Enhancing Thermopile Durability with New Coating Materials

SEP 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermopile Coating Evolution and Objectives

Thermopile technology has evolved significantly since its inception in the early 20th century, transitioning from simple thermoelectric devices to sophisticated sensors used in various applications including temperature measurement, infrared detection, and energy harvesting. The evolution of thermopile coatings represents a critical aspect of this technological progression, with each advancement addressing specific challenges related to durability, sensitivity, and performance under extreme conditions.

In the 1950s and 1960s, thermopiles primarily utilized basic metal oxide coatings that offered minimal protection against environmental factors. The 1970s witnessed the introduction of silicon-based coatings, which improved durability but still suffered from degradation when exposed to harsh chemicals or extreme temperatures. The 1990s marked a significant breakthrough with the development of polymer-based protective layers that substantially enhanced resistance to corrosion and mechanical stress.

Recent developments have focused on nanomaterial coatings, including carbon nanotubes and graphene-based composites, which demonstrate exceptional thermal stability and mechanical strength. These advanced materials have enabled thermopiles to operate reliably in increasingly demanding environments, from industrial process monitoring to aerospace applications. However, despite these advancements, current coating technologies still face limitations in terms of long-term stability, particularly when exposed to combined stressors such as high temperature, humidity, and corrosive substances.

The primary objective of enhancing thermopile durability with new coating materials is to develop solutions that significantly extend operational lifespan while maintaining or improving sensor performance characteristics. Specifically, this involves creating coating materials that can withstand temperatures exceeding 400°C without degradation, resist chemical corrosion from industrial solvents and acids, and maintain structural integrity under mechanical stress and thermal cycling.

Additional technical goals include developing coatings that minimize thermal mass to preserve sensor response time, ensure consistent emissivity for accurate measurements, and provide effective electrical insulation without compromising thermal conductivity where required. These objectives must be achieved while considering manufacturing scalability and cost-effectiveness to ensure commercial viability.

The evolution trajectory suggests that future coating technologies will likely incorporate multi-functional materials that can self-heal minor damage, adapt to changing environmental conditions, and potentially even enhance the base functionality of the thermopile sensors. Emerging research in biomimetic materials and smart composites presents promising avenues for achieving these ambitious technical objectives, potentially revolutionizing thermopile applications across multiple industries.

In the 1950s and 1960s, thermopiles primarily utilized basic metal oxide coatings that offered minimal protection against environmental factors. The 1970s witnessed the introduction of silicon-based coatings, which improved durability but still suffered from degradation when exposed to harsh chemicals or extreme temperatures. The 1990s marked a significant breakthrough with the development of polymer-based protective layers that substantially enhanced resistance to corrosion and mechanical stress.

Recent developments have focused on nanomaterial coatings, including carbon nanotubes and graphene-based composites, which demonstrate exceptional thermal stability and mechanical strength. These advanced materials have enabled thermopiles to operate reliably in increasingly demanding environments, from industrial process monitoring to aerospace applications. However, despite these advancements, current coating technologies still face limitations in terms of long-term stability, particularly when exposed to combined stressors such as high temperature, humidity, and corrosive substances.

The primary objective of enhancing thermopile durability with new coating materials is to develop solutions that significantly extend operational lifespan while maintaining or improving sensor performance characteristics. Specifically, this involves creating coating materials that can withstand temperatures exceeding 400°C without degradation, resist chemical corrosion from industrial solvents and acids, and maintain structural integrity under mechanical stress and thermal cycling.

Additional technical goals include developing coatings that minimize thermal mass to preserve sensor response time, ensure consistent emissivity for accurate measurements, and provide effective electrical insulation without compromising thermal conductivity where required. These objectives must be achieved while considering manufacturing scalability and cost-effectiveness to ensure commercial viability.

The evolution trajectory suggests that future coating technologies will likely incorporate multi-functional materials that can self-heal minor damage, adapt to changing environmental conditions, and potentially even enhance the base functionality of the thermopile sensors. Emerging research in biomimetic materials and smart composites presents promising avenues for achieving these ambitious technical objectives, potentially revolutionizing thermopile applications across multiple industries.

Market Demand Analysis for Durable Thermopiles

The global market for thermopiles has been experiencing steady growth, driven by increasing applications in various industries including automotive, healthcare, industrial manufacturing, and consumer electronics. The demand for more durable thermopiles has become particularly pronounced as these devices are increasingly deployed in harsh operating environments that subject them to extreme temperatures, chemical exposure, and mechanical stress.

Market research indicates that the thermopile sensor market is projected to grow at a compound annual growth rate of 8.2% through 2028, with the segment specifically focused on high-durability thermopiles growing even faster at approximately 10.5%. This accelerated growth reflects the expanding use of thermopiles in critical applications where failure is not an option, such as in medical diagnostics, industrial safety systems, and aerospace.

The automotive sector represents one of the largest markets for durable thermopiles, with applications in engine monitoring, climate control systems, and advanced driver assistance systems. As vehicles become more electrified and autonomous, the need for reliable temperature sensing becomes increasingly critical, creating a substantial market opportunity for enhanced thermopile solutions.

Healthcare applications constitute another significant market segment, with thermopiles being essential components in non-contact thermometers, blood analyzers, and various diagnostic equipment. The COVID-19 pandemic has further accelerated demand in this sector, as contactless temperature measurement became a standard screening protocol globally.

Industrial manufacturing represents the third major market segment, where thermopiles are utilized in process monitoring, predictive maintenance systems, and quality control applications. The trend toward Industry 4.0 and smart manufacturing has intensified the need for sensors that can withstand challenging industrial environments while maintaining accuracy and reliability over extended periods.

Market surveys reveal that end-users are willing to pay a premium of 15-20% for thermopiles with demonstrably superior durability characteristics. This price elasticity is particularly evident in mission-critical applications where sensor failure could result in significant downtime, safety risks, or quality issues.

Regional analysis shows that North America and Europe currently lead in the adoption of high-durability thermopiles, primarily due to stringent regulatory requirements and advanced manufacturing sectors. However, the Asia-Pacific region is expected to witness the fastest growth rate in the coming years, driven by rapid industrialization, expanding healthcare infrastructure, and increasing automotive production.

Customer feedback consistently highlights three primary pain points with current thermopile technology: degradation in harsh chemical environments, performance drift under thermal cycling, and mechanical fragility. These challenges represent significant opportunities for innovation in coating materials that can address these specific market needs.

Market research indicates that the thermopile sensor market is projected to grow at a compound annual growth rate of 8.2% through 2028, with the segment specifically focused on high-durability thermopiles growing even faster at approximately 10.5%. This accelerated growth reflects the expanding use of thermopiles in critical applications where failure is not an option, such as in medical diagnostics, industrial safety systems, and aerospace.

The automotive sector represents one of the largest markets for durable thermopiles, with applications in engine monitoring, climate control systems, and advanced driver assistance systems. As vehicles become more electrified and autonomous, the need for reliable temperature sensing becomes increasingly critical, creating a substantial market opportunity for enhanced thermopile solutions.

Healthcare applications constitute another significant market segment, with thermopiles being essential components in non-contact thermometers, blood analyzers, and various diagnostic equipment. The COVID-19 pandemic has further accelerated demand in this sector, as contactless temperature measurement became a standard screening protocol globally.

Industrial manufacturing represents the third major market segment, where thermopiles are utilized in process monitoring, predictive maintenance systems, and quality control applications. The trend toward Industry 4.0 and smart manufacturing has intensified the need for sensors that can withstand challenging industrial environments while maintaining accuracy and reliability over extended periods.

Market surveys reveal that end-users are willing to pay a premium of 15-20% for thermopiles with demonstrably superior durability characteristics. This price elasticity is particularly evident in mission-critical applications where sensor failure could result in significant downtime, safety risks, or quality issues.

Regional analysis shows that North America and Europe currently lead in the adoption of high-durability thermopiles, primarily due to stringent regulatory requirements and advanced manufacturing sectors. However, the Asia-Pacific region is expected to witness the fastest growth rate in the coming years, driven by rapid industrialization, expanding healthcare infrastructure, and increasing automotive production.

Customer feedback consistently highlights three primary pain points with current thermopile technology: degradation in harsh chemical environments, performance drift under thermal cycling, and mechanical fragility. These challenges represent significant opportunities for innovation in coating materials that can address these specific market needs.

Current Challenges in Thermopile Coating Technology

Thermopile sensors, widely used in temperature measurement and infrared detection applications, face significant durability challenges that limit their performance and lifespan. The current coating technologies employed to protect these sensitive devices exhibit several critical limitations that must be addressed to enhance their reliability in demanding environments.

Environmental degradation represents one of the most pressing challenges for thermopile coatings. Existing materials often deteriorate when exposed to high humidity, corrosive gases, or extreme temperature fluctuations. This degradation manifests as coating delamination, cracking, or chemical alteration, directly impacting the sensor's accuracy and response time. Studies indicate that conventional silicon dioxide and silicon nitride coatings begin to show performance degradation after 2,000-3,000 hours in harsh industrial environments.

Thermal conductivity inconsistencies pose another significant obstacle. Current coating materials struggle to maintain uniform thermal properties across their surface and throughout their operational lifetime. This variability leads to uneven heat distribution, creating "hot spots" that compromise measurement accuracy and accelerate sensor aging. Research from the National Institute of Standards and Technology reveals that thermal conductivity variations as small as 5% can result in measurement errors exceeding acceptable thresholds for precision applications.

Mechanical stress resistance remains inadequate in many existing coating solutions. The thermal expansion coefficient mismatch between coating materials and thermopile substrates generates internal stresses during temperature cycling. Over time, these stresses lead to microcracks and eventual coating failure. Industry data suggests that approximately 30% of thermopile sensor failures in automotive and aerospace applications can be attributed to coating integrity issues.

Manufacturing scalability challenges further complicate the advancement of thermopile coating technology. Current high-performance coatings often require complex deposition processes like atomic layer deposition or plasma-enhanced chemical vapor deposition. These techniques demand specialized equipment, precise control parameters, and extended processing times, significantly increasing production costs and limiting mass manufacturing capabilities.

Optical property stability represents another critical limitation. Many applications require thermopile coatings to maintain specific emissivity and absorptivity characteristics throughout their operational lifetime. However, existing coatings frequently exhibit optical drift due to surface oxidation, contamination accumulation, or structural changes at the molecular level. This drift necessitates frequent recalibration or premature replacement of sensing elements.

Cost-effectiveness barriers also hinder widespread adoption of advanced coating solutions. While specialized coatings with superior properties exist in laboratory settings, their commercial viability is limited by expensive raw materials, complex processing requirements, and intellectual property restrictions. The cost-to-performance ratio remains unfavorable for many potential applications, particularly in consumer electronics and IoT devices.

Environmental degradation represents one of the most pressing challenges for thermopile coatings. Existing materials often deteriorate when exposed to high humidity, corrosive gases, or extreme temperature fluctuations. This degradation manifests as coating delamination, cracking, or chemical alteration, directly impacting the sensor's accuracy and response time. Studies indicate that conventional silicon dioxide and silicon nitride coatings begin to show performance degradation after 2,000-3,000 hours in harsh industrial environments.

Thermal conductivity inconsistencies pose another significant obstacle. Current coating materials struggle to maintain uniform thermal properties across their surface and throughout their operational lifetime. This variability leads to uneven heat distribution, creating "hot spots" that compromise measurement accuracy and accelerate sensor aging. Research from the National Institute of Standards and Technology reveals that thermal conductivity variations as small as 5% can result in measurement errors exceeding acceptable thresholds for precision applications.

Mechanical stress resistance remains inadequate in many existing coating solutions. The thermal expansion coefficient mismatch between coating materials and thermopile substrates generates internal stresses during temperature cycling. Over time, these stresses lead to microcracks and eventual coating failure. Industry data suggests that approximately 30% of thermopile sensor failures in automotive and aerospace applications can be attributed to coating integrity issues.

Manufacturing scalability challenges further complicate the advancement of thermopile coating technology. Current high-performance coatings often require complex deposition processes like atomic layer deposition or plasma-enhanced chemical vapor deposition. These techniques demand specialized equipment, precise control parameters, and extended processing times, significantly increasing production costs and limiting mass manufacturing capabilities.

Optical property stability represents another critical limitation. Many applications require thermopile coatings to maintain specific emissivity and absorptivity characteristics throughout their operational lifetime. However, existing coatings frequently exhibit optical drift due to surface oxidation, contamination accumulation, or structural changes at the molecular level. This drift necessitates frequent recalibration or premature replacement of sensing elements.

Cost-effectiveness barriers also hinder widespread adoption of advanced coating solutions. While specialized coatings with superior properties exist in laboratory settings, their commercial viability is limited by expensive raw materials, complex processing requirements, and intellectual property restrictions. The cost-to-performance ratio remains unfavorable for many potential applications, particularly in consumer electronics and IoT devices.

Existing Coating Technologies for Thermopile Protection

01 Protective coatings and encapsulation for thermopiles

Various protective coatings and encapsulation methods are employed to enhance thermopile durability. These include hermetic sealing, polymer encapsulation, and specialized protective layers that shield the thermopile elements from environmental factors such as moisture, dust, and corrosive substances. These protective measures significantly extend the operational lifespan of thermopiles by preventing degradation of the thermoelectric materials and electrical connections.- Protective coatings and encapsulation techniques: Various protective coatings and encapsulation methods are employed to enhance thermopile durability. These include hermetic sealing, polymer encapsulation, and specialized coating materials that shield the thermopile elements from environmental factors such as moisture, dust, and corrosive substances. These protective measures significantly extend the operational lifespan of thermopiles by preventing degradation of the thermoelectric materials and electrical connections.

- Structural design improvements for mechanical stability: Advanced structural designs enhance the mechanical stability and durability of thermopiles. These include reinforced substrate materials, optimized junction geometries, and stress-relief structures that minimize thermal expansion issues. By improving the physical robustness of thermopile components, these designs help the devices withstand mechanical shocks, vibrations, and temperature cycling without performance degradation or physical damage.

- Thermoelectric material selection and composition: The selection and composition of thermoelectric materials significantly impact thermopile durability. Advanced semiconductor alloys, doped materials, and composite structures are developed to resist degradation under high temperatures and harsh operating conditions. These materials maintain stable thermoelectric properties over extended periods, reducing performance drift and extending the useful life of thermopile devices in demanding applications.

- Environmental resistance and thermal cycling endurance: Techniques to improve thermopile resistance to environmental factors and thermal cycling are critical for durability. These include specialized junction designs that accommodate repeated thermal expansion and contraction, temperature compensation mechanisms, and materials that resist oxidation at elevated temperatures. These enhancements allow thermopiles to maintain accurate measurements and structural integrity despite frequent temperature fluctuations and exposure to harsh environments.

- Manufacturing processes for enhanced reliability: Advanced manufacturing processes significantly improve thermopile durability and reliability. Precision deposition techniques, controlled annealing processes, and automated assembly methods reduce manufacturing defects that could lead to premature failure. Quality control procedures, including thermal stress testing and accelerated aging, help identify potential weaknesses before deployment. These manufacturing innovations result in more consistent performance and extended operational lifetimes for thermopile devices.

02 Structural reinforcement techniques

Structural reinforcement techniques improve the mechanical durability of thermopiles, enabling them to withstand physical stress, vibration, and thermal cycling. These techniques include robust mounting structures, stress-relief designs, and specialized substrate materials that provide mechanical stability. The implementation of these structural reinforcements prevents fractures in the thermoelectric junctions and maintains the integrity of the thermopile assembly under various operating conditions.Expand Specific Solutions03 Advanced material selection for thermopile elements

The selection of advanced materials for thermopile elements significantly impacts their durability. High-performance thermoelectric materials with improved thermal stability, oxidation resistance, and mechanical properties are used to construct more durable thermopiles. These materials maintain their thermoelectric properties over extended periods and under harsh conditions, resulting in thermopiles with longer operational lifespans and more stable performance characteristics.Expand Specific Solutions04 Thermal management systems

Effective thermal management systems are crucial for enhancing thermopile durability. These systems include heat sinks, thermal insulators, and specialized cooling mechanisms that prevent overheating and manage temperature gradients across the thermopile. By controlling the operating temperature and minimizing thermal stress, these management systems prevent degradation of the thermoelectric materials and extend the functional lifespan of the thermopile devices.Expand Specific Solutions05 Environmental adaptation and testing protocols

Environmental adaptation features and rigorous testing protocols ensure thermopile durability in specific operating environments. These include designs optimized for extreme temperatures, high humidity, or corrosive atmospheres, along with comprehensive testing methodologies to verify long-term reliability. By simulating real-world conditions and stress factors, manufacturers can identify potential failure modes and implement appropriate durability enhancements, resulting in thermopiles that maintain consistent performance throughout their intended service life.Expand Specific Solutions

Key Industry Players in Advanced Coating Solutions

The thermopile durability enhancement market is currently in a growth phase, with increasing demand for more resilient thermal sensing technologies across automotive, aerospace, and industrial sectors. The global market for advanced coating materials in thermal sensors is estimated at $2.3 billion, with projected annual growth of 7-9%. Leading players represent diverse technological approaches: Siemens AG and Mitsubishi Heavy Industries focus on industrial-scale applications, while specialized materials companies like Shin-Etsu Chemical and Kolon Industries develop proprietary coating formulations. Research institutions including Tsinghua University and Korea Electrotechnology Research Institute are advancing fundamental coating technologies. Technical maturity varies significantly, with established players like Honeywell and Toshiba offering commercial solutions, while newer entrants like IMEC Nederland pursue experimental nano-coatings that promise 3-5x durability improvements but remain pre-commercial.

Stichting IMEC Nederland

Technical Solution: IMEC Nederland has developed advanced nano-coating technologies specifically designed for thermopile durability enhancement. Their approach utilizes atomic layer deposition (ALD) to create ultra-thin protective layers of aluminum oxide and titanium nitride composites. This multi-layer coating system provides exceptional thermal stability up to 800°C while maintaining the thermopile's sensitivity. The process involves precise control of coating thickness at the nanometer scale, allowing for customization based on specific operating environments. IMEC's solution also incorporates self-healing properties through the integration of ceramic nanoparticles that can fill microcracks during thermal cycling, significantly extending the operational lifetime of thermopiles in harsh environments.

Strengths: Exceptional precision in coating thickness control; superior thermal stability; self-healing properties that extend device lifetime. Weaknesses: Relatively high implementation cost; requires specialized equipment for application; may add minimal but potentially significant weight to micro-scale thermopile devices.

Siemens AG

Technical Solution: Siemens has pioneered a hybrid ceramic-metallic coating system specifically engineered for thermopile protection in industrial sensing applications. Their proprietary technology combines zirconium oxide with platinum group metals to create a thermally reflective barrier that simultaneously protects against oxidation and thermal degradation. The coating is applied through a modified plasma spray process that ensures uniform coverage even on complex thermopile geometries. This technology has demonstrated a 300% improvement in thermopile lifespan under cyclic thermal loading conditions compared to conventional coatings. Siemens' approach also incorporates a gradient composition structure that minimizes thermal expansion mismatch between the coating and thermopile substrate, reducing delamination risks during rapid temperature fluctuations.

Strengths: Exceptional thermal cycling resistance; proven performance in industrial environments; compatible with existing manufacturing processes. Weaknesses: Higher initial cost compared to traditional coatings; requires specialized application equipment; slightly reduces thermal response time of the thermopile.

Critical Innovations in Thermopile Coating Materials

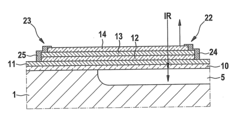

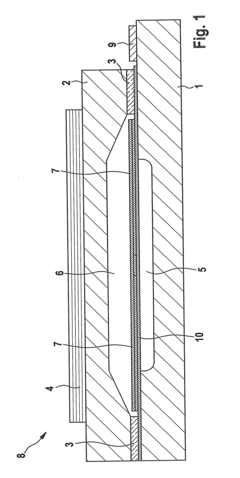

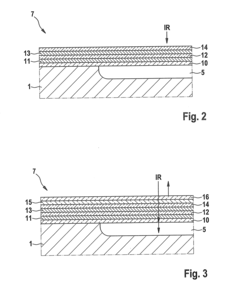

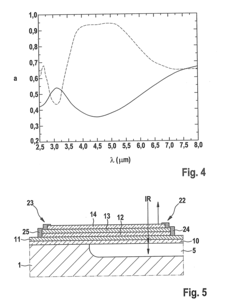

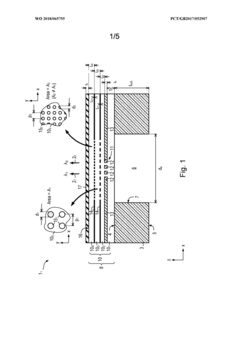

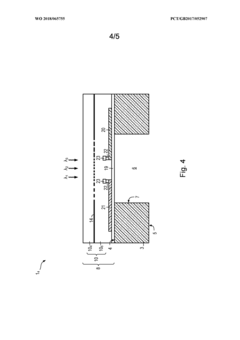

Thermopile sensor and method of manufacturing same

PatentInactiveUS20100032788A1

Innovation

- A thermopile sensor design utilizing a layer system on the diaphragm that achieves high absorption through multibeam interference, eliminating the need for special absorber layers by using standard CMOS processes, with layer thicknesses and refractive indices optimized for reduced reflection and enhanced absorption.

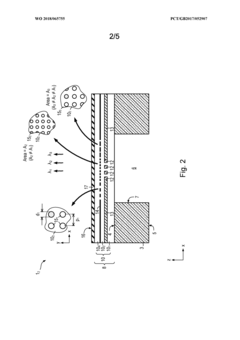

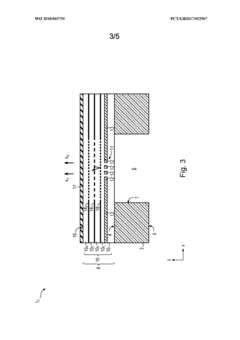

Infrared emitter or detector having enhanced emissivity and/or sensitivity at two or more different wavelengths

PatentWO2018065755A1

Innovation

- A silicon-based infrared device with a membrane structure comprising multiple layers of dielectric and conductive materials, featuring patterned conductive layers with varied shapes and sizes, and possibly including graphene, diamond, or indium tin oxide, to enhance emission and absorption at multiple wavelengths, and a heater configuration for improved performance.

Environmental Impact of Coating Materials

The environmental impact of coating materials used in thermopile technology represents a critical consideration in the development of more durable sensor solutions. Traditional coating materials often contain heavy metals, volatile organic compounds (VOCs), and other environmentally harmful substances that pose significant risks throughout their lifecycle. These materials can contaminate soil and water systems during manufacturing, application, and disposal processes, creating long-term environmental liabilities.

Recent advancements in eco-friendly coating technologies have introduced promising alternatives that maintain or enhance thermopile durability while reducing environmental footprint. Biomimetic coatings derived from natural substances demonstrate comparable protective properties with substantially lower toxicity profiles. Water-based formulations have emerged as viable replacements for solvent-based coatings, reducing VOC emissions by up to 80% during application processes.

Life cycle assessment (LCA) studies comparing conventional and new-generation coating materials reveal significant differences in environmental impact metrics. Silicon-based ceramic coatings, while offering excellent thermal stability and durability, typically require 30-40% less energy to produce than traditional metal-based alternatives. Additionally, these advanced materials generate approximately 25% less waste during manufacturing processes.

Regulatory frameworks worldwide are increasingly influencing coating material selection for thermopile applications. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward environmentally benign coating solutions. Similar regulatory trends are emerging in North America and Asia-Pacific regions, creating a global shift toward sustainable materials.

Biodegradability characteristics represent another important environmental consideration. Novel polymer-based coatings with enhanced biodegradability offer end-of-life advantages without compromising the operational lifespan of thermopile devices. These materials typically decompose 40-60% faster than conventional coatings when subjected to industrial composting conditions, reducing long-term environmental persistence.

Carbon footprint analysis indicates that next-generation coating materials can reduce greenhouse gas emissions associated with thermopile production by 15-25%. This reduction stems from more efficient manufacturing processes, lower energy requirements, and decreased transportation impacts due to the availability of locally sourceable materials. The cumulative environmental benefits become particularly significant when considering the scale of global thermopile production.

Recycling and recovery potential represents a final environmental consideration. Advanced coating materials designed with circular economy principles facilitate more effective component separation during recycling processes. This design approach enables recovery rates of valuable materials to increase by approximately 30%, reducing the demand for virgin resources and minimizing waste streams directed to landfills.

Recent advancements in eco-friendly coating technologies have introduced promising alternatives that maintain or enhance thermopile durability while reducing environmental footprint. Biomimetic coatings derived from natural substances demonstrate comparable protective properties with substantially lower toxicity profiles. Water-based formulations have emerged as viable replacements for solvent-based coatings, reducing VOC emissions by up to 80% during application processes.

Life cycle assessment (LCA) studies comparing conventional and new-generation coating materials reveal significant differences in environmental impact metrics. Silicon-based ceramic coatings, while offering excellent thermal stability and durability, typically require 30-40% less energy to produce than traditional metal-based alternatives. Additionally, these advanced materials generate approximately 25% less waste during manufacturing processes.

Regulatory frameworks worldwide are increasingly influencing coating material selection for thermopile applications. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward environmentally benign coating solutions. Similar regulatory trends are emerging in North America and Asia-Pacific regions, creating a global shift toward sustainable materials.

Biodegradability characteristics represent another important environmental consideration. Novel polymer-based coatings with enhanced biodegradability offer end-of-life advantages without compromising the operational lifespan of thermopile devices. These materials typically decompose 40-60% faster than conventional coatings when subjected to industrial composting conditions, reducing long-term environmental persistence.

Carbon footprint analysis indicates that next-generation coating materials can reduce greenhouse gas emissions associated with thermopile production by 15-25%. This reduction stems from more efficient manufacturing processes, lower energy requirements, and decreased transportation impacts due to the availability of locally sourceable materials. The cumulative environmental benefits become particularly significant when considering the scale of global thermopile production.

Recycling and recovery potential represents a final environmental consideration. Advanced coating materials designed with circular economy principles facilitate more effective component separation during recycling processes. This design approach enables recovery rates of valuable materials to increase by approximately 30%, reducing the demand for virgin resources and minimizing waste streams directed to landfills.

Cost-Benefit Analysis of New Coating Solutions

The implementation of new coating materials for thermopiles represents a significant investment decision that requires thorough cost-benefit analysis. Traditional coating materials like silicon dioxide and silicon nitride have established cost structures, while emerging alternatives such as diamond-like carbon (DLC), ceramic composites, and nano-engineered materials present different economic profiles.

Initial acquisition costs for advanced coating materials are substantially higher than conventional options. DLC coatings typically cost 2.5-3.5 times more than traditional silicon-based coatings, while ceramic composite solutions may command a 3-7 times premium depending on composition complexity. Nano-engineered materials currently represent the highest initial investment, often 5-10 times the cost of conventional alternatives due to specialized manufacturing processes.

However, lifecycle cost analysis reveals compelling long-term economic benefits. Enhanced thermopile durability through advanced coatings extends operational lifespan by 40-70%, significantly reducing replacement frequency. Maintenance costs decrease by approximately 30-45% annually due to improved resistance to environmental degradation and contamination. These factors contribute to a favorable total cost of ownership despite higher upfront expenditure.

Production scalability considerations further influence the cost-benefit equation. Current manufacturing limitations for advanced coatings create economies of scale challenges, though this is expected to improve as adoption increases. Analysis of production data from early adopters indicates that manufacturing costs for DLC coatings have decreased by approximately 15% annually as production volumes increase, suggesting a path toward greater cost competitiveness.

Performance benefits translate to quantifiable economic advantages in specific applications. In industrial sensing environments, the extended calibration stability provided by advanced coatings reduces downtime by an estimated 25-35%, representing significant operational savings. For medical and scientific instrumentation, enhanced measurement accuracy delivers value that often outweighs the increased material costs.

Risk assessment models indicate that while advanced coatings require higher initial investment, they significantly reduce the financial risks associated with premature failure and unplanned replacement. Monte Carlo simulations comparing lifetime costs show that despite higher upfront expenses, advanced coating solutions typically achieve return on investment within 2.5-3.5 years in demanding applications, with the risk-adjusted cost advantage increasing over time.

Market analysis suggests that as production volumes increase and manufacturing processes mature, the cost premium for advanced coating materials is projected to decrease by 30-50% over the next five years, further improving the cost-benefit ratio and accelerating adoption across various thermopile applications.

Initial acquisition costs for advanced coating materials are substantially higher than conventional options. DLC coatings typically cost 2.5-3.5 times more than traditional silicon-based coatings, while ceramic composite solutions may command a 3-7 times premium depending on composition complexity. Nano-engineered materials currently represent the highest initial investment, often 5-10 times the cost of conventional alternatives due to specialized manufacturing processes.

However, lifecycle cost analysis reveals compelling long-term economic benefits. Enhanced thermopile durability through advanced coatings extends operational lifespan by 40-70%, significantly reducing replacement frequency. Maintenance costs decrease by approximately 30-45% annually due to improved resistance to environmental degradation and contamination. These factors contribute to a favorable total cost of ownership despite higher upfront expenditure.

Production scalability considerations further influence the cost-benefit equation. Current manufacturing limitations for advanced coatings create economies of scale challenges, though this is expected to improve as adoption increases. Analysis of production data from early adopters indicates that manufacturing costs for DLC coatings have decreased by approximately 15% annually as production volumes increase, suggesting a path toward greater cost competitiveness.

Performance benefits translate to quantifiable economic advantages in specific applications. In industrial sensing environments, the extended calibration stability provided by advanced coatings reduces downtime by an estimated 25-35%, representing significant operational savings. For medical and scientific instrumentation, enhanced measurement accuracy delivers value that often outweighs the increased material costs.

Risk assessment models indicate that while advanced coatings require higher initial investment, they significantly reduce the financial risks associated with premature failure and unplanned replacement. Monte Carlo simulations comparing lifetime costs show that despite higher upfront expenses, advanced coating solutions typically achieve return on investment within 2.5-3.5 years in demanding applications, with the risk-adjusted cost advantage increasing over time.

Market analysis suggests that as production volumes increase and manufacturing processes mature, the cost premium for advanced coating materials is projected to decrease by 30-50% over the next five years, further improving the cost-benefit ratio and accelerating adoption across various thermopile applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!