DED For Additive Remanufacturing: Business Models And KPIs

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DED Technology Evolution and Remanufacturing Goals

Directed Energy Deposition (DED) technology has evolved significantly over the past three decades, transitioning from experimental applications to a commercially viable additive manufacturing process. Initially developed in the 1990s as a laser cladding technique, DED has progressively incorporated advanced powder delivery systems, multi-axis motion platforms, and sophisticated control algorithms. The technology's evolution has been marked by increasing precision, improved material utilization efficiency, and enhanced process stability, making it particularly suitable for remanufacturing applications.

The fundamental technological advancement in DED systems has been the integration of high-power lasers with precise powder or wire feeding mechanisms, allowing for controlled material deposition. Recent developments have focused on closed-loop monitoring systems that enable real-time quality control, a critical feature for remanufacturing where dimensional accuracy and material integrity are paramount. The integration of machine learning algorithms for process optimization represents the cutting edge of current DED technology evolution.

In the context of remanufacturing, DED technology aims to achieve several specific goals. Primary among these is the restoration of high-value components to their original specifications or better, extending their service life while reducing material consumption and manufacturing costs. This aligns with circular economy principles, where the emphasis is on maximizing resource utilization through repair, refurbishment, and remanufacturing rather than replacement.

Another significant goal is the development of hybrid manufacturing systems that combine DED with traditional subtractive processes, allowing for comprehensive component restoration within a single machine platform. This integration aims to streamline workflow, reduce handling operations, and improve dimensional accuracy of remanufactured parts.

The technology evolution trajectory is increasingly focused on material compatibility expansion, particularly for high-performance alloys used in aerospace, defense, and energy sectors. Research efforts are directed toward developing process parameters that ensure consistent metallurgical bonding between the substrate and deposited material, minimizing heat-affected zones, and controlling residual stresses.

Looking forward, the technological goals for DED in remanufacturing include achieving near-net-shape capabilities to minimize post-processing requirements, developing multi-material deposition capabilities for functionally graded components, and establishing standardized qualification procedures for remanufactured parts. These advancements are expected to significantly expand the application scope of DED technology in industrial remanufacturing operations, particularly for complex, high-value components where conventional repair methods are inadequate or economically unfeasible.

The fundamental technological advancement in DED systems has been the integration of high-power lasers with precise powder or wire feeding mechanisms, allowing for controlled material deposition. Recent developments have focused on closed-loop monitoring systems that enable real-time quality control, a critical feature for remanufacturing where dimensional accuracy and material integrity are paramount. The integration of machine learning algorithms for process optimization represents the cutting edge of current DED technology evolution.

In the context of remanufacturing, DED technology aims to achieve several specific goals. Primary among these is the restoration of high-value components to their original specifications or better, extending their service life while reducing material consumption and manufacturing costs. This aligns with circular economy principles, where the emphasis is on maximizing resource utilization through repair, refurbishment, and remanufacturing rather than replacement.

Another significant goal is the development of hybrid manufacturing systems that combine DED with traditional subtractive processes, allowing for comprehensive component restoration within a single machine platform. This integration aims to streamline workflow, reduce handling operations, and improve dimensional accuracy of remanufactured parts.

The technology evolution trajectory is increasingly focused on material compatibility expansion, particularly for high-performance alloys used in aerospace, defense, and energy sectors. Research efforts are directed toward developing process parameters that ensure consistent metallurgical bonding between the substrate and deposited material, minimizing heat-affected zones, and controlling residual stresses.

Looking forward, the technological goals for DED in remanufacturing include achieving near-net-shape capabilities to minimize post-processing requirements, developing multi-material deposition capabilities for functionally graded components, and establishing standardized qualification procedures for remanufactured parts. These advancements are expected to significantly expand the application scope of DED technology in industrial remanufacturing operations, particularly for complex, high-value components where conventional repair methods are inadequate or economically unfeasible.

Market Analysis for Additive Remanufacturing Services

The additive remanufacturing services market is experiencing significant growth as industries increasingly recognize the economic and environmental benefits of repairing and refurbishing components rather than replacing them. The global market for additive remanufacturing was valued at approximately $2.3 billion in 2022 and is projected to reach $5.7 billion by 2028, representing a compound annual growth rate (CAGR) of 16.4%.

Heavy industries such as aerospace, automotive, and energy generation are the primary drivers of this market expansion. In aerospace alone, additive remanufacturing services are expected to grow by 22% annually through 2027, as manufacturers seek to extend the lifecycle of high-value components. The automotive sector follows closely with projected annual growth of 18%, particularly in the remanufacturing of engine components and transmission systems.

Geographically, North America currently holds the largest market share at 38%, followed by Europe at 32% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next five years due to rapid industrialization and increasing adoption of advanced manufacturing technologies in countries like China, Japan, and South Korea.

Customer demand analysis reveals three primary market segments: OEMs seeking to offer remanufacturing as a service to their customers, third-party maintenance providers expanding their service portfolios, and specialized remanufacturing service bureaus. The OEM segment currently dominates with 45% market share, but third-party providers are growing at the fastest rate of 24% annually.

Key market drivers include increasing pressure to reduce waste and carbon footprints, rising costs of raw materials, and growing acceptance of remanufactured parts as quality alternatives to new components. Regulatory frameworks supporting circular economy initiatives, particularly in the European Union, are also accelerating market adoption.

Market barriers include concerns about quality assurance of remanufactured parts, high initial investment costs for DED technology, and intellectual property challenges related to remanufacturing proprietary components. Additionally, lack of standardization across the industry creates uncertainty for potential customers.

Customer willingness-to-pay analysis indicates that clients are typically prepared to spend 40-60% of new component costs for remanufactured alternatives, with this percentage increasing for high-value, critical components where lead times for new parts are extensive.

Heavy industries such as aerospace, automotive, and energy generation are the primary drivers of this market expansion. In aerospace alone, additive remanufacturing services are expected to grow by 22% annually through 2027, as manufacturers seek to extend the lifecycle of high-value components. The automotive sector follows closely with projected annual growth of 18%, particularly in the remanufacturing of engine components and transmission systems.

Geographically, North America currently holds the largest market share at 38%, followed by Europe at 32% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next five years due to rapid industrialization and increasing adoption of advanced manufacturing technologies in countries like China, Japan, and South Korea.

Customer demand analysis reveals three primary market segments: OEMs seeking to offer remanufacturing as a service to their customers, third-party maintenance providers expanding their service portfolios, and specialized remanufacturing service bureaus. The OEM segment currently dominates with 45% market share, but third-party providers are growing at the fastest rate of 24% annually.

Key market drivers include increasing pressure to reduce waste and carbon footprints, rising costs of raw materials, and growing acceptance of remanufactured parts as quality alternatives to new components. Regulatory frameworks supporting circular economy initiatives, particularly in the European Union, are also accelerating market adoption.

Market barriers include concerns about quality assurance of remanufactured parts, high initial investment costs for DED technology, and intellectual property challenges related to remanufacturing proprietary components. Additionally, lack of standardization across the industry creates uncertainty for potential customers.

Customer willingness-to-pay analysis indicates that clients are typically prepared to spend 40-60% of new component costs for remanufactured alternatives, with this percentage increasing for high-value, critical components where lead times for new parts are extensive.

Current DED Remanufacturing Capabilities and Barriers

Directed Energy Deposition (DED) technology has emerged as a promising approach for additive remanufacturing, offering capabilities to restore and enhance worn components with significant material efficiency. Current DED remanufacturing capabilities include the ability to deposit materials directly onto existing parts, enabling repair and modification of high-value components across aerospace, defense, and heavy machinery sectors. The technology demonstrates particular strength in processing a wide range of materials including titanium alloys, nickel-based superalloys, and tool steels, with deposition rates typically ranging from 0.5 to 2.0 kg/hour.

DED systems can achieve dimensional accuracy of approximately ±0.25mm and surface roughness values between 15-40 μm Ra, depending on process parameters and material characteristics. This level of precision allows for near-net-shape manufacturing, though secondary finishing operations are generally required to meet final dimensional specifications. The technology excels in applications requiring material compatibility with the substrate, structural integrity, and the ability to create functionally graded materials.

Despite these capabilities, several significant barriers impede widespread industrial adoption of DED for remanufacturing applications. Technical challenges include residual stress management, which can lead to part distortion and reduced fatigue performance. Microstructural inconsistencies between deposited material and the substrate remain problematic, particularly at the interface zones where mechanical properties may be compromised. Process monitoring and quality control systems, while advancing, still lack the robustness required for critical applications where certification is mandatory.

Economic barriers present equally formidable challenges. The high capital investment for DED equipment (ranging from $500,000 to over $2 million) creates significant entry barriers for small and medium enterprises. Operating costs, including specialized powders that can cost $100-500 per kilogram, skilled labor requirements, and energy consumption, further impact the business case. Additionally, the lack of standardized cost models for remanufacturing operations complicates return-on-investment calculations and business planning.

Regulatory and certification frameworks remain underdeveloped for remanufactured parts, particularly in safety-critical industries. The absence of universally accepted standards for testing and qualifying DED-remanufactured components creates uncertainty and limits market acceptance. This is compounded by knowledge gaps in design methodologies specifically tailored for remanufacturing, as traditional design approaches often fail to capitalize on DED's unique capabilities.

Supply chain considerations also present challenges, with material traceability requirements and the need for specialized powder handling infrastructure adding complexity to implementation. These barriers collectively highlight the need for integrated solutions that address both technical performance metrics and business model considerations to unlock the full potential of DED in remanufacturing applications.

DED systems can achieve dimensional accuracy of approximately ±0.25mm and surface roughness values between 15-40 μm Ra, depending on process parameters and material characteristics. This level of precision allows for near-net-shape manufacturing, though secondary finishing operations are generally required to meet final dimensional specifications. The technology excels in applications requiring material compatibility with the substrate, structural integrity, and the ability to create functionally graded materials.

Despite these capabilities, several significant barriers impede widespread industrial adoption of DED for remanufacturing applications. Technical challenges include residual stress management, which can lead to part distortion and reduced fatigue performance. Microstructural inconsistencies between deposited material and the substrate remain problematic, particularly at the interface zones where mechanical properties may be compromised. Process monitoring and quality control systems, while advancing, still lack the robustness required for critical applications where certification is mandatory.

Economic barriers present equally formidable challenges. The high capital investment for DED equipment (ranging from $500,000 to over $2 million) creates significant entry barriers for small and medium enterprises. Operating costs, including specialized powders that can cost $100-500 per kilogram, skilled labor requirements, and energy consumption, further impact the business case. Additionally, the lack of standardized cost models for remanufacturing operations complicates return-on-investment calculations and business planning.

Regulatory and certification frameworks remain underdeveloped for remanufactured parts, particularly in safety-critical industries. The absence of universally accepted standards for testing and qualifying DED-remanufactured components creates uncertainty and limits market acceptance. This is compounded by knowledge gaps in design methodologies specifically tailored for remanufacturing, as traditional design approaches often fail to capitalize on DED's unique capabilities.

Supply chain considerations also present challenges, with material traceability requirements and the need for specialized powder handling infrastructure adding complexity to implementation. These barriers collectively highlight the need for integrated solutions that address both technical performance metrics and business model considerations to unlock the full potential of DED in remanufacturing applications.

Established Business Models for Additive Remanufacturing

01 Service-based business models for DED technology

Directed Energy Deposition (DED) technology can be implemented through service-based business models where companies offer manufacturing as a service. This approach allows clients to access advanced additive manufacturing capabilities without significant capital investment. Service providers can offer design optimization, material selection consulting, and on-demand production, creating recurring revenue streams. Key performance indicators for this model include service utilization rates, customer retention, and time-to-delivery metrics.- Service-based business models for DED technology: Service-based business models for Directed Energy Deposition (DED) technology focus on providing manufacturing services rather than selling equipment. These models include pay-per-use, subscription-based services, and on-demand manufacturing platforms. Companies can offer specialized DED services for repair, prototyping, or custom part production, with key performance indicators including service utilization rates, customer retention, and time-to-delivery metrics.

- Performance monitoring and KPIs for DED processes: Effective performance monitoring systems for DED processes track key performance indicators such as deposition rate, material efficiency, energy consumption, and part quality metrics. These systems enable real-time process optimization, quality control, and predictive maintenance. Advanced monitoring solutions incorporate sensors, data analytics, and machine learning algorithms to identify process anomalies and recommend adjustments, ultimately improving operational efficiency and product quality.

- Collaborative and platform-based DED business models: Collaborative and platform-based business models for DED technology leverage partnerships between equipment manufacturers, material suppliers, software developers, and end-users. These models create ecosystems where stakeholders share resources, knowledge, and risks. Digital platforms facilitate connections between DED service providers and customers, enabling more efficient resource allocation and market access. Key performance indicators include platform adoption rates, partnership effectiveness, and ecosystem growth metrics.

- Value-based pricing and ROI models for DED implementation: Value-based pricing and return on investment models for DED implementation focus on quantifying the economic benefits of adopting DED technology. These models consider factors such as reduced material waste, shorter lead times, design optimization opportunities, and extended product lifecycles. Key performance indicators include cost per part, time-to-market reduction, material utilization efficiency, and overall equipment effectiveness. These metrics help organizations justify investments in DED technology and optimize their operational strategies.

- Integrated supply chain and digital twin models for DED operations: Integrated supply chain and digital twin models for DED operations combine physical manufacturing processes with digital representations to optimize production workflows. These models enable virtual testing, process simulation, and predictive analytics to enhance operational efficiency. Digital twins of DED systems facilitate remote monitoring, quality assurance, and supply chain integration. Key performance indicators include digital model accuracy, supply chain responsiveness, inventory optimization metrics, and production flexibility measures.

02 Performance monitoring and KPIs for DED operations

Effective monitoring of DED operations requires specific key performance indicators to evaluate process efficiency and product quality. These KPIs include material deposition rates, energy efficiency, build accuracy, surface finish quality, and mechanical properties of produced parts. Advanced monitoring systems can track these metrics in real-time, allowing for process optimization and quality control. Implementation of comprehensive KPI frameworks enables continuous improvement and helps identify bottlenecks in the production process.Expand Specific Solutions03 Integration of DED in hybrid manufacturing business models

Hybrid manufacturing business models combine DED technology with traditional manufacturing methods to leverage the advantages of both approaches. This integration allows for complex part production, repair services, and material-efficient manufacturing. Companies implementing hybrid models can offer unique value propositions such as part restoration, feature addition to existing components, and multi-material production capabilities. Success metrics include production flexibility, material utilization efficiency, and reduction in lead times compared to conventional manufacturing.Expand Specific Solutions04 Supply chain optimization for DED implementation

Implementing DED technology requires strategic supply chain optimization to ensure material availability, quality control, and cost efficiency. Business models focused on supply chain integration can create competitive advantages through vertical integration or strategic partnerships with material suppliers. Key performance indicators include material inventory turnover, supplier quality metrics, and raw material cost as a percentage of total production cost. Effective supply chain management directly impacts production capabilities and profit margins in DED-based manufacturing operations.Expand Specific Solutions05 Data-driven business intelligence for DED technology

Data-driven approaches to DED implementation leverage advanced analytics and business intelligence to optimize operations and strategic decision-making. These models incorporate machine learning algorithms to predict maintenance needs, optimize process parameters, and improve part quality. Performance metrics include predictive accuracy, process stability indicators, and defect reduction rates. By collecting and analyzing operational data, companies can develop intellectual property around process optimization, creating additional value streams beyond manufacturing capabilities.Expand Specific Solutions

Industry Leaders in DED Remanufacturing Solutions

The Directed Energy Deposition (DED) additive remanufacturing market is currently in a growth phase, with increasing adoption across aerospace, automotive, and energy sectors. The global market size is estimated to reach $1.5-2 billion by 2025, driven by sustainability demands and cost reduction opportunities. Technology maturity varies significantly among key players: GE Avio, Siemens Energy, and Divergent Technologies lead with commercial applications, while BeAM SAS and Norsk Titanium have established specialized DED solutions. Academic institutions like Northwestern University and Harbin Institute of Technology are advancing fundamental research, while companies such as 3D Systems and Air Products are developing supporting materials and processes. The industry is transitioning from early adoption to standardization, with business models evolving from equipment sales to service-based offerings focused on lifecycle value and sustainability metrics.

GE Avio Srl

Technical Solution: GE Avio has developed an integrated DED (Directed Energy Deposition) approach for additive remanufacturing of aerospace components, particularly focusing on turbine blades and other high-value aviation parts. Their business model centers on a "repair-instead-of-replace" paradigm, significantly extending component lifecycles while reducing material waste. The company has implemented a comprehensive digital twin system that tracks component performance history, enabling predictive maintenance scheduling and optimized repair timing. GE Avio's KPI framework measures success through repair cycle time reduction (currently achieving 60-70% reduction compared to conventional methods), material utilization efficiency (85-90%), and quality consistency metrics. Their technology incorporates real-time monitoring systems that analyze melt pool dynamics during deposition to ensure consistent metallurgical properties across repaired sections.

Strengths: Exceptional integration with existing aerospace maintenance infrastructure; comprehensive digital tracking system; proven material qualification processes for flight-critical components. Weaknesses: Higher initial capital investment requirements; limited to specific high-value component types; requires specialized operator training and certification.

Siemens Energy Global GmbH & Co. KG

Technical Solution: Siemens Energy has pioneered a service-oriented business model for DED additive remanufacturing focused primarily on power generation components. Their approach combines on-site and centralized remanufacturing capabilities, offering flexible solutions based on component criticality and downtime costs. The company has developed proprietary DED technology specifically optimized for turbine blade repair and gas turbine component remanufacturing, with specialized alloy formulations that match or exceed original component specifications. Siemens' KPI framework emphasizes total cost of ownership reduction (demonstrating 30-40% savings compared to new component replacement), downtime minimization (with 50-60% reduction in component availability timeframes), and sustainability metrics including CO2 emission reduction through material conservation. Their business model incorporates performance guarantees and long-term service agreements that align remanufacturing costs with customer operational benefits.

Strengths: Comprehensive service network with global reach; proven integration with existing maintenance schedules; sophisticated material science capabilities for specialized alloys. Weaknesses: Higher complexity in implementation for smaller operators; requires significant data integration with customer systems; technology optimization primarily focused on Siemens' own equipment.

Key Performance Indicators for DED Remanufacturing

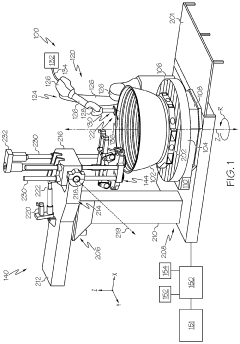

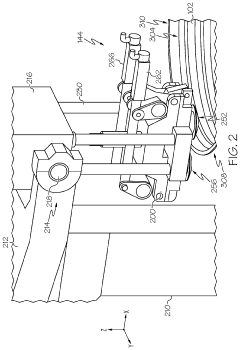

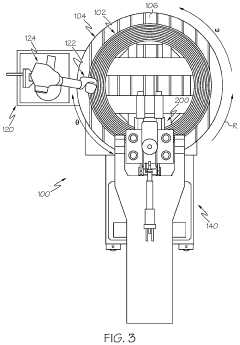

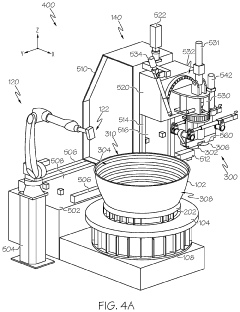

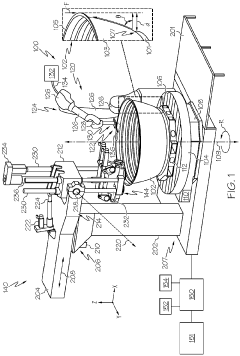

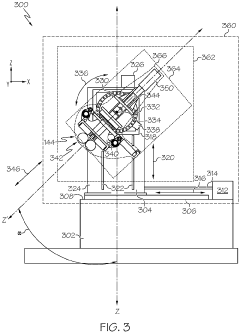

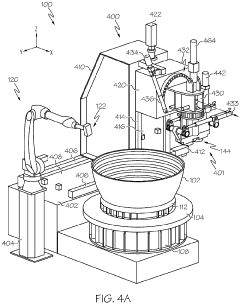

Additive manufacturing systems and methods for compression of material during material deposition

PatentPendingUS20240009740A1

Innovation

- A DED system that integrates a rotary build table and a compression rig allowing simultaneous deposition and compression phases, with a controller managing the application of compressive loads during material deposition to maintain constant temperature and improve microstructure homogeneity.

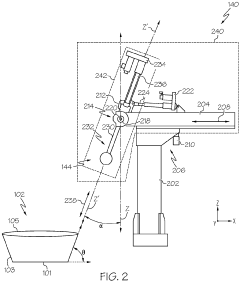

An apparatus for applying a compressive load

PatentPendingEP4302911A1

Innovation

- A compression rig with multiple degrees of freedom that can adjust the orientation of the compressive load in real-time, allowing it to be applied at various angles relative to the component's geometry, minimizing the risk of damage by using a combination of actuators and sensors to control the load's direction and magnitude.

Sustainability Impact and Circular Economy Benefits

Directed Energy Deposition (DED) technology for additive remanufacturing presents significant sustainability advantages that align with global circular economy initiatives. By enabling the repair and remanufacturing of high-value components rather than their replacement, DED processes substantially reduce raw material consumption—typically achieving 50-90% material savings compared to conventional manufacturing methods. This material efficiency translates directly to reduced environmental footprints across multiple dimensions.

The energy consumption profile of DED remanufacturing demonstrates considerable advantages, with studies indicating 60-80% energy savings compared to manufacturing new components. This reduction stems from eliminating energy-intensive primary material extraction and processing stages. Carbon emissions follow a similar pattern, with DED remanufacturing potentially reducing CO2 emissions by 40-70% depending on the specific application and material system.

Waste reduction represents another critical sustainability benefit. DED processes feature material utilization rates exceeding 90% in many applications, significantly higher than traditional subtractive manufacturing methods. The near-net-shape capabilities of DED minimize post-processing requirements, further reducing waste generation throughout the production lifecycle.

From a circular economy perspective, DED remanufacturing extends product lifecycles by enabling multiple service life extensions for components that would otherwise be discarded. This approach transforms the traditional linear "take-make-dispose" model into a circular system where materials maintain their highest utility and value for extended periods. The technology enables the implementation of product-as-a-service business models, where manufacturers retain ownership of physical assets while customers purchase the service those assets provide.

Economic analyses demonstrate that DED remanufacturing can reduce component lifecycle costs by 30-60% while maintaining equivalent or superior performance characteristics. These cost advantages become particularly pronounced for components manufactured from expensive materials such as nickel superalloys, titanium alloys, and specialty steels.

Key performance indicators for measuring sustainability impacts include material circularity index, embodied energy reduction, carbon footprint reduction, waste diversion rates, and component service life extension factors. These metrics provide quantifiable measures for evaluating the environmental benefits of DED remanufacturing implementations across different industrial sectors.

The technology's sustainability benefits extend beyond environmental considerations to include social dimensions, particularly through reshoring manufacturing capabilities, creating skilled technical jobs, and reducing dependence on volatile global supply chains for critical components and materials.

The energy consumption profile of DED remanufacturing demonstrates considerable advantages, with studies indicating 60-80% energy savings compared to manufacturing new components. This reduction stems from eliminating energy-intensive primary material extraction and processing stages. Carbon emissions follow a similar pattern, with DED remanufacturing potentially reducing CO2 emissions by 40-70% depending on the specific application and material system.

Waste reduction represents another critical sustainability benefit. DED processes feature material utilization rates exceeding 90% in many applications, significantly higher than traditional subtractive manufacturing methods. The near-net-shape capabilities of DED minimize post-processing requirements, further reducing waste generation throughout the production lifecycle.

From a circular economy perspective, DED remanufacturing extends product lifecycles by enabling multiple service life extensions for components that would otherwise be discarded. This approach transforms the traditional linear "take-make-dispose" model into a circular system where materials maintain their highest utility and value for extended periods. The technology enables the implementation of product-as-a-service business models, where manufacturers retain ownership of physical assets while customers purchase the service those assets provide.

Economic analyses demonstrate that DED remanufacturing can reduce component lifecycle costs by 30-60% while maintaining equivalent or superior performance characteristics. These cost advantages become particularly pronounced for components manufactured from expensive materials such as nickel superalloys, titanium alloys, and specialty steels.

Key performance indicators for measuring sustainability impacts include material circularity index, embodied energy reduction, carbon footprint reduction, waste diversion rates, and component service life extension factors. These metrics provide quantifiable measures for evaluating the environmental benefits of DED remanufacturing implementations across different industrial sectors.

The technology's sustainability benefits extend beyond environmental considerations to include social dimensions, particularly through reshoring manufacturing capabilities, creating skilled technical jobs, and reducing dependence on volatile global supply chains for critical components and materials.

Cost-Benefit Analysis of DED vs Traditional Remanufacturing

When comparing Directed Energy Deposition (DED) with traditional remanufacturing methods, a comprehensive cost-benefit analysis reveals significant economic and operational advantages. DED technology offers substantial material savings, with studies indicating a reduction in raw material consumption by up to 40-60% compared to conventional manufacturing processes. This efficiency stems from DED's additive nature, which deposits material only where needed, minimizing waste generation.

The initial capital investment for DED equipment ranges from $500,000 to $2 million, depending on system capabilities and specifications. While this represents a higher upfront cost than many traditional remanufacturing setups, the long-term return on investment demonstrates favorable economics, particularly for high-value components in aerospace, defense, and heavy machinery sectors.

Operational costs show a nuanced picture. DED processes typically consume more energy per unit volume of material deposited (approximately 15-25 kWh/kg) compared to conventional machining. However, this is offset by significant reductions in material costs and processing time for complex repair operations. Labor requirements also differ substantially, with DED systems requiring fewer operator hours but more specialized technical expertise.

Time-to-market metrics strongly favor DED technology. Case studies from industrial implementations show cycle time reductions of 30-70% for component repair and remanufacturing. This acceleration derives from eliminating multiple setup operations and reducing the need for specialized tooling and fixtures required in traditional approaches.

Quality considerations reveal that DED-remanufactured components frequently demonstrate mechanical properties comparable or superior to those produced through conventional methods. Metallurgical analyses show excellent bonding between substrate and deposited material, with proper process control yielding components with 95-100% of original performance specifications.

Environmental impact assessment indicates DED processes generate 40-60% less carbon footprint compared to manufacturing new components, primarily due to material conservation. Additionally, the localized nature of repairs minimizes transportation requirements throughout the supply chain.

Scalability and flexibility metrics strongly favor DED technology. Traditional remanufacturing often requires dedicated tooling for specific component geometries, whereas DED systems can rapidly adapt to different part configurations through software adjustments. This adaptability is particularly valuable for low-volume, high-mix production environments typical in remanufacturing operations.

Risk analysis indicates that while DED technology introduces new technical challenges related to process control and quality assurance, it significantly reduces supply chain vulnerabilities by enabling on-demand, localized repair capabilities. This becomes increasingly valuable as global supply chains face disruption from geopolitical and environmental factors.

The initial capital investment for DED equipment ranges from $500,000 to $2 million, depending on system capabilities and specifications. While this represents a higher upfront cost than many traditional remanufacturing setups, the long-term return on investment demonstrates favorable economics, particularly for high-value components in aerospace, defense, and heavy machinery sectors.

Operational costs show a nuanced picture. DED processes typically consume more energy per unit volume of material deposited (approximately 15-25 kWh/kg) compared to conventional machining. However, this is offset by significant reductions in material costs and processing time for complex repair operations. Labor requirements also differ substantially, with DED systems requiring fewer operator hours but more specialized technical expertise.

Time-to-market metrics strongly favor DED technology. Case studies from industrial implementations show cycle time reductions of 30-70% for component repair and remanufacturing. This acceleration derives from eliminating multiple setup operations and reducing the need for specialized tooling and fixtures required in traditional approaches.

Quality considerations reveal that DED-remanufactured components frequently demonstrate mechanical properties comparable or superior to those produced through conventional methods. Metallurgical analyses show excellent bonding between substrate and deposited material, with proper process control yielding components with 95-100% of original performance specifications.

Environmental impact assessment indicates DED processes generate 40-60% less carbon footprint compared to manufacturing new components, primarily due to material conservation. Additionally, the localized nature of repairs minimizes transportation requirements throughout the supply chain.

Scalability and flexibility metrics strongly favor DED technology. Traditional remanufacturing often requires dedicated tooling for specific component geometries, whereas DED systems can rapidly adapt to different part configurations through software adjustments. This adaptability is particularly valuable for low-volume, high-mix production environments typical in remanufacturing operations.

Risk analysis indicates that while DED technology introduces new technical challenges related to process control and quality assurance, it significantly reduces supply chain vulnerabilities by enabling on-demand, localized repair capabilities. This becomes increasingly valuable as global supply chains face disruption from geopolitical and environmental factors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!