Reshaping Market Dynamics with Ethyl Acetate Innovation

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Evolution

Ethyl acetate, a versatile organic compound, has undergone significant evolution since its discovery in the early 19th century. Initially synthesized through the esterification of ethanol and acetic acid, this colorless liquid with a characteristic sweet odor has become a cornerstone in various industries. The journey of ethyl acetate's development can be traced through several key milestones that have shaped its production methods and applications.

In the early stages, ethyl acetate was primarily produced on a small scale for laboratory use and limited industrial applications. The traditional Fischer esterification method, while effective, was not suitable for large-scale production due to its slow reaction rate and the need for continuous removal of water to drive the equilibrium towards the product. This limitation prompted researchers to explore more efficient synthesis routes.

The mid-20th century saw a significant breakthrough with the introduction of the Tishchenko reaction for ethyl acetate production. This process, which involves the dimerization of acetaldehyde in the presence of an aluminum alkoxide catalyst, offered a more economical and scalable approach. The Tishchenko method marked a turning point in ethyl acetate manufacturing, enabling increased production volumes to meet growing industrial demands.

As environmental concerns gained prominence in the latter part of the 20th century, the focus shifted towards developing greener and more sustainable production methods. This led to the exploration of bio-based routes for ethyl acetate synthesis, utilizing renewable feedstocks such as bioethanol and bio-acetic acid. These bio-derived processes not only reduced reliance on petrochemical sources but also aligned with the growing trend of eco-friendly chemical production.

The dawn of the 21st century brought about further innovations in ethyl acetate production. Advanced catalytic systems and process intensification techniques have been developed to enhance reaction efficiency and reduce energy consumption. Continuous flow reactors and reactive distillation technologies have emerged as promising approaches to overcome equilibrium limitations and improve product yield.

Recent years have witnessed a surge in research focused on novel applications of ethyl acetate, particularly in the fields of nanotechnology and advanced materials. Its role as a green solvent in the synthesis of nanoparticles and its potential in drug delivery systems have opened up new avenues for exploration. Additionally, the development of ethyl acetate-based composite materials with enhanced properties has garnered significant attention in the materials science community.

The evolution of ethyl acetate continues to be driven by the dual forces of technological advancement and sustainability. Ongoing research aims to further optimize production processes, explore new catalytic systems, and expand its application spectrum. As industries increasingly prioritize eco-friendly solutions, the future of ethyl acetate lies in balancing economic viability with environmental stewardship, paving the way for innovative and sustainable chemical processes.

In the early stages, ethyl acetate was primarily produced on a small scale for laboratory use and limited industrial applications. The traditional Fischer esterification method, while effective, was not suitable for large-scale production due to its slow reaction rate and the need for continuous removal of water to drive the equilibrium towards the product. This limitation prompted researchers to explore more efficient synthesis routes.

The mid-20th century saw a significant breakthrough with the introduction of the Tishchenko reaction for ethyl acetate production. This process, which involves the dimerization of acetaldehyde in the presence of an aluminum alkoxide catalyst, offered a more economical and scalable approach. The Tishchenko method marked a turning point in ethyl acetate manufacturing, enabling increased production volumes to meet growing industrial demands.

As environmental concerns gained prominence in the latter part of the 20th century, the focus shifted towards developing greener and more sustainable production methods. This led to the exploration of bio-based routes for ethyl acetate synthesis, utilizing renewable feedstocks such as bioethanol and bio-acetic acid. These bio-derived processes not only reduced reliance on petrochemical sources but also aligned with the growing trend of eco-friendly chemical production.

The dawn of the 21st century brought about further innovations in ethyl acetate production. Advanced catalytic systems and process intensification techniques have been developed to enhance reaction efficiency and reduce energy consumption. Continuous flow reactors and reactive distillation technologies have emerged as promising approaches to overcome equilibrium limitations and improve product yield.

Recent years have witnessed a surge in research focused on novel applications of ethyl acetate, particularly in the fields of nanotechnology and advanced materials. Its role as a green solvent in the synthesis of nanoparticles and its potential in drug delivery systems have opened up new avenues for exploration. Additionally, the development of ethyl acetate-based composite materials with enhanced properties has garnered significant attention in the materials science community.

The evolution of ethyl acetate continues to be driven by the dual forces of technological advancement and sustainability. Ongoing research aims to further optimize production processes, explore new catalytic systems, and expand its application spectrum. As industries increasingly prioritize eco-friendly solutions, the future of ethyl acetate lies in balancing economic viability with environmental stewardship, paving the way for innovative and sustainable chemical processes.

Market Demand Analysis

The global ethyl acetate market has been experiencing steady growth, driven by increasing demand across various industries. The versatility of ethyl acetate as a solvent and its eco-friendly properties have positioned it as a key component in numerous applications, including paints and coatings, adhesives, pharmaceuticals, and food packaging.

In the paints and coatings industry, ethyl acetate has gained significant traction due to its excellent solvency and fast evaporation rate. The growing construction sector, particularly in emerging economies, has fueled the demand for paints and coatings, consequently boosting the ethyl acetate market. Additionally, the automotive industry's recovery post-pandemic has further contributed to the increased consumption of ethyl acetate in automotive coatings.

The adhesives sector has also emerged as a major consumer of ethyl acetate. The packaging industry's expansion, driven by e-commerce growth and changing consumer preferences, has led to a surge in demand for adhesives. Ethyl acetate's role in producing high-performance adhesives has made it indispensable in this sector.

In the pharmaceutical industry, ethyl acetate is widely used as a solvent in the production of various drugs and active pharmaceutical ingredients (APIs). The global focus on healthcare and the continuous development of new drugs have sustained the demand for ethyl acetate in this sector.

The food and beverage industry represents another significant market for ethyl acetate. Its application in food packaging, particularly in flexible packaging films, has seen substantial growth. The increasing consumer preference for packaged and convenience foods has been a key driver in this segment.

Market analysts project the global ethyl acetate market to continue its growth trajectory in the coming years. The Asia-Pacific region, led by China and India, is expected to dominate the market due to rapid industrialization and urbanization. North America and Europe are also anticipated to maintain steady growth, primarily driven by technological advancements and stringent environmental regulations favoring eco-friendly solvents.

However, the market faces challenges such as volatile raw material prices and the availability of substitutes. Innovations in bio-based ethyl acetate production are emerging as a potential solution to address these challenges and meet the growing demand for sustainable products. This shift towards bio-based alternatives is likely to reshape the market dynamics, offering new opportunities for growth and differentiation.

In the paints and coatings industry, ethyl acetate has gained significant traction due to its excellent solvency and fast evaporation rate. The growing construction sector, particularly in emerging economies, has fueled the demand for paints and coatings, consequently boosting the ethyl acetate market. Additionally, the automotive industry's recovery post-pandemic has further contributed to the increased consumption of ethyl acetate in automotive coatings.

The adhesives sector has also emerged as a major consumer of ethyl acetate. The packaging industry's expansion, driven by e-commerce growth and changing consumer preferences, has led to a surge in demand for adhesives. Ethyl acetate's role in producing high-performance adhesives has made it indispensable in this sector.

In the pharmaceutical industry, ethyl acetate is widely used as a solvent in the production of various drugs and active pharmaceutical ingredients (APIs). The global focus on healthcare and the continuous development of new drugs have sustained the demand for ethyl acetate in this sector.

The food and beverage industry represents another significant market for ethyl acetate. Its application in food packaging, particularly in flexible packaging films, has seen substantial growth. The increasing consumer preference for packaged and convenience foods has been a key driver in this segment.

Market analysts project the global ethyl acetate market to continue its growth trajectory in the coming years. The Asia-Pacific region, led by China and India, is expected to dominate the market due to rapid industrialization and urbanization. North America and Europe are also anticipated to maintain steady growth, primarily driven by technological advancements and stringent environmental regulations favoring eco-friendly solvents.

However, the market faces challenges such as volatile raw material prices and the availability of substitutes. Innovations in bio-based ethyl acetate production are emerging as a potential solution to address these challenges and meet the growing demand for sustainable products. This shift towards bio-based alternatives is likely to reshape the market dynamics, offering new opportunities for growth and differentiation.

Technical Challenges

The ethyl acetate industry faces several significant technical challenges that are shaping its current landscape and future development. One of the primary hurdles is the optimization of production processes to enhance efficiency and reduce costs. Traditional methods of ethyl acetate synthesis often involve energy-intensive steps and generate substantial waste, leading to environmental concerns and increased production expenses.

Improving catalyst performance remains a critical challenge in ethyl acetate production. Researchers are striving to develop more selective and stable catalysts that can operate under milder conditions, thereby reducing energy consumption and improving product yield. The search for novel catalytic materials that can withstand the harsh reaction environments while maintaining high activity is ongoing.

Another technical obstacle is the purification of ethyl acetate to meet stringent quality standards required by various industries. The presence of impurities, such as water and acetic acid, can significantly affect the product's performance in end-use applications. Developing more efficient separation and purification techniques is crucial to produce high-purity ethyl acetate cost-effectively.

The industry is also grappling with the challenge of feedstock diversification. Traditional ethyl acetate production relies heavily on petrochemical-based raw materials, which are subject to price volatility and sustainability concerns. There is a growing need to explore alternative feedstocks, including bio-based sources, to create a more sustainable and economically viable production process.

Process intensification presents both an opportunity and a challenge for ethyl acetate manufacturers. Integrating multiple unit operations into more compact and efficient systems could lead to significant improvements in productivity and resource utilization. However, designing and implementing such advanced processes requires overcoming complex engineering and control challenges.

Addressing the environmental impact of ethyl acetate production is becoming increasingly important. Reducing greenhouse gas emissions, minimizing waste generation, and improving overall energy efficiency are key areas of focus. Developing cleaner production technologies and implementing effective waste management strategies are essential for the industry's long-term sustainability.

The digitalization of ethyl acetate production processes poses another technical challenge. Implementing advanced process control systems, leveraging big data analytics, and adopting Industry 4.0 technologies require significant investments in infrastructure and expertise. However, these digital transformations are crucial for optimizing production, predicting maintenance needs, and ensuring consistent product quality.

As the demand for ethyl acetate in various applications continues to grow, scaling up production capacities while maintaining product quality and process efficiency remains a persistent challenge. Manufacturers must innovate in reactor design and process engineering to meet the increasing market demands without compromising on performance or environmental standards.

Improving catalyst performance remains a critical challenge in ethyl acetate production. Researchers are striving to develop more selective and stable catalysts that can operate under milder conditions, thereby reducing energy consumption and improving product yield. The search for novel catalytic materials that can withstand the harsh reaction environments while maintaining high activity is ongoing.

Another technical obstacle is the purification of ethyl acetate to meet stringent quality standards required by various industries. The presence of impurities, such as water and acetic acid, can significantly affect the product's performance in end-use applications. Developing more efficient separation and purification techniques is crucial to produce high-purity ethyl acetate cost-effectively.

The industry is also grappling with the challenge of feedstock diversification. Traditional ethyl acetate production relies heavily on petrochemical-based raw materials, which are subject to price volatility and sustainability concerns. There is a growing need to explore alternative feedstocks, including bio-based sources, to create a more sustainable and economically viable production process.

Process intensification presents both an opportunity and a challenge for ethyl acetate manufacturers. Integrating multiple unit operations into more compact and efficient systems could lead to significant improvements in productivity and resource utilization. However, designing and implementing such advanced processes requires overcoming complex engineering and control challenges.

Addressing the environmental impact of ethyl acetate production is becoming increasingly important. Reducing greenhouse gas emissions, minimizing waste generation, and improving overall energy efficiency are key areas of focus. Developing cleaner production technologies and implementing effective waste management strategies are essential for the industry's long-term sustainability.

The digitalization of ethyl acetate production processes poses another technical challenge. Implementing advanced process control systems, leveraging big data analytics, and adopting Industry 4.0 technologies require significant investments in infrastructure and expertise. However, these digital transformations are crucial for optimizing production, predicting maintenance needs, and ensuring consistent product quality.

As the demand for ethyl acetate in various applications continues to grow, scaling up production capacities while maintaining product quality and process efficiency remains a persistent challenge. Manufacturers must innovate in reactor design and process engineering to meet the increasing market demands without compromising on performance or environmental standards.

Current Solutions

01 Market analysis and forecasting

Advanced analytics and forecasting techniques are used to analyze the Ethyl Acetate market dynamics. These methods involve data collection, trend analysis, and predictive modeling to understand market behavior, demand patterns, and future growth prospects. Such analysis helps stakeholders make informed decisions and develop effective strategies.- Market analysis and forecasting: Advanced techniques for analyzing and forecasting the Ethyl Acetate market dynamics, including demand prediction, price trends, and supply chain optimization. These methods utilize data analytics, machine learning, and economic models to provide accurate market insights and projections.

- Supply chain management: Innovative approaches to managing the Ethyl Acetate supply chain, focusing on inventory optimization, logistics efficiency, and risk mitigation. These strategies aim to improve overall market stability and responsiveness to fluctuations in demand and supply.

- Pricing strategies and market positioning: Development of dynamic pricing models and market positioning strategies for Ethyl Acetate products. These approaches consider factors such as competition, production costs, and market segmentation to optimize pricing and maintain competitive advantage.

- Regulatory compliance and environmental considerations: Methods for ensuring regulatory compliance and addressing environmental concerns in the Ethyl Acetate market. This includes strategies for sustainable production, waste management, and adherence to evolving environmental regulations affecting market dynamics.

- Market entry and expansion strategies: Innovative approaches for entering new markets and expanding existing market share in the Ethyl Acetate industry. These strategies encompass market research, competitive analysis, and tailored business models to capitalize on emerging opportunities and navigate market challenges.

02 Supply chain optimization

Efficient supply chain management is crucial in the Ethyl Acetate market. This involves optimizing production, distribution, and inventory management processes to meet market demand effectively. Advanced technologies and algorithms are employed to streamline operations, reduce costs, and improve overall supply chain performance.Expand Specific Solutions03 Pricing strategies and risk management

Developing effective pricing strategies and managing market risks are essential aspects of the Ethyl Acetate market dynamics. This includes analyzing market trends, competitor pricing, and implementing risk mitigation measures to ensure profitability and market competitiveness. Advanced financial models and risk assessment tools are utilized to support decision-making processes.Expand Specific Solutions04 Regulatory compliance and environmental considerations

The Ethyl Acetate market is subject to various regulations and environmental considerations. Market participants must navigate complex regulatory landscapes, ensure compliance with safety standards, and address environmental concerns. This involves implementing sustainable practices, monitoring regulatory changes, and adapting business strategies accordingly.Expand Specific Solutions05 Market segmentation and customer analysis

Understanding market segments and customer behavior is crucial for success in the Ethyl Acetate market. This involves analyzing customer preferences, identifying target markets, and developing tailored marketing strategies. Advanced data analytics and customer relationship management tools are employed to gain insights and improve market positioning.Expand Specific Solutions

Industry Leaders

The ethyl acetate market is experiencing significant innovation, reshaping industry dynamics. Currently in a growth phase, the market is expanding due to increasing demand across various sectors. The global ethyl acetate market size is projected to grow substantially, driven by applications in coatings, adhesives, and pharmaceuticals. Technological maturity varies among key players, with established companies like Celanese International Corp. and China Petroleum & Chemical Corp. leading in traditional production methods. Emerging players such as LanzaTech NZ, Inc. and Viridis Chemical LLC are introducing innovative bio-based production techniques, challenging the status quo. This technological diversification is creating a competitive landscape where both conventional and sustainable production methods coexist, driving further market evolution and sustainability efforts.

Celanese International Corp.

Technical Solution: Celanese has developed an innovative process for ethyl acetate production using advanced catalysts and reactive distillation technology. This method allows for the direct esterification of ethanol and acetic acid, achieving higher yields and improved energy efficiency compared to traditional processes[1]. The company has also implemented a bio-based feedstock approach, utilizing renewable ethanol sources to produce more sustainable ethyl acetate[2]. Additionally, Celanese has invested in process intensification techniques, such as membrane separation, to further optimize production and reduce environmental impact[3].

Strengths: High-efficiency production, sustainable feedstock options, and advanced process technologies. Weaknesses: Potential higher initial capital costs for implementing new technologies and dependence on ethanol market fluctuations.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a novel ethyl acetate production method using a heterogeneous catalyst system. This approach involves a one-step process that converts ethanol directly to ethyl acetate, bypassing the need for acetic acid as an intermediate[4]. The company has also implemented advanced process control systems and big data analytics to optimize production efficiency and product quality[5]. Furthermore, Sinopec has explored the integration of ethyl acetate production with existing refinery operations, creating synergies in energy utilization and raw material sourcing[6].

Strengths: Simplified production process, integration with existing infrastructure, and advanced process control. Weaknesses: Potential challenges in scaling up the new catalyst technology and reliance on petroleum-based feedstocks.

Key Patents Review

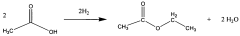

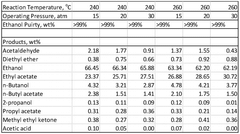

Direct and selective production of ethyl acetate from acetic acid utilizing a bimetal supported catalyst

PatentWO2010014145A2

Innovation

- A process utilizing a bimetallic catalyst supported on a suitable catalyst support, comprising metals like platinum, palladium, copper, and cobalt, which selectively hydrogenates acetic acid to ethyl acetate with high yield and selectivity, minimizing by-product formation.

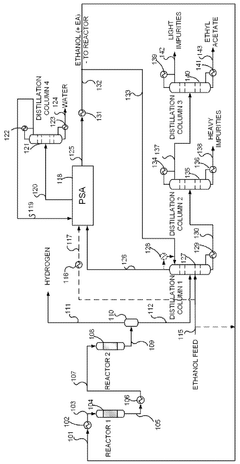

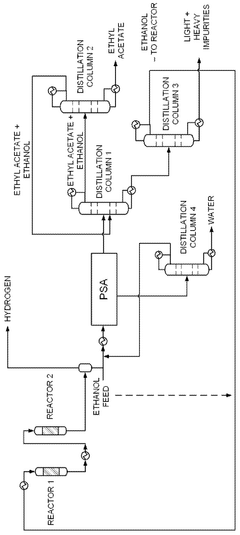

Process for production of ethyl acetate

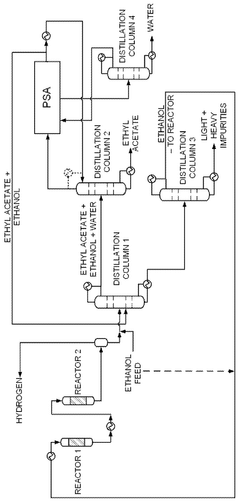

PatentWO2025072073A1

Innovation

- A novel process that converts ethanol to ethyl acetate through dehydrogenation, followed by selective hydrogenation of byproducts to facilitate easier separation, and utilizes pressure swing adsorption to minimize water content and protect the catalyst.

Regulatory Framework

The regulatory framework surrounding ethyl acetate production and usage plays a crucial role in shaping market dynamics and innovation in this sector. Governments and international bodies have established comprehensive guidelines to ensure the safe manufacture, handling, and application of ethyl acetate across various industries.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). The agency has set specific emission standards and reporting requirements for manufacturers and users of ethyl acetate. Additionally, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) to protect workers from potential health hazards associated with ethyl acetate exposure in the workplace.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers of ethyl acetate to register their substances and provide safety data. This regulation aims to ensure the protection of human health and the environment while promoting innovation and competitiveness in the chemical industry.

In Asia, countries like China and Japan have also developed their own regulatory frameworks for ethyl acetate. China's Ministry of Ecology and Environment has set national standards for ethyl acetate emissions and waste management, while Japan's Chemical Substances Control Law (CSCL) governs the manufacture and import of ethyl acetate and other chemical substances.

The global nature of the ethyl acetate market necessitates harmonization of regulations across different regions. The United Nations' Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to hazard communication, which many countries have adopted or are in the process of implementing.

Regulatory compliance presents both challenges and opportunities for ethyl acetate manufacturers and users. While stringent regulations may increase production costs and require significant investments in safety measures, they also drive innovation in cleaner production technologies and more sustainable applications of ethyl acetate.

As environmental concerns continue to grow, regulatory bodies are likely to focus on promoting the development of bio-based ethyl acetate and encouraging the adoption of circular economy principles in the ethyl acetate value chain. This shift in regulatory focus may reshape market dynamics by creating new opportunities for companies that invest in sustainable production methods and applications of ethyl acetate.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). The agency has set specific emission standards and reporting requirements for manufacturers and users of ethyl acetate. Additionally, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) to protect workers from potential health hazards associated with ethyl acetate exposure in the workplace.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers of ethyl acetate to register their substances and provide safety data. This regulation aims to ensure the protection of human health and the environment while promoting innovation and competitiveness in the chemical industry.

In Asia, countries like China and Japan have also developed their own regulatory frameworks for ethyl acetate. China's Ministry of Ecology and Environment has set national standards for ethyl acetate emissions and waste management, while Japan's Chemical Substances Control Law (CSCL) governs the manufacture and import of ethyl acetate and other chemical substances.

The global nature of the ethyl acetate market necessitates harmonization of regulations across different regions. The United Nations' Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to hazard communication, which many countries have adopted or are in the process of implementing.

Regulatory compliance presents both challenges and opportunities for ethyl acetate manufacturers and users. While stringent regulations may increase production costs and require significant investments in safety measures, they also drive innovation in cleaner production technologies and more sustainable applications of ethyl acetate.

As environmental concerns continue to grow, regulatory bodies are likely to focus on promoting the development of bio-based ethyl acetate and encouraging the adoption of circular economy principles in the ethyl acetate value chain. This shift in regulatory focus may reshape market dynamics by creating new opportunities for companies that invest in sustainable production methods and applications of ethyl acetate.

Sustainability Impact

The sustainability impact of ethyl acetate innovation is profound and far-reaching, reshaping market dynamics across multiple industries. As a renewable and biodegradable solvent, ethyl acetate derived from sustainable sources is poised to revolutionize production processes and end-user applications. This shift towards eco-friendly alternatives aligns with global sustainability goals and consumer preferences for environmentally responsible products.

In the coatings and adhesives sector, the adoption of bio-based ethyl acetate significantly reduces the carbon footprint of manufacturing processes. Traditional petroleum-derived solvents are being phased out in favor of this greener alternative, leading to decreased greenhouse gas emissions and minimized environmental impact. The transition not only improves the sustainability profile of end products but also enhances brand reputation for companies embracing this change.

The pharmaceutical industry stands to benefit greatly from the sustainability advantages of ethyl acetate innovation. As a key solvent in drug synthesis and formulation, the use of bio-based ethyl acetate contributes to the development of greener pharmaceuticals. This aligns with the industry's growing focus on sustainable practices and supports efforts to reduce the environmental impact of drug manufacturing and disposal.

In the food and beverage sector, the application of ethyl acetate derived from renewable sources is transforming flavor and fragrance production. This shift not only ensures compliance with stringent food safety regulations but also caters to the increasing consumer demand for natural and sustainable food additives. The ability to label products as containing naturally-derived ingredients provides a competitive edge in the market.

The electronics industry is another beneficiary of ethyl acetate's sustainability impact. As a cleaning agent in the production of electronic components, the use of bio-based ethyl acetate helps reduce the industry's reliance on harmful chemicals. This transition supports the development of more environmentally friendly electronic devices, aligning with global initiatives to minimize e-waste and promote circular economy principles.

Furthermore, the agricultural sector is experiencing positive changes due to ethyl acetate innovation. As a component in eco-friendly pesticides and herbicides, it offers a more sustainable approach to crop protection. This shift not only reduces the environmental impact of agricultural practices but also addresses growing concerns about chemical residues in food products.

The sustainability impact of ethyl acetate innovation extends beyond individual industries, influencing supply chains and fostering collaborations between sectors. It encourages the development of bio-refineries and promotes the use of agricultural waste as feedstock, creating new value streams in the circular economy. This interconnected approach to sustainability drives innovation across the entire value chain, from raw material sourcing to end-of-life product management.

In the coatings and adhesives sector, the adoption of bio-based ethyl acetate significantly reduces the carbon footprint of manufacturing processes. Traditional petroleum-derived solvents are being phased out in favor of this greener alternative, leading to decreased greenhouse gas emissions and minimized environmental impact. The transition not only improves the sustainability profile of end products but also enhances brand reputation for companies embracing this change.

The pharmaceutical industry stands to benefit greatly from the sustainability advantages of ethyl acetate innovation. As a key solvent in drug synthesis and formulation, the use of bio-based ethyl acetate contributes to the development of greener pharmaceuticals. This aligns with the industry's growing focus on sustainable practices and supports efforts to reduce the environmental impact of drug manufacturing and disposal.

In the food and beverage sector, the application of ethyl acetate derived from renewable sources is transforming flavor and fragrance production. This shift not only ensures compliance with stringent food safety regulations but also caters to the increasing consumer demand for natural and sustainable food additives. The ability to label products as containing naturally-derived ingredients provides a competitive edge in the market.

The electronics industry is another beneficiary of ethyl acetate's sustainability impact. As a cleaning agent in the production of electronic components, the use of bio-based ethyl acetate helps reduce the industry's reliance on harmful chemicals. This transition supports the development of more environmentally friendly electronic devices, aligning with global initiatives to minimize e-waste and promote circular economy principles.

Furthermore, the agricultural sector is experiencing positive changes due to ethyl acetate innovation. As a component in eco-friendly pesticides and herbicides, it offers a more sustainable approach to crop protection. This shift not only reduces the environmental impact of agricultural practices but also addresses growing concerns about chemical residues in food products.

The sustainability impact of ethyl acetate innovation extends beyond individual industries, influencing supply chains and fostering collaborations between sectors. It encourages the development of bio-refineries and promotes the use of agricultural waste as feedstock, creating new value streams in the circular economy. This interconnected approach to sustainability drives innovation across the entire value chain, from raw material sourcing to end-of-life product management.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!