Flexible Display Substrates: Material Standards and Qualification

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Substrate Evolution and Objectives

Flexible display technology has evolved significantly over the past two decades, transforming from conceptual research to commercial reality. The journey began in the early 2000s with rudimentary flexible electronic paper displays, progressing through various technological breakthroughs to today's advanced flexible OLED and AMOLED displays. This evolution has been driven by the persistent demand for more durable, lightweight, and versatile display solutions across consumer electronics, automotive interfaces, and wearable technology sectors.

The substrate materials have undergone parallel evolution, transitioning from rigid glass to flexible alternatives. Early flexible displays utilized modified polyethylene terephthalate (PET) and polyethylene naphthalate (PEN), which offered basic flexibility but limited thermal stability. The mid-2010s saw the introduction of polyimide (PI) substrates, which significantly improved both flexibility and thermal resistance, enabling more sophisticated manufacturing processes.

Current technological objectives in flexible display substrate development focus on several critical parameters. Material engineers are striving to achieve ultra-thin substrates (below 10 μm) while maintaining mechanical integrity and dimensional stability during manufacturing processes that often involve temperatures exceeding 300°C. Simultaneously, there is a push toward enhancing flexibility metrics, with targets including bend radii below 1mm and the capability to withstand over 200,000 folding cycles without performance degradation.

Barrier properties represent another crucial development objective, as flexible substrates must achieve water vapor transmission rates (WVTR) below 10^-6 g/m²/day to adequately protect sensitive display components. This represents a significant challenge given the inherently higher permeability of polymer materials compared to traditional glass substrates.

Optical performance remains paramount, with research focused on achieving transparency above 90% across the visible spectrum while minimizing birefringence effects that can compromise display quality during flexing operations. Additionally, surface roughness must be controlled to nanometer-scale precision to ensure uniform electrical characteristics in the thin-film transistor layers deposited on these substrates.

The industry is also prioritizing sustainability objectives, with increasing research dedicated to bio-based polymers and environmentally friendly manufacturing processes. This trend aligns with broader market demands for reduced environmental impact across the electronics supply chain, while simultaneously addressing cost considerations that remain critical for mass-market adoption.

The substrate materials have undergone parallel evolution, transitioning from rigid glass to flexible alternatives. Early flexible displays utilized modified polyethylene terephthalate (PET) and polyethylene naphthalate (PEN), which offered basic flexibility but limited thermal stability. The mid-2010s saw the introduction of polyimide (PI) substrates, which significantly improved both flexibility and thermal resistance, enabling more sophisticated manufacturing processes.

Current technological objectives in flexible display substrate development focus on several critical parameters. Material engineers are striving to achieve ultra-thin substrates (below 10 μm) while maintaining mechanical integrity and dimensional stability during manufacturing processes that often involve temperatures exceeding 300°C. Simultaneously, there is a push toward enhancing flexibility metrics, with targets including bend radii below 1mm and the capability to withstand over 200,000 folding cycles without performance degradation.

Barrier properties represent another crucial development objective, as flexible substrates must achieve water vapor transmission rates (WVTR) below 10^-6 g/m²/day to adequately protect sensitive display components. This represents a significant challenge given the inherently higher permeability of polymer materials compared to traditional glass substrates.

Optical performance remains paramount, with research focused on achieving transparency above 90% across the visible spectrum while minimizing birefringence effects that can compromise display quality during flexing operations. Additionally, surface roughness must be controlled to nanometer-scale precision to ensure uniform electrical characteristics in the thin-film transistor layers deposited on these substrates.

The industry is also prioritizing sustainability objectives, with increasing research dedicated to bio-based polymers and environmentally friendly manufacturing processes. This trend aligns with broader market demands for reduced environmental impact across the electronics supply chain, while simultaneously addressing cost considerations that remain critical for mass-market adoption.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has witnessed remarkable growth in recent years, driven by increasing consumer demand for more durable, lightweight, and versatile electronic devices. Market research indicates that the global flexible display market was valued at approximately 8.3 billion USD in 2020 and is projected to reach 22.7 billion USD by 2026, growing at a CAGR of 18.2% during the forecast period. This substantial growth trajectory underscores the significant market potential for flexible display technologies and their associated substrate materials.

Consumer electronics represents the largest application segment for flexible display technologies, with smartphones being the primary driver. Major smartphone manufacturers have increasingly incorporated flexible displays into their flagship products, responding to consumer preferences for larger screens without increasing device dimensions. The foldable smartphone segment, though still nascent, has shown promising growth potential, with sales increasing by 264% from 2020 to 2021 despite premium pricing.

Beyond smartphones, there is growing demand for flexible displays in wearable devices, automotive interfaces, and smart home applications. The wearable technology market, valued at 32.6 billion USD in 2020, is expected to reach 74.7 billion USD by 2026, creating substantial opportunities for flexible display integration. Similarly, the automotive industry is increasingly adopting flexible displays for dashboard interfaces and entertainment systems, with the automotive display market projected to grow at 8.1% CAGR through 2026.

Regional analysis reveals that Asia-Pacific dominates the flexible display market, accounting for over 60% of global production capacity. This is primarily due to the concentration of display manufacturers and electronics supply chains in countries like South Korea, Japan, China, and Taiwan. However, North America and Europe represent significant consumption markets, driven by high adoption rates of premium electronic devices.

Industry surveys indicate that end-users prioritize several key performance attributes in flexible displays: durability (resistance to repeated bending), visual quality (resolution and color accuracy), and energy efficiency. These consumer preferences directly influence material requirements for flexible display substrates, driving demand for advanced polymers and composite materials that can maintain optical and mechanical performance under stress conditions.

Market forecasts suggest that polyimide will remain the dominant substrate material in the near term, but emerging alternatives such as ultra-thin glass and hybrid organic-inorganic composites are gaining traction. The substrate materials market for flexible displays is expected to grow at 22.4% CAGR through 2026, outpacing the overall flexible display market growth due to increasing material performance requirements and diversification of substrate technologies.

Consumer electronics represents the largest application segment for flexible display technologies, with smartphones being the primary driver. Major smartphone manufacturers have increasingly incorporated flexible displays into their flagship products, responding to consumer preferences for larger screens without increasing device dimensions. The foldable smartphone segment, though still nascent, has shown promising growth potential, with sales increasing by 264% from 2020 to 2021 despite premium pricing.

Beyond smartphones, there is growing demand for flexible displays in wearable devices, automotive interfaces, and smart home applications. The wearable technology market, valued at 32.6 billion USD in 2020, is expected to reach 74.7 billion USD by 2026, creating substantial opportunities for flexible display integration. Similarly, the automotive industry is increasingly adopting flexible displays for dashboard interfaces and entertainment systems, with the automotive display market projected to grow at 8.1% CAGR through 2026.

Regional analysis reveals that Asia-Pacific dominates the flexible display market, accounting for over 60% of global production capacity. This is primarily due to the concentration of display manufacturers and electronics supply chains in countries like South Korea, Japan, China, and Taiwan. However, North America and Europe represent significant consumption markets, driven by high adoption rates of premium electronic devices.

Industry surveys indicate that end-users prioritize several key performance attributes in flexible displays: durability (resistance to repeated bending), visual quality (resolution and color accuracy), and energy efficiency. These consumer preferences directly influence material requirements for flexible display substrates, driving demand for advanced polymers and composite materials that can maintain optical and mechanical performance under stress conditions.

Market forecasts suggest that polyimide will remain the dominant substrate material in the near term, but emerging alternatives such as ultra-thin glass and hybrid organic-inorganic composites are gaining traction. The substrate materials market for flexible displays is expected to grow at 22.4% CAGR through 2026, outpacing the overall flexible display market growth due to increasing material performance requirements and diversification of substrate technologies.

Current Challenges in Flexible Substrate Materials

Despite significant advancements in flexible display technology, several critical challenges persist in the development and implementation of flexible substrate materials. The primary obstacle remains achieving the optimal balance between flexibility and durability. Current materials often demonstrate a trade-off between bendability and resistance to mechanical stress, with repeated folding or bending leading to microcracks and eventual failure points in the substrate structure.

Material uniformity presents another significant challenge, as manufacturing processes struggle to produce consistently homogeneous flexible substrates at scale. This inconsistency leads to variable performance across different areas of the same display, affecting both optical quality and mechanical reliability. The industry continues to grapple with yield rates that remain substantially lower than those achieved with rigid display technologies.

Temperature sensitivity constitutes a major limitation for many flexible substrate materials. Polymers commonly used in flexible displays, such as polyimide and polyethylene terephthalate (PET), exhibit dimensional instability when exposed to the high temperatures required during semiconductor deposition processes. This thermal expansion mismatch between substrate and electronic components creates internal stresses that compromise device integrity.

Barrier properties represent another critical challenge, as flexible substrates must effectively prevent oxygen and moisture permeation to protect sensitive organic light-emitting materials and thin-film transistors. Current barrier technologies often add significant thickness or reduce flexibility, counteracting the primary advantages of flexible displays.

Cost-effectiveness remains an industry-wide concern, with high-performance flexible substrates commanding premium prices that limit mass-market adoption. The complex manufacturing processes, specialized equipment, and high-purity materials required contribute to production costs significantly higher than those of conventional glass substrates.

Standardization issues further complicate development efforts, as the flexible display industry lacks unified testing protocols and performance metrics. This absence of standardized qualification methods makes it difficult to compare materials across suppliers and applications, slowing innovation and market growth.

Environmental stability presents ongoing challenges, with many flexible substrate materials demonstrating sensitivity to UV exposure, chemical contaminants, and environmental stressors. These vulnerabilities can lead to yellowing, embrittlement, or degradation of optical properties over the product lifecycle, affecting both aesthetic appeal and functional performance.

Material uniformity presents another significant challenge, as manufacturing processes struggle to produce consistently homogeneous flexible substrates at scale. This inconsistency leads to variable performance across different areas of the same display, affecting both optical quality and mechanical reliability. The industry continues to grapple with yield rates that remain substantially lower than those achieved with rigid display technologies.

Temperature sensitivity constitutes a major limitation for many flexible substrate materials. Polymers commonly used in flexible displays, such as polyimide and polyethylene terephthalate (PET), exhibit dimensional instability when exposed to the high temperatures required during semiconductor deposition processes. This thermal expansion mismatch between substrate and electronic components creates internal stresses that compromise device integrity.

Barrier properties represent another critical challenge, as flexible substrates must effectively prevent oxygen and moisture permeation to protect sensitive organic light-emitting materials and thin-film transistors. Current barrier technologies often add significant thickness or reduce flexibility, counteracting the primary advantages of flexible displays.

Cost-effectiveness remains an industry-wide concern, with high-performance flexible substrates commanding premium prices that limit mass-market adoption. The complex manufacturing processes, specialized equipment, and high-purity materials required contribute to production costs significantly higher than those of conventional glass substrates.

Standardization issues further complicate development efforts, as the flexible display industry lacks unified testing protocols and performance metrics. This absence of standardized qualification methods makes it difficult to compare materials across suppliers and applications, slowing innovation and market growth.

Environmental stability presents ongoing challenges, with many flexible substrate materials demonstrating sensitivity to UV exposure, chemical contaminants, and environmental stressors. These vulnerabilities can lead to yellowing, embrittlement, or degradation of optical properties over the product lifecycle, affecting both aesthetic appeal and functional performance.

Current Material Solutions and Qualification Standards

01 Polymer-based flexible substrate materials

Polymer-based materials such as polyimide, polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) are widely used as flexible substrates for display applications. These materials offer excellent flexibility, lightweight properties, and good thermal stability. The substrates can be manufactured with specific thickness standards to balance flexibility and durability, typically ranging from 10-100 micrometers. Various surface treatments can be applied to enhance adhesion properties and improve compatibility with subsequent display layers.- Polymer-based flexible substrate materials: Polymer-based materials such as polyimide, polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) are widely used as flexible substrates for displays due to their excellent mechanical flexibility, thermal stability, and optical transparency. These materials can withstand repeated bending and folding while maintaining their structural integrity and display performance. The polymer substrates are typically treated with special coatings to enhance their barrier properties against moisture and oxygen, which is crucial for the longevity of flexible displays.

- Thin-film encapsulation technologies: Thin-film encapsulation (TFE) technologies are essential for protecting flexible display components from environmental factors. These technologies involve depositing alternating inorganic and organic layers to create effective barrier films that prevent moisture and oxygen penetration while maintaining flexibility. Advanced TFE methods include atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD) to create ultra-thin, defect-free barrier layers. The encapsulation materials must meet stringent standards for transparency, flexibility, and barrier performance to ensure display longevity.

- Transparent conductive materials for flexible electrodes: Flexible displays require transparent conductive materials that maintain conductivity under bending stress. Indium tin oxide (ITO) has been traditionally used but has limitations in flexibility. Alternative materials include silver nanowires, carbon nanotubes, graphene, and metal mesh structures that offer superior mechanical flexibility while maintaining high conductivity and transparency. These materials must meet standards for sheet resistance (typically <100 ohms/square), optical transparency (>85%), and mechanical durability (withstanding thousands of bending cycles without significant performance degradation).

- Adhesive and bonding technologies for multilayer structures: Specialized adhesives and bonding technologies are critical for creating multilayer structures in flexible displays. These materials must maintain strong adhesion between different functional layers while allowing for flexibility. Optically clear adhesives (OCAs) with controlled refractive indices are used to minimize light reflection and maximize display brightness. The adhesive materials need to meet standards for optical clarity, UV stability, thermal resistance, and mechanical properties to ensure long-term reliability of the flexible display under various environmental conditions and mechanical stresses.

- Barrier and protection layer materials: Barrier and protection layers are essential components of flexible display substrates to prevent damage from environmental factors and mechanical stress. These materials include specialized coatings with high oxygen and moisture barrier properties, scratch-resistant layers, and anti-reflection films. Advanced barrier films often employ multilayer structures with alternating inorganic (such as silicon nitride or aluminum oxide) and organic layers to achieve ultra-low water vapor transmission rates (WVTR) below 10^-6 g/m²/day. These protective materials must maintain their barrier properties while accommodating the mechanical deformation of the flexible substrate.

02 Thin-film barrier layer standards

Flexible displays require high-performance barrier layers to protect sensitive electronic components from moisture and oxygen. These barrier layers typically consist of alternating inorganic and organic films that meet specific permeation rate standards (typically <10^-6 g/m²/day for water vapor). The barrier layers must maintain their protective properties even under repeated bending conditions. Advanced multi-layer structures with precisely controlled thickness and composition are employed to achieve the required barrier performance while maintaining overall substrate flexibility.Expand Specific Solutions03 Mechanical durability and bending radius specifications

Flexible display substrates must meet specific mechanical durability standards to withstand repeated bending and folding. These standards typically specify minimum bending radius requirements (commonly 1-5mm), along with cycle testing protocols that require substrates to maintain functionality after thousands of bending cycles. Material composition and thickness are carefully controlled to achieve the required balance between flexibility and durability. Surface hardness and scratch resistance properties are also standardized to ensure display longevity under normal usage conditions.Expand Specific Solutions04 Thermal stability and dimensional control standards

Flexible display substrates must maintain dimensional stability across a wide temperature range, typically from -40°C to 120°C. Coefficient of thermal expansion (CTE) values are strictly controlled to ensure compatibility with other display components. Manufacturing standards specify maximum allowable shrinkage rates (typically <0.1%) after thermal processing. Heat resistance properties are critical for withstanding high-temperature processes during display fabrication, such as thin-film transistor deposition and encapsulation, while maintaining the substrate's mechanical and optical properties.Expand Specific Solutions05 Optical performance requirements

Flexible display substrates must meet stringent optical performance standards, including high transparency (>85% in the visible spectrum), low haze (<1%), and controlled birefringence. Color neutrality is essential to avoid affecting the display's color reproduction. Refractive index uniformity across the substrate is tightly controlled to prevent optical distortions. Surface roughness standards (typically <10nm Ra) ensure optimal optical coupling with display layers and minimize light scattering. These optical properties must be maintained even after repeated mechanical deformation of the substrate.Expand Specific Solutions

Leading Companies in Flexible Display Material Development

The flexible display substrate market is currently in a growth phase, with an estimated market size exceeding $5 billion and projected to expand significantly as demand for foldable and rollable devices increases. Major players like Samsung Display, LG Display, and BOE Technology are leading technological innovation, having achieved commercial maturity in several flexible substrate technologies. These companies have established robust material standards and qualification processes, while emerging competitors such as TCL China Star Optoelectronics and E Ink are advancing specialized applications. Research institutions including Changchun Institute of Applied Chemistry and University of South Florida collaborate with industry leaders to develop next-generation materials. The competitive landscape is characterized by intense patent activity and strategic partnerships focused on improving durability, flexibility, and manufacturing scalability.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible display substrates using polyimide (PI) materials that can withstand bending radii of less than 1mm without performance degradation. Their proprietary manufacturing process involves coating PI varnish on carrier glass, followed by imidization at temperatures exceeding 300°C, and subsequent release using laser lift-off technology. BOE's flexible substrates achieve thickness control of ±2μm across large areas and maintain oxygen and water vapor transmission rates below 10^-6 g/m²/day[1]. The company has also pioneered in-cell touch technology integration directly into flexible substrates, reducing overall display module thickness by approximately 0.2mm while maintaining touch sensitivity comparable to traditional glass-based displays[3]. BOE's qualification standards include over 200,000 folding cycles at various temperatures (-20°C to 60°C) and humidity levels (20-90% RH) to ensure long-term reliability[5].

Strengths: Industry-leading thickness uniformity control and barrier properties against moisture and oxygen penetration. Comprehensive qualification testing that exceeds industry standards for mechanical durability. Weaknesses: Higher manufacturing costs compared to rigid display technologies, with yield rates approximately 15-20% lower than conventional glass substrate production. Limited high-volume production capacity for ultra-thin (<20μm) substrates.

LG Display Co., Ltd.

Technical Solution: LG Display has developed proprietary flexible display substrates based on modified polyimide technology with enhanced thermal stability (glass transition temperature >350°C) and mechanical properties (Young's modulus >8GPa). Their manufacturing process employs solution-casting techniques followed by thermal imidization and specialized surface treatments to improve adhesion with subsequent layers. LG's substrates feature a multi-layer barrier structure that achieves water vapor transmission rates below 5×10^-7 g/m²/day and oxygen transmission rates under 10^-6 cc/m²/day[2]. The company has established rigorous qualification standards including dynamic folding tests (200,000+ cycles at 3mm radius), environmental stability tests (-40°C to 85°C, 95% RH), and accelerated aging tests simulating 5+ years of usage. LG has also developed specialized colorless polyimide formulations that eliminate the traditional yellowish tint, achieving transparency levels exceeding 90% in the visible spectrum[4], which is particularly important for transparent display applications.

Strengths: Superior optical properties with high transparency and low yellowness index compared to competitors. Excellent barrier properties against environmental contaminants with industry-leading WVTR values. Weaknesses: Higher material costs compared to standard polyimide formulations, increasing overall display module costs by approximately 15-20%. Manufacturing process requires precise temperature control (±1°C) during imidization, creating production challenges at scale.

Key Patents and Innovations in Flexible Substrate Technology

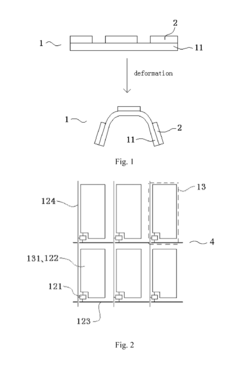

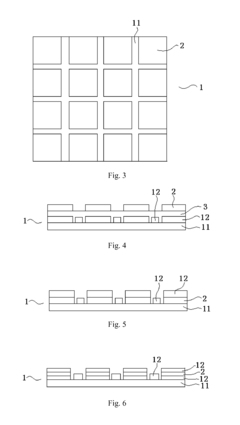

Flexible display substrate, the manufacturing method thereof and a flexible display device

PatentActiveUS9401485B2

Innovation

- A flexible display substrate with a hard material layer strategically positioned at fragile areas to enhance resistance to deformation, allowing for larger deformation without damage and maintaining good display performance, while using existing manufacturing processes and equipment to reduce costs.

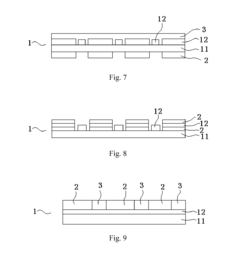

Substrate for Flexible Displays

PatentActiveUS20070224366A1

Innovation

- A substrate comprising a resin composition layer with an inorganic layer compound, such as clay minerals, dispersed in a solvent, where the inorganic layer compound constitutes between 10 weight % and 70 weight % of the total composition, providing a low thermal expansion coefficient and high visible light transmittance.

Supply Chain Considerations for Flexible Display Materials

The flexible display supply chain represents a complex ecosystem that requires careful management and strategic planning. Material sourcing for flexible substrates presents unique challenges compared to traditional rigid displays, with polyimide (PI), polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) being the primary substrate materials requiring specialized manufacturing capabilities.

Geographic concentration of supply presents significant risk factors, with South Korea, Japan, and Taiwan dominating high-quality flexible substrate production. This concentration creates potential vulnerabilities to regional disruptions such as natural disasters or geopolitical tensions. Companies like Kolon Industries, Sumitomo Chemical, and DuPont maintain significant market share in specialized substrate materials, creating potential bottlenecks during demand surges.

Lead times for specialized flexible display materials typically range from 8-16 weeks, considerably longer than conventional display components. This extended timeline necessitates more sophisticated inventory management and forecasting systems to prevent production delays. The qualification process for new suppliers can extend 6-12 months, including material testing, reliability verification, and manufacturing process validation.

Cost structures for flexible display materials remain significantly higher than rigid alternatives, with premium-grade polyimide substrates commanding 5-7 times the price of standard glass. However, economies of scale are gradually reducing this differential as production volumes increase. Material consistency across batches represents another critical supply chain consideration, as even minor variations in substrate properties can significantly impact yield rates and final product performance.

Environmental and regulatory compliance adds another layer of complexity, with different regions implementing varying standards for chemical usage, emissions, and end-of-life recycling. Forward-thinking manufacturers are increasingly adopting sustainable sourcing practices and developing recyclable substrate materials to address these concerns.

Vertical integration strategies are becoming more prevalent among major display manufacturers, with companies like Samsung and LG investing in their substrate production capabilities to ensure supply security and proprietary material advantages. This trend may reshape competitive dynamics within the flexible display ecosystem over the coming years.

Effective supply chain management for flexible display materials ultimately requires balancing cost considerations with quality requirements, supply security, and time-to-market pressures. Companies that develop robust supplier relationships, diversified sourcing strategies, and advanced forecasting capabilities will gain significant competitive advantages in this rapidly evolving market segment.

Geographic concentration of supply presents significant risk factors, with South Korea, Japan, and Taiwan dominating high-quality flexible substrate production. This concentration creates potential vulnerabilities to regional disruptions such as natural disasters or geopolitical tensions. Companies like Kolon Industries, Sumitomo Chemical, and DuPont maintain significant market share in specialized substrate materials, creating potential bottlenecks during demand surges.

Lead times for specialized flexible display materials typically range from 8-16 weeks, considerably longer than conventional display components. This extended timeline necessitates more sophisticated inventory management and forecasting systems to prevent production delays. The qualification process for new suppliers can extend 6-12 months, including material testing, reliability verification, and manufacturing process validation.

Cost structures for flexible display materials remain significantly higher than rigid alternatives, with premium-grade polyimide substrates commanding 5-7 times the price of standard glass. However, economies of scale are gradually reducing this differential as production volumes increase. Material consistency across batches represents another critical supply chain consideration, as even minor variations in substrate properties can significantly impact yield rates and final product performance.

Environmental and regulatory compliance adds another layer of complexity, with different regions implementing varying standards for chemical usage, emissions, and end-of-life recycling. Forward-thinking manufacturers are increasingly adopting sustainable sourcing practices and developing recyclable substrate materials to address these concerns.

Vertical integration strategies are becoming more prevalent among major display manufacturers, with companies like Samsung and LG investing in their substrate production capabilities to ensure supply security and proprietary material advantages. This trend may reshape competitive dynamics within the flexible display ecosystem over the coming years.

Effective supply chain management for flexible display materials ultimately requires balancing cost considerations with quality requirements, supply security, and time-to-market pressures. Companies that develop robust supplier relationships, diversified sourcing strategies, and advanced forecasting capabilities will gain significant competitive advantages in this rapidly evolving market segment.

Environmental Impact and Sustainability of Flexible Substrates

The environmental impact of flexible display substrates represents a critical consideration in the rapidly evolving display technology landscape. Traditional rigid display manufacturing processes involve significant energy consumption, hazardous chemicals, and generate substantial waste. In contrast, flexible substrates offer potential environmental advantages through reduced material usage, lower processing temperatures, and enhanced product longevity.

Polymer-based flexible substrates such as polyimide (PI) and polyethylene terephthalate (PET) present mixed sustainability profiles. While they enable thinner, lighter displays that require fewer raw materials, many are petroleum-derived and face end-of-life recycling challenges. Recent advancements in bio-based polymers show promise for reducing the carbon footprint of flexible displays, with materials derived from renewable resources achieving comparable performance to conventional options.

Life cycle assessment (LCA) studies indicate that the manufacturing phase of flexible substrates remains energy-intensive, particularly during high-temperature curing processes for polyimide. However, the operational phase demonstrates environmental benefits through reduced power consumption in finished devices. The thin, lightweight nature of flexible displays contributes to transportation efficiency and potentially extends device lifespans through enhanced durability against mechanical stress.

Water usage presents another significant environmental concern, with traditional display manufacturing requiring substantial ultrapure water resources. Emerging dry processing techniques for flexible substrates show potential for reducing water consumption by up to 40% compared to conventional methods. Additionally, chemical usage in flexible substrate production requires careful management, as some processing agents pose ecological risks if improperly handled.

End-of-life considerations remain challenging for flexible display substrates. Current recycling infrastructure is poorly equipped to handle multi-layer flexible displays with intimately bonded materials. Research into delamination techniques and design-for-disassembly approaches shows promise for improving recyclability. Several manufacturers have implemented take-back programs specifically targeting flexible display products.

Industry standards for environmental performance are evolving rapidly, with organizations like VESA and SID developing sustainability metrics specifically for flexible display technologies. These standards increasingly incorporate criteria for renewable material content, energy efficiency during manufacturing, hazardous substance restrictions, and end-of-life recoverability. Compliance with these emerging standards is becoming a competitive differentiator in the display market.

Polymer-based flexible substrates such as polyimide (PI) and polyethylene terephthalate (PET) present mixed sustainability profiles. While they enable thinner, lighter displays that require fewer raw materials, many are petroleum-derived and face end-of-life recycling challenges. Recent advancements in bio-based polymers show promise for reducing the carbon footprint of flexible displays, with materials derived from renewable resources achieving comparable performance to conventional options.

Life cycle assessment (LCA) studies indicate that the manufacturing phase of flexible substrates remains energy-intensive, particularly during high-temperature curing processes for polyimide. However, the operational phase demonstrates environmental benefits through reduced power consumption in finished devices. The thin, lightweight nature of flexible displays contributes to transportation efficiency and potentially extends device lifespans through enhanced durability against mechanical stress.

Water usage presents another significant environmental concern, with traditional display manufacturing requiring substantial ultrapure water resources. Emerging dry processing techniques for flexible substrates show potential for reducing water consumption by up to 40% compared to conventional methods. Additionally, chemical usage in flexible substrate production requires careful management, as some processing agents pose ecological risks if improperly handled.

End-of-life considerations remain challenging for flexible display substrates. Current recycling infrastructure is poorly equipped to handle multi-layer flexible displays with intimately bonded materials. Research into delamination techniques and design-for-disassembly approaches shows promise for improving recyclability. Several manufacturers have implemented take-back programs specifically targeting flexible display products.

Industry standards for environmental performance are evolving rapidly, with organizations like VESA and SID developing sustainability metrics specifically for flexible display technologies. These standards increasingly incorporate criteria for renewable material content, energy efficiency during manufacturing, hazardous substance restrictions, and end-of-life recoverability. Compliance with these emerging standards is becoming a competitive differentiator in the display market.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!