Flexible Display Substrates: Evaluation of Catalytic Materials

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Evolution and Research Objectives

Flexible display technology has evolved significantly over the past two decades, transitioning from conceptual research to commercial applications. The journey began in the early 2000s with rudimentary flexible electronic paper displays, progressing through various technological iterations to today's advanced flexible OLED and AMOLED displays. This evolution has been driven by continuous improvements in substrate materials, particularly the development of catalytic materials that enhance flexibility while maintaining structural integrity and electronic performance.

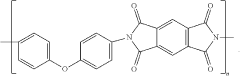

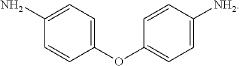

The initial flexible displays utilized plastic substrates with limited durability and poor thermal stability. By 2010, polyimide-based substrates emerged as a breakthrough, offering superior heat resistance and mechanical flexibility. The subsequent integration of catalytic materials to modify substrate properties marked a pivotal advancement, enabling thinner, more durable, and highly flexible displays with improved optical transparency and reduced weight.

Current research focuses on next-generation substrate materials that can withstand extreme bending conditions while supporting high-resolution display technologies. Catalytic materials play a crucial role in this development, as they facilitate the formation of specialized polymer structures and nanocomposites with enhanced properties. These materials modify the molecular architecture of substrates, creating cross-linking networks that improve mechanical resilience without compromising flexibility.

The technical objectives of this research encompass several dimensions. First, we aim to evaluate various catalytic materials for their effectiveness in enhancing substrate flexibility, focusing on transition metal complexes and organometallic compounds that promote controlled polymerization. Second, we seek to quantify the relationship between catalyst concentration and substrate performance metrics, including bend radius, cycle durability, and optical clarity.

Additionally, this research intends to develop novel catalyst systems that can operate at lower temperatures, reducing energy consumption during manufacturing while maintaining or improving substrate quality. We also aim to identify catalytic approaches that minimize environmental impact through reduced use of hazardous chemicals and improved recyclability of display components.

The ultimate goal is to establish a comprehensive framework for selecting and optimizing catalytic materials for specific flexible display applications, ranging from foldable smartphones to rollable televisions and wearable devices. This framework will consider not only technical performance but also scalability for mass production, cost-effectiveness, and compatibility with existing manufacturing infrastructure.

By advancing our understanding of catalytic materials in flexible display substrates, we anticipate enabling the next generation of display technologies that transcend current limitations in flexibility, durability, and form factor, opening new possibilities for device design and user interaction.

The initial flexible displays utilized plastic substrates with limited durability and poor thermal stability. By 2010, polyimide-based substrates emerged as a breakthrough, offering superior heat resistance and mechanical flexibility. The subsequent integration of catalytic materials to modify substrate properties marked a pivotal advancement, enabling thinner, more durable, and highly flexible displays with improved optical transparency and reduced weight.

Current research focuses on next-generation substrate materials that can withstand extreme bending conditions while supporting high-resolution display technologies. Catalytic materials play a crucial role in this development, as they facilitate the formation of specialized polymer structures and nanocomposites with enhanced properties. These materials modify the molecular architecture of substrates, creating cross-linking networks that improve mechanical resilience without compromising flexibility.

The technical objectives of this research encompass several dimensions. First, we aim to evaluate various catalytic materials for their effectiveness in enhancing substrate flexibility, focusing on transition metal complexes and organometallic compounds that promote controlled polymerization. Second, we seek to quantify the relationship between catalyst concentration and substrate performance metrics, including bend radius, cycle durability, and optical clarity.

Additionally, this research intends to develop novel catalyst systems that can operate at lower temperatures, reducing energy consumption during manufacturing while maintaining or improving substrate quality. We also aim to identify catalytic approaches that minimize environmental impact through reduced use of hazardous chemicals and improved recyclability of display components.

The ultimate goal is to establish a comprehensive framework for selecting and optimizing catalytic materials for specific flexible display applications, ranging from foldable smartphones to rollable televisions and wearable devices. This framework will consider not only technical performance but also scalability for mass production, cost-effectiveness, and compatibility with existing manufacturing infrastructure.

By advancing our understanding of catalytic materials in flexible display substrates, we anticipate enabling the next generation of display technologies that transcend current limitations in flexibility, durability, and form factor, opening new possibilities for device design and user interaction.

Market Analysis for Flexible Display Technologies

The flexible display market has experienced remarkable growth in recent years, driven by increasing consumer demand for portable, lightweight, and durable electronic devices. The global flexible display market was valued at approximately $23.1 billion in 2021 and is projected to reach $42.5 billion by 2027, growing at a CAGR of 10.5% during the forecast period. This substantial growth trajectory underscores the significant market potential for flexible display technologies and the catalytic materials that enable them.

Consumer electronics remains the dominant application segment, accounting for over 60% of the flexible display market. Smartphones represent the largest sub-segment, with major manufacturers like Samsung, Apple, and Huawei increasingly incorporating flexible display technologies into their flagship devices. The foldable smartphone market alone is expected to grow from 7.1 million units in 2021 to 27.6 million units by 2025.

Beyond smartphones, emerging application areas include wearable devices, automotive displays, and smart home appliances. The wearable technology market is particularly promising, with flexible displays enabling innovative form factors for smartwatches, fitness trackers, and healthcare monitoring devices. This segment is projected to grow at a CAGR of 15.2% through 2027.

Regional analysis reveals that Asia-Pacific dominates the flexible display market, accounting for approximately 45% of global market share. This dominance is attributed to the strong presence of display manufacturers and electronic device producers in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow, with growing adoption rates driven by technological innovation and consumer preferences for cutting-edge devices.

The substrate materials market for flexible displays is experiencing parallel growth, with polymeric substrates (particularly polyimide) currently dominating with a market share of approximately 52%. However, ultra-thin glass substrates are gaining traction due to their superior barrier properties and surface quality, projected to grow at a CAGR of 18.3% through 2027.

Catalytic materials used in flexible display manufacturing processes represent a specialized but critical market segment. These materials, essential for processes like metal deposition, etching, and surface modification, are estimated to reach a market value of $1.2 billion by 2025. The demand for high-performance catalytic materials is particularly strong as manufacturers seek to improve yield rates and reduce production costs.

Market challenges include high production costs, technical limitations in mass production, and competition from alternative display technologies. However, ongoing R&D investments and increasing economies of scale are expected to gradually address these challenges, further expanding market opportunities for flexible display technologies and associated catalytic materials.

Consumer electronics remains the dominant application segment, accounting for over 60% of the flexible display market. Smartphones represent the largest sub-segment, with major manufacturers like Samsung, Apple, and Huawei increasingly incorporating flexible display technologies into their flagship devices. The foldable smartphone market alone is expected to grow from 7.1 million units in 2021 to 27.6 million units by 2025.

Beyond smartphones, emerging application areas include wearable devices, automotive displays, and smart home appliances. The wearable technology market is particularly promising, with flexible displays enabling innovative form factors for smartwatches, fitness trackers, and healthcare monitoring devices. This segment is projected to grow at a CAGR of 15.2% through 2027.

Regional analysis reveals that Asia-Pacific dominates the flexible display market, accounting for approximately 45% of global market share. This dominance is attributed to the strong presence of display manufacturers and electronic device producers in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow, with growing adoption rates driven by technological innovation and consumer preferences for cutting-edge devices.

The substrate materials market for flexible displays is experiencing parallel growth, with polymeric substrates (particularly polyimide) currently dominating with a market share of approximately 52%. However, ultra-thin glass substrates are gaining traction due to their superior barrier properties and surface quality, projected to grow at a CAGR of 18.3% through 2027.

Catalytic materials used in flexible display manufacturing processes represent a specialized but critical market segment. These materials, essential for processes like metal deposition, etching, and surface modification, are estimated to reach a market value of $1.2 billion by 2025. The demand for high-performance catalytic materials is particularly strong as manufacturers seek to improve yield rates and reduce production costs.

Market challenges include high production costs, technical limitations in mass production, and competition from alternative display technologies. However, ongoing R&D investments and increasing economies of scale are expected to gradually address these challenges, further expanding market opportunities for flexible display technologies and associated catalytic materials.

Current Challenges in Catalytic Materials for Flexible Substrates

Despite significant advancements in flexible display technology, catalytic materials for flexible substrates face several critical challenges that impede further progress. The primary obstacle remains achieving optimal balance between catalytic efficiency and mechanical flexibility. Current catalytic materials often exhibit reduced performance when subjected to repeated bending and folding, with degradation occurring at bend radii below 5mm, limiting their practical application in highly flexible devices.

Thermal stability presents another significant challenge, as many catalytic materials require high-temperature processing (>300°C) that exceeds the thermal tolerance of polymer substrates commonly used in flexible displays. This temperature incompatibility creates manufacturing bottlenecks and restricts material selection, forcing compromises between catalytic performance and substrate integrity.

Adhesion issues between catalytic layers and flexible substrates persist across the industry. Delamination and cracking frequently occur during flexing operations, particularly at interfaces between materials with dissimilar mechanical properties. Current adhesion promoters often introduce electrical resistance or optical interference that compromises overall device performance.

Uniformity in deposition represents a persistent manufacturing challenge. Achieving consistent catalytic layer thickness across large-area flexible substrates remains difficult with existing deposition technologies. Variations as small as 5-10nm can lead to significant performance inconsistencies across the display surface, resulting in visible defects and functional irregularities.

Environmental stability poses increasing concerns as flexible displays move toward broader consumer applications. Many high-performance catalytic materials demonstrate sensitivity to oxygen and moisture, requiring complex encapsulation solutions that add bulk and reduce flexibility. Current barrier technologies struggle to maintain hermeticity when subjected to repeated mechanical stress.

Scalability challenges further complicate commercial implementation. Laboratory-scale processes for creating high-performance catalytic materials often rely on techniques difficult to scale to production volumes. Vacuum-based deposition methods commonly used for precise catalytic layer formation face throughput limitations and high operational costs at industrial scales.

Cost factors remain prohibitive for widespread adoption, with rare earth elements and precious metals frequently required for optimal catalytic performance. Alternative materials with comparable functionality but lower cost profiles have yet to demonstrate equivalent performance metrics, particularly regarding longevity and stability under mechanical stress.

Thermal stability presents another significant challenge, as many catalytic materials require high-temperature processing (>300°C) that exceeds the thermal tolerance of polymer substrates commonly used in flexible displays. This temperature incompatibility creates manufacturing bottlenecks and restricts material selection, forcing compromises between catalytic performance and substrate integrity.

Adhesion issues between catalytic layers and flexible substrates persist across the industry. Delamination and cracking frequently occur during flexing operations, particularly at interfaces between materials with dissimilar mechanical properties. Current adhesion promoters often introduce electrical resistance or optical interference that compromises overall device performance.

Uniformity in deposition represents a persistent manufacturing challenge. Achieving consistent catalytic layer thickness across large-area flexible substrates remains difficult with existing deposition technologies. Variations as small as 5-10nm can lead to significant performance inconsistencies across the display surface, resulting in visible defects and functional irregularities.

Environmental stability poses increasing concerns as flexible displays move toward broader consumer applications. Many high-performance catalytic materials demonstrate sensitivity to oxygen and moisture, requiring complex encapsulation solutions that add bulk and reduce flexibility. Current barrier technologies struggle to maintain hermeticity when subjected to repeated mechanical stress.

Scalability challenges further complicate commercial implementation. Laboratory-scale processes for creating high-performance catalytic materials often rely on techniques difficult to scale to production volumes. Vacuum-based deposition methods commonly used for precise catalytic layer formation face throughput limitations and high operational costs at industrial scales.

Cost factors remain prohibitive for widespread adoption, with rare earth elements and precious metals frequently required for optimal catalytic performance. Alternative materials with comparable functionality but lower cost profiles have yet to demonstrate equivalent performance metrics, particularly regarding longevity and stability under mechanical stress.

Current Catalytic Material Solutions for Flexible Displays

01 Flexible substrate materials for display applications

Various materials can be used as flexible substrates for display applications, including polymers, thin glass, and metal foils. These materials provide the necessary flexibility while maintaining structural integrity. The choice of substrate material affects the overall performance of the flexible display, including its durability, flexibility, and optical properties. Advanced manufacturing techniques are employed to ensure these substrates meet the requirements for flexible display applications.- Flexible substrate materials for display applications: Various materials can be used as flexible substrates for display applications, including polymers, thin glass, and metal foils. These materials provide the necessary flexibility while maintaining structural integrity. The substrates can be engineered to have specific properties such as transparency, thermal stability, and chemical resistance, which are crucial for display performance. Advanced manufacturing techniques ensure uniform thickness and surface quality for optimal display functionality.

- Catalytic materials for flexible display manufacturing: Catalytic materials play a critical role in the manufacturing processes of flexible displays. These materials facilitate the deposition and growth of active layers on flexible substrates at lower temperatures, which is essential to prevent substrate deformation. Metal nanoparticles, transition metal compounds, and organometallic complexes are commonly used as catalysts. These materials enable precise control over the crystallization and orientation of semiconductor layers, resulting in improved electronic performance of the display devices.

- Integration of electronic components on flexible substrates: The integration of electronic components on flexible substrates involves specialized techniques to ensure functionality and durability. This includes methods for depositing thin-film transistors, conductive traces, and other circuit elements directly onto the flexible material. Advanced bonding technologies are employed to attach components while maintaining flexibility. Stress management techniques are implemented to prevent component failure during bending and folding operations, ensuring the longevity of the flexible display system.

- Surface treatment and modification of flexible substrates: Surface treatments and modifications are essential for enhancing the adhesion, barrier properties, and performance of flexible display substrates. These treatments include plasma processing, chemical functionalization, and the application of specialized coatings. Surface modification can improve the wettability of the substrate, enabling better deposition of subsequent layers. Barrier layers can be applied to prevent moisture and oxygen penetration, which is critical for extending the lifespan of flexible display devices.

- Novel manufacturing processes for flexible display substrates: Innovative manufacturing processes have been developed specifically for flexible display substrates, including roll-to-roll processing, solution-based deposition, and laser-assisted fabrication. These techniques enable high-throughput production while maintaining precise control over material properties. Low-temperature processes are particularly important to prevent thermal damage to temperature-sensitive flexible substrates. Advanced patterning methods allow for the creation of high-resolution features necessary for modern display applications.

02 Catalytic materials for flexible display manufacturing

Catalytic materials play a crucial role in the manufacturing process of flexible displays. These materials facilitate various chemical reactions during the fabrication process, such as the deposition of thin films and the formation of conductive patterns. The selection of appropriate catalytic materials can significantly improve the efficiency of the manufacturing process and enhance the quality of the resulting flexible displays. Novel catalytic materials are being developed to address specific challenges in flexible display manufacturing.Expand Specific Solutions03 Integration of electronic components on flexible substrates

The integration of electronic components on flexible substrates involves specialized techniques to ensure proper functionality and durability. This includes methods for attaching thin-film transistors, organic light-emitting diodes, and other electronic components to the flexible substrate. Advanced bonding techniques and interconnect technologies are employed to maintain electrical connectivity during bending and flexing. The integration process must account for the mechanical stress that occurs when the display is flexed or bent.Expand Specific Solutions04 Protective coatings and encapsulation for flexible displays

Protective coatings and encapsulation technologies are essential for enhancing the durability and longevity of flexible displays. These coatings protect the sensitive electronic components from environmental factors such as moisture, oxygen, and mechanical damage. Various materials, including thin-film barriers and composite structures, are used to provide effective encapsulation while maintaining the flexibility of the display. Advanced coating techniques ensure uniform coverage and strong adhesion to the flexible substrate.Expand Specific Solutions05 Manufacturing processes for flexible display substrates

Specialized manufacturing processes are required for the production of flexible display substrates. These processes include roll-to-roll manufacturing, solution processing, and various deposition techniques. The manufacturing methods must ensure uniform thickness, surface smoothness, and appropriate mechanical properties of the substrate. Temperature control and precise handling are critical factors in the production process to prevent damage to the delicate materials. Innovative manufacturing approaches continue to be developed to improve the quality and reduce the cost of flexible display substrates.Expand Specific Solutions

Industry Leaders in Flexible Display and Catalytic Materials

The flexible display substrate market is currently in a growth phase, with increasing demand driven by consumer electronics and automotive applications. Major players like Samsung Display, LG Display, BOE Technology, and Japan Display are leading technological innovation in this space. The market for catalytic materials in flexible displays is expected to reach significant value as manufacturers seek more durable, lightweight, and energy-efficient solutions. Technology maturity varies across companies, with Samsung and LG demonstrating advanced capabilities in OLED flexible displays, while emerging players like Shenzhen Huake Chuangzhi and Industrial Technology Research Institute are developing novel catalytic materials to enhance substrate performance. Research collaborations between commercial entities and institutions like University of Electronic Science & Technology of China are accelerating innovation in this competitive landscape.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible display substrates using novel catalytic materials that enhance the performance of their OLED displays. Their proprietary technology employs metal nanoparticle catalysts (primarily platinum and palladium) embedded in polyimide substrates to improve adhesion between layers and enhance flexibility[1]. BOE's catalytic approach allows for lower processing temperatures (around 150-200°C compared to traditional 300-350°C), which reduces thermal stress on the polymer substrates[3]. Their latest generation employs a dual-catalyst system where different catalytic materials are used for the substrate preparation and the subsequent thin-film transistor (TFT) formation, resulting in displays that can withstand over 200,000 bending cycles without performance degradation[5]. BOE has also pioneered the use of solution-processed catalytic materials that enable more uniform deposition across large substrate areas, critical for their Gen 8.5+ production lines.

Strengths: Superior flexibility performance with high bend radius reliability; scalable manufacturing process suitable for mass production; lower energy consumption during manufacturing due to reduced processing temperatures. Weaknesses: Higher material costs associated with precious metal catalysts; some catalytic materials have limited lifespans requiring periodic process adjustments; potential for catalyst contamination affecting display performance over time.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered a catalytic conversion approach for flexible display substrates that utilizes transition metal catalysts (primarily ruthenium and iridium complexes) to facilitate polymerization of their proprietary plastic substrate materials[2]. Their P-OLED (Plastic OLED) technology incorporates catalytic materials at the interface between the plastic substrate and the barrier layers, which enhances adhesion while maintaining flexibility. LG's process employs a gradient catalyst concentration technique where the catalyst density varies through the substrate thickness, optimizing both mechanical properties and electrical performance[4]. Their latest innovation includes a self-healing catalytic layer that can repair microcracks formed during bending, extending the display lifetime by approximately 40% compared to previous generations[6]. LG Display has also developed a low-temperature catalytic deposition process (operating at around 120°C) that enables the use of more temperature-sensitive substrate materials while maintaining excellent TFT performance characteristics.

Strengths: Industry-leading flexibility with displays capable of rolling into a 3mm radius; innovative self-healing properties extend product lifespan; highly transparent substrates (>90% light transmission) enhance display brightness. Weaknesses: Complex manufacturing process with multiple catalytic stages increases production costs; some catalytic materials used have environmental concerns; limited scalability for ultra-large display formats.

Key Patents and Innovations in Flexible Substrate Catalysis

Substrate for Flexible Displays

PatentActiveUS20070224366A1

Innovation

- A substrate comprising a resin composition layer with an inorganic layer compound, such as clay minerals, dispersed in a solvent, where the inorganic layer compound constitutes between 10 weight % and 70 weight % of the total composition, providing a low thermal expansion coefficient and high visible light transmittance.

Flexible substrate material, method of manufacturing flexible display panel substrate and flexible display panel

PatentInactiveUS20210408403A1

Innovation

- A flexible substrate material is developed by incorporating carbon nanotube reinforcement dispersed within a polyimide substrate, linked through chemical bonds such as amide, conjugated, and hydrogen bonds, enhancing the mechanical properties and forming a composite structure with improved curl deformation and crack resistance.

Supply Chain Analysis for Flexible Display Materials

The flexible display supply chain represents a complex ecosystem of material suppliers, manufacturers, and technology providers that must work in harmony to deliver innovative display solutions. For catalytic materials used in flexible display substrates, the supply chain begins with raw material extraction and refinement, primarily involving precious metals like platinum, palladium, and ruthenium that serve as essential catalysts in the production process.

Primary suppliers of these catalytic materials include global mining corporations and specialized chemical companies that have established robust extraction and purification capabilities. Notable players include Johnson Matthey, BASF, and Umicore, who collectively control approximately 65% of the global catalytic materials market for electronics applications. These suppliers maintain strategic reserves to buffer against market volatility, though recent geopolitical tensions have introduced new uncertainties.

The midstream segment consists of specialized chemical processors who transform raw catalytic materials into application-specific formulations optimized for flexible display manufacturing. These processors have developed proprietary techniques to enhance catalytic efficiency while reducing material usage, addressing both cost and sustainability concerns. The just-in-time delivery systems implemented by these processors have reduced inventory costs by approximately 18% across the industry.

Geographical distribution of the supply chain reveals significant concentration risks, with over 70% of catalytic material processing occurring in East Asia. This regional concentration has prompted display manufacturers to pursue supply diversification strategies, including development of alternative materials and investment in recycling technologies that can recover up to 90% of catalytic materials from end-of-life products.

Vertical integration trends are becoming increasingly prominent, with major display manufacturers acquiring stakes in catalytic material suppliers to secure preferential access. This integration has accelerated technology transfer between material scientists and display engineers, resulting in catalytic formulations specifically optimized for flexible substrate applications.

Supply chain resilience has become a critical focus following recent disruptions, with manufacturers implementing dual-sourcing strategies and increasing safety stock levels of critical catalytic materials. Advanced analytics and blockchain-based tracking systems are being deployed to improve supply chain visibility and predict potential disruptions before they impact production schedules.

Primary suppliers of these catalytic materials include global mining corporations and specialized chemical companies that have established robust extraction and purification capabilities. Notable players include Johnson Matthey, BASF, and Umicore, who collectively control approximately 65% of the global catalytic materials market for electronics applications. These suppliers maintain strategic reserves to buffer against market volatility, though recent geopolitical tensions have introduced new uncertainties.

The midstream segment consists of specialized chemical processors who transform raw catalytic materials into application-specific formulations optimized for flexible display manufacturing. These processors have developed proprietary techniques to enhance catalytic efficiency while reducing material usage, addressing both cost and sustainability concerns. The just-in-time delivery systems implemented by these processors have reduced inventory costs by approximately 18% across the industry.

Geographical distribution of the supply chain reveals significant concentration risks, with over 70% of catalytic material processing occurring in East Asia. This regional concentration has prompted display manufacturers to pursue supply diversification strategies, including development of alternative materials and investment in recycling technologies that can recover up to 90% of catalytic materials from end-of-life products.

Vertical integration trends are becoming increasingly prominent, with major display manufacturers acquiring stakes in catalytic material suppliers to secure preferential access. This integration has accelerated technology transfer between material scientists and display engineers, resulting in catalytic formulations specifically optimized for flexible substrate applications.

Supply chain resilience has become a critical focus following recent disruptions, with manufacturers implementing dual-sourcing strategies and increasing safety stock levels of critical catalytic materials. Advanced analytics and blockchain-based tracking systems are being deployed to improve supply chain visibility and predict potential disruptions before they impact production schedules.

Environmental Impact of Catalytic Processes in Display Manufacturing

The catalytic processes employed in flexible display manufacturing present significant environmental considerations that must be addressed as this technology advances. The primary environmental concerns stem from the use of heavy metals and rare earth elements as catalysts, which can lead to resource depletion and toxic waste generation. Particularly, platinum group metals and transition metal catalysts used in polyimide substrate preparation and thin-film deposition processes require careful environmental management.

Manufacturing processes for flexible displays typically consume substantial energy, with catalytic reactions often requiring elevated temperatures and controlled atmospheres. This energy demand contributes to the carbon footprint of display production, especially when power sources are not renewable. Additionally, the chemical precursors and solvents used alongside catalytic materials frequently include volatile organic compounds (VOCs) and other hazardous substances that pose risks to air and water quality.

Waste streams from catalytic processes contain residual metals and chemical byproducts that require specialized treatment. Current industry practices include recovery systems for precious metal catalysts, but efficiency rates vary significantly across manufacturers. Without proper management, these materials can contaminate soil and water systems, potentially causing long-term ecological damage and human health concerns in manufacturing regions.

Regulatory frameworks addressing these environmental impacts continue to evolve globally. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have pushed manufacturers to develop greener catalytic processes. Similarly, initiatives in Asia, particularly in South Korea and Japan where much flexible display manufacturing occurs, have established stricter environmental standards for electronic component production.

Industry response has included the development of more environmentally benign catalytic materials, such as iron-based catalysts replacing platinum-group metals, and water-based processing systems that reduce solvent requirements. Closed-loop manufacturing systems that capture and reuse catalytic materials have demonstrated promising results in reducing waste generation by up to 40% in pilot implementations.

Life cycle assessment (LCA) studies indicate that the environmental impact of catalytic processes represents approximately 15-20% of the total ecological footprint of flexible display production. This significant contribution highlights the importance of continued innovation in green chemistry approaches to catalysis for sustainable manufacturing advancement in this rapidly growing technology sector.

Manufacturing processes for flexible displays typically consume substantial energy, with catalytic reactions often requiring elevated temperatures and controlled atmospheres. This energy demand contributes to the carbon footprint of display production, especially when power sources are not renewable. Additionally, the chemical precursors and solvents used alongside catalytic materials frequently include volatile organic compounds (VOCs) and other hazardous substances that pose risks to air and water quality.

Waste streams from catalytic processes contain residual metals and chemical byproducts that require specialized treatment. Current industry practices include recovery systems for precious metal catalysts, but efficiency rates vary significantly across manufacturers. Without proper management, these materials can contaminate soil and water systems, potentially causing long-term ecological damage and human health concerns in manufacturing regions.

Regulatory frameworks addressing these environmental impacts continue to evolve globally. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have pushed manufacturers to develop greener catalytic processes. Similarly, initiatives in Asia, particularly in South Korea and Japan where much flexible display manufacturing occurs, have established stricter environmental standards for electronic component production.

Industry response has included the development of more environmentally benign catalytic materials, such as iron-based catalysts replacing platinum-group metals, and water-based processing systems that reduce solvent requirements. Closed-loop manufacturing systems that capture and reuse catalytic materials have demonstrated promising results in reducing waste generation by up to 40% in pilot implementations.

Life cycle assessment (LCA) studies indicate that the environmental impact of catalytic processes represents approximately 15-20% of the total ecological footprint of flexible display production. This significant contribution highlights the importance of continued innovation in green chemistry approaches to catalysis for sustainable manufacturing advancement in this rapidly growing technology sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!