Dual-ion batteries for grid storage and industrial energy management solutions

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Dual-ion Battery Technology Evolution and Objectives

Dual-ion batteries (DIBs) have emerged as a promising energy storage technology over the past decade, evolving from theoretical concepts to practical implementations. The development trajectory began in the early 2000s with fundamental research on intercalation mechanisms of both anions and cations, distinguishing DIBs from conventional lithium-ion batteries that rely solely on cation intercalation. This dual-ion mechanism enables potentially higher energy densities and voltage outputs, making them particularly suitable for grid-scale applications.

The evolution of DIB technology has been marked by significant breakthroughs in electrode materials. Initially, graphite was the predominant material for both cathodes and anodes, but recent advancements have introduced novel materials such as expanded graphite, metal oxides, and organic compounds that enhance ion storage capacity and cycling stability. These material innovations have addressed early limitations in energy density and cycle life that previously hindered commercial viability.

Electrolyte development represents another critical evolutionary path in DIB technology. Traditional electrolytes faced challenges with anion intercalation efficiency and stability at high voltages. Modern formulations incorporating ionic liquids and concentrated salt systems have substantially improved electrochemical performance and safety profiles, enabling operation under more demanding grid storage conditions.

The technical objectives for DIBs in grid storage applications focus on several key parameters. First, achieving energy densities exceeding 100 Wh/kg at the system level would position DIBs competitively against existing technologies like lithium-ion and flow batteries. Second, extending cycle life to 10,000+ cycles is essential for the economics of grid storage, where frequent replacement would be prohibitively expensive. Third, reducing cost to below $100/kWh represents a critical threshold for widespread adoption in utility-scale implementations.

For industrial energy management solutions specifically, DIBs aim to provide rapid response capabilities (under 100ms) for frequency regulation and peak shaving applications. Additionally, they target operational stability across wide temperature ranges (-20°C to 60°C) to accommodate diverse industrial environments without requiring costly thermal management systems. Safety objectives include non-flammability and minimal thermal runaway risk, addressing critical concerns for industrial deployments.

The technology roadmap envisions incremental improvements in the near term (1-3 years) focused on electrolyte optimization and electrode manufacturing, followed by more transformative advances in novel materials and cell architectures in the medium term (3-7 years). Long-term objectives (7-10 years) include fully integrated systems with advanced battery management capabilities and grid-interactive functionalities that enable DIBs to provide multiple stacked services to electricity markets and industrial users.

The evolution of DIB technology has been marked by significant breakthroughs in electrode materials. Initially, graphite was the predominant material for both cathodes and anodes, but recent advancements have introduced novel materials such as expanded graphite, metal oxides, and organic compounds that enhance ion storage capacity and cycling stability. These material innovations have addressed early limitations in energy density and cycle life that previously hindered commercial viability.

Electrolyte development represents another critical evolutionary path in DIB technology. Traditional electrolytes faced challenges with anion intercalation efficiency and stability at high voltages. Modern formulations incorporating ionic liquids and concentrated salt systems have substantially improved electrochemical performance and safety profiles, enabling operation under more demanding grid storage conditions.

The technical objectives for DIBs in grid storage applications focus on several key parameters. First, achieving energy densities exceeding 100 Wh/kg at the system level would position DIBs competitively against existing technologies like lithium-ion and flow batteries. Second, extending cycle life to 10,000+ cycles is essential for the economics of grid storage, where frequent replacement would be prohibitively expensive. Third, reducing cost to below $100/kWh represents a critical threshold for widespread adoption in utility-scale implementations.

For industrial energy management solutions specifically, DIBs aim to provide rapid response capabilities (under 100ms) for frequency regulation and peak shaving applications. Additionally, they target operational stability across wide temperature ranges (-20°C to 60°C) to accommodate diverse industrial environments without requiring costly thermal management systems. Safety objectives include non-flammability and minimal thermal runaway risk, addressing critical concerns for industrial deployments.

The technology roadmap envisions incremental improvements in the near term (1-3 years) focused on electrolyte optimization and electrode manufacturing, followed by more transformative advances in novel materials and cell architectures in the medium term (3-7 years). Long-term objectives (7-10 years) include fully integrated systems with advanced battery management capabilities and grid-interactive functionalities that enable DIBs to provide multiple stacked services to electricity markets and industrial users.

Grid Storage Market Demand Analysis

The global grid storage market is experiencing unprecedented growth driven by the increasing integration of renewable energy sources and the need for grid stability. Current projections indicate the grid-scale energy storage market will reach $15.1 billion by 2025, growing at a compound annual growth rate of approximately 20% from 2020. This expansion is primarily fueled by the transition toward decarbonized electricity systems, with over 160 countries having established renewable energy targets requiring complementary storage solutions.

Dual-ion batteries (DIBs) are emerging as a promising technology for grid storage applications due to their cost-effectiveness and environmental advantages compared to traditional lithium-ion batteries. Market analysis reveals that industrial energy management solutions represent a particularly strong growth segment, with manufacturing facilities seeking to reduce peak demand charges and enhance energy resilience. These facilities typically face electricity costs comprising 10-20% of their operational expenses, creating substantial incentive for implementing storage solutions.

Utility companies are increasingly investing in grid-scale storage to address multiple challenges simultaneously. Data shows that grid congestion costs power utilities billions annually, while frequency regulation services represent a $3.8 billion market opportunity for storage technologies. DIBs offer particular advantages in these applications due to their rapid response capabilities and potential for extended cycle life compared to conventional battery technologies.

Regional market analysis indicates varying adoption patterns based on regulatory frameworks and energy needs. Asia-Pacific currently leads in grid storage deployment volume, with China investing heavily in dual-ion and alternative battery technologies as part of its energy security strategy. European markets show strong demand driven by aggressive renewable energy targets, with Germany, the UK, and France implementing supportive policies for grid-scale storage integration.

Commercial and industrial customers represent a rapidly growing market segment, with energy-intensive industries seeking to implement behind-the-meter storage solutions to reduce operational costs. These customers typically consume above 1 GWh annually and face significant demand charges, making them ideal candidates for DIB implementation. Market surveys indicate that 68% of industrial energy managers consider energy storage a priority investment for the next five years.

The market demand for grid storage is further accelerated by declining costs across battery technologies. While lithium-ion batteries have seen cost reductions of approximately 85% over the past decade, emerging technologies like DIBs promise even greater cost advantages due to their use of abundant materials and simpler manufacturing processes. This cost trajectory is critical for market expansion, as economic viability remains the primary adoption barrier cited by potential customers.

Dual-ion batteries (DIBs) are emerging as a promising technology for grid storage applications due to their cost-effectiveness and environmental advantages compared to traditional lithium-ion batteries. Market analysis reveals that industrial energy management solutions represent a particularly strong growth segment, with manufacturing facilities seeking to reduce peak demand charges and enhance energy resilience. These facilities typically face electricity costs comprising 10-20% of their operational expenses, creating substantial incentive for implementing storage solutions.

Utility companies are increasingly investing in grid-scale storage to address multiple challenges simultaneously. Data shows that grid congestion costs power utilities billions annually, while frequency regulation services represent a $3.8 billion market opportunity for storage technologies. DIBs offer particular advantages in these applications due to their rapid response capabilities and potential for extended cycle life compared to conventional battery technologies.

Regional market analysis indicates varying adoption patterns based on regulatory frameworks and energy needs. Asia-Pacific currently leads in grid storage deployment volume, with China investing heavily in dual-ion and alternative battery technologies as part of its energy security strategy. European markets show strong demand driven by aggressive renewable energy targets, with Germany, the UK, and France implementing supportive policies for grid-scale storage integration.

Commercial and industrial customers represent a rapidly growing market segment, with energy-intensive industries seeking to implement behind-the-meter storage solutions to reduce operational costs. These customers typically consume above 1 GWh annually and face significant demand charges, making them ideal candidates for DIB implementation. Market surveys indicate that 68% of industrial energy managers consider energy storage a priority investment for the next five years.

The market demand for grid storage is further accelerated by declining costs across battery technologies. While lithium-ion batteries have seen cost reductions of approximately 85% over the past decade, emerging technologies like DIBs promise even greater cost advantages due to their use of abundant materials and simpler manufacturing processes. This cost trajectory is critical for market expansion, as economic viability remains the primary adoption barrier cited by potential customers.

Technical Barriers and Global Development Status

Dual-ion batteries (DIBs) face several significant technical barriers that have hindered their widespread commercial adoption for grid storage applications. The primary challenge remains the limited energy density compared to conventional lithium-ion batteries, with current DIB systems typically achieving only 50-70 Wh/kg versus 150-250 Wh/kg for commercial lithium-ion counterparts. This limitation stems from the inherent chemistry of DIBs, where both anions and cations participate in the electrochemical process.

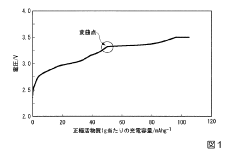

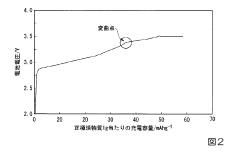

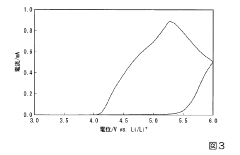

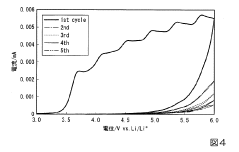

Another critical barrier is the voltage instability during cycling, particularly at the cathode interface. The high operating voltage (often exceeding 4.5V) leads to electrolyte decomposition and subsequent formation of unstable solid-electrolyte interphase (SEI) layers, resulting in capacity fading after repeated cycles. Most DIB prototypes demonstrate capacity retention of only 80-85% after 1000 cycles, falling short of the 90%+ retention required for grid storage applications.

Electrode materials present additional challenges, with graphite-based electrodes suffering from exfoliation during anion intercalation, while alternative materials like reduced graphene oxide face scalability and cost issues. The electrolyte systems also require improvement, as conventional carbonate-based electrolytes decompose at the high operating voltages of DIBs, while more stable alternatives like ionic liquids remain prohibitively expensive for large-scale deployment.

From a global development perspective, research on DIBs has accelerated significantly since 2015, with China leading in patent applications (approximately 45% of global filings) and published research papers. European research institutions, particularly in Germany and France, have made substantial contributions to fundamental understanding of DIB mechanisms, while Japanese companies have focused on electrolyte innovations.

Commercial development remains primarily at the prototype and small-scale demonstration level. Chinese companies like Contemporary Amperex Technology (CATL) and BYD have established pilot production lines for DIB modules targeting industrial energy management applications. In Europe, several startups backed by EU innovation funding are developing specialized DIB solutions for renewable energy integration, though none have reached commercial scale.

The United States has seen increased interest in DIB technology through Department of Energy initiatives, with research consortia at national laboratories focusing on overcoming the electrolyte stability challenges. However, U.S. commercial activity lags behind Asia and Europe, with only a handful of startups actively pursuing DIB technology for grid applications.

Another critical barrier is the voltage instability during cycling, particularly at the cathode interface. The high operating voltage (often exceeding 4.5V) leads to electrolyte decomposition and subsequent formation of unstable solid-electrolyte interphase (SEI) layers, resulting in capacity fading after repeated cycles. Most DIB prototypes demonstrate capacity retention of only 80-85% after 1000 cycles, falling short of the 90%+ retention required for grid storage applications.

Electrode materials present additional challenges, with graphite-based electrodes suffering from exfoliation during anion intercalation, while alternative materials like reduced graphene oxide face scalability and cost issues. The electrolyte systems also require improvement, as conventional carbonate-based electrolytes decompose at the high operating voltages of DIBs, while more stable alternatives like ionic liquids remain prohibitively expensive for large-scale deployment.

From a global development perspective, research on DIBs has accelerated significantly since 2015, with China leading in patent applications (approximately 45% of global filings) and published research papers. European research institutions, particularly in Germany and France, have made substantial contributions to fundamental understanding of DIB mechanisms, while Japanese companies have focused on electrolyte innovations.

Commercial development remains primarily at the prototype and small-scale demonstration level. Chinese companies like Contemporary Amperex Technology (CATL) and BYD have established pilot production lines for DIB modules targeting industrial energy management applications. In Europe, several startups backed by EU innovation funding are developing specialized DIB solutions for renewable energy integration, though none have reached commercial scale.

The United States has seen increased interest in DIB technology through Department of Energy initiatives, with research consortia at national laboratories focusing on overcoming the electrolyte stability challenges. However, U.S. commercial activity lags behind Asia and Europe, with only a handful of startups actively pursuing DIB technology for grid applications.

Current Dual-ion Battery Solutions for Grid Applications

01 Electrode materials for dual-ion batteries

Various materials can be used as electrodes in dual-ion batteries to improve performance. These include carbon-based materials, metal oxides, and composite materials that can intercalate both cations and anions. The selection of appropriate electrode materials is crucial for enhancing energy density, cycle life, and charge-discharge efficiency of dual-ion batteries.- Electrode materials for dual-ion batteries: Various materials can be used as electrodes in dual-ion batteries to improve performance. These include carbon-based materials, metal oxides, and composite materials that enhance ion storage capacity and cycling stability. The electrode materials are designed to facilitate the intercalation and de-intercalation of both cations and anions during charge-discharge cycles, which is essential for the dual-ion mechanism.

- Electrolyte compositions for dual-ion batteries: Specialized electrolyte formulations are crucial for dual-ion batteries, as they must support the movement of both positive and negative ions. These electrolytes typically contain specific salts dissolved in organic solvents or ionic liquids that enable efficient ion transport while maintaining electrochemical stability. The composition of the electrolyte significantly affects battery performance, including capacity, rate capability, and cycle life.

- Battery management systems for dual-ion batteries: Battery management systems specifically designed for dual-ion batteries help optimize performance and ensure safety. These systems monitor and control parameters such as voltage, current, temperature, and state of charge to prevent overcharging, over-discharging, and thermal runaway. Advanced management systems may incorporate algorithms that account for the unique characteristics of dual-ion chemistry to extend battery life and improve efficiency.

- Structural designs for dual-ion batteries: Innovative structural designs for dual-ion batteries focus on optimizing the arrangement of components to enhance performance. These designs may include novel cell configurations, separator structures, and packaging solutions that improve ion transport, reduce internal resistance, and increase energy density. Some designs also address thermal management and mechanical stability to enhance safety and durability under various operating conditions.

- Applications and integration of dual-ion batteries: Dual-ion batteries are being developed for various applications including portable electronics, electric vehicles, and grid-scale energy storage. Integration technologies focus on adapting these batteries to specific use cases by addressing requirements such as form factor, power output, charging protocols, and environmental conditions. Some innovations also explore hybrid systems that combine dual-ion batteries with other energy storage technologies to leverage complementary advantages.

02 Electrolyte compositions for dual-ion batteries

Specialized electrolyte formulations are essential for dual-ion batteries, as they must facilitate the movement of both cations and anions. These electrolytes typically contain specific salts dissolved in organic solvents or ionic liquids. The composition of the electrolyte significantly affects the battery's performance, including its voltage window, ionic conductivity, and stability during cycling.Expand Specific Solutions03 Battery management systems for dual-ion batteries

Battery management systems designed specifically for dual-ion batteries help optimize performance and ensure safety. These systems monitor and control parameters such as voltage, current, temperature, and state of charge. Advanced management systems may incorporate algorithms that account for the unique characteristics of dual-ion chemistry, extending battery life and preventing degradation.Expand Specific Solutions04 Structural designs for dual-ion batteries

Innovative structural designs for dual-ion batteries focus on optimizing the arrangement of electrodes, separators, and current collectors. These designs aim to maximize energy density, improve ion transport, and enhance mechanical stability. Some approaches include layered structures, 3D architectures, and flexible configurations that can be adapted for various applications.Expand Specific Solutions05 Manufacturing processes for dual-ion batteries

Specialized manufacturing techniques are developed for producing dual-ion batteries with consistent quality and performance. These processes include methods for electrode preparation, electrolyte filling, cell assembly, and sealing. Advanced manufacturing approaches focus on scalability, cost reduction, and environmental sustainability while maintaining the unique electrochemical properties of dual-ion systems.Expand Specific Solutions

Leading Companies and Competitive Landscape

Dual-ion batteries (DIBs) for grid storage and industrial energy management are emerging as a promising technology in the energy storage landscape. The market is currently in an early growth phase, with increasing demand driven by renewable energy integration and industrial decarbonization efforts. The global market size for grid-scale energy storage is projected to expand significantly, with DIBs poised to capture a growing share due to their cost advantages and performance characteristics. Technologically, DIBs are advancing rapidly, with companies like BYD, Hitachi, and Panasonic Energy leading commercial development. Research institutions such as Shenzhen Institutes of Advanced Technology and Wisconsin Alumni Research Foundation are pioneering fundamental innovations. While still less mature than lithium-ion technology, DIBs are gaining traction through strategic partnerships between established energy players and specialized battery manufacturers, particularly in Asia where companies like SAIC GM Wuling and Sharp are investing in production capacity.

The Shenzhen Institutes of Advanced Technology

Technical Solution: The Shenzhen Institutes of Advanced Technology (SIAT) has developed cutting-edge dual-ion battery technology specifically tailored for grid storage applications. Their approach utilizes a graphite cathode and sodium/potassium-based anode system with a novel electrolyte formulation that enables efficient bi-directional ion transport. SIAT's technology features a unique electrode architecture that maximizes active material utilization while minimizing internal resistance, resulting in high rate capabilities essential for grid stabilization functions. Their research has demonstrated energy densities of approximately 90-110 Wh/kg with exceptional cycling stability exceeding 4,000 cycles at 80% depth of discharge. SIAT has pioneered advanced electrolyte additives that form stable solid-electrolyte interphase layers, significantly reducing capacity fade during extended cycling. The institute has also developed sophisticated computational models that predict battery performance under various grid demand scenarios, enabling optimized system design for specific applications. Their technology incorporates thermal management systems specifically designed to maintain optimal operating temperatures in diverse environmental conditions, enhancing both safety and longevity.

Strengths: Utilizes abundant, low-cost materials (primarily carbon and sodium/potassium salts) reducing overall system costs; excellent cycling stability suitable for stationary applications; inherently safer chemistry with reduced fire risk compared to lithium-ion alternatives; environmentally benign components. Weaknesses: Lower energy density compared to some competing technologies; temperature sensitivity affecting performance in extreme conditions; technology still in pre-commercial development phase with limited large-scale deployment experience; requires specialized manufacturing processes not yet widely established.

BYD Co., Ltd.

Technical Solution: BYD has developed advanced dual-ion battery (DIB) technology specifically designed for grid storage applications. Their DIB system utilizes graphite cathodes and metal-based anodes with specialized electrolytes containing lithium salts. The technology employs a dual-carrier mechanism where both anions and cations participate in the electrochemical process, enabling higher energy density compared to traditional lithium-ion batteries. BYD's implementation features a modular design that can be scaled from kilowatt to megawatt capacity, making it suitable for various grid storage applications. Their DIBs incorporate advanced battery management systems (BMS) that optimize charging/discharging cycles and extend operational lifespan. The company has integrated these systems with their own energy management software to provide comprehensive industrial energy solutions that can respond to fluctuating grid demands within milliseconds.

Strengths: Cost-effective due to abundant and inexpensive materials (primarily carbon-based); higher voltage output than conventional lithium-ion batteries; excellent cycling stability suitable for grid applications. Weaknesses: Lower energy density compared to some competing technologies; temperature sensitivity requiring additional thermal management systems; relatively early stage of commercialization compared to more established battery technologies.

Key Patents and Technical Innovations

Dual ion power storage device

PatentActiveJP2020187825A

Innovation

- A dual-ion electricity storage device using graphite as the positive electrode active material, lithium titanate (LTO) as the negative electrode, and a specific electrolyte composition with lithium imide salt and lithium hexafluorophosphate to maintain low positive electrode potential and suppress discharge capacity decrease in low-temperature environments.

dual ion battery

PatentActiveJPWO2020110230A1

Innovation

- The use of aluminum current collectors coated with an amorphous carbon film, optionally with a conductive carbon layer, to prevent corrosion and enhance high-temperature durability.

Regulatory Framework for Grid Energy Storage Systems

The regulatory landscape for grid energy storage systems, particularly those utilizing dual-ion battery technology, is evolving rapidly across global markets. In the United States, the Federal Energy Regulatory Commission (FERC) has established Order 841, which requires system operators to develop participation models allowing energy storage resources to provide capacity, energy, and ancillary services. This landmark regulation has created pathways for dual-ion battery integration into grid infrastructure while addressing market barriers.

The European Union has implemented the Clean Energy Package, which explicitly recognizes energy storage as a distinct asset class within power systems. This regulatory framework enables dual-ion battery systems to participate in multiple market segments simultaneously, enhancing their economic viability. Additionally, the EU's Sustainable Finance Taxonomy classifies energy storage technologies based on their environmental impact, providing incentives for low-carbon solutions like advanced battery systems.

Safety standards represent a critical regulatory component for grid-scale battery deployment. Organizations such as UL, IEC, and IEEE have developed specific standards addressing fire protection, thermal runaway prevention, and operational safety for large-scale battery installations. Dual-ion batteries must demonstrate compliance with these standards, which typically include rigorous testing protocols for thermal stability, cycle life, and failure mode analysis.

Permitting processes for grid storage installations vary significantly by jurisdiction, creating challenges for widespread deployment. Environmental impact assessments, grid interconnection studies, and local zoning requirements can extend project timelines and increase costs. Several countries have initiated regulatory streamlining efforts to address these barriers, including expedited permitting for systems below certain capacity thresholds.

End-of-life management regulations are increasingly important as battery deployments accelerate. The EU Battery Directive and similar frameworks in Asia mandate recycling targets and producer responsibility for battery waste. These regulations are driving innovation in dual-ion battery design to facilitate material recovery and reduce environmental impact throughout the product lifecycle.

Grid codes and interconnection standards are being updated to accommodate the unique characteristics of battery storage systems. Requirements for frequency regulation, voltage support, and fault ride-through capabilities are becoming more sophisticated, reflecting the growing role of battery systems in maintaining grid stability. Dual-ion batteries must demonstrate compliance with these technical requirements to secure grid connection approval.

The European Union has implemented the Clean Energy Package, which explicitly recognizes energy storage as a distinct asset class within power systems. This regulatory framework enables dual-ion battery systems to participate in multiple market segments simultaneously, enhancing their economic viability. Additionally, the EU's Sustainable Finance Taxonomy classifies energy storage technologies based on their environmental impact, providing incentives for low-carbon solutions like advanced battery systems.

Safety standards represent a critical regulatory component for grid-scale battery deployment. Organizations such as UL, IEC, and IEEE have developed specific standards addressing fire protection, thermal runaway prevention, and operational safety for large-scale battery installations. Dual-ion batteries must demonstrate compliance with these standards, which typically include rigorous testing protocols for thermal stability, cycle life, and failure mode analysis.

Permitting processes for grid storage installations vary significantly by jurisdiction, creating challenges for widespread deployment. Environmental impact assessments, grid interconnection studies, and local zoning requirements can extend project timelines and increase costs. Several countries have initiated regulatory streamlining efforts to address these barriers, including expedited permitting for systems below certain capacity thresholds.

End-of-life management regulations are increasingly important as battery deployments accelerate. The EU Battery Directive and similar frameworks in Asia mandate recycling targets and producer responsibility for battery waste. These regulations are driving innovation in dual-ion battery design to facilitate material recovery and reduce environmental impact throughout the product lifecycle.

Grid codes and interconnection standards are being updated to accommodate the unique characteristics of battery storage systems. Requirements for frequency regulation, voltage support, and fault ride-through capabilities are becoming more sophisticated, reflecting the growing role of battery systems in maintaining grid stability. Dual-ion batteries must demonstrate compliance with these technical requirements to secure grid connection approval.

Economic Viability and Cost Reduction Strategies

The economic viability of dual-ion batteries (DIBs) for grid storage and industrial energy management solutions hinges on several critical factors. Current cost analyses indicate that DIBs have potential advantages over conventional lithium-ion batteries, with material costs estimated to be 30-40% lower due to the absence of expensive cathode materials like cobalt and nickel. The use of aluminum and graphite as primary electrode materials significantly reduces raw material expenses, positioning DIBs as a cost-effective alternative for large-scale applications.

Manufacturing scalability represents another crucial economic consideration. The production processes for DIBs can leverage existing battery manufacturing infrastructure with relatively minor modifications, avoiding the substantial capital investments typically required for new battery technologies. This manufacturing compatibility could accelerate market entry and reduce initial deployment costs by an estimated 25% compared to other emerging battery technologies.

Lifecycle cost analysis reveals promising economic prospects for DIBs. With theoretical cycle lives exceeding 5,000 cycles and minimal capacity degradation rates of 0.01-0.02% per cycle, the levelized cost of storage (LCOS) for DIBs is projected to reach $0.05-0.08 per kWh-cycle at scale. This positions them competitively against other grid storage solutions, particularly for applications requiring frequent cycling.

Several cost reduction strategies are being actively pursued to enhance DIB economic viability. Material optimization efforts focus on developing lower-cost electrolyte formulations that maintain performance while reducing expenses. Current research indicates potential electrolyte cost reductions of 15-20% through solvent substitution and additive optimization without compromising battery performance.

Manufacturing process innovations represent another significant cost reduction pathway. Advanced electrode coating techniques and automated assembly processes could reduce production costs by an estimated 10-15% while improving quality consistency. Additionally, increasing production volumes would enable economies of scale, with modeling suggesting that reaching gigawatt-hour production levels could drive down costs by approximately 30% compared to initial commercial production.

Integration with renewable energy systems offers further economic advantages. DIBs' rapid response capabilities and high power density make them particularly suitable for grid balancing applications, potentially generating additional revenue streams through grid services. Economic modeling indicates that participation in frequency regulation markets could improve return on investment by 15-25% compared to energy arbitrage applications alone.

Manufacturing scalability represents another crucial economic consideration. The production processes for DIBs can leverage existing battery manufacturing infrastructure with relatively minor modifications, avoiding the substantial capital investments typically required for new battery technologies. This manufacturing compatibility could accelerate market entry and reduce initial deployment costs by an estimated 25% compared to other emerging battery technologies.

Lifecycle cost analysis reveals promising economic prospects for DIBs. With theoretical cycle lives exceeding 5,000 cycles and minimal capacity degradation rates of 0.01-0.02% per cycle, the levelized cost of storage (LCOS) for DIBs is projected to reach $0.05-0.08 per kWh-cycle at scale. This positions them competitively against other grid storage solutions, particularly for applications requiring frequent cycling.

Several cost reduction strategies are being actively pursued to enhance DIB economic viability. Material optimization efforts focus on developing lower-cost electrolyte formulations that maintain performance while reducing expenses. Current research indicates potential electrolyte cost reductions of 15-20% through solvent substitution and additive optimization without compromising battery performance.

Manufacturing process innovations represent another significant cost reduction pathway. Advanced electrode coating techniques and automated assembly processes could reduce production costs by an estimated 10-15% while improving quality consistency. Additionally, increasing production volumes would enable economies of scale, with modeling suggesting that reaching gigawatt-hour production levels could drive down costs by approximately 30% compared to initial commercial production.

Integration with renewable energy systems offers further economic advantages. DIBs' rapid response capabilities and high power density make them particularly suitable for grid balancing applications, potentially generating additional revenue streams through grid services. Economic modeling indicates that participation in frequency regulation markets could improve return on investment by 15-25% compared to energy arbitrage applications alone.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!