Emerging Ethyl Acetate Alternatives: A Comparative Study

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EA Alternatives Background and Objectives

Ethyl acetate (EA) has long been a staple solvent in various industries, including coatings, adhesives, and pharmaceuticals. However, growing environmental concerns and regulatory pressures have sparked a search for more sustainable alternatives. This comparative study aims to explore emerging ethyl acetate alternatives, evaluating their potential to replace this widely used solvent while maintaining or improving performance characteristics.

The evolution of solvent technology has been driven by the need for safer, more environmentally friendly options. Ethyl acetate, despite its widespread use, has drawbacks such as high volatility and flammability. These factors, coupled with increasing awareness of VOC emissions and their impact on air quality, have accelerated the development of alternative solvents. The industry is now at a critical juncture, seeking solutions that balance performance, cost-effectiveness, and environmental sustainability.

This study's primary objective is to comprehensively assess the current landscape of ethyl acetate alternatives. We aim to identify and evaluate emerging solvents that could potentially replace ethyl acetate in various applications. The focus will be on comparing these alternatives in terms of their chemical properties, performance characteristics, environmental impact, and economic viability.

Key areas of investigation include bio-based solvents derived from renewable resources, novel synthetic compounds with improved safety profiles, and water-based systems that minimize or eliminate the need for traditional organic solvents. The study will also explore hybrid solutions that combine different approaches to achieve optimal performance while addressing environmental concerns.

Another crucial aspect of this research is to analyze the technical challenges associated with transitioning from ethyl acetate to alternative solvents. This includes assessing compatibility with existing manufacturing processes, potential modifications required in formulations, and the impact on end-product quality and performance. By addressing these challenges, we aim to provide a roadmap for industries looking to adopt more sustainable solvent solutions.

Furthermore, this study will consider the regulatory landscape and market trends influencing the adoption of ethyl acetate alternatives. We will examine current and upcoming regulations affecting solvent use, as well as consumer preferences driving the demand for greener products. This analysis will help predict future market dynamics and guide strategic decision-making for businesses in the affected industries.

By conducting this comprehensive comparative study, we aim to contribute valuable insights to the ongoing efforts in developing sustainable solvent technologies. The findings will serve as a foundation for future research and development initiatives, potentially leading to innovative solutions that can revolutionize solvent use across multiple industries.

The evolution of solvent technology has been driven by the need for safer, more environmentally friendly options. Ethyl acetate, despite its widespread use, has drawbacks such as high volatility and flammability. These factors, coupled with increasing awareness of VOC emissions and their impact on air quality, have accelerated the development of alternative solvents. The industry is now at a critical juncture, seeking solutions that balance performance, cost-effectiveness, and environmental sustainability.

This study's primary objective is to comprehensively assess the current landscape of ethyl acetate alternatives. We aim to identify and evaluate emerging solvents that could potentially replace ethyl acetate in various applications. The focus will be on comparing these alternatives in terms of their chemical properties, performance characteristics, environmental impact, and economic viability.

Key areas of investigation include bio-based solvents derived from renewable resources, novel synthetic compounds with improved safety profiles, and water-based systems that minimize or eliminate the need for traditional organic solvents. The study will also explore hybrid solutions that combine different approaches to achieve optimal performance while addressing environmental concerns.

Another crucial aspect of this research is to analyze the technical challenges associated with transitioning from ethyl acetate to alternative solvents. This includes assessing compatibility with existing manufacturing processes, potential modifications required in formulations, and the impact on end-product quality and performance. By addressing these challenges, we aim to provide a roadmap for industries looking to adopt more sustainable solvent solutions.

Furthermore, this study will consider the regulatory landscape and market trends influencing the adoption of ethyl acetate alternatives. We will examine current and upcoming regulations affecting solvent use, as well as consumer preferences driving the demand for greener products. This analysis will help predict future market dynamics and guide strategic decision-making for businesses in the affected industries.

By conducting this comprehensive comparative study, we aim to contribute valuable insights to the ongoing efforts in developing sustainable solvent technologies. The findings will serve as a foundation for future research and development initiatives, potentially leading to innovative solutions that can revolutionize solvent use across multiple industries.

Market Demand Analysis for EA Substitutes

The global market for ethyl acetate (EA) substitutes is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures. As industries seek more sustainable and eco-friendly alternatives, the demand for EA substitutes has surged across various sectors, including coatings, adhesives, pharmaceuticals, and food packaging.

In the coatings industry, which accounts for a substantial portion of EA consumption, there is a growing shift towards water-based and high-solids formulations. This transition is fueled by stringent volatile organic compound (VOC) regulations and consumer preferences for environmentally friendly products. Consequently, the market for EA substitutes in this sector is projected to expand rapidly in the coming years.

The adhesives industry is another key driver of demand for EA alternatives. With the rise of green building practices and sustainable manufacturing, manufacturers are increasingly adopting bio-based and low-VOC adhesives. This trend is particularly pronounced in developed markets such as North America and Europe, where regulatory frameworks incentivize the use of environmentally friendly alternatives.

In the pharmaceutical sector, the demand for EA substitutes is primarily driven by the need for safer and more sustainable solvents in drug manufacturing processes. As pharmaceutical companies strive to reduce their environmental footprint and improve worker safety, the adoption of greener alternatives to EA is gaining momentum.

The food packaging industry is also contributing to the growing market for EA substitutes. With increasing consumer awareness about food safety and environmental issues, there is a rising demand for packaging materials that are free from harmful chemicals and easily recyclable. This has led to the development of new, bio-based alternatives that can replace EA in food packaging applications.

Geographically, the market for EA substitutes is showing strong growth in regions with stringent environmental regulations, such as Europe and North America. However, emerging economies in Asia-Pacific and Latin America are also witnessing increased demand, driven by rapid industrialization and growing environmental awareness.

The market potential for EA substitutes is further amplified by ongoing research and development efforts aimed at improving the performance and cost-effectiveness of alternative solvents. As new technologies emerge and production scales up, the competitiveness of EA substitutes is expected to improve, potentially accelerating market adoption across various industries.

In the coatings industry, which accounts for a substantial portion of EA consumption, there is a growing shift towards water-based and high-solids formulations. This transition is fueled by stringent volatile organic compound (VOC) regulations and consumer preferences for environmentally friendly products. Consequently, the market for EA substitutes in this sector is projected to expand rapidly in the coming years.

The adhesives industry is another key driver of demand for EA alternatives. With the rise of green building practices and sustainable manufacturing, manufacturers are increasingly adopting bio-based and low-VOC adhesives. This trend is particularly pronounced in developed markets such as North America and Europe, where regulatory frameworks incentivize the use of environmentally friendly alternatives.

In the pharmaceutical sector, the demand for EA substitutes is primarily driven by the need for safer and more sustainable solvents in drug manufacturing processes. As pharmaceutical companies strive to reduce their environmental footprint and improve worker safety, the adoption of greener alternatives to EA is gaining momentum.

The food packaging industry is also contributing to the growing market for EA substitutes. With increasing consumer awareness about food safety and environmental issues, there is a rising demand for packaging materials that are free from harmful chemicals and easily recyclable. This has led to the development of new, bio-based alternatives that can replace EA in food packaging applications.

Geographically, the market for EA substitutes is showing strong growth in regions with stringent environmental regulations, such as Europe and North America. However, emerging economies in Asia-Pacific and Latin America are also witnessing increased demand, driven by rapid industrialization and growing environmental awareness.

The market potential for EA substitutes is further amplified by ongoing research and development efforts aimed at improving the performance and cost-effectiveness of alternative solvents. As new technologies emerge and production scales up, the competitiveness of EA substitutes is expected to improve, potentially accelerating market adoption across various industries.

Current Status and Challenges of EA Alternatives

The current status of ethyl acetate (EA) alternatives is characterized by a growing interest in sustainable and environmentally friendly solvents. While EA remains widely used in various industries due to its versatility and effectiveness, concerns about its environmental impact and potential health risks have driven research into alternative solutions. Several promising alternatives have emerged, including bio-based solvents, water-based systems, and novel synthetic compounds.

Bio-based alternatives, such as methyl esters derived from vegetable oils and lactate esters, have gained significant attention. These solvents offer similar performance characteristics to EA while boasting improved biodegradability and reduced toxicity. However, their widespread adoption faces challenges related to production costs and scalability. The development of efficient and cost-effective production methods remains a key focus area for researchers and manufacturers.

Water-based alternatives have also shown promise in certain applications, particularly in coatings and adhesives. These systems offer excellent environmental profiles and reduced VOC emissions. However, they often struggle to match the performance of EA in terms of drying time and solvent power, limiting their applicability in some industrial processes.

Novel synthetic compounds, designed to mimic EA's properties while addressing its drawbacks, represent another avenue of research. These include modified esters and custom-designed molecules that aim to balance performance, safety, and environmental impact. While some of these alternatives show great potential, they often face regulatory hurdles and require extensive testing before widespread adoption.

A significant challenge in the development of EA alternatives is achieving a balance between performance, cost, and environmental impact. Many alternatives excel in one or two of these areas but struggle to match EA across all three. This has led to a fragmented market, with different industries adopting various solutions based on their specific needs and priorities.

Another major hurdle is the established infrastructure and processes built around EA usage. Transitioning to alternatives often requires significant investment in new equipment and process modifications, which can be a barrier for many companies, especially smaller ones. Additionally, the lack of standardization and long-term performance data for many alternatives creates uncertainty and hesitation among potential adopters.

Regulatory frameworks also play a crucial role in the adoption of EA alternatives. While there is a general trend towards stricter environmental regulations, the pace and specifics of these changes vary across regions. This creates a complex landscape for manufacturers and users of solvents, who must navigate different requirements in global markets.

Bio-based alternatives, such as methyl esters derived from vegetable oils and lactate esters, have gained significant attention. These solvents offer similar performance characteristics to EA while boasting improved biodegradability and reduced toxicity. However, their widespread adoption faces challenges related to production costs and scalability. The development of efficient and cost-effective production methods remains a key focus area for researchers and manufacturers.

Water-based alternatives have also shown promise in certain applications, particularly in coatings and adhesives. These systems offer excellent environmental profiles and reduced VOC emissions. However, they often struggle to match the performance of EA in terms of drying time and solvent power, limiting their applicability in some industrial processes.

Novel synthetic compounds, designed to mimic EA's properties while addressing its drawbacks, represent another avenue of research. These include modified esters and custom-designed molecules that aim to balance performance, safety, and environmental impact. While some of these alternatives show great potential, they often face regulatory hurdles and require extensive testing before widespread adoption.

A significant challenge in the development of EA alternatives is achieving a balance between performance, cost, and environmental impact. Many alternatives excel in one or two of these areas but struggle to match EA across all three. This has led to a fragmented market, with different industries adopting various solutions based on their specific needs and priorities.

Another major hurdle is the established infrastructure and processes built around EA usage. Transitioning to alternatives often requires significant investment in new equipment and process modifications, which can be a barrier for many companies, especially smaller ones. Additionally, the lack of standardization and long-term performance data for many alternatives creates uncertainty and hesitation among potential adopters.

Regulatory frameworks also play a crucial role in the adoption of EA alternatives. While there is a general trend towards stricter environmental regulations, the pace and specifics of these changes vary across regions. This creates a complex landscape for manufacturers and users of solvents, who must navigate different requirements in global markets.

Existing EA Replacement Solutions

01 Use of methyl acetate as an alternative

Methyl acetate can be used as an alternative to ethyl acetate in various applications. It has similar solvent properties and can be produced through esterification of methanol and acetic acid. This alternative is particularly useful in industries such as coatings, adhesives, and pharmaceutical manufacturing.- Use of methyl acetate as an alternative: Methyl acetate can be used as an alternative to ethyl acetate in various applications. It has similar solvent properties and can be produced through esterification of methanol and acetic acid. Methyl acetate is considered a more environmentally friendly option due to its lower toxicity and faster biodegradability.

- Utilization of propyl acetate as a substitute: Propyl acetate is another potential alternative to ethyl acetate. It has comparable solvent properties and can be used in similar applications. Propyl acetate is produced by the esterification of propanol and acetic acid. It offers advantages in terms of lower volatility and improved stability in certain formulations.

- Application of butyl acetate as an ethyl acetate replacement: Butyl acetate can serve as an effective substitute for ethyl acetate in various industrial processes. It has similar solvent properties and is produced by the esterification of butanol and acetic acid. Butyl acetate offers advantages such as lower volatility and improved film-forming properties in certain applications.

- Use of eco-friendly solvents derived from renewable resources: Environmentally friendly solvents derived from renewable resources can be used as alternatives to ethyl acetate. These include bio-based esters, lactate esters, and other green solvents. These alternatives offer improved sustainability profiles and can be tailored to meet specific application requirements.

- Development of solvent-free or low-solvent processes: To reduce or eliminate the use of ethyl acetate, researchers are developing solvent-free or low-solvent processes. These approaches involve alternative technologies such as supercritical fluid extraction, ionic liquids, or mechanochemical processes. These methods aim to minimize environmental impact and improve process efficiency.

02 Propyl acetate and butyl acetate as substitutes

Propyl acetate and butyl acetate are potential alternatives to ethyl acetate. These compounds have similar chemical properties and can be used in various applications such as solvents, flavoring agents, and in the production of coatings and inks. They offer different volatility profiles, which can be advantageous in certain processes.Expand Specific Solutions03 Bio-based alternatives to ethyl acetate

Bio-based alternatives to ethyl acetate are being developed from renewable resources. These include esters derived from bio-alcohols and bio-acids, offering more environmentally friendly options. Such alternatives can be used in various industries, including cosmetics, pharmaceuticals, and food processing, while reducing dependence on petroleum-based solvents.Expand Specific Solutions04 Acetone and other ketones as replacements

Acetone and other ketones can serve as alternatives to ethyl acetate in certain applications. These compounds offer different solvent properties and can be suitable for various industrial processes, including cleaning, degreasing, and as reaction media in chemical synthesis. The choice depends on specific requirements of the application and environmental considerations.Expand Specific Solutions05 Water-based systems as ethyl acetate alternatives

Water-based systems are being developed as environmentally friendly alternatives to ethyl acetate and other organic solvents. These systems often involve the use of surfactants, emulsifiers, or other additives to achieve desired properties. They find applications in coatings, adhesives, and cleaning formulations, offering reduced VOC emissions and improved safety profiles.Expand Specific Solutions

Key Players in Alternative Solvents Industry

The emerging ethyl acetate alternatives market is in its early growth stage, characterized by increasing research and development efforts from major chemical and pharmaceutical companies. The market size is expanding as industries seek more sustainable and environmentally friendly solvents. While the technology is still evolving, companies like Eastman Chemical, Dow Global Technologies, and BASF are at the forefront of developing innovative alternatives. Pharmaceutical giants such as Pfizer, Gilead Sciences, and Janssen Pharmaceutica are also investing in this area, recognizing the potential for safer and more efficient solvents in drug manufacturing. The competitive landscape is dynamic, with both established players and newcomers vying for market share in this promising field.

Eastman Chemical Co.

Technical Solution: Eastman Chemical has introduced a family of non-phthalate plasticizers and coalescents as alternatives to ethyl acetate. Their Eastman Texanol™ ester alcohol is a low-VOC coalescent that has gained significant market share in water-based coatings [4]. The company has also developed Eastman Optifilm™ enhancer 400, a low-odor, low-VOC coalescent that improves film formation in architectural coatings [5]. Eastman's research focuses on creating solvents that maintain performance while reducing environmental impact. They have invested in green chemistry initiatives and circular economy solutions, aiming to recycle up to 500 million pounds of plastic waste annually by 2030 [6].

Strengths: Established market presence, diverse product portfolio, and commitment to sustainability. Weaknesses: Some alternatives may still have environmental concerns and potential regulatory challenges in certain regions.

Dow Global Technologies LLC

Technical Solution: Dow has developed ECOSURF™ EH surfactants as potential replacements for ethyl acetate in various applications. These biodegradable, low-foam surfactants are designed to be more environmentally friendly while maintaining high performance [7]. Dow's approach involves using ethylene oxide/propylene oxide technology to create surfactants with improved efficiency and reduced environmental impact. The company has also introduced DOWSIL™ OS fluids, which are volatile silicone alternatives to traditional solvents, offering low surface tension and fast evaporation rates [8]. Dow's research extends to bio-based materials, with ongoing projects to develop sustainable alternatives derived from renewable resources [9].

Strengths: Strong R&D capabilities, diverse product range, and global market presence. Weaknesses: Some alternatives may have higher costs and potential limitations in certain applications compared to ethyl acetate.

Core Innovations in Green Solvents

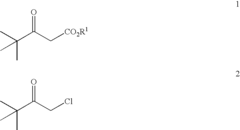

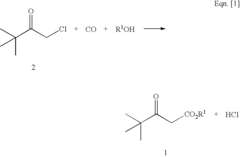

Process for generating pivaloylacetate esters via carbonylation of chloropinacolone

PatentInactiveUS20060149094A1

Innovation

- A process involving the carbonylation of chloropinacolone with carbon monoxide and an alcohol in the presence of a palladium catalyst and a trisubstituted phosphine, such as tricyclohexylphosphine, to produce pivaloylacetate esters, optimizing catalyst and base ratios for improved economics and selectivity.

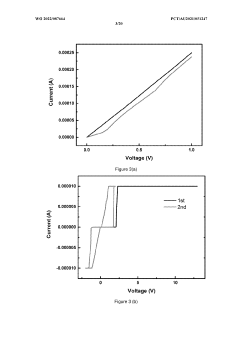

Threshold switching materials and devices

PatentWO2022087664A1

Innovation

- A threshold switching material comprising a composite of silver nanowires embedded in a low dielectric constant organic polymer matrix, allowing for flexible and transparent devices with reduced sneak path currents, and a new architecture for RRAM devices that prevents sneak path currents by using a composite of particulate metal oxide and low dielectric constant material as selectors.

Environmental Impact Assessment

The environmental impact assessment of emerging ethyl acetate alternatives is a critical aspect of their comparative study. These alternatives are being developed to address the environmental concerns associated with traditional ethyl acetate production and usage. The assessment focuses on several key areas to determine the overall ecological footprint of these new alternatives.

One primary consideration is the raw materials used in the production of these alternatives. Many emerging options utilize renewable resources or bio-based feedstocks, which can significantly reduce the reliance on fossil fuels and decrease the carbon footprint of the production process. The sourcing and cultivation of these raw materials are evaluated for their land use impact, water consumption, and potential effects on biodiversity.

The manufacturing processes for these alternatives are also scrutinized for their energy efficiency and emissions. Advanced production techniques, such as green chemistry principles and catalytic processes, are often employed to minimize waste generation and reduce the overall environmental impact. The assessment includes an analysis of air and water emissions, as well as the potential for accidental releases during production and transportation.

The end-use phase of these alternatives is another crucial aspect of the environmental impact assessment. Factors such as volatility, toxicity, and biodegradability are compared to those of traditional ethyl acetate. Many alternatives aim to offer improved safety profiles and reduced environmental persistence, which can lead to less harmful effects on ecosystems and human health.

Lifecycle analysis is a key tool used in this assessment, tracking the environmental impacts from raw material extraction through production, use, and disposal or recycling. This comprehensive approach helps identify potential environmental hotspots and areas for improvement in the overall lifecycle of these alternatives.

The potential for these alternatives to contribute to circular economy principles is also evaluated. This includes assessing their recyclability, the feasibility of closed-loop systems, and the potential for upcycling or repurposing waste streams generated during their production or use.

Regulatory compliance and future environmental legislation are considered in the assessment. As environmental regulations become more stringent, the ability of these alternatives to meet or exceed current and anticipated standards is crucial for their long-term viability and market acceptance.

Lastly, the assessment examines the broader environmental benefits that could result from the widespread adoption of these alternatives. This includes potential reductions in greenhouse gas emissions, improvements in air and water quality, and the conservation of non-renewable resources. The cumulative effect of replacing traditional ethyl acetate with these alternatives on a global scale is projected to provide significant environmental advantages.

One primary consideration is the raw materials used in the production of these alternatives. Many emerging options utilize renewable resources or bio-based feedstocks, which can significantly reduce the reliance on fossil fuels and decrease the carbon footprint of the production process. The sourcing and cultivation of these raw materials are evaluated for their land use impact, water consumption, and potential effects on biodiversity.

The manufacturing processes for these alternatives are also scrutinized for their energy efficiency and emissions. Advanced production techniques, such as green chemistry principles and catalytic processes, are often employed to minimize waste generation and reduce the overall environmental impact. The assessment includes an analysis of air and water emissions, as well as the potential for accidental releases during production and transportation.

The end-use phase of these alternatives is another crucial aspect of the environmental impact assessment. Factors such as volatility, toxicity, and biodegradability are compared to those of traditional ethyl acetate. Many alternatives aim to offer improved safety profiles and reduced environmental persistence, which can lead to less harmful effects on ecosystems and human health.

Lifecycle analysis is a key tool used in this assessment, tracking the environmental impacts from raw material extraction through production, use, and disposal or recycling. This comprehensive approach helps identify potential environmental hotspots and areas for improvement in the overall lifecycle of these alternatives.

The potential for these alternatives to contribute to circular economy principles is also evaluated. This includes assessing their recyclability, the feasibility of closed-loop systems, and the potential for upcycling or repurposing waste streams generated during their production or use.

Regulatory compliance and future environmental legislation are considered in the assessment. As environmental regulations become more stringent, the ability of these alternatives to meet or exceed current and anticipated standards is crucial for their long-term viability and market acceptance.

Lastly, the assessment examines the broader environmental benefits that could result from the widespread adoption of these alternatives. This includes potential reductions in greenhouse gas emissions, improvements in air and water quality, and the conservation of non-renewable resources. The cumulative effect of replacing traditional ethyl acetate with these alternatives on a global scale is projected to provide significant environmental advantages.

Regulatory Framework for New Solvents

The regulatory framework for new solvents is a critical aspect of the emerging ethyl acetate alternatives landscape. As the industry seeks more sustainable and environmentally friendly options, regulatory bodies worldwide are adapting their policies to ensure the safe and responsible use of these novel solvents.

At the forefront of this regulatory evolution is the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. REACH requires manufacturers and importers to register new chemical substances, including alternative solvents, before they can be placed on the market. This process involves comprehensive safety assessments and risk evaluations, ensuring that potential health and environmental impacts are thoroughly understood and mitigated.

In the United States, the Environmental Protection Agency (EPA) plays a pivotal role in regulating new solvents through the Toxic Substances Control Act (TSCA). The TSCA mandates that manufacturers submit premanufacture notices (PMNs) for new chemical substances, allowing the EPA to review and assess potential risks before commercialization. Additionally, the EPA's Significant New Use Rules (SNURs) may be implemented to restrict or control the use of certain solvents if deemed necessary.

Global harmonization efforts, such as the Globally Harmonized System of Classification and Labeling of Chemicals (GHS), are crucial in standardizing the communication of hazards associated with new solvents. This system ensures consistent labeling and safety data sheets across different countries, facilitating international trade and improving workplace safety.

Many countries are also implementing or updating their own chemical management regulations. For instance, China's Order No. 7, also known as "China REACH," establishes a framework for new chemical substance notification and registration similar to the EU's REACH regulation. Japan's Chemical Substances Control Law (CSCL) likewise requires manufacturers to submit safety data for new chemical substances.

As environmental concerns gain prominence, regulations are increasingly focusing on the lifecycle impact of solvents. This includes considerations for biodegradability, bioaccumulation potential, and overall environmental persistence. The EU's Biocidal Products Regulation (BPR) and the US EPA's Safer Choice program are examples of initiatives that promote the use of safer alternatives in various applications.

Regulatory bodies are also placing greater emphasis on occupational health and safety aspects of new solvents. This includes setting occupational exposure limits (OELs) and requiring comprehensive workplace risk assessments. The International Labor Organization (ILO) provides guidelines for the safe use of chemicals at work, which many countries incorporate into their national regulations.

As the field of ethyl acetate alternatives continues to evolve, it is crucial for manufacturers, researchers, and end-users to stay abreast of these regulatory developments. Compliance with these frameworks not only ensures legal operation but also promotes innovation in safer and more sustainable solvent technologies.

At the forefront of this regulatory evolution is the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. REACH requires manufacturers and importers to register new chemical substances, including alternative solvents, before they can be placed on the market. This process involves comprehensive safety assessments and risk evaluations, ensuring that potential health and environmental impacts are thoroughly understood and mitigated.

In the United States, the Environmental Protection Agency (EPA) plays a pivotal role in regulating new solvents through the Toxic Substances Control Act (TSCA). The TSCA mandates that manufacturers submit premanufacture notices (PMNs) for new chemical substances, allowing the EPA to review and assess potential risks before commercialization. Additionally, the EPA's Significant New Use Rules (SNURs) may be implemented to restrict or control the use of certain solvents if deemed necessary.

Global harmonization efforts, such as the Globally Harmonized System of Classification and Labeling of Chemicals (GHS), are crucial in standardizing the communication of hazards associated with new solvents. This system ensures consistent labeling and safety data sheets across different countries, facilitating international trade and improving workplace safety.

Many countries are also implementing or updating their own chemical management regulations. For instance, China's Order No. 7, also known as "China REACH," establishes a framework for new chemical substance notification and registration similar to the EU's REACH regulation. Japan's Chemical Substances Control Law (CSCL) likewise requires manufacturers to submit safety data for new chemical substances.

As environmental concerns gain prominence, regulations are increasingly focusing on the lifecycle impact of solvents. This includes considerations for biodegradability, bioaccumulation potential, and overall environmental persistence. The EU's Biocidal Products Regulation (BPR) and the US EPA's Safer Choice program are examples of initiatives that promote the use of safer alternatives in various applications.

Regulatory bodies are also placing greater emphasis on occupational health and safety aspects of new solvents. This includes setting occupational exposure limits (OELs) and requiring comprehensive workplace risk assessments. The International Labor Organization (ILO) provides guidelines for the safe use of chemicals at work, which many countries incorporate into their national regulations.

As the field of ethyl acetate alternatives continues to evolve, it is crucial for manufacturers, researchers, and end-users to stay abreast of these regulatory developments. Compliance with these frameworks not only ensures legal operation but also promotes innovation in safer and more sustainable solvent technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!