Exploring Coating Materials in Organoid Culture Systems

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Organoid Coating Materials Background and Objectives

Organoid culture systems have emerged as revolutionary tools in biomedical research over the past decade, providing three-dimensional cellular models that more accurately recapitulate in vivo tissue architecture and functionality compared to traditional two-dimensional cell cultures. The development of these systems traces back to the early 2000s, with significant breakthroughs occurring around 2009 when Clevers and colleagues established the first long-term culture of intestinal organoids. Since then, the field has expanded dramatically, with organoids now being developed for virtually every major organ system.

The evolution of coating materials has been integral to this progress. Initially, researchers relied primarily on Matrigel, a complex mixture of extracellular matrix proteins derived from Engelbreth-Holm-Swarm mouse sarcoma cells. While effective, Matrigel presents several limitations including batch-to-batch variability, undefined composition, animal origin, and high cost, which have driven the search for alternatives.

Recent technological trends indicate a shift toward chemically defined, synthetic hydrogels that offer greater reproducibility and customization. These materials aim to mimic the natural extracellular matrix while providing consistent mechanical properties and biochemical cues necessary for organoid formation and maintenance. Additionally, there is growing interest in developing coating materials that enable specific differentiation pathways or model disease states.

The primary technical objectives in this field include developing coating materials that: (1) provide consistent and tunable mechanical properties to support organoid growth; (2) incorporate specific biochemical signals to direct cellular differentiation and organization; (3) enable scalable production for high-throughput applications; (4) reduce reliance on animal-derived components; and (5) improve accessibility and cost-effectiveness for broader research and clinical applications.

Furthermore, there is increasing focus on creating coating materials that facilitate downstream applications such as drug screening, personalized medicine approaches, and regenerative therapies. This includes materials that allow for easy retrieval of organoids, compatibility with imaging techniques, and integration with microfluidic systems for organ-on-chip applications.

The ultimate goal is to develop next-generation coating materials that overcome current limitations while expanding the capabilities and applications of organoid technology. Success in this endeavor would significantly advance our understanding of human development and disease, accelerate drug discovery processes, and potentially enable personalized regenerative medicine approaches using patient-derived organoids.

The evolution of coating materials has been integral to this progress. Initially, researchers relied primarily on Matrigel, a complex mixture of extracellular matrix proteins derived from Engelbreth-Holm-Swarm mouse sarcoma cells. While effective, Matrigel presents several limitations including batch-to-batch variability, undefined composition, animal origin, and high cost, which have driven the search for alternatives.

Recent technological trends indicate a shift toward chemically defined, synthetic hydrogels that offer greater reproducibility and customization. These materials aim to mimic the natural extracellular matrix while providing consistent mechanical properties and biochemical cues necessary for organoid formation and maintenance. Additionally, there is growing interest in developing coating materials that enable specific differentiation pathways or model disease states.

The primary technical objectives in this field include developing coating materials that: (1) provide consistent and tunable mechanical properties to support organoid growth; (2) incorporate specific biochemical signals to direct cellular differentiation and organization; (3) enable scalable production for high-throughput applications; (4) reduce reliance on animal-derived components; and (5) improve accessibility and cost-effectiveness for broader research and clinical applications.

Furthermore, there is increasing focus on creating coating materials that facilitate downstream applications such as drug screening, personalized medicine approaches, and regenerative therapies. This includes materials that allow for easy retrieval of organoids, compatibility with imaging techniques, and integration with microfluidic systems for organ-on-chip applications.

The ultimate goal is to develop next-generation coating materials that overcome current limitations while expanding the capabilities and applications of organoid technology. Success in this endeavor would significantly advance our understanding of human development and disease, accelerate drug discovery processes, and potentially enable personalized regenerative medicine approaches using patient-derived organoids.

Market Analysis for Advanced Organoid Culture Systems

The global market for advanced organoid culture systems is experiencing robust growth, driven primarily by increasing applications in drug discovery, personalized medicine, and disease modeling. Current market valuations indicate the organoid culture market reached approximately 1.3 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 22.5% through 2030. This exceptional growth trajectory reflects the expanding utility of organoid technologies across pharmaceutical, biotechnology, and academic research sectors.

Demand analysis reveals several key market drivers propelling the adoption of advanced coating materials in organoid culture systems. Foremost among these is the pharmaceutical industry's shift toward more physiologically relevant in vitro models for drug screening and toxicity testing. Traditional 2D cell cultures have proven inadequate for predicting in vivo responses, creating substantial demand for organoid systems that better recapitulate human tissue architecture and functionality.

The clinical research segment represents another significant market opportunity, with hospitals and diagnostic centers increasingly incorporating organoid technologies for personalized medicine applications. Patient-derived organoids cultured on specialized coating materials enable tailored therapeutic approaches, particularly in oncology where treatment response prediction has shown promising clinical utility.

Regional market assessment indicates North America currently dominates the advanced organoid culture systems market, accounting for approximately 40% of global revenue. This leadership position stems from substantial research funding, presence of major biotechnology companies, and early adoption of cutting-edge technologies. However, the Asia-Pacific region is emerging as the fastest-growing market, with countries like China, Japan, and South Korea making significant investments in regenerative medicine research infrastructure.

End-user segmentation reveals pharmaceutical and biotechnology companies as the largest consumer segment, followed by academic and research institutions. The clinical segment, while currently smaller, is anticipated to exhibit the highest growth rate as organoid technologies transition from research tools to clinical applications.

Market challenges include the high cost of specialized coating materials and culture media, technical complexity requiring specialized expertise, and regulatory uncertainties surrounding clinical applications. Additionally, reproducibility concerns and standardization issues present barriers to wider commercial adoption, particularly in clinical settings where consistency is paramount.

Future market trends indicate growing demand for chemically defined, xeno-free coating materials that support long-term organoid culture while maintaining physiological relevance. The integration of organoid systems with other emerging technologies, such as microfluidics and bioprinting, is expected to create new market opportunities and applications, further driving demand for advanced coating materials optimized for these hybrid platforms.

Demand analysis reveals several key market drivers propelling the adoption of advanced coating materials in organoid culture systems. Foremost among these is the pharmaceutical industry's shift toward more physiologically relevant in vitro models for drug screening and toxicity testing. Traditional 2D cell cultures have proven inadequate for predicting in vivo responses, creating substantial demand for organoid systems that better recapitulate human tissue architecture and functionality.

The clinical research segment represents another significant market opportunity, with hospitals and diagnostic centers increasingly incorporating organoid technologies for personalized medicine applications. Patient-derived organoids cultured on specialized coating materials enable tailored therapeutic approaches, particularly in oncology where treatment response prediction has shown promising clinical utility.

Regional market assessment indicates North America currently dominates the advanced organoid culture systems market, accounting for approximately 40% of global revenue. This leadership position stems from substantial research funding, presence of major biotechnology companies, and early adoption of cutting-edge technologies. However, the Asia-Pacific region is emerging as the fastest-growing market, with countries like China, Japan, and South Korea making significant investments in regenerative medicine research infrastructure.

End-user segmentation reveals pharmaceutical and biotechnology companies as the largest consumer segment, followed by academic and research institutions. The clinical segment, while currently smaller, is anticipated to exhibit the highest growth rate as organoid technologies transition from research tools to clinical applications.

Market challenges include the high cost of specialized coating materials and culture media, technical complexity requiring specialized expertise, and regulatory uncertainties surrounding clinical applications. Additionally, reproducibility concerns and standardization issues present barriers to wider commercial adoption, particularly in clinical settings where consistency is paramount.

Future market trends indicate growing demand for chemically defined, xeno-free coating materials that support long-term organoid culture while maintaining physiological relevance. The integration of organoid systems with other emerging technologies, such as microfluidics and bioprinting, is expected to create new market opportunities and applications, further driving demand for advanced coating materials optimized for these hybrid platforms.

Current Challenges in Organoid Coating Technologies

Despite significant advancements in organoid culture systems, coating technologies continue to present substantial challenges that impede research progress and clinical applications. The primary obstacle remains the inconsistency in matrix composition across different batches of natural extracellular matrix (ECM) derivatives such as Matrigel and Cultrex. This variability introduces experimental reproducibility issues and complicates standardization efforts, particularly problematic for pharmaceutical applications and clinical translation.

Cost considerations represent another significant barrier, with high-quality ECM products commanding premium prices that can exceed $300 per milliliter. This financial burden disproportionately affects smaller research institutions and limits large-scale experimentation necessary for drug screening and personalized medicine applications.

The animal-derived nature of current mainstream coating materials raises additional concerns. These materials carry inherent risks of immunogenicity, pathogen transmission, and ethical considerations that complicate their use in clinical settings. Regulatory agencies maintain strict oversight of animal-derived products in therapeutic applications, creating substantial hurdles for translational research.

Technical limitations further compound these challenges. Current coating materials often exhibit poor mechanical tunability, preventing researchers from accurately replicating the specific stiffness and elasticity of native tissues. This mechanical mismatch can significantly alter organoid development and cellular behavior, potentially leading to models that inadequately represent in vivo conditions.

Degradation kinetics present another unresolved technical issue. Researchers struggle to control the rate at which coating materials break down, which directly impacts organoid growth dynamics and long-term culture stability. Premature degradation can disrupt experiments, while overly stable matrices may restrict proper organoid expansion and maturation.

The limited functionality of existing coating materials also restricts their utility in advanced applications. Most current options lack the capacity for spatiotemporal control of biochemical cues and mechanical properties, features increasingly recognized as essential for accurately modeling complex developmental processes and disease states.

Scalability remains problematic for industrial and clinical applications. Current coating protocols are labor-intensive, difficult to automate, and challenging to implement consistently at scale. This bottleneck significantly impedes the transition from research-scale organoid culture to industrial production necessary for drug discovery pipelines and regenerative medicine.

These multifaceted challenges highlight the urgent need for innovative approaches to organoid coating technologies that address reproducibility, cost-effectiveness, ethical considerations, and technical performance simultaneously.

Cost considerations represent another significant barrier, with high-quality ECM products commanding premium prices that can exceed $300 per milliliter. This financial burden disproportionately affects smaller research institutions and limits large-scale experimentation necessary for drug screening and personalized medicine applications.

The animal-derived nature of current mainstream coating materials raises additional concerns. These materials carry inherent risks of immunogenicity, pathogen transmission, and ethical considerations that complicate their use in clinical settings. Regulatory agencies maintain strict oversight of animal-derived products in therapeutic applications, creating substantial hurdles for translational research.

Technical limitations further compound these challenges. Current coating materials often exhibit poor mechanical tunability, preventing researchers from accurately replicating the specific stiffness and elasticity of native tissues. This mechanical mismatch can significantly alter organoid development and cellular behavior, potentially leading to models that inadequately represent in vivo conditions.

Degradation kinetics present another unresolved technical issue. Researchers struggle to control the rate at which coating materials break down, which directly impacts organoid growth dynamics and long-term culture stability. Premature degradation can disrupt experiments, while overly stable matrices may restrict proper organoid expansion and maturation.

The limited functionality of existing coating materials also restricts their utility in advanced applications. Most current options lack the capacity for spatiotemporal control of biochemical cues and mechanical properties, features increasingly recognized as essential for accurately modeling complex developmental processes and disease states.

Scalability remains problematic for industrial and clinical applications. Current coating protocols are labor-intensive, difficult to automate, and challenging to implement consistently at scale. This bottleneck significantly impedes the transition from research-scale organoid culture to industrial production necessary for drug discovery pipelines and regenerative medicine.

These multifaceted challenges highlight the urgent need for innovative approaches to organoid coating technologies that address reproducibility, cost-effectiveness, ethical considerations, and technical performance simultaneously.

Current Coating Solutions for Organoid Culture

01 Polymer-based coating materials

Polymer-based coatings provide excellent durability and protection for various surfaces. These coatings typically include synthetic polymers such as polyurethanes, epoxies, and acrylics that form protective films with high resistance to environmental factors. The polymers can be modified with additives to enhance specific properties like adhesion, flexibility, and chemical resistance. These coatings are widely used in industrial applications, automotive finishes, and protective coatings for metals and other substrates.- Polymer-based coating materials: Polymer-based coatings provide excellent durability and protection for various surfaces. These coatings typically consist of polymeric materials such as polyurethanes, epoxies, and acrylics that form a protective film when applied to a substrate. The polymers can be modified with additives to enhance specific properties like adhesion, flexibility, and chemical resistance. These coatings are widely used in industrial applications, automotive finishes, and protective coatings for metals and other materials.

- Environmentally friendly coating materials: Environmentally friendly coatings are formulated to reduce environmental impact while maintaining performance. These coatings typically have low or zero volatile organic compound (VOC) content, are free from heavy metals and other toxic substances, and may be derived from renewable resources. Water-based formulations, powder coatings, and bio-based materials are common approaches to creating sustainable coating solutions. These environmentally responsible alternatives are increasingly important in meeting regulatory requirements and consumer demands for greener products.

- Nanoparticle-enhanced coating materials: Nanoparticle-enhanced coatings incorporate nanoscale materials to achieve superior properties compared to conventional coatings. These nanoparticles, which can include metal oxides, carbon nanotubes, or silica, provide benefits such as increased scratch resistance, improved thermal stability, enhanced UV protection, and antimicrobial properties. The small size of these particles allows them to be evenly dispersed throughout the coating matrix, resulting in uniform performance enhancements without significantly altering the appearance or application properties of the coating.

- Specialized functional coating materials: Specialized functional coatings are designed to provide specific performance characteristics beyond basic protection. These include anti-corrosion coatings for metal protection, fire-resistant coatings for building materials, anti-fouling coatings for marine applications, and conductive coatings for electronic components. The formulations are tailored to the specific functional requirements of the application, often incorporating specialized additives and resins to achieve the desired properties while maintaining compatibility with the substrate and application methods.

- Traditional mineral-based coating materials: Traditional mineral-based coatings utilize naturally occurring materials such as clays, lime, and mineral pigments to create protective and decorative finishes. These coatings have been used for centuries and continue to be relevant for specific applications due to their breathability, sustainability, and aesthetic qualities. Modern formulations often combine these traditional materials with contemporary binders and additives to improve durability and application properties while maintaining the characteristic appearance and beneficial properties of mineral-based coatings.

02 Environmentally friendly coating materials

Eco-friendly coating materials are formulated to reduce environmental impact while maintaining performance. These coatings typically use water-based formulations instead of solvent-based ones, reducing volatile organic compound (VOC) emissions. They may incorporate renewable resources such as plant-derived polymers, natural oils, and biodegradable components. Some environmentally friendly coatings also feature self-cleaning properties or photocatalytic effects that help break down pollutants. These sustainable alternatives are increasingly important in construction, consumer products, and industrial applications.Expand Specific Solutions03 Metal-based protective coatings

Metal-based protective coatings provide superior corrosion resistance and durability for various substrates. These coatings typically incorporate metal particles such as zinc, aluminum, or stainless steel, which can form sacrificial layers that protect the underlying material. Some formulations include metal oxides or metal-organic compounds that enhance adhesion and provide additional protective properties. These coatings are commonly used in marine environments, infrastructure projects, and industrial equipment where exposure to harsh conditions is expected.Expand Specific Solutions04 Ceramic and glass coating materials

Ceramic and glass-based coatings provide exceptional hardness, heat resistance, and chemical stability. These coatings typically contain silica, alumina, zirconia, or other ceramic materials that form a dense, protective layer when applied to surfaces. They can withstand extreme temperatures and provide excellent insulation properties. Some formulations incorporate nano-sized ceramic particles to enhance specific properties like scratch resistance or self-cleaning capabilities. These coatings are widely used in electronics, aerospace, automotive, and architectural applications where durability under extreme conditions is required.Expand Specific Solutions05 Functional coating materials with special properties

Functional coatings are designed with specific enhanced properties beyond basic protection. These include self-healing coatings that can repair minor damage automatically, antimicrobial coatings that inhibit the growth of bacteria and fungi, and conductive coatings that allow electrical current to flow. Other functional coatings include hydrophobic or hydrophilic surfaces, thermochromic coatings that change color with temperature, and flame-retardant formulations. These specialized coatings often incorporate advanced materials such as nanoparticles, phase-change materials, or reactive compounds to achieve their unique properties.Expand Specific Solutions

Key Industry Players in Organoid Technology

The organoid culture coating materials market is in a growth phase, characterized by increasing adoption across research and clinical applications. The market size is expanding rapidly, driven by the rising demand for more physiologically relevant in vitro models. Technologically, the field shows moderate maturity with established players like Miltenyi Biotec and Molecular Devices offering standardized solutions, while innovative companies such as Finnadvance, Cellesce, and Organoidsciences are developing specialized coating materials and microfluidic platforms. Academic institutions including Zhejiang University and research centers like Memorial Sloan Kettering Cancer Center are advancing fundamental research, while commercial entities like CYTOO and Cell Microsystems focus on high-throughput applications. The competitive landscape reflects a balance between established biotechnology companies and specialized startups targeting niche applications in this emerging field.

Finnadvance Oy

Technical Solution: Finnadvance has developed a proprietary microfluidic organ-on-chip platform with advanced coating materials specifically designed for organoid culture systems. Their technology utilizes a combination of extracellular matrix (ECM) components and synthetic hydrogels that mimic the native tissue microenvironment. The company's coating materials incorporate laminin-rich matrices supplemented with tissue-specific growth factors that enhance organoid attachment, growth, and differentiation. Their platform allows for precise control of the mechanical properties of the coating materials, with tunable stiffness ranging from 0.2 kPa to 50 kPa to match different tissue types. Finnadvance's coating technology also features integrated sensors that monitor organoid development in real-time, providing continuous feedback on cellular responses to different coating compositions.

Strengths: Superior microfluidic integration allowing dynamic control of coating conditions; excellent reproducibility across batches; compatibility with high-throughput screening applications. Weaknesses: Higher cost compared to conventional coating materials; requires specialized equipment for optimal implementation; limited long-term stability for certain tissue types.

Cell Microsystems, Inc.

Technical Solution: Cell Microsystems has pioneered the CellRaft Technology, an innovative approach to organoid culture coating materials. Their system utilizes a microwell array platform with specialized surface coatings that support organoid formation and growth. The company has developed proprietary CytoSort Arrays with various coating formulations, including modified polystyrene surfaces with nanopatterned topography that enhances cellular adhesion while maintaining stemness. Their coating materials incorporate biodegradable polymers infused with tissue-specific ECM proteins that gradually release as organoids develop, providing temporal control over the microenvironment. The technology allows for single-cell derived organoid culture with tracking capabilities, enabling researchers to monitor clonal organoid development from individual stem cells through their proprietary imaging system.

Strengths: Exceptional single-cell isolation capabilities; excellent optical clarity for high-resolution imaging; automated selection and retrieval of specific organoids. Weaknesses: Limited scalability for large organoid production; higher initial investment compared to traditional culture systems; requires specialized training for optimal utilization.

Critical Innovations in Organoid Coating Materials

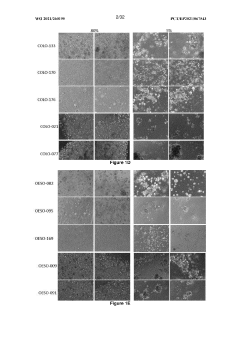

Culture of organoids

PatentWO2021260195A1

Innovation

- Culturing organoids in suspension with a low percentage (2-18% v/v) of a complex protein hydrogel scaffold matrix at concentrations between 12-18 mg/ml, allowing for efficient expansion and maintenance of organoids in low adhesion cell culture containers, reducing the amount of ECM required and facilitating large-scale expansions.

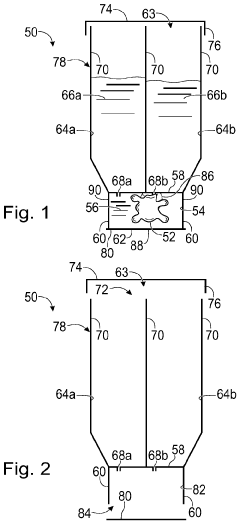

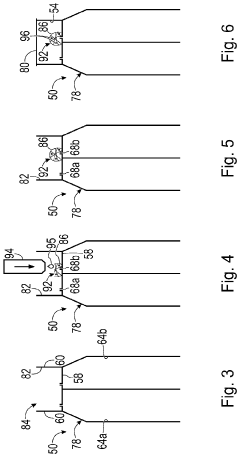

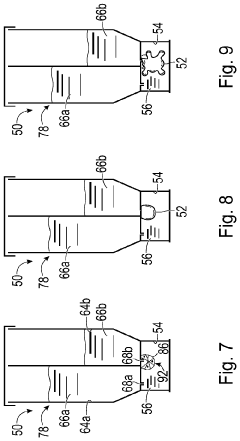

System and method for organoid culture

PatentPendingUS20230089445A1

Innovation

- A system comprising a vessel with a receptacle and sealing member to create a chamber for organoid culture, allowing for media exchange and imaging, using 3D printing to form scaffolds and integrate optical windows for light-sheet microscopy, enabling efficient growth, monitoring, and analysis of large organoids.

Regulatory Considerations for Organoid Culture Materials

The regulatory landscape for organoid culture materials presents a complex framework that developers and researchers must navigate carefully. In the United States, the FDA's regulatory approach depends largely on the intended use of organoids and their associated coating materials. For research applications, materials fall under laboratory research regulations with less stringent requirements. However, when organoids are developed for clinical applications or drug testing, coating materials must meet more rigorous standards under both medical device and biological product regulations.

European regulatory frameworks, particularly under the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), classify organoid culture systems based on risk levels. Coating materials used in these systems must demonstrate biocompatibility, stability, and consistency in manufacturing. The European Medicines Agency (EMA) has also begun developing specific guidance for advanced therapy medicinal products (ATMPs) that may include organoid-based therapies.

Quality control standards present significant challenges for manufacturers of coating materials. ISO 13485 certification is increasingly becoming a baseline requirement, mandating robust quality management systems for the production of materials used in medical applications. Additionally, Good Manufacturing Practice (GMP) compliance is essential for coating materials intended for clinical applications, requiring extensive documentation and validation of manufacturing processes.

Batch-to-batch consistency represents a critical regulatory concern, as variations in coating material composition can significantly impact organoid development and function. Regulatory bodies increasingly require manufacturers to implement comprehensive characterization protocols and demonstrate consistency across production batches through standardized testing methodologies.

Ethical and safety considerations also influence regulatory approaches to organoid culture materials. Patient-derived materials used in coatings must address consent and privacy concerns, while animal-derived components face increasing scrutiny regarding potential pathogen transmission and ethical sourcing. This has accelerated the development of synthetic alternatives that can meet regulatory requirements more consistently.

Looking forward, regulatory harmonization efforts are underway to standardize requirements across different regions. The International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) has begun initiatives to develop global standards for advanced cellular models, including organoid systems and their supporting materials. These efforts aim to reduce regulatory barriers while maintaining appropriate safety and efficacy standards.

European regulatory frameworks, particularly under the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), classify organoid culture systems based on risk levels. Coating materials used in these systems must demonstrate biocompatibility, stability, and consistency in manufacturing. The European Medicines Agency (EMA) has also begun developing specific guidance for advanced therapy medicinal products (ATMPs) that may include organoid-based therapies.

Quality control standards present significant challenges for manufacturers of coating materials. ISO 13485 certification is increasingly becoming a baseline requirement, mandating robust quality management systems for the production of materials used in medical applications. Additionally, Good Manufacturing Practice (GMP) compliance is essential for coating materials intended for clinical applications, requiring extensive documentation and validation of manufacturing processes.

Batch-to-batch consistency represents a critical regulatory concern, as variations in coating material composition can significantly impact organoid development and function. Regulatory bodies increasingly require manufacturers to implement comprehensive characterization protocols and demonstrate consistency across production batches through standardized testing methodologies.

Ethical and safety considerations also influence regulatory approaches to organoid culture materials. Patient-derived materials used in coatings must address consent and privacy concerns, while animal-derived components face increasing scrutiny regarding potential pathogen transmission and ethical sourcing. This has accelerated the development of synthetic alternatives that can meet regulatory requirements more consistently.

Looking forward, regulatory harmonization efforts are underway to standardize requirements across different regions. The International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) has begun initiatives to develop global standards for advanced cellular models, including organoid systems and their supporting materials. These efforts aim to reduce regulatory barriers while maintaining appropriate safety and efficacy standards.

Scalability and Manufacturing Challenges

The scaling of organoid culture systems from laboratory to industrial production presents significant manufacturing challenges that must be addressed for widespread commercial application. Current coating materials used in organoid culture, such as Matrigel and other ECM-derived substrates, face substantial limitations in large-scale production scenarios. These materials exhibit batch-to-batch variability and often lack standardization, creating inconsistencies in organoid development when production volumes increase.

Cost considerations represent another critical barrier to scalability. High-quality coating materials like Matrigel remain prohibitively expensive for large-scale applications, with prices ranging from $100-300 per milliliter. This cost structure becomes economically unsustainable when scaling to industrial production levels, particularly for therapeutic applications requiring thousands of organoid units.

Manufacturing processes for coating materials present additional complexities. Many ECM-derived coatings require specialized extraction and purification protocols that are difficult to standardize across large production batches. The temperature sensitivity of these materials further complicates handling during manufacturing, as most require cold-chain management throughout production and distribution channels.

Regulatory compliance adds another layer of complexity to scaling coating material production. Animal-derived matrices face stringent regulatory scrutiny, particularly for clinical applications, necessitating extensive documentation of source materials and production processes. The transition to synthetic alternatives, while promising, introduces new manufacturing challenges related to polymer chemistry consistency and quality control.

Automation compatibility represents a significant hurdle in scaling organoid culture systems. Many current coating protocols involve manual handling steps that are difficult to automate, creating bottlenecks in production workflows. The viscosity and gelation properties of coating materials often require specialized dispensing equipment that must maintain precise temperature control during application.

Storage stability and shelf-life limitations further complicate large-scale manufacturing. Most biological coating materials exhibit limited stability, requiring specialized preservation methods and creating logistical challenges for distribution networks. Synthetic alternatives generally offer improved stability but may lack the biological complexity needed for optimal organoid development.

The environmental footprint of coating material production also warrants consideration as manufacturing scales. Production processes for both natural and synthetic matrices can generate significant waste streams that require proper management, particularly when involving solvents or biological materials with potential biohazard classifications.

Cost considerations represent another critical barrier to scalability. High-quality coating materials like Matrigel remain prohibitively expensive for large-scale applications, with prices ranging from $100-300 per milliliter. This cost structure becomes economically unsustainable when scaling to industrial production levels, particularly for therapeutic applications requiring thousands of organoid units.

Manufacturing processes for coating materials present additional complexities. Many ECM-derived coatings require specialized extraction and purification protocols that are difficult to standardize across large production batches. The temperature sensitivity of these materials further complicates handling during manufacturing, as most require cold-chain management throughout production and distribution channels.

Regulatory compliance adds another layer of complexity to scaling coating material production. Animal-derived matrices face stringent regulatory scrutiny, particularly for clinical applications, necessitating extensive documentation of source materials and production processes. The transition to synthetic alternatives, while promising, introduces new manufacturing challenges related to polymer chemistry consistency and quality control.

Automation compatibility represents a significant hurdle in scaling organoid culture systems. Many current coating protocols involve manual handling steps that are difficult to automate, creating bottlenecks in production workflows. The viscosity and gelation properties of coating materials often require specialized dispensing equipment that must maintain precise temperature control during application.

Storage stability and shelf-life limitations further complicate large-scale manufacturing. Most biological coating materials exhibit limited stability, requiring specialized preservation methods and creating logistical challenges for distribution networks. Synthetic alternatives generally offer improved stability but may lack the biological complexity needed for optimal organoid development.

The environmental footprint of coating material production also warrants consideration as manufacturing scales. Production processes for both natural and synthetic matrices can generate significant waste streams that require proper management, particularly when involving solvents or biological materials with potential biohazard classifications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!