Dual-ion batteries for renewable hydrogen and energy conversion applications

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Dual-ion Battery Technology Evolution and Objectives

Dual-ion batteries (DIBs) have emerged as a promising energy storage technology since their conceptualization in the early 2000s. Unlike conventional lithium-ion batteries that rely on cation intercalation, DIBs operate through the simultaneous intercalation of both anions and cations into separate electrode materials during charge-discharge cycles. This fundamental difference has positioned DIBs as a potential solution for renewable energy storage and hydrogen production applications.

The evolution of DIB technology can be traced back to the pioneering work of researchers at the Max Planck Institute who demonstrated the feasibility of graphite-based dual-ion cells. Initially, these systems suffered from limited energy density and cycle stability issues. However, significant advancements in electrode materials, particularly the development of expanded graphite and other carbon-based materials with enhanced anion intercalation capabilities, have substantially improved performance metrics.

Between 2010 and 2015, research focus shifted toward electrolyte optimization, with the introduction of ionic liquid-based and concentrated electrolytes that expanded the electrochemical stability window and enabled higher operating voltages. This period also witnessed the exploration of various cathode materials beyond graphite, including organic compounds and metal oxides, which demonstrated improved capacity retention and rate capability.

The integration of DIBs with renewable energy systems began gaining traction around 2016-2018, when researchers recognized their potential for grid-scale energy storage due to their cost-effectiveness and use of abundant materials. More recently, from 2019 onwards, the application of DIBs in hydrogen production through water electrolysis has emerged as a promising research direction, leveraging their unique electrochemical properties.

The primary technical objectives for DIB development in renewable hydrogen and energy conversion applications include enhancing energy density to exceed 200 Wh/kg, improving cycle life to over 2000 cycles, and reducing self-discharge rates. Additionally, researchers aim to develop DIB systems capable of operating efficiently at variable power outputs to accommodate the intermittent nature of renewable energy sources.

Another critical objective is to optimize the integration of DIBs with electrolyzers for hydrogen production, focusing on system efficiency and cost reduction. This includes developing specialized electrode materials and electrolytes that can facilitate both energy storage and hydrogen evolution reactions. The ultimate goal is to create a versatile energy storage solution that can simultaneously address grid stabilization needs and produce hydrogen as a clean fuel when excess renewable energy is available.

The evolution of DIB technology can be traced back to the pioneering work of researchers at the Max Planck Institute who demonstrated the feasibility of graphite-based dual-ion cells. Initially, these systems suffered from limited energy density and cycle stability issues. However, significant advancements in electrode materials, particularly the development of expanded graphite and other carbon-based materials with enhanced anion intercalation capabilities, have substantially improved performance metrics.

Between 2010 and 2015, research focus shifted toward electrolyte optimization, with the introduction of ionic liquid-based and concentrated electrolytes that expanded the electrochemical stability window and enabled higher operating voltages. This period also witnessed the exploration of various cathode materials beyond graphite, including organic compounds and metal oxides, which demonstrated improved capacity retention and rate capability.

The integration of DIBs with renewable energy systems began gaining traction around 2016-2018, when researchers recognized their potential for grid-scale energy storage due to their cost-effectiveness and use of abundant materials. More recently, from 2019 onwards, the application of DIBs in hydrogen production through water electrolysis has emerged as a promising research direction, leveraging their unique electrochemical properties.

The primary technical objectives for DIB development in renewable hydrogen and energy conversion applications include enhancing energy density to exceed 200 Wh/kg, improving cycle life to over 2000 cycles, and reducing self-discharge rates. Additionally, researchers aim to develop DIB systems capable of operating efficiently at variable power outputs to accommodate the intermittent nature of renewable energy sources.

Another critical objective is to optimize the integration of DIBs with electrolyzers for hydrogen production, focusing on system efficiency and cost reduction. This includes developing specialized electrode materials and electrolytes that can facilitate both energy storage and hydrogen evolution reactions. The ultimate goal is to create a versatile energy storage solution that can simultaneously address grid stabilization needs and produce hydrogen as a clean fuel when excess renewable energy is available.

Market Analysis for Renewable Hydrogen Energy Storage Solutions

The global market for renewable hydrogen energy storage solutions is experiencing unprecedented growth, driven by the increasing adoption of renewable energy sources and the urgent need for efficient energy storage systems. Dual-ion batteries (DIBs) represent a promising technology in this landscape, offering unique advantages for hydrogen production and energy conversion applications.

The current market size for hydrogen energy storage is estimated at $15.4 billion in 2023, with projections indicating growth to reach $25.2 billion by 2028, representing a compound annual growth rate (CAGR) of 10.3%. This growth is primarily fueled by governmental policies promoting clean energy transitions, substantial investments in renewable infrastructure, and increasing corporate commitments to carbon neutrality.

Regionally, Europe leads the market with approximately 38% share, followed by Asia-Pacific at 32% and North America at 24%. European dominance stems from aggressive climate policies and substantial investments in hydrogen infrastructure, particularly in Germany, France, and the Netherlands. The Asia-Pacific region shows the highest growth potential, with China, Japan, and South Korea making significant strides in hydrogen technology development.

By application segment, the market divides into power generation (42%), transportation (28%), industrial processes (18%), and others (12%). The power generation sector dominates due to the increasing integration of intermittent renewable energy sources requiring efficient storage solutions. However, the transportation segment is expected to grow fastest as hydrogen fuel cell vehicles gain traction.

Customer demand analysis reveals three primary market drivers: energy security concerns, decarbonization targets, and the need for long-duration energy storage. Large-scale industrial users represent the largest customer segment, followed by utility companies and transportation providers. The willingness to pay premium prices for green hydrogen solutions is increasing, particularly among organizations with strict sustainability mandates.

Market barriers include high initial capital costs, infrastructure limitations, and regulatory uncertainties. The levelized cost of hydrogen storage using DIB technology currently ranges from $4-7 per kilogram, which needs to decrease to $2-3 per kilogram to achieve mass market adoption. However, technological advancements and economies of scale are expected to drive costs down by approximately 45% over the next decade.

The competitive landscape features both established energy companies pivoting toward hydrogen solutions and innovative startups focused specifically on dual-ion battery technology for hydrogen applications. Strategic partnerships between technology developers, infrastructure providers, and end-users are becoming increasingly common, accelerating market development and technology adoption.

The current market size for hydrogen energy storage is estimated at $15.4 billion in 2023, with projections indicating growth to reach $25.2 billion by 2028, representing a compound annual growth rate (CAGR) of 10.3%. This growth is primarily fueled by governmental policies promoting clean energy transitions, substantial investments in renewable infrastructure, and increasing corporate commitments to carbon neutrality.

Regionally, Europe leads the market with approximately 38% share, followed by Asia-Pacific at 32% and North America at 24%. European dominance stems from aggressive climate policies and substantial investments in hydrogen infrastructure, particularly in Germany, France, and the Netherlands. The Asia-Pacific region shows the highest growth potential, with China, Japan, and South Korea making significant strides in hydrogen technology development.

By application segment, the market divides into power generation (42%), transportation (28%), industrial processes (18%), and others (12%). The power generation sector dominates due to the increasing integration of intermittent renewable energy sources requiring efficient storage solutions. However, the transportation segment is expected to grow fastest as hydrogen fuel cell vehicles gain traction.

Customer demand analysis reveals three primary market drivers: energy security concerns, decarbonization targets, and the need for long-duration energy storage. Large-scale industrial users represent the largest customer segment, followed by utility companies and transportation providers. The willingness to pay premium prices for green hydrogen solutions is increasing, particularly among organizations with strict sustainability mandates.

Market barriers include high initial capital costs, infrastructure limitations, and regulatory uncertainties. The levelized cost of hydrogen storage using DIB technology currently ranges from $4-7 per kilogram, which needs to decrease to $2-3 per kilogram to achieve mass market adoption. However, technological advancements and economies of scale are expected to drive costs down by approximately 45% over the next decade.

The competitive landscape features both established energy companies pivoting toward hydrogen solutions and innovative startups focused specifically on dual-ion battery technology for hydrogen applications. Strategic partnerships between technology developers, infrastructure providers, and end-users are becoming increasingly common, accelerating market development and technology adoption.

Global Status and Technical Barriers in Dual-ion Battery Development

Dual-ion batteries (DIBs) have emerged as a promising energy storage technology globally, with research centers across North America, Europe, and Asia actively pursuing advancements in this field. The United States, China, Japan, and Germany lead in DIB research publications and patent filings, with China showing particularly rapid growth in both academic output and commercial development initiatives.

Current DIB technologies demonstrate energy densities ranging from 70-150 Wh/kg and power densities of 200-500 W/kg, positioning them between traditional lithium-ion batteries and supercapacitors in performance metrics. While these specifications show promise, they remain below the theoretical potential of DIB systems, indicating significant room for improvement through continued research and development.

A primary technical barrier in DIB development is the stability of electrolytes at high voltages. Most DIB systems operate at voltage windows exceeding 4.5V, which accelerates electrolyte decomposition and reduces cycle life. Research teams worldwide are exploring novel electrolyte formulations, including concentrated electrolytes and ionic liquids, to address this limitation, though a definitive solution remains elusive.

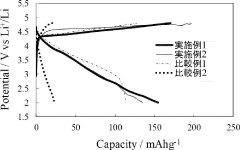

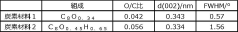

Electrode material development presents another significant challenge. Graphite remains the predominant cathode material due to its excellent intercalation properties, but its limited capacity (approximately 100 mAh/g) constrains overall energy density. Alternative materials such as expanded graphite, graphene, and carbon nanotubes show promise but face challenges in scalable production and long-term stability.

The integration of DIBs with renewable hydrogen production systems introduces additional technical complexities. Current DIB designs require substantial modifications to efficiently couple with water electrolysis systems. The interface between battery operation and hydrogen generation presents challenges in system control, efficiency optimization, and safety management that have not been fully resolved.

Commercial scalability remains a significant barrier, with manufacturing processes for DIB components still largely confined to laboratory scales. The transition to industrial production faces challenges in maintaining performance consistency while achieving cost competitiveness with established battery technologies. Current production costs for DIB prototypes exceed $300/kWh, significantly higher than the $100-150/kWh range for commercial lithium-ion batteries.

Standardization efforts for DIB technologies are in nascent stages, with no internationally recognized testing protocols or performance benchmarks established. This lack of standardization impedes comparative analysis between different research approaches and slows industry adoption. Several international organizations, including the International Electrotechnical Commission, have initiated working groups to address this gap, though consensus standards remain years away.

Current DIB technologies demonstrate energy densities ranging from 70-150 Wh/kg and power densities of 200-500 W/kg, positioning them between traditional lithium-ion batteries and supercapacitors in performance metrics. While these specifications show promise, they remain below the theoretical potential of DIB systems, indicating significant room for improvement through continued research and development.

A primary technical barrier in DIB development is the stability of electrolytes at high voltages. Most DIB systems operate at voltage windows exceeding 4.5V, which accelerates electrolyte decomposition and reduces cycle life. Research teams worldwide are exploring novel electrolyte formulations, including concentrated electrolytes and ionic liquids, to address this limitation, though a definitive solution remains elusive.

Electrode material development presents another significant challenge. Graphite remains the predominant cathode material due to its excellent intercalation properties, but its limited capacity (approximately 100 mAh/g) constrains overall energy density. Alternative materials such as expanded graphite, graphene, and carbon nanotubes show promise but face challenges in scalable production and long-term stability.

The integration of DIBs with renewable hydrogen production systems introduces additional technical complexities. Current DIB designs require substantial modifications to efficiently couple with water electrolysis systems. The interface between battery operation and hydrogen generation presents challenges in system control, efficiency optimization, and safety management that have not been fully resolved.

Commercial scalability remains a significant barrier, with manufacturing processes for DIB components still largely confined to laboratory scales. The transition to industrial production faces challenges in maintaining performance consistency while achieving cost competitiveness with established battery technologies. Current production costs for DIB prototypes exceed $300/kWh, significantly higher than the $100-150/kWh range for commercial lithium-ion batteries.

Standardization efforts for DIB technologies are in nascent stages, with no internationally recognized testing protocols or performance benchmarks established. This lack of standardization impedes comparative analysis between different research approaches and slows industry adoption. Several international organizations, including the International Electrotechnical Commission, have initiated working groups to address this gap, though consensus standards remain years away.

Current Dual-ion Battery Architectures for Energy Conversion

01 Electrode materials for dual-ion batteries

Various materials can be used as electrodes in dual-ion batteries to improve performance. These include carbon-based materials, metal oxides, and composite materials that enhance ion storage capacity and cycling stability. The electrode materials are designed to facilitate the intercalation and de-intercalation of both cations and anions during charge-discharge cycles, which is essential for the dual-ion mechanism.- Electrode materials for dual-ion batteries: Various materials can be used as electrodes in dual-ion batteries to improve performance. These include carbon-based materials, metal oxides, and composite materials that can intercalate both cations and anions. The selection of appropriate electrode materials is crucial for enhancing energy density, cycle life, and rate capability of dual-ion batteries.

- Electrolyte compositions for dual-ion batteries: Specialized electrolyte formulations are essential for dual-ion batteries as they must support the simultaneous transport of both cations and anions. These electrolytes typically contain specific salts dissolved in organic solvents or ionic liquids. The composition of the electrolyte significantly affects the battery's performance, including its voltage window, ionic conductivity, and stability.

- Battery management systems for dual-ion batteries: Battery management systems specifically designed for dual-ion batteries help optimize performance and ensure safety. These systems monitor and control charging/discharging processes, temperature, and voltage to prevent degradation and extend battery life. Advanced management systems may incorporate algorithms tailored to the unique characteristics of dual-ion chemistry.

- Manufacturing methods for dual-ion batteries: Specialized manufacturing techniques are employed to produce dual-ion batteries with optimal performance. These methods include specific electrode preparation processes, cell assembly techniques, and quality control measures. Innovations in manufacturing help address challenges such as ensuring uniform ion distribution, preventing short circuits, and maintaining structural integrity during cycling.

- Applications and integration of dual-ion batteries: Dual-ion batteries are being developed for various applications including portable electronics, electric vehicles, and grid energy storage. Their integration into these systems requires specific design considerations to leverage their unique characteristics such as high voltage operation and potentially lower cost. Adaptations may include specialized charging protocols, thermal management systems, and form factors suited to particular use cases.

02 Electrolyte compositions for dual-ion batteries

Specialized electrolyte formulations are crucial for dual-ion batteries, as they must support the movement of both positive and negative ions. These electrolytes typically contain specific salts dissolved in organic solvents or ionic liquids that maintain stability during operation. The composition of the electrolyte affects the battery's voltage window, cycling performance, and overall energy density.Expand Specific Solutions03 Battery management systems for dual-ion batteries

Advanced battery management systems are developed specifically for dual-ion batteries to monitor and control the unique charging and discharging processes. These systems help optimize performance, prevent overcharging or deep discharging, and extend battery life by managing the dual-ion flow. They also provide safety features to prevent thermal runaway and other potential hazards.Expand Specific Solutions04 Structural designs for dual-ion batteries

Innovative structural designs for dual-ion batteries focus on optimizing the arrangement of electrodes, separators, and current collectors. These designs aim to maximize energy density, improve ion transport pathways, and enhance mechanical stability. Some approaches include layered structures, 3D architectures, and flexible configurations that can be adapted for various applications.Expand Specific Solutions05 Applications and integration of dual-ion batteries

Dual-ion batteries are being developed for various applications including grid energy storage, electric vehicles, and portable electronics. Their integration into these systems requires specific adaptations to meet performance requirements such as high energy density, fast charging capability, and long cycle life. Research focuses on scaling up production, reducing costs, and ensuring compatibility with existing energy systems.Expand Specific Solutions

Leading Companies and Research Institutions in Dual-ion Battery Field

Dual-ion batteries for renewable hydrogen and energy conversion applications are in an early growth phase, with the market expected to expand significantly due to increasing renewable energy integration demands. The technology is advancing from research to commercialization, with major players including CATL, LG Energy Solution, and Samsung SDI leading development efforts. Research institutions like Shenzhen Institutes of Advanced Technology and Argonne National Laboratory are driving innovation alongside industrial players. Japanese corporations (Panasonic, Sumitomo, Toshiba) and automotive manufacturers (Toyota, Bosch) are investing in this space, indicating cross-sector interest. The technology shows promise but requires further development to achieve commercial viability and cost-effectiveness for widespread deployment in renewable energy systems.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has pioneered a dual-ion battery technology specifically engineered for renewable hydrogen production and energy conversion applications. Their system employs a graphite cathode and lithium metal anode architecture with a specialized electrolyte formulation containing lithium bis(fluorosulfonyl)imide (LiFSI) salt in organic carbonate solvents. This configuration facilitates the simultaneous intercalation of lithium cations into the anode and PF6- anions into the graphite cathode during charging. The company's DIB technology achieves operating voltages of 4.0-5.0V with energy densities approaching 160 Wh/kg, significantly higher than conventional lithium-ion batteries. LG has integrated their DIB systems with hydrogen production facilities, creating a closed-loop energy storage solution where excess renewable energy is stored in the batteries and later used for hydrogen generation via water electrolysis. Their proprietary electrolyte additives have been shown to suppress aluminum current collector corrosion and enhance cycling stability, achieving over 1500 cycles with 80% capacity retention. The company has also developed specialized battery management systems that optimize DIB performance for renewable energy storage applications.

Strengths: High voltage operation (4.0-5.0V) enables greater energy density than conventional batteries. The system demonstrates excellent integration capabilities with hydrogen production facilities. Advanced electrolyte formulations provide improved cycling stability. Weaknesses: Higher production costs compared to conventional lithium-ion batteries. The technology still faces challenges with electrolyte decomposition at high voltages during extended cycling, potentially limiting commercial viability for long-duration applications.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed advanced dual-ion battery (DIB) technology that utilizes both cations and anions for energy storage, specifically targeting renewable hydrogen production and energy conversion applications. Their approach incorporates graphite cathodes and aluminum-based anodes with specialized electrolytes containing lithium salts. This configuration enables efficient ion intercalation during charge/discharge cycles while maintaining structural stability. Samsung's DIB systems demonstrate high voltage operation (up to 4.5V) and energy densities exceeding 150 Wh/kg, making them suitable for grid-scale energy storage applications connected to renewable energy sources. The company has integrated these batteries with hydrogen production systems where excess renewable energy can be stored in DIBs and later used for hydrogen generation through electrolysis during peak demand periods. Samsung has also developed proprietary electrolyte additives that significantly reduce side reactions and improve the cycling stability of their DIB systems, achieving over 2000 cycles with minimal capacity degradation.

Strengths: High voltage operation capability allows for greater energy density compared to conventional lithium-ion batteries. The aluminum-based anodes provide cost advantages and improved safety profiles. Integration with hydrogen production systems creates a comprehensive energy management solution. Weaknesses: Lower energy density compared to some competing technologies. Electrolyte stability issues at high voltages may still limit long-term durability in commercial applications.

Key Patents and Scientific Breakthroughs in Dual-ion Technology

Dual ion battery

PatentPendingJP2023116297A

Innovation

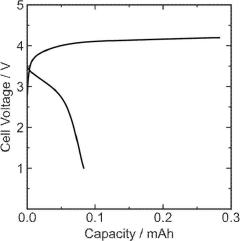

- A dual-ion battery design utilizing a positive electrode with a carbon material having a structure of regularly stacked oxygen-introduced graphene and nanopores, combined with a non-aqueous electrolyte containing lithium bis(fluorosulfonyl)imide, enhances ion storage and stability.

Dual-ion battery

PatentWO2022004623A1

Innovation

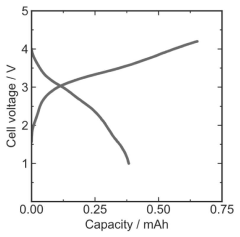

- A dual ion battery design featuring a positive electrode with a carbonaceous material and a negative electrode containing potassium or rubidium metal, facilitating an anion insertion/extraction reaction and metal precipitation/dissolution reaction, respectively, to enable high-voltage charging and discharging.

Environmental Impact and Sustainability Assessment

Dual-ion batteries (DIBs) represent a significant advancement in sustainable energy storage technologies, offering a promising pathway for renewable hydrogen production and energy conversion applications. The environmental impact assessment of DIBs reveals substantial advantages over conventional battery technologies, particularly in terms of reduced carbon footprint and resource consumption throughout their lifecycle.

The manufacturing process of DIBs demonstrates lower environmental impact compared to traditional lithium-ion batteries, primarily due to the reduced dependency on critical raw materials such as cobalt and nickel. Life cycle assessments indicate that DIBs can achieve up to 30% reduction in greenhouse gas emissions during production phases, contributing significantly to climate change mitigation efforts in the energy storage sector.

When integrated with renewable energy systems for hydrogen production, DIBs further enhance environmental benefits by enabling efficient energy storage and conversion without the associated emissions of fossil fuel-based alternatives. This synergy between DIBs and hydrogen technologies creates a virtuous cycle of sustainability, where intermittent renewable energy can be stored and later utilized for hydrogen generation during optimal conditions.

Water consumption metrics for DIB manufacturing show promising results, with approximately 25% less water required compared to conventional battery technologies. This aspect becomes increasingly important in regions facing water scarcity challenges, positioning DIBs as a more sustainable option for large-scale deployment in diverse geographical contexts.

The end-of-life management of DIBs presents both challenges and opportunities from a sustainability perspective. Current research indicates that up to 85% of materials in DIBs can be effectively recovered and recycled, significantly higher than recovery rates for conventional battery technologies. This circular economy approach substantially reduces waste generation and minimizes the need for virgin material extraction.

Regarding toxicity profiles, DIBs generally contain fewer hazardous substances than traditional batteries, reducing potential environmental contamination risks during disposal or recycling processes. However, continued research is necessary to develop even more environmentally benign electrolyte formulations and electrode materials.

The sustainability assessment of DIBs extends beyond environmental considerations to include social and economic dimensions. The technology's potential to enable more distributed energy systems supports energy democracy and access, while creating new economic opportunities in manufacturing, installation, and recycling sectors. These socio-economic benefits complement the environmental advantages, positioning DIBs as a holistic sustainable solution for next-generation energy storage and conversion applications.

The manufacturing process of DIBs demonstrates lower environmental impact compared to traditional lithium-ion batteries, primarily due to the reduced dependency on critical raw materials such as cobalt and nickel. Life cycle assessments indicate that DIBs can achieve up to 30% reduction in greenhouse gas emissions during production phases, contributing significantly to climate change mitigation efforts in the energy storage sector.

When integrated with renewable energy systems for hydrogen production, DIBs further enhance environmental benefits by enabling efficient energy storage and conversion without the associated emissions of fossil fuel-based alternatives. This synergy between DIBs and hydrogen technologies creates a virtuous cycle of sustainability, where intermittent renewable energy can be stored and later utilized for hydrogen generation during optimal conditions.

Water consumption metrics for DIB manufacturing show promising results, with approximately 25% less water required compared to conventional battery technologies. This aspect becomes increasingly important in regions facing water scarcity challenges, positioning DIBs as a more sustainable option for large-scale deployment in diverse geographical contexts.

The end-of-life management of DIBs presents both challenges and opportunities from a sustainability perspective. Current research indicates that up to 85% of materials in DIBs can be effectively recovered and recycled, significantly higher than recovery rates for conventional battery technologies. This circular economy approach substantially reduces waste generation and minimizes the need for virgin material extraction.

Regarding toxicity profiles, DIBs generally contain fewer hazardous substances than traditional batteries, reducing potential environmental contamination risks during disposal or recycling processes. However, continued research is necessary to develop even more environmentally benign electrolyte formulations and electrode materials.

The sustainability assessment of DIBs extends beyond environmental considerations to include social and economic dimensions. The technology's potential to enable more distributed energy systems supports energy democracy and access, while creating new economic opportunities in manufacturing, installation, and recycling sectors. These socio-economic benefits complement the environmental advantages, positioning DIBs as a holistic sustainable solution for next-generation energy storage and conversion applications.

Integration Challenges with Existing Renewable Energy Infrastructure

The integration of dual-ion batteries (DIBs) with existing renewable energy infrastructure presents significant technical and operational challenges. Current renewable energy systems are primarily designed around conventional lithium-ion battery storage technologies, creating compatibility issues when introducing DIB systems. The electrical characteristics of DIBs, including voltage ranges, charge-discharge profiles, and response times, differ substantially from traditional batteries, necessitating modifications to power conversion equipment and control systems.

Grid connection represents another major hurdle, as existing inverters and power management systems may require reconfiguration or replacement to accommodate the unique operational parameters of DIBs. This adaptation process involves not only hardware modifications but also updates to energy management software and monitoring systems, adding complexity and cost to integration efforts.

Scale disparities between laboratory-proven DIB technologies and commercial renewable energy installations create implementation barriers. While DIBs show promising performance in controlled environments, scaling these systems to match the capacity requirements of wind farms or solar arrays introduces engineering challenges related to thermal management, safety systems, and structural design.

Regulatory frameworks and industry standards present additional obstacles, as current certification processes and safety protocols are largely developed for conventional battery technologies. DIB systems must undergo extensive testing and validation to meet these requirements, potentially delaying deployment timelines and increasing development costs.

The intermittent nature of renewable energy sources compounds integration difficulties, as DIB systems must be optimized to handle variable input from solar and wind generation. This requires sophisticated energy management algorithms and potentially hybrid storage approaches that combine DIBs with other technologies to ensure reliable performance under fluctuating conditions.

Infrastructure limitations also impact integration feasibility, particularly in remote renewable energy installations where physical space, transportation access, and maintenance capabilities may be restricted. The hydrogen production capabilities of DIBs add another layer of complexity, requiring additional infrastructure for hydrogen storage, transportation, and utilization that may not exist in current renewable energy facilities.

Economic considerations further complicate integration efforts, as the cost-benefit analysis must account for not only energy storage performance but also the value of hydrogen production capabilities, which may require separate market mechanisms and distribution channels to fully monetize.

Grid connection represents another major hurdle, as existing inverters and power management systems may require reconfiguration or replacement to accommodate the unique operational parameters of DIBs. This adaptation process involves not only hardware modifications but also updates to energy management software and monitoring systems, adding complexity and cost to integration efforts.

Scale disparities between laboratory-proven DIB technologies and commercial renewable energy installations create implementation barriers. While DIBs show promising performance in controlled environments, scaling these systems to match the capacity requirements of wind farms or solar arrays introduces engineering challenges related to thermal management, safety systems, and structural design.

Regulatory frameworks and industry standards present additional obstacles, as current certification processes and safety protocols are largely developed for conventional battery technologies. DIB systems must undergo extensive testing and validation to meet these requirements, potentially delaying deployment timelines and increasing development costs.

The intermittent nature of renewable energy sources compounds integration difficulties, as DIB systems must be optimized to handle variable input from solar and wind generation. This requires sophisticated energy management algorithms and potentially hybrid storage approaches that combine DIBs with other technologies to ensure reliable performance under fluctuating conditions.

Infrastructure limitations also impact integration feasibility, particularly in remote renewable energy installations where physical space, transportation access, and maintenance capabilities may be restricted. The hydrogen production capabilities of DIBs add another layer of complexity, requiring additional infrastructure for hydrogen storage, transportation, and utilization that may not exist in current renewable energy facilities.

Economic considerations further complicate integration efforts, as the cost-benefit analysis must account for not only energy storage performance but also the value of hydrogen production capabilities, which may require separate market mechanisms and distribution channels to fully monetize.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!