Flexible Display Substrate Innovation: Patent Developments

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Evolution and Innovation Objectives

Flexible display technology has evolved significantly over the past two decades, transforming from conceptual designs to commercially viable products. The journey began in the early 2000s with rudimentary flexible electronic paper displays, progressing through various technological iterations to today's advanced flexible OLED and AMOLED displays. This evolution has been characterized by continuous improvements in substrate materials, moving from rigid glass to flexible polymers and ultrathin glass composites that enable bendable, foldable, and rollable display applications.

The technological progression has been driven by several key factors, including miniaturization demands, consumer preference for larger screens in compact devices, and the pursuit of novel form factors. Market trends indicate a growing preference for devices that can transform their shape or size according to user needs, pushing display technology beyond traditional rigid constraints. This evolution represents a fundamental shift in how we conceptualize and interact with display technologies.

Patent developments in flexible display substrates reveal an accelerating innovation curve, with significant breakthroughs in materials science enabling unprecedented display flexibility while maintaining optical performance. Early patents focused primarily on basic flexibility, while recent innovations address more complex challenges such as crease resistance, durability during repeated folding cycles, and integration with other device components. The intellectual property landscape shows intensifying competition among major technology companies to secure foundational patents in this space.

Current innovation objectives in flexible display substrate technology center around several critical areas. First is the development of ultra-thin substrate materials with enhanced mechanical properties that can withstand thousands of folding cycles without degradation. Second is the creation of transparent barrier layers that effectively prevent moisture and oxygen penetration while maintaining flexibility. Third is the advancement of adhesive technologies that maintain integrity across temperature fluctuations and mechanical stress.

Looking forward, the field aims to achieve truly rollable and stretchable displays that can conform to complex three-dimensional surfaces. This requires fundamental innovations in substrate composition, including the development of hybrid organic-inorganic materials and nanocomposites with self-healing properties. Additional objectives include reducing manufacturing costs to enable mass-market adoption and improving sustainability through recyclable or biodegradable substrate materials.

The convergence of these technological developments and innovation objectives is expected to enable next-generation devices that blur the distinction between rigid and flexible electronics, potentially revolutionizing industries from consumer electronics to healthcare, automotive interfaces, and wearable technology.

The technological progression has been driven by several key factors, including miniaturization demands, consumer preference for larger screens in compact devices, and the pursuit of novel form factors. Market trends indicate a growing preference for devices that can transform their shape or size according to user needs, pushing display technology beyond traditional rigid constraints. This evolution represents a fundamental shift in how we conceptualize and interact with display technologies.

Patent developments in flexible display substrates reveal an accelerating innovation curve, with significant breakthroughs in materials science enabling unprecedented display flexibility while maintaining optical performance. Early patents focused primarily on basic flexibility, while recent innovations address more complex challenges such as crease resistance, durability during repeated folding cycles, and integration with other device components. The intellectual property landscape shows intensifying competition among major technology companies to secure foundational patents in this space.

Current innovation objectives in flexible display substrate technology center around several critical areas. First is the development of ultra-thin substrate materials with enhanced mechanical properties that can withstand thousands of folding cycles without degradation. Second is the creation of transparent barrier layers that effectively prevent moisture and oxygen penetration while maintaining flexibility. Third is the advancement of adhesive technologies that maintain integrity across temperature fluctuations and mechanical stress.

Looking forward, the field aims to achieve truly rollable and stretchable displays that can conform to complex three-dimensional surfaces. This requires fundamental innovations in substrate composition, including the development of hybrid organic-inorganic materials and nanocomposites with self-healing properties. Additional objectives include reducing manufacturing costs to enable mass-market adoption and improving sustainability through recyclable or biodegradable substrate materials.

The convergence of these technological developments and innovation objectives is expected to enable next-generation devices that blur the distinction between rigid and flexible electronics, potentially revolutionizing industries from consumer electronics to healthcare, automotive interfaces, and wearable technology.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has witnessed exponential growth over the past decade, driven primarily by consumer electronics applications. Market research indicates that the global flexible display market reached approximately $23.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 33.1% through 2030. This remarkable expansion reflects the increasing consumer preference for devices with larger screens, improved durability, and innovative form factors.

Smartphone manufacturers represent the largest demand segment, accounting for roughly 65% of flexible display consumption. The introduction of foldable smartphones by major brands has accelerated market adoption, with shipments of foldable devices increasing by 264% between 2020 and 2022. This trend is expected to continue as manufacturing costs decrease and consumer acceptance grows.

Beyond smartphones, significant market demand is emerging in wearable technology, automotive displays, and smart home devices. The wearable segment, including smartwatches and fitness trackers, is growing at 41% annually, driven by consumer health consciousness and the integration of advanced health monitoring features requiring flexible display solutions.

Commercial and industrial applications represent an expanding market opportunity, with flexible digital signage and retail display solutions projected to grow at 28% annually through 2025. These sectors value the space-saving benefits and visual impact of curved and flexible display installations.

Regional analysis reveals Asia-Pacific as the dominant market for flexible display technologies, accounting for 58% of global demand, followed by North America (22%) and Europe (15%). China and South Korea lead manufacturing capacity, while North American and European markets drive premium segment innovation and adoption.

Consumer research indicates that key purchase drivers for flexible display products include durability (cited by 72% of consumers), visual quality (68%), and novel form factors (61%). The ability to withstand repeated folding or bending cycles without performance degradation remains a critical market requirement, highlighting the importance of substrate innovation.

Supply chain constraints present significant market challenges, with substrate materials representing a particular bottleneck. Industry surveys indicate that 78% of manufacturers cite substrate availability and cost as limiting factors for production scaling. This underscores the strategic importance of patent developments in flexible substrate technologies as enablers of market growth.

Smartphone manufacturers represent the largest demand segment, accounting for roughly 65% of flexible display consumption. The introduction of foldable smartphones by major brands has accelerated market adoption, with shipments of foldable devices increasing by 264% between 2020 and 2022. This trend is expected to continue as manufacturing costs decrease and consumer acceptance grows.

Beyond smartphones, significant market demand is emerging in wearable technology, automotive displays, and smart home devices. The wearable segment, including smartwatches and fitness trackers, is growing at 41% annually, driven by consumer health consciousness and the integration of advanced health monitoring features requiring flexible display solutions.

Commercial and industrial applications represent an expanding market opportunity, with flexible digital signage and retail display solutions projected to grow at 28% annually through 2025. These sectors value the space-saving benefits and visual impact of curved and flexible display installations.

Regional analysis reveals Asia-Pacific as the dominant market for flexible display technologies, accounting for 58% of global demand, followed by North America (22%) and Europe (15%). China and South Korea lead manufacturing capacity, while North American and European markets drive premium segment innovation and adoption.

Consumer research indicates that key purchase drivers for flexible display products include durability (cited by 72% of consumers), visual quality (68%), and novel form factors (61%). The ability to withstand repeated folding or bending cycles without performance degradation remains a critical market requirement, highlighting the importance of substrate innovation.

Supply chain constraints present significant market challenges, with substrate materials representing a particular bottleneck. Industry surveys indicate that 78% of manufacturers cite substrate availability and cost as limiting factors for production scaling. This underscores the strategic importance of patent developments in flexible substrate technologies as enablers of market growth.

Current Substrate Technologies and Technical Barriers

The flexible display substrate market is currently dominated by several key technologies, each with distinct advantages and limitations. Polyimide (PI) films represent the most mature substrate solution, offering excellent thermal stability and mechanical flexibility. These films can withstand temperatures up to 300°C during manufacturing processes while maintaining dimensional stability. However, PI substrates face challenges in optical transparency, with yellowish tints that can affect display quality and color accuracy.

Polyethylene terephthalate (PET) and polyethylene naphthalate (PEN) substrates offer superior optical clarity compared to PI, with light transmittance exceeding 85%. These materials are also more cost-effective, making them attractive for mass-market applications. Their primary limitation lies in thermal stability, as they cannot withstand processing temperatures above 150-200°C, restricting manufacturing options and potentially compromising device performance.

Ultra-thin glass (UTG) has emerged as a premium substrate solution, combining glass-like optical properties with moderate flexibility. With thicknesses between 30-100μm, UTG delivers exceptional barrier properties against oxygen and moisture while maintaining superior surface smoothness. The critical barriers for UTG include high production costs and brittleness concerns that complicate handling during manufacturing and increase fracture risks during repeated folding operations.

Metal foil substrates, particularly stainless steel and aluminum alloys, offer outstanding thermal stability and effective electromagnetic shielding. However, their opacity necessitates top-emission display designs, adding complexity and cost to device architecture. Surface roughness also presents challenges for consistent thin-film deposition.

Hybrid substrate technologies combining multiple materials are gaining traction, with approaches such as polymer-glass laminates and polymer-metal composites showing promise. These solutions aim to balance flexibility, durability, and thermal performance but face integration challenges and increased manufacturing complexity.

The technical barriers common across substrate technologies include achieving the optimal balance between flexibility and durability, with most materials showing degradation after repeated folding cycles. Permeation barriers against oxygen and moisture remain critical challenges, as flexible substrates generally offer inferior protection compared to rigid glass. Surface quality inconsistencies, particularly nanoscale roughness, impact thin-film uniformity and device performance.

Manufacturing scalability presents another significant barrier, with many advanced substrate technologies confined to laboratory-scale production. The transition to roll-to-roll processing for high-volume manufacturing introduces additional challenges in maintaining dimensional stability and preventing substrate deformation during high-temperature processes.

Polyethylene terephthalate (PET) and polyethylene naphthalate (PEN) substrates offer superior optical clarity compared to PI, with light transmittance exceeding 85%. These materials are also more cost-effective, making them attractive for mass-market applications. Their primary limitation lies in thermal stability, as they cannot withstand processing temperatures above 150-200°C, restricting manufacturing options and potentially compromising device performance.

Ultra-thin glass (UTG) has emerged as a premium substrate solution, combining glass-like optical properties with moderate flexibility. With thicknesses between 30-100μm, UTG delivers exceptional barrier properties against oxygen and moisture while maintaining superior surface smoothness. The critical barriers for UTG include high production costs and brittleness concerns that complicate handling during manufacturing and increase fracture risks during repeated folding operations.

Metal foil substrates, particularly stainless steel and aluminum alloys, offer outstanding thermal stability and effective electromagnetic shielding. However, their opacity necessitates top-emission display designs, adding complexity and cost to device architecture. Surface roughness also presents challenges for consistent thin-film deposition.

Hybrid substrate technologies combining multiple materials are gaining traction, with approaches such as polymer-glass laminates and polymer-metal composites showing promise. These solutions aim to balance flexibility, durability, and thermal performance but face integration challenges and increased manufacturing complexity.

The technical barriers common across substrate technologies include achieving the optimal balance between flexibility and durability, with most materials showing degradation after repeated folding cycles. Permeation barriers against oxygen and moisture remain critical challenges, as flexible substrates generally offer inferior protection compared to rigid glass. Surface quality inconsistencies, particularly nanoscale roughness, impact thin-film uniformity and device performance.

Manufacturing scalability presents another significant barrier, with many advanced substrate technologies confined to laboratory-scale production. The transition to roll-to-roll processing for high-volume manufacturing introduces additional challenges in maintaining dimensional stability and preventing substrate deformation during high-temperature processes.

Current Patent-Protected Substrate Solutions

01 Materials for flexible substrates

Various materials are used in flexible display substrates to enhance flexibility while maintaining structural integrity. These include polymeric materials, thin films, and composite structures that can withstand repeated bending and folding without degradation. The selection of substrate materials is crucial for achieving the desired balance between flexibility and durability in display applications.- Substrate materials for flexible displays: Various materials are used as substrates for flexible displays to achieve the desired flexibility. These include polymeric materials such as polyimide, polyethylene terephthalate (PET), and other plastic films that provide the necessary mechanical properties. These materials offer advantages such as low weight, thinness, and the ability to bend without breaking, making them ideal for flexible display applications.

- Structural design for enhancing flexibility: Specific structural designs are implemented to enhance the flexibility of display substrates. These include the use of thin film layers, incorporation of stress-relief patterns, and specialized lamination techniques. Some designs feature neutral plane engineering where active components are positioned at or near the neutral bending plane to minimize strain during flexing. Other approaches involve segmented or island structures that allow for greater deformation without damage.

- Protective layers and encapsulation techniques: Protective layers and encapsulation techniques are crucial for maintaining the integrity and performance of flexible displays. These include barrier films that prevent moisture and oxygen penetration, which can degrade organic materials in displays. Advanced multi-layer encapsulation structures combine inorganic and organic materials to provide both flexibility and protection. Some solutions incorporate self-healing materials that can repair minor damage caused by bending or folding.

- Connection and wiring technologies for flexible displays: Specialized connection and wiring technologies are developed to maintain electrical connectivity during bending and folding operations. These include stretchable conductive materials, serpentine wiring patterns that can extend during bending, and specialized bonding techniques that maintain connections under mechanical stress. Some approaches use liquid metal or conductive polymers that maintain conductivity even when deformed, ensuring signal integrity throughout the flexible display.

- Manufacturing processes for flexible substrates: Advanced manufacturing processes are employed to produce flexible display substrates with consistent quality and performance. These include roll-to-roll processing techniques that enable continuous production of flexible substrates, specialized coating methods for uniform layer deposition, and low-temperature processes that prevent thermal damage to temperature-sensitive flexible materials. Some processes incorporate laser patterning and precision etching to create microstructures that enhance flexibility while maintaining display performance.

02 Structural design for improved flexibility

Specific structural designs are implemented to enhance the flexibility of display substrates. These include multi-layered structures, strategic placement of components, and specialized patterns that distribute stress during bending. The structural configuration helps to minimize strain on critical components while maximizing the overall flexibility of the display substrate.Expand Specific Solutions03 Interconnection technologies for flexible displays

Advanced interconnection technologies are employed to maintain electrical connectivity during bending and flexing of display substrates. These include stretchable conductors, specialized bonding techniques, and flexible circuit designs that can accommodate dimensional changes without losing functionality. These technologies ensure reliable operation of flexible displays under various deformation conditions.Expand Specific Solutions04 Protective layers and encapsulation methods

Protective layers and encapsulation methods are utilized to shield flexible display components from environmental factors while maintaining flexibility. These include thin-film encapsulation, barrier layers, and specialized coatings that prevent moisture and oxygen ingress without compromising the substrate's ability to bend. These protection systems are essential for ensuring the longevity of flexible displays.Expand Specific Solutions05 Testing and reliability enhancement methods

Specialized testing methodologies and reliability enhancement techniques are developed for flexible display substrates. These include cyclic bend testing, stress distribution analysis, and reinforcement strategies for vulnerable areas. These methods help to identify potential failure modes and improve the overall durability and lifespan of flexible display substrates under repeated bending conditions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible display substrate innovation landscape is currently in a growth phase, with the market expanding rapidly due to increasing demand for bendable and foldable displays in consumer electronics. Major players like Samsung Display, BOE Technology, and LG Display are leading technological advancements, with significant patent developments indicating a maturing technology ecosystem. Asian manufacturers dominate the competitive landscape, with Chinese companies (BOE, TCL CSOT, Visionox) rapidly closing the technology gap with Korean leaders (Samsung, LG). Japanese firms like Japan Display are also contributing significant innovations. The technology is approaching commercial maturity for certain applications, though advanced flexible substrate solutions continue to evolve through intensive R&D and strategic patent positioning.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible display substrate technologies focusing on ultra-thin glass (UTG) and polyimide (PI) film innovations. Their patented "Cyclo-olefin Polymer (COP) Composite Substrate" combines organic and inorganic materials to achieve superior flexibility while maintaining structural integrity. BOE's "Multi-layer Buffer Structure" technology incorporates stress-relief layers between the substrate and active components, allowing for repeated bending without damage to the display elements. Their patents also cover novel encapsulation methods using alternating inorganic/organic layers to protect OLED elements from oxygen and moisture while maintaining flexibility. BOE has further developed specialized barrier films with water vapor transmission rates below 10^-6 g/m²/day, enabling longer display lifespans in flexible applications[1][3]. Their manufacturing process innovations include low-temperature polysilicon (LTPS) deposition techniques specifically optimized for flexible substrates.

Strengths: Industry-leading barrier film technology provides superior protection against environmental factors; extensive manufacturing capacity allows for scale production; comprehensive patent portfolio covering multiple substrate approaches. Weaknesses: Higher production costs compared to rigid display technologies; some flexibility limitations in extreme temperature conditions; potential yield challenges in mass production of their most advanced substrate technologies.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered "Hybrid Substrate Technology" combining plastic and ultra-thin glass layers to achieve optimal flexibility while maintaining barrier properties. Their patented "Neutral Plane Engineering" positions critical electronic components precisely at the neutral bending axis of the substrate, significantly reducing stress during flexing operations. LG's "Nano-composite Barrier Film" incorporates silica nanoparticles within polymer matrices to enhance moisture resistance while maintaining transparency and flexibility. The company has also developed specialized "Stress Distribution Layer" technology that redistributes mechanical forces during bending, extending the operational lifespan of flexible displays. Their patents cover advanced plasma treatment methods that improve adhesion between substrate layers without compromising flexibility characteristics[2]. LG Display's "Gradient Hardness Coating" technology creates substrates with varying mechanical properties across their thickness, optimizing both durability and flexibility simultaneously.

Strengths: Superior neutral plane engineering reduces component failure during flexing; advanced barrier properties extend display lifetime in variable environments; strong integration with their vertical manufacturing ecosystem. Weaknesses: Higher production complexity increases manufacturing costs; some technologies still face scalability challenges for mass production; certain substrate formulations have limited temperature operating ranges.

Critical Patent Analysis for Flexible Display Substrates

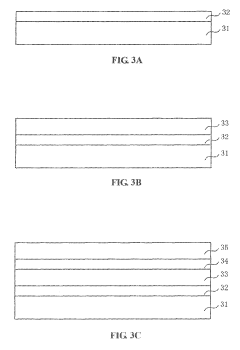

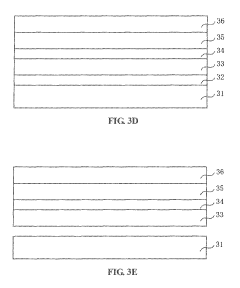

Method for manufacturing flexible display substrate

PatentActiveUS10353228B2

Innovation

- A method involving the use of a soluble polymer, such as poly(3,4-ethylenedioxythiophene)-poly(styrenesulfonate) (PEDOT:PSS), is introduced between the flexible display substrate and the carrier substrate, allowing for the flexible substrate to be peeled off by dissolving the polymer, thereby simplifying the manufacturing process and preventing damage.

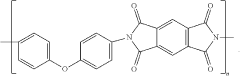

Flexible substrate material, method of manufacturing flexible display panel substrate and flexible display panel

PatentInactiveUS20210408403A1

Innovation

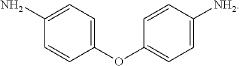

- A flexible substrate material is developed by incorporating carbon nanotube reinforcement dispersed within a polyimide substrate, linked through chemical bonds such as amide, conjugated, and hydrogen bonds, enhancing the mechanical properties and forming a composite structure with improved curl deformation and crack resistance.

Intellectual Property Strategy and Patent Portfolio Management

In the rapidly evolving field of flexible display technology, intellectual property (IP) protection has become a critical strategic asset. Companies investing in flexible display substrate innovations must develop comprehensive IP strategies to safeguard their technological advancements and maintain competitive advantages. Patent portfolio management requires a balanced approach between defensive and offensive strategies, ensuring both protection of core technologies and freedom to operate in the market.

Strategic patent filing has emerged as a key practice among industry leaders. Companies like Samsung, LG Display, and BOE Technology have established extensive patent portfolios covering various aspects of flexible substrate technology, from material compositions to manufacturing processes. These portfolios are strategically constructed to create protective barriers around core innovations while simultaneously blocking competitors from entering specific technological domains.

Cross-licensing agreements have become increasingly common in the flexible display ecosystem. As the technology complexity increases, no single company can own all necessary patents, leading to strategic alliances and licensing arrangements. These agreements not only provide access to complementary technologies but also reduce litigation risks and associated costs, creating a more stable innovation environment.

Patent landscaping and competitive intelligence have evolved into essential tools for R&D direction setting. Regular analysis of patent filing trends reveals emerging technological approaches and identifies potential white spaces for innovation. Companies leveraging these insights can more effectively allocate R&D resources toward promising areas with lower IP saturation and higher potential returns.

Geographical considerations play a significant role in patent strategy for flexible display substrates. While major markets like the US, China, South Korea, and Japan remain primary filing destinations, companies are increasingly extending protection to emerging markets where manufacturing capabilities are developing. This global approach ensures comprehensive protection across both production and consumption markets.

Risk management strategies have become more sophisticated, with companies conducting freedom-to-operate analyses before major product launches. These assessments identify potential infringement risks and inform design-around strategies when necessary. Additionally, defensive publication has emerged as a complementary approach to patenting, strategically disclosing innovations that may not warrant patent protection but should remain in the public domain to prevent competitors from obtaining exclusive rights.

Strategic patent filing has emerged as a key practice among industry leaders. Companies like Samsung, LG Display, and BOE Technology have established extensive patent portfolios covering various aspects of flexible substrate technology, from material compositions to manufacturing processes. These portfolios are strategically constructed to create protective barriers around core innovations while simultaneously blocking competitors from entering specific technological domains.

Cross-licensing agreements have become increasingly common in the flexible display ecosystem. As the technology complexity increases, no single company can own all necessary patents, leading to strategic alliances and licensing arrangements. These agreements not only provide access to complementary technologies but also reduce litigation risks and associated costs, creating a more stable innovation environment.

Patent landscaping and competitive intelligence have evolved into essential tools for R&D direction setting. Regular analysis of patent filing trends reveals emerging technological approaches and identifies potential white spaces for innovation. Companies leveraging these insights can more effectively allocate R&D resources toward promising areas with lower IP saturation and higher potential returns.

Geographical considerations play a significant role in patent strategy for flexible display substrates. While major markets like the US, China, South Korea, and Japan remain primary filing destinations, companies are increasingly extending protection to emerging markets where manufacturing capabilities are developing. This global approach ensures comprehensive protection across both production and consumption markets.

Risk management strategies have become more sophisticated, with companies conducting freedom-to-operate analyses before major product launches. These assessments identify potential infringement risks and inform design-around strategies when necessary. Additionally, defensive publication has emerged as a complementary approach to patenting, strategically disclosing innovations that may not warrant patent protection but should remain in the public domain to prevent competitors from obtaining exclusive rights.

Environmental Sustainability in Flexible Display Manufacturing

The environmental impact of flexible display manufacturing has become a critical concern as production volumes increase globally. Current substrate manufacturing processes involve significant use of chemicals, high energy consumption, and generation of waste materials that pose environmental challenges. Industry data indicates that producing one square meter of flexible display substrate can consume up to 1,900 liters of water and generate approximately 2.5 kg of hazardous waste, highlighting the urgent need for sustainable innovations.

Recent patent developments reveal promising approaches to reducing the environmental footprint of flexible display substrates. Bio-based polymers derived from renewable resources are emerging as alternatives to petroleum-based substrates, with companies like Samsung and LG filing patents for cellulose-based and lignin-derived materials that maintain performance while offering biodegradability. These innovations could potentially reduce carbon emissions by 30-45% compared to conventional substrates.

Water conservation technologies feature prominently in recent patent filings, with closed-loop water recycling systems showing potential to reduce water consumption by up to 80% in substrate manufacturing. BOE Technology's patented water purification system specifically designed for display manufacturing processes represents a significant advancement in this area, allowing for the recovery and reuse of process water.

Energy efficiency improvements are another key focus area, with patents revealing novel low-temperature processing techniques that can reduce energy requirements by 40-60%. These innovations include ambient-temperature curing methods and energy-efficient plasma treatments that maintain substrate performance while significantly reducing the carbon footprint of manufacturing operations.

End-of-life considerations are increasingly addressed in flexible display substrate patents, with design-for-recycling approaches gaining traction. Notable innovations include easily separable multi-layer structures and mono-material designs that facilitate material recovery. Particularly promising is Apple's patent for substrate materials with reversible cross-linking, enabling complete material separation and recovery at end-of-life.

Regulatory pressures are accelerating sustainable innovation, with the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations driving the development of halogen-free and low-VOC substrate materials. Patents from companies like 3M and DuPont showcase novel formulations that eliminate substances of concern while maintaining critical performance parameters.

The economic viability of environmentally sustainable substrate technologies is improving rapidly, with recent cost modeling studies suggesting that bio-based and recyclable substrates could achieve cost parity with conventional materials by 2025, driven by economies of scale and process optimization. This economic trajectory, combined with consumer demand for sustainable electronics, is likely to accelerate industry adoption of environmentally responsible flexible display substrate technologies.

Recent patent developments reveal promising approaches to reducing the environmental footprint of flexible display substrates. Bio-based polymers derived from renewable resources are emerging as alternatives to petroleum-based substrates, with companies like Samsung and LG filing patents for cellulose-based and lignin-derived materials that maintain performance while offering biodegradability. These innovations could potentially reduce carbon emissions by 30-45% compared to conventional substrates.

Water conservation technologies feature prominently in recent patent filings, with closed-loop water recycling systems showing potential to reduce water consumption by up to 80% in substrate manufacturing. BOE Technology's patented water purification system specifically designed for display manufacturing processes represents a significant advancement in this area, allowing for the recovery and reuse of process water.

Energy efficiency improvements are another key focus area, with patents revealing novel low-temperature processing techniques that can reduce energy requirements by 40-60%. These innovations include ambient-temperature curing methods and energy-efficient plasma treatments that maintain substrate performance while significantly reducing the carbon footprint of manufacturing operations.

End-of-life considerations are increasingly addressed in flexible display substrate patents, with design-for-recycling approaches gaining traction. Notable innovations include easily separable multi-layer structures and mono-material designs that facilitate material recovery. Particularly promising is Apple's patent for substrate materials with reversible cross-linking, enabling complete material separation and recovery at end-of-life.

Regulatory pressures are accelerating sustainable innovation, with the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations driving the development of halogen-free and low-VOC substrate materials. Patents from companies like 3M and DuPont showcase novel formulations that eliminate substances of concern while maintaining critical performance parameters.

The economic viability of environmentally sustainable substrate technologies is improving rapidly, with recent cost modeling studies suggesting that bio-based and recyclable substrates could achieve cost parity with conventional materials by 2025, driven by economies of scale and process optimization. This economic trajectory, combined with consumer demand for sustainable electronics, is likely to accelerate industry adoption of environmentally responsible flexible display substrate technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!