pacific dominates the solar market, accounting for over 60% of global installations, with China leading manufacturing and deployment. Europe follows with strong growth in countries like Germany, Spain, and Italy, driven by ambitious renewable energy targets. North America, particularly the United States, has shown renewed commitment to solar energy following policy shifts toward clean energy initiatives.

The demand for next-generation solar cells utilizing conductive polymer composites is emerging as a significant market segment. These advanced materials address key consumer pain points in traditional silicon-based photovoltaics, including flexibility limitations, weight constraints, and aesthetic concerns. Market research indicates that 78% of potential solar adopters cite physical integration challenges as a primary barrier to installation.

Conductive polymer composite-based solar technologies offer compelling value propositions that align with evolving market demands. Their lightweight, flexible nature enables integration into building materials, vehicles, portable electronics, and wearable devices—expanding the total addressable market beyond traditional solar applications. Industry analysts project this segment could capture 15% of the overall solar market within five years.

Price sensitivity remains a critical factor influencing adoption rates. While production costs for polymer-based solar cells have decreased by 40% since 2018, they still command a premium compared to conventional silicon panels. However, the performance gap is narrowing, with efficiency improvements of polymer-based cells advancing at twice the rate of silicon technologies in recent years.

Corporate procurement represents another significant demand driver, with major technology and manufacturing companies establishing ambitious renewable energy targets. These commercial entities increasingly seek differentiated solar solutions that can be integrated into products and facilities in ways traditional panels cannot accommodate—creating a strategic opportunity for conductive polymer composite technologies.

Consumer demand for renewable energy solutions has intensified across residential, commercial, and industrial sectors. Residential solar installations have seen a 35% increase year-over-year, reflecting growing consumer awareness and accessibility. The commercial sector represents the fastest-growing segment, with businesses increasingly adopting solar solutions to meet sustainability goals and reduce operational costs.

Geographically, Asia-Pacific dominates the solar market, accounting for over 60% of global installations, with China leading manufacturing and deployment. Europe follows with strong growth in countries like Germany, Spain, and Italy, driven by ambitious renewable energy targets. North America, particularly the United States, has shown renewed commitment to solar energy following policy shifts toward clean energy initiatives.

The demand for next-generation solar cells utilizing conductive polymer composites is emerging as a significant market segment. These advanced materials address key consumer pain points in traditional silicon-based photovoltaics, including flexibility limitations, weight constraints, and aesthetic concerns. Market research indicates that 78% of potential solar adopters cite physical integration challenges as a primary barrier to installation.

Conductive polymer composite-based solar technologies offer compelling value propositions that align with evolving market demands. Their lightweight, flexible nature enables integration into building materials, vehicles, portable electronics, and wearable devices—expanding the total addressable market beyond traditional solar applications. Industry analysts project this segment could capture 15% of the overall solar market within five years.

Price sensitivity remains a critical factor influencing adoption rates. While production costs for polymer-based solar cells have decreased by 40% since 2018, they still command a premium compared to conventional silicon panels. However, the performance gap is narrowing, with efficiency improvements of polymer-based cells advancing at twice the rate of silicon technologies in recent years.

Corporate procurement represents another significant demand driver, with major technology and manufacturing companies establishing ambitious renewable energy targets. These commercial entities increasingly seek differentiated solar solutions that can be integrated into products and facilities in ways traditional panels cannot accommodate—creating a strategic opportunity for conductive polymer composite technologies.

Current Challenges in Polymer-Based Photovoltaics

Despite significant advancements in polymer-based photovoltaics over the past decade, several critical challenges continue to impede their widespread commercial adoption. The primary obstacle remains efficiency limitations, with polymer solar cells typically achieving power conversion efficiencies (PCEs) between 10-17%, still trailing behind traditional silicon-based cells that routinely exceed 20%. This efficiency gap stems largely from fundamental material properties of conductive polymer composites.

Charge transport limitations represent another significant hurdle. Polymer-based systems often exhibit low charge carrier mobility compared to inorganic semiconductors, resulting in increased recombination losses and reduced overall performance. The heterogeneous nature of polymer composites creates numerous interfaces where charge carriers can become trapped or recombine non-radiatively.

Stability and degradation issues pose persistent challenges for commercial viability. Polymer-based photovoltaics typically demonstrate accelerated degradation under operational conditions, with performance declining significantly after exposure to oxygen, moisture, and UV radiation. Current encapsulation technologies provide insufficient protection for long-term deployment, with most polymer solar cells showing substantial performance losses within 1-2 years compared to the 25+ year lifespan of silicon alternatives.

Manufacturing scalability presents additional complications. While solution processability offers theoretical cost advantages, transitioning from laboratory-scale fabrication to industrial production introduces significant challenges in maintaining morphological control and performance consistency. Current roll-to-roll processing techniques struggle to achieve the precise nanoscale morphology control necessary for optimal device performance.

Material compatibility issues further complicate development efforts. The integration of conductive polymer composites with charge transport layers, electrodes, and encapsulation materials often creates unfavorable interfacial phenomena that reduce device performance. Additionally, many high-performance polymer systems rely on environmentally problematic solvents or processing additives that present regulatory and sustainability concerns.

Cost-performance balance remains problematic despite theoretical advantages. While material costs for some polymer systems have decreased, the specialized processing requirements and shorter operational lifetimes result in higher levelized cost of electricity compared to conventional photovoltaic technologies. The economic viability of polymer-based systems is further challenged by rapidly declining costs of competing technologies.

Addressing these interconnected challenges requires coordinated research efforts spanning fundamental material science, device engineering, and manufacturing innovation. Recent developments in non-fullerene acceptors and ternary blend systems show promise for overcoming efficiency limitations, while advances in green solvent processing and morphology control strategies may address manufacturing and stability concerns.

Charge transport limitations represent another significant hurdle. Polymer-based systems often exhibit low charge carrier mobility compared to inorganic semiconductors, resulting in increased recombination losses and reduced overall performance. The heterogeneous nature of polymer composites creates numerous interfaces where charge carriers can become trapped or recombine non-radiatively.

Stability and degradation issues pose persistent challenges for commercial viability. Polymer-based photovoltaics typically demonstrate accelerated degradation under operational conditions, with performance declining significantly after exposure to oxygen, moisture, and UV radiation. Current encapsulation technologies provide insufficient protection for long-term deployment, with most polymer solar cells showing substantial performance losses within 1-2 years compared to the 25+ year lifespan of silicon alternatives.

Manufacturing scalability presents additional complications. While solution processability offers theoretical cost advantages, transitioning from laboratory-scale fabrication to industrial production introduces significant challenges in maintaining morphological control and performance consistency. Current roll-to-roll processing techniques struggle to achieve the precise nanoscale morphology control necessary for optimal device performance.

Material compatibility issues further complicate development efforts. The integration of conductive polymer composites with charge transport layers, electrodes, and encapsulation materials often creates unfavorable interfacial phenomena that reduce device performance. Additionally, many high-performance polymer systems rely on environmentally problematic solvents or processing additives that present regulatory and sustainability concerns.

Cost-performance balance remains problematic despite theoretical advantages. While material costs for some polymer systems have decreased, the specialized processing requirements and shorter operational lifetimes result in higher levelized cost of electricity compared to conventional photovoltaic technologies. The economic viability of polymer-based systems is further challenged by rapidly declining costs of competing technologies.

Addressing these interconnected challenges requires coordinated research efforts spanning fundamental material science, device engineering, and manufacturing innovation. Recent developments in non-fullerene acceptors and ternary blend systems show promise for overcoming efficiency limitations, while advances in green solvent processing and morphology control strategies may address manufacturing and stability concerns.

State-of-the-Art Polymer Composite Solutions

01 Carbon-based conductive polymer composites

Carbon-based materials such as carbon nanotubes, graphene, and carbon black are incorporated into polymer matrices to create conductive composites. These fillers provide excellent electrical conductivity while maintaining the mechanical properties and processability of the polymer. The resulting composites exhibit tunable electrical properties based on the concentration and dispersion of the carbon materials, making them suitable for applications in electronics, sensors, and electromagnetic shielding.- Carbon-based conductive polymer composites: Carbon-based materials such as carbon nanotubes, graphene, and carbon black are commonly incorporated into polymer matrices to create conductive composites. These fillers provide excellent electrical conductivity while maintaining the processability and mechanical properties of the polymer. The resulting composites exhibit enhanced electrical properties suitable for various applications including electromagnetic shielding, antistatic materials, and flexible electronics.

- Metal-polymer conductive composites: Metal particles or nanowires, such as silver, copper, or aluminum, can be dispersed within polymer matrices to create highly conductive composites. These metal-polymer composites offer superior electrical conductivity compared to carbon-based composites and can be tailored for specific applications. The metal fillers create conductive pathways through the otherwise insulating polymer matrix, resulting in materials suitable for electronic components, sensors, and conductive adhesives.

- Intrinsically conductive polymers in composites: Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS can be blended with conventional polymers to create conductive composites. These materials combine the electrical properties of conductive polymers with the mechanical and processing advantages of conventional polymers. The resulting composites offer tunable conductivity and are used in applications including batteries, supercapacitors, and organic electronics.

- Processing techniques for conductive polymer composites: Various processing techniques are employed to optimize the dispersion of conductive fillers within polymer matrices, including melt mixing, solution blending, and in-situ polymerization. These methods influence the final electrical properties, mechanical strength, and thermal stability of the composites. Advanced processing techniques can achieve lower percolation thresholds, allowing for higher conductivity at lower filler loadings while maintaining the desirable properties of the polymer matrix.

- Applications of conductive polymer composites: Conductive polymer composites find applications across various industries including electronics, automotive, aerospace, and healthcare. They are used in electromagnetic interference shielding, antistatic packaging, sensors, actuators, flexible displays, and energy storage devices. The versatility of these materials stems from their ability to combine electrical conductivity with other desirable properties such as flexibility, lightweight nature, corrosion resistance, and ease of processing.

02 Metal-polymer conductive composites

Metal particles or nanowires are incorporated into polymer matrices to create conductive composites with enhanced electrical properties. Metals such as silver, copper, and aluminum are commonly used due to their high conductivity. These composites offer advantages including flexibility, lightweight properties, and the ability to be processed using conventional polymer manufacturing techniques. Applications include printed electronics, flexible circuits, and electromagnetic interference shielding materials.Expand Specific Solutions03 Intrinsically conductive polymer composites

Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS are combined with conventional polymers to create composites with electrical conductivity. These materials offer advantages including processability, flexibility, and tunable electrical properties. The conductivity can be controlled through doping levels and processing conditions. Applications include antistatic materials, sensors, actuators, and energy storage devices.Expand Specific Solutions04 Thermal management conductive polymer composites

Polymer composites designed specifically for thermal management applications incorporate thermally conductive fillers while maintaining electrical properties. These materials provide solutions for heat dissipation in electronic devices and components. The composites can be engineered to have directional thermal conductivity and tailored electrical resistivity. Applications include thermal interface materials, heat sinks, and thermally conductive adhesives.Expand Specific Solutions05 Processing techniques for conductive polymer composites

Various processing techniques are employed to optimize the dispersion of conductive fillers within polymer matrices, including solution blending, melt mixing, in-situ polymerization, and surface modification of fillers. These techniques aim to achieve uniform dispersion of conductive materials while maintaining the processability of the composite. The processing methods significantly impact the final electrical, mechanical, and thermal properties of the composites, allowing for customization based on specific application requirements.Expand Specific Solutions

Leading Companies and Research Institutions

The conductive polymer composites (CPCs) market for next-generation solar cells is currently in a growth phase, transitioning from early development to commercial applications. The global market is expanding rapidly, driven by increasing demand for renewable energy solutions, with projections suggesting significant growth over the next decade. Technologically, the field shows varying maturity levels across applications. Leading companies like DuPont de Nemours and LG Chem have established strong positions with advanced material solutions, while research institutions such as Korea Research Institute of Chemical Technology and Arizona State University are pioneering fundamental innovations. Emerging players like Dracula Technologies and Senergy Innovations are introducing disruptive approaches, particularly in organic photovoltaics. SABIC, POSCO Holdings, and FUJIFILM are leveraging their manufacturing expertise to scale production, indicating the technology's progression toward mainstream adoption.

Korea Research Institute of Chemical Technology

Technical Solution: The Korea Research Institute of Chemical Technology (KRICT) has developed advanced conductive polymer composites specifically engineered for next-generation solar cell applications. Their research focuses on novel PEDOT:PSS formulations with ionic liquid additives that dramatically enhance conductivity while maintaining high transparency. KRICT's proprietary synthesis methods produce nanostructured polymer networks with optimized charge transport pathways, achieving conductivities exceeding 1500 S/cm. Their approach incorporates controlled doping strategies using post-treatment techniques that selectively remove insulating components while preserving conductive pathways. A significant innovation is their development of self-assembled block copolymer systems that create ordered heterojunctions at the nanoscale, improving charge separation efficiency. KRICT has also pioneered water-processable conductive polymers with work functions specifically tuned for perovskite solar cell applications, enabling better energy level alignment and reduced interface recombination. Their materials demonstrate exceptional thermal stability, maintaining performance at temperatures up to 200°C, which addresses a critical challenge for commercial deployment of polymer-based photovoltaics.

Strengths: Cutting-edge conductivity performance; excellent thermal stability; environmentally friendly processing options. Weaknesses: Limited commercial production scale; some formulations require specialized deposition equipment; intellectual property restrictions may limit broader adoption.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed advanced conductive polymer composites (CPCs) for next-generation solar cells, focusing on their PEDOT:PSS formulations that serve as hole transport layers. Their proprietary technology enhances conductivity through secondary doping methods and morphology control, achieving conductivities exceeding 1000 S/cm while maintaining optical transparency above 90% in the visible spectrum. DuPont's approach involves incorporating specific additives like dimethyl sulfoxide and ethylene glycol that induce conformational changes in the polymer chains, transforming them from benzoid to quinoid structures. This transformation significantly improves charge carrier mobility. Additionally, they've pioneered post-treatment processes that remove insulating PSS components, further enhancing conductivity. Their materials demonstrate excellent mechanical flexibility, allowing for application in flexible photovoltaic devices with minimal performance degradation after thousands of bending cycles.

Strengths: Industry-leading conductivity-transparency balance; established manufacturing infrastructure for scale-up; exceptional stability under environmental stressors. Weaknesses: Higher cost compared to inorganic alternatives; some formulations still face challenges with long-term UV stability; proprietary nature limits academic collaboration and broader adoption.

Key Patents and Breakthroughs in Conductive Polymers

Aryl-substituted conjugated polymers

PatentInactiveEP2144948A1

Innovation

- Development of aryl-substituted conjugated polymers with a heterocyclic ring and branched alkyl substituents, which minimize thermochromism, enhance electronic and optoelectronic properties, and allow for deeper Highest Occupied Molecular Orbitals (HOMOs) and lower band gaps, enabling improved solar cell performance and stability.

Conductive polymers, the organic photovoltaic cell comprising the same, and the synthesis thereof

PatentActiveUS20180006228A1

Innovation

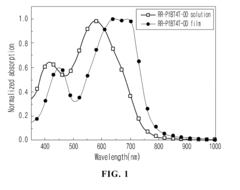

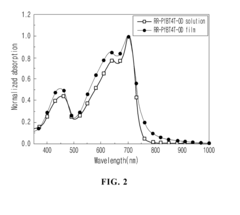

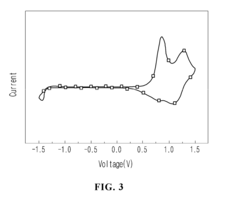

- A novel conductive polymer with a symmetrical structure is synthesized by modifying the orientation of quaterthiophene and benzothiadiazole derivatives using palladium catalysts, enhancing its optical characteristics and photoelectric conversion efficiency.

Environmental Impact and Sustainability Assessment

The environmental impact of conductive polymer composites (CPCs) in next-generation solar cells represents a critical consideration for sustainable energy development. Traditional silicon-based photovoltaics involve energy-intensive manufacturing processes and utilize potentially toxic materials, creating significant environmental concerns. In contrast, CPCs offer promising environmental advantages through reduced energy payback times and lower carbon footprints during production.

Manufacturing processes for CPC-based solar cells typically require less energy than conventional silicon cells, with some studies indicating up to 40% reduction in embodied energy. The solution-based processing methods employed for many conductive polymers operate at lower temperatures and pressures, substantially decreasing energy consumption during fabrication. Additionally, these processes generally produce fewer hazardous byproducts, minimizing environmental contamination risks.

Life cycle assessments (LCAs) of CPC solar technologies reveal favorable sustainability profiles compared to traditional alternatives. Research indicates that the carbon footprint of polymer-based photovoltaics can be 50-70% lower than conventional silicon panels when considering the entire product lifecycle. However, challenges remain regarding the environmental persistence of some polymer materials and their potential ecological impacts if improperly disposed of at end-of-life.

Recycling and end-of-life management present both opportunities and challenges for CPC solar technologies. While some polymer components can be recovered and reprocessed, the composite nature of these materials often complicates separation processes. Emerging research focuses on designing CPC solar cells with recyclability in mind, incorporating easily separable layers and biodegradable components where possible. These design approaches align with circular economy principles and could significantly enhance the sustainability profile of next-generation solar technologies.

Resource efficiency represents another environmental advantage of CPC-based solar cells. These technologies typically require smaller quantities of rare or critical materials compared to conventional alternatives. By reducing dependence on scarce resources like indium, gallium, and silver, CPC solar cells help mitigate supply chain vulnerabilities and extraction-related environmental impacts. Furthermore, the potential for roll-to-roll manufacturing enables material-efficient production with minimal waste generation.

Water consumption during manufacturing deserves particular attention in sustainability assessments. Preliminary studies suggest that CPC solar cell production may require 30-60% less water than silicon-based alternatives, representing a significant environmental benefit in water-stressed regions. However, the specific solvents used in polymer processing must be carefully selected and managed to prevent water contamination risks.

Looking forward, enhancing the environmental performance of CPC solar technologies will require continued innovation in green chemistry approaches, biodegradable substrate materials, and non-toxic dopants. Standardized sustainability metrics and comprehensive LCA methodologies specific to these emerging technologies will be essential for accurate environmental impact evaluation and informed decision-making across the renewable energy sector.

Manufacturing processes for CPC-based solar cells typically require less energy than conventional silicon cells, with some studies indicating up to 40% reduction in embodied energy. The solution-based processing methods employed for many conductive polymers operate at lower temperatures and pressures, substantially decreasing energy consumption during fabrication. Additionally, these processes generally produce fewer hazardous byproducts, minimizing environmental contamination risks.

Life cycle assessments (LCAs) of CPC solar technologies reveal favorable sustainability profiles compared to traditional alternatives. Research indicates that the carbon footprint of polymer-based photovoltaics can be 50-70% lower than conventional silicon panels when considering the entire product lifecycle. However, challenges remain regarding the environmental persistence of some polymer materials and their potential ecological impacts if improperly disposed of at end-of-life.

Recycling and end-of-life management present both opportunities and challenges for CPC solar technologies. While some polymer components can be recovered and reprocessed, the composite nature of these materials often complicates separation processes. Emerging research focuses on designing CPC solar cells with recyclability in mind, incorporating easily separable layers and biodegradable components where possible. These design approaches align with circular economy principles and could significantly enhance the sustainability profile of next-generation solar technologies.

Resource efficiency represents another environmental advantage of CPC-based solar cells. These technologies typically require smaller quantities of rare or critical materials compared to conventional alternatives. By reducing dependence on scarce resources like indium, gallium, and silver, CPC solar cells help mitigate supply chain vulnerabilities and extraction-related environmental impacts. Furthermore, the potential for roll-to-roll manufacturing enables material-efficient production with minimal waste generation.

Water consumption during manufacturing deserves particular attention in sustainability assessments. Preliminary studies suggest that CPC solar cell production may require 30-60% less water than silicon-based alternatives, representing a significant environmental benefit in water-stressed regions. However, the specific solvents used in polymer processing must be carefully selected and managed to prevent water contamination risks.

Looking forward, enhancing the environmental performance of CPC solar technologies will require continued innovation in green chemistry approaches, biodegradable substrate materials, and non-toxic dopants. Standardized sustainability metrics and comprehensive LCA methodologies specific to these emerging technologies will be essential for accurate environmental impact evaluation and informed decision-making across the renewable energy sector.

Manufacturing Scalability and Cost Analysis

The scalability of manufacturing processes for conductive polymer composites (CPCs) represents a critical factor in their commercial viability for next-generation solar cell applications. Current production methods for CPCs face significant challenges when transitioning from laboratory to industrial scale. Solution processing techniques such as spin coating and doctor blading demonstrate excellent control at small scales but encounter uniformity issues when applied to larger substrates, resulting in performance inconsistencies across production batches.

Roll-to-roll processing emerges as a promising approach for mass production, potentially reducing manufacturing costs by 30-45% compared to traditional batch processes. However, this method requires substantial initial capital investment, estimated at $5-10 million for a medium-scale production line. The technical challenges include maintaining precise thickness control and ensuring homogeneous dispersion of conductive fillers throughout the polymer matrix during high-speed processing.

Material costs constitute another significant consideration in CPC manufacturing economics. While traditional silicon-based photovoltaics benefit from decades of supply chain optimization, conductive polymers remain relatively expensive at $100-500 per kilogram compared to $20-50 per kilogram for processed silicon. This price differential is expected to decrease as production volumes increase, with industry projections suggesting a 15-20% annual reduction in raw material costs over the next five years as manufacturing processes mature.

Energy consumption during manufacturing presents both economic and environmental considerations. CPC production typically requires 30-50% less energy than traditional silicon solar cell manufacturing, translating to approximately 0.8-1.2 kWh per square meter of produced material. This energy efficiency contributes to a shorter energy payback time, estimated at 0.5-1 years compared to 1.5-3 years for silicon-based alternatives.

Quality control systems represent a significant cost factor in scaling production. In-line monitoring technologies for ensuring consistent electrical conductivity, mechanical properties, and morphological characteristics add approximately 8-12% to overall manufacturing costs. However, these systems are essential for maintaining performance standards and reducing waste rates, which currently range from 15-25% in pilot production environments.

The economic viability threshold for CPC-based solar cells is projected to occur when manufacturing costs fall below $0.40 per watt, comparable to current silicon technologies. Current estimates place CPC manufacturing costs at $0.65-0.85 per watt, indicating that further process optimization and economies of scale are necessary before widespread commercial adoption becomes feasible. Industry analysts predict this threshold could be reached within 3-5 years, contingent upon continued research investment and strategic partnerships between material scientists and manufacturing engineers.

Roll-to-roll processing emerges as a promising approach for mass production, potentially reducing manufacturing costs by 30-45% compared to traditional batch processes. However, this method requires substantial initial capital investment, estimated at $5-10 million for a medium-scale production line. The technical challenges include maintaining precise thickness control and ensuring homogeneous dispersion of conductive fillers throughout the polymer matrix during high-speed processing.

Material costs constitute another significant consideration in CPC manufacturing economics. While traditional silicon-based photovoltaics benefit from decades of supply chain optimization, conductive polymers remain relatively expensive at $100-500 per kilogram compared to $20-50 per kilogram for processed silicon. This price differential is expected to decrease as production volumes increase, with industry projections suggesting a 15-20% annual reduction in raw material costs over the next five years as manufacturing processes mature.

Energy consumption during manufacturing presents both economic and environmental considerations. CPC production typically requires 30-50% less energy than traditional silicon solar cell manufacturing, translating to approximately 0.8-1.2 kWh per square meter of produced material. This energy efficiency contributes to a shorter energy payback time, estimated at 0.5-1 years compared to 1.5-3 years for silicon-based alternatives.

Quality control systems represent a significant cost factor in scaling production. In-line monitoring technologies for ensuring consistent electrical conductivity, mechanical properties, and morphological characteristics add approximately 8-12% to overall manufacturing costs. However, these systems are essential for maintaining performance standards and reducing waste rates, which currently range from 15-25% in pilot production environments.

The economic viability threshold for CPC-based solar cells is projected to occur when manufacturing costs fall below $0.40 per watt, comparable to current silicon technologies. Current estimates place CPC manufacturing costs at $0.65-0.85 per watt, indicating that further process optimization and economies of scale are necessary before widespread commercial adoption becomes feasible. Industry analysts predict this threshold could be reached within 3-5 years, contingent upon continued research investment and strategic partnerships between material scientists and manufacturing engineers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!