What Drives Flexible Display Substrate Use in Industrial Appliances

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Display Evolution and Industrial Application Goals

Flexible display technology has evolved significantly over the past two decades, transitioning from laboratory curiosities to commercially viable products. The journey began in the early 2000s with rudimentary flexible electronic paper displays, progressing through various technological breakthroughs in materials science and manufacturing processes. By 2010, the first generation of flexible OLED displays emerged, though with limited flexibility and durability. The subsequent decade witnessed remarkable advancements in substrate materials, encapsulation techniques, and thin-film transistor technologies, enabling displays with greater flexibility, resilience, and performance characteristics.

The evolution trajectory has been characterized by progressive improvements in bend radius capabilities, from initial displays that could only be curved once during manufacturing to modern iterations that withstand thousands of folding cycles. Concurrently, resolution, color gamut, and energy efficiency have steadily improved, making flexible displays increasingly suitable for demanding industrial applications beyond consumer electronics.

Industrial application goals for flexible display substrates differ substantially from consumer-oriented implementations. While consumer electronics prioritize aesthetics and novel form factors, industrial applications emphasize robustness, reliability under harsh conditions, and extended operational lifespans. Key technical objectives include developing substrates that maintain performance integrity under extreme temperature variations (-40°C to 85°C), resist chemical exposure common in manufacturing environments, and withstand high-vibration scenarios typical in heavy machinery.

Another critical goal is enhancing the integration capabilities of flexible displays with existing industrial control systems and IoT infrastructure. This requires developing standardized interfaces and communication protocols that enable seamless data visualization across diverse industrial settings. Additionally, industrial applications demand displays with higher brightness levels (1000+ nits) to ensure visibility in varied lighting conditions, from direct sunlight to dimly lit facilities.

Long-term reliability represents perhaps the most significant technical objective, with industrial applications requiring operational lifespans of 7-10 years compared to the 2-3 years typical of consumer devices. This necessitates advanced substrate materials and encapsulation technologies that prevent moisture ingress and oxygen degradation over extended periods, even in challenging industrial environments.

The convergence of these evolutionary trends and application-specific goals is driving research toward specialized flexible display substrates that balance mechanical flexibility with environmental resilience. Current development efforts focus on hybrid substrate architectures that combine multiple material layers, each optimized for specific performance attributes required in industrial settings.

The evolution trajectory has been characterized by progressive improvements in bend radius capabilities, from initial displays that could only be curved once during manufacturing to modern iterations that withstand thousands of folding cycles. Concurrently, resolution, color gamut, and energy efficiency have steadily improved, making flexible displays increasingly suitable for demanding industrial applications beyond consumer electronics.

Industrial application goals for flexible display substrates differ substantially from consumer-oriented implementations. While consumer electronics prioritize aesthetics and novel form factors, industrial applications emphasize robustness, reliability under harsh conditions, and extended operational lifespans. Key technical objectives include developing substrates that maintain performance integrity under extreme temperature variations (-40°C to 85°C), resist chemical exposure common in manufacturing environments, and withstand high-vibration scenarios typical in heavy machinery.

Another critical goal is enhancing the integration capabilities of flexible displays with existing industrial control systems and IoT infrastructure. This requires developing standardized interfaces and communication protocols that enable seamless data visualization across diverse industrial settings. Additionally, industrial applications demand displays with higher brightness levels (1000+ nits) to ensure visibility in varied lighting conditions, from direct sunlight to dimly lit facilities.

Long-term reliability represents perhaps the most significant technical objective, with industrial applications requiring operational lifespans of 7-10 years compared to the 2-3 years typical of consumer devices. This necessitates advanced substrate materials and encapsulation technologies that prevent moisture ingress and oxygen degradation over extended periods, even in challenging industrial environments.

The convergence of these evolutionary trends and application-specific goals is driving research toward specialized flexible display substrates that balance mechanical flexibility with environmental resilience. Current development efforts focus on hybrid substrate architectures that combine multiple material layers, each optimized for specific performance attributes required in industrial settings.

Market Demand Analysis for Industrial Flexible Displays

The industrial sector's demand for flexible display substrates has witnessed significant growth in recent years, driven by the increasing need for durable, adaptable visual interfaces in harsh operating environments. Market research indicates that industrial applications for flexible displays are expanding at a compound annual growth rate of approximately 18% between 2020 and 2025, outpacing consumer electronics in certain segments.

Primary demand drivers include the industrial automation trend, where flexible displays offer superior integration capabilities in non-standard form factors and curved surfaces. Manufacturing facilities are increasingly adopting human-machine interfaces that can withstand vibration, temperature fluctuations, and exposure to chemicals—conditions where traditional rigid displays often fail.

The oil and gas industry represents a particularly strong vertical market, with demand for flexible displays in portable monitoring equipment growing by 22% annually. These displays provide crucial real-time data visualization in challenging field environments while reducing equipment weight and increasing durability against impact and environmental stressors.

Healthcare and medical equipment manufacturers constitute another significant market segment, with demand focused on sterilizable, conformable displays for medical devices and monitoring systems. The ability to integrate displays onto curved surfaces of medical equipment has opened new design possibilities previously constrained by flat, rigid display limitations.

Transportation and logistics applications are driving substantial demand growth, particularly in fleet management systems, warehouse automation interfaces, and industrial vehicle dashboards. The vibration resistance and reduced breakage risk of flexible displays translate directly to lower total cost of ownership in these high-use scenarios.

Market analysis reveals regional variations in industrial adoption patterns. North American industries lead in flexible display implementation for industrial control systems, while European manufacturers show stronger demand in precision instrumentation applications. The Asia-Pacific region demonstrates the fastest growth rate, particularly in manufacturing equipment interfaces and industrial IoT applications.

End-user surveys indicate that durability under extreme conditions ranks as the primary purchase consideration, followed by power efficiency and readability in variable lighting conditions. Weight reduction benefits rank lower in industrial applications compared to consumer markets, while conformability to non-standard surfaces represents a more significant value proposition for industrial equipment designers.

Forward-looking market indicators suggest emerging demand in previously untapped industrial segments, including agricultural equipment, construction machinery, and specialized manufacturing tools, where environmental exposure has traditionally limited display integration options.

Primary demand drivers include the industrial automation trend, where flexible displays offer superior integration capabilities in non-standard form factors and curved surfaces. Manufacturing facilities are increasingly adopting human-machine interfaces that can withstand vibration, temperature fluctuations, and exposure to chemicals—conditions where traditional rigid displays often fail.

The oil and gas industry represents a particularly strong vertical market, with demand for flexible displays in portable monitoring equipment growing by 22% annually. These displays provide crucial real-time data visualization in challenging field environments while reducing equipment weight and increasing durability against impact and environmental stressors.

Healthcare and medical equipment manufacturers constitute another significant market segment, with demand focused on sterilizable, conformable displays for medical devices and monitoring systems. The ability to integrate displays onto curved surfaces of medical equipment has opened new design possibilities previously constrained by flat, rigid display limitations.

Transportation and logistics applications are driving substantial demand growth, particularly in fleet management systems, warehouse automation interfaces, and industrial vehicle dashboards. The vibration resistance and reduced breakage risk of flexible displays translate directly to lower total cost of ownership in these high-use scenarios.

Market analysis reveals regional variations in industrial adoption patterns. North American industries lead in flexible display implementation for industrial control systems, while European manufacturers show stronger demand in precision instrumentation applications. The Asia-Pacific region demonstrates the fastest growth rate, particularly in manufacturing equipment interfaces and industrial IoT applications.

End-user surveys indicate that durability under extreme conditions ranks as the primary purchase consideration, followed by power efficiency and readability in variable lighting conditions. Weight reduction benefits rank lower in industrial applications compared to consumer markets, while conformability to non-standard surfaces represents a more significant value proposition for industrial equipment designers.

Forward-looking market indicators suggest emerging demand in previously untapped industrial segments, including agricultural equipment, construction machinery, and specialized manufacturing tools, where environmental exposure has traditionally limited display integration options.

Current Substrate Technologies and Implementation Challenges

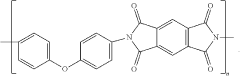

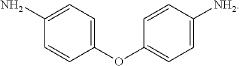

The flexible display industry currently employs several substrate technologies, each with distinct advantages and implementation challenges. Polyimide (PI) dominates the market due to its exceptional thermal stability (withstanding temperatures up to 400°C), chemical resistance, and mechanical durability. PI substrates can achieve bend radii below 1mm while maintaining structural integrity through thousands of folding cycles. However, PI presents challenges including high production costs, complex processing requirements, and yellowing tendencies that can affect optical performance in industrial environments.

Polyethylene terephthalate (PET) offers a cost-effective alternative with good optical transparency (>85%) and adequate flexibility for less demanding applications. Its lower temperature tolerance (approximately 150°C) significantly restricts manufacturing processes, particularly for displays requiring high-temperature thin-film transistor (TFT) deposition. This limitation has confined PET primarily to simpler industrial display applications where extreme durability is not required.

Polyethylene naphthalate (PEN) represents a middle-ground solution, providing better thermal stability than PET (up to 200°C) while maintaining good optical properties and moderate cost. PEN has gained traction in industrial control panels and monitoring systems where moderate flexibility and environmental resistance are sufficient. However, its limited heat resistance still poses challenges for advanced manufacturing processes.

Metal foils, particularly stainless steel and specialized aluminum alloys, offer exceptional durability and heat resistance for harsh industrial environments. These substrates can withstand extreme temperatures and provide excellent barrier properties against moisture and oxygen. The primary drawbacks include their opacity (requiring top-emission display architectures), higher weight, and potential electrical interference issues that necessitate additional insulation layers.

Ultrathin glass (UTG) has emerged as a premium substrate option, offering glass-like optical performance (>90% transparency) with flexibility down to 100μm thickness. UTG provides superior barrier properties and compatibility with established display manufacturing processes. Implementation challenges include its relatively high brittleness compared to polymer alternatives, complex handling requirements during manufacturing, and significantly higher costs that have limited widespread adoption in industrial applications.

A critical implementation challenge across all substrate technologies is the integration of touch functionality and protective layers without compromising flexibility or durability. Industrial environments often require displays to withstand vibration, impact, chemical exposure, and temperature fluctuations while maintaining consistent performance. This necessitates complex multi-layer structures that must bend uniformly without delamination or performance degradation.

Manufacturing scalability remains another significant hurdle, with roll-to-roll processing capabilities varying substantially between substrate types. While polymers like PI and PET are amenable to continuous processing, UTG and specialized composites often require more complex handling systems that increase production costs and limit economies of scale.

Polyethylene terephthalate (PET) offers a cost-effective alternative with good optical transparency (>85%) and adequate flexibility for less demanding applications. Its lower temperature tolerance (approximately 150°C) significantly restricts manufacturing processes, particularly for displays requiring high-temperature thin-film transistor (TFT) deposition. This limitation has confined PET primarily to simpler industrial display applications where extreme durability is not required.

Polyethylene naphthalate (PEN) represents a middle-ground solution, providing better thermal stability than PET (up to 200°C) while maintaining good optical properties and moderate cost. PEN has gained traction in industrial control panels and monitoring systems where moderate flexibility and environmental resistance are sufficient. However, its limited heat resistance still poses challenges for advanced manufacturing processes.

Metal foils, particularly stainless steel and specialized aluminum alloys, offer exceptional durability and heat resistance for harsh industrial environments. These substrates can withstand extreme temperatures and provide excellent barrier properties against moisture and oxygen. The primary drawbacks include their opacity (requiring top-emission display architectures), higher weight, and potential electrical interference issues that necessitate additional insulation layers.

Ultrathin glass (UTG) has emerged as a premium substrate option, offering glass-like optical performance (>90% transparency) with flexibility down to 100μm thickness. UTG provides superior barrier properties and compatibility with established display manufacturing processes. Implementation challenges include its relatively high brittleness compared to polymer alternatives, complex handling requirements during manufacturing, and significantly higher costs that have limited widespread adoption in industrial applications.

A critical implementation challenge across all substrate technologies is the integration of touch functionality and protective layers without compromising flexibility or durability. Industrial environments often require displays to withstand vibration, impact, chemical exposure, and temperature fluctuations while maintaining consistent performance. This necessitates complex multi-layer structures that must bend uniformly without delamination or performance degradation.

Manufacturing scalability remains another significant hurdle, with roll-to-roll processing capabilities varying substantially between substrate types. While polymers like PI and PET are amenable to continuous processing, UTG and specialized composites often require more complex handling systems that increase production costs and limit economies of scale.

Current Substrate Solutions for Industrial Applications

01 Polymer-based flexible substrates

Polymer materials such as polyimide, polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) are widely used as base materials for flexible display substrates due to their excellent mechanical flexibility, lightweight properties, and thermal stability. These polymer substrates can be modified with various additives to enhance their barrier properties against oxygen and moisture, which is crucial for protecting sensitive display components. The polymer layers can be processed through techniques like spin-coating, roll-to-roll processing, or solution casting to achieve the desired thickness and uniformity.- Polymer-based flexible substrates: Polymer materials such as polyimide, polyethylene terephthalate (PET), and other plastic films are widely used as base materials for flexible display substrates. These materials offer excellent flexibility, lightweight properties, and can withstand repeated bending without damage. The polymer substrates can be modified with various coatings to enhance their barrier properties against moisture and oxygen, which is crucial for protecting sensitive display components.

- Thin-film transistor structures for flexible displays: Specialized thin-film transistor (TFT) structures are designed for flexible display applications. These TFTs are fabricated using low-temperature processes compatible with polymer substrates and incorporate materials that maintain electrical performance under mechanical stress. Various configurations include oxide semiconductor TFTs, organic TFTs, and low-temperature polysilicon TFTs that provide the necessary switching capabilities while maintaining flexibility.

- Barrier and encapsulation technologies: Advanced barrier and encapsulation technologies are essential for protecting flexible display components from environmental factors. Multi-layer barrier films consisting of alternating organic and inorganic layers provide effective protection against moisture and oxygen penetration. Thin-film encapsulation techniques using atomic layer deposition create ultra-thin yet highly effective barrier layers that maintain flexibility while extending the lifetime of display devices.

- Flexible OLED display structures: Flexible organic light-emitting diode (OLED) displays incorporate specialized layer structures designed to maintain performance during bending. These structures include flexible electrodes made from materials like indium tin oxide, silver nanowires, or graphene; flexible light-emitting layers; and specialized buffer layers that absorb mechanical stress. The entire stack is engineered to distribute strain evenly during flexing to prevent damage to critical components.

- Manufacturing processes for flexible substrates: Novel manufacturing processes have been developed specifically for flexible display substrates. These include roll-to-roll processing techniques that enable continuous production of large-area flexible substrates, laser lift-off methods for transferring thin films from rigid carriers to flexible supports, and specialized lamination processes. Low-temperature deposition techniques allow for the fabrication of high-quality electronic components on temperature-sensitive flexible materials.

02 Thin-film transistor structures for flexible displays

Advanced thin-film transistor (TFT) structures are essential components of flexible display substrates, enabling pixel addressing and control. These TFTs are typically fabricated using low-temperature processes compatible with flexible substrates, such as oxide semiconductors (like IGZO), organic semiconductors, or low-temperature polysilicon. The TFT structures are designed to maintain electrical performance even when subjected to mechanical bending and stretching, often incorporating strain-relief features or neutral plane engineering to minimize stress on active semiconductor layers during flexing operations.Expand Specific Solutions03 Barrier and encapsulation technologies

Effective barrier and encapsulation technologies are critical for flexible display substrates to protect sensitive organic and electronic components from environmental factors such as oxygen and moisture. These technologies often employ multi-layer structures combining inorganic layers (like silicon nitride or aluminum oxide) with organic layers to create tortuous diffusion paths for contaminants. Advanced encapsulation methods include atomic layer deposition (ALD) for ultra-thin barrier films, hybrid organic-inorganic multilayers, and edge sealing techniques specifically designed to address the vulnerability of flexible displays at their edges and interfaces.Expand Specific Solutions04 Mechanical durability enhancement techniques

Various techniques are employed to enhance the mechanical durability of flexible display substrates, allowing them to withstand repeated bending, folding, or rolling operations without performance degradation. These include neutral plane engineering to position sensitive components at the neutral stress plane, stress-relief structures like serpentine interconnects or island-bridge configurations, composite substrate designs with reinforcement layers, and specialized adhesives that maintain integrity during flexing. Some approaches also incorporate self-healing materials or distributed mechanical buffers to absorb and dissipate mechanical stress during deformation.Expand Specific Solutions05 Integration of functional layers in flexible substrates

Modern flexible display substrates incorporate multiple functional layers beyond basic structural support, including transparent conductive layers (using materials like ITO, silver nanowires, or graphene), touch-sensing elements, color filters, and light management structures. These functional layers are integrated through specialized deposition and patterning techniques compatible with flexible substrates, such as solution processing, transfer printing, or laser patterning. The integration approach often employs strategic layer sequencing and interface engineering to maintain electrical connectivity and optical performance during mechanical deformation while minimizing delamination risks between different functional materials.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The flexible display substrate market for industrial appliances is in a growth phase, characterized by increasing adoption across manufacturing, healthcare, and automotive sectors. The market is expanding rapidly, projected to reach significant value as industries seek more durable, lightweight, and adaptable display solutions. Technologically, the field shows varying maturity levels, with established players like Samsung Display, LG Display, and BOE Technology leading innovation through substantial R&D investments. These companies have developed advanced OLED and AMOLED technologies on flexible substrates, while newer entrants like China Star Optoelectronics and Tianma Microelectronics are gaining ground with competitive offerings. The ecosystem is evolving from rigid to flexible solutions, driven by demands for improved durability, space efficiency, and enhanced user interfaces in industrial environments.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced flexible display substrate technologies specifically for industrial applications, focusing on their B-OLED (BOE Organic Light Emitting Diode) technology. Their approach utilizes ultra-thin polyimide (PI) films as substrates with thickness ranging from 20-100μm, allowing for displays that can be bent, folded, or rolled. BOE's industrial flexible displays incorporate specialized barrier layers that provide exceptional resistance to moisture and oxygen penetration (with water vapor transmission rates below 10^-6 g/m²/day), critical for harsh industrial environments. Their manufacturing process employs low-temperature polysilicon (LTPS) backplane technology combined with thin-film encapsulation (TFE) techniques to ensure durability while maintaining flexibility. For industrial control panels and HMI systems, BOE has engineered substrates with enhanced temperature resistance (-40°C to 85°C) and vibration tolerance up to 5G, significantly outperforming rigid display alternatives. Their recent innovations include integrating touch functionality directly into the flexible substrate layer, reducing overall thickness while improving responsiveness in industrial gloved-hand operations.

Strengths: Superior flexibility and durability in harsh industrial environments; excellent temperature resistance range suitable for extreme manufacturing conditions; advanced moisture barriers extending product lifespan. Weaknesses: Higher production costs compared to conventional displays; limited maximum size capabilities for industrial applications requiring larger interfaces; potential concerns about long-term reliability under continuous mechanical stress in 24/7 industrial operations.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered flexible display substrate technology for industrial appliances through their P-OLED (Plastic OLED) platform. Their approach centers on ultra-thin polyimide (PI) substrates with thickness between 25-75μm that replace traditional glass, enabling displays that can conform to curved surfaces while maintaining structural integrity. For industrial applications, LG has developed specialized multi-layer barrier films that achieve oxygen transmission rates below 10^-5 cc/m²/day and water vapor transmission rates under 10^-6 g/m²/day, essential for maintaining display performance in humid factory environments. Their manufacturing process employs a proprietary "roll-to-roll" technique that allows for cost-effective mass production while maintaining precise tolerances required for industrial control interfaces. LG's industrial flexible displays feature reinforced substrate structures that can withstand over 200,000 bending cycles without performance degradation and operate reliably in temperature ranges from -30°C to 80°C. Recent innovations include integration of their In-Touch technology directly into the flexible substrate, eliminating the need for separate touch panels and reducing overall thickness to below 1mm for space-constrained industrial equipment.

Strengths: Industry-leading roll-to-roll manufacturing capability enabling cost-effective mass production; exceptional durability with proven performance in high-vibration industrial environments; advanced barrier technology providing superior protection against environmental contaminants. Weaknesses: More limited color gamut compared to rigid display alternatives; challenges in achieving uniform brightness across curved surfaces; higher initial implementation costs for industrial equipment manufacturers transitioning from traditional displays.

Core Patents and Innovations in Flexible Substrate Materials

Flexible substrate material, method of manufacturing flexible display panel substrate and flexible display panel

PatentInactiveUS20210408403A1

Innovation

- A flexible substrate material is developed by incorporating carbon nanotube reinforcement dispersed within a polyimide substrate, linked through chemical bonds such as amide, conjugated, and hydrogen bonds, enhancing the mechanical properties and forming a composite structure with improved curl deformation and crack resistance.

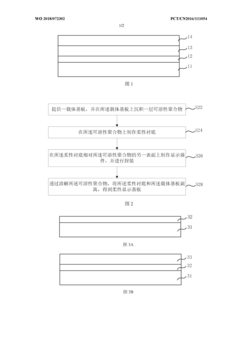

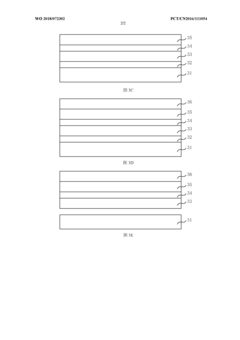

Method for manufacturing flexible display substrate

PatentWO2018072302A1

Innovation

- A soluble polymer is deposited on a carrier substrate to make a flexible substrate and a display device is encapsulated on its surface. The flexible display substrate and the carrier substrate are peeled off by dissolving the soluble polymer.

Durability and Reliability Considerations in Harsh Environments

Industrial environments present unique challenges for flexible display substrates, requiring exceptional durability and reliability under harsh conditions. Temperature fluctuations in industrial settings can range from sub-zero in refrigerated facilities to over 85°C near heavy machinery or furnaces. These extreme variations place significant stress on flexible display materials, potentially causing delamination, distortion, or complete failure of the display components.

Chemical exposure represents another critical challenge, as industrial environments frequently contain corrosive substances, oils, solvents, and cleaning agents. Flexible display substrates must maintain their structural integrity and optical properties despite regular contact with these potentially damaging compounds. Manufacturers have responded by developing specialized protective coatings and encapsulation techniques that shield sensitive electronic components while preserving flexibility.

Mechanical stress factors, including vibration, impact, and repeated flexing, constitute a third major consideration. Industrial equipment generates constant vibrations that can fatigue materials over time, while accidental impacts are common in busy work environments. Advanced flexible substrates now incorporate shock-absorbing layers and reinforced attachment points to mitigate these risks without compromising flexibility or display performance.

Humidity and dust protection has emerged as a critical reliability factor, with IP65 or higher ratings becoming standard for industrial applications. Moisture ingress can cause catastrophic failure in electronic components, while particulate contamination degrades optical clarity and touch sensitivity. Hermetic sealing technologies and advanced edge bonding methods have been developed specifically to address these environmental challenges.

Longevity requirements for industrial displays typically exceed consumer applications by 3-5 times, with expected operational lifespans of 5-10 years under continuous use. This necessitates materials that resist UV degradation, maintain consistent optical properties, and avoid yellowing or brittleness over time. Accelerated aging tests have become standard practice, with manufacturers subjecting prototypes to conditions simulating years of exposure to verify long-term reliability.

Serviceability considerations have driven modular design approaches, allowing for component replacement rather than complete display assembly replacement. This trend acknowledges the reality that even the most durable flexible displays may eventually require maintenance in demanding industrial settings, balancing initial cost investments against total ownership costs over the product lifecycle.

Chemical exposure represents another critical challenge, as industrial environments frequently contain corrosive substances, oils, solvents, and cleaning agents. Flexible display substrates must maintain their structural integrity and optical properties despite regular contact with these potentially damaging compounds. Manufacturers have responded by developing specialized protective coatings and encapsulation techniques that shield sensitive electronic components while preserving flexibility.

Mechanical stress factors, including vibration, impact, and repeated flexing, constitute a third major consideration. Industrial equipment generates constant vibrations that can fatigue materials over time, while accidental impacts are common in busy work environments. Advanced flexible substrates now incorporate shock-absorbing layers and reinforced attachment points to mitigate these risks without compromising flexibility or display performance.

Humidity and dust protection has emerged as a critical reliability factor, with IP65 or higher ratings becoming standard for industrial applications. Moisture ingress can cause catastrophic failure in electronic components, while particulate contamination degrades optical clarity and touch sensitivity. Hermetic sealing technologies and advanced edge bonding methods have been developed specifically to address these environmental challenges.

Longevity requirements for industrial displays typically exceed consumer applications by 3-5 times, with expected operational lifespans of 5-10 years under continuous use. This necessitates materials that resist UV degradation, maintain consistent optical properties, and avoid yellowing or brittleness over time. Accelerated aging tests have become standard practice, with manufacturers subjecting prototypes to conditions simulating years of exposure to verify long-term reliability.

Serviceability considerations have driven modular design approaches, allowing for component replacement rather than complete display assembly replacement. This trend acknowledges the reality that even the most durable flexible displays may eventually require maintenance in demanding industrial settings, balancing initial cost investments against total ownership costs over the product lifecycle.

Supply Chain and Manufacturing Process Analysis

The flexible display supply chain represents a complex ecosystem involving multiple specialized manufacturers and processes. Raw material suppliers provide essential components such as polyimide films, transparent conductive materials, and specialized adhesives that form the foundation of flexible substrates. These materials undergo rigorous quality control before entering the manufacturing pipeline, as even minor defects can significantly impact the final display performance in industrial applications.

Manufacturing processes for flexible display substrates involve several critical stages, beginning with substrate preparation through techniques like solution casting or extrusion. The production of polyimide-based substrates, particularly dominant in industrial applications, requires precise temperature control during imidization processes that can exceed 300°C. This is followed by surface treatment procedures to enhance adhesion properties and application of barrier layers to protect against moisture and oxygen penetration.

Thin-film transistor (TFT) deposition represents another crucial manufacturing step, with low-temperature polysilicon (LTPS) and oxide semiconductor technologies being preferred for industrial applications due to their superior electron mobility and stability under mechanical stress. The integration of these active components onto flexible substrates requires specialized equipment capable of maintaining alignment precision at the micron level despite substrate deformation during processing.

Supply chain vulnerabilities have become increasingly apparent, with 70% of specialized chemical precursors sourced from a limited number of suppliers in East Asia. This geographic concentration creates potential bottlenecks, as evidenced during recent global supply disruptions. Additionally, the manufacturing equipment market is dominated by a small number of providers, with Japanese and German manufacturers controlling approximately 65% of the critical deposition and patterning equipment market.

Just-in-time manufacturing principles have been challenging to implement in flexible display production due to the specialized nature of materials and long lead times, often exceeding 12-16 weeks for custom substrate formulations. This has prompted leading industrial appliance manufacturers to adopt strategic stockpiling of critical components and vertical integration strategies to mitigate supply risks.

Yield rates remain a significant factor affecting cost structures, with current industry averages for flexible display substrates ranging between 75-85% for high-performance industrial applications—considerably lower than the 92-95% achieved in rigid display manufacturing. These yield challenges directly impact pricing and availability, particularly for specialized industrial applications requiring enhanced durability and temperature resistance characteristics.

Manufacturing processes for flexible display substrates involve several critical stages, beginning with substrate preparation through techniques like solution casting or extrusion. The production of polyimide-based substrates, particularly dominant in industrial applications, requires precise temperature control during imidization processes that can exceed 300°C. This is followed by surface treatment procedures to enhance adhesion properties and application of barrier layers to protect against moisture and oxygen penetration.

Thin-film transistor (TFT) deposition represents another crucial manufacturing step, with low-temperature polysilicon (LTPS) and oxide semiconductor technologies being preferred for industrial applications due to their superior electron mobility and stability under mechanical stress. The integration of these active components onto flexible substrates requires specialized equipment capable of maintaining alignment precision at the micron level despite substrate deformation during processing.

Supply chain vulnerabilities have become increasingly apparent, with 70% of specialized chemical precursors sourced from a limited number of suppliers in East Asia. This geographic concentration creates potential bottlenecks, as evidenced during recent global supply disruptions. Additionally, the manufacturing equipment market is dominated by a small number of providers, with Japanese and German manufacturers controlling approximately 65% of the critical deposition and patterning equipment market.

Just-in-time manufacturing principles have been challenging to implement in flexible display production due to the specialized nature of materials and long lead times, often exceeding 12-16 weeks for custom substrate formulations. This has prompted leading industrial appliance manufacturers to adopt strategic stockpiling of critical components and vertical integration strategies to mitigate supply risks.

Yield rates remain a significant factor affecting cost structures, with current industry averages for flexible display substrates ranging between 75-85% for high-performance industrial applications—considerably lower than the 92-95% achieved in rigid display manufacturing. These yield challenges directly impact pricing and availability, particularly for specialized industrial applications requiring enhanced durability and temperature resistance characteristics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!