Material Properties of Flexible Display Substrates in LED Devices

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Evolution and Objectives

Flexible display technology has evolved significantly over the past two decades, transforming from conceptual research to commercial reality. The journey began in the early 2000s with rudimentary prototypes featuring limited flexibility and poor durability. These early displays utilized modified glass substrates with minimal bend capabilities, primarily serving as proof-of-concept rather than practical applications. The technological breakthrough came with the introduction of plastic-based substrates around 2010, enabling truly flexible displays with improved mechanical properties.

The evolution accelerated dramatically between 2013 and 2018, when manufacturers successfully addressed critical challenges in material science, particularly regarding substrate stability under repeated flexing conditions. This period saw the transition from rigid OLED displays to flexible variants, with companies like Samsung and LG introducing the first commercially viable flexible displays in smartphones and wearable devices. The substrate materials evolved from modified polyimide films to more sophisticated composite materials offering enhanced barrier properties against oxygen and moisture.

Current flexible display technology employs advanced substrate materials including ultra-thin glass (UTG), modified polyimide films, and hybrid organic-inorganic composites. These materials have enabled the development of foldable smartphones, rollable displays, and conformable screens that can adapt to non-flat surfaces. The substrate thickness has been progressively reduced from over 200 microns to less than 50 microns, while simultaneously improving mechanical durability and barrier properties.

The primary objectives in flexible display substrate development for LED devices focus on several critical parameters. First, achieving optimal mechanical properties including flexibility, fold endurance, and dimensional stability under repeated deformation cycles. Second, enhancing barrier properties against oxygen and moisture penetration, which remains crucial for extending the operational lifetime of organic LED components. Third, improving optical transparency and surface smoothness to maintain display quality comparable to rigid counterparts.

Additional technical objectives include reducing thickness while maintaining structural integrity, developing cost-effective manufacturing processes for mass production, and ensuring compatibility with existing display fabrication infrastructure. Temperature stability during processing represents another significant challenge, as substrate materials must withstand high-temperature deposition processes while maintaining dimensional stability.

The trajectory of flexible display evolution points toward increasingly sophisticated applications, including fully rollable displays, stretchable screens, and conformable displays that can be integrated into non-traditional surfaces and form factors. This evolution necessitates continuous innovation in substrate materials, with particular emphasis on improving the balance between mechanical flexibility and barrier properties against environmental degradation factors.

The evolution accelerated dramatically between 2013 and 2018, when manufacturers successfully addressed critical challenges in material science, particularly regarding substrate stability under repeated flexing conditions. This period saw the transition from rigid OLED displays to flexible variants, with companies like Samsung and LG introducing the first commercially viable flexible displays in smartphones and wearable devices. The substrate materials evolved from modified polyimide films to more sophisticated composite materials offering enhanced barrier properties against oxygen and moisture.

Current flexible display technology employs advanced substrate materials including ultra-thin glass (UTG), modified polyimide films, and hybrid organic-inorganic composites. These materials have enabled the development of foldable smartphones, rollable displays, and conformable screens that can adapt to non-flat surfaces. The substrate thickness has been progressively reduced from over 200 microns to less than 50 microns, while simultaneously improving mechanical durability and barrier properties.

The primary objectives in flexible display substrate development for LED devices focus on several critical parameters. First, achieving optimal mechanical properties including flexibility, fold endurance, and dimensional stability under repeated deformation cycles. Second, enhancing barrier properties against oxygen and moisture penetration, which remains crucial for extending the operational lifetime of organic LED components. Third, improving optical transparency and surface smoothness to maintain display quality comparable to rigid counterparts.

Additional technical objectives include reducing thickness while maintaining structural integrity, developing cost-effective manufacturing processes for mass production, and ensuring compatibility with existing display fabrication infrastructure. Temperature stability during processing represents another significant challenge, as substrate materials must withstand high-temperature deposition processes while maintaining dimensional stability.

The trajectory of flexible display evolution points toward increasingly sophisticated applications, including fully rollable displays, stretchable screens, and conformable displays that can be integrated into non-traditional surfaces and form factors. This evolution necessitates continuous innovation in substrate materials, with particular emphasis on improving the balance between mechanical flexibility and barrier properties against environmental degradation factors.

Market Analysis for Flexible LED Display Technologies

The flexible LED display market has witnessed remarkable growth in recent years, driven by increasing consumer demand for innovative display technologies across multiple sectors. Current market valuations place the global flexible display market at approximately 15.8 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 33.4% through 2028. The flexible LED segment specifically represents about 22% of this market, with particularly strong momentum in consumer electronics and automotive applications.

Consumer electronics remains the dominant application sector, accounting for nearly 48% of market share. Smartphones and wearable devices are the primary drivers, with major manufacturers increasingly incorporating flexible display technologies into flagship products. The automotive sector follows as the second-largest market segment at 17%, where flexible displays are revolutionizing dashboard interfaces and entertainment systems.

Regional analysis reveals Asia-Pacific as the dominant market, controlling approximately 62% of global market share. This dominance stems from the concentration of display manufacturing infrastructure in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 21% and 14% market shares respectively, with both regions showing accelerated adoption rates in premium consumer products and automotive applications.

Market penetration analysis indicates varying adoption rates across different sectors. While consumer electronics shows high penetration at 37%, automotive applications are growing rapidly from a lower base of 14%. Emerging applications in healthcare devices and smart home systems represent significant growth opportunities, currently at nascent adoption levels below 8%.

Key market drivers include miniaturization trends in electronics, growing demand for foldable smartphones, increasing automotive display requirements, and expanding applications in wearable technology. The market also benefits from significant R&D investments, with major display manufacturers allocating between 8-12% of annual revenue to flexible display research.

Market challenges primarily revolve around production costs, which remain 30-40% higher than conventional rigid displays. Material durability concerns persist, with current flexible substrates showing degradation after 200,000-300,000 fold cycles. Supply chain constraints, particularly for specialized materials like polyimide films and flexible barrier layers, continue to impact production scaling capabilities.

Future market trends point toward increased integration of flexible displays with other emerging technologies, including augmented reality systems, transparent displays, and stretchable electronics. The market is expected to see significant diversification beyond current applications, with potential breakthroughs in medical imaging, smart textiles, and architectural displays representing substantial long-term growth vectors.

Consumer electronics remains the dominant application sector, accounting for nearly 48% of market share. Smartphones and wearable devices are the primary drivers, with major manufacturers increasingly incorporating flexible display technologies into flagship products. The automotive sector follows as the second-largest market segment at 17%, where flexible displays are revolutionizing dashboard interfaces and entertainment systems.

Regional analysis reveals Asia-Pacific as the dominant market, controlling approximately 62% of global market share. This dominance stems from the concentration of display manufacturing infrastructure in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 21% and 14% market shares respectively, with both regions showing accelerated adoption rates in premium consumer products and automotive applications.

Market penetration analysis indicates varying adoption rates across different sectors. While consumer electronics shows high penetration at 37%, automotive applications are growing rapidly from a lower base of 14%. Emerging applications in healthcare devices and smart home systems represent significant growth opportunities, currently at nascent adoption levels below 8%.

Key market drivers include miniaturization trends in electronics, growing demand for foldable smartphones, increasing automotive display requirements, and expanding applications in wearable technology. The market also benefits from significant R&D investments, with major display manufacturers allocating between 8-12% of annual revenue to flexible display research.

Market challenges primarily revolve around production costs, which remain 30-40% higher than conventional rigid displays. Material durability concerns persist, with current flexible substrates showing degradation after 200,000-300,000 fold cycles. Supply chain constraints, particularly for specialized materials like polyimide films and flexible barrier layers, continue to impact production scaling capabilities.

Future market trends point toward increased integration of flexible displays with other emerging technologies, including augmented reality systems, transparent displays, and stretchable electronics. The market is expected to see significant diversification beyond current applications, with potential breakthroughs in medical imaging, smart textiles, and architectural displays representing substantial long-term growth vectors.

Current Material Limitations and Technical Barriers

Despite significant advancements in flexible display technology, several material limitations and technical barriers continue to challenge the widespread adoption and performance optimization of flexible LED displays. Current polyimide (PI) substrates, while offering good thermal stability and mechanical flexibility, exhibit inherent yellowing tendencies that reduce light transmission efficiency, particularly affecting white light emission quality. This color shift problem becomes more pronounced with extended usage and exposure to environmental factors, limiting display longevity and color accuracy.

Oxygen and water vapor permeability represents another critical limitation of existing flexible substrate materials. Unlike rigid glass substrates with near-perfect barrier properties, flexible polymeric materials typically allow oxygen and moisture penetration at rates between 10^-3 to 10^-6 g/m²/day, significantly higher than the 10^-6 g/m²/day threshold required for adequate OLED protection. This permeability accelerates oxidation of sensitive organic materials and metal electrodes within the display structure, leading to dark spots, delamination, and premature device failure.

Thermal management presents a substantial technical barrier in flexible displays. Current substrate materials exhibit thermal conductivity values typically below 0.3 W/m·K, considerably lower than glass (1.0 W/m·K) or silicon (150 W/m·K). This poor thermal dissipation capability results in localized heating during operation, causing differential thermal expansion, mechanical stress, and potential delamination between layers. The heat accumulation also accelerates material degradation and reduces overall device lifespan.

Surface roughness of flexible substrates remains problematic, with typical RMS (root mean square) roughness values of 5-10 nm compared to the sub-nanometer smoothness of display-grade glass. This topographical variation creates non-uniform electric fields, increases current leakage pathways, and compromises pixel definition in high-resolution displays. While planarization layers can partially mitigate this issue, they add manufacturing complexity and potential delamination risks during flexing.

Dimensional stability under thermal cycling represents another significant barrier. Current flexible substrates exhibit coefficient of thermal expansion (CTE) values between 15-60 ppm/°C, creating substantial mismatch with inorganic electronic components (typically 3-7 ppm/°C). This mismatch generates cumulative mechanical stress during thermal cycling that can lead to cracking of brittle inorganic layers, particularly transparent conductive oxides like ITO, which maintain acceptable conductivity only up to strain levels of approximately 1.2%.

Adhesion between the substrate and subsequent functional layers remains suboptimal, with peel strengths typically below 10 N/m for many material combinations. This weak interfacial bonding becomes particularly problematic during repeated mechanical flexing, leading to progressive delamination and device failure. Current adhesion promotion techniques often involve chemical treatments that can potentially degrade the substrate's optical or mechanical properties.

Oxygen and water vapor permeability represents another critical limitation of existing flexible substrate materials. Unlike rigid glass substrates with near-perfect barrier properties, flexible polymeric materials typically allow oxygen and moisture penetration at rates between 10^-3 to 10^-6 g/m²/day, significantly higher than the 10^-6 g/m²/day threshold required for adequate OLED protection. This permeability accelerates oxidation of sensitive organic materials and metal electrodes within the display structure, leading to dark spots, delamination, and premature device failure.

Thermal management presents a substantial technical barrier in flexible displays. Current substrate materials exhibit thermal conductivity values typically below 0.3 W/m·K, considerably lower than glass (1.0 W/m·K) or silicon (150 W/m·K). This poor thermal dissipation capability results in localized heating during operation, causing differential thermal expansion, mechanical stress, and potential delamination between layers. The heat accumulation also accelerates material degradation and reduces overall device lifespan.

Surface roughness of flexible substrates remains problematic, with typical RMS (root mean square) roughness values of 5-10 nm compared to the sub-nanometer smoothness of display-grade glass. This topographical variation creates non-uniform electric fields, increases current leakage pathways, and compromises pixel definition in high-resolution displays. While planarization layers can partially mitigate this issue, they add manufacturing complexity and potential delamination risks during flexing.

Dimensional stability under thermal cycling represents another significant barrier. Current flexible substrates exhibit coefficient of thermal expansion (CTE) values between 15-60 ppm/°C, creating substantial mismatch with inorganic electronic components (typically 3-7 ppm/°C). This mismatch generates cumulative mechanical stress during thermal cycling that can lead to cracking of brittle inorganic layers, particularly transparent conductive oxides like ITO, which maintain acceptable conductivity only up to strain levels of approximately 1.2%.

Adhesion between the substrate and subsequent functional layers remains suboptimal, with peel strengths typically below 10 N/m for many material combinations. This weak interfacial bonding becomes particularly problematic during repeated mechanical flexing, leading to progressive delamination and device failure. Current adhesion promotion techniques often involve chemical treatments that can potentially degrade the substrate's optical or mechanical properties.

Contemporary Flexible Substrate Solutions

01 Polymer-based flexible substrates

Polymer materials such as polyimide, polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) are widely used as flexible substrates for displays due to their excellent mechanical flexibility, lightweight properties, and thermal stability. These materials can withstand repeated bending and folding while maintaining their structural integrity. The polymer substrates can be modified with various additives to enhance their barrier properties against moisture and oxygen, which is crucial for the longevity of flexible displays.- Polymer-based flexible substrates: Polymer materials such as polyimide, polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) are widely used as flexible substrates for display applications due to their excellent mechanical flexibility, optical transparency, and thermal stability. These materials can withstand repeated bending and folding while maintaining their structural integrity. The polymer substrates can be modified with various additives to enhance their barrier properties against moisture and oxygen, which is crucial for the longevity of flexible displays.

- Thin-film encapsulation technologies: Thin-film encapsulation technologies are essential for protecting flexible display components from environmental factors. These technologies involve depositing alternating inorganic and organic layers to create effective moisture and oxygen barriers while maintaining flexibility. The encapsulation layers must have specific material properties including high transparency, low permeability to water and oxygen, and the ability to withstand mechanical deformation without cracking or delamination. Advanced thin-film encapsulation methods can significantly extend the lifespan of flexible displays.

- Transparent conductive materials: Transparent conductive materials are critical components in flexible displays, serving as electrodes while maintaining optical transparency. Traditional indium tin oxide (ITO) has limitations in flexibility, leading to the development of alternative materials such as silver nanowires, carbon nanotubes, graphene, and metal mesh structures. These materials offer superior mechanical flexibility while providing the necessary electrical conductivity and optical transparency. The balance between conductivity, transparency, and mechanical durability is crucial for the performance of flexible displays.

- Mechanical and thermal stability enhancements: Enhancing the mechanical and thermal stability of flexible display substrates is essential for ensuring device reliability. This involves developing materials with optimized elastic modulus, tensile strength, and thermal expansion coefficients. Composite structures that combine different materials can provide improved mechanical properties while maintaining flexibility. Various surface treatments and reinforcement techniques can be applied to prevent crack propagation and enhance the durability of flexible substrates under repeated bending and temperature fluctuations.

- Novel substrate architectures: Innovative substrate architectures are being developed to overcome the limitations of conventional materials. These include ultrathin glass substrates, hybrid organic-inorganic composites, and multilayer structures with engineered interfaces. Some designs incorporate stress-relief patterns or neutral plane concepts to minimize strain during bending. Advanced manufacturing techniques such as roll-to-roll processing enable the production of these complex substrate architectures at scale. These novel approaches aim to achieve an optimal balance of flexibility, durability, and display performance.

02 Thin-film transistor structures on flexible substrates

Specialized thin-film transistor (TFT) structures are designed for flexible displays to maintain electrical performance during bending. These TFTs often incorporate low-temperature processing techniques to avoid thermal damage to the flexible substrate. The transistor layers are engineered with strain-resistant materials and configurations that can distribute mechanical stress during flexing. Advanced TFT designs may include buffer layers between the substrate and active components to improve adhesion and prevent delamination under mechanical stress.Expand Specific Solutions03 Barrier and encapsulation technologies

Flexible displays require effective barrier and encapsulation technologies to protect sensitive electronic components from environmental factors. Multi-layer barrier films combining organic and inorganic materials are used to achieve ultra-low water vapor and oxygen transmission rates. These barrier structures often employ alternating layers of different materials to create tortuous paths for gas molecules. Advanced encapsulation techniques may include atomic layer deposition (ALD) to create ultra-thin, highly conformal barrier layers that maintain their protective properties even when flexed.Expand Specific Solutions04 Mechanical properties and durability enhancement

Enhancing the mechanical durability of flexible display substrates involves specialized material formulations and structural designs. Techniques include incorporating reinforcement materials, optimizing thickness profiles, and developing stress-relief structures. Neutral plane engineering positions sensitive components at locations that experience minimal strain during bending. Surface treatments and coatings are applied to improve scratch resistance while maintaining flexibility. Testing protocols evaluate performance under various bending radii, folding cycles, and environmental conditions to ensure long-term reliability.Expand Specific Solutions05 Transparent conductive materials for flexible displays

Specialized transparent conductive materials are developed for flexible display applications to maintain conductivity during bending. These include metal nanowire networks, carbon nanotubes, graphene, and metal mesh structures that offer both transparency and flexibility. Hybrid systems combining different conductive materials can achieve optimal balance between optical transparency, electrical conductivity, and mechanical flexibility. These materials are engineered to withstand repeated deformation cycles without significant increase in resistance or loss of optical properties, which is essential for touch functionality in flexible displays.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The flexible display substrate market for LED devices is currently in a growth phase, characterized by rapid technological advancements and expanding applications. The market size is projected to increase significantly as demand for foldable smartphones, wearables, and automotive displays rises. Technologically, the field shows varying maturity levels, with established players like BOE Technology, LG Display, and TCL China Star Optoelectronics leading innovation in substrate materials. These companies have developed proprietary flexible substrate technologies, while newer entrants like Tianma Microelectronics and InfoVision Optoelectronics are gaining ground through specialized applications. Material science breakthroughs from research institutions like Changchun Institute of Applied Chemistry and corporate R&D centers are accelerating the transition from laboratory concepts to commercial viability, particularly in areas of durability, flexibility, and optical performance.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible display substrates using ultra-thin glass (UTG) technology with thickness below 30μm, combined with proprietary polymer composites to enhance flexibility and durability. Their patented "BOE Flexible OLED" technology incorporates a multi-layer structure with specialized barrier films that prevent moisture and oxygen penetration while maintaining optical clarity. The company has pioneered a unique low-temperature polyimide (PI) processing technique that achieves higher thermal stability (up to 300°C) and lower coefficient of thermal expansion (CTE < 15 ppm/°C) compared to conventional materials[1]. BOE's flexible substrates feature specialized surface treatments that improve adhesion between organic layers and inorganic barrier films, resulting in bend radii capabilities below 1mm without performance degradation after 200,000+ folding cycles[3]. Their latest generation incorporates nano-composite materials that enhance mechanical strength while maintaining transparency above 90% in the visible spectrum.

Strengths: Industry-leading flexibility with proven durability in commercial products; excellent barrier properties against moisture/oxygen; high optical transparency. Weaknesses: Higher production costs compared to rigid substrates; some limitations in extreme temperature environments; requires specialized handling during manufacturing process.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed an innovative flexible display substrate technology called "H-UTG" (Hybrid Ultra-Thin Glass), which combines the advantages of both glass and polymer materials. This proprietary substrate consists of an ultra-thin glass core (thickness approximately 20-30μm) sandwiched between specially formulated polymer layers that enhance flexibility while maintaining the superior optical properties of glass. Their technology incorporates a unique stress distribution layer that allows for bend radii as small as 3mm without compromising structural integrity[5]. TCL CSOT's substrates feature advanced barrier properties with water vapor transmission rates below 10^-5 g/m²/day, achieved through a multi-layer structure with alternating inorganic and organic films. The company has also pioneered a low-temperature processing technique that enables direct TFT fabrication on flexible substrates without the thermal damage typically associated with traditional manufacturing processes. Their latest generation incorporates nano-composite materials that improve impact resistance while maintaining high light transmission (>91%) across the visible spectrum[7].

Strengths: Excellent balance between flexibility and durability; superior optical properties compared to pure polymer substrates; good thermal stability for manufacturing processes. Weaknesses: More complex manufacturing process than single-material solutions; higher cost structure; slightly thicker overall construction compared to pure polymer alternatives.

Critical Material Science Innovations

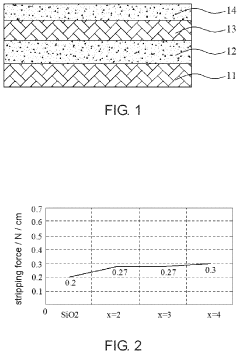

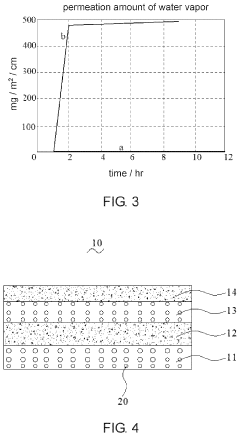

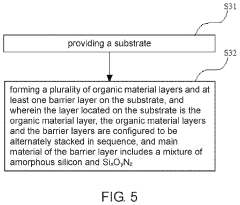

Flexible substrate, manufacturing method thereof, and organic light emitting display panel

PatentInactiveUS20210288275A1

Innovation

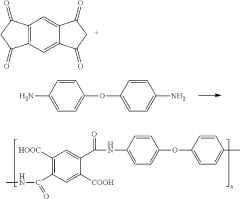

- Alternately stacking organic material layers with barrier layers made of a mixture of amorphous silicon and silicon-based oxynitride (SixOyNz) enhances adhesion forces by embedding amorphous silicon in polyimide macromolecules and increasing bonding tightness with nitrogen and oxygen atoms, improving water and oxygen blocking performance.

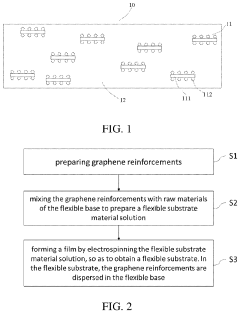

Flexible substrate material, manufacturing method of flexible substrate and flexible display panel

PatentInactiveUS20220115608A1

Innovation

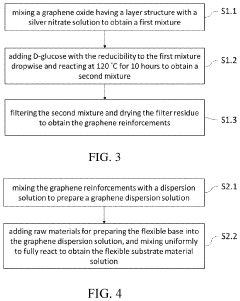

- A flexible substrate material is developed by incorporating graphene reinforcements with metal nanoparticles dispersed on their surface, enhancing thermal conductivity while maintaining bending characteristics and deformation resistance, achieved through a manufacturing method involving electrospinning and chemical bonding.

Environmental Impact and Sustainability Considerations

The environmental impact of flexible display substrates in LED devices represents a critical consideration in the sustainable development of next-generation display technologies. Traditional display manufacturing processes involve substantial use of hazardous chemicals, high energy consumption, and generation of significant waste. Flexible substrates, particularly those used in LED applications, present both challenges and opportunities in addressing these environmental concerns.

Material selection for flexible substrates directly influences the environmental footprint of LED displays throughout their lifecycle. Polymeric materials such as polyimide (PI), polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) dominate the flexible substrate market, each carrying distinct environmental implications. While these materials enable thinner, lighter displays that potentially reduce transportation emissions and material usage, their production often involves petroleum-based feedstocks and energy-intensive manufacturing processes.

Recyclability remains a significant challenge for flexible display substrates. The multi-layer construction necessary for functionality—combining barrier layers, conductive elements, and the substrate itself—creates complex material composites that are difficult to separate at end-of-life. Current recycling infrastructure is inadequately equipped to process these advanced materials, resulting in most flexible displays ultimately entering landfills or incineration streams.

Biodegradable alternatives represent an emerging research direction with promising environmental benefits. Bio-based polymers derived from renewable resources such as cellulose, starch, and protein-based materials are being investigated as potential substitutes for conventional petroleum-based substrates. These materials offer reduced carbon footprints and improved end-of-life scenarios, though challenges in matching the performance characteristics of traditional substrates remain significant barriers to widespread adoption.

Energy efficiency during the operational phase presents another important sustainability dimension. Flexible substrates can enable more efficient LED displays through improved thermal management and optical properties, potentially reducing energy consumption during the use phase—often the most impactful period in a display's lifecycle. Advancements in substrate materials that enhance light extraction efficiency and reduce operating temperatures directly contribute to sustainability goals.

Manufacturing processes for flexible substrates are evolving toward more environmentally responsible approaches. Roll-to-roll processing techniques reduce material waste and energy consumption compared to traditional batch processing methods. Additionally, innovations in solvent-free deposition techniques and water-based processing are reducing the reliance on hazardous chemicals in production environments, minimizing worker exposure risks and environmental contamination.

Regulatory frameworks worldwide are increasingly addressing the environmental impacts of electronic displays. Extended Producer Responsibility (EPR) programs, restrictions on hazardous substances, and energy efficiency standards are driving manufacturers toward more sustainable material choices and design approaches for flexible LED displays. These regulatory pressures, combined with growing consumer demand for environmentally responsible products, are accelerating industry adoption of sustainable practices in flexible substrate development.

Material selection for flexible substrates directly influences the environmental footprint of LED displays throughout their lifecycle. Polymeric materials such as polyimide (PI), polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) dominate the flexible substrate market, each carrying distinct environmental implications. While these materials enable thinner, lighter displays that potentially reduce transportation emissions and material usage, their production often involves petroleum-based feedstocks and energy-intensive manufacturing processes.

Recyclability remains a significant challenge for flexible display substrates. The multi-layer construction necessary for functionality—combining barrier layers, conductive elements, and the substrate itself—creates complex material composites that are difficult to separate at end-of-life. Current recycling infrastructure is inadequately equipped to process these advanced materials, resulting in most flexible displays ultimately entering landfills or incineration streams.

Biodegradable alternatives represent an emerging research direction with promising environmental benefits. Bio-based polymers derived from renewable resources such as cellulose, starch, and protein-based materials are being investigated as potential substitutes for conventional petroleum-based substrates. These materials offer reduced carbon footprints and improved end-of-life scenarios, though challenges in matching the performance characteristics of traditional substrates remain significant barriers to widespread adoption.

Energy efficiency during the operational phase presents another important sustainability dimension. Flexible substrates can enable more efficient LED displays through improved thermal management and optical properties, potentially reducing energy consumption during the use phase—often the most impactful period in a display's lifecycle. Advancements in substrate materials that enhance light extraction efficiency and reduce operating temperatures directly contribute to sustainability goals.

Manufacturing processes for flexible substrates are evolving toward more environmentally responsible approaches. Roll-to-roll processing techniques reduce material waste and energy consumption compared to traditional batch processing methods. Additionally, innovations in solvent-free deposition techniques and water-based processing are reducing the reliance on hazardous chemicals in production environments, minimizing worker exposure risks and environmental contamination.

Regulatory frameworks worldwide are increasingly addressing the environmental impacts of electronic displays. Extended Producer Responsibility (EPR) programs, restrictions on hazardous substances, and energy efficiency standards are driving manufacturers toward more sustainable material choices and design approaches for flexible LED displays. These regulatory pressures, combined with growing consumer demand for environmentally responsible products, are accelerating industry adoption of sustainable practices in flexible substrate development.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of flexible display substrates for LED devices presents significant challenges and opportunities for industry players. Current production methods for flexible substrates such as polyimide (PI), polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) vary considerably in their cost structures and scalability potential. Traditional batch processing methods have given way to roll-to-roll (R2R) manufacturing techniques, which have demonstrated up to 40% reduction in production costs when fully optimized.

Analysis of manufacturing economics reveals that substrate material costs typically account for 15-25% of the total flexible display production expenses. However, this percentage can fluctuate based on production volume and yield rates. High-performance polyimide substrates, while offering superior thermal stability and mechanical properties, command premium prices ranging from $50-100 per square meter, significantly higher than conventional rigid substrates at $10-20 per square meter.

Yield management represents a critical factor in cost analysis, with current industry standards achieving 70-85% yields for flexible substrate production. Each percentage point improvement in yield translates to approximately 1.2-1.5% reduction in overall manufacturing costs. The primary yield-limiting factors include surface defects, thickness variations, and contamination during the coating and curing processes.

Equipment investment requirements present another significant consideration. A full-scale flexible substrate production line typically requires capital expenditure of $50-100 million, with depreciation costs spread over 5-7 years of operational life. This high initial investment creates substantial barriers to entry for new market participants and favors established manufacturers with existing infrastructure.

Energy consumption metrics indicate that flexible substrate production consumes 30-40% less energy compared to traditional glass substrate manufacturing when normalized for equivalent display area. This energy efficiency advantage contributes to both cost savings and environmental sustainability objectives, though it is partially offset by higher material costs.

Supply chain resilience has emerged as a critical factor in manufacturing scalability assessment. The specialized nature of high-performance polymer materials creates potential bottlenecks, with 65% of global production capacity concentrated among five major chemical suppliers. Diversification strategies and alternative material development are being pursued to mitigate these supply risks.

Future cost reduction pathways primarily focus on three areas: process optimization through advanced automation and machine learning algorithms, material innovations including nano-composite substrates with enhanced properties at lower costs, and equipment advances enabling higher throughput and precision. Industry projections suggest potential for 30-40% cost reduction over the next five years through these combined approaches.

Analysis of manufacturing economics reveals that substrate material costs typically account for 15-25% of the total flexible display production expenses. However, this percentage can fluctuate based on production volume and yield rates. High-performance polyimide substrates, while offering superior thermal stability and mechanical properties, command premium prices ranging from $50-100 per square meter, significantly higher than conventional rigid substrates at $10-20 per square meter.

Yield management represents a critical factor in cost analysis, with current industry standards achieving 70-85% yields for flexible substrate production. Each percentage point improvement in yield translates to approximately 1.2-1.5% reduction in overall manufacturing costs. The primary yield-limiting factors include surface defects, thickness variations, and contamination during the coating and curing processes.

Equipment investment requirements present another significant consideration. A full-scale flexible substrate production line typically requires capital expenditure of $50-100 million, with depreciation costs spread over 5-7 years of operational life. This high initial investment creates substantial barriers to entry for new market participants and favors established manufacturers with existing infrastructure.

Energy consumption metrics indicate that flexible substrate production consumes 30-40% less energy compared to traditional glass substrate manufacturing when normalized for equivalent display area. This energy efficiency advantage contributes to both cost savings and environmental sustainability objectives, though it is partially offset by higher material costs.

Supply chain resilience has emerged as a critical factor in manufacturing scalability assessment. The specialized nature of high-performance polymer materials creates potential bottlenecks, with 65% of global production capacity concentrated among five major chemical suppliers. Diversification strategies and alternative material development are being pursued to mitigate these supply risks.

Future cost reduction pathways primarily focus on three areas: process optimization through advanced automation and machine learning algorithms, material innovations including nano-composite substrates with enhanced properties at lower costs, and equipment advances enabling higher throughput and precision. Industry projections suggest potential for 30-40% cost reduction over the next five years through these combined approaches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!