Evaluation of Dual-ion batteries patents and licensing strategies in advanced energy storage

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Dual-ion Battery Technology Evolution and Objectives

Dual-ion batteries (DIBs) represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. The concept of DIBs was first introduced in the early 1990s, but substantial research momentum only began building in the late 2000s as limitations of traditional battery technologies became increasingly apparent. Unlike conventional batteries where only one type of ion participates in the electrochemical process, DIBs utilize both cations and anions during charge-discharge cycles, potentially offering higher energy density and improved cycling stability.

The technological trajectory of DIBs has been marked by several key advancements. Initially, research focused on proof-of-concept designs using graphite electrodes and conventional electrolytes. By the mid-2010s, significant progress was made in developing specialized electrolytes that could support stable anion intercalation without decomposition at high voltages. Recent years have witnessed innovations in electrode materials, particularly carbon-based materials with optimized structures for ion storage, as well as novel electrolyte formulations that enhance ionic conductivity and electrochemical stability.

Current technological objectives for DIBs center on addressing several critical challenges. Foremost among these is increasing energy density to competitive levels with commercial lithium-ion batteries while maintaining the inherent cost advantages of DIBs. Researchers aim to achieve energy densities exceeding 200 Wh/kg at the cell level, compared to current prototypes that typically deliver 100-150 Wh/kg. Another primary objective is extending cycle life beyond 1000 cycles with minimal capacity degradation, which requires significant improvements in electrode stability during repeated ion intercalation/de-intercalation processes.

Voltage efficiency represents another crucial target, with efforts directed toward minimizing the voltage hysteresis between charge and discharge cycles. Current DIB systems often exhibit voltage inefficiencies that reduce overall energy efficiency. Additionally, rate capability improvement remains a key goal, with researchers working to develop DIBs capable of fast charging while maintaining capacity retention.

From a commercial perspective, the technology aims to leverage potentially lower production costs due to the absence of transition metals in cathodes. This aligns with broader industry objectives of developing more sustainable and resource-efficient energy storage solutions. The ultimate goal is positioning DIBs as a complementary technology to lithium-ion batteries, particularly for stationary energy storage applications where cost considerations often outweigh strict energy density requirements.

The technological trajectory of DIBs has been marked by several key advancements. Initially, research focused on proof-of-concept designs using graphite electrodes and conventional electrolytes. By the mid-2010s, significant progress was made in developing specialized electrolytes that could support stable anion intercalation without decomposition at high voltages. Recent years have witnessed innovations in electrode materials, particularly carbon-based materials with optimized structures for ion storage, as well as novel electrolyte formulations that enhance ionic conductivity and electrochemical stability.

Current technological objectives for DIBs center on addressing several critical challenges. Foremost among these is increasing energy density to competitive levels with commercial lithium-ion batteries while maintaining the inherent cost advantages of DIBs. Researchers aim to achieve energy densities exceeding 200 Wh/kg at the cell level, compared to current prototypes that typically deliver 100-150 Wh/kg. Another primary objective is extending cycle life beyond 1000 cycles with minimal capacity degradation, which requires significant improvements in electrode stability during repeated ion intercalation/de-intercalation processes.

Voltage efficiency represents another crucial target, with efforts directed toward minimizing the voltage hysteresis between charge and discharge cycles. Current DIB systems often exhibit voltage inefficiencies that reduce overall energy efficiency. Additionally, rate capability improvement remains a key goal, with researchers working to develop DIBs capable of fast charging while maintaining capacity retention.

From a commercial perspective, the technology aims to leverage potentially lower production costs due to the absence of transition metals in cathodes. This aligns with broader industry objectives of developing more sustainable and resource-efficient energy storage solutions. The ultimate goal is positioning DIBs as a complementary technology to lithium-ion batteries, particularly for stationary energy storage applications where cost considerations often outweigh strict energy density requirements.

Market Analysis for Advanced Energy Storage Solutions

The global energy storage market is experiencing unprecedented growth, driven by the increasing adoption of renewable energy sources and the need for grid stabilization. The market value reached $180 billion in 2022 and is projected to grow at a CAGR of 8.5% through 2030. Within this landscape, advanced battery technologies are emerging as critical components, with dual-ion batteries (DIBs) representing a promising segment that addresses limitations of conventional lithium-ion batteries.

Dual-ion batteries have attracted significant attention due to their potential cost advantages, with materials costs estimated at 30% lower than traditional lithium-ion batteries. This cost efficiency stems from the use of abundant materials like graphite for both electrodes, reducing dependency on scarce metals such as cobalt and nickel. Market research indicates that DIBs could capture up to 15% of the stationary energy storage market by 2028 if current technical challenges are overcome.

Consumer electronics and electric vehicles represent the largest potential markets for DIBs, with combined annual demand projected to exceed 500 GWh by 2025. However, grid-scale energy storage presents the most immediate opportunity, as this application can better tolerate the current limitations in energy density while benefiting from DIBs' excellent cycling stability and potentially lower costs.

Regional analysis reveals Asia-Pacific as the dominant market for advanced battery technologies, accounting for 45% of global production capacity. China leads patent filings in DIB technology with over 60% of global applications, followed by Japan, South Korea, and the United States. European markets show increasing interest, particularly in Germany and France, where research institutions have established collaborative ventures with industry partners.

Market barriers for DIB commercialization include technical challenges such as limited energy density (currently 30-40% lower than commercial lithium-ion batteries) and electrolyte stability issues. Additionally, the established manufacturing infrastructure for lithium-ion batteries creates significant entry barriers for new technologies, requiring substantial capital investment for scaled production.

Customer demand patterns indicate growing interest in sustainable battery solutions with reduced environmental impact. DIBs offer advantages in this regard, with preliminary lifecycle assessments suggesting a 25% lower carbon footprint compared to conventional lithium-ion batteries. This aligns with regulatory trends toward stricter environmental standards and extended producer responsibility in major markets.

Competitive analysis reveals that while startups hold many foundational patents in DIB technology, established battery manufacturers are increasingly acquiring licenses and developing proprietary variations, suggesting market consolidation may occur before widespread commercialization.

Dual-ion batteries have attracted significant attention due to their potential cost advantages, with materials costs estimated at 30% lower than traditional lithium-ion batteries. This cost efficiency stems from the use of abundant materials like graphite for both electrodes, reducing dependency on scarce metals such as cobalt and nickel. Market research indicates that DIBs could capture up to 15% of the stationary energy storage market by 2028 if current technical challenges are overcome.

Consumer electronics and electric vehicles represent the largest potential markets for DIBs, with combined annual demand projected to exceed 500 GWh by 2025. However, grid-scale energy storage presents the most immediate opportunity, as this application can better tolerate the current limitations in energy density while benefiting from DIBs' excellent cycling stability and potentially lower costs.

Regional analysis reveals Asia-Pacific as the dominant market for advanced battery technologies, accounting for 45% of global production capacity. China leads patent filings in DIB technology with over 60% of global applications, followed by Japan, South Korea, and the United States. European markets show increasing interest, particularly in Germany and France, where research institutions have established collaborative ventures with industry partners.

Market barriers for DIB commercialization include technical challenges such as limited energy density (currently 30-40% lower than commercial lithium-ion batteries) and electrolyte stability issues. Additionally, the established manufacturing infrastructure for lithium-ion batteries creates significant entry barriers for new technologies, requiring substantial capital investment for scaled production.

Customer demand patterns indicate growing interest in sustainable battery solutions with reduced environmental impact. DIBs offer advantages in this regard, with preliminary lifecycle assessments suggesting a 25% lower carbon footprint compared to conventional lithium-ion batteries. This aligns with regulatory trends toward stricter environmental standards and extended producer responsibility in major markets.

Competitive analysis reveals that while startups hold many foundational patents in DIB technology, established battery manufacturers are increasingly acquiring licenses and developing proprietary variations, suggesting market consolidation may occur before widespread commercialization.

Global DIB Technology Landscape and Barriers

The global landscape of Dual-ion Batteries (DIBs) technology reveals a complex interplay of scientific advancement, industrial adoption, and regional development patterns. Currently, Asia-Pacific dominates the DIB research and development ecosystem, with China, Japan, and South Korea leading in patent filings and commercial applications. European countries, particularly Germany and France, have established strong academic foundations in DIB technology, while North American contributions focus primarily on innovative electrode materials and electrolyte formulations.

Despite promising theoretical advantages, DIB technology faces significant barriers to widespread commercialization. The primary technical challenge remains the limited energy density compared to conventional lithium-ion batteries, with current DIB prototypes achieving only 70-80% of commercial LIB energy density. This performance gap creates a substantial market entry barrier, particularly for electric vehicle applications where energy density directly impacts range capabilities.

Cycle stability presents another critical obstacle, with most DIB systems demonstrating significant capacity fade after 500-1000 cycles—insufficient for long-term energy storage applications. This degradation stems largely from structural instability in graphite cathodes during anion intercalation processes, causing exfoliation and active material loss over repeated cycling.

Electrolyte optimization represents perhaps the most complex barrier, requiring systems that simultaneously support efficient anion and cation transport while maintaining stability across wide voltage windows (often exceeding 5V). Current electrolyte formulations struggle with decomposition at higher voltages, limiting the practical energy density achievable in commercial systems.

Manufacturing scalability introduces additional challenges, as DIB production requires modifications to existing battery manufacturing infrastructure. The higher operating voltages necessitate enhanced safety protocols and specialized battery management systems that can handle the unique charging/discharging characteristics of dual-ion chemistry.

Regulatory frameworks worldwide have not yet fully adapted to DIB technology, creating uncertainty regarding safety certification, transportation regulations, and end-of-life recycling protocols. This regulatory ambiguity slows commercial deployment and increases compliance costs for early market entrants.

The intellectual property landscape reveals fragmented patent ownership across multiple institutions and companies, creating potential licensing complexities for manufacturers seeking to commercialize comprehensive DIB solutions. This fragmentation contrasts sharply with the more consolidated IP landscape of traditional lithium-ion technology.

Despite promising theoretical advantages, DIB technology faces significant barriers to widespread commercialization. The primary technical challenge remains the limited energy density compared to conventional lithium-ion batteries, with current DIB prototypes achieving only 70-80% of commercial LIB energy density. This performance gap creates a substantial market entry barrier, particularly for electric vehicle applications where energy density directly impacts range capabilities.

Cycle stability presents another critical obstacle, with most DIB systems demonstrating significant capacity fade after 500-1000 cycles—insufficient for long-term energy storage applications. This degradation stems largely from structural instability in graphite cathodes during anion intercalation processes, causing exfoliation and active material loss over repeated cycling.

Electrolyte optimization represents perhaps the most complex barrier, requiring systems that simultaneously support efficient anion and cation transport while maintaining stability across wide voltage windows (often exceeding 5V). Current electrolyte formulations struggle with decomposition at higher voltages, limiting the practical energy density achievable in commercial systems.

Manufacturing scalability introduces additional challenges, as DIB production requires modifications to existing battery manufacturing infrastructure. The higher operating voltages necessitate enhanced safety protocols and specialized battery management systems that can handle the unique charging/discharging characteristics of dual-ion chemistry.

Regulatory frameworks worldwide have not yet fully adapted to DIB technology, creating uncertainty regarding safety certification, transportation regulations, and end-of-life recycling protocols. This regulatory ambiguity slows commercial deployment and increases compliance costs for early market entrants.

The intellectual property landscape reveals fragmented patent ownership across multiple institutions and companies, creating potential licensing complexities for manufacturers seeking to commercialize comprehensive DIB solutions. This fragmentation contrasts sharply with the more consolidated IP landscape of traditional lithium-ion technology.

Current DIB Patent Portfolios and Licensing Models

01 Dual-ion battery electrode materials and compositions

Various electrode materials and compositions are used in dual-ion batteries to enhance performance. These include specialized cathode and anode materials that can intercalate both anions and cations, improving energy density and cycle life. Advanced electrolyte formulations are also developed to facilitate efficient ion transport between electrodes, which is crucial for dual-ion battery operation.- Dual-ion battery electrode materials and compositions: Various electrode materials and compositions are used in dual-ion batteries to enhance performance. These include specialized cathode and anode materials designed to facilitate the intercalation and de-intercalation of different ions. The materials are selected for their ability to improve energy density, cycling stability, and overall battery efficiency. Innovations in this area focus on novel material combinations and structures that optimize the dual-ion mechanism.

- Electrolyte systems for dual-ion batteries: Electrolyte formulations play a crucial role in dual-ion battery performance. These systems are designed to support the simultaneous movement of different ions between electrodes. Innovations include novel electrolyte compositions, additives that enhance ion mobility, and formulations that prevent unwanted side reactions. Advanced electrolyte systems help improve battery safety, extend cycle life, and enable operation across wider temperature ranges.

- Battery management systems and control methods: Specialized battery management systems are developed for dual-ion batteries to monitor and control their unique operational characteristics. These systems include algorithms for state-of-charge estimation, thermal management solutions, and safety protocols specific to dual-ion chemistry. Advanced control methods help optimize charging/discharging cycles, extend battery lifespan, and prevent degradation mechanisms particular to dual-ion systems.

- Licensing and commercialization strategies: Various approaches to licensing and commercializing dual-ion battery technology are employed in the industry. These include exclusive and non-exclusive licensing agreements, joint development partnerships, and technology transfer arrangements. Strategic considerations include market segmentation, application-specific licensing, and geographic territory restrictions. Effective licensing strategies balance revenue generation with market penetration objectives while protecting core intellectual property.

- Manufacturing processes and scale-up technologies: Specialized manufacturing processes have been developed for dual-ion batteries to address their unique assembly requirements. These include techniques for electrode fabrication, cell assembly methods that accommodate the dual-ion mechanism, and quality control processes specific to this battery type. Innovations focus on scalable production methods, cost reduction strategies, and techniques to ensure consistent performance across mass-produced cells.

02 Manufacturing processes and assembly techniques

Innovative manufacturing processes and assembly techniques are essential for dual-ion battery production. These include specialized methods for electrode preparation, cell assembly, and quality control procedures that ensure consistent performance. Advanced manufacturing techniques help optimize the interface between components and improve overall battery reliability and safety.Expand Specific Solutions03 Battery management systems and control methods

Battery management systems and control methods are developed specifically for dual-ion batteries to optimize performance and extend lifespan. These systems monitor and regulate charging/discharging processes, temperature, and other operational parameters. Advanced algorithms are implemented to predict battery behavior and prevent degradation mechanisms unique to dual-ion chemistry.Expand Specific Solutions04 Patent portfolio development and protection strategies

Strategic approaches to developing and protecting dual-ion battery intellectual property include comprehensive patent filing strategies across multiple jurisdictions. Companies focus on building robust patent portfolios covering core technologies, manufacturing processes, and applications. Defensive patenting strategies are employed to create freedom to operate while blocking competitors from key technological areas.Expand Specific Solutions05 Licensing models and commercialization approaches

Various licensing models and commercialization approaches are utilized in the dual-ion battery industry. These include exclusive and non-exclusive licensing agreements, cross-licensing arrangements between technology developers, and strategic partnerships for market entry. Royalty structures are designed to balance upfront payments with ongoing fees based on production volume or revenue generation.Expand Specific Solutions

Key Industry Players and Patent Holders

The dual-ion batteries (DIBs) market is currently in an early growth phase, characterized by increasing patent activity and strategic licensing agreements among key players. The global market size is projected to expand significantly as DIBs offer advantages in energy density, cost, and sustainability over conventional lithium-ion technologies. From a technological maturity perspective, companies like Contemporary Amperex Technology (CATL), LG Energy Solution, and Samsung SDI are leading commercial development, while research institutions such as Shenzhen Advanced Technology Research Institute and China University of Petroleum are advancing fundamental innovations. Applied Materials and Semiconductor Energy Laboratory are focusing on materials optimization, while automotive manufacturers including Honda, Toyota, and Subaru are exploring DIB integration for electric vehicles. The competitive landscape shows a mix of established battery manufacturers and new entrants seeking to capitalize on DIBs' potential in stationary storage and transportation applications.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed advanced dual-ion battery (DIB) technology that utilizes graphite as both cathode and anode materials, with aluminum ions as charge carriers. Their patented approach incorporates a novel electrolyte system containing AlCl3 in organic solvents, enabling higher energy density compared to conventional lithium-ion batteries. CATL's DIB technology achieves energy densities of 150-180 Wh/kg and demonstrates excellent cycling stability with capacity retention exceeding 80% after 1000 cycles. The company has implemented a multi-layer electrode design that enhances ion transport and reduces internal resistance, resulting in improved rate capability. CATL has also developed proprietary manufacturing processes that allow for cost-effective production using existing battery manufacturing infrastructure with minimal modifications, positioning them as a leader in commercialization efforts for dual-ion battery technology.

Strengths: Leverages existing manufacturing infrastructure, reducing implementation costs; achieves higher energy density than many competing DIB designs; demonstrates superior cycling stability. Weaknesses: Still faces challenges with electrolyte stability at extreme temperatures; energy density remains lower than cutting-edge lithium-ion technologies; requires further optimization for fast-charging applications.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has pioneered a dual-ion battery system utilizing a graphite cathode and lithium metal anode configuration with a proprietary electrolyte formulation containing lithium bis(fluorosulfonyl)imide (LiFSI). Their patented technology incorporates a protective artificial solid electrolyte interphase (SEI) layer on the lithium metal anode to prevent dendrite formation and enhance cycling stability. The company's DIB design achieves energy densities approaching 200 Wh/kg while maintaining operational stability across a wide temperature range (-20°C to 60°C). LG's innovation includes a novel electrode manufacturing process that creates optimized pore structures in graphite cathodes, facilitating faster anion intercalation and improving rate capability. Their patent portfolio covers various electrolyte additives that enhance the stability of the graphite-electrolyte interface during high-voltage operation, addressing a key challenge in DIB commercialization.

Strengths: Higher energy density than conventional DIBs; excellent temperature performance range; innovative SEI protection technology prevents dendrite formation. Weaknesses: Higher manufacturing complexity increases production costs; lithium metal anode presents safety challenges despite protective measures; requires specialized manufacturing equipment for electrode preparation.

Critical Patent Analysis and Technical Innovations

dual ion battery

PatentActiveJPWO2020110230A1

Innovation

- The use of aluminum current collectors coated with an amorphous carbon film, optionally with a conductive carbon layer, to prevent corrosion and enhance high-temperature durability.

Dual-ion battery performance

PatentPendingUS20240006664A1

Innovation

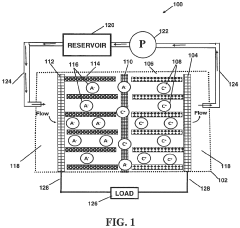

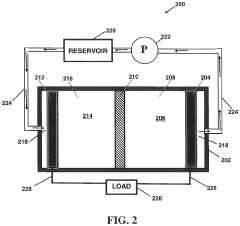

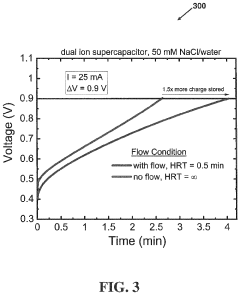

- Implementing an external electrolyte reservoir with forced convection to reduce diffusion limitations and allow for optimal conductivity, enabling the use of minimally thick separators and minimizing volume changes, thereby enhancing ion participation in energy storage.

IP Monetization Strategies for DIB Technologies

Monetizing intellectual property in the Dual-ion Batteries (DIB) sector requires strategic approaches that balance immediate revenue generation with long-term market positioning. Patent licensing represents the most direct monetization pathway, with exclusive licensing commanding premium rates while providing licensees with competitive advantages in specific market segments. Non-exclusive licensing, while generating lower per-license revenue, can establish DIB technology as an industry standard and create broader market adoption.

Cross-industry licensing presents particularly promising opportunities for DIB technologies. Energy storage innovations developed for electric vehicles can be licensed to stationary storage providers, while manufacturing process patents may find applications in adjacent battery technologies. This diversification strategy maximizes return on R&D investments while reducing dependency on any single market segment.

Patent pooling emerges as an increasingly viable strategy for DIB technology holders. By combining complementary patents from multiple organizations, these pools create comprehensive technology packages that simplify licensing processes and reduce transaction costs. For emerging DIB technologies facing adoption barriers, patent pools can accelerate commercialization by providing potential implementers with access to necessary IP rights through a single agreement.

Joint ventures and strategic partnerships offer alternative monetization approaches, particularly valuable for startups and research institutions lacking manufacturing capabilities. These arrangements can combine IP assets with production capacity, market access, and distribution networks. Revenue-sharing models within such partnerships should be structured to reflect both initial IP contributions and ongoing development commitments.

Direct technology transfer represents another monetization pathway, particularly appropriate for organizations seeking to exit specific DIB technology segments. Complete transfer of patent portfolios, associated know-how, and technical documentation can generate substantial one-time revenue while eliminating ongoing patent maintenance costs.

Defensive patent strategies must complement monetization efforts. Strategic patent filings should protect core DIB technologies while creating sufficient peripheral coverage to prevent competitors from developing workarounds. Freedom-to-operate analyses should precede major licensing initiatives to ensure that commercialization pathways remain unobstructed by third-party IP rights.

Valuation methodologies for DIB patents must consider both technical merit and market applicability. Cost-based approaches should account for R&D investments, while income-based methods must project future revenue streams from various licensing scenarios. Comparative market analyses of similar energy storage technology transactions provide additional valuation benchmarks.

Cross-industry licensing presents particularly promising opportunities for DIB technologies. Energy storage innovations developed for electric vehicles can be licensed to stationary storage providers, while manufacturing process patents may find applications in adjacent battery technologies. This diversification strategy maximizes return on R&D investments while reducing dependency on any single market segment.

Patent pooling emerges as an increasingly viable strategy for DIB technology holders. By combining complementary patents from multiple organizations, these pools create comprehensive technology packages that simplify licensing processes and reduce transaction costs. For emerging DIB technologies facing adoption barriers, patent pools can accelerate commercialization by providing potential implementers with access to necessary IP rights through a single agreement.

Joint ventures and strategic partnerships offer alternative monetization approaches, particularly valuable for startups and research institutions lacking manufacturing capabilities. These arrangements can combine IP assets with production capacity, market access, and distribution networks. Revenue-sharing models within such partnerships should be structured to reflect both initial IP contributions and ongoing development commitments.

Direct technology transfer represents another monetization pathway, particularly appropriate for organizations seeking to exit specific DIB technology segments. Complete transfer of patent portfolios, associated know-how, and technical documentation can generate substantial one-time revenue while eliminating ongoing patent maintenance costs.

Defensive patent strategies must complement monetization efforts. Strategic patent filings should protect core DIB technologies while creating sufficient peripheral coverage to prevent competitors from developing workarounds. Freedom-to-operate analyses should precede major licensing initiatives to ensure that commercialization pathways remain unobstructed by third-party IP rights.

Valuation methodologies for DIB patents must consider both technical merit and market applicability. Cost-based approaches should account for R&D investments, while income-based methods must project future revenue streams from various licensing scenarios. Comparative market analyses of similar energy storage technology transactions provide additional valuation benchmarks.

Regulatory Framework for Energy Storage Patents

The regulatory landscape for energy storage patents, particularly those related to Dual-ion batteries (DIBs), operates within a complex framework of international and national intellectual property laws. Patent protection for energy storage technologies typically extends for 20 years from the filing date, providing inventors with exclusive rights to commercialize their innovations while encouraging public disclosure of technical advancements.

In the United States, the U.S. Patent and Trademark Office (USPTO) governs energy storage patents under Title 35 of the U.S. Code, with recent policy shifts emphasizing expedited examination for clean energy technologies through initiatives like the Green Technology Pilot Program. The European Patent Office (EPO) similarly offers accelerated processing for environmentally beneficial inventions through the "Green Channel" program, significantly reducing waiting times for DIB patent applications.

China has emerged as a critical jurisdiction for energy storage patents, with the China National Intellectual Property Administration (CNIPA) implementing specialized examination guidelines for battery technologies. The country's 14th Five-Year Plan explicitly prioritizes advanced energy storage innovations, creating a favorable regulatory environment for DIB patent applications.

Standard-essential patents (SEPs) present unique regulatory challenges in the DIB ecosystem. Organizations like the International Electrotechnical Commission (IEC) and IEEE have established technical standards for battery safety, performance, and interoperability that often incorporate patented technologies. This necessitates fair, reasonable, and non-discriminatory (FRAND) licensing terms to balance innovation protection with market access.

Environmental regulations increasingly influence patent strategies for energy storage technologies. The EU Battery Directive and similar regulations in other jurisdictions impose sustainability requirements that must be considered during patent drafting and licensing negotiations. Patents that address recycling methods, reduced toxic materials, or improved energy efficiency may receive preferential treatment during examination.

Recent legal precedents have shaped the DIB patent landscape, with landmark cases like Samsung SDI Co. v. Matsushita Electric establishing boundaries for battery chemistry claims. The 2021 ruling in LG Energy Solution v. SK Innovation regarding trade secrets in battery manufacturing has further clarified intellectual property protections in this sector.

For effective DIB patent licensing strategies, companies must navigate export control regulations that may restrict technology transfer across borders, particularly for innovations with potential dual-use applications. Additionally, antitrust considerations increasingly influence licensing practices, with regulatory authorities scrutinizing patent pools and cross-licensing agreements in the energy storage sector to prevent market monopolization.

In the United States, the U.S. Patent and Trademark Office (USPTO) governs energy storage patents under Title 35 of the U.S. Code, with recent policy shifts emphasizing expedited examination for clean energy technologies through initiatives like the Green Technology Pilot Program. The European Patent Office (EPO) similarly offers accelerated processing for environmentally beneficial inventions through the "Green Channel" program, significantly reducing waiting times for DIB patent applications.

China has emerged as a critical jurisdiction for energy storage patents, with the China National Intellectual Property Administration (CNIPA) implementing specialized examination guidelines for battery technologies. The country's 14th Five-Year Plan explicitly prioritizes advanced energy storage innovations, creating a favorable regulatory environment for DIB patent applications.

Standard-essential patents (SEPs) present unique regulatory challenges in the DIB ecosystem. Organizations like the International Electrotechnical Commission (IEC) and IEEE have established technical standards for battery safety, performance, and interoperability that often incorporate patented technologies. This necessitates fair, reasonable, and non-discriminatory (FRAND) licensing terms to balance innovation protection with market access.

Environmental regulations increasingly influence patent strategies for energy storage technologies. The EU Battery Directive and similar regulations in other jurisdictions impose sustainability requirements that must be considered during patent drafting and licensing negotiations. Patents that address recycling methods, reduced toxic materials, or improved energy efficiency may receive preferential treatment during examination.

Recent legal precedents have shaped the DIB patent landscape, with landmark cases like Samsung SDI Co. v. Matsushita Electric establishing boundaries for battery chemistry claims. The 2021 ruling in LG Energy Solution v. SK Innovation regarding trade secrets in battery manufacturing has further clarified intellectual property protections in this sector.

For effective DIB patent licensing strategies, companies must navigate export control regulations that may restrict technology transfer across borders, particularly for innovations with potential dual-use applications. Additionally, antitrust considerations increasingly influence licensing practices, with regulatory authorities scrutinizing patent pools and cross-licensing agreements in the energy storage sector to prevent market monopolization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!