Thermopile vs Semiconductor Sensors: Energy Efficiency Faceoff

SEP 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Sensing Technology Background and Objectives

Thermal sensing technology has evolved significantly over the past several decades, transitioning from basic thermocouples to sophisticated semiconductor and thermopile sensors. The journey began in the early 20th century with rudimentary temperature measurement devices and has now reached a point where thermal sensors are integral components in numerous applications ranging from industrial process control to consumer electronics and medical diagnostics.

The evolution of thermal sensing technology has been driven by increasing demands for higher accuracy, faster response times, lower power consumption, and miniaturization. Traditional thermal sensing methods often suffered from limitations in sensitivity, response time, and energy efficiency. These constraints prompted continuous innovation in the field, leading to the development of various sensor types including resistance temperature detectors (RTDs), thermistors, thermocouples, thermopiles, and semiconductor-based sensors.

Thermopile sensors, which operate based on the Seebeck effect, have been widely adopted for their ability to measure temperature without direct contact. These sensors generate voltage proportional to temperature differences and have traditionally been valued for their passive operation and reliability. In parallel, semiconductor-based thermal sensors have emerged as powerful alternatives, leveraging advances in microelectronics to offer high precision and integration capabilities.

The current technological landscape presents a critical comparison between thermopile and semiconductor sensors, particularly regarding their energy efficiency profiles. This comparison is increasingly relevant as industries worldwide prioritize sustainability and energy conservation. The fundamental differences in operating principles between these technologies create distinct advantages and limitations that impact their suitability for various applications.

The primary objective of this technical research is to conduct a comprehensive analysis of thermopile and semiconductor thermal sensing technologies with a specific focus on their energy efficiency characteristics. This investigation aims to identify which technology offers superior performance in terms of power consumption across different operating conditions and application scenarios.

Additionally, this research seeks to map the technological trajectory of both sensor types, identifying emerging innovations that may further enhance their energy efficiency profiles. By understanding the current state and future potential of these technologies, organizations can make informed decisions about sensor selection for their specific applications, balancing performance requirements with energy conservation goals.

The findings from this research will provide valuable insights for product developers, system designers, and technology strategists seeking to optimize thermal sensing solutions in an increasingly energy-conscious market environment. Furthermore, this analysis will help identify potential research and development opportunities to address existing limitations in both technologies.

The evolution of thermal sensing technology has been driven by increasing demands for higher accuracy, faster response times, lower power consumption, and miniaturization. Traditional thermal sensing methods often suffered from limitations in sensitivity, response time, and energy efficiency. These constraints prompted continuous innovation in the field, leading to the development of various sensor types including resistance temperature detectors (RTDs), thermistors, thermocouples, thermopiles, and semiconductor-based sensors.

Thermopile sensors, which operate based on the Seebeck effect, have been widely adopted for their ability to measure temperature without direct contact. These sensors generate voltage proportional to temperature differences and have traditionally been valued for their passive operation and reliability. In parallel, semiconductor-based thermal sensors have emerged as powerful alternatives, leveraging advances in microelectronics to offer high precision and integration capabilities.

The current technological landscape presents a critical comparison between thermopile and semiconductor sensors, particularly regarding their energy efficiency profiles. This comparison is increasingly relevant as industries worldwide prioritize sustainability and energy conservation. The fundamental differences in operating principles between these technologies create distinct advantages and limitations that impact their suitability for various applications.

The primary objective of this technical research is to conduct a comprehensive analysis of thermopile and semiconductor thermal sensing technologies with a specific focus on their energy efficiency characteristics. This investigation aims to identify which technology offers superior performance in terms of power consumption across different operating conditions and application scenarios.

Additionally, this research seeks to map the technological trajectory of both sensor types, identifying emerging innovations that may further enhance their energy efficiency profiles. By understanding the current state and future potential of these technologies, organizations can make informed decisions about sensor selection for their specific applications, balancing performance requirements with energy conservation goals.

The findings from this research will provide valuable insights for product developers, system designers, and technology strategists seeking to optimize thermal sensing solutions in an increasingly energy-conscious market environment. Furthermore, this analysis will help identify potential research and development opportunities to address existing limitations in both technologies.

Market Demand Analysis for Energy-Efficient Sensors

The global market for energy-efficient sensors is experiencing robust growth, driven by increasing awareness of energy conservation and sustainability across industries. The demand for sensors that can provide accurate measurements while consuming minimal power has surged significantly in recent years. This trend is particularly evident in the comparison between thermopile and semiconductor sensors, where energy efficiency has become a critical differentiating factor.

Consumer electronics represent one of the largest market segments for energy-efficient sensors, with smartphones, wearables, and smart home devices incorporating temperature sensing capabilities that must operate on limited battery power. According to market research, the global temperature sensor market is projected to reach $8.8 billion by 2027, with energy-efficient variants capturing an increasing share of this growth.

Industrial automation and process control industries are rapidly adopting energy-efficient sensors to reduce operational costs and meet sustainability goals. These sectors value sensors that can operate continuously for extended periods without requiring frequent maintenance or battery replacement. The industrial IoT movement has further accelerated this demand, as remote sensing applications require sensors with minimal power consumption to ensure long-term deployment viability.

Healthcare and medical devices constitute another significant market driver, where portable diagnostic equipment and patient monitoring systems benefit from sensors that extend battery life while maintaining measurement accuracy. The COVID-19 pandemic has accelerated this trend, with non-contact temperature measurement devices seeing unprecedented demand growth of over 300% during 2020-2021.

Automotive applications represent an emerging high-growth segment, particularly with the rise of electric vehicles where energy efficiency is paramount. Temperature sensors for battery management systems must deliver precise measurements while minimizing power drain on the vehicle's electrical system. The automotive sensor market is expected to grow at a CAGR of 6.3% through 2026, with energy efficiency being a key selection criterion.

Building automation systems are increasingly incorporating energy-efficient sensors as part of smart building initiatives and green building certifications. These systems require distributed sensor networks that can operate for years without maintenance, making power consumption a critical consideration in sensor selection.

Regional analysis indicates that Asia-Pacific currently leads the market demand for energy-efficient sensors, driven by manufacturing growth in China, Japan, and South Korea. North America follows closely, with strong demand from technology and healthcare sectors, while Europe shows accelerating adoption rates due to stringent energy efficiency regulations and sustainability initiatives.

Consumer electronics represent one of the largest market segments for energy-efficient sensors, with smartphones, wearables, and smart home devices incorporating temperature sensing capabilities that must operate on limited battery power. According to market research, the global temperature sensor market is projected to reach $8.8 billion by 2027, with energy-efficient variants capturing an increasing share of this growth.

Industrial automation and process control industries are rapidly adopting energy-efficient sensors to reduce operational costs and meet sustainability goals. These sectors value sensors that can operate continuously for extended periods without requiring frequent maintenance or battery replacement. The industrial IoT movement has further accelerated this demand, as remote sensing applications require sensors with minimal power consumption to ensure long-term deployment viability.

Healthcare and medical devices constitute another significant market driver, where portable diagnostic equipment and patient monitoring systems benefit from sensors that extend battery life while maintaining measurement accuracy. The COVID-19 pandemic has accelerated this trend, with non-contact temperature measurement devices seeing unprecedented demand growth of over 300% during 2020-2021.

Automotive applications represent an emerging high-growth segment, particularly with the rise of electric vehicles where energy efficiency is paramount. Temperature sensors for battery management systems must deliver precise measurements while minimizing power drain on the vehicle's electrical system. The automotive sensor market is expected to grow at a CAGR of 6.3% through 2026, with energy efficiency being a key selection criterion.

Building automation systems are increasingly incorporating energy-efficient sensors as part of smart building initiatives and green building certifications. These systems require distributed sensor networks that can operate for years without maintenance, making power consumption a critical consideration in sensor selection.

Regional analysis indicates that Asia-Pacific currently leads the market demand for energy-efficient sensors, driven by manufacturing growth in China, Japan, and South Korea. North America follows closely, with strong demand from technology and healthcare sectors, while Europe shows accelerating adoption rates due to stringent energy efficiency regulations and sustainability initiatives.

Current State and Challenges in Thermal Sensing

Thermal sensing technology has evolved significantly over the past decade, with thermopile and semiconductor sensors emerging as the two dominant approaches in the market. Currently, thermopile sensors leverage the Seebeck effect to generate voltage in response to temperature differentials, offering non-contact temperature measurement capabilities. These sensors have achieved measurement accuracies of ±0.1°C in controlled environments, though performance can degrade in fluctuating ambient conditions.

Semiconductor-based thermal sensors, particularly thermistors and integrated circuit (IC) sensors, have seen rapid advancement with the miniaturization of semiconductor manufacturing processes. Modern semiconductor sensors can achieve resolutions down to 0.01°C with response times under 1 second, significantly outpacing traditional thermopile response rates of 5-10 seconds.

A significant challenge in the thermal sensing landscape is the trade-off between energy efficiency and performance. Thermopile sensors inherently consume minimal power (typically 5-50 μW) as they generate voltage rather than requiring it for operation. In contrast, semiconductor sensors generally require continuous power (0.1-10 mW range), creating a substantial efficiency gap that becomes critical in battery-powered and IoT applications.

Calibration and drift compensation represent persistent technical hurdles. Thermopile sensors exhibit less drift over time (typically 0.1% per year) compared to semiconductor alternatives (0.2-0.5% annually), but require more complex initial calibration procedures to account for emissivity variations across different measured surfaces.

Integration density presents another challenge, with semiconductor sensors currently holding a significant advantage. Modern semiconductor thermal arrays can achieve densities of 80×60 pixels in a 5×5 mm package, while comparable thermopile arrays remain substantially larger and more costly to manufacture at similar resolutions.

Environmental resilience varies significantly between technologies. Thermopile sensors demonstrate superior performance in extreme temperature environments (-40°C to 125°C) while maintaining measurement integrity. Semiconductor sensors typically operate reliably in a narrower range (-20°C to 85°C) but offer better immunity to electromagnetic interference.

The geographical distribution of thermal sensing technology development shows concentration in East Asia for manufacturing (particularly Japan and China), while R&D remains centered in North America and Europe. This distribution creates supply chain vulnerabilities that became evident during recent global disruptions.

Cross-technology integration represents both a challenge and opportunity, with hybrid sensing approaches emerging that combine thermopile and semiconductor elements to leverage complementary strengths. However, these integrated solutions face significant hurdles in terms of manufacturing complexity, calibration requirements, and cost-effective production at scale.

Semiconductor-based thermal sensors, particularly thermistors and integrated circuit (IC) sensors, have seen rapid advancement with the miniaturization of semiconductor manufacturing processes. Modern semiconductor sensors can achieve resolutions down to 0.01°C with response times under 1 second, significantly outpacing traditional thermopile response rates of 5-10 seconds.

A significant challenge in the thermal sensing landscape is the trade-off between energy efficiency and performance. Thermopile sensors inherently consume minimal power (typically 5-50 μW) as they generate voltage rather than requiring it for operation. In contrast, semiconductor sensors generally require continuous power (0.1-10 mW range), creating a substantial efficiency gap that becomes critical in battery-powered and IoT applications.

Calibration and drift compensation represent persistent technical hurdles. Thermopile sensors exhibit less drift over time (typically 0.1% per year) compared to semiconductor alternatives (0.2-0.5% annually), but require more complex initial calibration procedures to account for emissivity variations across different measured surfaces.

Integration density presents another challenge, with semiconductor sensors currently holding a significant advantage. Modern semiconductor thermal arrays can achieve densities of 80×60 pixels in a 5×5 mm package, while comparable thermopile arrays remain substantially larger and more costly to manufacture at similar resolutions.

Environmental resilience varies significantly between technologies. Thermopile sensors demonstrate superior performance in extreme temperature environments (-40°C to 125°C) while maintaining measurement integrity. Semiconductor sensors typically operate reliably in a narrower range (-20°C to 85°C) but offer better immunity to electromagnetic interference.

The geographical distribution of thermal sensing technology development shows concentration in East Asia for manufacturing (particularly Japan and China), while R&D remains centered in North America and Europe. This distribution creates supply chain vulnerabilities that became evident during recent global disruptions.

Cross-technology integration represents both a challenge and opportunity, with hybrid sensing approaches emerging that combine thermopile and semiconductor elements to leverage complementary strengths. However, these integrated solutions face significant hurdles in terms of manufacturing complexity, calibration requirements, and cost-effective production at scale.

Comparative Analysis of Current Sensing Solutions

01 Thermopile sensor design for improved energy efficiency

Thermopile sensors can be designed with specific structures to enhance their energy efficiency. These designs include optimized thermal isolation, improved junction configurations, and specialized materials that increase the thermoelectric conversion efficiency. By reducing heat loss and improving the temperature gradient detection, these sensors can operate with lower power consumption while maintaining high sensitivity to thermal radiation.- Thermopile sensor design for improved energy efficiency: Thermopile sensors can be designed with specific structures to improve their energy efficiency. These designs include optimized thermal isolation, specialized junction arrangements, and improved heat flow management. By enhancing the thermal gradient across the sensor, these designs increase the voltage output per unit of thermal energy input, resulting in more efficient energy conversion and lower power requirements for operation.

- Semiconductor sensor power optimization techniques: Various techniques can be employed to optimize the power consumption of semiconductor sensors. These include implementing power management circuits, duty cycling operations, and low-power standby modes. Advanced semiconductor materials and fabrication processes also contribute to reducing the energy requirements while maintaining or improving sensing performance. These optimization techniques are crucial for extending battery life in portable devices and reducing overall energy consumption.

- Integration of renewable energy sources with sensor systems: Sensor systems can be integrated with renewable energy sources such as solar panels to improve their energy efficiency and sustainability. These integrated systems can harvest ambient energy to power the sensors, reducing or eliminating the need for battery replacements or external power sources. This approach is particularly valuable for remote sensing applications where regular maintenance is challenging.

- Hybrid sensor systems combining thermopile and semiconductor technologies: Hybrid sensor systems that combine thermopile and semiconductor technologies can leverage the advantages of both sensor types. Thermopiles offer excellent thermal sensitivity with zero standby power, while semiconductor sensors provide precision and versatility. By intelligently integrating these technologies, systems can achieve higher energy efficiency through optimized sensing strategies, selective activation, and complementary operation modes.

- Energy-efficient signal processing for sensor data: Advanced signal processing techniques can significantly improve the energy efficiency of sensor systems. These include implementing edge computing algorithms, optimized data compression, and intelligent filtering to reduce the computational load and data transmission requirements. By processing sensor data more efficiently, these techniques minimize power consumption while maintaining or enhancing the quality and usefulness of the sensor information.

02 Semiconductor sensor power management techniques

Various power management techniques can be implemented in semiconductor sensors to reduce energy consumption. These include duty cycling, adaptive sampling rates, and low-power sleep modes when sensing is not required. Advanced power control circuits can dynamically adjust the operating parameters based on environmental conditions or application requirements, significantly extending battery life in portable devices while maintaining sensing performance.Expand Specific Solutions03 Integration of renewable energy sources with sensor systems

Sensor systems can be integrated with renewable energy sources such as solar cells to create self-powered or energy-harvesting sensing solutions. These integrated systems can capture ambient energy to power both thermopile and semiconductor sensors, reducing or eliminating the need for external power sources. This approach is particularly valuable for remote monitoring applications where regular battery replacement is impractical.Expand Specific Solutions04 Hybrid sensor systems combining thermopile and semiconductor technologies

Hybrid sensing systems that combine thermopile and semiconductor sensor technologies can leverage the advantages of both approaches. Thermopiles offer excellent passive sensing capabilities with no need for power during measurement, while semiconductor sensors provide precision and versatility. By intelligently managing when each sensor type is active, these hybrid systems can achieve optimal energy efficiency while maintaining comprehensive sensing capabilities.Expand Specific Solutions05 Advanced signal processing for energy-efficient sensor operation

Implementing advanced signal processing techniques can significantly improve the energy efficiency of both thermopile and semiconductor sensors. These techniques include on-chip filtering, adaptive amplification, and intelligent threshold detection that minimize the need for continuous high-power operation. By processing sensor data more efficiently and reducing the computational load on the main system, these approaches enable lower overall power consumption while maintaining or improving sensing accuracy.Expand Specific Solutions

Key Industry Players in Thermal Sensing Market

The thermopile versus semiconductor sensor market is currently in a growth phase, with increasing demand driven by energy efficiency applications across multiple industries. The global market is expanding at approximately 6-8% CAGR, valued at over $8 billion. Technologically, semiconductor sensors dominate with higher maturity and precision, led by established players like Infineon Technologies, Maxim Integrated, and ROHM Co. offering advanced integrated solutions. Thermopile technology, while less mature, is gaining traction in specific applications where energy efficiency is paramount, with companies like Sensirion AG and Melexis Technologies developing innovative implementations. Major semiconductor manufacturers including Taiwan Semiconductor, Intel, and Sony Semiconductor Solutions are investing heavily in energy-efficient sensor technologies, indicating the strategic importance of this market segment.

Sensirion AG

Technical Solution: Sensirion has developed highly specialized sensor solutions focusing on the energy efficiency comparison between thermopile and semiconductor technologies. Their STS series semiconductor temperature sensors achieve industry-leading precision (±0.1°C) while consuming only 0.7μA in sleep mode and 45μA during measurements. For applications requiring non-contact temperature sensing, Sensirion's thermopile-based sensors utilize proprietary thin-film technology that reduces thermal mass and improves response time while maintaining power consumption below 12mW in active mode. Their patented CMOSens® technology integrates sensing elements with signal processing circuitry on a single chip, reducing both power consumption and physical footprint. Sensirion has pioneered ultra-low-power sampling techniques that leverage intelligent wake-up thresholds, allowing sensors to remain in deep sleep modes for over 99% of operational time in many applications. Their latest innovations include energy harvesting integration options that can power sensors entirely from ambient temperature differentials in certain industrial environments, effectively achieving zero net energy consumption for continuous monitoring applications.

Strengths: Industry-leading precision-to-power consumption ratio; highly optimized sleep modes; innovative energy harvesting capabilities; compact integration reducing system-level power requirements. Weaknesses: Application-specific optimization required for maximum efficiency; premium pricing for advanced models; more complex integration compared to basic sensor solutions.

Infineon Technologies AG

Technical Solution: Infineon has developed a comprehensive portfolio addressing both thermopile and semiconductor sensor technologies with a focus on energy efficiency optimization. Their XENSIV™ sensor family includes both technologies with specialized power management. For thermopiles, Infineon employs proprietary vacuum-sealed MEMS technology that reduces thermal conductance losses by over 75% compared to conventional designs. Their semiconductor-based temperature sensors utilize an innovative low-power BiCMOS process technology that enables operation down to 1.71V with current consumption as low as 1.5μA in standby mode. Infineon's dual-technology approach allows system designers to select optimal sensors based on application requirements. Their integrated power management circuits include auto-wake functionality that activates full sensing capabilities only when needed, reducing average power consumption by up to 85% in intermittent sensing applications. Infineon has also pioneered multi-sensor fusion techniques that combine data from both sensor types to achieve higher accuracy while maintaining minimal power consumption.

Strengths: Comprehensive portfolio covering both sensor technologies; advanced power management features; industry-leading standby power consumption; extensive application-specific optimization options. Weaknesses: Higher implementation complexity when utilizing sensor fusion approaches; premium pricing compared to single-technology solutions; requires more sophisticated firmware for optimal energy efficiency.

Technical Deep Dive: Core Sensing Mechanisms

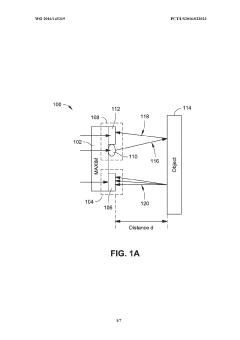

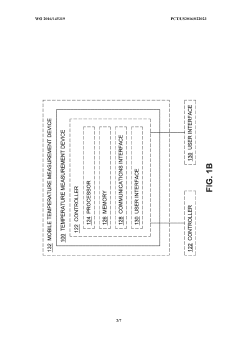

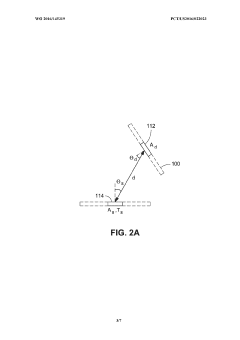

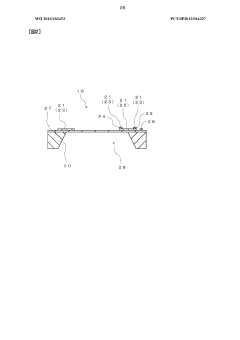

Device and method for temperature correction using a proximity sensor in a non-contact thermopile thermometer

PatentWO2016145319A1

Innovation

- A temperature measurement device equipped with a thermopile temperature sensor and a proximity sensor, where the proximity sensor detects the distance between the thermopile and the object, and a controller uses this information to correct the temperature measurement by accounting for the received radiation and distance, providing an accurate reading.

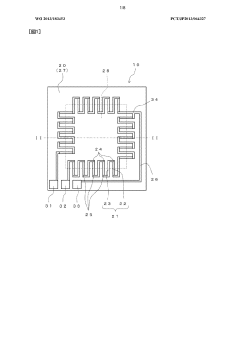

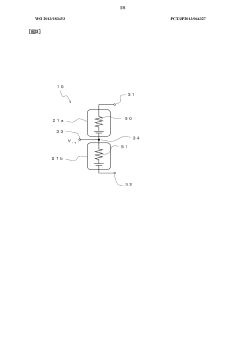

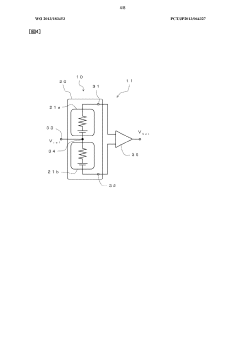

Thermopile, thermopile sensor using same, and infrared sensor

PatentWO2013183453A1

Innovation

- A thermopile design with a series circuit of thermocouples connected to a reference potential at the midpoint, dividing the resistance values and ensuring the same temperature coefficient for both thermocouple groups, eliminating the need for external resistors and minimizing impedance differences.

Environmental Impact and Sustainability Considerations

The environmental footprint of sensor technologies has become increasingly important as industries strive for sustainability. When comparing thermopile and semiconductor sensors from an environmental perspective, several critical factors emerge that influence their overall ecological impact throughout their lifecycle.

Manufacturing processes for semiconductor sensors typically require more energy-intensive fabrication techniques, involving multiple steps of material deposition, etching, and doping in cleanroom environments. These processes generate significant carbon emissions and utilize various chemicals that may pose environmental hazards if not properly managed. In contrast, thermopile sensors generally require fewer manufacturing steps and less energy-intensive processes, resulting in a smaller carbon footprint during production.

Raw material considerations also favor thermopile sensors in many cases. Semiconductor sensors often incorporate rare earth elements and specialized materials that involve environmentally destructive mining practices. Thermopile sensors typically utilize more common materials with less environmental impact during extraction and processing, though this advantage varies depending on specific sensor designs and applications.

Energy consumption during operation represents a critical sustainability factor. Semiconductor sensors generally require continuous power for operation, whereas thermopile sensors can operate passively in many applications, harvesting thermal energy from their environment. This passive operation capability significantly reduces lifetime energy consumption, particularly in remote or battery-powered applications where energy efficiency directly translates to extended service life and reduced battery waste.

End-of-life considerations reveal additional sustainability implications. Semiconductor sensors often contain more complex material compositions that complicate recycling efforts. The presence of multiple integrated components and specialized materials can make separation and recovery challenging. Thermopile sensors typically feature simpler construction with fewer material types, potentially facilitating more straightforward recycling processes.

Longevity and durability factors also influence environmental impact. Thermopile sensors generally demonstrate superior resilience to environmental stressors and electromagnetic interference, potentially resulting in longer operational lifespans. This durability reduces replacement frequency and associated manufacturing impacts, though semiconductor sensors continue to improve in this regard through advanced packaging and protection technologies.

Regulatory compliance and industry standards increasingly emphasize environmental considerations, with initiatives like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives shaping manufacturing practices. Both sensor technologies face ongoing pressure to reduce hazardous materials and improve recyclability, driving innovation in more sustainable design approaches and manufacturing processes.

Manufacturing processes for semiconductor sensors typically require more energy-intensive fabrication techniques, involving multiple steps of material deposition, etching, and doping in cleanroom environments. These processes generate significant carbon emissions and utilize various chemicals that may pose environmental hazards if not properly managed. In contrast, thermopile sensors generally require fewer manufacturing steps and less energy-intensive processes, resulting in a smaller carbon footprint during production.

Raw material considerations also favor thermopile sensors in many cases. Semiconductor sensors often incorporate rare earth elements and specialized materials that involve environmentally destructive mining practices. Thermopile sensors typically utilize more common materials with less environmental impact during extraction and processing, though this advantage varies depending on specific sensor designs and applications.

Energy consumption during operation represents a critical sustainability factor. Semiconductor sensors generally require continuous power for operation, whereas thermopile sensors can operate passively in many applications, harvesting thermal energy from their environment. This passive operation capability significantly reduces lifetime energy consumption, particularly in remote or battery-powered applications where energy efficiency directly translates to extended service life and reduced battery waste.

End-of-life considerations reveal additional sustainability implications. Semiconductor sensors often contain more complex material compositions that complicate recycling efforts. The presence of multiple integrated components and specialized materials can make separation and recovery challenging. Thermopile sensors typically feature simpler construction with fewer material types, potentially facilitating more straightforward recycling processes.

Longevity and durability factors also influence environmental impact. Thermopile sensors generally demonstrate superior resilience to environmental stressors and electromagnetic interference, potentially resulting in longer operational lifespans. This durability reduces replacement frequency and associated manufacturing impacts, though semiconductor sensors continue to improve in this regard through advanced packaging and protection technologies.

Regulatory compliance and industry standards increasingly emphasize environmental considerations, with initiatives like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives shaping manufacturing practices. Both sensor technologies face ongoing pressure to reduce hazardous materials and improve recyclability, driving innovation in more sustainable design approaches and manufacturing processes.

Manufacturing Scalability and Cost Analysis

The manufacturing processes for thermopile and semiconductor sensors present distinct challenges and opportunities that significantly impact their scalability and cost structures. Thermopile sensors utilize relatively straightforward manufacturing techniques based on the thermoelectric effect, employing materials like bismuth telluride or antimony telluride arranged in thermocouples. This simplicity translates to lower initial tooling costs and fewer specialized equipment requirements compared to semiconductor alternatives.

Semiconductor sensors, particularly those utilizing CMOS technology, benefit from established high-volume manufacturing infrastructure within the semiconductor industry. While initial capital expenditure for semiconductor fabrication facilities is substantially higher—often requiring investments of hundreds of millions to billions of dollars—the marginal production cost per unit decreases dramatically at scale due to batch processing capabilities where thousands of sensors can be produced simultaneously on a single wafer.

Production yield rates also differ significantly between these technologies. Thermopile manufacturing typically achieves yields of 85-90% in mature production lines, while semiconductor sensors can reach 95-98% yields in advanced facilities. This yield differential directly impacts per-unit costs, with each percentage point improvement potentially reducing costs by 0.5-1.5% depending on the specific manufacturing setup.

Material costs constitute another critical factor. Thermopile sensors rely on specialized thermoelectric materials that may face supply constraints and price volatility. Conversely, semiconductor sensors primarily use silicon, one of the most abundant elements on Earth, providing greater price stability and supply chain resilience, though requiring more complex processing steps and higher-purity materials.

Miniaturization capabilities also influence manufacturing economics. Semiconductor sensors excel in this regard, with current technologies enabling dimensions below 1mm² per sensor, facilitating higher integration density and lower material consumption. Thermopile sensors typically require larger surface areas to achieve equivalent sensitivity, limiting their miniaturization potential and resulting in higher material costs per functional unit.

Labor requirements differ substantially between these technologies. Thermopile production can be less automated in certain stages, requiring approximately 15-25% more direct labor hours per unit than highly automated semiconductor fabrication. This labor differential becomes increasingly significant in regions with rising labor costs, potentially offsetting thermopile's lower capital equipment requirements.

Environmental considerations also impact manufacturing costs through regulatory compliance requirements. Semiconductor fabrication typically generates more hazardous waste per square centimeter of sensor area, requiring sophisticated treatment systems that add 3-7% to overall production costs compared to the generally cleaner thermopile manufacturing processes.

Semiconductor sensors, particularly those utilizing CMOS technology, benefit from established high-volume manufacturing infrastructure within the semiconductor industry. While initial capital expenditure for semiconductor fabrication facilities is substantially higher—often requiring investments of hundreds of millions to billions of dollars—the marginal production cost per unit decreases dramatically at scale due to batch processing capabilities where thousands of sensors can be produced simultaneously on a single wafer.

Production yield rates also differ significantly between these technologies. Thermopile manufacturing typically achieves yields of 85-90% in mature production lines, while semiconductor sensors can reach 95-98% yields in advanced facilities. This yield differential directly impacts per-unit costs, with each percentage point improvement potentially reducing costs by 0.5-1.5% depending on the specific manufacturing setup.

Material costs constitute another critical factor. Thermopile sensors rely on specialized thermoelectric materials that may face supply constraints and price volatility. Conversely, semiconductor sensors primarily use silicon, one of the most abundant elements on Earth, providing greater price stability and supply chain resilience, though requiring more complex processing steps and higher-purity materials.

Miniaturization capabilities also influence manufacturing economics. Semiconductor sensors excel in this regard, with current technologies enabling dimensions below 1mm² per sensor, facilitating higher integration density and lower material consumption. Thermopile sensors typically require larger surface areas to achieve equivalent sensitivity, limiting their miniaturization potential and resulting in higher material costs per functional unit.

Labor requirements differ substantially between these technologies. Thermopile production can be less automated in certain stages, requiring approximately 15-25% more direct labor hours per unit than highly automated semiconductor fabrication. This labor differential becomes increasingly significant in regions with rising labor costs, potentially offsetting thermopile's lower capital equipment requirements.

Environmental considerations also impact manufacturing costs through regulatory compliance requirements. Semiconductor fabrication typically generates more hazardous waste per square centimeter of sensor area, requiring sophisticated treatment systems that add 3-7% to overall production costs compared to the generally cleaner thermopile manufacturing processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!