Exploring Ethyl Acetate in Industrial Transformation: Key Insights

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Overview and Objectives

Ethyl acetate, a versatile organic compound with the formula CH3COOC2H5, has played a significant role in industrial processes for decades. This colorless liquid, known for its characteristic sweet smell, has become a cornerstone in various sectors due to its unique properties and wide-ranging applications. The evolution of ethyl acetate's use in industry reflects the broader trends in chemical engineering and sustainable manufacturing practices.

The primary objective of this technical research report is to explore the transformative potential of ethyl acetate in industrial applications. We aim to provide a comprehensive overview of its current uses, emerging trends, and future prospects. This investigation will delve into the compound's physical and chemical properties, production methods, and its impact on different industrial sectors.

Historically, ethyl acetate has been utilized primarily as a solvent in industries such as paints and coatings, adhesives, and pharmaceuticals. However, recent technological advancements and a growing emphasis on environmentally friendly processes have expanded its role. The compound's low toxicity, biodegradability, and relatively low production costs make it an attractive option for industries seeking to reduce their environmental footprint while maintaining operational efficiency.

One of the key trends driving the increased interest in ethyl acetate is the shift towards green solvents. As regulatory pressures mount and consumer preferences evolve, industries are actively seeking alternatives to traditional petroleum-based solvents. Ethyl acetate, derived from renewable resources like ethanol and acetic acid, aligns well with these sustainability goals.

In the context of industrial transformation, ethyl acetate is poised to play a pivotal role in several emerging applications. Its potential in advanced materials production, such as in the manufacture of high-performance polymers and composites, is particularly noteworthy. Additionally, its use in the development of novel drug delivery systems and as a key component in next-generation cleaning solutions highlights its versatility and adaptability to evolving industrial needs.

This report will examine the technical challenges and opportunities associated with ethyl acetate's expanded use. We will explore innovative production methods, including bio-based routes, that promise to enhance the compound's sustainability profile. Furthermore, we will investigate how advancements in process engineering and catalysis are optimizing ethyl acetate synthesis, potentially leading to more efficient and cost-effective industrial applications.

By providing a thorough analysis of ethyl acetate's role in industrial transformation, this report aims to guide strategic decision-making for businesses and researchers alike. It will offer insights into market trends, technological innovations, and potential areas for further research and development. Ultimately, our goal is to illuminate the pathways through which ethyl acetate can contribute to more sustainable, efficient, and innovative industrial processes in the years to come.

The primary objective of this technical research report is to explore the transformative potential of ethyl acetate in industrial applications. We aim to provide a comprehensive overview of its current uses, emerging trends, and future prospects. This investigation will delve into the compound's physical and chemical properties, production methods, and its impact on different industrial sectors.

Historically, ethyl acetate has been utilized primarily as a solvent in industries such as paints and coatings, adhesives, and pharmaceuticals. However, recent technological advancements and a growing emphasis on environmentally friendly processes have expanded its role. The compound's low toxicity, biodegradability, and relatively low production costs make it an attractive option for industries seeking to reduce their environmental footprint while maintaining operational efficiency.

One of the key trends driving the increased interest in ethyl acetate is the shift towards green solvents. As regulatory pressures mount and consumer preferences evolve, industries are actively seeking alternatives to traditional petroleum-based solvents. Ethyl acetate, derived from renewable resources like ethanol and acetic acid, aligns well with these sustainability goals.

In the context of industrial transformation, ethyl acetate is poised to play a pivotal role in several emerging applications. Its potential in advanced materials production, such as in the manufacture of high-performance polymers and composites, is particularly noteworthy. Additionally, its use in the development of novel drug delivery systems and as a key component in next-generation cleaning solutions highlights its versatility and adaptability to evolving industrial needs.

This report will examine the technical challenges and opportunities associated with ethyl acetate's expanded use. We will explore innovative production methods, including bio-based routes, that promise to enhance the compound's sustainability profile. Furthermore, we will investigate how advancements in process engineering and catalysis are optimizing ethyl acetate synthesis, potentially leading to more efficient and cost-effective industrial applications.

By providing a thorough analysis of ethyl acetate's role in industrial transformation, this report aims to guide strategic decision-making for businesses and researchers alike. It will offer insights into market trends, technological innovations, and potential areas for further research and development. Ultimately, our goal is to illuminate the pathways through which ethyl acetate can contribute to more sustainable, efficient, and innovative industrial processes in the years to come.

Market Demand Analysis for Ethyl Acetate

The global market for ethyl acetate has been experiencing steady growth, driven by its versatile applications across various industries. As a key solvent and intermediate in chemical processes, ethyl acetate's demand is closely tied to the performance of end-use sectors such as paints and coatings, adhesives, pharmaceuticals, and food and beverages.

In the paints and coatings industry, ethyl acetate serves as an essential solvent due to its excellent solvency and low toxicity. The growing construction and automotive sectors, particularly in emerging economies, are fueling the demand for paints and coatings, consequently boosting ethyl acetate consumption. The adhesives industry also relies heavily on ethyl acetate for its fast-evaporating properties, making it ideal for quick-drying adhesives used in packaging and woodworking applications.

The pharmaceutical sector represents another significant market for ethyl acetate. Its use as a solvent in drug formulation and as an extraction agent in the production of antibiotics contributes to the increasing demand. As global healthcare expenditure rises and new drug developments accelerate, the pharmaceutical industry's consumption of ethyl acetate is expected to grow substantially.

In the food and beverage industry, ethyl acetate finds applications as a flavoring agent and in the decaffeination of coffee and tea. The rising consumer preference for natural and organic products has led to an increased use of ethyl acetate as a more environmentally friendly alternative to traditional chemical solvents in these processes.

The Asia-Pacific region, led by China and India, is anticipated to be the fastest-growing market for ethyl acetate. Rapid industrialization, urbanization, and the expansion of manufacturing sectors in these countries are driving the demand. North America and Europe, while mature markets, continue to show steady growth, primarily due to innovations in end-use applications and the shift towards eco-friendly solvents.

Market analysts project the global ethyl acetate market to grow at a compound annual growth rate (CAGR) of around 5-6% over the next five years. This growth is attributed to the increasing industrial activities in developing nations, technological advancements in production processes, and the expanding application scope of ethyl acetate in various industries.

However, the market faces challenges such as volatile raw material prices and environmental regulations concerning VOC emissions. These factors are prompting manufacturers to invest in research and development of bio-based ethyl acetate, which could potentially reshape the market landscape in the coming years.

In the paints and coatings industry, ethyl acetate serves as an essential solvent due to its excellent solvency and low toxicity. The growing construction and automotive sectors, particularly in emerging economies, are fueling the demand for paints and coatings, consequently boosting ethyl acetate consumption. The adhesives industry also relies heavily on ethyl acetate for its fast-evaporating properties, making it ideal for quick-drying adhesives used in packaging and woodworking applications.

The pharmaceutical sector represents another significant market for ethyl acetate. Its use as a solvent in drug formulation and as an extraction agent in the production of antibiotics contributes to the increasing demand. As global healthcare expenditure rises and new drug developments accelerate, the pharmaceutical industry's consumption of ethyl acetate is expected to grow substantially.

In the food and beverage industry, ethyl acetate finds applications as a flavoring agent and in the decaffeination of coffee and tea. The rising consumer preference for natural and organic products has led to an increased use of ethyl acetate as a more environmentally friendly alternative to traditional chemical solvents in these processes.

The Asia-Pacific region, led by China and India, is anticipated to be the fastest-growing market for ethyl acetate. Rapid industrialization, urbanization, and the expansion of manufacturing sectors in these countries are driving the demand. North America and Europe, while mature markets, continue to show steady growth, primarily due to innovations in end-use applications and the shift towards eco-friendly solvents.

Market analysts project the global ethyl acetate market to grow at a compound annual growth rate (CAGR) of around 5-6% over the next five years. This growth is attributed to the increasing industrial activities in developing nations, technological advancements in production processes, and the expanding application scope of ethyl acetate in various industries.

However, the market faces challenges such as volatile raw material prices and environmental regulations concerning VOC emissions. These factors are prompting manufacturers to invest in research and development of bio-based ethyl acetate, which could potentially reshape the market landscape in the coming years.

Current Challenges in Ethyl Acetate Production

The production of ethyl acetate faces several significant challenges in the current industrial landscape. One of the primary issues is the reliance on traditional petrochemical feedstocks, which are subject to price volatility and environmental concerns. The conventional production method, involving the esterification of ethanol and acetic acid, requires high energy inputs and often results in low yields due to the reversible nature of the reaction.

Another major challenge is the presence of azeotropes in the ethyl acetate production process. The azeotropic mixture of ethyl acetate and water complicates the separation and purification steps, leading to increased energy consumption and reduced product purity. This necessitates complex distillation techniques, which add to the overall production costs and environmental footprint.

The corrosive nature of acetic acid, a key reactant in ethyl acetate synthesis, poses significant material challenges. It requires the use of specialized, corrosion-resistant equipment, which increases capital and maintenance costs. Additionally, the handling and storage of large quantities of acetic acid present safety concerns that must be carefully managed.

Environmental regulations pose another set of challenges for ethyl acetate producers. The emission of volatile organic compounds (VOCs) during production and use of ethyl acetate is subject to increasingly stringent controls. Manufacturers must invest in emission control technologies and continuously improve their processes to meet evolving environmental standards.

The quest for greener production methods is also a pressing challenge. There is growing demand for bio-based ethyl acetate, derived from renewable resources. However, developing economically viable and scalable bio-based production routes remains a significant technical hurdle. Current bio-based methods often suffer from low yields, high production costs, and inconsistent product quality.

Quality control is another critical challenge, particularly in high-purity applications such as pharmaceuticals and electronics. Achieving and maintaining the required purity levels, while minimizing impurities like water and acetic acid, demands sophisticated analytical techniques and rigorous process control.

Lastly, the industry faces challenges in optimizing catalyst performance. Current catalysts used in ethyl acetate production often have limited lifespans and selectivity issues. Developing more efficient, longer-lasting catalysts that can operate under milder conditions is crucial for improving process economics and sustainability.

Another major challenge is the presence of azeotropes in the ethyl acetate production process. The azeotropic mixture of ethyl acetate and water complicates the separation and purification steps, leading to increased energy consumption and reduced product purity. This necessitates complex distillation techniques, which add to the overall production costs and environmental footprint.

The corrosive nature of acetic acid, a key reactant in ethyl acetate synthesis, poses significant material challenges. It requires the use of specialized, corrosion-resistant equipment, which increases capital and maintenance costs. Additionally, the handling and storage of large quantities of acetic acid present safety concerns that must be carefully managed.

Environmental regulations pose another set of challenges for ethyl acetate producers. The emission of volatile organic compounds (VOCs) during production and use of ethyl acetate is subject to increasingly stringent controls. Manufacturers must invest in emission control technologies and continuously improve their processes to meet evolving environmental standards.

The quest for greener production methods is also a pressing challenge. There is growing demand for bio-based ethyl acetate, derived from renewable resources. However, developing economically viable and scalable bio-based production routes remains a significant technical hurdle. Current bio-based methods often suffer from low yields, high production costs, and inconsistent product quality.

Quality control is another critical challenge, particularly in high-purity applications such as pharmaceuticals and electronics. Achieving and maintaining the required purity levels, while minimizing impurities like water and acetic acid, demands sophisticated analytical techniques and rigorous process control.

Lastly, the industry faces challenges in optimizing catalyst performance. Current catalysts used in ethyl acetate production often have limited lifespans and selectivity issues. Developing more efficient, longer-lasting catalysts that can operate under milder conditions is crucial for improving process economics and sustainability.

Existing Ethyl Acetate Production Methods

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described. These include esterification processes, distillation techniques, and the use of specific catalysts to improve yield and purity. The production methods aim to optimize the synthesis of ethyl acetate from its precursors, typically ethanol and acetic acid.- Production and purification of ethyl acetate: Various methods and processes for producing and purifying ethyl acetate are described. These include esterification reactions, distillation techniques, and the use of specific catalysts to improve yield and purity. The processes aim to optimize the production of ethyl acetate for industrial applications.

- Applications of ethyl acetate in chemical processes: Ethyl acetate is utilized in various chemical processes and applications. It serves as a solvent, reactant, or intermediate in the production of other chemicals, pharmaceuticals, and materials. Its versatility makes it valuable in industries such as coatings, adhesives, and polymer manufacturing.

- Ethyl acetate in extraction and separation processes: Ethyl acetate is employed in extraction and separation processes for various compounds. It is used as a solvent to isolate specific substances from mixtures or natural sources. The compound's properties make it suitable for liquid-liquid extraction and other separation techniques in chemical and pharmaceutical industries.

- Environmental and safety considerations for ethyl acetate: Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, reducing emissions, and enhancing handling and storage practices to minimize risks associated with its flammability and volatility.

- Novel applications and formulations containing ethyl acetate: Innovative applications and formulations incorporating ethyl acetate are being developed. These include its use in specialized coatings, adhesives, and composite materials. Research is ongoing to explore new potential uses of ethyl acetate in various industries, leveraging its unique properties and compatibility with other substances.

02 Applications of ethyl acetate in industrial processes

Ethyl acetate finds diverse applications in industrial processes. It is used as a solvent in various industries, including pharmaceuticals, coatings, and electronics. The compound is also utilized in extraction processes, as a reaction medium, and in the production of other chemicals.Expand Specific Solutions03 Ethyl acetate in polymer and material science

Ethyl acetate plays a role in polymer and material science applications. It is used in the preparation of various polymers, as a solvent for resins, and in the development of composite materials. The compound's properties make it suitable for use in adhesives, coatings, and film-forming applications.Expand Specific Solutions04 Environmental and safety considerations for ethyl acetate

Research and development efforts focus on addressing environmental and safety concerns related to ethyl acetate use. This includes developing more sustainable production methods, improving handling and storage practices, and exploring alternatives in certain applications to reduce environmental impact and enhance worker safety.Expand Specific Solutions05 Novel synthesis routes and catalysts for ethyl acetate production

Innovative approaches to ethyl acetate synthesis are being explored, including the development of new catalysts and reaction pathways. These efforts aim to improve efficiency, reduce energy consumption, and enable the use of alternative feedstocks in ethyl acetate production.Expand Specific Solutions

Key Players in Ethyl Acetate Industry

The ethyl acetate market is in a mature growth stage, characterized by steady demand across various industries. The global market size is estimated to be around $3-4 billion, with projected annual growth of 5-6% through 2025. Technologically, ethyl acetate production is well-established, with major players like Celanese, China Petroleum & Chemical Corp, and Eastman Chemical Co. leading in capacity and innovation. These companies are focusing on process optimizations and exploring bio-based feedstocks to enhance sustainability. Emerging players such as Velocys and Synfuels China are developing novel catalytic processes, potentially disrupting traditional production methods. The competitive landscape is moderately concentrated, with increasing emphasis on product quality, cost-efficiency, and environmental compliance driving market dynamics.

Celanese International Corp.

Technical Solution: Celanese has developed an advanced process for ethyl acetate production using reactive distillation technology. This innovative approach combines reaction and separation in a single unit operation, significantly improving process efficiency and reducing energy consumption. The company's method utilizes ethanol and acetic acid as feedstocks, employing a proprietary catalyst system that enhances conversion rates and selectivity. Celanese's process achieves ethyl acetate purity levels exceeding 99.9% [1], meeting stringent industry standards for various applications including coatings, pharmaceuticals, and electronics. The company has also implemented advanced process control systems and heat integration techniques to optimize production and minimize waste [3].

Strengths: High product purity, improved energy efficiency, and reduced equipment footprint. Weaknesses: Potential higher initial capital investment and reliance on specific catalyst technology.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a novel ethyl acetate production process based on direct ethylene oxidative esterification. This innovative approach utilizes ethylene and acetic acid as raw materials, employing a unique palladium-based catalyst system. The process operates under mild conditions, with temperatures around 150-180°C and pressures of 1-2 MPa [2]. Sinopec's method achieves high ethyl acetate selectivity of over 95% and single-pass ethylene conversion rates exceeding 10% [4]. The company has also implemented advanced separation and purification techniques, including extractive distillation, to ensure high product quality. Additionally, Sinopec has integrated this process with its existing ethylene and acetic acid production facilities, creating a highly efficient and cost-effective value chain [5].

Strengths: Direct use of ethylene feedstock, high selectivity, and integration with existing petrochemical infrastructure. Weaknesses: Potential catalyst cost and complexity in handling ethylene as a raw material.

Innovative Approaches in Ethyl Acetate Synthesis

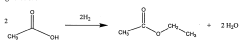

Catalysts for making ethyl acetate from acetic acid

PatentInactiveEP2493612A1

Innovation

- Development of catalysts comprising specific metals like nickel, palladium, and platinum, combined with metals like molybdenum, rhenium, and tin, supported on high surface area silica or alumina, which facilitate the hydrogenation of acetic acid to ethyl acetate with high selectivity and productivity while minimizing by-product formation.

Catalysts for making ethyl acetate from acetic acid

PatentWO2011053367A1

Innovation

- Development of catalysts comprising metals like nickel, palladium, or platinum, combined with metals like molybdenum, rhenium, or tin, supported on high surface area silica or alumina, which achieve high selectivity to ethyl acetate with reduced formation of by-products when hydrogenating acetic acid.

Environmental Impact of Ethyl Acetate Production

The production and use of ethyl acetate in industrial processes have significant environmental implications that warrant careful consideration. The manufacturing of ethyl acetate primarily involves the esterification of ethanol with acetic acid, a process that consumes substantial energy and resources. This energy-intensive production contributes to greenhouse gas emissions, particularly when fossil fuels are the primary energy source.

Water consumption is another critical environmental factor in ethyl acetate production. The process requires large volumes of water for cooling and separation stages, potentially straining local water resources in areas of production. Additionally, wastewater from the manufacturing process may contain trace amounts of organic compounds, necessitating proper treatment before discharge to prevent water pollution.

Air quality is also affected by ethyl acetate production and use. As a volatile organic compound (VOC), ethyl acetate can contribute to the formation of ground-level ozone when released into the atmosphere. This can lead to smog formation and associated respiratory health issues in urban areas. Industrial facilities must implement effective emission control technologies to mitigate these air quality impacts.

The disposal and potential environmental release of ethyl acetate present further challenges. Improper handling or accidental spills can lead to soil and groundwater contamination. While ethyl acetate is biodegradable and does not persist long-term in the environment, high concentrations can still have acute toxic effects on aquatic ecosystems.

On a positive note, ethyl acetate is considered less harmful than many other solvents used in industrial applications. It has a lower ozone depletion potential and global warming potential compared to chlorinated solvents. Furthermore, its biodegradability means it breaks down relatively quickly in the environment, reducing long-term ecological impacts.

The life cycle assessment of ethyl acetate reveals opportunities for environmental improvement. Shifting towards renewable energy sources in production can significantly reduce the carbon footprint. Implementing closed-loop systems and improving process efficiency can minimize water consumption and waste generation. Additionally, exploring bio-based feedstocks for ethyl acetate production could further enhance its sustainability profile.

As industries continue to prioritize sustainability, there is growing interest in developing greener alternatives to traditional ethyl acetate production methods. Research into enzymatic processes and the use of waste biomass as feedstock shows promise for reducing the environmental footprint of ethyl acetate manufacturing in the future.

Water consumption is another critical environmental factor in ethyl acetate production. The process requires large volumes of water for cooling and separation stages, potentially straining local water resources in areas of production. Additionally, wastewater from the manufacturing process may contain trace amounts of organic compounds, necessitating proper treatment before discharge to prevent water pollution.

Air quality is also affected by ethyl acetate production and use. As a volatile organic compound (VOC), ethyl acetate can contribute to the formation of ground-level ozone when released into the atmosphere. This can lead to smog formation and associated respiratory health issues in urban areas. Industrial facilities must implement effective emission control technologies to mitigate these air quality impacts.

The disposal and potential environmental release of ethyl acetate present further challenges. Improper handling or accidental spills can lead to soil and groundwater contamination. While ethyl acetate is biodegradable and does not persist long-term in the environment, high concentrations can still have acute toxic effects on aquatic ecosystems.

On a positive note, ethyl acetate is considered less harmful than many other solvents used in industrial applications. It has a lower ozone depletion potential and global warming potential compared to chlorinated solvents. Furthermore, its biodegradability means it breaks down relatively quickly in the environment, reducing long-term ecological impacts.

The life cycle assessment of ethyl acetate reveals opportunities for environmental improvement. Shifting towards renewable energy sources in production can significantly reduce the carbon footprint. Implementing closed-loop systems and improving process efficiency can minimize water consumption and waste generation. Additionally, exploring bio-based feedstocks for ethyl acetate production could further enhance its sustainability profile.

As industries continue to prioritize sustainability, there is growing interest in developing greener alternatives to traditional ethyl acetate production methods. Research into enzymatic processes and the use of waste biomass as feedstock shows promise for reducing the environmental footprint of ethyl acetate manufacturing in the future.

Regulatory Framework for Ethyl Acetate Use

The regulatory framework for ethyl acetate use is a complex and evolving landscape that significantly impacts its industrial applications. At the global level, organizations such as the World Health Organization (WHO) and the International Labour Organization (ILO) provide guidelines on the safe handling and exposure limits of ethyl acetate in occupational settings. These recommendations often serve as a basis for national regulations.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). The Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) for ethyl acetate in the workplace, currently set at 400 parts per million (ppm) as an 8-hour time-weighted average. The Food and Drug Administration (FDA) also regulates ethyl acetate as an indirect food additive and solvent in food packaging materials.

The European Union has implemented REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, which require manufacturers and importers to register ethyl acetate and provide safety data. The European Chemicals Agency (ECHA) oversees this process and maintains a database of registered substances. Additionally, the EU has set occupational exposure limits for ethyl acetate through Directive 2017/164/EU.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment regulates ethyl acetate under the Measures for Environmental Management of New Chemical Substances. Japan's Ministry of Health, Labour and Welfare sets occupational exposure limits and regulates its use in food contact materials.

Many countries have implemented specific regulations for volatile organic compounds (VOCs), which include ethyl acetate. These regulations often focus on emissions control in industrial processes and consumer products. For instance, California's Air Resources Board (CARB) has stringent VOC regulations that affect the use of ethyl acetate in various products.

The transportation of ethyl acetate is subject to international agreements such as the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR) and the International Maritime Dangerous Goods (IMDG) Code. These regulations specify packaging, labeling, and handling requirements for the safe transport of ethyl acetate.

As environmental concerns grow, there is an increasing trend towards stricter regulations on chemical use and emissions. This may lead to more stringent controls on ethyl acetate in the future, potentially driving innovation in alternative solvents or application methods. Industries using ethyl acetate must stay informed about these regulatory developments to ensure compliance and adapt their processes accordingly.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). The Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) for ethyl acetate in the workplace, currently set at 400 parts per million (ppm) as an 8-hour time-weighted average. The Food and Drug Administration (FDA) also regulates ethyl acetate as an indirect food additive and solvent in food packaging materials.

The European Union has implemented REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, which require manufacturers and importers to register ethyl acetate and provide safety data. The European Chemicals Agency (ECHA) oversees this process and maintains a database of registered substances. Additionally, the EU has set occupational exposure limits for ethyl acetate through Directive 2017/164/EU.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment regulates ethyl acetate under the Measures for Environmental Management of New Chemical Substances. Japan's Ministry of Health, Labour and Welfare sets occupational exposure limits and regulates its use in food contact materials.

Many countries have implemented specific regulations for volatile organic compounds (VOCs), which include ethyl acetate. These regulations often focus on emissions control in industrial processes and consumer products. For instance, California's Air Resources Board (CARB) has stringent VOC regulations that affect the use of ethyl acetate in various products.

The transportation of ethyl acetate is subject to international agreements such as the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR) and the International Maritime Dangerous Goods (IMDG) Code. These regulations specify packaging, labeling, and handling requirements for the safe transport of ethyl acetate.

As environmental concerns grow, there is an increasing trend towards stricter regulations on chemical use and emissions. This may lead to more stringent controls on ethyl acetate in the future, potentially driving innovation in alternative solvents or application methods. Industries using ethyl acetate must stay informed about these regulatory developments to ensure compliance and adapt their processes accordingly.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!