Material Analysis of Polymer-Based Flexible Display Substrates

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Polymer Substrate Technology Background and Objectives

Polymer-based flexible display substrates represent a revolutionary advancement in display technology, marking a significant departure from traditional rigid glass substrates. The evolution of this technology can be traced back to the early 2000s when researchers began exploring alternatives to conventional display materials. Initially driven by the need for more durable and lightweight displays for mobile devices, the development of polymer substrates has since expanded to address broader market demands for flexible, foldable, and even rollable display technologies.

The technological trajectory has been characterized by progressive improvements in material properties, particularly focusing on thermal stability, optical transparency, surface smoothness, and dimensional stability. Early polymer substrates suffered from limitations in these areas, restricting their commercial viability. However, continuous research efforts have led to significant breakthroughs in polymer chemistry and processing techniques, enabling the development of substrates with increasingly superior performance characteristics.

Current polymer substrate technologies primarily utilize polyimide (PI), polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) as base materials. Each offers distinct advantages: polyimide provides excellent thermal stability and mechanical strength but presents challenges in optical transparency; PET offers good optical properties at lower cost but limited thermal resistance; PEN represents a middle ground with balanced properties but higher manufacturing complexity.

The primary objective of polymer substrate technology development is to achieve a material composition that simultaneously satisfies multiple critical requirements: optical transparency exceeding 90%, surface roughness below 5nm, thermal stability up to 300°C, and mechanical flexibility allowing for bending radii under 1mm without performance degradation. Additionally, these materials must maintain dimensional stability during manufacturing processes and throughout the product lifecycle.

Recent technological advancements have focused on composite structures and hybrid materials that combine the beneficial properties of different polymers while mitigating their individual limitations. Surface modification techniques, including plasma treatment and application of specialized barrier layers, have emerged as crucial approaches to enhance substrate performance.

Looking forward, the technology aims to enable truly flexible displays with seamless folding capabilities, improved durability, and enhanced environmental resistance. The ultimate goal extends beyond merely replacing glass substrates to creating entirely new form factors and applications that were previously impossible with rigid display technologies, potentially revolutionizing consumer electronics, automotive displays, wearable technology, and medical devices.

The technological trajectory has been characterized by progressive improvements in material properties, particularly focusing on thermal stability, optical transparency, surface smoothness, and dimensional stability. Early polymer substrates suffered from limitations in these areas, restricting their commercial viability. However, continuous research efforts have led to significant breakthroughs in polymer chemistry and processing techniques, enabling the development of substrates with increasingly superior performance characteristics.

Current polymer substrate technologies primarily utilize polyimide (PI), polyethylene terephthalate (PET), and polyethylene naphthalate (PEN) as base materials. Each offers distinct advantages: polyimide provides excellent thermal stability and mechanical strength but presents challenges in optical transparency; PET offers good optical properties at lower cost but limited thermal resistance; PEN represents a middle ground with balanced properties but higher manufacturing complexity.

The primary objective of polymer substrate technology development is to achieve a material composition that simultaneously satisfies multiple critical requirements: optical transparency exceeding 90%, surface roughness below 5nm, thermal stability up to 300°C, and mechanical flexibility allowing for bending radii under 1mm without performance degradation. Additionally, these materials must maintain dimensional stability during manufacturing processes and throughout the product lifecycle.

Recent technological advancements have focused on composite structures and hybrid materials that combine the beneficial properties of different polymers while mitigating their individual limitations. Surface modification techniques, including plasma treatment and application of specialized barrier layers, have emerged as crucial approaches to enhance substrate performance.

Looking forward, the technology aims to enable truly flexible displays with seamless folding capabilities, improved durability, and enhanced environmental resistance. The ultimate goal extends beyond merely replacing glass substrates to creating entirely new form factors and applications that were previously impossible with rigid display technologies, potentially revolutionizing consumer electronics, automotive displays, wearable technology, and medical devices.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has witnessed exponential growth over the past decade, driven by increasing consumer demand for portable, durable, and innovative electronic devices. Market research indicates that the global flexible display market is projected to reach $15.5 billion by 2025, growing at a CAGR of 35% from 2020. This remarkable growth trajectory is primarily fueled by the expanding applications in smartphones, wearables, automotive displays, and emerging IoT devices.

Consumer electronics remains the dominant application segment, accounting for over 60% of the flexible display market. Smartphone manufacturers have been at the forefront of adopting flexible display technologies, with foldable phones gaining significant traction since 2019. The premium smartphone segment has particularly embraced polymer-based flexible substrates to enable innovative form factors that differentiate products in an increasingly competitive market.

Wearable technology represents another rapidly growing segment, with smartwatches and fitness trackers incorporating flexible displays to conform to the human body's contours. Market analysis reveals that consumers are willing to pay a premium of 15-20% for devices featuring flexible displays, perceiving them as more advanced and user-friendly.

The automotive industry has emerged as a promising growth sector for flexible display technologies. Modern vehicles increasingly incorporate curved displays in dashboards and entertainment systems, with luxury automobile manufacturers leading this integration. Industry forecasts suggest that by 2026, approximately 40% of new premium vehicles will feature some form of flexible display technology.

Regional analysis shows Asia-Pacific dominating the flexible display market, with South Korea, Japan, and China serving as manufacturing hubs. North America and Europe follow as significant consumers of end products incorporating flexible display technologies, driven by higher disposable incomes and greater technology adoption rates.

Market challenges include high production costs and technical limitations of current polymer substrates. The average manufacturing cost of flexible displays remains approximately 30% higher than traditional rigid displays, creating a barrier to mass-market adoption. However, this gap is narrowing as production scales and technologies mature.

Consumer surveys indicate growing awareness and preference for devices with flexible displays, with durability, reduced weight, and novel form factors cited as key purchasing factors. Enterprise customers in healthcare, military, and industrial sectors are also showing increased interest in flexible display solutions for specialized applications requiring conformable interfaces and enhanced durability.

Consumer electronics remains the dominant application segment, accounting for over 60% of the flexible display market. Smartphone manufacturers have been at the forefront of adopting flexible display technologies, with foldable phones gaining significant traction since 2019. The premium smartphone segment has particularly embraced polymer-based flexible substrates to enable innovative form factors that differentiate products in an increasingly competitive market.

Wearable technology represents another rapidly growing segment, with smartwatches and fitness trackers incorporating flexible displays to conform to the human body's contours. Market analysis reveals that consumers are willing to pay a premium of 15-20% for devices featuring flexible displays, perceiving them as more advanced and user-friendly.

The automotive industry has emerged as a promising growth sector for flexible display technologies. Modern vehicles increasingly incorporate curved displays in dashboards and entertainment systems, with luxury automobile manufacturers leading this integration. Industry forecasts suggest that by 2026, approximately 40% of new premium vehicles will feature some form of flexible display technology.

Regional analysis shows Asia-Pacific dominating the flexible display market, with South Korea, Japan, and China serving as manufacturing hubs. North America and Europe follow as significant consumers of end products incorporating flexible display technologies, driven by higher disposable incomes and greater technology adoption rates.

Market challenges include high production costs and technical limitations of current polymer substrates. The average manufacturing cost of flexible displays remains approximately 30% higher than traditional rigid displays, creating a barrier to mass-market adoption. However, this gap is narrowing as production scales and technologies mature.

Consumer surveys indicate growing awareness and preference for devices with flexible displays, with durability, reduced weight, and novel form factors cited as key purchasing factors. Enterprise customers in healthcare, military, and industrial sectors are also showing increased interest in flexible display solutions for specialized applications requiring conformable interfaces and enhanced durability.

Current State and Challenges in Polymer Substrate Development

Polymer-based flexible display substrates have emerged as a critical component in the development of next-generation display technologies. Currently, the field is dominated by several key materials including polyimide (PI), polyethylene terephthalate (PET), polyethylene naphthalate (PEN), and polycarbonate (PC). Among these, polyimide has gained significant traction due to its exceptional thermal stability, chemical resistance, and mechanical durability, making it the preferred choice for high-performance flexible displays.

The global research landscape shows varying degrees of advancement across regions. East Asian countries, particularly South Korea, Japan, and China, have established strong leadership positions in polymer substrate development. Companies like Samsung, LG Display, and BOE have made substantial investments in R&D facilities dedicated to flexible display technologies. In contrast, North American and European entities have focused more on specialized applications and fundamental research aspects.

Despite significant progress, several technical challenges continue to impede the widespread adoption of polymer-based flexible substrates. Foremost among these is the inherent trade-off between flexibility and barrier properties. As substrate thickness decreases to enhance flexibility, oxygen and moisture permeability typically increases, adversely affecting the longevity of display components. Current oxygen transmission rates (OTR) and water vapor transmission rates (WVTR) still fall short of ideal requirements for long-term device stability.

Surface roughness presents another significant challenge. Polymer substrates naturally exhibit higher surface roughness compared to glass, which can lead to non-uniform electrical properties in the thin-film transistors (TFTs) deposited on them. This inconsistency ultimately affects display performance and yield rates in manufacturing.

Thermal stability remains a critical limitation for many polymer candidates. While polyimide offers superior thermal resistance compared to other polymers, even PI-based substrates experience dimensional changes at temperatures required for certain manufacturing processes. This thermal expansion mismatch between substrate and functional layers can result in delamination and device failure.

Yellowing and optical clarity issues persist across most polymer options. Polyimide, despite its excellent mechanical properties, exhibits an inherent yellowish tint that reduces light transmission and affects color accuracy in displays. Alternative materials with better optical properties often compromise on thermal or mechanical stability.

Manufacturing scalability represents a significant hurdle in commercialization efforts. Current roll-to-roll processing techniques for polymer substrates still struggle with maintaining consistent quality across large production volumes, particularly regarding thickness uniformity and defect control. The integration of barrier layers and functional coatings at industrial scales further complicates manufacturing processes.

The global research landscape shows varying degrees of advancement across regions. East Asian countries, particularly South Korea, Japan, and China, have established strong leadership positions in polymer substrate development. Companies like Samsung, LG Display, and BOE have made substantial investments in R&D facilities dedicated to flexible display technologies. In contrast, North American and European entities have focused more on specialized applications and fundamental research aspects.

Despite significant progress, several technical challenges continue to impede the widespread adoption of polymer-based flexible substrates. Foremost among these is the inherent trade-off between flexibility and barrier properties. As substrate thickness decreases to enhance flexibility, oxygen and moisture permeability typically increases, adversely affecting the longevity of display components. Current oxygen transmission rates (OTR) and water vapor transmission rates (WVTR) still fall short of ideal requirements for long-term device stability.

Surface roughness presents another significant challenge. Polymer substrates naturally exhibit higher surface roughness compared to glass, which can lead to non-uniform electrical properties in the thin-film transistors (TFTs) deposited on them. This inconsistency ultimately affects display performance and yield rates in manufacturing.

Thermal stability remains a critical limitation for many polymer candidates. While polyimide offers superior thermal resistance compared to other polymers, even PI-based substrates experience dimensional changes at temperatures required for certain manufacturing processes. This thermal expansion mismatch between substrate and functional layers can result in delamination and device failure.

Yellowing and optical clarity issues persist across most polymer options. Polyimide, despite its excellent mechanical properties, exhibits an inherent yellowish tint that reduces light transmission and affects color accuracy in displays. Alternative materials with better optical properties often compromise on thermal or mechanical stability.

Manufacturing scalability represents a significant hurdle in commercialization efforts. Current roll-to-roll processing techniques for polymer substrates still struggle with maintaining consistent quality across large production volumes, particularly regarding thickness uniformity and defect control. The integration of barrier layers and functional coatings at industrial scales further complicates manufacturing processes.

Current Material Solutions for Flexible Display Substrates

01 Polyimide-based flexible substrates for displays

Polyimide materials are widely used as flexible substrates for display applications due to their excellent thermal stability, mechanical strength, and dimensional stability. These polymer-based substrates can withstand high processing temperatures while maintaining flexibility, making them ideal for flexible display manufacturing. The polyimide films can be modified with various additives to enhance properties such as transparency, adhesion, and barrier performance against moisture and oxygen.- Polyimide-based flexible substrates: Polyimide materials are widely used as flexible substrates for display applications due to their excellent thermal stability, mechanical strength, and chemical resistance. These substrates can withstand high processing temperatures required for display manufacturing while maintaining flexibility. Polyimide films can be modified with various additives to enhance properties such as transparency, adhesion, and dimensional stability, making them suitable for next-generation flexible displays.

- Polymer composite substrates with barrier properties: Polymer composite substrates incorporate multiple layers to achieve both flexibility and barrier properties against oxygen and moisture. These composites typically combine flexible polymer bases with inorganic barrier layers to protect sensitive display components. The multi-layer structure allows for customization of properties such as transparency, gas permeability, and mechanical durability while maintaining the flexibility required for bendable display applications.

- Manufacturing processes for flexible display substrates: Specialized manufacturing techniques are employed to produce polymer-based flexible display substrates with consistent quality and performance. These processes include solution casting, roll-to-roll processing, and various coating methods that enable large-scale production of thin, uniform polymer films. Advanced curing and treatment steps are implemented to optimize the mechanical and optical properties of the substrates while ensuring compatibility with subsequent display fabrication processes.

- Integration of electronic components with flexible substrates: Methods for integrating electronic components directly onto flexible polymer substrates enable the creation of fully functional flexible displays. These techniques include low-temperature deposition processes, transfer printing, and specialized bonding methods that preserve the flexibility of the substrate while ensuring reliable electrical connections. The integration approaches address challenges related to thermal expansion mismatch, mechanical stress during bending, and maintaining electrical performance under deformation.

- Optical enhancement technologies for polymer substrates: Various optical enhancement technologies are applied to polymer substrates to improve display performance. These include anti-reflection coatings, light management structures, and optical compensation layers that enhance brightness, contrast, and viewing angles. Specialized surface treatments and additives are used to modify the refractive index, reduce haze, and improve light transmission through the flexible substrate, resulting in displays with superior visual quality despite the use of polymer materials.

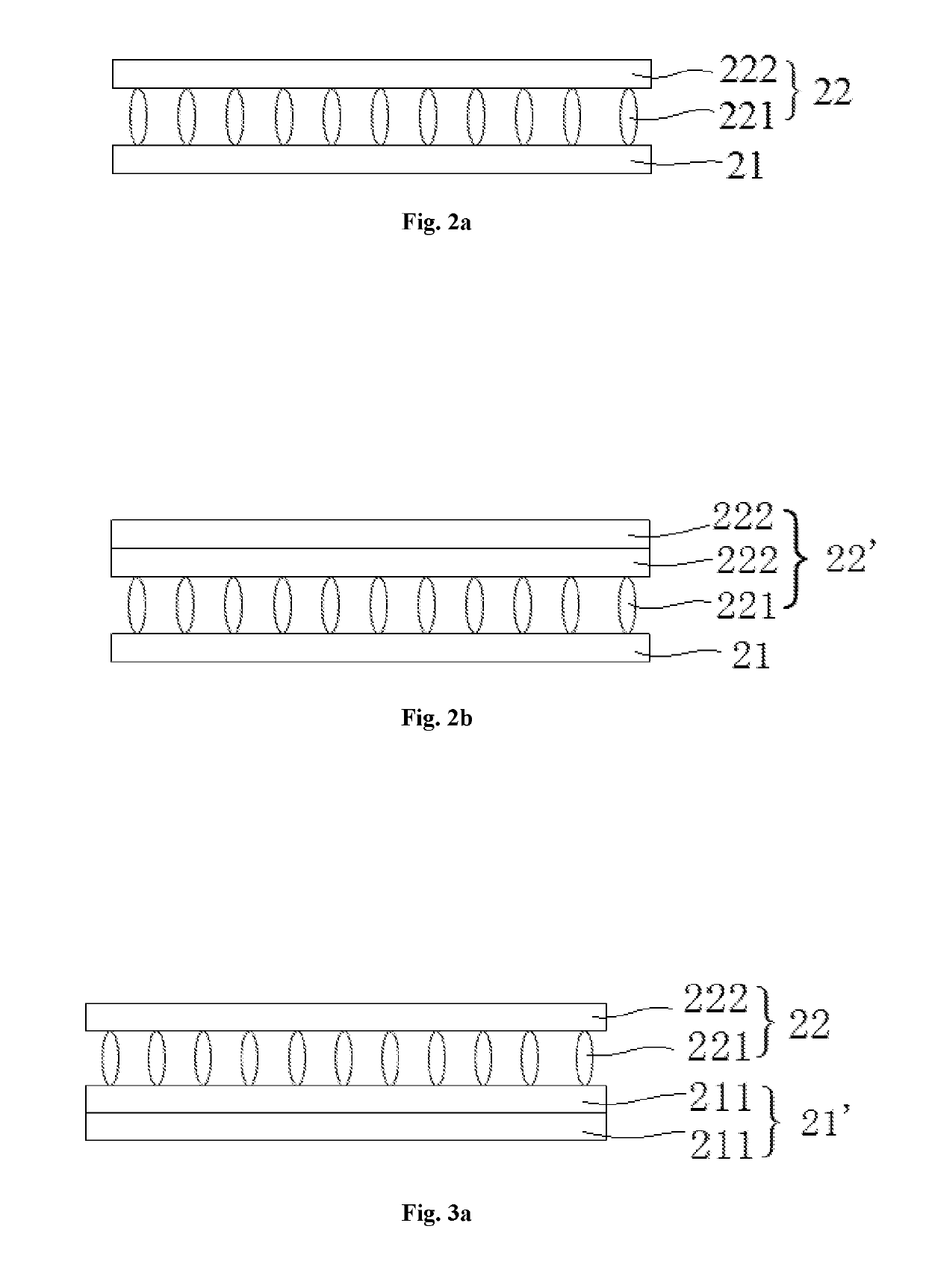

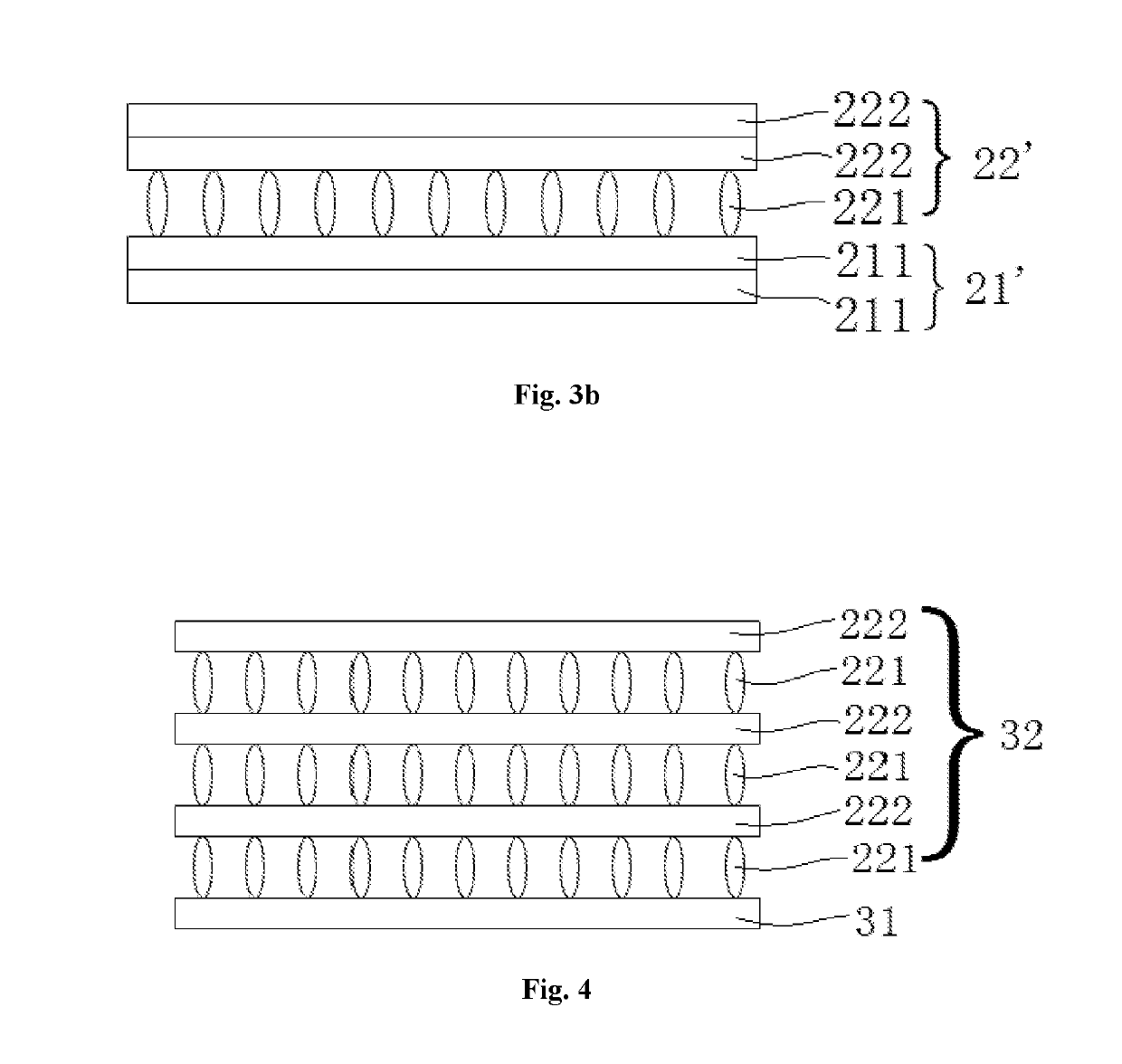

02 Multilayer polymer structures for flexible displays

Multilayer polymer structures combine different materials to achieve optimal performance for flexible display substrates. These structures typically include barrier layers to prevent moisture and oxygen penetration, adhesion promotion layers, planarization layers, and the main flexible polymer substrate. The multilayer approach allows for customization of properties such as flexibility, transparency, and thermal stability while maintaining the mechanical integrity required for display applications.Expand Specific Solutions03 Surface treatment and modification of polymer substrates

Various surface treatment methods are employed to modify polymer-based flexible substrates to improve their compatibility with display components. These treatments include plasma processing, UV irradiation, chemical modification, and coating with functional materials. Surface modifications enhance adhesion between the substrate and subsequent layers, improve wettability, reduce surface defects, and can provide additional functionality such as anti-reflection or hardness properties.Expand Specific Solutions04 Integration of electronic components with polymer substrates

Techniques for integrating electronic components directly onto or within polymer-based flexible substrates enable the creation of fully functional flexible displays. These methods include direct printing of circuits, embedding of components, and development of specialized connection interfaces that maintain functionality during bending. The integration approaches must accommodate the mechanical stress that occurs during flexing while ensuring reliable electrical connections and component performance.Expand Specific Solutions05 Novel polymer composites for enhanced display performance

Advanced polymer composites incorporate nanomaterials, reinforcing agents, or functional additives to enhance the performance of flexible display substrates. These composites can provide improved mechanical properties, better thermal management, enhanced optical clarity, and reduced coefficient of thermal expansion. By engineering the polymer matrix with specific additives, these materials can meet the demanding requirements of next-generation flexible and foldable display technologies.Expand Specific Solutions

Key Industry Players in Polymer-Based Flexible Displays

The polymer-based flexible display substrate market is in a growth phase, with increasing demand driven by the expansion of flexible electronics applications. The market size is projected to grow significantly as consumer electronics manufacturers seek thinner, lighter, and more durable display solutions. Technologically, the field is advancing rapidly but still maturing, with key players at different development stages. Samsung Display and LG Display lead with commercial production capabilities, while BOE Technology and TCL China Star Optoelectronics are rapidly advancing their technologies. Companies like Corning, Sumitomo Chemical, and LG Chem are developing specialized materials to enhance substrate performance. E Ink and Semiconductor Energy Laboratory focus on specialized applications, creating a competitive landscape where material innovation is the primary differentiator for market advantage.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive polymer-based flexible display substrate technology centered around their proprietary modified polyimide (PI) materials. Their approach involves a precision solution casting process that achieves thickness uniformity of ±0.5μm across large areas (up to Gen 6 substrate sizes). BOE's material science innovations include the incorporation of fluorinated PI derivatives that significantly reduce the yellowing index to below 3.0 while maintaining thermal stability (decomposition temperatures >450°C). Their substrate architecture employs a multi-layer structure with specialized planarization layers that achieve surface roughness below 0.5nm RMS, critical for consistent thin-film transistor performance. For moisture and oxygen protection, BOE utilizes a hybrid barrier system combining Al2O3 and SiNx layers deposited via atomic layer deposition, achieving water vapor transmission rates below 10^-6 g/m²/day. Recent advancements include the development of stress-relief microstructures within the polymer matrix that enable bending radii below 1mm without performance degradation and specialized surface treatments that enhance adhesion between the substrate and subsequent functional layers by over 40% compared to conventional methods[1][5].

Strengths: Strong vertical integration from materials to finished displays; advanced manufacturing capabilities for large-area flexible substrates; innovative surface treatment technologies. Weaknesses: Relatively newer entrant to flexible display commercialization compared to Korean competitors; challenges with ultra-thin substrate handling; higher initial defect rates during production ramp-up.

SAMSUNG DISPLAY CO LTD

Technical Solution: Samsung Display has pioneered advanced polymer-based flexible display substrates through their proprietary Polyimide (PI) technology. Their flexible OLED displays utilize ultra-thin PI films (approximately 10-30 micrometers thick) that undergo specialized thermal imidization processes to achieve high thermal stability (withstanding temperatures up to 300°C) while maintaining excellent mechanical flexibility. The company employs a multi-layer structure approach where the PI substrate is complemented by barrier layers to prevent moisture and oxygen penetration, achieving water vapor transmission rates below 10^-6 g/m²/day. Samsung's material engineering includes surface planarization techniques and specialized adhesion promotion layers that ensure uniform electrical performance across bending conditions. Their latest generation substrates incorporate modified PI formulations with enhanced elongation properties (>5%) and reduced yellowing index, supporting fold radii below 1.5mm for commercial foldable devices while maintaining optical transparency above 90% in the visible spectrum range[1][3].

Strengths: Industry-leading polyimide technology with exceptional thermal stability and mechanical durability; proven mass production capabilities; vertical integration from materials to finished displays. Weaknesses: Higher production costs compared to rigid displays; yellowing issues with some PI formulations requiring additional optical compensation layers; limited substrate options beyond polyimide.

Critical Material Properties and Characterization Techniques

Flexible substrate

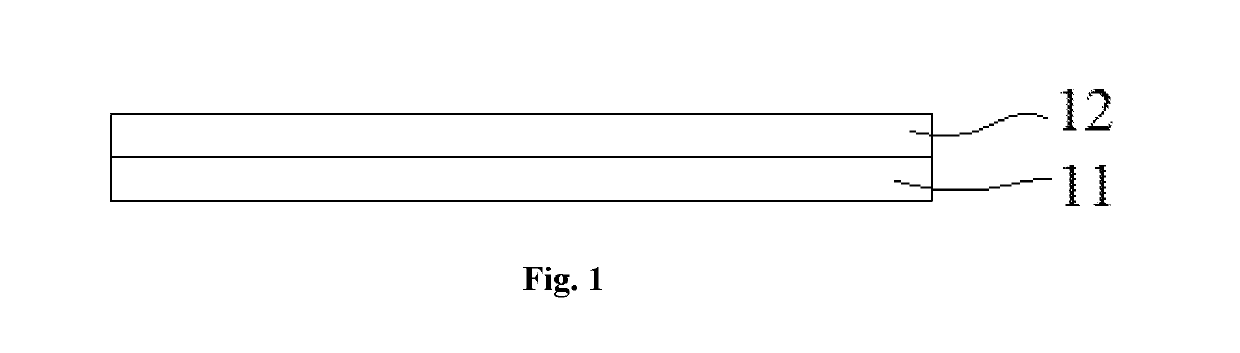

PatentActiveUS20190094599A1

Innovation

- A flexible substrate structure comprising a negative polyimide film with an optical axis perpendicular to its surface, paired with a second film of positive uniaxial macromolecular material, such as positive uniaxial liquid crystal, to counteract birefringence effects and eliminate phase retardation, thereby improving display quality and reducing manufacturing complexity and cost.

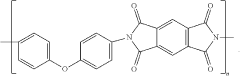

Flexible substrate material, method of manufacturing flexible display panel substrate and flexible display panel

PatentInactiveUS20210408403A1

Innovation

- A flexible substrate material is developed by incorporating carbon nanotube reinforcement dispersed within a polyimide substrate, linked through chemical bonds such as amide, conjugated, and hydrogen bonds, enhancing the mechanical properties and forming a composite structure with improved curl deformation and crack resistance.

Manufacturing Process Optimization for Polymer Substrates

The optimization of manufacturing processes for polymer substrates represents a critical factor in the commercial viability of flexible display technologies. Current manufacturing approaches primarily utilize solution processing methods, including spin coating, slot-die coating, and inkjet printing, which offer varying degrees of precision and throughput capabilities. Recent advancements have focused on roll-to-roll (R2R) processing techniques that significantly enhance production efficiency while maintaining consistent quality across large substrate areas.

Temperature control during polymer substrate manufacturing has emerged as a paramount consideration, with research indicating that precise thermal management can reduce defect rates by up to 40%. The crystallization behavior of semi-crystalline polymers such as polyethylene naphthalate (PEN) and polyethylene terephthalate (PET) is particularly sensitive to thermal history during processing, directly impacting mechanical flexibility and optical transparency.

Surface treatment methodologies have evolved substantially, with plasma treatment and corona discharge techniques showing particular promise for enhancing adhesion properties between substrate layers. These treatments modify the surface energy of polymer films, creating functional groups that improve compatibility with subsequent coating layers. Studies demonstrate that optimized surface treatments can increase interlayer adhesion strength by 30-60% compared to untreated substrates.

Contamination control represents another significant challenge in polymer substrate manufacturing. Particulate matter as small as 1-5 μm can create visible defects in the final display. Advanced cleanroom protocols combined with in-line filtration systems have been implemented by leading manufacturers, reducing defect rates to below 0.1 defects per square meter in best-practice scenarios.

Dimensional stability during processing remains a persistent challenge, with polymer substrates exhibiting thermal expansion coefficients typically 10-20 times higher than glass. Stress relaxation techniques, including annealing processes and controlled cooling rates, have demonstrated effectiveness in reducing dimensional variations to below 50 ppm, approaching the requirements for high-resolution display manufacturing.

Recent innovations in crosslinking methodologies during polymer processing have shown promise for enhancing thermal stability without compromising flexibility. UV-initiated and chemical crosslinking approaches allow for targeted modification of polymer chain mobility, resulting in substrates with improved resistance to processing temperatures while maintaining essential mechanical properties for flexible applications.

Temperature control during polymer substrate manufacturing has emerged as a paramount consideration, with research indicating that precise thermal management can reduce defect rates by up to 40%. The crystallization behavior of semi-crystalline polymers such as polyethylene naphthalate (PEN) and polyethylene terephthalate (PET) is particularly sensitive to thermal history during processing, directly impacting mechanical flexibility and optical transparency.

Surface treatment methodologies have evolved substantially, with plasma treatment and corona discharge techniques showing particular promise for enhancing adhesion properties between substrate layers. These treatments modify the surface energy of polymer films, creating functional groups that improve compatibility with subsequent coating layers. Studies demonstrate that optimized surface treatments can increase interlayer adhesion strength by 30-60% compared to untreated substrates.

Contamination control represents another significant challenge in polymer substrate manufacturing. Particulate matter as small as 1-5 μm can create visible defects in the final display. Advanced cleanroom protocols combined with in-line filtration systems have been implemented by leading manufacturers, reducing defect rates to below 0.1 defects per square meter in best-practice scenarios.

Dimensional stability during processing remains a persistent challenge, with polymer substrates exhibiting thermal expansion coefficients typically 10-20 times higher than glass. Stress relaxation techniques, including annealing processes and controlled cooling rates, have demonstrated effectiveness in reducing dimensional variations to below 50 ppm, approaching the requirements for high-resolution display manufacturing.

Recent innovations in crosslinking methodologies during polymer processing have shown promise for enhancing thermal stability without compromising flexibility. UV-initiated and chemical crosslinking approaches allow for targeted modification of polymer chain mobility, resulting in substrates with improved resistance to processing temperatures while maintaining essential mechanical properties for flexible applications.

Environmental Impact and Sustainability Considerations

The environmental footprint of polymer-based flexible display substrates represents a critical consideration in the sustainable development of next-generation display technologies. Traditional display manufacturing processes involve substantial energy consumption, hazardous chemical usage, and generate significant waste. Polymer-based flexible substrates offer potential advantages in reducing environmental impact through decreased material requirements and energy-efficient manufacturing processes compared to rigid glass alternatives.

Life cycle assessment (LCA) studies indicate that the production phase of polymer substrates typically consumes 30-45% less energy than conventional glass substrates. This reduction stems primarily from lower processing temperatures and simplified manufacturing steps. However, the environmental benefits are partially offset by the use of petroleum-derived polymers in many current substrate formulations, which raises concerns regarding resource depletion and end-of-life management.

Biodegradability remains a significant challenge for most high-performance polymers used in flexible displays. Materials such as polyimide (PI) and polyethylene terephthalate (PET) offer excellent mechanical and thermal properties but demonstrate poor biodegradability. Recent research has focused on developing bio-based alternatives, including cellulose derivatives and polylactic acid (PLA) composites, which show promising degradation profiles while maintaining acceptable performance characteristics.

Recycling capabilities present another crucial sustainability dimension. Current flexible display substrates often incorporate multiple material layers and additives that complicate recycling efforts. Advanced separation technologies, including solvent-based and mechanical recycling methods, are being developed specifically for multi-layer polymer composites. These approaches have demonstrated recovery rates of 65-80% in laboratory settings, though commercial-scale implementation remains limited.

Water consumption in polymer substrate manufacturing deserves particular attention, as production processes typically require 40-60% less water than glass substrate manufacturing. This reduction represents a significant environmental advantage in regions facing water scarcity challenges. Additionally, the lighter weight of polymer substrates contributes to reduced transportation-related emissions throughout the supply chain.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of electronic components. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives have specific implications for display technologies. Manufacturers are responding by developing halogen-free polymer formulations and implementing take-back programs for end-of-life products, though comprehensive circular economy solutions remain in early development stages.

Life cycle assessment (LCA) studies indicate that the production phase of polymer substrates typically consumes 30-45% less energy than conventional glass substrates. This reduction stems primarily from lower processing temperatures and simplified manufacturing steps. However, the environmental benefits are partially offset by the use of petroleum-derived polymers in many current substrate formulations, which raises concerns regarding resource depletion and end-of-life management.

Biodegradability remains a significant challenge for most high-performance polymers used in flexible displays. Materials such as polyimide (PI) and polyethylene terephthalate (PET) offer excellent mechanical and thermal properties but demonstrate poor biodegradability. Recent research has focused on developing bio-based alternatives, including cellulose derivatives and polylactic acid (PLA) composites, which show promising degradation profiles while maintaining acceptable performance characteristics.

Recycling capabilities present another crucial sustainability dimension. Current flexible display substrates often incorporate multiple material layers and additives that complicate recycling efforts. Advanced separation technologies, including solvent-based and mechanical recycling methods, are being developed specifically for multi-layer polymer composites. These approaches have demonstrated recovery rates of 65-80% in laboratory settings, though commercial-scale implementation remains limited.

Water consumption in polymer substrate manufacturing deserves particular attention, as production processes typically require 40-60% less water than glass substrate manufacturing. This reduction represents a significant environmental advantage in regions facing water scarcity challenges. Additionally, the lighter weight of polymer substrates contributes to reduced transportation-related emissions throughout the supply chain.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of electronic components. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives have specific implications for display technologies. Manufacturers are responding by developing halogen-free polymer formulations and implementing take-back programs for end-of-life products, though comprehensive circular economy solutions remain in early development stages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!