What are the key regulatory requirements for Dual-ion batteries in EV and industrial deployment

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Dual-ion Battery Technology Background and Objectives

Dual-ion batteries (DIBs) represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. First conceptualized in the 1990s, DIBs have gained substantial research attention over the past decade due to their unique operating mechanism that utilizes both cations and anions during charge-discharge cycles. This bidirectional ion movement distinguishes DIBs from traditional battery systems and offers potential advantages in terms of energy density, cost-effectiveness, and environmental sustainability.

The technological evolution of DIBs has been marked by significant improvements in electrode materials, electrolyte compositions, and cell architectures. Early DIB prototypes suffered from limited cycle life and energy density, but recent advancements in graphitic carbon cathodes, metal-based anodes, and specialized electrolytes have substantially enhanced performance metrics. The development trajectory shows a clear trend toward higher voltage windows, improved capacity retention, and enhanced rate capabilities.

In the context of electric vehicles (EVs) and industrial applications, DIBs present a compelling value proposition due to their potential for higher energy density, faster charging capabilities, and reduced reliance on critical raw materials like cobalt and nickel. These advantages align well with the automotive industry's push toward more sustainable and cost-effective battery solutions for next-generation electric mobility.

The regulatory landscape for DIBs is currently evolving, with frameworks being adapted from existing battery technologies. As DIBs move closer to commercial deployment in EVs and industrial settings, establishing clear regulatory guidelines becomes increasingly critical. These regulations must address safety standards, performance requirements, environmental impact assessments, and end-of-life management protocols specific to the unique characteristics of dual-ion chemistry.

The primary technical objectives for DIB development in EV and industrial applications include achieving energy densities exceeding 300 Wh/kg, cycle life of over 2,000 cycles, fast charging capabilities (80% in under 15 minutes), and operational stability across wide temperature ranges (-20°C to 60°C). Additionally, meeting stringent safety requirements for thermal runaway prevention, mechanical integrity, and electrical safety represents a crucial development goal.

Regulatory objectives focus on establishing standardized testing protocols, certification procedures, and safety requirements tailored to DIB technology. This includes developing specific guidelines for transportation, installation, operation, and recycling that account for the distinct chemical composition and operational characteristics of dual-ion systems. Harmonizing these regulations across major markets (EU, US, China, Japan) will be essential for facilitating global adoption and commercialization.

The technological evolution of DIBs has been marked by significant improvements in electrode materials, electrolyte compositions, and cell architectures. Early DIB prototypes suffered from limited cycle life and energy density, but recent advancements in graphitic carbon cathodes, metal-based anodes, and specialized electrolytes have substantially enhanced performance metrics. The development trajectory shows a clear trend toward higher voltage windows, improved capacity retention, and enhanced rate capabilities.

In the context of electric vehicles (EVs) and industrial applications, DIBs present a compelling value proposition due to their potential for higher energy density, faster charging capabilities, and reduced reliance on critical raw materials like cobalt and nickel. These advantages align well with the automotive industry's push toward more sustainable and cost-effective battery solutions for next-generation electric mobility.

The regulatory landscape for DIBs is currently evolving, with frameworks being adapted from existing battery technologies. As DIBs move closer to commercial deployment in EVs and industrial settings, establishing clear regulatory guidelines becomes increasingly critical. These regulations must address safety standards, performance requirements, environmental impact assessments, and end-of-life management protocols specific to the unique characteristics of dual-ion chemistry.

The primary technical objectives for DIB development in EV and industrial applications include achieving energy densities exceeding 300 Wh/kg, cycle life of over 2,000 cycles, fast charging capabilities (80% in under 15 minutes), and operational stability across wide temperature ranges (-20°C to 60°C). Additionally, meeting stringent safety requirements for thermal runaway prevention, mechanical integrity, and electrical safety represents a crucial development goal.

Regulatory objectives focus on establishing standardized testing protocols, certification procedures, and safety requirements tailored to DIB technology. This includes developing specific guidelines for transportation, installation, operation, and recycling that account for the distinct chemical composition and operational characteristics of dual-ion systems. Harmonizing these regulations across major markets (EU, US, China, Japan) will be essential for facilitating global adoption and commercialization.

Market Demand Analysis for EV and Industrial Applications

The dual-ion battery (DIB) market for electric vehicles (EVs) and industrial applications is experiencing significant growth driven by the global push towards electrification and sustainable energy solutions. Current market analysis indicates that the EV sector alone is projected to reach $802 billion by 2030, with battery technologies being a critical component of this expansion. DIBs are gaining attention as potential alternatives to conventional lithium-ion batteries due to their cost advantages, improved safety profiles, and reduced dependency on critical raw materials.

In the EV segment, market demand is primarily driven by the need for batteries with higher energy density, faster charging capabilities, and longer cycle life. DIBs show promise in addressing these requirements, particularly in applications where cost considerations outweigh absolute energy density requirements. The commercial vehicle sector, including delivery vans and public transportation, represents a particularly promising market segment for DIB technology due to predictable routes and regular charging schedules.

Industrial applications present another substantial market opportunity for DIBs. Stationary energy storage systems for grid stabilization, renewable energy integration, and backup power are experiencing rapid growth, with the global market expected to deploy over 400 GWh of capacity by 2030. DIBs' potential advantages in these applications include lower cost per kWh, enhanced safety characteristics, and potentially longer operational lifetimes compared to conventional lithium-ion technologies.

Regional market analysis reveals varying adoption potentials. Europe leads in regulatory support for sustainable battery technologies, with initiatives like the European Battery Alliance and the European Battery Regulation creating favorable conditions for DIB deployment. Asia-Pacific represents the largest manufacturing base, with China, Japan, and South Korea investing heavily in next-generation battery technologies. North America shows strong interest in DIBs for grid-scale applications and commercial vehicle fleets.

Customer demand patterns indicate growing interest in total cost of ownership rather than upfront costs alone. DIBs' potential advantages in cycle life and reduced maintenance requirements align well with this market shift. Additionally, corporate sustainability goals and ESG (Environmental, Social, and Governance) requirements are creating demand for batteries with improved environmental profiles and reduced reliance on conflict minerals.

Market forecasts suggest that DIBs could capture 5-10% of the EV battery market by 2030, with higher penetration in specific industrial applications where their characteristics provide distinct advantages. The technology's market potential is closely tied to ongoing improvements in energy density and the establishment of dedicated manufacturing infrastructure to achieve economies of scale.

In the EV segment, market demand is primarily driven by the need for batteries with higher energy density, faster charging capabilities, and longer cycle life. DIBs show promise in addressing these requirements, particularly in applications where cost considerations outweigh absolute energy density requirements. The commercial vehicle sector, including delivery vans and public transportation, represents a particularly promising market segment for DIB technology due to predictable routes and regular charging schedules.

Industrial applications present another substantial market opportunity for DIBs. Stationary energy storage systems for grid stabilization, renewable energy integration, and backup power are experiencing rapid growth, with the global market expected to deploy over 400 GWh of capacity by 2030. DIBs' potential advantages in these applications include lower cost per kWh, enhanced safety characteristics, and potentially longer operational lifetimes compared to conventional lithium-ion technologies.

Regional market analysis reveals varying adoption potentials. Europe leads in regulatory support for sustainable battery technologies, with initiatives like the European Battery Alliance and the European Battery Regulation creating favorable conditions for DIB deployment. Asia-Pacific represents the largest manufacturing base, with China, Japan, and South Korea investing heavily in next-generation battery technologies. North America shows strong interest in DIBs for grid-scale applications and commercial vehicle fleets.

Customer demand patterns indicate growing interest in total cost of ownership rather than upfront costs alone. DIBs' potential advantages in cycle life and reduced maintenance requirements align well with this market shift. Additionally, corporate sustainability goals and ESG (Environmental, Social, and Governance) requirements are creating demand for batteries with improved environmental profiles and reduced reliance on conflict minerals.

Market forecasts suggest that DIBs could capture 5-10% of the EV battery market by 2030, with higher penetration in specific industrial applications where their characteristics provide distinct advantages. The technology's market potential is closely tied to ongoing improvements in energy density and the establishment of dedicated manufacturing infrastructure to achieve economies of scale.

Global Regulatory Landscape and Technical Challenges

Dual-ion batteries (DIBs) face a complex global regulatory landscape that varies significantly across regions, creating challenges for manufacturers seeking international deployment in electric vehicles (EVs) and industrial applications. In the European Union, DIBs must comply with the Battery Directive (2006/66/EC) and its recent update, the Battery Regulation (2023/1542), which introduces stricter requirements for carbon footprint declarations, recycled content, and due diligence in supply chains. These regulations specifically address battery chemistry safety, performance standards, and end-of-life management.

In North America, the regulatory framework is more fragmented. The United States lacks a comprehensive federal battery regulation, instead relying on a patchwork of EPA guidelines, DOT transportation requirements (49 CFR), and state-level initiatives like California's advanced battery policies. Canada has recently aligned more closely with EU standards through its Canadian Environmental Protection Act amendments, creating regulatory divergence within the continent.

Asian markets present another layer of complexity. China, as the world's largest battery producer, has implemented GB/T standards specifically for new battery chemistries, including provisions for dual-ion technologies under their New Energy Vehicle (NEV) policies. Japan's stringent safety standards through METI focus heavily on thermal runaway prevention and cycle life verification, while South Korea emphasizes recycling infrastructure through the K-Battery Act.

A significant technical challenge emerges from the lack of standardized testing protocols specifically designed for DIBs. Current regulatory frameworks were largely developed for lithium-ion batteries, creating evaluation gaps for DIBs' unique characteristics such as their different electrolyte behaviors, voltage profiles, and aging mechanisms. This misalignment forces manufacturers to adapt existing protocols that may not accurately reflect DIB performance or safety parameters.

Material certification presents another major hurdle. DIBs often utilize novel electrode materials and electrolyte compositions that lack established safety records in transportation applications. Regulatory bodies require extensive toxicity data, environmental impact assessments, and long-term stability evidence before granting approvals. The absence of harmonized international standards for these materials creates redundant testing requirements across markets.

Transportation regulations pose particular challenges for DIBs due to their unique chemistry. The UN Manual of Tests and Criteria (UN38.3) for dangerous goods transportation lacks specific provisions for dual-ion configurations, creating uncertainty in classification. This regulatory gap has led to inconsistent shipping requirements and potential barriers to global supply chain integration, significantly impacting commercial viability for EV applications where cross-border component sourcing is common.

In North America, the regulatory framework is more fragmented. The United States lacks a comprehensive federal battery regulation, instead relying on a patchwork of EPA guidelines, DOT transportation requirements (49 CFR), and state-level initiatives like California's advanced battery policies. Canada has recently aligned more closely with EU standards through its Canadian Environmental Protection Act amendments, creating regulatory divergence within the continent.

Asian markets present another layer of complexity. China, as the world's largest battery producer, has implemented GB/T standards specifically for new battery chemistries, including provisions for dual-ion technologies under their New Energy Vehicle (NEV) policies. Japan's stringent safety standards through METI focus heavily on thermal runaway prevention and cycle life verification, while South Korea emphasizes recycling infrastructure through the K-Battery Act.

A significant technical challenge emerges from the lack of standardized testing protocols specifically designed for DIBs. Current regulatory frameworks were largely developed for lithium-ion batteries, creating evaluation gaps for DIBs' unique characteristics such as their different electrolyte behaviors, voltage profiles, and aging mechanisms. This misalignment forces manufacturers to adapt existing protocols that may not accurately reflect DIB performance or safety parameters.

Material certification presents another major hurdle. DIBs often utilize novel electrode materials and electrolyte compositions that lack established safety records in transportation applications. Regulatory bodies require extensive toxicity data, environmental impact assessments, and long-term stability evidence before granting approvals. The absence of harmonized international standards for these materials creates redundant testing requirements across markets.

Transportation regulations pose particular challenges for DIBs due to their unique chemistry. The UN Manual of Tests and Criteria (UN38.3) for dangerous goods transportation lacks specific provisions for dual-ion configurations, creating uncertainty in classification. This regulatory gap has led to inconsistent shipping requirements and potential barriers to global supply chain integration, significantly impacting commercial viability for EV applications where cross-border component sourcing is common.

Current Compliance Solutions and Implementation Strategies

01 Electrode materials for dual-ion batteries

Various materials can be used as electrodes in dual-ion batteries to improve performance. These include carbon-based materials, metal oxides, and composite materials that enhance ion storage capacity and cycling stability. The electrode materials are designed to facilitate the intercalation and deintercalation of both cations and anions during charge-discharge cycles, which is a distinctive feature of dual-ion batteries compared to conventional lithium-ion batteries.- Electrode materials for dual-ion batteries: Various materials can be used as electrodes in dual-ion batteries to improve performance. These include carbon-based materials, metal oxides, and composite materials that enhance ion storage capacity and cycling stability. The electrode materials are designed to facilitate the intercalation and de-intercalation of different ions, improving the overall energy density and efficiency of the battery system.

- Electrolyte compositions for dual-ion batteries: Specialized electrolyte formulations are crucial for dual-ion batteries, as they must support the movement of both cations and anions. These electrolytes typically contain specific salts dissolved in organic solvents or ionic liquids that enable efficient ion transport while maintaining electrochemical stability. The composition of the electrolyte significantly affects the battery's performance, including its capacity, rate capability, and cycle life.

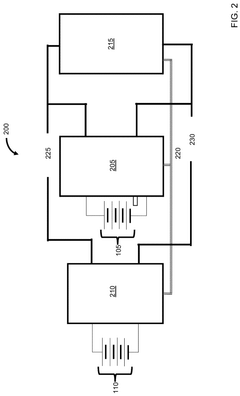

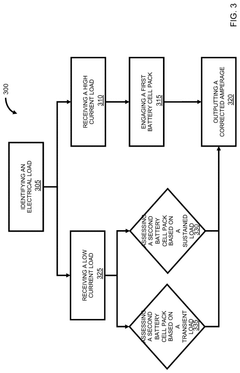

- Battery management systems for dual-ion batteries: Advanced battery management systems are developed specifically for dual-ion batteries to monitor and control the charging and discharging processes. These systems help optimize performance, prevent overcharging or deep discharging, and extend battery life. They include sensors, control algorithms, and protective circuits designed to handle the unique characteristics of dual-ion battery chemistry.

- Structural designs for dual-ion battery cells: Innovative structural designs for dual-ion battery cells focus on optimizing the arrangement of electrodes, separators, and current collectors. These designs aim to maximize energy density, improve ion transport pathways, and enhance mechanical stability. Various cell configurations, including pouch, prismatic, and cylindrical formats, are adapted specifically for dual-ion battery chemistry to address challenges related to volume changes during cycling.

- Applications and integration of dual-ion batteries: Dual-ion batteries are being developed for various applications including portable electronics, electric vehicles, and grid-scale energy storage. Their integration into these systems requires specific adaptations to address thermal management, safety features, and compatibility with existing power management systems. Research focuses on optimizing dual-ion batteries for specific use cases by balancing energy density, power output, cycle life, and cost considerations.

02 Electrolyte compositions for dual-ion batteries

Specialized electrolyte formulations are crucial for dual-ion battery performance. These electrolytes typically contain salts that provide both cations and anions for the dual-ion intercalation process. Innovations in electrolyte composition focus on improving ionic conductivity, electrochemical stability window, and compatibility with electrode materials to enhance overall battery efficiency and lifespan.Expand Specific Solutions03 Battery management systems for dual-ion batteries

Advanced battery management systems are developed specifically for dual-ion batteries to monitor and control charging/discharging processes. These systems help optimize battery performance, prevent overcharging or deep discharging, and extend battery life. They include sophisticated algorithms that account for the unique characteristics of dual-ion chemistry, such as different voltage profiles and state-of-charge indicators compared to conventional batteries.Expand Specific Solutions04 Structural designs for dual-ion batteries

Innovative structural designs for dual-ion batteries focus on optimizing cell architecture to improve energy density, power density, and mechanical stability. These designs include novel cell configurations, separator technologies, and packaging solutions that accommodate the bidirectional ion flow characteristic of dual-ion batteries. Some designs also address thermal management challenges specific to this battery technology.Expand Specific Solutions05 Manufacturing processes for dual-ion batteries

Specialized manufacturing techniques have been developed for dual-ion batteries to ensure consistent quality and performance. These processes include precise methods for electrode preparation, electrolyte filling, and cell assembly that address the unique requirements of dual-ion chemistry. Advanced manufacturing approaches also focus on scalability and cost-effectiveness to make dual-ion technology commercially viable for various applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The dual-ion battery (DIB) market for EV and industrial applications is in an early growth phase, characterized by increasing regulatory scrutiny as the technology matures. Major players including CATL, BYD, and LG Energy Solution are driving innovation while navigating complex regulatory frameworks across different markets. The regulatory landscape focuses on safety standards, performance requirements, and environmental considerations, with particular emphasis on thermal stability and fire prevention—areas where companies like Safire Technology Group are developing specialized solutions. Asian manufacturers, particularly from China, Japan, and South Korea, dominate the competitive landscape, with automotive OEMs like Hyundai, Kia, and Nissan forming strategic partnerships to accelerate commercialization while ensuring compliance with evolving regional certification requirements.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: Contemporary Amperex Technology (CATL) has developed comprehensive regulatory compliance frameworks for dual-ion batteries in EVs, focusing on safety certification standards across global markets. Their approach includes specialized Battery Management Systems (BMS) that monitor ion movement between electrodes to prevent thermal runaway events. CATL has implemented rigorous testing protocols that exceed UN38.3 transportation requirements and comply with IEC 62660 for EV applications. Their regulatory strategy addresses lifecycle management with end-of-life recycling processes that meet EU Battery Directive standards and emerging global regulations. CATL has also pioneered thermal propagation prevention designs that align with GTR No. 20 Phase 2 requirements, incorporating physical cell separation and flame-retardant materials to meet stringent vehicle-level safety standards.

Strengths: Global regulatory expertise across multiple markets; integrated compliance approach from cell to pack level; established relationships with regulatory bodies. Weaknesses: Higher compliance costs potentially affecting market competitiveness; longer certification timelines compared to conventional lithium-ion technologies.

Semiconductor Energy Laboratory Co., Ltd.

Technical Solution: Semiconductor Energy Laboratory (SEL) has pioneered advanced regulatory approaches for dual-ion batteries focusing on materials science compliance. Their strategy addresses the unique challenges of novel electrode materials used in their dual-ion technology, with comprehensive toxicity assessments that meet REACH and RoHS requirements in global markets. SEL has developed specialized testing protocols for evaluating the long-term stability of their proprietary electrolyte formulations, which has been critical for obtaining Japanese regulatory approvals. Their compliance framework includes detailed analysis of ion transport mechanisms during charge-discharge cycles to demonstrate safety under various abuse conditions, meeting JIS C8715-2 standards. SEL has also implemented advanced manufacturing quality control systems that align with ISO 9001 and automotive-specific IATF 16949 requirements, establishing traceability for regulatory documentation from material synthesis through cell production.

Strengths: Deep expertise in materials science regulatory requirements; strong intellectual property position; established relationships with Japanese regulatory authorities. Weaknesses: Limited experience with large-scale automotive deployment regulations; potential challenges scaling laboratory compliance processes to mass production.

Critical Patents and Technical Standards Analysis

Systems and methods for controlling a dual cell bank battery

PatentPendingUS20240372374A1

Innovation

- A dual cell bank battery system comprising a primary battery cell pack and a protective battery cell pack with an electrolyte additive, managed by a battery management system that switches loads based on predetermined thresholds using field-effect transistors and shunts to redirect current, voltage, or temperature loads between the two packs.

dual LITHIUM-ION BATTERY SYSTEM FOR ELECTRIC VEHICLES

PatentInactiveDE102014204211A1

Innovation

- A dual lithium-ion battery system comprising a high-capacity battery pack for transient power demands and a high-energy battery pack for extended range, each optimized for its specific function, controlled by a Battery Energy Control Module to manage power and energy distribution.

Safety Certification Frameworks and Testing Protocols

Dual-ion batteries (DIBs) for electric vehicles (EVs) and industrial applications must adhere to rigorous safety certification frameworks and testing protocols before market deployment. The International Electrotechnical Commission (IEC) has established several standards specifically for battery safety, including IEC 62660 for EV applications and IEC 62619 for industrial implementations. These standards outline comprehensive testing requirements covering thermal stability, electrical performance, mechanical integrity, and environmental resilience.

The UN Transportation Testing (UN 38.3) represents another critical certification framework, mandating altitude simulation, thermal cycling, vibration, shock, external short circuit, impact, overcharge, and forced discharge tests. For DIBs to be transported internationally, compliance with these protocols is non-negotiable, requiring manufacturers to submit detailed test reports and safety documentation.

Regional certification bodies implement additional requirements tailored to local safety priorities. In North America, Underwriters Laboratories (UL) standards such as UL 2580 for EV batteries and UL 1973 for stationary applications establish specific safety parameters. The European Union enforces compliance with the Battery Directive (2006/66/EC) and upcoming Battery Regulation, which introduce stringent safety and sustainability requirements.

Testing protocols for DIBs must address their unique characteristics compared to conventional lithium-ion batteries. The dual-intercalation mechanism necessitates specialized testing for electrolyte stability, electrode degradation, and ion transport dynamics. Accelerated aging tests must evaluate capacity retention and safety performance over extended cycling, while abuse testing protocols examine thermal runaway resistance, gas evolution patterns, and failure modes specific to DIB chemistry.

Real-world validation through field testing represents the final certification hurdle, requiring DIBs to demonstrate safety performance under actual operating conditions. This includes monitoring thermal management during rapid charging/discharging cycles, evaluating battery management system responses to abnormal conditions, and assessing overall system integration safety.

Certification processes are evolving to address emerging concerns about DIB safety, with increasing focus on recyclability, second-life applications, and end-of-life management. Testing protocols now increasingly incorporate sustainability metrics alongside traditional safety parameters, reflecting the holistic approach required for next-generation battery technologies in transportation and industrial energy storage applications.

The UN Transportation Testing (UN 38.3) represents another critical certification framework, mandating altitude simulation, thermal cycling, vibration, shock, external short circuit, impact, overcharge, and forced discharge tests. For DIBs to be transported internationally, compliance with these protocols is non-negotiable, requiring manufacturers to submit detailed test reports and safety documentation.

Regional certification bodies implement additional requirements tailored to local safety priorities. In North America, Underwriters Laboratories (UL) standards such as UL 2580 for EV batteries and UL 1973 for stationary applications establish specific safety parameters. The European Union enforces compliance with the Battery Directive (2006/66/EC) and upcoming Battery Regulation, which introduce stringent safety and sustainability requirements.

Testing protocols for DIBs must address their unique characteristics compared to conventional lithium-ion batteries. The dual-intercalation mechanism necessitates specialized testing for electrolyte stability, electrode degradation, and ion transport dynamics. Accelerated aging tests must evaluate capacity retention and safety performance over extended cycling, while abuse testing protocols examine thermal runaway resistance, gas evolution patterns, and failure modes specific to DIB chemistry.

Real-world validation through field testing represents the final certification hurdle, requiring DIBs to demonstrate safety performance under actual operating conditions. This includes monitoring thermal management during rapid charging/discharging cycles, evaluating battery management system responses to abnormal conditions, and assessing overall system integration safety.

Certification processes are evolving to address emerging concerns about DIB safety, with increasing focus on recyclability, second-life applications, and end-of-life management. Testing protocols now increasingly incorporate sustainability metrics alongside traditional safety parameters, reflecting the holistic approach required for next-generation battery technologies in transportation and industrial energy storage applications.

Environmental Impact and End-of-Life Management

Dual-ion batteries (DIBs) present unique environmental challenges and opportunities compared to conventional lithium-ion batteries. The environmental footprint of DIBs is significantly influenced by their material composition, which typically includes aluminum or graphite cathodes and various electrolyte formulations. Life cycle assessments indicate that DIBs may offer reduced environmental impact due to their reliance on more abundant materials and potentially simpler manufacturing processes, resulting in lower energy consumption during production.

The extraction and processing of raw materials for DIBs generally requires less intensive mining operations compared to traditional lithium-ion batteries, particularly when utilizing aluminum-based cathodes. This translates to reduced habitat disruption, water usage, and greenhouse gas emissions in the material sourcing phase. However, the environmental impact varies considerably depending on specific material choices and manufacturing locations.

During operation, DIBs demonstrate promising environmental performance through their high energy efficiency and reduced risk of thermal runaway events. The absence of cobalt and reduced lithium content addresses critical resource depletion concerns that plague conventional battery technologies. Nevertheless, the electrolytes used in DIBs often contain fluorinated compounds that pose potential environmental risks if released.

End-of-life management for DIBs presents both challenges and opportunities. Current recycling infrastructure is primarily designed for conventional lithium-ion batteries, necessitating adaptation for DIB processing. The simpler chemistry of DIBs potentially enables more straightforward recycling processes, with higher recovery rates for key materials like aluminum and graphite. Several pilot recycling programs have demonstrated recovery rates exceeding 90% for the aluminum components.

Regulatory frameworks governing DIB disposal are still evolving, with the EU Battery Directive and similar regulations in Asia and North America beginning to address these newer battery chemistries. Extended Producer Responsibility (EPR) schemes are increasingly being applied to battery manufacturers, requiring them to establish collection and recycling systems for end-of-life products.

The development of closed-loop systems for DIBs represents a significant opportunity to minimize environmental impact. Second-life applications, particularly in stationary energy storage, can extend the useful life of DIBs before recycling becomes necessary. Research indicates that DIBs may retain sufficient capacity for secondary applications after their performance no longer meets the demanding requirements of electric vehicles.

As DIB technology advances toward commercial deployment, manufacturers must design for disassembly and recyclability from the outset. This design-for-environment approach, coupled with transparent supply chain practices and comprehensive life cycle management, will be essential for minimizing the environmental footprint of this promising battery technology.

The extraction and processing of raw materials for DIBs generally requires less intensive mining operations compared to traditional lithium-ion batteries, particularly when utilizing aluminum-based cathodes. This translates to reduced habitat disruption, water usage, and greenhouse gas emissions in the material sourcing phase. However, the environmental impact varies considerably depending on specific material choices and manufacturing locations.

During operation, DIBs demonstrate promising environmental performance through their high energy efficiency and reduced risk of thermal runaway events. The absence of cobalt and reduced lithium content addresses critical resource depletion concerns that plague conventional battery technologies. Nevertheless, the electrolytes used in DIBs often contain fluorinated compounds that pose potential environmental risks if released.

End-of-life management for DIBs presents both challenges and opportunities. Current recycling infrastructure is primarily designed for conventional lithium-ion batteries, necessitating adaptation for DIB processing. The simpler chemistry of DIBs potentially enables more straightforward recycling processes, with higher recovery rates for key materials like aluminum and graphite. Several pilot recycling programs have demonstrated recovery rates exceeding 90% for the aluminum components.

Regulatory frameworks governing DIB disposal are still evolving, with the EU Battery Directive and similar regulations in Asia and North America beginning to address these newer battery chemistries. Extended Producer Responsibility (EPR) schemes are increasingly being applied to battery manufacturers, requiring them to establish collection and recycling systems for end-of-life products.

The development of closed-loop systems for DIBs represents a significant opportunity to minimize environmental impact. Second-life applications, particularly in stationary energy storage, can extend the useful life of DIBs before recycling becomes necessary. Research indicates that DIBs may retain sufficient capacity for secondary applications after their performance no longer meets the demanding requirements of electric vehicles.

As DIB technology advances toward commercial deployment, manufacturers must design for disassembly and recyclability from the outset. This design-for-environment approach, coupled with transparent supply chain practices and comprehensive life cycle management, will be essential for minimizing the environmental footprint of this promising battery technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!