Thermopile Vs Bolometer: Signal Detection Comparison

SEP 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Sensing Technology Background and Objectives

Thermal sensing technology has evolved significantly over the past several decades, transforming from simple temperature measurement tools to sophisticated detection systems capable of precise thermal imaging and analysis. The development trajectory began with basic thermocouples in the early 20th century, progressing through various semiconductor-based sensors in the mid-century, and culminating in today's advanced microelectromechanical systems (MEMS) thermal detectors. This evolution has been driven by increasing demands for higher sensitivity, faster response times, and greater reliability across multiple industries.

The two predominant thermal sensing technologies in current applications are thermopiles and bolometers, each representing distinct approaches to infrared radiation detection. Thermopiles, based on the Seebeck effect, generate voltage in response to temperature gradients across thermoelectric junctions. Bolometers, conversely, detect radiation through temperature-dependent electrical resistance changes in their sensing elements. These fundamental operational differences create distinct performance characteristics that make each technology suitable for specific application scenarios.

Market trends indicate a growing convergence of these technologies in consumer electronics, medical diagnostics, automotive safety systems, and industrial process monitoring. The miniaturization of thermal sensors has enabled their integration into portable devices, creating new application possibilities while simultaneously driving demands for improved performance metrics. Current research focuses on enhancing signal-to-noise ratios, reducing power consumption, and increasing detection range and accuracy.

The primary objective in comparing thermopile and bolometer technologies is to establish a comprehensive understanding of their respective signal detection capabilities across various operational parameters. This includes sensitivity thresholds, response times, noise immunity, power efficiency, and environmental stability. Such analysis aims to identify optimal deployment scenarios for each technology and potential hybridization opportunities that leverage the strengths of both approaches.

Technical challenges in thermal sensing currently center on improving detection accuracy in variable ambient conditions, reducing cross-sensitivity to non-thermal stimuli, and maintaining calibration stability over extended operational periods. Additionally, researchers are exploring novel materials and fabrication techniques to enhance thermal isolation, increase absorption efficiency, and reduce manufacturing costs while maintaining or improving performance characteristics.

The global landscape of thermal sensing technology development shows concentrated innovation clusters in North America, Europe, and East Asia, with specialized research centers focusing on different aspects of the technology. This geographical distribution has created diverse approaches to solving common technical challenges, resulting in a rich ecosystem of complementary innovations that collectively advance the field.

The two predominant thermal sensing technologies in current applications are thermopiles and bolometers, each representing distinct approaches to infrared radiation detection. Thermopiles, based on the Seebeck effect, generate voltage in response to temperature gradients across thermoelectric junctions. Bolometers, conversely, detect radiation through temperature-dependent electrical resistance changes in their sensing elements. These fundamental operational differences create distinct performance characteristics that make each technology suitable for specific application scenarios.

Market trends indicate a growing convergence of these technologies in consumer electronics, medical diagnostics, automotive safety systems, and industrial process monitoring. The miniaturization of thermal sensors has enabled their integration into portable devices, creating new application possibilities while simultaneously driving demands for improved performance metrics. Current research focuses on enhancing signal-to-noise ratios, reducing power consumption, and increasing detection range and accuracy.

The primary objective in comparing thermopile and bolometer technologies is to establish a comprehensive understanding of their respective signal detection capabilities across various operational parameters. This includes sensitivity thresholds, response times, noise immunity, power efficiency, and environmental stability. Such analysis aims to identify optimal deployment scenarios for each technology and potential hybridization opportunities that leverage the strengths of both approaches.

Technical challenges in thermal sensing currently center on improving detection accuracy in variable ambient conditions, reducing cross-sensitivity to non-thermal stimuli, and maintaining calibration stability over extended operational periods. Additionally, researchers are exploring novel materials and fabrication techniques to enhance thermal isolation, increase absorption efficiency, and reduce manufacturing costs while maintaining or improving performance characteristics.

The global landscape of thermal sensing technology development shows concentrated innovation clusters in North America, Europe, and East Asia, with specialized research centers focusing on different aspects of the technology. This geographical distribution has created diverse approaches to solving common technical challenges, resulting in a rich ecosystem of complementary innovations that collectively advance the field.

Market Applications and Demand Analysis

The thermal sensing market has witnessed substantial growth in recent years, driven by increasing applications across multiple industries. The global thermal imaging market, which encompasses both thermopile and bolometer technologies, was valued at approximately $3.8 billion in 2022 and is projected to reach $5.6 billion by 2027, growing at a CAGR of 8.2%. This growth trajectory underscores the expanding demand for thermal detection technologies across various sectors.

In the consumer electronics segment, both thermopile and bolometer sensors have found significant applications, particularly in smartphones for temperature measurement and thermal imaging capabilities. The COVID-19 pandemic accelerated this trend, with thermal scanning becoming essential for public health screening. Thermopiles, being more cost-effective and energy-efficient, have dominated the non-contact thermometer market, which experienced a 300% growth during the pandemic period.

The automotive industry represents another major market for these technologies. Advanced Driver Assistance Systems (ADAS) and autonomous vehicles increasingly rely on thermal sensors for enhanced night vision and pedestrian detection. Bolometers, with their superior image resolution and sensitivity, are preferred in high-end automotive applications where detailed thermal imaging is critical. Market analysis indicates that approximately 35% of premium vehicles now incorporate some form of thermal sensing technology.

Industrial applications constitute a substantial market segment, with predictive maintenance in manufacturing facilities driving adoption. The industrial IoT market, where thermal sensors play a crucial role in equipment monitoring, is expected to grow at 22% annually through 2026. Thermopiles are widely deployed in industrial settings due to their robustness and lower cost, while bolometers are preferred for applications requiring higher thermal resolution.

Healthcare applications represent a rapidly expanding market for both technologies. Beyond the obvious application in clinical thermometers, thermal imaging is increasingly used for diagnostic purposes, vascular monitoring, and inflammation detection. The medical thermal imaging market segment is growing at approximately 6.8% annually, with bolometers gaining market share due to their superior resolution capabilities essential for medical diagnostics.

Building automation and energy management systems represent an emerging application area, with thermal sensors being deployed for occupancy detection, HVAC optimization, and energy efficiency monitoring. This market segment is projected to grow at 12% annually, with thermopiles currently dominating due to their cost-effectiveness and sufficient performance characteristics for most building applications.

Regional analysis reveals that North America currently leads in adoption of high-end bolometer technology, while Asia-Pacific shows the fastest growth rate in thermopile applications, particularly in consumer electronics and industrial sectors. Europe demonstrates balanced adoption across both technologies, with strong growth in automotive and healthcare applications.

In the consumer electronics segment, both thermopile and bolometer sensors have found significant applications, particularly in smartphones for temperature measurement and thermal imaging capabilities. The COVID-19 pandemic accelerated this trend, with thermal scanning becoming essential for public health screening. Thermopiles, being more cost-effective and energy-efficient, have dominated the non-contact thermometer market, which experienced a 300% growth during the pandemic period.

The automotive industry represents another major market for these technologies. Advanced Driver Assistance Systems (ADAS) and autonomous vehicles increasingly rely on thermal sensors for enhanced night vision and pedestrian detection. Bolometers, with their superior image resolution and sensitivity, are preferred in high-end automotive applications where detailed thermal imaging is critical. Market analysis indicates that approximately 35% of premium vehicles now incorporate some form of thermal sensing technology.

Industrial applications constitute a substantial market segment, with predictive maintenance in manufacturing facilities driving adoption. The industrial IoT market, where thermal sensors play a crucial role in equipment monitoring, is expected to grow at 22% annually through 2026. Thermopiles are widely deployed in industrial settings due to their robustness and lower cost, while bolometers are preferred for applications requiring higher thermal resolution.

Healthcare applications represent a rapidly expanding market for both technologies. Beyond the obvious application in clinical thermometers, thermal imaging is increasingly used for diagnostic purposes, vascular monitoring, and inflammation detection. The medical thermal imaging market segment is growing at approximately 6.8% annually, with bolometers gaining market share due to their superior resolution capabilities essential for medical diagnostics.

Building automation and energy management systems represent an emerging application area, with thermal sensors being deployed for occupancy detection, HVAC optimization, and energy efficiency monitoring. This market segment is projected to grow at 12% annually, with thermopiles currently dominating due to their cost-effectiveness and sufficient performance characteristics for most building applications.

Regional analysis reveals that North America currently leads in adoption of high-end bolometer technology, while Asia-Pacific shows the fastest growth rate in thermopile applications, particularly in consumer electronics and industrial sectors. Europe demonstrates balanced adoption across both technologies, with strong growth in automotive and healthcare applications.

Current State and Challenges in Thermal Detection

Thermal detection technology has evolved significantly over the past decades, with thermopiles and bolometers emerging as two dominant technologies in the field. Currently, both technologies coexist in the market, each with distinct advantages and limitations that make them suitable for different applications. The global thermal detection market was valued at approximately $8.3 billion in 2022 and is projected to reach $12.7 billion by 2027, indicating substantial growth potential.

Thermopile technology, based on the Seebeck effect, has reached maturity with established manufacturing processes. Modern thermopiles typically offer response times in the 10-30ms range and can detect temperature differences as small as 0.1°C. They operate without requiring external power for the sensing element itself, which represents a significant advantage in power-constrained applications. However, they face challenges in miniaturization while maintaining sensitivity, as reducing junction numbers directly impacts signal strength.

Bolometers, conversely, have seen remarkable advancements in recent years, particularly in microbolometer arrays for imaging applications. Current state-of-the-art uncooled bolometers achieve noise equivalent temperature differences (NETD) of approximately 30-50mK, with some research prototypes pushing below 20mK. Their integration with CMOS technology has enabled high-density pixel arrays, though this comes with increased power consumption compared to thermopiles.

A significant challenge in thermal detection is the signal-to-noise ratio (SNR), especially in environments with fluctuating ambient temperatures. Both technologies struggle with thermal drift, requiring sophisticated compensation algorithms. Thermopiles generally exhibit better long-term stability but lower sensitivity, while bolometers offer higher sensitivity but require more complex readout circuitry and calibration.

Manufacturing scalability presents another challenge, particularly for bolometers which require specialized vacuum packaging to achieve optimal performance. This contributes to higher production costs compared to thermopiles, though economies of scale are gradually reducing this gap as thermal imaging applications become more widespread in consumer electronics.

Power efficiency remains a critical consideration, especially for battery-operated devices. While thermopiles have an inherent advantage in passive sensing, advances in low-power CMOS circuits have improved bolometer efficiency. Current research focuses on novel materials and structures to further reduce power consumption while maintaining or improving detection performance.

Resolution limitations persist in both technologies, with pixel size reduction efforts ongoing. The smallest commercial thermopile arrays currently achieve pixel pitches of approximately 80-100μm, while microbolometer arrays have reached 12-17μm pixel pitches in production devices, with research prototypes demonstrating sub-10μm capabilities.

Thermopile technology, based on the Seebeck effect, has reached maturity with established manufacturing processes. Modern thermopiles typically offer response times in the 10-30ms range and can detect temperature differences as small as 0.1°C. They operate without requiring external power for the sensing element itself, which represents a significant advantage in power-constrained applications. However, they face challenges in miniaturization while maintaining sensitivity, as reducing junction numbers directly impacts signal strength.

Bolometers, conversely, have seen remarkable advancements in recent years, particularly in microbolometer arrays for imaging applications. Current state-of-the-art uncooled bolometers achieve noise equivalent temperature differences (NETD) of approximately 30-50mK, with some research prototypes pushing below 20mK. Their integration with CMOS technology has enabled high-density pixel arrays, though this comes with increased power consumption compared to thermopiles.

A significant challenge in thermal detection is the signal-to-noise ratio (SNR), especially in environments with fluctuating ambient temperatures. Both technologies struggle with thermal drift, requiring sophisticated compensation algorithms. Thermopiles generally exhibit better long-term stability but lower sensitivity, while bolometers offer higher sensitivity but require more complex readout circuitry and calibration.

Manufacturing scalability presents another challenge, particularly for bolometers which require specialized vacuum packaging to achieve optimal performance. This contributes to higher production costs compared to thermopiles, though economies of scale are gradually reducing this gap as thermal imaging applications become more widespread in consumer electronics.

Power efficiency remains a critical consideration, especially for battery-operated devices. While thermopiles have an inherent advantage in passive sensing, advances in low-power CMOS circuits have improved bolometer efficiency. Current research focuses on novel materials and structures to further reduce power consumption while maintaining or improving detection performance.

Resolution limitations persist in both technologies, with pixel size reduction efforts ongoing. The smallest commercial thermopile arrays currently achieve pixel pitches of approximately 80-100μm, while microbolometer arrays have reached 12-17μm pixel pitches in production devices, with research prototypes demonstrating sub-10μm capabilities.

Technical Comparison of Thermopile and Bolometer Solutions

01 Thermopile signal detection techniques

Thermopile sensors are used for detecting thermal radiation by converting temperature differences into electrical signals. Advanced signal detection techniques for thermopiles include specialized amplification circuits, noise reduction methods, and signal processing algorithms that enhance sensitivity and accuracy. These techniques enable thermopiles to detect minute temperature variations and improve overall performance in various applications such as infrared sensing and thermal imaging.- Thermopile signal detection techniques: Thermopile sensors detect thermal radiation by converting temperature differences into electrical signals. Advanced signal detection techniques for thermopiles include specialized amplification circuits, noise reduction methods, and signal processing algorithms that enhance sensitivity and accuracy. These techniques often involve differential measurement approaches to compensate for ambient temperature variations and improve the signal-to-noise ratio in thermal sensing applications.

- Bolometer-based detection systems: Bolometers measure radiation by detecting temperature changes in a material with temperature-dependent electrical resistance. Signal detection in bolometer systems involves specialized readout integrated circuits (ROICs), temperature compensation mechanisms, and calibration techniques. These systems often incorporate microelectromechanical systems (MEMS) technology to achieve higher sensitivity and faster response times for applications in infrared imaging and spectroscopy.

- Integrated sensor array architectures: Advanced architectures integrate multiple thermopile or bolometer elements into sensor arrays for enhanced detection capabilities. These designs incorporate multiplexing circuits, addressing schemes, and parallel readout mechanisms to efficiently process signals from multiple sensing elements simultaneously. Such architectures enable higher spatial resolution in thermal imaging applications while maintaining signal integrity through optimized layout and isolation techniques.

- Signal processing and noise reduction methods: Specialized signal processing techniques are employed to enhance the detection capabilities of thermopile and bolometer sensors. These methods include digital filtering algorithms, lock-in amplification, chopper stabilization, and adaptive noise cancellation. Advanced signal conditioning circuits and computational approaches help extract weak thermal signals from background noise, improving detection limits and measurement accuracy in various environmental conditions.

- Calibration and temperature compensation techniques: Accurate thermal signal detection requires sophisticated calibration and temperature compensation techniques to account for ambient temperature variations and sensor drift. These approaches include reference channel measurements, dynamic offset correction, and temperature-dependent gain adjustment algorithms. Self-calibration mechanisms and thermal stabilization techniques ensure measurement consistency and reliability across varying operating conditions and over extended periods of use.

02 Bolometer signal processing methods

Bolometers measure incident electromagnetic radiation through changes in electrical resistance. Signal processing methods for bolometers include temperature compensation techniques, readout integrated circuits (ROIC), and digital signal processing algorithms. These methods help to enhance signal-to-noise ratio, improve thermal response time, and increase detection accuracy in applications such as infrared imaging and spectroscopy.Expand Specific Solutions03 Integrated sensor arrays with signal detection

Integrated sensor arrays combine multiple thermopile or bolometer elements with signal detection circuitry on a single substrate. These arrays feature multiplexing techniques, on-chip signal conditioning, and advanced readout architectures to process signals from multiple sensing elements simultaneously. The integration enhances spatial resolution, reduces power consumption, and enables more compact thermal imaging systems for various applications.Expand Specific Solutions04 Noise reduction in thermal sensor signal detection

Noise reduction techniques are critical for improving the performance of thermopile and bolometer signal detection systems. These techniques include chopper stabilization, correlated double sampling, low-noise amplifiers, and digital filtering algorithms. By minimizing thermal noise, 1/f noise, and other interference sources, these methods significantly enhance the signal-to-noise ratio and detection sensitivity of thermal sensors.Expand Specific Solutions05 Calibration methods for thermal sensor signal detection

Calibration methods ensure accurate and reliable signal detection in thermopile and bolometer systems. These methods include temperature compensation algorithms, reference signal comparison, auto-zeroing techniques, and gain adjustment procedures. Proper calibration accounts for environmental variations, sensor drift, and manufacturing inconsistencies, resulting in more precise thermal measurements across different operating conditions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The thermopile versus bolometer signal detection market is currently in a growth phase, with increasing applications in thermal imaging, IoT sensors, and consumer electronics driving expansion. The global market is estimated to reach $1.5 billion by 2025, with a CAGR of approximately 8%. Technology maturity varies between the two approaches, with thermopiles being more established while bolometers offer higher sensitivity advantages. Key industry players demonstrate diverse technological approaches: STMicroelectronics and Texas Instruments lead in commercial thermopile solutions, while Raytheon and Northrop Grumman focus on high-performance bolometer technologies for specialized applications. Asian manufacturers like Seiko Epson and KEYENCE are rapidly advancing cost-effective solutions, while research partnerships between companies like Robert Bosch and academic institutions are accelerating innovation in both technologies.

Stmicroelectronics Srl

Technical Solution: STMicroelectronics has pioneered thermopile sensor technology with their MEMS-based infrared sensors that feature silicon thermopile arrays with high sensitivity and fast response times. Their thermopile solutions utilize a silicon-based membrane structure with thermocouples arranged in series to maximize output voltage per incident radiation. ST's thermopile sensors incorporate vacuum packaging technology to minimize thermal conductance losses and improve detection capabilities. The company has developed specialized signal processing algorithms that enhance temperature measurement accuracy to ±0.1°C in their high-end models. ST's thermopile technology features built-in temperature compensation and digital interfaces (I2C/SPI), allowing for easy integration into various systems. Their latest generation sensors achieve response times of approximately 30ms while maintaining power consumption below 100μW during active operation.

Strengths: Excellent thermal stability with minimal drift over time; inherently radiation-hard and resistant to mechanical shock; compact form factor allowing integration into space-constrained applications. Weaknesses: Limited spectral response range compared to some bolometer technologies; typically requires more complex signal conditioning circuitry to achieve highest performance levels.

Maxim Integrated Products LLC

Technical Solution: Maxim Integrated has developed specialized thermopile sensor technology optimized for medical and industrial temperature measurement applications. Their thermopile solutions feature silicon-based thermopile arrays with integrated thermistors for cold junction compensation, achieving measurement accuracy of ±0.1°C in controlled environments. Maxim's proprietary packaging technology creates a sealed thermal environment that minimizes drift and improves long-term stability. Their sensors incorporate specialized optical filters to optimize spectral response in the 5-14μm wavelength range, ideal for human body temperature measurement. Maxim has implemented advanced signal processing algorithms that perform real-time compensation for ambient temperature variations and emissivity differences. Their thermopile technology features ultra-low power consumption (below 100μW in active mode) with fast wake-up times under 10ms from sleep mode. Maxim's latest generation thermopile sensors include factory calibration and digital interfaces that simplify integration into portable medical devices.

Strengths: Extremely low power consumption ideal for battery-powered medical devices; excellent long-term stability with minimal drift; inherently self-powered operation requiring no bias current. Weaknesses: Lower sensitivity than bolometers for detecting very small temperature gradients; typically slower response time compared to some bolometer technologies.

Core Detection Principles and Signal Processing Methods

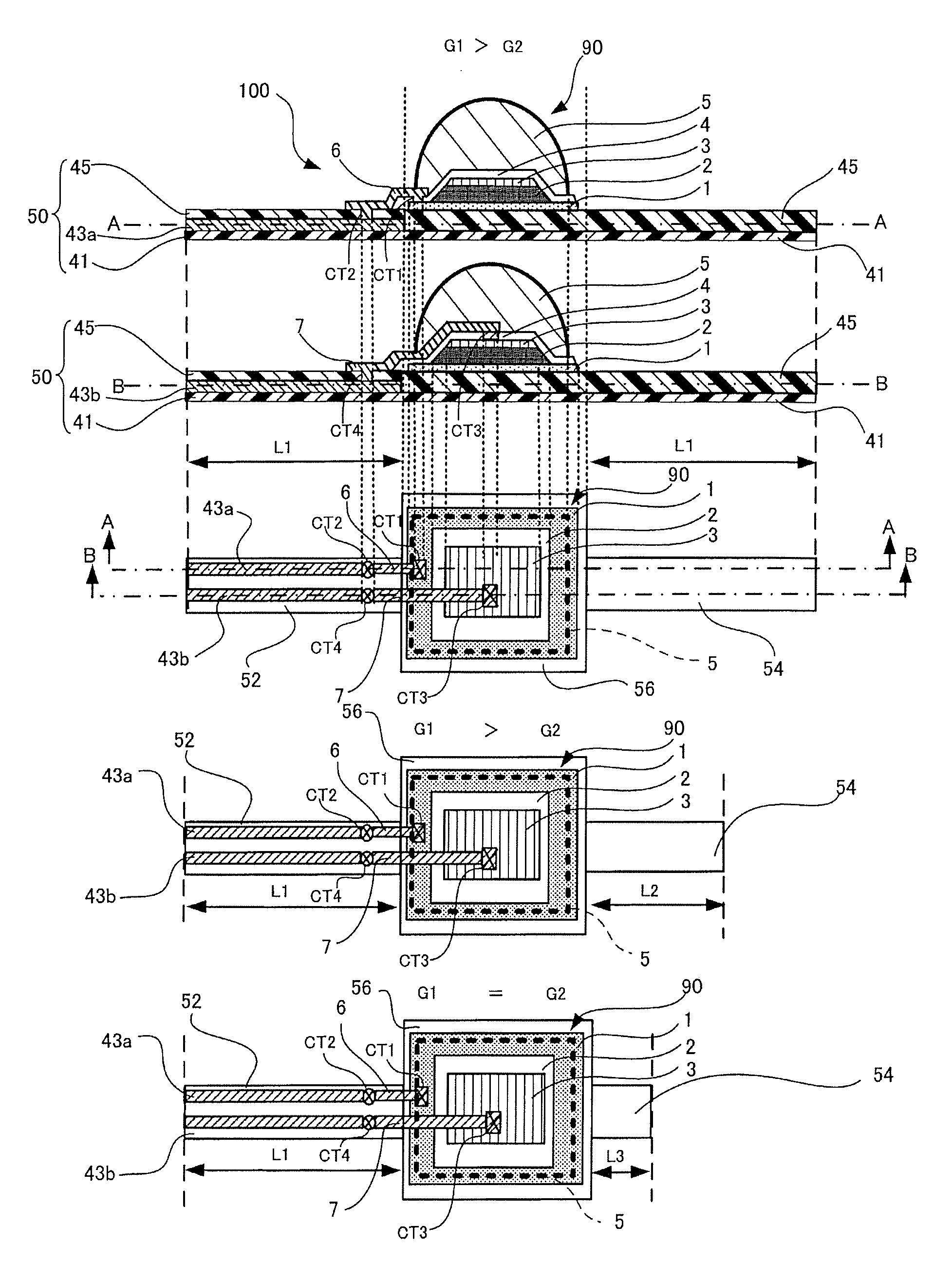

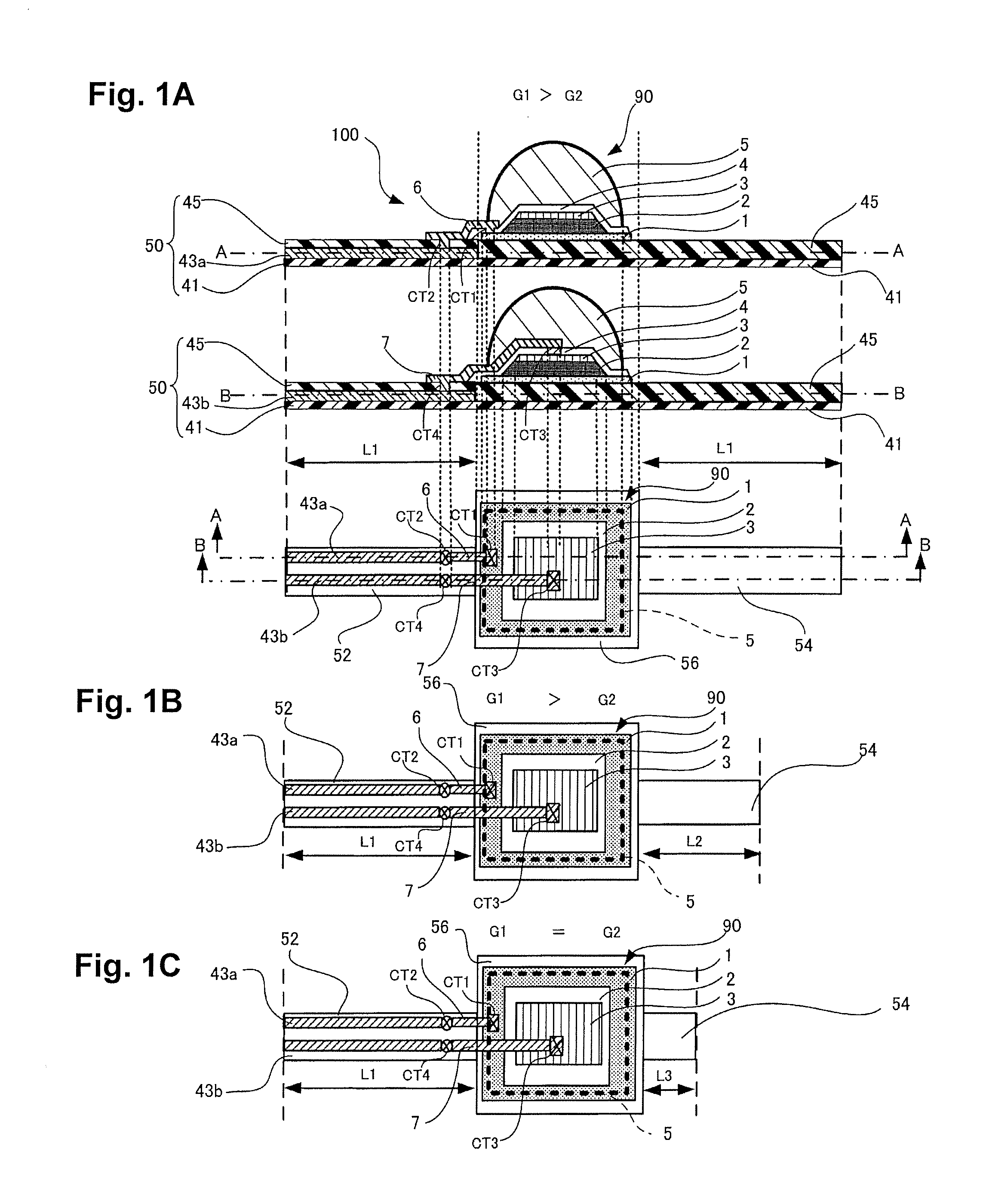

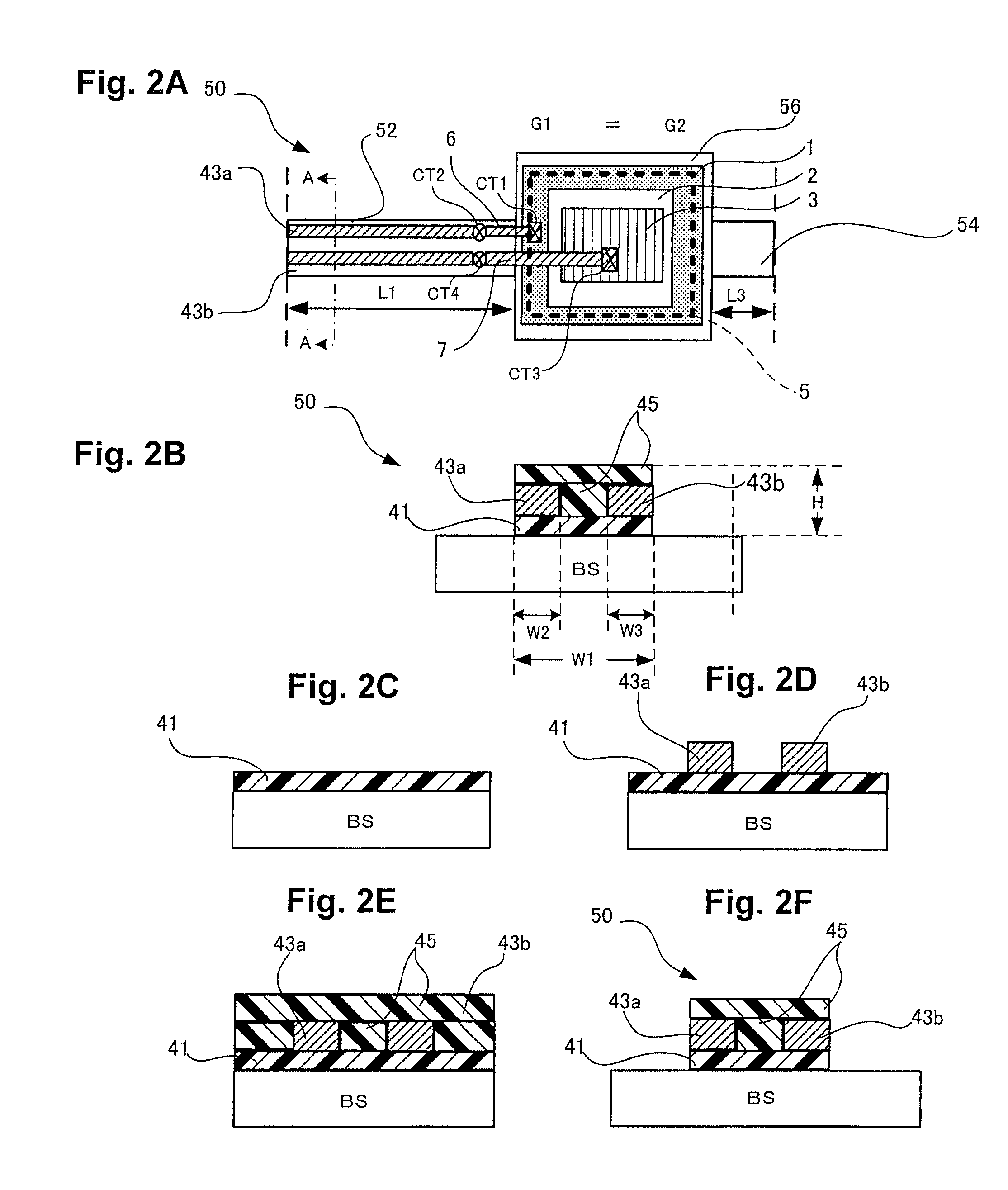

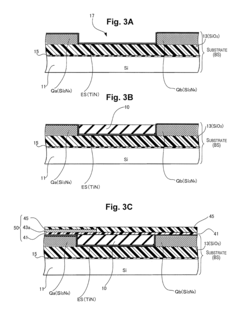

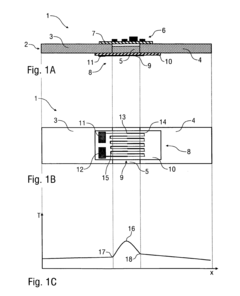

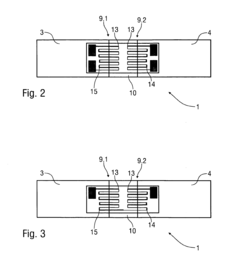

Thermal detector, thermal detector device, and electronic instrument

PatentInactiveUS20110272581A1

Innovation

- A thermal detector design featuring asymmetrical arm lengths with a double-supported structure, where the second arm is shorter than the first, and asymmetrical in thermal conductance, reducing the occupied surface area and enhancing mechanical stability by utilizing a plurality of wirings on the first arm and insulating materials on the second, thereby maintaining thermal design focus on the first arm.

Electronic component, in particular current sensor

PatentActiveUS20160154035A1

Innovation

- A current sensor that measures the temperature difference between the resistance element and connection parts using thermoelements, generating a thermoelectric voltage to derive the electrical current, with a thermopile arrangement that allows for low heat transfer resistance and optional evaluation of temporal changes in temperature difference for slower response times, and integrates with a voltage measurement unit for redundant current measurement.

Cost-Performance Analysis and Manufacturing Considerations

When comparing thermopile and bolometer technologies for signal detection applications, cost-performance considerations play a crucial role in technology selection and implementation strategies. Thermopile sensors generally offer a more favorable initial cost structure, with typical unit prices ranging from $5-15 for standard commercial components, compared to bolometers which often start at $20-30 for basic models and can exceed $100 for high-performance variants.

Manufacturing processes significantly impact these cost differentials. Thermopiles utilize relatively straightforward production techniques involving thermocouple junctions on silicon substrates, enabling higher production yields and lower manufacturing complexity. The simpler architecture translates to fewer critical failure points during fabrication. Conversely, bolometer manufacturing requires more sophisticated micromachining processes, including the precise deposition of temperature-sensitive resistive materials and often necessitates vacuum packaging to achieve optimal performance.

Scale economies present different trajectories for these technologies. Thermopile production benefits from established manufacturing infrastructure, with incremental cost reductions of approximately 8-12% annually as production volumes increase. Bolometer technologies, while initially more expensive, have demonstrated steeper cost reduction curves of 15-20% annually as manufacturing techniques mature and volumes increase, suggesting potential cost convergence in specific application segments over the next 3-5 years.

Performance-to-cost ratios reveal interesting trade-offs. Thermopiles deliver superior cost efficiency in applications requiring moderate temperature resolution (typically >0.1°C) and response times in the 10-30ms range. For applications demanding higher sensitivity and faster response times, bolometers provide better value despite higher initial costs, particularly when considering the total system cost including signal processing requirements.

Maintenance and operational expenses further differentiate these technologies. Thermopiles typically offer longer operational lifespans (often exceeding 10 years) with minimal drift characteristics, reducing recalibration and replacement costs. Bolometers may require more frequent recalibration and can have shorter effective lifespans in certain environmental conditions, potentially increasing the total cost of ownership despite superior performance specifications.

Integration costs also factor significantly into the equation. Thermopiles generally require simpler interface electronics and less sophisticated signal processing, reducing system-level implementation expenses. Bolometers often necessitate more complex readout integrated circuits (ROICs) and temperature stabilization mechanisms, adding 30-50% to the overall system implementation cost compared to equivalent thermopile-based solutions.

Manufacturing processes significantly impact these cost differentials. Thermopiles utilize relatively straightforward production techniques involving thermocouple junctions on silicon substrates, enabling higher production yields and lower manufacturing complexity. The simpler architecture translates to fewer critical failure points during fabrication. Conversely, bolometer manufacturing requires more sophisticated micromachining processes, including the precise deposition of temperature-sensitive resistive materials and often necessitates vacuum packaging to achieve optimal performance.

Scale economies present different trajectories for these technologies. Thermopile production benefits from established manufacturing infrastructure, with incremental cost reductions of approximately 8-12% annually as production volumes increase. Bolometer technologies, while initially more expensive, have demonstrated steeper cost reduction curves of 15-20% annually as manufacturing techniques mature and volumes increase, suggesting potential cost convergence in specific application segments over the next 3-5 years.

Performance-to-cost ratios reveal interesting trade-offs. Thermopiles deliver superior cost efficiency in applications requiring moderate temperature resolution (typically >0.1°C) and response times in the 10-30ms range. For applications demanding higher sensitivity and faster response times, bolometers provide better value despite higher initial costs, particularly when considering the total system cost including signal processing requirements.

Maintenance and operational expenses further differentiate these technologies. Thermopiles typically offer longer operational lifespans (often exceeding 10 years) with minimal drift characteristics, reducing recalibration and replacement costs. Bolometers may require more frequent recalibration and can have shorter effective lifespans in certain environmental conditions, potentially increasing the total cost of ownership despite superior performance specifications.

Integration costs also factor significantly into the equation. Thermopiles generally require simpler interface electronics and less sophisticated signal processing, reducing system-level implementation expenses. Bolometers often necessitate more complex readout integrated circuits (ROICs) and temperature stabilization mechanisms, adding 30-50% to the overall system implementation cost compared to equivalent thermopile-based solutions.

Integration Challenges and System Design Implications

The integration of thermopile and bolometer sensors into larger systems presents distinct challenges that significantly impact overall system design. Thermopiles, with their self-generating voltage output, offer simpler integration pathways but require careful consideration of thermal isolation to maintain reference junction stability. This necessitates specialized packaging solutions that can add complexity to the manufacturing process while increasing costs.

Bolometers, conversely, demand more sophisticated readout circuitry due to their resistance-based measurement principle. This typically includes constant current sources, Wheatstone bridge configurations, and high-precision amplification stages. The additional circuitry increases power consumption and introduces potential noise sources that must be carefully managed through proper PCB layout and shielding techniques.

Thermal management represents a critical integration challenge for both technologies. Bolometers are particularly sensitive to ambient temperature fluctuations, requiring advanced temperature compensation algorithms or reference elements to maintain measurement accuracy. Thermopiles, while inherently differential in nature, still benefit from stable thermal environments to optimize signal-to-noise ratios.

Form factor considerations vary significantly between the technologies. Thermopiles typically require larger packages to accommodate their junction arrays and maintain thermal gradients. Bolometers can be fabricated using MEMS techniques, enabling smaller footprints but introducing compatibility issues with standard semiconductor processes. These physical constraints directly influence system miniaturization capabilities and application suitability.

Power budget allocation presents another key design implication. Thermopiles operate with minimal power requirements, making them ideal for battery-operated devices. Bolometers, with their need for bias currents and supporting electronics, impose greater demands on power supplies. System designers must carefully balance detection performance against power efficiency, particularly in portable or remote sensing applications.

Signal processing requirements differ substantially between the technologies. Bolometers typically produce higher noise outputs necessitating more sophisticated filtering and amplification. Thermopiles generate cleaner signals but at lower voltage levels, requiring careful amplification to preserve signal integrity. These differences impact microcontroller selection, ADC requirements, and overall system complexity.

Ultimately, the choice between thermopile and bolometer technology creates cascading effects throughout the system design process. Designers must consider not only the immediate sensor interface but also the broader implications for power management, thermal design, mechanical integration, and signal processing architecture to optimize system performance for specific application requirements.

Bolometers, conversely, demand more sophisticated readout circuitry due to their resistance-based measurement principle. This typically includes constant current sources, Wheatstone bridge configurations, and high-precision amplification stages. The additional circuitry increases power consumption and introduces potential noise sources that must be carefully managed through proper PCB layout and shielding techniques.

Thermal management represents a critical integration challenge for both technologies. Bolometers are particularly sensitive to ambient temperature fluctuations, requiring advanced temperature compensation algorithms or reference elements to maintain measurement accuracy. Thermopiles, while inherently differential in nature, still benefit from stable thermal environments to optimize signal-to-noise ratios.

Form factor considerations vary significantly between the technologies. Thermopiles typically require larger packages to accommodate their junction arrays and maintain thermal gradients. Bolometers can be fabricated using MEMS techniques, enabling smaller footprints but introducing compatibility issues with standard semiconductor processes. These physical constraints directly influence system miniaturization capabilities and application suitability.

Power budget allocation presents another key design implication. Thermopiles operate with minimal power requirements, making them ideal for battery-operated devices. Bolometers, with their need for bias currents and supporting electronics, impose greater demands on power supplies. System designers must carefully balance detection performance against power efficiency, particularly in portable or remote sensing applications.

Signal processing requirements differ substantially between the technologies. Bolometers typically produce higher noise outputs necessitating more sophisticated filtering and amplification. Thermopiles generate cleaner signals but at lower voltage levels, requiring careful amplification to preserve signal integrity. These differences impact microcontroller selection, ADC requirements, and overall system complexity.

Ultimately, the choice between thermopile and bolometer technology creates cascading effects throughout the system design process. Designers must consider not only the immediate sensor interface but also the broader implications for power management, thermal design, mechanical integration, and signal processing architecture to optimize system performance for specific application requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!