Effect of Regulatory Standards on Flexible Display Substrate Market

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Regulatory Background and Objectives

Flexible display technology has evolved significantly over the past decade, transforming from experimental prototypes to commercially viable products. The regulatory landscape governing these innovative displays has simultaneously developed to address emerging concerns related to materials safety, environmental impact, and consumer protection. Initially, flexible displays were primarily regulated under broader electronic device frameworks, but as their unique characteristics became apparent, specialized standards began to emerge around 2012-2015, focusing particularly on substrate materials which form the foundation of these displays.

The evolution of regulatory standards has been driven by several key factors, including the increasing use of novel materials such as polyimide films, thin glass, and various polymer composites that enable flexibility while maintaining display performance. Environmental considerations have also shaped regulatory development, with growing emphasis on reducing hazardous substances, improving recyclability, and minimizing electronic waste as flexible displays enter the consumer market at scale.

Geographically, regulatory frameworks have developed unevenly, with regions such as the European Union, Japan, and South Korea establishing more comprehensive standards earlier than other markets. The EU's approach through the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations has been particularly influential in setting global benchmarks for flexible display substrates, while South Korea has focused on performance standards that address the unique durability requirements of flexible technologies.

The primary technical objectives of current regulatory standards include ensuring consistent performance under repeated flexing conditions, establishing minimum durability thresholds, preventing chemical leaching from substrate materials, and guaranteeing electrical safety despite the novel form factors. Secondary objectives focus on interoperability between different manufacturers' components and establishing testing methodologies that accurately reflect real-world usage conditions.

Looking forward, regulatory development aims to balance innovation enablement with appropriate safeguards. Key goals include harmonizing international standards to reduce compliance complexity for manufacturers, developing accelerated aging tests that can reliably predict long-term performance of flexible substrates, and creating frameworks that can rapidly adapt to emerging substrate technologies such as stretchable and biodegradable materials that are currently in research phases.

The interplay between regulatory standards and market development creates a feedback loop where regulations both respond to and shape technological innovation in the flexible display substrate market, ultimately influencing which technologies achieve commercial viability and widespread adoption.

The evolution of regulatory standards has been driven by several key factors, including the increasing use of novel materials such as polyimide films, thin glass, and various polymer composites that enable flexibility while maintaining display performance. Environmental considerations have also shaped regulatory development, with growing emphasis on reducing hazardous substances, improving recyclability, and minimizing electronic waste as flexible displays enter the consumer market at scale.

Geographically, regulatory frameworks have developed unevenly, with regions such as the European Union, Japan, and South Korea establishing more comprehensive standards earlier than other markets. The EU's approach through the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations has been particularly influential in setting global benchmarks for flexible display substrates, while South Korea has focused on performance standards that address the unique durability requirements of flexible technologies.

The primary technical objectives of current regulatory standards include ensuring consistent performance under repeated flexing conditions, establishing minimum durability thresholds, preventing chemical leaching from substrate materials, and guaranteeing electrical safety despite the novel form factors. Secondary objectives focus on interoperability between different manufacturers' components and establishing testing methodologies that accurately reflect real-world usage conditions.

Looking forward, regulatory development aims to balance innovation enablement with appropriate safeguards. Key goals include harmonizing international standards to reduce compliance complexity for manufacturers, developing accelerated aging tests that can reliably predict long-term performance of flexible substrates, and creating frameworks that can rapidly adapt to emerging substrate technologies such as stretchable and biodegradable materials that are currently in research phases.

The interplay between regulatory standards and market development creates a feedback loop where regulations both respond to and shape technological innovation in the flexible display substrate market, ultimately influencing which technologies achieve commercial viability and widespread adoption.

Market Demand Analysis for Flexible Display Substrates

The flexible display substrate market has witnessed substantial growth in recent years, driven primarily by increasing consumer demand for foldable smartphones, wearable devices, and other innovative electronic products. Market research indicates that the global flexible display market is expected to grow at a compound annual growth rate of 28% between 2021 and 2026, with the substrate segment representing a critical component of this expansion.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of the total market share. Within this segment, smartphones and tablets constitute the largest portion, followed by smartwatches and other wearable technology. The automotive industry has emerged as the second-largest market for flexible display substrates, with growing implementation in dashboard displays, entertainment systems, and heads-up displays.

Regional analysis reveals that Asia-Pacific currently dominates the market, with South Korea, Japan, and China leading in both production and consumption. North America and Europe follow as significant markets, primarily driven by high consumer purchasing power and rapid technology adoption rates.

Market demand is increasingly influenced by consumer preferences for thinner, lighter, and more durable electronic devices. Survey data shows that 78% of smartphone users consider device thickness and weight as important purchasing factors, while 82% express interest in devices with flexible or foldable displays. This consumer sentiment has accelerated research and development investments in advanced substrate materials.

The substrate material landscape is evolving rapidly, with polyimide (PI) currently holding the largest market share at approximately 45%. However, alternative materials such as ultra-thin glass and polyethylene terephthalate (PET) are gaining traction due to their unique properties and potential cost advantages.

Price sensitivity analysis indicates that while consumers show willingness to pay premium prices for flexible display technology, there exists a definitive threshold beyond which adoption rates decline significantly. This price elasticity varies considerably across different geographic markets and product categories.

Supply chain dynamics reveal increasing vertical integration among major players, with substrate manufacturers forming strategic partnerships with display manufacturers and end-product companies. This trend has been accelerated by recent global supply chain disruptions, prompting companies to secure material sources and production capabilities.

Future market projections suggest that demand will continue to grow as flexible display technology expands into new application areas including healthcare devices, smart home systems, and industrial equipment. The development of more cost-effective manufacturing processes for flexible substrates will likely serve as a critical factor in determining market expansion rates and penetration into new product categories.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of the total market share. Within this segment, smartphones and tablets constitute the largest portion, followed by smartwatches and other wearable technology. The automotive industry has emerged as the second-largest market for flexible display substrates, with growing implementation in dashboard displays, entertainment systems, and heads-up displays.

Regional analysis reveals that Asia-Pacific currently dominates the market, with South Korea, Japan, and China leading in both production and consumption. North America and Europe follow as significant markets, primarily driven by high consumer purchasing power and rapid technology adoption rates.

Market demand is increasingly influenced by consumer preferences for thinner, lighter, and more durable electronic devices. Survey data shows that 78% of smartphone users consider device thickness and weight as important purchasing factors, while 82% express interest in devices with flexible or foldable displays. This consumer sentiment has accelerated research and development investments in advanced substrate materials.

The substrate material landscape is evolving rapidly, with polyimide (PI) currently holding the largest market share at approximately 45%. However, alternative materials such as ultra-thin glass and polyethylene terephthalate (PET) are gaining traction due to their unique properties and potential cost advantages.

Price sensitivity analysis indicates that while consumers show willingness to pay premium prices for flexible display technology, there exists a definitive threshold beyond which adoption rates decline significantly. This price elasticity varies considerably across different geographic markets and product categories.

Supply chain dynamics reveal increasing vertical integration among major players, with substrate manufacturers forming strategic partnerships with display manufacturers and end-product companies. This trend has been accelerated by recent global supply chain disruptions, prompting companies to secure material sources and production capabilities.

Future market projections suggest that demand will continue to grow as flexible display technology expands into new application areas including healthcare devices, smart home systems, and industrial equipment. The development of more cost-effective manufacturing processes for flexible substrates will likely serve as a critical factor in determining market expansion rates and penetration into new product categories.

Current Regulatory Challenges in Flexible Display Technology

The regulatory landscape for flexible display technology is currently characterized by a complex web of standards that vary significantly across regions and jurisdictions. In North America, the Federal Communications Commission (FCC) imposes electromagnetic compatibility requirements that flexible displays must meet, while the Consumer Product Safety Commission (CPSC) enforces safety standards related to potential hazards such as overheating or chemical leaching from substrates. These regulations often create compliance challenges for manufacturers operating in multiple markets.

In the European Union, the Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations place strict limitations on materials that can be used in flexible display substrates. Manufacturers must ensure their polyimide films, polyethylene terephthalate (PET), and other substrate materials comply with these chemical restrictions, which can significantly impact material selection and manufacturing processes.

Asian markets present their own regulatory hurdles. Japan's high standards for product durability and China's evolving environmental protection laws create additional compliance requirements. South Korea, despite being home to major flexible display manufacturers, maintains stringent safety certification processes that can delay product launches and increase development costs.

A critical challenge facing the industry is the lack of harmonized global standards specifically designed for flexible display technology. Current regulations were largely developed for rigid display technologies and traditional electronics, creating interpretation difficulties when applied to novel flexible substrates. This regulatory gap forces manufacturers to navigate a patchwork of requirements that may not adequately address the unique properties of flexible displays.

Environmental regulations present another significant hurdle. End-of-life disposal requirements vary widely, with some jurisdictions implementing extended producer responsibility schemes that hold manufacturers accountable for the entire lifecycle of their products. The recyclability of flexible display substrates, particularly those containing specialized polymers and adhesives, remains problematic under current waste management frameworks.

Certification processes also pose challenges. Testing methodologies developed for conventional displays often fail to adequately assess the unique characteristics of flexible displays, such as bend radius limitations, folding endurance, and substrate degradation over time. This testing gap creates uncertainty regarding compliance and product reliability.

The rapidly evolving nature of flexible display technology further complicates regulatory compliance. As new substrate materials and manufacturing techniques emerge, regulatory frameworks struggle to keep pace. This regulatory lag creates market uncertainty and can potentially stifle innovation as manufacturers hesitate to invest in technologies that may face future regulatory barriers.

In the European Union, the Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations place strict limitations on materials that can be used in flexible display substrates. Manufacturers must ensure their polyimide films, polyethylene terephthalate (PET), and other substrate materials comply with these chemical restrictions, which can significantly impact material selection and manufacturing processes.

Asian markets present their own regulatory hurdles. Japan's high standards for product durability and China's evolving environmental protection laws create additional compliance requirements. South Korea, despite being home to major flexible display manufacturers, maintains stringent safety certification processes that can delay product launches and increase development costs.

A critical challenge facing the industry is the lack of harmonized global standards specifically designed for flexible display technology. Current regulations were largely developed for rigid display technologies and traditional electronics, creating interpretation difficulties when applied to novel flexible substrates. This regulatory gap forces manufacturers to navigate a patchwork of requirements that may not adequately address the unique properties of flexible displays.

Environmental regulations present another significant hurdle. End-of-life disposal requirements vary widely, with some jurisdictions implementing extended producer responsibility schemes that hold manufacturers accountable for the entire lifecycle of their products. The recyclability of flexible display substrates, particularly those containing specialized polymers and adhesives, remains problematic under current waste management frameworks.

Certification processes also pose challenges. Testing methodologies developed for conventional displays often fail to adequately assess the unique characteristics of flexible displays, such as bend radius limitations, folding endurance, and substrate degradation over time. This testing gap creates uncertainty regarding compliance and product reliability.

The rapidly evolving nature of flexible display technology further complicates regulatory compliance. As new substrate materials and manufacturing techniques emerge, regulatory frameworks struggle to keep pace. This regulatory lag creates market uncertainty and can potentially stifle innovation as manufacturers hesitate to invest in technologies that may face future regulatory barriers.

Current Regulatory Frameworks for Flexible Displays

01 Material composition standards for flexible substrates

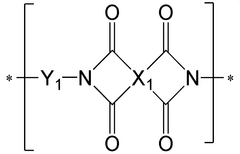

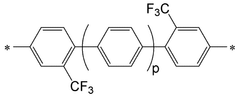

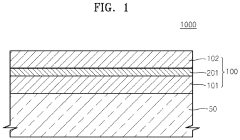

Regulatory standards for flexible display substrates focus on the material composition requirements. These standards specify the types of polymers, such as polyimide and polyethylene terephthalate (PET), that can be used as base materials. They also define acceptable additives, fillers, and plasticizers that enhance flexibility while maintaining structural integrity. The standards ensure that materials used in flexible substrates meet specific purity levels and are free from harmful substances that could affect display performance or user safety.- Material composition standards for flexible display substrates: Regulatory standards for flexible display substrates focus on material composition requirements to ensure flexibility while maintaining structural integrity. These standards specify acceptable polymeric materials, including polyimide and polyethylene terephthalate (PET), that provide the necessary mechanical properties for bending and folding operations. The regulations also address the composition of barrier layers to prevent moisture and oxygen penetration, which can degrade display performance and lifetime.

- Mechanical durability and reliability requirements: Standards for flexible display substrates establish minimum requirements for mechanical durability, including bend radius limitations, folding endurance, and resistance to delamination. These regulations specify testing protocols for evaluating substrate performance under repeated bending and folding cycles, temperature variations, and humidity conditions. Compliance with these standards ensures that flexible displays maintain functionality and visual quality throughout their expected operational lifetime even when subjected to mechanical stress.

- Electrical performance and safety standards: Regulatory frameworks for flexible display substrates include specifications for electrical performance and safety. These standards address requirements for electrical insulation properties, electromagnetic interference shielding, and static discharge protection. Additionally, they establish parameters for maximum current leakage, dielectric strength, and thermal management to prevent overheating. Compliance with these electrical standards ensures safe operation of flexible displays in various consumer and industrial applications.

- Environmental impact and sustainability regulations: Standards governing flexible display substrates include environmental regulations addressing the use of hazardous substances, recyclability, and end-of-life management. These regulations limit or prohibit the use of certain chemicals and heavy metals in substrate manufacturing, in alignment with global initiatives like RoHS and REACH. Additionally, they establish requirements for biodegradability, carbon footprint reduction, and sustainable sourcing of raw materials used in flexible display substrate production.

- Manufacturing process and quality control standards: Regulatory standards for flexible display substrates establish requirements for manufacturing processes and quality control procedures. These include specifications for cleanroom environments, contamination control, and defect inspection methodologies. The standards define acceptable tolerance levels for substrate thickness uniformity, surface roughness, and optical transparency. They also mandate documentation and traceability requirements throughout the manufacturing process to ensure consistent quality and performance of flexible display substrates.

02 Mechanical durability and flexibility requirements

Regulatory standards establish specific mechanical performance criteria for flexible display substrates, including bend radius limitations, folding endurance, and tensile strength requirements. These standards define test methods for evaluating substrate durability under repeated bending or folding conditions, ensuring reliable performance throughout the product lifecycle. Requirements typically specify minimum cycles of bending without performance degradation and maximum allowable physical deformation under stress. Standards also address resistance to cracking, delamination, and other mechanical failures specific to flexible display applications.Expand Specific Solutions03 Electrical and optical performance standards

Regulatory standards for flexible display substrates establish requirements for electrical and optical properties. These include specifications for transparency, haze, light transmission, and color neutrality to ensure optimal display performance. Electrical standards cover parameters such as surface resistivity, dielectric strength, and electromagnetic interference shielding capabilities. The standards also define acceptable levels of optical distortion under bending conditions and requirements for maintaining consistent electrical performance during flexing operations. Testing protocols are specified to verify compliance with these electrical and optical performance criteria.Expand Specific Solutions04 Environmental stability and reliability standards

Regulatory standards address the environmental stability requirements for flexible display substrates, including resistance to temperature extremes, humidity, UV exposure, and chemical agents. These standards specify accelerated aging test protocols to predict long-term reliability and define acceptable performance degradation limits over time. Requirements typically include thermal cycling endurance, moisture barrier properties, and chemical compatibility with display components. Standards also cover substrate behavior under various environmental conditions that might be encountered during manufacturing, transportation, storage, and end-use applications.Expand Specific Solutions05 Manufacturing process and quality control standards

Regulatory standards establish requirements for manufacturing processes and quality control of flexible display substrates. These include specifications for substrate thickness uniformity, surface roughness, and defect density limits. The standards define acceptable manufacturing variations and tolerances for critical dimensions and properties. Quality control protocols are specified, including sampling methods, inspection techniques, and statistical process control requirements. Standards also address clean room requirements, contamination control, and handling procedures specific to flexible substrate production to ensure consistent quality and performance in the final display products.Expand Specific Solutions

Key Industry Players and Regulatory Compliance

The flexible display substrate market is currently in a growth phase, driven by increasing demand for foldable smartphones and wearable devices. Regulatory standards significantly impact market dynamics by establishing quality benchmarks and safety requirements. Key players like Samsung Display, LG Display, and BOE Technology are leading innovation in this space, with substantial investments in R&D to develop compliant yet advanced flexible substrates. Chinese manufacturers including TCL China Star and Tianma Microelectronics are rapidly gaining market share by leveraging government support and strategic partnerships. The market is characterized by intense competition between established Japanese and Korean firms and emerging Chinese companies, with regulatory compliance becoming a critical differentiator in global competitiveness.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive regulatory compliance strategy for their flexible display substrates, focusing on both environmental and performance standards. Their approach includes the development of OLED flexible displays using ultra-thin glass substrates that meet stringent international regulations including RoHS, REACH, and California Proposition 65[1]. BOE has invested heavily in manufacturing facilities that comply with ISO 14001 environmental management standards, allowing them to produce flexible display substrates with reduced hazardous substances. Their technical solution incorporates a proprietary low-temperature polysilicon (LTPS) process that enables the production of flexible displays while maintaining compliance with energy efficiency standards across global markets[2]. BOE has also implemented a transparent supply chain verification system to ensure all materials used in their flexible substrates meet regulatory requirements in key markets including China, EU, US, and Japan.

Strengths: Comprehensive global regulatory compliance strategy; advanced manufacturing facilities designed specifically for regulatory adherence; strong R&D capabilities for developing compliant materials. Weaknesses: Higher production costs associated with regulatory compliance; longer time-to-market due to extensive testing requirements; challenges in maintaining uniform standards across different manufacturing locations.

SAMSUNG DISPLAY CO LTD

Technical Solution: Samsung Display has pioneered a regulatory-adaptive flexible display substrate technology that proactively addresses evolving standards across global markets. Their solution centers on their proprietary Y-OCTA (Youm On-Cell Touch AMOLED) technology, which integrates touch sensors directly into the display panel, reducing thickness while meeting strict regulatory requirements for both consumer electronics and automotive applications[3]. Samsung has developed specialized low-toxic adhesives and barrier films that comply with EU's RoHS and REACH regulations while maintaining the mechanical flexibility required for foldable displays. Their technical approach includes a modular design philosophy that allows for rapid adaptation to regional regulatory changes without complete redesign of manufacturing processes[4]. Samsung has also implemented an advanced materials verification system that tracks over 2,000 substances across their supply chain to ensure compliance with varying international chemical safety regulations, particularly focusing on their UTG (Ultra Thin Glass) technology used in premium flexible displays.

Strengths: Industry-leading R&D capabilities specifically focused on regulatory-compliant materials; established relationships with regulatory bodies allowing early adaptation to upcoming standards; vertical integration providing greater control over compliance throughout the supply chain. Weaknesses: Premium pricing strategy limits market penetration in price-sensitive segments; higher material costs associated with meeting the most stringent global standards; complex supply chain management required for global regulatory compliance.

Critical Standards and Certification Requirements

Board for display device or flexible display device, and display device or flexible display device

PatentWO2022108207A1

Innovation

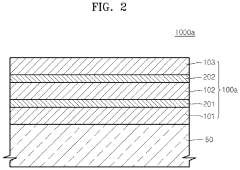

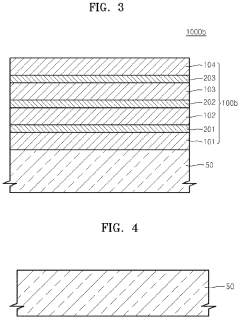

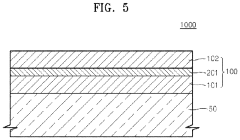

- A substrate for flexible display devices is developed, comprising a first polyimide resin layer with a high Td of 570°C or higher and yellowness of 25 to 60, a second polyimide resin layer with yellowness less than 25, and inorganic material layers of specific thicknesses between them, ensuring excellent heat resistance and dimensional stability without deformation at high temperatures.

Flexible display and method of manufacturing the same

PatentActiveUS20210288173A1

Innovation

- A flexible substrate with a plastic substrate having a glass transition temperature between 350° C. and 500° C., combined with a multi-layer barrier layer composed of alternately stacked silicon oxide and silicon nitride layers, providing excellent oxygen and moisture blocking characteristics and uniform film stress.

Global Regulatory Harmonization Efforts

The global regulatory landscape for flexible display substrates presents a complex patchwork of standards that significantly impacts market development and innovation. Recognizing this challenge, international organizations and industry consortia have initiated several harmonization efforts aimed at creating more unified regulatory frameworks. These initiatives seek to reduce compliance costs, accelerate time-to-market, and foster innovation while maintaining safety and performance standards.

The International Electrotechnical Commission (IEC) has established working groups specifically focused on flexible electronics standards, bringing together experts from over 30 countries to develop consensus-based technical specifications. Their TC 119 committee on Printed Electronics has been instrumental in creating standardized testing methodologies for flexible display substrates, which are gradually being adopted across multiple jurisdictions.

Similarly, the International Organization for Standardization (ISO) has launched parallel efforts through its technical committees on materials, electronics, and environmental standards. The ISO/TC 61 committee on plastics has developed standards particularly relevant to polymer-based flexible substrates, creating common terminology and testing protocols that facilitate international trade and technology transfer.

Regional harmonization initiatives have also gained momentum. The Trilateral Cooperation between regulatory bodies in the United States, European Union, and Japan has established mutual recognition agreements for certain testing and certification procedures related to electronic displays. This cooperation has reduced redundant testing requirements and streamlined approval processes for manufacturers operating across these major markets.

Industry-led consortia play an equally important role in regulatory harmonization. The Flexible Display Standards Alliance (FDSA), comprising major manufacturers, research institutions, and regulatory experts, has developed voluntary industry standards that often serve as precursors to formal regulations. Their technical recommendations on substrate durability, bend radius specifications, and environmental performance have been incorporated into regulatory frameworks in multiple countries.

The Asia-Pacific Economic Cooperation (APEC) has established a Regulatory Harmonization Steering Committee that specifically addresses emerging technologies including flexible electronics. Their work focuses on capacity building in developing economies and creating pathways for regulatory convergence that acknowledge different levels of technical infrastructure while moving toward common standards.

Despite these efforts, significant challenges remain. Differences in fundamental regulatory philosophies—such as the EU's precautionary approach versus the more market-driven approach in the US—continue to create divergence in standards. Additionally, rapidly evolving technology often outpaces regulatory development, creating temporary regulatory gaps that can impede market growth.

The International Electrotechnical Commission (IEC) has established working groups specifically focused on flexible electronics standards, bringing together experts from over 30 countries to develop consensus-based technical specifications. Their TC 119 committee on Printed Electronics has been instrumental in creating standardized testing methodologies for flexible display substrates, which are gradually being adopted across multiple jurisdictions.

Similarly, the International Organization for Standardization (ISO) has launched parallel efforts through its technical committees on materials, electronics, and environmental standards. The ISO/TC 61 committee on plastics has developed standards particularly relevant to polymer-based flexible substrates, creating common terminology and testing protocols that facilitate international trade and technology transfer.

Regional harmonization initiatives have also gained momentum. The Trilateral Cooperation between regulatory bodies in the United States, European Union, and Japan has established mutual recognition agreements for certain testing and certification procedures related to electronic displays. This cooperation has reduced redundant testing requirements and streamlined approval processes for manufacturers operating across these major markets.

Industry-led consortia play an equally important role in regulatory harmonization. The Flexible Display Standards Alliance (FDSA), comprising major manufacturers, research institutions, and regulatory experts, has developed voluntary industry standards that often serve as precursors to formal regulations. Their technical recommendations on substrate durability, bend radius specifications, and environmental performance have been incorporated into regulatory frameworks in multiple countries.

The Asia-Pacific Economic Cooperation (APEC) has established a Regulatory Harmonization Steering Committee that specifically addresses emerging technologies including flexible electronics. Their work focuses on capacity building in developing economies and creating pathways for regulatory convergence that acknowledge different levels of technical infrastructure while moving toward common standards.

Despite these efforts, significant challenges remain. Differences in fundamental regulatory philosophies—such as the EU's precautionary approach versus the more market-driven approach in the US—continue to create divergence in standards. Additionally, rapidly evolving technology often outpaces regulatory development, creating temporary regulatory gaps that can impede market growth.

Environmental Compliance and Sustainability Impact

The regulatory landscape governing flexible display substrates has evolved significantly in response to growing environmental concerns. Major markets including the EU, North America, and Asia have implemented stringent regulations targeting hazardous substances, electronic waste management, and carbon emissions. The EU's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives have particularly influenced material selection for flexible displays, limiting the use of heavy metals and certain chemical compounds.

These environmental regulations have catalyzed innovation in substrate materials, with manufacturers developing halogen-free, recyclable, and biodegradable alternatives. Companies investing in environmentally compliant technologies have gained competitive advantages through access to regulated markets and improved brand reputation. The transition to water-based processing techniques and solvent recovery systems has further reduced environmental impact while meeting regulatory requirements.

Life Cycle Assessment (LCA) has become a critical tool for manufacturers to evaluate environmental footprints across production, use, and disposal phases. This approach has revealed that substrate manufacturing typically accounts for 30-40% of a flexible display's total environmental impact, highlighting the importance of sustainable material selection and processing methods.

Energy efficiency standards have driven the development of low-power flexible displays, with regulatory bodies increasingly focusing on energy consumption during both manufacturing and product operation. The International Electrotechnical Commission (IEC) and regional energy efficiency programs have established benchmarks that manufacturers must meet to access key markets.

Circular economy principles are increasingly reflected in regulations, with extended producer responsibility (EPR) schemes requiring manufacturers to consider end-of-life management. This has prompted research into substrate materials that facilitate disassembly and recycling, with some pioneering companies achieving recycling rates of up to 85% for flexible display components.

Carbon footprint regulations, including carbon taxes and cap-and-trade systems, have incentivized manufacturers to reduce emissions throughout the supply chain. Leading companies have responded by implementing renewable energy in production facilities and optimizing logistics to minimize transportation-related emissions.

Industry collaboration through consortia such as the Sustainable Electronics Manufacturing Working Group has accelerated the development of standardized approaches to environmental compliance. These collaborative efforts have helped establish best practices for sustainable substrate manufacturing while reducing compliance costs for individual companies.

These environmental regulations have catalyzed innovation in substrate materials, with manufacturers developing halogen-free, recyclable, and biodegradable alternatives. Companies investing in environmentally compliant technologies have gained competitive advantages through access to regulated markets and improved brand reputation. The transition to water-based processing techniques and solvent recovery systems has further reduced environmental impact while meeting regulatory requirements.

Life Cycle Assessment (LCA) has become a critical tool for manufacturers to evaluate environmental footprints across production, use, and disposal phases. This approach has revealed that substrate manufacturing typically accounts for 30-40% of a flexible display's total environmental impact, highlighting the importance of sustainable material selection and processing methods.

Energy efficiency standards have driven the development of low-power flexible displays, with regulatory bodies increasingly focusing on energy consumption during both manufacturing and product operation. The International Electrotechnical Commission (IEC) and regional energy efficiency programs have established benchmarks that manufacturers must meet to access key markets.

Circular economy principles are increasingly reflected in regulations, with extended producer responsibility (EPR) schemes requiring manufacturers to consider end-of-life management. This has prompted research into substrate materials that facilitate disassembly and recycling, with some pioneering companies achieving recycling rates of up to 85% for flexible display components.

Carbon footprint regulations, including carbon taxes and cap-and-trade systems, have incentivized manufacturers to reduce emissions throughout the supply chain. Leading companies have responded by implementing renewable energy in production facilities and optimizing logistics to minimize transportation-related emissions.

Industry collaboration through consortia such as the Sustainable Electronics Manufacturing Working Group has accelerated the development of standardized approaches to environmental compliance. These collaborative efforts have helped establish best practices for sustainable substrate manufacturing while reducing compliance costs for individual companies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!