Guide to Process Monitoring for Direct Lithium Extraction Operations

SEP 12, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DLE Process Monitoring Background and Objectives

Direct Lithium Extraction (DLE) has emerged as a transformative technology in the lithium production landscape, offering a more sustainable and efficient alternative to traditional extraction methods. The evolution of DLE technologies began in the 1990s with initial research into selective adsorption materials, but significant commercial development has only materialized in the last decade as global demand for lithium has surged due to the electric vehicle revolution and renewable energy storage requirements.

The lithium market has experienced unprecedented growth, with projections indicating a potential supply gap of up to 1.7 million metric tons by 2035 if current extraction methods remain predominant. This market pressure has accelerated interest in DLE technologies, which promise higher recovery rates, reduced environmental footprint, and faster production cycles compared to conventional evaporation ponds or hard rock mining operations.

Process monitoring represents a critical component within DLE operations, serving as the nervous system that ensures optimal performance, resource efficiency, and quality control. Historically, monitoring systems in extraction industries have evolved from manual sampling and offline analysis to sophisticated real-time sensor networks and integrated digital platforms. This technological progression mirrors the increasing complexity and precision requirements of modern extraction processes.

The primary objectives of DLE process monitoring are multifaceted. First, to establish continuous visibility into critical operational parameters including solution chemistry, flow rates, pressure differentials, and selective material performance. Second, to enable predictive maintenance capabilities that minimize downtime and extend equipment lifespan. Third, to optimize resource utilization through precise control of reagents, energy inputs, and water consumption. Fourth, to ensure consistent product quality by maintaining tight control over extraction conditions and impurity levels.

Current technological trends in DLE monitoring include the integration of artificial intelligence for anomaly detection, the deployment of advanced spectroscopic techniques for real-time composition analysis, and the development of specialized ion-selective electrodes capable of withstanding the challenging chemical environments present in lithium brines. These innovations are driving toward a future where DLE operations achieve unprecedented levels of efficiency and sustainability.

The technical trajectory for DLE process monitoring is moving toward fully integrated digital twins that combine real-time monitoring with predictive modeling, allowing operators to simulate process adjustments before implementation and optimize extraction parameters dynamically in response to changing brine compositions or market demands.

The lithium market has experienced unprecedented growth, with projections indicating a potential supply gap of up to 1.7 million metric tons by 2035 if current extraction methods remain predominant. This market pressure has accelerated interest in DLE technologies, which promise higher recovery rates, reduced environmental footprint, and faster production cycles compared to conventional evaporation ponds or hard rock mining operations.

Process monitoring represents a critical component within DLE operations, serving as the nervous system that ensures optimal performance, resource efficiency, and quality control. Historically, monitoring systems in extraction industries have evolved from manual sampling and offline analysis to sophisticated real-time sensor networks and integrated digital platforms. This technological progression mirrors the increasing complexity and precision requirements of modern extraction processes.

The primary objectives of DLE process monitoring are multifaceted. First, to establish continuous visibility into critical operational parameters including solution chemistry, flow rates, pressure differentials, and selective material performance. Second, to enable predictive maintenance capabilities that minimize downtime and extend equipment lifespan. Third, to optimize resource utilization through precise control of reagents, energy inputs, and water consumption. Fourth, to ensure consistent product quality by maintaining tight control over extraction conditions and impurity levels.

Current technological trends in DLE monitoring include the integration of artificial intelligence for anomaly detection, the deployment of advanced spectroscopic techniques for real-time composition analysis, and the development of specialized ion-selective electrodes capable of withstanding the challenging chemical environments present in lithium brines. These innovations are driving toward a future where DLE operations achieve unprecedented levels of efficiency and sustainability.

The technical trajectory for DLE process monitoring is moving toward fully integrated digital twins that combine real-time monitoring with predictive modeling, allowing operators to simulate process adjustments before implementation and optimize extraction parameters dynamically in response to changing brine compositions or market demands.

Market Analysis for DLE Technology Solutions

The Direct Lithium Extraction (DLE) technology market is experiencing significant growth driven by the increasing demand for lithium in battery production for electric vehicles and energy storage systems. Current market valuations place the global DLE technology sector at approximately $1.2 billion in 2023, with projections indicating a compound annual growth rate of 25-30% over the next decade, potentially reaching $9-10 billion by 2033.

Market segmentation reveals three primary categories of DLE technology solutions: adsorption-based systems, ion-exchange technologies, and membrane separation processes. Adsorption-based systems currently dominate with roughly 45% market share due to their scalability and relatively lower operational costs. Ion-exchange technologies follow at 35%, while membrane separation processes account for 20% of the market.

Geographically, North America leads the DLE technology market with 40% share, primarily due to substantial lithium reserves in the United States and significant investments in research and development. Asia-Pacific follows closely at 35%, driven by China's aggressive push toward lithium self-sufficiency and technological innovation. Europe represents 20% of the market, with Latin America accounting for the remaining 5% despite hosting substantial lithium reserves.

Customer segmentation indicates that mining companies constitute 55% of end-users, seeking to enhance extraction efficiency from brine resources. Battery manufacturers represent 25% of customers, increasingly investing in backward integration to secure lithium supply chains. The remaining 20% comprises technology developers and government-backed research initiatives.

Key market drivers include the exponential growth in electric vehicle production, with global EV sales projected to increase from 10 million units in 2022 to over 40 million by 2030. Additionally, governmental policies promoting clean energy and critical mineral security are creating favorable regulatory environments for DLE technology adoption.

Market challenges include high initial capital requirements, with typical commercial-scale DLE installations costing between $50-150 million. Technical barriers related to selectivity and recovery rates in complex brine chemistries also remain significant obstacles. Furthermore, water usage concerns in water-stressed regions present both environmental and operational challenges for widespread adoption.

The competitive landscape is characterized by a mix of established mining technology providers, specialized DLE startups, and chemical processing companies. Recent market consolidation through strategic acquisitions indicates the sector is entering a maturation phase, with larger players seeking to secure technological advantages through portfolio expansion.

Market segmentation reveals three primary categories of DLE technology solutions: adsorption-based systems, ion-exchange technologies, and membrane separation processes. Adsorption-based systems currently dominate with roughly 45% market share due to their scalability and relatively lower operational costs. Ion-exchange technologies follow at 35%, while membrane separation processes account for 20% of the market.

Geographically, North America leads the DLE technology market with 40% share, primarily due to substantial lithium reserves in the United States and significant investments in research and development. Asia-Pacific follows closely at 35%, driven by China's aggressive push toward lithium self-sufficiency and technological innovation. Europe represents 20% of the market, with Latin America accounting for the remaining 5% despite hosting substantial lithium reserves.

Customer segmentation indicates that mining companies constitute 55% of end-users, seeking to enhance extraction efficiency from brine resources. Battery manufacturers represent 25% of customers, increasingly investing in backward integration to secure lithium supply chains. The remaining 20% comprises technology developers and government-backed research initiatives.

Key market drivers include the exponential growth in electric vehicle production, with global EV sales projected to increase from 10 million units in 2022 to over 40 million by 2030. Additionally, governmental policies promoting clean energy and critical mineral security are creating favorable regulatory environments for DLE technology adoption.

Market challenges include high initial capital requirements, with typical commercial-scale DLE installations costing between $50-150 million. Technical barriers related to selectivity and recovery rates in complex brine chemistries also remain significant obstacles. Furthermore, water usage concerns in water-stressed regions present both environmental and operational challenges for widespread adoption.

The competitive landscape is characterized by a mix of established mining technology providers, specialized DLE startups, and chemical processing companies. Recent market consolidation through strategic acquisitions indicates the sector is entering a maturation phase, with larger players seeking to secure technological advantages through portfolio expansion.

Current Challenges in DLE Process Monitoring

Despite significant advancements in Direct Lithium Extraction (DLE) technologies, process monitoring remains one of the most challenging aspects of implementation. Current DLE operations face substantial monitoring difficulties that impede optimal performance and commercial scalability. These challenges span across technical, operational, and analytical domains.

Real-time monitoring capabilities for lithium concentration and selectivity during extraction represent a primary challenge. Conventional analytical methods often require sample preparation and laboratory analysis, creating significant time delays between sampling and results. This lag prevents operators from making timely adjustments to process parameters, resulting in suboptimal extraction efficiency and increased operational costs.

Sensor technology limitations present another significant hurdle. The harsh chemical environments typical in DLE operations—including high salinity, extreme pH conditions, and presence of interfering ions—frequently compromise sensor accuracy and longevity. Current sensor technologies struggle to maintain calibration stability and often experience rapid degradation, necessitating frequent replacement and recalibration.

Data integration across multiple process parameters presents complex challenges for DLE operations. Most facilities collect disparate data streams from various monitoring points, but lack sophisticated systems to integrate these inputs into actionable intelligence. The absence of comprehensive monitoring platforms that can correlate lithium concentration, flow rates, pressure differentials, and chemical consumption creates blind spots in process optimization.

Scaling monitoring systems from pilot to commercial scale introduces additional complications. Monitoring approaches that function effectively in controlled laboratory environments or small pilot plants often fail to translate to industrial-scale operations. The increased process volumes, flow rates, and equipment sizes create new monitoring challenges that weren't apparent at smaller scales.

Remote monitoring capabilities remain underdeveloped for DLE operations in geographically challenging locations. Many lithium-rich brines are located in remote areas with limited infrastructure, complicating the implementation of advanced monitoring systems that require stable connectivity and technical support.

Predictive monitoring capabilities are largely absent in current DLE operations. While reactive monitoring (identifying problems after they occur) is standard practice, the industry lacks sophisticated predictive tools that can forecast potential process deviations before they impact production. This reactive approach results in unnecessary downtime and reduced operational efficiency.

Cost-effectiveness of monitoring solutions represents a final significant challenge. Advanced monitoring technologies often require substantial capital investment, creating barriers to adoption, particularly for smaller operators or projects in early development stages.

Real-time monitoring capabilities for lithium concentration and selectivity during extraction represent a primary challenge. Conventional analytical methods often require sample preparation and laboratory analysis, creating significant time delays between sampling and results. This lag prevents operators from making timely adjustments to process parameters, resulting in suboptimal extraction efficiency and increased operational costs.

Sensor technology limitations present another significant hurdle. The harsh chemical environments typical in DLE operations—including high salinity, extreme pH conditions, and presence of interfering ions—frequently compromise sensor accuracy and longevity. Current sensor technologies struggle to maintain calibration stability and often experience rapid degradation, necessitating frequent replacement and recalibration.

Data integration across multiple process parameters presents complex challenges for DLE operations. Most facilities collect disparate data streams from various monitoring points, but lack sophisticated systems to integrate these inputs into actionable intelligence. The absence of comprehensive monitoring platforms that can correlate lithium concentration, flow rates, pressure differentials, and chemical consumption creates blind spots in process optimization.

Scaling monitoring systems from pilot to commercial scale introduces additional complications. Monitoring approaches that function effectively in controlled laboratory environments or small pilot plants often fail to translate to industrial-scale operations. The increased process volumes, flow rates, and equipment sizes create new monitoring challenges that weren't apparent at smaller scales.

Remote monitoring capabilities remain underdeveloped for DLE operations in geographically challenging locations. Many lithium-rich brines are located in remote areas with limited infrastructure, complicating the implementation of advanced monitoring systems that require stable connectivity and technical support.

Predictive monitoring capabilities are largely absent in current DLE operations. While reactive monitoring (identifying problems after they occur) is standard practice, the industry lacks sophisticated predictive tools that can forecast potential process deviations before they impact production. This reactive approach results in unnecessary downtime and reduced operational efficiency.

Cost-effectiveness of monitoring solutions represents a final significant challenge. Advanced monitoring technologies often require substantial capital investment, creating barriers to adoption, particularly for smaller operators or projects in early development stages.

Existing DLE Process Monitoring Solutions

01 Real-time monitoring systems for DLE processes

Advanced monitoring systems are employed in Direct Lithium Extraction processes to track key parameters in real-time. These systems utilize sensors and analytical instruments to measure lithium concentration, pH levels, temperature, and flow rates throughout the extraction process. Real-time data collection enables immediate process adjustments, optimizing extraction efficiency and ensuring consistent lithium recovery rates. These monitoring systems often incorporate automated alerts for parameter deviations, allowing operators to respond quickly to potential issues.- Real-time monitoring systems for DLE processes: Advanced monitoring systems are employed in Direct Lithium Extraction processes to track key parameters in real-time. These systems utilize sensors and analytical instruments to continuously measure lithium concentration, pH levels, temperature, and flow rates throughout the extraction process. Real-time data collection enables immediate adjustments to process conditions, optimizing extraction efficiency and ensuring consistent lithium recovery rates. These monitoring systems often incorporate automated alerts for parameter deviations, allowing operators to quickly address potential issues before they affect production quality.

- Spectroscopic analysis techniques for lithium concentration monitoring: Spectroscopic analysis methods provide non-destructive, continuous monitoring of lithium concentrations during the DLE process. These techniques include atomic absorption spectroscopy, inductively coupled plasma spectroscopy, and laser-induced breakdown spectroscopy, which can detect lithium ions with high precision. By integrating spectroscopic analyzers into the extraction circuit, operators can monitor lithium concentrations at various stages of the process without interrupting operations. This enables precise control of adsorption and desorption cycles, optimization of sorbent performance, and verification of final product quality.

- Automated control systems for DLE process optimization: Automated control systems integrate monitoring data with process control mechanisms to optimize DLE operations. These systems employ algorithms and machine learning to analyze real-time data and automatically adjust process parameters such as flow rates, temperature, pressure, and chemical dosing. By continuously optimizing operating conditions based on monitoring feedback, these systems can maximize lithium recovery while minimizing reagent consumption and energy usage. Advanced control systems also maintain detailed operational logs for quality assurance, regulatory compliance, and process improvement initiatives.

- Selective ion monitoring for impurity detection and removal: Selective ion monitoring technologies are implemented in DLE processes to detect and quantify impurities that could affect product quality. These systems specifically target common contaminants such as sodium, calcium, magnesium, and other metal ions that may compete with lithium during extraction. By continuously monitoring impurity levels throughout the process, operators can adjust separation parameters to maintain high selectivity for lithium. This approach enables production of high-purity lithium compounds while optimizing the regeneration cycles of selective sorbents and minimizing chemical consumption for impurity removal.

- Integrated data management systems for DLE process analysis: Comprehensive data management systems collect, store, and analyze monitoring data from DLE operations to support process optimization and quality control. These systems integrate data from multiple monitoring points throughout the extraction process, creating a holistic view of operations. Advanced analytics tools process this data to identify trends, predict maintenance needs, and recommend process improvements. Historical performance data enables benchmarking of different operational strategies and supports continuous improvement initiatives. These systems often feature customizable dashboards that present key performance indicators in user-friendly formats for operators and management.

02 Ion-selective electrode technology for lithium concentration monitoring

Ion-selective electrode (ISE) technology provides continuous monitoring of lithium ion concentrations during the DLE process. These specialized electrodes can selectively detect lithium ions in complex brine solutions containing multiple ionic species. The technology enables operators to track lithium recovery efficiency in real-time without requiring frequent manual sampling and laboratory analysis. Advanced ISE systems incorporate temperature compensation and automatic calibration features to maintain measurement accuracy throughout the extraction process.Expand Specific Solutions03 Spectroscopic methods for DLE process monitoring

Spectroscopic techniques including UV-visible, infrared, and Raman spectroscopy are implemented for non-invasive monitoring of DLE processes. These methods analyze the spectral signatures of process streams to determine lithium concentration and detect impurities without requiring physical sampling. Spectroscopic monitoring enables continuous quality control throughout the extraction process, ensuring that the final lithium product meets purity specifications. Advanced systems incorporate chemometric algorithms to interpret complex spectral data and provide actionable insights for process optimization.Expand Specific Solutions04 Integrated data management systems for DLE process control

Comprehensive data management systems integrate monitoring data from multiple sensors throughout the DLE process chain. These systems employ advanced analytics and machine learning algorithms to identify patterns, predict process outcomes, and recommend optimization strategies. The integrated approach enables holistic process control, connecting upstream extraction parameters with downstream purification results. Historical data analysis helps identify long-term trends and opportunities for process improvement, while real-time dashboards provide operators with actionable insights for immediate decision-making.Expand Specific Solutions05 Automated sampling and analysis systems for DLE quality control

Automated sampling systems collect and analyze process samples at predetermined intervals throughout the DLE process. These systems incorporate robotic sample handling, preparation, and analytical techniques such as ICP-MS or atomic absorption spectroscopy to determine lithium concentration and detect impurities. Automation reduces human error in the sampling process and enables more frequent analysis than would be practical with manual methods. Results are automatically integrated into the process control system, allowing for timely adjustments to extraction parameters based on quality control data.Expand Specific Solutions

Leading Companies in DLE Monitoring Systems

The direct lithium extraction (DLE) technology landscape is currently in an early growth phase, characterized by rapid innovation and increasing commercial interest. The global market for DLE is projected to expand significantly as demand for lithium in battery applications continues to surge. Technologically, the field shows varying maturity levels, with established energy companies like Schlumberger, Koch Technology Solutions, and Saudi Aramco bringing substantial resources to advance DLE processes. Specialized players such as Vulcan Energy, Lyten, and Watercycle Technologies are developing proprietary extraction methods, while academic institutions including North Carolina State University and Ningbo University contribute fundamental research. BYD and other battery manufacturers are increasingly interested in securing lithium supply chains through advanced extraction technologies, driving further innovation in process monitoring and control systems.

Schlumberger Technologies, Inc.

Technical Solution: Schlumberger has developed comprehensive process monitoring solutions for Direct Lithium Extraction (DLE) operations that integrate real-time data acquisition with advanced analytics. Their NeoLith Energy platform employs a combination of IoT sensors, distributed control systems, and proprietary algorithms to monitor critical parameters throughout the DLE process. The system captures data on brine chemistry, adsorption/desorption cycles, pressure differentials, and selective ion exchange efficiency. Schlumberger's monitoring technology incorporates predictive maintenance capabilities that use machine learning to identify potential equipment failures before they occur, reducing downtime in extraction operations. Their DLE monitoring solutions also feature digital twin technology that creates virtual replicas of physical extraction plants, allowing operators to simulate process changes and optimize performance without disrupting actual operations. The platform includes specialized monitoring for lithium selectivity and recovery rates, which are crucial metrics for operational efficiency in DLE facilities.

Strengths: Leverages extensive oil and gas industry experience in process monitoring; offers integrated solutions that connect upstream and downstream operations; provides advanced predictive analytics capabilities. Weaknesses: Solutions may be cost-prohibitive for smaller DLE operations; requires significant technical expertise to implement and maintain; system complexity may present challenges for rapid deployment in emerging markets.

Koch Technology Solutions LLC

Technical Solution: Koch Technology Solutions has engineered a sophisticated process monitoring framework specifically for Direct Lithium Extraction operations that focuses on membrane-based separation technologies. Their system employs advanced spectroscopic analysis tools that provide real-time monitoring of lithium concentration, impurity levels, and separation efficiency throughout the extraction process. Koch's monitoring solution integrates proprietary sensors that can withstand the harsh chemical environments typical in DLE operations while maintaining measurement accuracy. The platform features a multi-tiered data architecture that processes information from field instruments through edge computing devices before transmission to centralized control systems, reducing latency in critical control decisions. Their technology incorporates specialized flow monitoring capabilities that track fluid dynamics through adsorption columns and membrane systems, optimizing the hydraulic performance of extraction circuits. Koch's monitoring system also includes comprehensive energy consumption tracking that helps operators identify opportunities for efficiency improvements in what is typically an energy-intensive process.

Strengths: Exceptional expertise in membrane technology monitoring; robust sensors designed specifically for chemical processing environments; strong focus on energy efficiency optimization. Weaknesses: Less experience in lithium-specific extraction compared to some competitors; solutions may be more focused on certain extraction methodologies than others; integration with legacy systems can be challenging.

Key Monitoring Technologies for DLE Operations

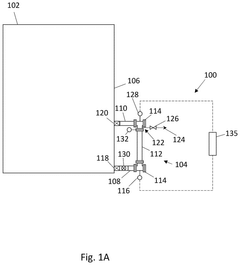

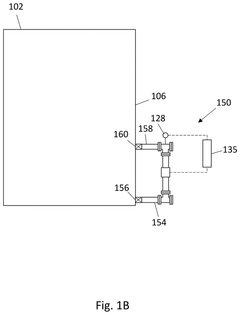

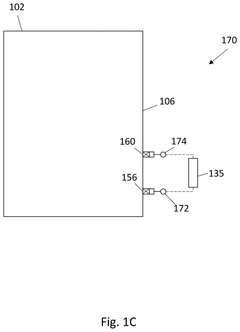

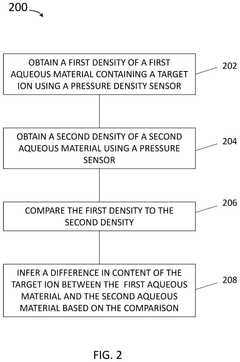

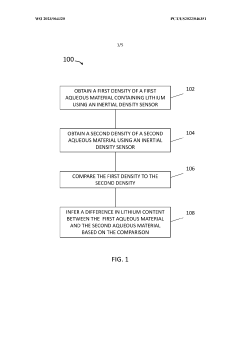

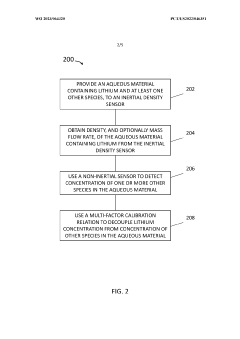

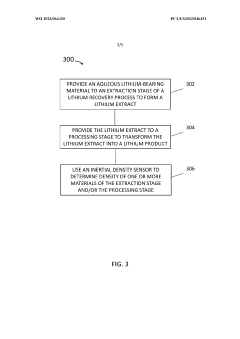

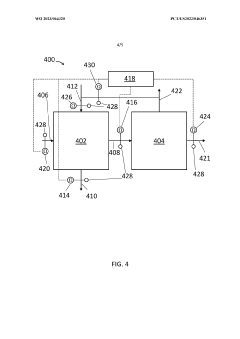

Method for continuous monitoring of extraction process

PatentPendingUS20250205616A1

Innovation

- The use of pressure density sensors to measure the density of aqueous materials before and after extraction, allowing for continuous monitoring of lithium content by comparing density changes, and adjusting the extraction process accordingly.

Method for continuous monitoring of extraction process

PatentWO2023064320A1

Innovation

- The use of inertial density sensors, such as Coriolis meters, to detect changes in lithium concentration by comparing the densities of aqueous materials before and after lithium extraction, allowing for real-time monitoring and control of the extraction process.

Environmental Impact Assessment of DLE Monitoring

Environmental monitoring is a critical component of Direct Lithium Extraction (DLE) operations, requiring comprehensive assessment frameworks to ensure sustainable practices. DLE technologies offer significant advantages over traditional evaporation pond methods, potentially reducing water consumption by up to 65% and land use by approximately 85%. However, these operations still present environmental challenges that necessitate rigorous monitoring protocols. The primary environmental concerns include groundwater quality alterations, potential subsidence in extraction areas, chemical reagent management, and energy consumption patterns.

Continuous monitoring systems deployed across DLE operations can provide real-time data on water usage efficiency, detecting anomalies that might indicate excessive consumption or leakage. These systems typically incorporate sensor networks measuring flow rates, pressure differentials, and water quality parameters at critical points throughout the extraction process. Advanced monitoring technologies now enable detection of trace contaminants at parts-per-billion levels, essential for identifying potential groundwater impacts before they become significant environmental issues.

Waste stream characterization represents another crucial monitoring focus, with particular attention to the composition of reject brines and spent sorbents. Regular sampling and analysis of these materials help operations maintain compliance with discharge regulations while identifying opportunities for byproduct recovery or treatment optimization. Modern spectroscopic techniques allow for rapid, on-site analysis of waste streams, reducing response times to potential environmental concerns.

Air quality monitoring around DLE facilities tracks emissions from energy generation and chemical processing activities. Particulate matter, volatile organic compounds, and greenhouse gases require different monitoring approaches, often combining fixed monitoring stations with periodic mobile sampling campaigns. The integration of these monitoring data with meteorological information provides context for understanding dispersion patterns and potential community impacts.

Ecological monitoring extends beyond the immediate operational footprint to assess broader ecosystem effects. This includes tracking changes in local flora and fauna populations, soil characteristics, and surface water quality in surrounding areas. Establishing robust baseline data before operations begin is essential for meaningful comparative analysis throughout the facility lifecycle. Remote sensing technologies increasingly supplement ground-based ecological monitoring, providing cost-effective coverage of larger geographical areas.

The environmental impact assessment of DLE monitoring must also consider the monitoring systems' own footprint, including energy requirements, maintenance needs, and end-of-life disposal considerations. As monitoring technology advances, the trend toward lower-power, longer-lasting sensors with reduced calibration requirements is improving the sustainability profile of these essential systems.

Continuous monitoring systems deployed across DLE operations can provide real-time data on water usage efficiency, detecting anomalies that might indicate excessive consumption or leakage. These systems typically incorporate sensor networks measuring flow rates, pressure differentials, and water quality parameters at critical points throughout the extraction process. Advanced monitoring technologies now enable detection of trace contaminants at parts-per-billion levels, essential for identifying potential groundwater impacts before they become significant environmental issues.

Waste stream characterization represents another crucial monitoring focus, with particular attention to the composition of reject brines and spent sorbents. Regular sampling and analysis of these materials help operations maintain compliance with discharge regulations while identifying opportunities for byproduct recovery or treatment optimization. Modern spectroscopic techniques allow for rapid, on-site analysis of waste streams, reducing response times to potential environmental concerns.

Air quality monitoring around DLE facilities tracks emissions from energy generation and chemical processing activities. Particulate matter, volatile organic compounds, and greenhouse gases require different monitoring approaches, often combining fixed monitoring stations with periodic mobile sampling campaigns. The integration of these monitoring data with meteorological information provides context for understanding dispersion patterns and potential community impacts.

Ecological monitoring extends beyond the immediate operational footprint to assess broader ecosystem effects. This includes tracking changes in local flora and fauna populations, soil characteristics, and surface water quality in surrounding areas. Establishing robust baseline data before operations begin is essential for meaningful comparative analysis throughout the facility lifecycle. Remote sensing technologies increasingly supplement ground-based ecological monitoring, providing cost-effective coverage of larger geographical areas.

The environmental impact assessment of DLE monitoring must also consider the monitoring systems' own footprint, including energy requirements, maintenance needs, and end-of-life disposal considerations. As monitoring technology advances, the trend toward lower-power, longer-lasting sensors with reduced calibration requirements is improving the sustainability profile of these essential systems.

Regulatory Compliance for Lithium Extraction Operations

Direct Lithium Extraction (DLE) operations are subject to a complex web of regulatory frameworks that vary significantly across jurisdictions. Compliance with these regulations is not merely a legal obligation but a critical component of sustainable and responsible lithium production. Environmental protection agencies worldwide have established stringent guidelines for water usage, chemical handling, and waste management in extraction processes, with particular emphasis on groundwater protection in regions where lithium brine extraction occurs.

The U.S. Environmental Protection Agency (EPA) and equivalent bodies in other countries mandate regular monitoring and reporting of process parameters, including chemical concentrations, water quality metrics, and emissions data. These requirements necessitate sophisticated monitoring systems capable of continuous data collection and analysis. Companies must maintain comprehensive records of all monitoring activities, typically for periods of 3-7 years depending on local regulations.

Safety regulations present another critical compliance area, with OSHA in the United States and similar organizations globally enforcing strict protocols for handling the chemicals used in DLE processes. These include requirements for personal protective equipment, emergency response procedures, and regular safety training for all personnel involved in extraction operations. Monitoring systems must include safety interlocks and alarm functions that trigger automatic responses when parameters exceed safe operating ranges.

Resource management regulations govern extraction rates and resource utilization efficiency. In many jurisdictions, lithium extraction operations require permits that specify maximum extraction volumes and mandate regular reporting on resource depletion. Process monitoring systems must accurately track extraction volumes and efficiency metrics to demonstrate compliance with these permits and to support renewal applications.

International standards such as ISO 14001 for environmental management systems and ISO 45001 for occupational health and safety provide frameworks that many regulatory bodies reference in their compliance requirements. Implementing these standards can streamline compliance efforts across multiple jurisdictions and provide a structured approach to monitoring and reporting.

Emerging regulations around carbon footprint and sustainability are increasingly affecting DLE operations. Several countries have introduced or are developing regulations that require monitoring and reporting of energy consumption and carbon emissions associated with extraction processes. These regulations may include carbon pricing mechanisms that directly impact operational costs, making energy-efficient monitoring systems increasingly valuable.

Regulatory compliance should be viewed as an evolving landscape rather than a static requirement. Process monitoring systems must be designed with sufficient flexibility to accommodate regulatory changes without requiring complete system overhauls. Regular regulatory reviews and proactive engagement with regulatory bodies can help operations anticipate and prepare for upcoming changes in compliance requirements.

The U.S. Environmental Protection Agency (EPA) and equivalent bodies in other countries mandate regular monitoring and reporting of process parameters, including chemical concentrations, water quality metrics, and emissions data. These requirements necessitate sophisticated monitoring systems capable of continuous data collection and analysis. Companies must maintain comprehensive records of all monitoring activities, typically for periods of 3-7 years depending on local regulations.

Safety regulations present another critical compliance area, with OSHA in the United States and similar organizations globally enforcing strict protocols for handling the chemicals used in DLE processes. These include requirements for personal protective equipment, emergency response procedures, and regular safety training for all personnel involved in extraction operations. Monitoring systems must include safety interlocks and alarm functions that trigger automatic responses when parameters exceed safe operating ranges.

Resource management regulations govern extraction rates and resource utilization efficiency. In many jurisdictions, lithium extraction operations require permits that specify maximum extraction volumes and mandate regular reporting on resource depletion. Process monitoring systems must accurately track extraction volumes and efficiency metrics to demonstrate compliance with these permits and to support renewal applications.

International standards such as ISO 14001 for environmental management systems and ISO 45001 for occupational health and safety provide frameworks that many regulatory bodies reference in their compliance requirements. Implementing these standards can streamline compliance efforts across multiple jurisdictions and provide a structured approach to monitoring and reporting.

Emerging regulations around carbon footprint and sustainability are increasingly affecting DLE operations. Several countries have introduced or are developing regulations that require monitoring and reporting of energy consumption and carbon emissions associated with extraction processes. These regulations may include carbon pricing mechanisms that directly impact operational costs, making energy-efficient monitoring systems increasingly valuable.

Regulatory compliance should be viewed as an evolving landscape rather than a static requirement. Process monitoring systems must be designed with sufficient flexibility to accommodate regulatory changes without requiring complete system overhauls. Regular regulatory reviews and proactive engagement with regulatory bodies can help operations anticipate and prepare for upcoming changes in compliance requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!