Future Directions for Ethyl Acetate in Global Markets

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Evolution

Ethyl acetate has undergone significant evolution since its discovery in the early 19th century. Initially used primarily as a solvent in laboratory settings, its applications have expanded dramatically over time. The evolution of ethyl acetate can be traced through several key phases, each marked by technological advancements and shifting market demands.

In the early 20th century, ethyl acetate found its first major industrial application in the production of artificial silk and celluloid films. This period marked the beginning of its commercial significance. As the chemical industry developed, new synthesis methods were introduced, improving production efficiency and reducing costs.

The mid-20th century saw a surge in ethyl acetate's use as a solvent in various industries. Its low toxicity and pleasant fruity odor made it an attractive option for paints, coatings, and adhesives. This era also witnessed the development of continuous production processes, further enhancing its availability and economic viability.

The late 20th century brought about increased environmental awareness, leading to the development of more sustainable production methods for ethyl acetate. Bio-based production techniques emerged, utilizing renewable resources like sugarcane and corn. This shift aligned with growing consumer demand for eco-friendly products and stricter environmental regulations.

In recent years, the evolution of ethyl acetate has been characterized by its expanding role in emerging technologies. Its use in the electronics industry, particularly in the production of flexible displays and advanced semiconductors, has grown significantly. Additionally, its application in 3D printing as a solvent for certain filaments has opened new avenues in additive manufacturing.

The pharmaceutical industry has also driven innovation in ethyl acetate production and application. Its use as a reaction medium in drug synthesis and as an extraction solvent in natural product isolation has led to the development of high-purity grades and specialized formulations.

Looking ahead, the evolution of ethyl acetate is likely to continue along several trajectories. Advancements in green chemistry are expected to yield more sustainable production methods, potentially utilizing waste biomass or atmospheric carbon dioxide as feedstock. The development of novel catalysts and process intensification techniques may further improve production efficiency and reduce environmental impact.

As global markets increasingly prioritize sustainability, the future of ethyl acetate will likely see a greater emphasis on circular economy principles. This could involve the development of more efficient recycling technologies and the integration of ethyl acetate into closed-loop industrial processes.

In the early 20th century, ethyl acetate found its first major industrial application in the production of artificial silk and celluloid films. This period marked the beginning of its commercial significance. As the chemical industry developed, new synthesis methods were introduced, improving production efficiency and reducing costs.

The mid-20th century saw a surge in ethyl acetate's use as a solvent in various industries. Its low toxicity and pleasant fruity odor made it an attractive option for paints, coatings, and adhesives. This era also witnessed the development of continuous production processes, further enhancing its availability and economic viability.

The late 20th century brought about increased environmental awareness, leading to the development of more sustainable production methods for ethyl acetate. Bio-based production techniques emerged, utilizing renewable resources like sugarcane and corn. This shift aligned with growing consumer demand for eco-friendly products and stricter environmental regulations.

In recent years, the evolution of ethyl acetate has been characterized by its expanding role in emerging technologies. Its use in the electronics industry, particularly in the production of flexible displays and advanced semiconductors, has grown significantly. Additionally, its application in 3D printing as a solvent for certain filaments has opened new avenues in additive manufacturing.

The pharmaceutical industry has also driven innovation in ethyl acetate production and application. Its use as a reaction medium in drug synthesis and as an extraction solvent in natural product isolation has led to the development of high-purity grades and specialized formulations.

Looking ahead, the evolution of ethyl acetate is likely to continue along several trajectories. Advancements in green chemistry are expected to yield more sustainable production methods, potentially utilizing waste biomass or atmospheric carbon dioxide as feedstock. The development of novel catalysts and process intensification techniques may further improve production efficiency and reduce environmental impact.

As global markets increasingly prioritize sustainability, the future of ethyl acetate will likely see a greater emphasis on circular economy principles. This could involve the development of more efficient recycling technologies and the integration of ethyl acetate into closed-loop industrial processes.

Global Market Dynamics

The global ethyl acetate market is experiencing significant growth and transformation, driven by evolving industrial applications and changing consumer preferences. As a versatile solvent and chemical intermediate, ethyl acetate plays a crucial role in various industries, including paints and coatings, adhesives, pharmaceuticals, and food packaging. The market dynamics are shaped by several key factors that influence supply, demand, and pricing trends.

One of the primary drivers of market growth is the increasing demand for eco-friendly and low-VOC (volatile organic compound) solvents in the paints and coatings industry. Ethyl acetate, with its relatively low toxicity and quick evaporation rate, has become a preferred choice for manufacturers seeking to comply with stringent environmental regulations. This trend is particularly pronounced in developed regions such as North America and Europe, where sustainability initiatives are gaining momentum.

In the Asia-Pacific region, rapid industrialization and urbanization are fueling the demand for ethyl acetate across multiple sectors. Countries like China and India are witnessing substantial growth in construction activities, leading to increased consumption of paints, coatings, and adhesives. Additionally, the expanding packaging industry in these countries is driving the demand for flexible packaging materials, where ethyl acetate is used as a solvent in printing inks and lamination adhesives.

The pharmaceutical industry is another significant contributor to the global ethyl acetate market. As the healthcare sector continues to grow worldwide, the demand for ethyl acetate in drug formulations and as a reaction medium in the synthesis of various pharmaceutical compounds is expected to rise. This trend is particularly evident in emerging markets where healthcare infrastructure is rapidly developing.

However, the market is not without challenges. Fluctuations in raw material prices, particularly ethanol and acetic acid, can significantly impact the production costs and profit margins of ethyl acetate manufacturers. The volatility in crude oil prices, which affects the cost of petrochemical-derived raw materials, adds another layer of complexity to the market dynamics.

The competitive landscape of the global ethyl acetate market is characterized by the presence of both large multinational corporations and regional players. Key market participants are focusing on capacity expansions, technological advancements, and strategic partnerships to strengthen their market position. The increasing emphasis on bio-based ethyl acetate production, derived from renewable resources, is emerging as a notable trend that could reshape the market in the coming years.

One of the primary drivers of market growth is the increasing demand for eco-friendly and low-VOC (volatile organic compound) solvents in the paints and coatings industry. Ethyl acetate, with its relatively low toxicity and quick evaporation rate, has become a preferred choice for manufacturers seeking to comply with stringent environmental regulations. This trend is particularly pronounced in developed regions such as North America and Europe, where sustainability initiatives are gaining momentum.

In the Asia-Pacific region, rapid industrialization and urbanization are fueling the demand for ethyl acetate across multiple sectors. Countries like China and India are witnessing substantial growth in construction activities, leading to increased consumption of paints, coatings, and adhesives. Additionally, the expanding packaging industry in these countries is driving the demand for flexible packaging materials, where ethyl acetate is used as a solvent in printing inks and lamination adhesives.

The pharmaceutical industry is another significant contributor to the global ethyl acetate market. As the healthcare sector continues to grow worldwide, the demand for ethyl acetate in drug formulations and as a reaction medium in the synthesis of various pharmaceutical compounds is expected to rise. This trend is particularly evident in emerging markets where healthcare infrastructure is rapidly developing.

However, the market is not without challenges. Fluctuations in raw material prices, particularly ethanol and acetic acid, can significantly impact the production costs and profit margins of ethyl acetate manufacturers. The volatility in crude oil prices, which affects the cost of petrochemical-derived raw materials, adds another layer of complexity to the market dynamics.

The competitive landscape of the global ethyl acetate market is characterized by the presence of both large multinational corporations and regional players. Key market participants are focusing on capacity expansions, technological advancements, and strategic partnerships to strengthen their market position. The increasing emphasis on bio-based ethyl acetate production, derived from renewable resources, is emerging as a notable trend that could reshape the market in the coming years.

Technical Hurdles

Despite the widespread use and established production processes of ethyl acetate, several technical hurdles persist in its global market expansion. One of the primary challenges is the optimization of production efficiency while maintaining environmental sustainability. Current manufacturing methods, particularly those based on esterification of ethanol and acetic acid, often require high energy inputs and generate significant waste streams.

Improving catalytic systems remains a key focus area for overcoming these hurdles. While heterogeneous catalysts have shown promise in enhancing reaction rates and selectivity, their long-term stability and recyclability still need improvement. Researchers are exploring novel catalyst designs, including supported metal nanoparticles and engineered porous materials, to address these limitations.

Another significant technical challenge lies in the purification and separation processes. Traditional distillation methods used for ethyl acetate purification are energy-intensive and can lead to azeotrope formation, complicating the separation process. Developing more efficient separation technologies, such as advanced membrane systems or hybrid separation processes, is crucial for reducing energy consumption and improving product quality.

The sourcing of raw materials presents an additional hurdle. As the demand for bio-based ethyl acetate grows, finding sustainable and cost-effective sources of bio-ethanol and bio-acetic acid becomes increasingly important. This challenge is compounded by the variability in feedstock quality and the need for efficient pretreatment processes to ensure consistent product quality.

Addressing the volatility of ethyl acetate is another technical concern, particularly in applications requiring long-term stability or those exposed to varying environmental conditions. Developing formulations or encapsulation techniques to reduce volatility without compromising functionality is an ongoing area of research.

Lastly, the industry faces challenges in scaling up new production technologies from laboratory to industrial levels. This includes optimizing reactor designs, improving heat and mass transfer efficiencies, and developing robust process control systems capable of handling the complexities of large-scale ethyl acetate production.

Overcoming these technical hurdles will be crucial for the future growth and sustainability of the global ethyl acetate market. Collaborative efforts between academia and industry, coupled with investments in research and development, will be key drivers in addressing these challenges and unlocking new opportunities for ethyl acetate in diverse applications worldwide.

Improving catalytic systems remains a key focus area for overcoming these hurdles. While heterogeneous catalysts have shown promise in enhancing reaction rates and selectivity, their long-term stability and recyclability still need improvement. Researchers are exploring novel catalyst designs, including supported metal nanoparticles and engineered porous materials, to address these limitations.

Another significant technical challenge lies in the purification and separation processes. Traditional distillation methods used for ethyl acetate purification are energy-intensive and can lead to azeotrope formation, complicating the separation process. Developing more efficient separation technologies, such as advanced membrane systems or hybrid separation processes, is crucial for reducing energy consumption and improving product quality.

The sourcing of raw materials presents an additional hurdle. As the demand for bio-based ethyl acetate grows, finding sustainable and cost-effective sources of bio-ethanol and bio-acetic acid becomes increasingly important. This challenge is compounded by the variability in feedstock quality and the need for efficient pretreatment processes to ensure consistent product quality.

Addressing the volatility of ethyl acetate is another technical concern, particularly in applications requiring long-term stability or those exposed to varying environmental conditions. Developing formulations or encapsulation techniques to reduce volatility without compromising functionality is an ongoing area of research.

Lastly, the industry faces challenges in scaling up new production technologies from laboratory to industrial levels. This includes optimizing reactor designs, improving heat and mass transfer efficiencies, and developing robust process control systems capable of handling the complexities of large-scale ethyl acetate production.

Overcoming these technical hurdles will be crucial for the future growth and sustainability of the global ethyl acetate market. Collaborative efforts between academia and industry, coupled with investments in research and development, will be key drivers in addressing these challenges and unlocking new opportunities for ethyl acetate in diverse applications worldwide.

Current Applications

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described, including esterification processes, distillation techniques, and separation methods. These processes aim to improve the yield and purity of ethyl acetate for industrial applications.- Production and purification of ethyl acetate: Various methods for producing and purifying ethyl acetate are described. These include esterification processes, distillation techniques, and the use of specific catalysts to improve yield and purity. The processes aim to optimize the production of ethyl acetate for industrial applications.

- Applications of ethyl acetate in chemical processes: Ethyl acetate is utilized in various chemical processes and industries. It serves as a solvent, reactant, or intermediate in the production of other chemicals, pharmaceuticals, and materials. Its versatility makes it valuable in diverse manufacturing applications.

- Ethyl acetate in extraction and separation processes: Ethyl acetate is employed in extraction and separation processes for various compounds. Its properties make it suitable for liquid-liquid extraction, chromatography, and other separation techniques used in chemical and pharmaceutical industries.

- Environmental and safety considerations for ethyl acetate: Research and development efforts focus on improving the environmental impact and safety of ethyl acetate production and use. This includes developing greener production methods, reducing emissions, and enhancing handling and storage practices to minimize risks associated with its flammability and volatility.

- Novel applications and formulations of ethyl acetate: Innovative uses and formulations of ethyl acetate are being explored in various fields. These include its application in advanced materials, specialty coatings, and as a component in novel chemical compositions for specific industrial or consumer products.

02 Applications of ethyl acetate in chemical processes

Ethyl acetate is utilized in various chemical processes as a solvent, reactant, or intermediate. It finds applications in the production of other chemicals, pharmaceuticals, and materials, showcasing its versatility in industrial chemistry.Expand Specific Solutions03 Ethyl acetate in extraction and separation processes

The use of ethyl acetate as an extraction solvent or in separation processes is explored. Its properties make it suitable for extracting various compounds from mixtures or separating components in industrial applications.Expand Specific Solutions04 Ethyl acetate in formulations and compositions

Ethyl acetate is incorporated into various formulations and compositions for different purposes. These may include adhesives, coatings, inks, or other products where its solvent properties and volatility are beneficial.Expand Specific Solutions05 Environmental and safety considerations for ethyl acetate

Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, reducing emissions, and enhancing handling procedures.Expand Specific Solutions

Industry Leaders

The global ethyl acetate market is in a mature growth stage, with a steady increase in demand driven by various industrial applications. The market size is substantial, estimated to be in the billions of dollars annually. Technologically, ethyl acetate production is well-established, with major players like Celanese International Corp., China Petroleum & Chemical Corp., and Eastman Chemical Co. leading the way. However, there is ongoing research and development, particularly in sustainable production methods, as evidenced by the involvement of academic institutions such as Tianjin University and Nanjing Tech University. Companies like LanzaTech NZ, Inc. are exploring innovative bio-based production techniques, indicating potential future shifts in the industry towards more environmentally friendly processes.

Celanese International Corp.

Technical Solution: Celanese is pioneering advanced ethyl acetate production methods, focusing on sustainability and efficiency. They have developed a novel acetic acid esterification process using reactive distillation technology, which combines reaction and separation in a single unit operation [1]. This approach significantly reduces energy consumption and equipment costs. Additionally, Celanese is exploring bio-based feedstocks for ethyl acetate production, aiming to reduce carbon footprint. Their research includes utilizing lignocellulosic biomass as a renewable source for ethanol, a key component in ethyl acetate synthesis [3]. The company is also investigating catalytic membrane reactors to enhance conversion rates and product purity in ethyl acetate production [5].

Strengths: Advanced process integration, reduced energy consumption, exploration of bio-based feedstocks. Weaknesses: Potential higher initial investment costs, dependence on biomass availability for bio-based production.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) is advancing ethyl acetate production through innovative catalytic processes. They have developed a high-efficiency, low-energy consumption technology for ethyl acetate synthesis using a novel zeolite catalyst [2]. This process achieves over 99% selectivity and 95% conversion in a single pass, significantly improving production efficiency. Sinopec is also exploring the integration of ethyl acetate production with existing refinery operations, utilizing ethanol from bio-refineries and acetic acid from methanol carbonylation [4]. Furthermore, they are researching membrane separation techniques to enhance product purification, potentially reducing energy consumption in the distillation process by up to 30% [6].

Strengths: High-efficiency catalytic processes, integration with existing operations, advanced separation techniques. Weaknesses: Potential reliance on petroleum-based feedstocks, need for significant infrastructure investments.

Innovative Formulations

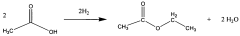

Direct and selective production of ethyl acetate from acetic acid utilizing a bimetal supported catalyst

PatentWO2010014145A2

Innovation

- A process utilizing a bimetallic catalyst supported on a suitable catalyst support, comprising metals like platinum, palladium, copper, and cobalt, which selectively hydrogenates acetic acid to ethyl acetate with high yield and selectivity, minimizing by-product formation.

Direct and selective production of ethyl acetate from acetic acid utilizing a bimetal supported catalyst

PatentInactiveEP2318353A2

Innovation

- A bimetallic catalyst system comprising metals like platinum, palladium, copper, and cobalt supported on catalysts such as silica or zeolites is used for the hydrogenation of acetic acid, optimizing the reaction conditions to achieve high selectivity and yield of ethyl acetate while minimizing by-product formation.

Sustainability Aspects

Sustainability has become a critical aspect of the global ethyl acetate market, driving innovation and shaping future directions. As environmental concerns gain prominence, the industry is increasingly focusing on developing sustainable production methods and applications for ethyl acetate.

One of the key sustainability trends in the ethyl acetate market is the shift towards bio-based production. Traditional ethyl acetate production relies heavily on petrochemical feedstocks, contributing to carbon emissions and resource depletion. However, emerging technologies are enabling the synthesis of ethyl acetate from renewable resources such as biomass and agricultural waste. This bio-based approach not only reduces the carbon footprint but also promotes circular economy principles by utilizing waste streams as valuable raw materials.

Water conservation is another crucial sustainability aspect gaining attention in ethyl acetate production. Conventional manufacturing processes often require significant water usage, leading to concerns about water scarcity and pollution. To address this, innovative water recycling and treatment technologies are being implemented to minimize water consumption and improve overall process efficiency.

Energy efficiency is also a major focus area for sustainable ethyl acetate production. Companies are investing in advanced process optimization techniques, such as heat integration and energy recovery systems, to reduce energy consumption and associated greenhouse gas emissions. Additionally, the adoption of renewable energy sources, like solar and wind power, in manufacturing facilities is becoming increasingly common.

The end-of-life management of ethyl acetate-based products is another important sustainability consideration. As regulations on waste management and circular economy practices become more stringent, there is a growing emphasis on developing recyclable and biodegradable formulations. This includes research into novel polymer blends and additives that can enhance the biodegradability of ethyl acetate-based coatings and adhesives without compromising performance.

Furthermore, the ethyl acetate industry is exploring opportunities for carbon capture and utilization. Some innovative approaches involve capturing CO2 emissions from production processes and converting them into valuable chemicals, including ethyl acetate itself. This not only reduces the carbon footprint but also creates a potential revenue stream from waste emissions.

As sustainability becomes increasingly important to consumers and regulators, ethyl acetate manufacturers are also focusing on transparent supply chain management and lifecycle assessments. This involves tracking and reporting the environmental impact of ethyl acetate production from raw material extraction to end-use and disposal. Such transparency is crucial for meeting evolving sustainability standards and maintaining competitiveness in global markets.

One of the key sustainability trends in the ethyl acetate market is the shift towards bio-based production. Traditional ethyl acetate production relies heavily on petrochemical feedstocks, contributing to carbon emissions and resource depletion. However, emerging technologies are enabling the synthesis of ethyl acetate from renewable resources such as biomass and agricultural waste. This bio-based approach not only reduces the carbon footprint but also promotes circular economy principles by utilizing waste streams as valuable raw materials.

Water conservation is another crucial sustainability aspect gaining attention in ethyl acetate production. Conventional manufacturing processes often require significant water usage, leading to concerns about water scarcity and pollution. To address this, innovative water recycling and treatment technologies are being implemented to minimize water consumption and improve overall process efficiency.

Energy efficiency is also a major focus area for sustainable ethyl acetate production. Companies are investing in advanced process optimization techniques, such as heat integration and energy recovery systems, to reduce energy consumption and associated greenhouse gas emissions. Additionally, the adoption of renewable energy sources, like solar and wind power, in manufacturing facilities is becoming increasingly common.

The end-of-life management of ethyl acetate-based products is another important sustainability consideration. As regulations on waste management and circular economy practices become more stringent, there is a growing emphasis on developing recyclable and biodegradable formulations. This includes research into novel polymer blends and additives that can enhance the biodegradability of ethyl acetate-based coatings and adhesives without compromising performance.

Furthermore, the ethyl acetate industry is exploring opportunities for carbon capture and utilization. Some innovative approaches involve capturing CO2 emissions from production processes and converting them into valuable chemicals, including ethyl acetate itself. This not only reduces the carbon footprint but also creates a potential revenue stream from waste emissions.

As sustainability becomes increasingly important to consumers and regulators, ethyl acetate manufacturers are also focusing on transparent supply chain management and lifecycle assessments. This involves tracking and reporting the environmental impact of ethyl acetate production from raw material extraction to end-use and disposal. Such transparency is crucial for meeting evolving sustainability standards and maintaining competitiveness in global markets.

Regulatory Landscape

The regulatory landscape for ethyl acetate is complex and dynamic, with varying standards and requirements across different regions and countries. In the European Union, ethyl acetate is regulated under the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers and importers to register substances and provide safety data. The EU has also set specific limits for ethyl acetate in certain consumer products, such as cosmetics and food contact materials.

In the United States, the Food and Drug Administration (FDA) regulates ethyl acetate as a food additive and solvent, with specific guidelines for its use in food processing and packaging. The Environmental Protection Agency (EPA) oversees its industrial applications and emissions under the Clean Air Act and the Toxic Substances Control Act (TSCA).

Asian countries, particularly China and India, have been strengthening their chemical regulations in recent years. China's new chemical substance notification system, similar to REACH, has implications for ethyl acetate production and import. Japan's Chemical Substances Control Law (CSCL) also governs the use and manufacture of ethyl acetate.

Globally, there is a trend towards stricter environmental regulations, which may impact ethyl acetate production and use. Many countries are implementing or considering volatile organic compound (VOC) emission controls, which could affect industries using ethyl acetate as a solvent. This regulatory pressure is driving innovation in low-VOC and bio-based alternatives.

The transportation of ethyl acetate is subject to international regulations for hazardous materials, such as the UN Recommendations on the Transport of Dangerous Goods. These regulations affect packaging, labeling, and shipping requirements for ethyl acetate in global trade.

As sustainability becomes a key focus in chemical regulations, there is growing interest in the lifecycle assessment of ethyl acetate. Regulators are increasingly considering the environmental impact of chemicals from production to disposal. This trend may lead to new requirements for manufacturers to demonstrate the sustainability of their ethyl acetate production processes.

Future regulatory directions may include increased emphasis on circular economy principles, potentially affecting how ethyl acetate is produced, used, and recycled. There may also be a push for harmonization of global chemical regulations, which could streamline compliance for ethyl acetate manufacturers operating in multiple markets.

In the United States, the Food and Drug Administration (FDA) regulates ethyl acetate as a food additive and solvent, with specific guidelines for its use in food processing and packaging. The Environmental Protection Agency (EPA) oversees its industrial applications and emissions under the Clean Air Act and the Toxic Substances Control Act (TSCA).

Asian countries, particularly China and India, have been strengthening their chemical regulations in recent years. China's new chemical substance notification system, similar to REACH, has implications for ethyl acetate production and import. Japan's Chemical Substances Control Law (CSCL) also governs the use and manufacture of ethyl acetate.

Globally, there is a trend towards stricter environmental regulations, which may impact ethyl acetate production and use. Many countries are implementing or considering volatile organic compound (VOC) emission controls, which could affect industries using ethyl acetate as a solvent. This regulatory pressure is driving innovation in low-VOC and bio-based alternatives.

The transportation of ethyl acetate is subject to international regulations for hazardous materials, such as the UN Recommendations on the Transport of Dangerous Goods. These regulations affect packaging, labeling, and shipping requirements for ethyl acetate in global trade.

As sustainability becomes a key focus in chemical regulations, there is growing interest in the lifecycle assessment of ethyl acetate. Regulators are increasingly considering the environmental impact of chemicals from production to disposal. This trend may lead to new requirements for manufacturers to demonstrate the sustainability of their ethyl acetate production processes.

Future regulatory directions may include increased emphasis on circular economy principles, potentially affecting how ethyl acetate is produced, used, and recycled. There may also be a push for harmonization of global chemical regulations, which could streamline compliance for ethyl acetate manufacturers operating in multiple markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!