Standards Compliance in Flexible Display Substrate Manufacturing

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Standards Evolution and Objectives

Flexible display technology has evolved significantly over the past two decades, transitioning from laboratory curiosities to commercially viable products. The journey began in the early 2000s with rudimentary prototypes featuring limited flexibility and durability. Initial standards focused primarily on basic mechanical properties and minimal electrical performance requirements, with organizations like the Society for Information Display (SID) and the International Electrotechnical Commission (IEC) leading early standardization efforts.

By 2010, the industry recognized the need for more comprehensive standards as flexible displays moved toward mass production. This period saw the emergence of the first generation of standards addressing substrate materials, focusing on polyimide and thin glass properties. The Flexible Display Standards Working Group (FDSWG) was established in 2012, bringing together manufacturers, material suppliers, and research institutions to develop cohesive guidelines for the emerging technology.

The evolution accelerated between 2015-2020 with the introduction of the IEC 62715 series specifically addressing flexible display technologies. These standards expanded beyond basic mechanical properties to include environmental testing protocols, reliability metrics, and manufacturing process controls. Concurrently, ASTM International developed testing methodologies for flexible substrate materials, establishing D7867 and D7739 standards for measuring critical parameters like bend radius tolerance and delamination resistance.

Current standards have matured to address the complex manufacturing ecosystem of flexible displays, with particular emphasis on substrate manufacturing compliance. The International Committee for Display Metrology (ICDM) has incorporated flexible display metrics into its Information Display Measurements Standard, while ISO has developed specialized standards for optical and mechanical characterization of flexible substrates under TC 61 (Plastics) and TC 42 (Photography).

The primary objectives of these evolving standards are multifaceted: ensuring manufacturing consistency across global supply chains, establishing minimum performance requirements for consumer safety and satisfaction, enabling interoperability between components from different manufacturers, and providing benchmarks for quality control and reliability testing. Additionally, standards aim to accelerate innovation by creating common technical languages and testing methodologies.

Looking forward, standards development is focusing on emerging challenges including ultra-thin substrate handling, roll-to-roll manufacturing processes, and integration with other flexible electronic components. Environmental sustainability metrics are also becoming increasingly important, with new standards under development to address recyclability, biodegradability, and reduced use of hazardous materials in flexible display substrates.

By 2010, the industry recognized the need for more comprehensive standards as flexible displays moved toward mass production. This period saw the emergence of the first generation of standards addressing substrate materials, focusing on polyimide and thin glass properties. The Flexible Display Standards Working Group (FDSWG) was established in 2012, bringing together manufacturers, material suppliers, and research institutions to develop cohesive guidelines for the emerging technology.

The evolution accelerated between 2015-2020 with the introduction of the IEC 62715 series specifically addressing flexible display technologies. These standards expanded beyond basic mechanical properties to include environmental testing protocols, reliability metrics, and manufacturing process controls. Concurrently, ASTM International developed testing methodologies for flexible substrate materials, establishing D7867 and D7739 standards for measuring critical parameters like bend radius tolerance and delamination resistance.

Current standards have matured to address the complex manufacturing ecosystem of flexible displays, with particular emphasis on substrate manufacturing compliance. The International Committee for Display Metrology (ICDM) has incorporated flexible display metrics into its Information Display Measurements Standard, while ISO has developed specialized standards for optical and mechanical characterization of flexible substrates under TC 61 (Plastics) and TC 42 (Photography).

The primary objectives of these evolving standards are multifaceted: ensuring manufacturing consistency across global supply chains, establishing minimum performance requirements for consumer safety and satisfaction, enabling interoperability between components from different manufacturers, and providing benchmarks for quality control and reliability testing. Additionally, standards aim to accelerate innovation by creating common technical languages and testing methodologies.

Looking forward, standards development is focusing on emerging challenges including ultra-thin substrate handling, roll-to-roll manufacturing processes, and integration with other flexible electronic components. Environmental sustainability metrics are also becoming increasingly important, with new standards under development to address recyclability, biodegradability, and reduced use of hazardous materials in flexible display substrates.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has witnessed exponential growth over the past decade, driven by increasing consumer demand for more durable, lightweight, and versatile electronic devices. Market research indicates that the global flexible display market is projected to reach $42.85 billion by 2027, growing at a CAGR of 28.1% from 2020 to 2027. This remarkable growth trajectory underscores the significant market potential for flexible display technologies across various industries.

Consumer electronics remains the dominant application sector, with smartphones and wearable devices leading the adoption of flexible display technologies. The smartphone segment alone accounts for approximately 65% of the current flexible display market, as major manufacturers like Samsung, Apple, and Huawei increasingly incorporate flexible OLED displays into their flagship products. The foldable smartphone market segment has shown particularly strong growth, with shipments increasing by 264% year-over-year in 2021.

Beyond consumer electronics, automotive displays represent a rapidly expanding market for flexible display technologies. The automotive industry's shift toward smart cockpits and enhanced user interfaces has created substantial demand for curved and flexible displays that can conform to interior design requirements while maintaining durability standards. Industry analysts predict that the automotive flexible display market will grow at a CAGR of 24.3% through 2026.

Healthcare and retail sectors are emerging as promising markets for flexible display applications. In healthcare, flexible displays enable the development of advanced wearable monitoring devices and portable diagnostic equipment. The retail sector is adopting flexible displays for innovative advertising solutions and interactive customer experiences, with digital signage applications showing particular promise.

Regional analysis reveals that Asia Pacific dominates the flexible display market, accounting for over 60% of global production capacity. This regional concentration is primarily due to the presence of major display manufacturers in South Korea, Japan, China, and Taiwan. However, North America and Europe are witnessing accelerated growth in flexible display adoption, particularly in premium consumer electronics and automotive applications.

Market challenges persist despite the positive growth outlook. Price sensitivity remains a significant barrier to widespread adoption, as flexible display manufacturing costs continue to exceed those of conventional rigid displays by 30-40%. Additionally, concerns regarding long-term durability and reliability under various environmental conditions have tempered adoption rates in certain industrial applications where operational longevity is paramount.

The market increasingly demands standardized manufacturing processes that ensure consistent quality and performance across different suppliers. This standardization pressure is driving industry-wide efforts to establish comprehensive compliance frameworks for flexible display substrate manufacturing, creating opportunities for companies that can demonstrate leadership in standards development and implementation.

Consumer electronics remains the dominant application sector, with smartphones and wearable devices leading the adoption of flexible display technologies. The smartphone segment alone accounts for approximately 65% of the current flexible display market, as major manufacturers like Samsung, Apple, and Huawei increasingly incorporate flexible OLED displays into their flagship products. The foldable smartphone market segment has shown particularly strong growth, with shipments increasing by 264% year-over-year in 2021.

Beyond consumer electronics, automotive displays represent a rapidly expanding market for flexible display technologies. The automotive industry's shift toward smart cockpits and enhanced user interfaces has created substantial demand for curved and flexible displays that can conform to interior design requirements while maintaining durability standards. Industry analysts predict that the automotive flexible display market will grow at a CAGR of 24.3% through 2026.

Healthcare and retail sectors are emerging as promising markets for flexible display applications. In healthcare, flexible displays enable the development of advanced wearable monitoring devices and portable diagnostic equipment. The retail sector is adopting flexible displays for innovative advertising solutions and interactive customer experiences, with digital signage applications showing particular promise.

Regional analysis reveals that Asia Pacific dominates the flexible display market, accounting for over 60% of global production capacity. This regional concentration is primarily due to the presence of major display manufacturers in South Korea, Japan, China, and Taiwan. However, North America and Europe are witnessing accelerated growth in flexible display adoption, particularly in premium consumer electronics and automotive applications.

Market challenges persist despite the positive growth outlook. Price sensitivity remains a significant barrier to widespread adoption, as flexible display manufacturing costs continue to exceed those of conventional rigid displays by 30-40%. Additionally, concerns regarding long-term durability and reliability under various environmental conditions have tempered adoption rates in certain industrial applications where operational longevity is paramount.

The market increasingly demands standardized manufacturing processes that ensure consistent quality and performance across different suppliers. This standardization pressure is driving industry-wide efforts to establish comprehensive compliance frameworks for flexible display substrate manufacturing, creating opportunities for companies that can demonstrate leadership in standards development and implementation.

Current Challenges in Flexible Substrate Manufacturing

The flexible display substrate manufacturing industry faces significant challenges in maintaining standards compliance across its complex production ecosystem. Current manufacturing processes involve multiple stages including material preparation, coating, curing, and quality control, each requiring adherence to specific technical parameters and quality standards. The lack of unified global standards specifically tailored for flexible display substrates creates substantial compliance difficulties for manufacturers operating in international markets.

Material consistency represents a primary challenge, as flexible substrates require precise thickness control, uniform surface properties, and consistent mechanical characteristics. Manufacturers struggle to maintain these properties within acceptable tolerance ranges across large production batches, leading to yield issues and increased production costs. The dynamic nature of flexible materials further complicates compliance, as substrates may exhibit different properties under various environmental conditions.

Temperature and humidity control during manufacturing presents another critical compliance challenge. Flexible substrates are highly sensitive to environmental variations, requiring stringent climate-controlled production environments. Maintaining these conditions consistently across large manufacturing facilities demands sophisticated environmental control systems and continuous monitoring, adding complexity to standards compliance efforts.

Surface defect detection and classification standards remain inconsistent across the industry. While traditional rigid display manufacturing has well-established defect classification systems, flexible substrates introduce new types of defects including micro-cracks, delamination issues, and stress-induced imperfections that current standards inadequately address. This creates ambiguity in quality control processes and complicates compliance verification.

Chemical composition compliance presents additional challenges, particularly regarding restricted substances and environmental regulations. Flexible display substrates often incorporate novel materials and chemical compounds that may not be explicitly covered by existing regulatory frameworks. Manufacturers must navigate a complex landscape of regional chemical regulations including REACH in Europe, RoHS globally, and various national environmental protection standards.

Testing methodologies for flexible substrates lack standardization, with different regions and organizations employing varied approaches to measure critical parameters such as flexibility endurance, barrier properties, and optical characteristics. This inconsistency creates difficulties in comparing products across manufacturers and verifying compliance claims, ultimately impeding industry-wide quality improvements.

Supply chain traceability requirements add another layer of compliance complexity. As flexible display manufacturing involves numerous specialized materials and components from global suppliers, maintaining documentation for standards compliance throughout the supply chain becomes increasingly challenging. This is particularly problematic for certifications requiring complete material provenance documentation.

Material consistency represents a primary challenge, as flexible substrates require precise thickness control, uniform surface properties, and consistent mechanical characteristics. Manufacturers struggle to maintain these properties within acceptable tolerance ranges across large production batches, leading to yield issues and increased production costs. The dynamic nature of flexible materials further complicates compliance, as substrates may exhibit different properties under various environmental conditions.

Temperature and humidity control during manufacturing presents another critical compliance challenge. Flexible substrates are highly sensitive to environmental variations, requiring stringent climate-controlled production environments. Maintaining these conditions consistently across large manufacturing facilities demands sophisticated environmental control systems and continuous monitoring, adding complexity to standards compliance efforts.

Surface defect detection and classification standards remain inconsistent across the industry. While traditional rigid display manufacturing has well-established defect classification systems, flexible substrates introduce new types of defects including micro-cracks, delamination issues, and stress-induced imperfections that current standards inadequately address. This creates ambiguity in quality control processes and complicates compliance verification.

Chemical composition compliance presents additional challenges, particularly regarding restricted substances and environmental regulations. Flexible display substrates often incorporate novel materials and chemical compounds that may not be explicitly covered by existing regulatory frameworks. Manufacturers must navigate a complex landscape of regional chemical regulations including REACH in Europe, RoHS globally, and various national environmental protection standards.

Testing methodologies for flexible substrates lack standardization, with different regions and organizations employing varied approaches to measure critical parameters such as flexibility endurance, barrier properties, and optical characteristics. This inconsistency creates difficulties in comparing products across manufacturers and verifying compliance claims, ultimately impeding industry-wide quality improvements.

Supply chain traceability requirements add another layer of compliance complexity. As flexible display manufacturing involves numerous specialized materials and components from global suppliers, maintaining documentation for standards compliance throughout the supply chain becomes increasingly challenging. This is particularly problematic for certifications requiring complete material provenance documentation.

Current Compliance Solutions for Flexible Substrates

01 Flexible display substrate manufacturing standards

Manufacturing standards for flexible display substrates involve specific processes and materials to ensure flexibility while maintaining structural integrity. These standards address the fabrication techniques, material selection, and quality control measures necessary for producing reliable flexible displays. Compliance with these standards ensures that the substrates can withstand repeated bending and folding without degradation of display performance.- Flexible display substrate manufacturing standards: Manufacturing standards for flexible display substrates involve specific processes and materials to ensure flexibility while maintaining structural integrity. These standards address the fabrication techniques, material selection, and quality control measures necessary for producing reliable flexible displays. Compliance with these standards ensures that the substrates can withstand repeated bending and folding without degradation of display performance.

- Testing and certification protocols for flexible displays: Testing and certification protocols for flexible display substrates include standardized methods for evaluating mechanical durability, electrical performance, and optical characteristics. These protocols specify test conditions such as bending radius, number of flex cycles, temperature ranges, and humidity levels. Certification processes ensure that flexible displays meet industry requirements for reliability and performance under various environmental and usage conditions.

- Material compliance standards for flexible substrates: Material compliance standards for flexible display substrates specify requirements for substrate materials, including polymers, thin films, and barrier layers. These standards address properties such as transparency, thermal stability, chemical resistance, and environmental impact. Compliance ensures that materials used in flexible displays meet safety regulations, environmental guidelines, and performance specifications necessary for commercial applications.

- Electrical and optical performance standards: Electrical and optical performance standards for flexible display substrates define requirements for conductivity, resistivity, transparency, color accuracy, and brightness uniformity. These standards ensure that flexible displays maintain consistent performance during bending and under various lighting conditions. Compliance with these standards guarantees that flexible displays deliver acceptable image quality and power efficiency comparable to rigid displays.

- Reliability and durability standards: Reliability and durability standards for flexible display substrates establish requirements for longevity, mechanical strength, and resistance to environmental factors. These standards specify acceptable performance after repeated bending cycles, exposure to temperature extremes, humidity, and UV radiation. Compliance ensures that flexible displays maintain functionality throughout their expected lifetime and withstand normal usage conditions without premature failure.

02 Testing and certification requirements for flexible displays

Testing and certification procedures are essential for verifying compliance with flexible display substrate standards. These include mechanical stress tests, environmental durability assessments, and performance evaluations under various conditions. Certification processes validate that flexible display substrates meet industry requirements for reliability, safety, and performance, providing assurance to manufacturers and end-users about product quality and longevity.Expand Specific Solutions03 Material composition standards for flexible substrates

Standards for material composition of flexible display substrates specify the acceptable materials and their properties. These standards cover polymer substrates, barrier layers, conductive materials, and other components essential for flexible display functionality. Compliance ensures that materials used can provide the necessary flexibility, transparency, thermal stability, and electrical properties required for reliable operation of flexible displays in various applications.Expand Specific Solutions04 Durability and reliability standards for flexible displays

Durability and reliability standards establish the minimum requirements for flexible display substrates to withstand operational stresses. These standards define acceptable performance parameters under conditions such as repeated folding cycles, temperature variations, humidity exposure, and impact resistance. Compliance with these standards ensures that flexible displays maintain their functionality and appearance throughout their expected service life in consumer and industrial applications.Expand Specific Solutions05 Compliance verification and documentation systems

Systems and methods for verifying and documenting compliance with flexible display substrate standards involve specific protocols for testing, reporting, and maintaining records. These systems include software tools, documentation templates, and verification procedures that manufacturers must follow to demonstrate adherence to industry standards. Proper compliance documentation is essential for regulatory approval, market access, and customer acceptance of flexible display products.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible display substrate manufacturing industry is currently in a growth phase, with the market expected to reach significant scale due to increasing demand for flexible displays in consumer electronics. The technology maturity varies among key players, with companies like Samsung Display, LG Display, and BOE Technology Group leading innovation through substantial R&D investments and established manufacturing capabilities. These companies have developed proprietary substrate technologies and hold significant patent portfolios. Mid-tier players including Tianma Microelectronics, Japan Display, and E Ink are advancing specialized applications, while emerging companies like Visionox (Kunshan Govisionox) are rapidly developing capabilities. Standards compliance remains challenging due to the evolving nature of the technology, with major players actively participating in international standardization efforts to establish industry benchmarks.

BOE Technology Group Co., Ltd.

Technical Solution: BOE Technology has established comprehensive standards compliance frameworks for flexible display substrate manufacturing, focusing on their proprietary COP (Chip on Plastic) and COF (Chip on Film) technologies. Their flexible OLED production adheres to GB/T 38464-2020 Chinese national standards for flexible display panels and IEC 62715 international standards for flexible display devices. BOE's substrate manufacturing process incorporates high-precision laser cutting technology with tolerance control of ±5 micrometers, ensuring dimensional stability across production batches. Their flexible display substrates undergo standardized reliability testing including 200,000+ folding cycles at various temperatures (-20°C to 60°C) and humidity levels (45-85% RH) to verify compliance with durability standards. BOE has implemented automated optical inspection systems that can detect surface defects as small as 1 micrometer across their production lines, maintaining quality control standards with 99.5% yield rates. Their manufacturing facilities maintain ISO 14644-1 Class 5 cleanroom environments with particle counts below 100,000 per cubic meter to ensure contamination-free substrate production.

Strengths: Strong position in the Chinese market with government support for standards development; extensive production capacity allowing for economies of scale; comprehensive vertical integration from substrate to finished display. Weaknesses: International standards recognition still developing compared to Korean competitors; relatively newer entrant to ultra-thin glass substrate technology; higher defect rates reported in some early flexible display products.

SAMSUNG DISPLAY CO LTD

Technical Solution: Samsung Display has developed comprehensive standards compliance frameworks for flexible display substrate manufacturing, focusing on their proprietary Y-OCTA (Youm On-Cell Touch AMOLED) technology. This approach integrates the touch sensor directly into the display panel, eliminating the need for a separate touch film layer and resulting in thinner, more flexible displays. Their manufacturing process adheres to IEC 62341 standards for OLED displays and ISO 14001/45001 for environmental and safety management. Samsung has pioneered ultra-thin glass (UTG) technology with standardized thickness parameters of approximately 30 micrometers, enabling displays to be folded over 200,000 times without damage. Their substrate manufacturing includes rigorous quality control protocols with automated optical inspection (AOI) systems that detect defects as small as 3 micrometers, ensuring 99.9% yield rates in their flexible display production lines.

Strengths: Industry-leading UTG technology provides superior durability compared to polyimide alternatives; vertical integration allows for complete control over supply chain and quality standards; established global certification expertise across multiple markets. Weaknesses: Proprietary standards may limit compatibility with other manufacturers' components; higher production costs compared to rigid display manufacturing; requires specialized equipment for quality verification.

Critical Patents and Technical Literature Review

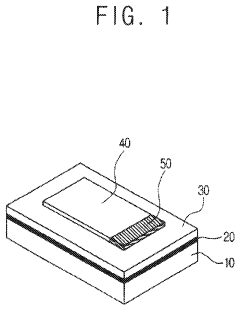

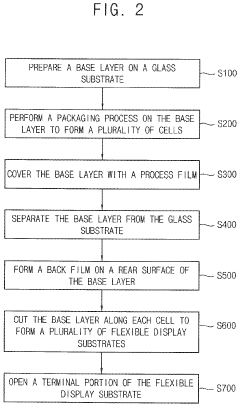

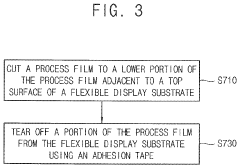

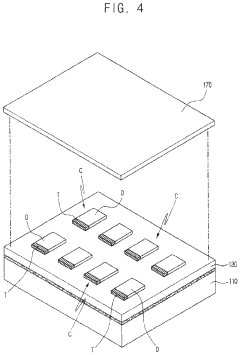

Method of manufacturing a flexible display substrate and process film for manufacturing a flexible display substrate

PatentPendingUS20240246328A1

Innovation

- A method using a process film with a base layer prepared on a glass substrate, where cells are formed and covered with a process film to separate and cut the base layer into multiple flexible substrates, incorporating adhesion layers and anti-static coatings to enhance bonding strength and prevent contamination.

Flexible substrate material, method of manufacturing flexible display panel substrate and flexible display panel

PatentInactiveUS20210408403A1

Innovation

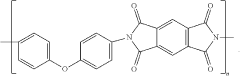

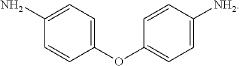

- A flexible substrate material is developed by incorporating carbon nanotube reinforcement dispersed within a polyimide substrate, linked through chemical bonds such as amide, conjugated, and hydrogen bonds, enhancing the mechanical properties and forming a composite structure with improved curl deformation and crack resistance.

Regulatory Framework for Flexible Display Manufacturing

The regulatory landscape for flexible display manufacturing is complex and multifaceted, encompassing international standards, regional regulations, and industry-specific guidelines. At the global level, the International Electrotechnical Commission (IEC) has established several standards specifically addressing flexible electronic components, including IEC 62715 for flexible display devices and IEC 62969 for semiconductor devices in flexible electronics. These standards provide crucial benchmarks for electrical safety, mechanical durability, and performance characteristics that manufacturers must adhere to.

In the United States, the regulatory framework is primarily overseen by the Federal Communications Commission (FCC) and Underwriters Laboratories (UL), which have developed specialized testing protocols for flexible display technologies. UL 2054 and UL 8139 standards are particularly relevant for battery components often integrated into flexible display systems. Additionally, the Environmental Protection Agency (EPA) regulates the chemical substances used in substrate manufacturing through the Toxic Substances Control Act (TSCA).

The European Union implements more stringent regulations through directives such as the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), which significantly impact material selection for flexible substrates. The EU's Waste Electrical and Electronic Equipment (WEEE) directive also influences end-of-life considerations in product design, pushing manufacturers toward more sustainable and recyclable substrate materials.

In Asia, Japan's JISQ standards and South Korea's KS certification system have established specific requirements for flexible electronics. China has rapidly developed its regulatory framework through the China Compulsory Certification (CCC) system, which now includes specialized provisions for flexible display technologies manufactured within its borders.

Industry consortia like the Flexible Display Center (FDC) and the Flexible Electronics and Display Center (FEDC) have developed voluntary standards that often exceed regulatory requirements, establishing best practices for substrate manufacturing processes. These include guidelines for clean room operations, material handling protocols, and quality control procedures specific to flexible substrates.

Compliance challenges are particularly acute in the area of material consistency across global supply chains. Manufacturers must navigate varying requirements for chemical disclosure, hazardous substance limitations, and performance testing methodologies across different markets. This regulatory fragmentation has led to the emergence of specialized compliance management systems designed specifically for flexible display manufacturers, incorporating automated documentation and traceability features.

In the United States, the regulatory framework is primarily overseen by the Federal Communications Commission (FCC) and Underwriters Laboratories (UL), which have developed specialized testing protocols for flexible display technologies. UL 2054 and UL 8139 standards are particularly relevant for battery components often integrated into flexible display systems. Additionally, the Environmental Protection Agency (EPA) regulates the chemical substances used in substrate manufacturing through the Toxic Substances Control Act (TSCA).

The European Union implements more stringent regulations through directives such as the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), which significantly impact material selection for flexible substrates. The EU's Waste Electrical and Electronic Equipment (WEEE) directive also influences end-of-life considerations in product design, pushing manufacturers toward more sustainable and recyclable substrate materials.

In Asia, Japan's JISQ standards and South Korea's KS certification system have established specific requirements for flexible electronics. China has rapidly developed its regulatory framework through the China Compulsory Certification (CCC) system, which now includes specialized provisions for flexible display technologies manufactured within its borders.

Industry consortia like the Flexible Display Center (FDC) and the Flexible Electronics and Display Center (FEDC) have developed voluntary standards that often exceed regulatory requirements, establishing best practices for substrate manufacturing processes. These include guidelines for clean room operations, material handling protocols, and quality control procedures specific to flexible substrates.

Compliance challenges are particularly acute in the area of material consistency across global supply chains. Manufacturers must navigate varying requirements for chemical disclosure, hazardous substance limitations, and performance testing methodologies across different markets. This regulatory fragmentation has led to the emergence of specialized compliance management systems designed specifically for flexible display manufacturers, incorporating automated documentation and traceability features.

Environmental Sustainability in Substrate Production

Environmental sustainability has become a critical consideration in flexible display substrate manufacturing, with increasing regulatory pressure and market demand for greener production processes. The substrate production phase represents one of the most resource-intensive and environmentally impactful stages in the flexible display manufacturing chain. Traditional substrate materials like polyimide (PI) and polyethylene terephthalate (PET) typically involve energy-intensive processing and hazardous chemical treatments that generate significant waste streams and emissions.

Leading manufacturers are now implementing closed-loop water systems that reduce freshwater consumption by up to 60% compared to conventional methods. These systems incorporate advanced filtration and purification technologies that allow for the recirculation of process water, significantly reducing both water intake and wastewater discharge volumes. Additionally, chemical recovery systems are being deployed to recapture and reuse solvents and other process chemicals, minimizing hazardous waste generation.

Energy efficiency improvements represent another key sustainability frontier in substrate production. The transition from conventional thermal curing processes to UV-curing and other low-temperature alternatives has reduced energy consumption by 30-45% in some production facilities. Furthermore, the integration of renewable energy sources, particularly solar and wind power, is becoming increasingly common in new substrate manufacturing plants, with several major producers committing to 100% renewable energy targets by 2030.

Material innovation is driving substantial sustainability gains in the sector. Bio-based and biodegradable substrate alternatives derived from cellulose and other renewable resources are emerging as viable options for certain applications. These materials offer reduced environmental footprints across their lifecycle, though challenges remain regarding their performance characteristics and production scalability. Concurrently, advances in material efficiency are enabling thinner substrates that maintain required performance specifications while reducing raw material consumption.

Waste reduction strategies have evolved significantly, with manufacturers implementing comprehensive recycling programs for production scrap and developing take-back initiatives for end-of-life products. Advanced waste-to-energy technologies are being employed to derive value from non-recyclable waste streams, further reducing landfill impacts. Several industry leaders have achieved zero-waste-to-landfill status at their substrate production facilities through these integrated approaches.

Standardization bodies including ISO, ASTM, and IEC have developed specific environmental sustainability metrics and certification frameworks for flexible electronics manufacturing. These standards address carbon footprint, water usage, chemical management, and waste reduction, providing manufacturers with clear benchmarks and compliance pathways. The emergence of these standards has accelerated the adoption of sustainable practices throughout the substrate production ecosystem.

Leading manufacturers are now implementing closed-loop water systems that reduce freshwater consumption by up to 60% compared to conventional methods. These systems incorporate advanced filtration and purification technologies that allow for the recirculation of process water, significantly reducing both water intake and wastewater discharge volumes. Additionally, chemical recovery systems are being deployed to recapture and reuse solvents and other process chemicals, minimizing hazardous waste generation.

Energy efficiency improvements represent another key sustainability frontier in substrate production. The transition from conventional thermal curing processes to UV-curing and other low-temperature alternatives has reduced energy consumption by 30-45% in some production facilities. Furthermore, the integration of renewable energy sources, particularly solar and wind power, is becoming increasingly common in new substrate manufacturing plants, with several major producers committing to 100% renewable energy targets by 2030.

Material innovation is driving substantial sustainability gains in the sector. Bio-based and biodegradable substrate alternatives derived from cellulose and other renewable resources are emerging as viable options for certain applications. These materials offer reduced environmental footprints across their lifecycle, though challenges remain regarding their performance characteristics and production scalability. Concurrently, advances in material efficiency are enabling thinner substrates that maintain required performance specifications while reducing raw material consumption.

Waste reduction strategies have evolved significantly, with manufacturers implementing comprehensive recycling programs for production scrap and developing take-back initiatives for end-of-life products. Advanced waste-to-energy technologies are being employed to derive value from non-recyclable waste streams, further reducing landfill impacts. Several industry leaders have achieved zero-waste-to-landfill status at their substrate production facilities through these integrated approaches.

Standardization bodies including ISO, ASTM, and IEC have developed specific environmental sustainability metrics and certification frameworks for flexible electronics manufacturing. These standards address carbon footprint, water usage, chemical management, and waste reduction, providing manufacturers with clear benchmarks and compliance pathways. The emergence of these standards has accelerated the adoption of sustainable practices throughout the substrate production ecosystem.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!