Impact of Standards on Flexible Display Substrate Performance

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Standards Evolution and Objectives

Flexible display technology has evolved significantly over the past two decades, transitioning from laboratory curiosities to commercially viable products. The development of standards for flexible displays has played a crucial role in this evolution, providing a framework for consistent performance evaluation and quality assurance across the industry. Initially, standards focused primarily on rigid display technologies, with minimal consideration for the unique challenges posed by flexible substrates.

The first significant standards for flexible displays emerged around 2008-2010, when organizations such as the Society for Information Display (SID) and the International Committee for Display Metrology (ICDM) began acknowledging the distinct requirements of flexible display technologies. These early standards primarily addressed basic mechanical properties such as bend radius and cycle durability, without comprehensive consideration of substrate performance under various environmental conditions.

Between 2012 and 2016, a more robust framework of standards began to take shape as major industry players like Samsung, LG, and BOE accelerated their research and development efforts in flexible display technology. During this period, standards expanded to include more detailed specifications for substrate materials, including polyimide, polyethylene terephthalate (PET), and thin glass composites. These standards established baseline requirements for thermal stability, dimensional accuracy, and barrier properties.

The most recent evolution in flexible display standards (2017-present) has been characterized by increased sophistication and specialization. Current standards address not only mechanical and physical properties but also electrical performance, optical characteristics, and long-term reliability under various environmental stressors. Organizations such as ASTM International, IEC, and JEDEC have developed test methods specifically designed to evaluate substrate performance under conditions that simulate real-world usage scenarios.

The primary objectives of contemporary flexible display standards are multifaceted. First, they aim to establish uniform testing methodologies that enable accurate comparison of different substrate materials and technologies. Second, they seek to define minimum performance thresholds that ensure consumer satisfaction and device reliability. Third, they strive to anticipate future technological developments by creating adaptable frameworks that can accommodate emerging materials and manufacturing processes.

Looking forward, standards development is increasingly focused on sustainability metrics, including recyclability, biodegradability, and reduced environmental impact during manufacturing. Additionally, there is growing emphasis on standards that address the integration of flexible displays with other emerging technologies, such as stretchable electronics, advanced haptics, and self-healing materials, reflecting the industry's trajectory toward more versatile and robust flexible display solutions.

The first significant standards for flexible displays emerged around 2008-2010, when organizations such as the Society for Information Display (SID) and the International Committee for Display Metrology (ICDM) began acknowledging the distinct requirements of flexible display technologies. These early standards primarily addressed basic mechanical properties such as bend radius and cycle durability, without comprehensive consideration of substrate performance under various environmental conditions.

Between 2012 and 2016, a more robust framework of standards began to take shape as major industry players like Samsung, LG, and BOE accelerated their research and development efforts in flexible display technology. During this period, standards expanded to include more detailed specifications for substrate materials, including polyimide, polyethylene terephthalate (PET), and thin glass composites. These standards established baseline requirements for thermal stability, dimensional accuracy, and barrier properties.

The most recent evolution in flexible display standards (2017-present) has been characterized by increased sophistication and specialization. Current standards address not only mechanical and physical properties but also electrical performance, optical characteristics, and long-term reliability under various environmental stressors. Organizations such as ASTM International, IEC, and JEDEC have developed test methods specifically designed to evaluate substrate performance under conditions that simulate real-world usage scenarios.

The primary objectives of contemporary flexible display standards are multifaceted. First, they aim to establish uniform testing methodologies that enable accurate comparison of different substrate materials and technologies. Second, they seek to define minimum performance thresholds that ensure consumer satisfaction and device reliability. Third, they strive to anticipate future technological developments by creating adaptable frameworks that can accommodate emerging materials and manufacturing processes.

Looking forward, standards development is increasingly focused on sustainability metrics, including recyclability, biodegradability, and reduced environmental impact during manufacturing. Additionally, there is growing emphasis on standards that address the integration of flexible displays with other emerging technologies, such as stretchable electronics, advanced haptics, and self-healing materials, reflecting the industry's trajectory toward more versatile and robust flexible display solutions.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has witnessed exponential growth over the past decade, driven primarily by consumer electronics applications. Market research indicates that the global flexible display market is projected to reach $15.5 billion by 2023, with a compound annual growth rate (CAGR) of 34.8% during the forecast period. This remarkable growth trajectory underscores the increasing demand for flexible display technologies across various industries.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of the total market share. Smartphones and wearable devices are the primary drivers within this segment, with major manufacturers incorporating flexible displays to enhance product differentiation and user experience. The automotive industry represents the second-largest application sector, with flexible displays increasingly being integrated into dashboard systems, entertainment consoles, and heads-up displays.

Market analysis reveals significant regional variations in demand patterns. Asia-Pacific currently leads the market, representing 48% of global demand, followed by North America (27%) and Europe (18%). China and South Korea have emerged as manufacturing hubs, while North America and Europe primarily serve as consumption markets with strong research and development capabilities.

The substrate material market for flexible displays is experiencing a shift from traditional materials toward more advanced alternatives. Polyimide substrates currently dominate with 56% market share, followed by polyethylene terephthalate (PET) at 23%. However, emerging materials like ultrathin glass and hybrid organic-inorganic composites are gaining traction due to their superior performance characteristics.

Consumer preferences are increasingly favoring devices with flexible displays, with market surveys indicating that 78% of smartphone users consider flexibility and durability as important purchasing factors. This trend is particularly pronounced among younger demographics (18-34 years), who demonstrate higher willingness to pay premium prices for devices with advanced display technologies.

Industry forecasts suggest that standardization will play a crucial role in market expansion. The lack of unified standards for flexible display substrates currently represents a significant barrier to mass adoption, with 67% of manufacturers citing standardization issues as a major challenge. Establishing comprehensive industry standards could potentially accelerate market growth by 15-20% by reducing production costs and improving compatibility across the supply chain.

Consumer electronics remains the dominant application sector, accounting for approximately 65% of the total market share. Smartphones and wearable devices are the primary drivers within this segment, with major manufacturers incorporating flexible displays to enhance product differentiation and user experience. The automotive industry represents the second-largest application sector, with flexible displays increasingly being integrated into dashboard systems, entertainment consoles, and heads-up displays.

Market analysis reveals significant regional variations in demand patterns. Asia-Pacific currently leads the market, representing 48% of global demand, followed by North America (27%) and Europe (18%). China and South Korea have emerged as manufacturing hubs, while North America and Europe primarily serve as consumption markets with strong research and development capabilities.

The substrate material market for flexible displays is experiencing a shift from traditional materials toward more advanced alternatives. Polyimide substrates currently dominate with 56% market share, followed by polyethylene terephthalate (PET) at 23%. However, emerging materials like ultrathin glass and hybrid organic-inorganic composites are gaining traction due to their superior performance characteristics.

Consumer preferences are increasingly favoring devices with flexible displays, with market surveys indicating that 78% of smartphone users consider flexibility and durability as important purchasing factors. This trend is particularly pronounced among younger demographics (18-34 years), who demonstrate higher willingness to pay premium prices for devices with advanced display technologies.

Industry forecasts suggest that standardization will play a crucial role in market expansion. The lack of unified standards for flexible display substrates currently represents a significant barrier to mass adoption, with 67% of manufacturers citing standardization issues as a major challenge. Establishing comprehensive industry standards could potentially accelerate market growth by 15-20% by reducing production costs and improving compatibility across the supply chain.

Current Substrate Technologies and Technical Barriers

Flexible display technology currently relies on several substrate materials, each with distinct performance characteristics and limitations. Polyimide (PI) dominates the market due to its excellent thermal stability (withstanding temperatures up to 300°C), good chemical resistance, and mechanical flexibility. However, PI substrates face challenges including yellowing under prolonged UV exposure, limited transparency (approximately 80-85%), and relatively high water vapor transmission rates that can compromise OLED device longevity.

Polyethylene naphthalate (PEN) and polyethylene terephthalate (PET) represent alternative substrate options with superior optical clarity (>90% transparency) and lower production costs. These materials, however, exhibit lower thermal stability (maximum processing temperatures of 180°C for PEN and 150°C for PET), restricting their compatibility with certain manufacturing processes. Their inferior dimensional stability during thermal cycling also presents challenges for precise multilayer alignment in display fabrication.

Ultrathin glass substrates (UTG) have emerged as premium alternatives offering exceptional barrier properties and surface smoothness. With thickness ranging from 30-100μm, UTG provides superior optical transparency (>92%) and near-zero gas permeability. The primary barriers to widespread UTG adoption include high manufacturing costs, handling complexity during production, and concerns regarding crack propagation despite flexibility improvements.

The technical barriers across all substrate technologies converge around several critical parameters. Achieving the optimal balance between flexibility and durability remains challenging, with most substrates demonstrating performance degradation after repeated folding cycles (typically 100,000-200,000 cycles). Surface roughness control presents another significant barrier, as even nanoscale irregularities can cause pixel defects and electrical shorts in thin-film transistor arrays.

Barrier performance against oxygen and moisture represents perhaps the most formidable challenge. Current substrates require additional multilayer barrier coatings to achieve acceptable water vapor transmission rates (WVTR) below 10^-6 g/m²/day for OLED applications. These barrier layers add complexity, cost, and potential flexibility constraints to the final display structure.

Manufacturing scalability constitutes another major barrier, particularly for emerging substrate technologies. While roll-to-roll processing offers theoretical cost advantages for polymer substrates, achieving consistent quality across large areas remains problematic. Yield rates for flexible displays typically lag behind rigid display manufacturing by 15-20 percentage points, significantly impacting production economics.

Polyethylene naphthalate (PEN) and polyethylene terephthalate (PET) represent alternative substrate options with superior optical clarity (>90% transparency) and lower production costs. These materials, however, exhibit lower thermal stability (maximum processing temperatures of 180°C for PEN and 150°C for PET), restricting their compatibility with certain manufacturing processes. Their inferior dimensional stability during thermal cycling also presents challenges for precise multilayer alignment in display fabrication.

Ultrathin glass substrates (UTG) have emerged as premium alternatives offering exceptional barrier properties and surface smoothness. With thickness ranging from 30-100μm, UTG provides superior optical transparency (>92%) and near-zero gas permeability. The primary barriers to widespread UTG adoption include high manufacturing costs, handling complexity during production, and concerns regarding crack propagation despite flexibility improvements.

The technical barriers across all substrate technologies converge around several critical parameters. Achieving the optimal balance between flexibility and durability remains challenging, with most substrates demonstrating performance degradation after repeated folding cycles (typically 100,000-200,000 cycles). Surface roughness control presents another significant barrier, as even nanoscale irregularities can cause pixel defects and electrical shorts in thin-film transistor arrays.

Barrier performance against oxygen and moisture represents perhaps the most formidable challenge. Current substrates require additional multilayer barrier coatings to achieve acceptable water vapor transmission rates (WVTR) below 10^-6 g/m²/day for OLED applications. These barrier layers add complexity, cost, and potential flexibility constraints to the final display structure.

Manufacturing scalability constitutes another major barrier, particularly for emerging substrate technologies. While roll-to-roll processing offers theoretical cost advantages for polymer substrates, achieving consistent quality across large areas remains problematic. Yield rates for flexible displays typically lag behind rigid display manufacturing by 15-20 percentage points, significantly impacting production economics.

Current Standardization Approaches for Substrate Performance

01 Materials for flexible display substrates

Various materials are used to create flexible display substrates that can withstand bending and folding while maintaining performance. These materials include polymers like polyimide, polyethylene terephthalate (PET), and specialized composites that offer a balance of flexibility and durability. The selection of substrate materials directly impacts the overall performance characteristics of flexible displays, including bend radius capabilities, mechanical strength, and lifetime under repeated flexing conditions.- Materials for flexible display substrates: Various materials are used in flexible display substrates to achieve the desired flexibility while maintaining performance. These materials include polymers, thin films, and composite structures that can withstand repeated bending without degradation. The selection of substrate materials directly impacts the overall flexibility, durability, and display performance. Advanced materials with optimized mechanical properties enable the development of displays that can be folded or rolled while maintaining electrical and optical functionality.

- Structural design for flexibility and durability: Innovative structural designs are implemented to enhance the flexibility and durability of display substrates. These designs include multi-layered structures, stress-relief patterns, and specialized interconnects that accommodate bending stress. By optimizing the physical architecture of the substrate, manufacturers can prevent cracking and delamination during flexing operations. These structural innovations allow for thinner profiles while maintaining the mechanical integrity necessary for reliable operation in flexible display applications.

- Barrier properties and encapsulation techniques: Flexible display substrates require effective barrier properties to protect sensitive electronic components from environmental factors such as moisture and oxygen. Advanced encapsulation techniques including multi-layer barrier films, inorganic-organic hybrid structures, and edge sealing methods are employed to extend device lifetime. These barrier systems must maintain their protective properties even when the display is bent or flexed, requiring specialized materials and deposition techniques that preserve barrier integrity under mechanical stress.

- Electrical performance optimization: Maintaining consistent electrical performance during flexing is critical for flexible display substrates. This involves specialized electrode designs, conductive materials, and circuit layouts that can withstand mechanical deformation without significant changes in electrical properties. Techniques such as stretchable conductors, serpentine interconnects, and stress-resistant thin-film transistors help preserve signal integrity and power distribution across the flexible substrate, ensuring stable display performance regardless of the bending state.

- Manufacturing processes for flexible substrates: Specialized manufacturing processes are developed for producing high-performance flexible display substrates. These include roll-to-roll processing, low-temperature deposition techniques, laser patterning, and transfer printing methods that enable the fabrication of complex electronic structures on flexible materials. Process innovations focus on maintaining precise dimensional control and layer alignment while accommodating the unique challenges of working with flexible materials. Advanced manufacturing approaches help reduce defects and enhance yield rates for commercially viable flexible display production.

02 Barrier layer technologies for moisture and oxygen protection

Flexible display substrates require effective barrier layers to prevent moisture and oxygen penetration, which can degrade organic light-emitting materials and other sensitive components. Advanced multi-layer barrier technologies incorporate alternating inorganic and organic layers to create tortuous paths for moisture diffusion while maintaining flexibility. These barrier layers are critical for ensuring long-term reliability and performance of flexible displays in various environmental conditions.Expand Specific Solutions03 Structural design for improved mechanical performance

Innovative structural designs enhance the mechanical performance of flexible display substrates. These include neutral plane engineering, where sensitive components are positioned at the neutral bending axis to minimize strain, and the use of stress-relief patterns or structures that distribute bending forces. Some designs incorporate reinforcement layers at strategic locations or utilize composite structures with varying elastic properties to improve durability during repeated flexing cycles.Expand Specific Solutions04 Thin-film transistor configurations for flexible displays

Specialized thin-film transistor (TFT) configurations are developed for flexible display substrates to maintain electrical performance during bending. These include oxide semiconductor TFTs, low-temperature polysilicon (LTPS) TFTs, and organic TFTs that can withstand mechanical deformation. The backplane architecture is designed to minimize performance degradation when the display is flexed, with considerations for interconnect reliability and stress distribution across the active matrix.Expand Specific Solutions05 Manufacturing processes for flexible substrate production

Advanced manufacturing processes are essential for producing high-performance flexible display substrates. These include roll-to-roll processing for continuous production, laser debonding techniques for ultra-thin substrate formation, and specialized coating methods for uniform layer deposition. Process innovations focus on achieving precise thickness control, minimizing defects, and ensuring compatibility with subsequent display fabrication steps while maintaining the substrate's flexibility and dimensional stability.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible display substrate market is currently in a growth phase, with increasing demand driven by the proliferation of foldable smartphones and wearable devices. The market is expected to reach significant scale by 2025, with a compound annual growth rate exceeding 20%. Standards development remains critical as major players like Samsung Display, LG Display, and BOE Technology compete for market dominance. These companies are investing heavily in R&D to overcome technical challenges related to substrate durability, flexibility, and production yield. While Korean manufacturers maintain technological leadership, Chinese companies including TCL China Star and Tianma Microelectronics are rapidly closing the gap through aggressive capacity expansion and government support. The industry is transitioning from polyimide-based substrates toward more advanced materials, with standardization efforts focused on performance metrics, testing protocols, and environmental sustainability.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible display substrate technologies that comply with international standards like JEDEC and IEC. Their approach focuses on ultra-thin glass and high-performance polyimide (PI) substrates with enhanced mechanical flexibility and thermal stability. BOE's PI substrates feature a multi-layer structure with specialized barrier layers that prevent moisture and oxygen penetration while maintaining flexibility. The company has implemented standardized testing protocols for substrate reliability, including bend radius tests (achieving <1mm bend radius) and cyclic durability tests (>200,000 cycles without performance degradation). Their substrates incorporate standardized interface layers that improve adhesion between the substrate and thin-film transistor (TFT) layers, resulting in more stable electrical performance across temperature variations and mechanical stress conditions.

Strengths: Superior mechanical flexibility with industry-leading bend radius capabilities; excellent barrier properties against environmental contaminants; standardized manufacturing processes enabling consistent quality. Weaknesses: Higher production costs compared to rigid substrates; challenges in scaling production to ultra-large formats; potential limitations in extreme temperature environments.

SAMSUNG DISPLAY CO LTD

Technical Solution: Samsung Display has developed a comprehensive flexible substrate technology platform that adheres to and often exceeds international standards. Their approach centers on an advanced polyimide-based substrate system with proprietary surface treatment technologies that enhance adhesion and stability. Samsung's substrates incorporate multi-layered barrier structures achieving oxygen transmission rates below 10^-7 g/m²/day and water vapor transmission rates below 10^-6 g/m²/day, surpassing ASTM F1927 requirements. The company has implemented standardized testing protocols aligned with IEC 62715 for flexible display evaluation, including mechanical durability tests demonstrating stability after 300,000+ folding cycles at various temperatures (-20°C to 60°C). Their substrates feature standardized thickness control (±0.5μm across 2000mm width) and surface roughness parameters (Ra<0.5nm) that exceed industry standards. Samsung has also pioneered standardized interface layers between the substrate and active components, resulting in improved thermal expansion matching and enhanced electrical stability during flexing operations.

Strengths: Superior barrier properties against environmental contaminants; exceptional mechanical durability with industry-leading folding endurance; precise dimensional control enabling higher yield rates in manufacturing. Weaknesses: Complex multi-layer structure increases production costs; challenges in achieving ultra-high transparency; potential limitations in extreme environmental conditions requiring specialized formulations.

Critical Patents and Technical Literature Review

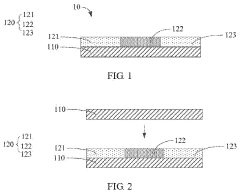

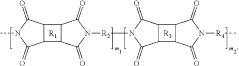

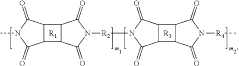

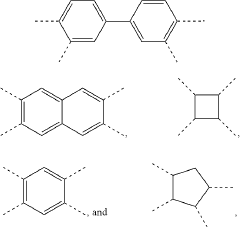

Flexible substrate and method of manufacturing same

PatentActiveUS20210407332A1

Innovation

- A flexible substrate with a polyimide film divided into rigid and flexible regions, where the rigid segments constitute 75-95% by weight and flexible segments 80-98% by weight, with a surface roughness of less than 1 nanometer, manufactured by coating polyamic acid solutions and subsequent heat treatment, and separated from a glass substrate using laser irradiation.

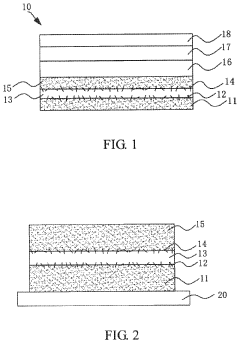

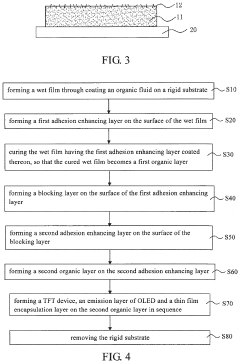

Flexible display panel and preparation method

PatentActiveUS20210359254A1

Innovation

- A flexible display panel is designed with a first and second organic layer, each having an adhesion enhancing layer made from silica nanotubes distributed between the organic layers and the blocking layer, respectively, to enhance adhesion and stability, using materials like polyimide and silicon dioxide.

Regulatory Framework Impact on Substrate Development

The regulatory landscape governing flexible display substrates has evolved significantly over the past decade, creating both constraints and opportunities for technological advancement. International standards organizations such as ISO, IEC, and ASTM have established comprehensive frameworks that define minimum performance requirements for flexible display substrates, particularly focusing on mechanical durability, chemical stability, and environmental impact. These standards have fundamentally shaped research directions and manufacturing processes across the industry.

Regulatory requirements regarding hazardous substances have been particularly influential in substrate development. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have effectively eliminated certain materials from consideration in substrate formulations. This regulatory pressure has accelerated innovation in environmentally friendly alternatives, leading to the development of bio-based polymers and halogen-free flame retardants specifically designed for flexible display applications.

Safety certification standards have similarly transformed substrate design parameters. UL 94 flammability ratings and IEC 60695 fire hazard testing protocols have established stringent benchmarks for substrate materials, necessitating sophisticated flame-retardant systems that maintain flexibility while meeting safety requirements. These regulations have driven significant investment in novel flame-retardant technologies that preserve the mechanical properties essential for flexible displays.

Energy efficiency regulations, including Energy Star requirements and the EU's Ecodesign Directive, have indirectly influenced substrate development by prioritizing materials that contribute to overall device power efficiency. This has accelerated research into substrates with enhanced thermal management properties and reduced optical losses, creating a new competitive dimension in the substrate market focused on energy performance characteristics.

Regional variations in regulatory frameworks have created complex challenges for global manufacturers. Japanese industrial standards (JIS) often emphasize durability metrics that differ from European or American counterparts, while China's growing influence through GB standards introduces additional compliance considerations. These regional differences have prompted the development of versatile substrate formulations capable of meeting multiple regulatory requirements simultaneously, though at the cost of increased development complexity and production expenses.

The regulatory certification process itself has become a significant factor in substrate innovation cycles. Extended testing periods required for safety and environmental compliance can delay market introduction by 12-18 months, creating substantial pressure to anticipate regulatory trends during early-stage research. Forward-looking companies have responded by incorporating regulatory forecasting into their substrate development roadmaps, attempting to align material innovation with projected regulatory requirements 3-5 years ahead of implementation.

Regulatory requirements regarding hazardous substances have been particularly influential in substrate development. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have effectively eliminated certain materials from consideration in substrate formulations. This regulatory pressure has accelerated innovation in environmentally friendly alternatives, leading to the development of bio-based polymers and halogen-free flame retardants specifically designed for flexible display applications.

Safety certification standards have similarly transformed substrate design parameters. UL 94 flammability ratings and IEC 60695 fire hazard testing protocols have established stringent benchmarks for substrate materials, necessitating sophisticated flame-retardant systems that maintain flexibility while meeting safety requirements. These regulations have driven significant investment in novel flame-retardant technologies that preserve the mechanical properties essential for flexible displays.

Energy efficiency regulations, including Energy Star requirements and the EU's Ecodesign Directive, have indirectly influenced substrate development by prioritizing materials that contribute to overall device power efficiency. This has accelerated research into substrates with enhanced thermal management properties and reduced optical losses, creating a new competitive dimension in the substrate market focused on energy performance characteristics.

Regional variations in regulatory frameworks have created complex challenges for global manufacturers. Japanese industrial standards (JIS) often emphasize durability metrics that differ from European or American counterparts, while China's growing influence through GB standards introduces additional compliance considerations. These regional differences have prompted the development of versatile substrate formulations capable of meeting multiple regulatory requirements simultaneously, though at the cost of increased development complexity and production expenses.

The regulatory certification process itself has become a significant factor in substrate innovation cycles. Extended testing periods required for safety and environmental compliance can delay market introduction by 12-18 months, creating substantial pressure to anticipate regulatory trends during early-stage research. Forward-looking companies have responded by incorporating regulatory forecasting into their substrate development roadmaps, attempting to align material innovation with projected regulatory requirements 3-5 years ahead of implementation.

Environmental Sustainability Considerations in Flexible Displays

The environmental impact of flexible displays represents a critical consideration in the evolution of display technologies. As industry standards for flexible display substrates continue to develop, they increasingly incorporate sustainability metrics that influence both material selection and manufacturing processes. Current standards are beginning to address carbon footprint calculations, requiring manufacturers to document emissions throughout the product lifecycle from raw material extraction to end-of-life disposal.

Material recyclability has emerged as a key focus area within these standards. Traditional display technologies often utilize materials that are difficult to separate and recycle, whereas newer flexible substrate standards promote designs that facilitate disassembly and material recovery. This shift is particularly evident in specifications for polymer-based substrates, where biodegradable alternatives to conventional plastics are gaining recognition in standardization frameworks.

Energy consumption during manufacturing represents another significant environmental concern addressed by evolving standards. The production of flexible displays typically requires less energy than rigid counterparts due to lower processing temperatures, particularly when utilizing plastic substrates rather than glass. Standards organizations are now incorporating maximum energy consumption thresholds for production processes, driving innovation in low-temperature deposition techniques and energy-efficient manufacturing equipment.

Chemical usage regulations within these standards have become increasingly stringent, with particular attention to hazardous substances. Restrictions on halogenated compounds, certain adhesives, and heavy metals are being incorporated into flexible display substrate specifications. These regulations not only protect environmental systems but also improve workplace safety conditions throughout the supply chain.

End-of-life management protocols are being formalized within substrate performance standards, requiring manufacturers to develop take-back programs and demonstrate closed-loop material flows. This represents a significant shift from earlier standards that focused exclusively on performance metrics without consideration for disposal impacts. The integration of these requirements is driving research into substrates that maintain high performance while offering improved biodegradability or recyclability characteristics.

Water usage during manufacturing processes is another environmental metric gaining prominence in substrate standards. Flexible display production often involves wet chemical processes that can generate significant wastewater. Emerging standards are establishing limits on water consumption per unit area of substrate produced, as well as requirements for water treatment and recycling systems within production facilities.

Material recyclability has emerged as a key focus area within these standards. Traditional display technologies often utilize materials that are difficult to separate and recycle, whereas newer flexible substrate standards promote designs that facilitate disassembly and material recovery. This shift is particularly evident in specifications for polymer-based substrates, where biodegradable alternatives to conventional plastics are gaining recognition in standardization frameworks.

Energy consumption during manufacturing represents another significant environmental concern addressed by evolving standards. The production of flexible displays typically requires less energy than rigid counterparts due to lower processing temperatures, particularly when utilizing plastic substrates rather than glass. Standards organizations are now incorporating maximum energy consumption thresholds for production processes, driving innovation in low-temperature deposition techniques and energy-efficient manufacturing equipment.

Chemical usage regulations within these standards have become increasingly stringent, with particular attention to hazardous substances. Restrictions on halogenated compounds, certain adhesives, and heavy metals are being incorporated into flexible display substrate specifications. These regulations not only protect environmental systems but also improve workplace safety conditions throughout the supply chain.

End-of-life management protocols are being formalized within substrate performance standards, requiring manufacturers to develop take-back programs and demonstrate closed-loop material flows. This represents a significant shift from earlier standards that focused exclusively on performance metrics without consideration for disposal impacts. The integration of these requirements is driving research into substrates that maintain high performance while offering improved biodegradability or recyclability characteristics.

Water usage during manufacturing processes is another environmental metric gaining prominence in substrate standards. Flexible display production often involves wet chemical processes that can generate significant wastewater. Emerging standards are establishing limits on water consumption per unit area of substrate produced, as well as requirements for water treatment and recycling systems within production facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!