How Does Metal Mesh Compare to Nanomaterials in Electronics

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Mesh vs Nanomaterials: Background and Objectives

The evolution of electronic materials has been a cornerstone of technological advancement since the mid-20th century. Metal mesh technology, with its origins in traditional conductive grid structures, has evolved significantly from basic wire screens to sophisticated patterned conductive networks. Concurrently, nanomaterials emerged in the late 1980s and gained substantial momentum in the 2000s with breakthroughs in carbon nanotubes, graphene, and metal nanoparticles. This technological convergence presents a critical juncture for electronics innovation.

Metal mesh technology utilizes microscale conductive patterns, typically composed of copper, silver, or aluminum, arranged in grid-like structures. These meshes offer excellent conductivity while maintaining optical transparency when properly designed. The manufacturing processes have evolved from traditional lithography to advanced techniques including nanoimprint lithography and roll-to-roll processing, enabling cost-effective production at industrial scales.

Nanomaterials, by contrast, operate at dimensions below 100 nanometers, exhibiting unique quantum mechanical properties absent in bulk materials. Carbon-based nanomaterials (graphene, carbon nanotubes), metal nanowires, and nanoparticles represent the primary categories relevant to electronic applications. Their exceptional electrical, thermal, and mechanical properties have positioned them as potential disruptors in next-generation electronics.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of metal mesh and nanomaterial technologies in electronic applications. This includes evaluating their respective performance metrics, manufacturing scalability, cost structures, and environmental impacts. Additionally, we aim to identify optimal application scenarios for each technology and potential hybrid approaches that leverage the strengths of both.

Current market trends indicate growing demand for flexible, transparent, and efficient electronic components across multiple industries including consumer electronics, automotive systems, healthcare devices, and energy technologies. Both metal mesh and nanomaterials are positioned to address these needs, albeit through different technological approaches and with varying degrees of market readiness.

The technological trajectory suggests potential convergence paths where metal mesh structures incorporate nanomaterial elements to create hybrid solutions with enhanced performance characteristics. Understanding this evolution is crucial for strategic positioning in the rapidly evolving electronics materials market.

This research will establish a foundation for evaluating investment priorities, research directions, and product development strategies in advanced electronic materials. By comprehensively mapping the technological landscape, we aim to identify strategic opportunities at the intersection of established metal mesh technologies and emerging nanomaterial innovations.

Metal mesh technology utilizes microscale conductive patterns, typically composed of copper, silver, or aluminum, arranged in grid-like structures. These meshes offer excellent conductivity while maintaining optical transparency when properly designed. The manufacturing processes have evolved from traditional lithography to advanced techniques including nanoimprint lithography and roll-to-roll processing, enabling cost-effective production at industrial scales.

Nanomaterials, by contrast, operate at dimensions below 100 nanometers, exhibiting unique quantum mechanical properties absent in bulk materials. Carbon-based nanomaterials (graphene, carbon nanotubes), metal nanowires, and nanoparticles represent the primary categories relevant to electronic applications. Their exceptional electrical, thermal, and mechanical properties have positioned them as potential disruptors in next-generation electronics.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of metal mesh and nanomaterial technologies in electronic applications. This includes evaluating their respective performance metrics, manufacturing scalability, cost structures, and environmental impacts. Additionally, we aim to identify optimal application scenarios for each technology and potential hybrid approaches that leverage the strengths of both.

Current market trends indicate growing demand for flexible, transparent, and efficient electronic components across multiple industries including consumer electronics, automotive systems, healthcare devices, and energy technologies. Both metal mesh and nanomaterials are positioned to address these needs, albeit through different technological approaches and with varying degrees of market readiness.

The technological trajectory suggests potential convergence paths where metal mesh structures incorporate nanomaterial elements to create hybrid solutions with enhanced performance characteristics. Understanding this evolution is crucial for strategic positioning in the rapidly evolving electronics materials market.

This research will establish a foundation for evaluating investment priorities, research directions, and product development strategies in advanced electronic materials. By comprehensively mapping the technological landscape, we aim to identify strategic opportunities at the intersection of established metal mesh technologies and emerging nanomaterial innovations.

Market Demand Analysis for Advanced Electronic Materials

The global market for advanced electronic materials is experiencing unprecedented growth, driven by the increasing demand for smaller, faster, and more efficient electronic devices. The market size for advanced electronic materials reached approximately $57.3 billion in 2022 and is projected to grow at a CAGR of 8.2% through 2028. This growth is particularly evident in sectors such as consumer electronics, automotive electronics, and telecommunications, where the push for miniaturization and enhanced performance is relentless.

Metal mesh and nanomaterials represent two critical segments within this market. The metal mesh market, valued at $4.6 billion in 2022, is primarily driven by its applications in transparent conductive electrodes for touchscreens, EMI shielding, and flexible displays. Industry analysts predict this segment will grow at 7.5% annually as manufacturers seek alternatives to traditional materials like indium tin oxide (ITO).

Meanwhile, the electronic nanomaterials market, including carbon nanotubes, graphene, and metal nanoparticles, has reached $3.2 billion and is growing at an impressive 12.3% annually. This accelerated growth reflects the superior electrical, thermal, and mechanical properties these materials offer compared to conventional alternatives.

Regional analysis reveals Asia-Pacific dominates the advanced electronic materials market with a 45% share, followed by North America (28%) and Europe (20%). China, Japan, South Korea, and Taiwan are particularly significant manufacturing hubs, with substantial investments in R&D and production facilities for both metal mesh and nanomaterial technologies.

Consumer demand trends indicate a growing preference for devices with longer battery life, faster processing speeds, and enhanced durability – all attributes that advanced materials like metal mesh and nanomaterials can help deliver. The automotive sector represents the fastest-growing application segment, with a 14.7% annual growth rate, as electric vehicles and autonomous driving systems require increasingly sophisticated electronic components.

Supply chain considerations are becoming increasingly critical, with 78% of electronics manufacturers reporting concerns about material availability. This has accelerated interest in developing alternative material solutions and diversifying supply sources, benefiting both metal mesh and nanomaterial producers who can offer domestically produced alternatives to traditional imported materials.

Market forecasts suggest that while metal mesh will maintain dominance in certain applications like large-area touch panels and EMI shielding through 2025, nanomaterials will progressively capture market share in high-performance computing, flexible electronics, and energy storage applications, where their unique properties provide significant competitive advantages.

Metal mesh and nanomaterials represent two critical segments within this market. The metal mesh market, valued at $4.6 billion in 2022, is primarily driven by its applications in transparent conductive electrodes for touchscreens, EMI shielding, and flexible displays. Industry analysts predict this segment will grow at 7.5% annually as manufacturers seek alternatives to traditional materials like indium tin oxide (ITO).

Meanwhile, the electronic nanomaterials market, including carbon nanotubes, graphene, and metal nanoparticles, has reached $3.2 billion and is growing at an impressive 12.3% annually. This accelerated growth reflects the superior electrical, thermal, and mechanical properties these materials offer compared to conventional alternatives.

Regional analysis reveals Asia-Pacific dominates the advanced electronic materials market with a 45% share, followed by North America (28%) and Europe (20%). China, Japan, South Korea, and Taiwan are particularly significant manufacturing hubs, with substantial investments in R&D and production facilities for both metal mesh and nanomaterial technologies.

Consumer demand trends indicate a growing preference for devices with longer battery life, faster processing speeds, and enhanced durability – all attributes that advanced materials like metal mesh and nanomaterials can help deliver. The automotive sector represents the fastest-growing application segment, with a 14.7% annual growth rate, as electric vehicles and autonomous driving systems require increasingly sophisticated electronic components.

Supply chain considerations are becoming increasingly critical, with 78% of electronics manufacturers reporting concerns about material availability. This has accelerated interest in developing alternative material solutions and diversifying supply sources, benefiting both metal mesh and nanomaterial producers who can offer domestically produced alternatives to traditional imported materials.

Market forecasts suggest that while metal mesh will maintain dominance in certain applications like large-area touch panels and EMI shielding through 2025, nanomaterials will progressively capture market share in high-performance computing, flexible electronics, and energy storage applications, where their unique properties provide significant competitive advantages.

Current Technological Landscape and Challenges

The global landscape of electronic materials is witnessing a significant transformation with the emergence of both metal mesh and nanomaterial technologies. Currently, metal mesh technology has achieved considerable market penetration in transparent conductive electrodes (TCEs), particularly in touch panels, displays, and EMI shielding applications. The technology leverages established manufacturing processes such as photolithography, gravure printing, and roll-to-roll techniques, which has facilitated its relatively rapid industrial adoption compared to some nanomaterial alternatives.

Metal mesh solutions typically offer sheet resistances ranging from 0.5 to 10 ohms per square with optical transparencies of 80-90%, positioning them competitively against traditional indium tin oxide (ITO) solutions. Major manufacturers including 3M, Fujifilm, and Toppan Printing have developed commercial metal mesh products, indicating the technology's industrial maturity.

Concurrently, nanomaterials such as carbon nanotubes (CNTs), graphene, and silver nanowires are advancing rapidly in the electronics sector. These materials offer theoretical performance advantages including higher flexibility, potentially lower production costs at scale, and in some cases superior conductivity-to-transparency ratios. Silver nanowires, for instance, have demonstrated sheet resistances below 10 ohms per square with over 90% transparency.

Despite these promising developments, both technologies face significant challenges. Metal mesh technology struggles with moiré pattern issues in display applications, limited flexibility compared to some nanomaterial alternatives, and relatively complex manufacturing processes that can impact yield rates and production costs. The visible pattern of metal mesh can also be problematic for certain high-resolution display applications.

Nanomaterials, while theoretically superior in many aspects, face their own set of challenges including scalability issues, long-term stability concerns, and integration difficulties with existing manufacturing infrastructure. Graphene, despite its exceptional theoretical properties, continues to face commercial-scale production barriers that limit its widespread adoption in electronics.

Geographically, metal mesh technology development is concentrated in East Asia (particularly Japan, South Korea, and Taiwan) and North America, with companies like Hitachi Chemical and C3Nano leading innovation. Nanomaterial research shows a broader distribution with significant activities in China, Europe, and North America, reflecting the more academic and early-stage commercial nature of many nanomaterial developments.

The regulatory landscape adds another layer of complexity, with nanomaterials facing increasing scrutiny regarding environmental impact and potential health effects, while metal mesh technologies generally align with existing electronic manufacturing regulations but may face challenges related to rare metal usage and recycling requirements.

Metal mesh solutions typically offer sheet resistances ranging from 0.5 to 10 ohms per square with optical transparencies of 80-90%, positioning them competitively against traditional indium tin oxide (ITO) solutions. Major manufacturers including 3M, Fujifilm, and Toppan Printing have developed commercial metal mesh products, indicating the technology's industrial maturity.

Concurrently, nanomaterials such as carbon nanotubes (CNTs), graphene, and silver nanowires are advancing rapidly in the electronics sector. These materials offer theoretical performance advantages including higher flexibility, potentially lower production costs at scale, and in some cases superior conductivity-to-transparency ratios. Silver nanowires, for instance, have demonstrated sheet resistances below 10 ohms per square with over 90% transparency.

Despite these promising developments, both technologies face significant challenges. Metal mesh technology struggles with moiré pattern issues in display applications, limited flexibility compared to some nanomaterial alternatives, and relatively complex manufacturing processes that can impact yield rates and production costs. The visible pattern of metal mesh can also be problematic for certain high-resolution display applications.

Nanomaterials, while theoretically superior in many aspects, face their own set of challenges including scalability issues, long-term stability concerns, and integration difficulties with existing manufacturing infrastructure. Graphene, despite its exceptional theoretical properties, continues to face commercial-scale production barriers that limit its widespread adoption in electronics.

Geographically, metal mesh technology development is concentrated in East Asia (particularly Japan, South Korea, and Taiwan) and North America, with companies like Hitachi Chemical and C3Nano leading innovation. Nanomaterial research shows a broader distribution with significant activities in China, Europe, and North America, reflecting the more academic and early-stage commercial nature of many nanomaterial developments.

The regulatory landscape adds another layer of complexity, with nanomaterials facing increasing scrutiny regarding environmental impact and potential health effects, while metal mesh technologies generally align with existing electronic manufacturing regulations but may face challenges related to rare metal usage and recycling requirements.

Technical Comparison of Metal Mesh and Nanomaterial Solutions

01 Electrical conductivity comparison between metal mesh and nanomaterials

Metal meshes typically offer higher electrical conductivity compared to most nanomaterials, making them suitable for applications requiring efficient current flow. However, certain nanomaterials like carbon nanotubes and graphene can achieve comparable conductivity levels while offering advantages in flexibility and weight. The performance difference becomes particularly significant in transparent conductive applications where nanomaterials can maintain conductivity at higher transparency levels than traditional metal meshes.- Electrical conductivity comparison between metal mesh and nanomaterials: Metal mesh structures generally offer higher electrical conductivity compared to nanomaterials due to their continuous metallic pathways. However, certain nanomaterials like carbon nanotubes and graphene can achieve comparable conductivity levels with significantly less material. The performance difference is particularly notable in applications requiring high current capacity, where metal mesh typically outperforms, while nanomaterials excel in applications requiring flexibility and transparency combined with conductivity.

- Mechanical properties and flexibility comparison: Nanomaterials often demonstrate superior flexibility and mechanical resilience compared to traditional metal mesh structures. While metal mesh provides structural stability and strength, nanomaterial-based films can withstand repeated bending and stretching without significant performance degradation. This makes nanomaterials particularly advantageous for flexible electronics, wearable devices, and applications requiring conformability to irregular surfaces. The integration of nanomaterials with polymeric substrates can further enhance flexibility while maintaining functional performance.

- Optical transparency and light transmission characteristics: Nanomaterials typically offer superior optical transparency compared to metal mesh structures of similar conductivity. While properly designed metal mesh can achieve good transparency through optimized grid patterns, nanomaterial films like graphene and carbon nanotube networks can provide uniform transparency across the visible spectrum. This performance difference is critical in display technologies, solar cells, and smart windows where light transmission quality impacts overall device performance. The trade-off between conductivity and transparency differs significantly between these material systems.

- EMI shielding and frequency-dependent performance: Metal mesh structures and nanomaterials exhibit different electromagnetic interference (EMI) shielding characteristics across frequency ranges. Metal mesh typically provides superior shielding at lower frequencies due to its continuous conductive pathways, while certain nanomaterials demonstrate better performance at higher frequencies. Hybrid structures combining both material types can achieve broadband EMI shielding. The thickness, pattern density, and material composition significantly influence the shielding effectiveness, with nanomaterials offering advantages in weight and thickness reduction.

- Manufacturing scalability and cost considerations: Metal mesh fabrication technologies are generally more mature and cost-effective for large-scale production compared to nanomaterial-based alternatives. However, advances in nanomaterial synthesis and deposition methods are rapidly improving scalability. Metal mesh typically requires more complex patterning processes but uses established materials, while nanomaterial production often involves specialized synthesis conditions. The overall cost-performance ratio depends on specific application requirements, with nanomaterials becoming increasingly competitive for specialized high-performance applications where their unique properties justify higher production costs.

02 Mechanical properties and flexibility comparison

Nanomaterials generally exhibit superior flexibility and stretchability compared to conventional metal meshes, allowing for applications in flexible electronics and wearable devices. Metal meshes tend to have higher tensile strength but are more prone to mechanical failure under repeated bending or stretching. Hybrid structures combining metal meshes with nanomaterials can achieve an optimal balance of mechanical properties, leveraging the strength of metals with the flexibility of nanomaterials.Expand Specific Solutions03 Optical transparency and electromagnetic shielding effectiveness

Both metal meshes and nanomaterials can be engineered for high optical transparency while maintaining electromagnetic shielding capabilities, but they achieve this through different mechanisms. Metal meshes rely on precise geometric patterns with openings smaller than the wavelength of interest, while nanomaterials utilize their inherent properties at the nanoscale. Nanomaterials typically offer more uniform transparency across broader wavelength ranges, whereas metal meshes may exhibit wavelength-dependent transmission characteristics.Expand Specific Solutions04 Thermal stability and environmental durability comparison

Metal meshes generally demonstrate superior thermal stability and environmental durability compared to many nanomaterials. They can withstand higher operating temperatures without degradation and are less susceptible to oxidation or environmental factors. However, certain nanomaterials, particularly ceramic-based ones, can offer exceptional thermal resistance. The long-term stability of nanomaterials often depends on their surface functionalization and protective coatings, while metal meshes may face challenges related to corrosion in harsh environments.Expand Specific Solutions05 Manufacturing scalability and cost-effectiveness

Metal mesh manufacturing technologies are generally more mature and cost-effective for large-scale production compared to many nanomaterial fabrication methods. Traditional metal mesh production benefits from established industrial processes, while nanomaterial synthesis often requires more specialized equipment and precise control. However, emerging roll-to-roll and solution-based processing techniques are improving the scalability of nanomaterial production. The cost-performance ratio depends on the specific application requirements, with nanomaterials offering advantages in applications where material quantity is minimal but performance requirements are demanding.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The metal mesh and nanomaterials competition in electronics is currently in a growth phase, with the market expanding rapidly due to increasing demand for transparent conductive materials in touchscreens and flexible electronics. While the global market size is projected to reach several billion dollars by 2025, metal mesh technology has achieved greater commercial maturity compared to many nanomaterial alternatives. Companies like Jiangsu Xsignal and G. Bopp & Co. AG have established metal mesh manufacturing capabilities, while academic institutions including Northwestern University, Rice University, and University of California are advancing nanomaterial research. BASF, BYD, and Honeywell are investing in both technologies, with nanomaterials showing superior theoretical performance but facing scalability challenges that metal mesh has largely overcome.

The Regents of the University of California

Technical Solution: The University of California has developed advanced metal mesh transparent conductors that offer exceptional performance for flexible electronics applications. Their technology utilizes nanoimprint lithography to create ultra-fine metal mesh structures with line widths below 500 nm, achieving transparency above 90% while maintaining sheet resistance below 10 ohms per square. This approach combines the advantages of traditional metal conductivity with nanomaterial-like optical transparency. Their research demonstrates that copper-based metal mesh can achieve conductivity values approaching bulk copper while maintaining high optical transparency, outperforming many carbon nanotube and graphene implementations. The university has also pioneered self-healing metal mesh technologies that can repair microcracks through localized Joule heating, addressing a key durability concern in flexible electronics applications.

Strengths: Superior conductivity compared to most nanomaterials while maintaining high transparency; established manufacturing processes; excellent mechanical flexibility; self-healing capabilities. Weaknesses: More complex fabrication process than some nanomaterial deposition methods; potential for visible patterns that may affect optical applications; higher initial production costs compared to some nanomaterial alternatives.

Northwestern University

Technical Solution: Northwestern University has pioneered hybrid metal mesh-nanomaterial composites that leverage the strengths of both technologies. Their approach integrates silver nanowire networks with patterned metal mesh structures to create transparent conductors with exceptional performance characteristics. This hybrid technology achieves sheet resistance below 5 ohms per square while maintaining optical transparency above 85%. The university's research demonstrates that these hybrid structures offer superior mechanical durability under repeated bending and stretching compared to either technology alone. Their fabrication process utilizes solution-based deposition of silver nanowires followed by selective metal deposition to reinforce the conductive network, creating a hierarchical structure that maintains conductivity even when individual elements fail. This approach addresses the trade-off between transparency and conductivity that limits both conventional metal mesh and nanomaterial implementations.

Strengths: Combines the high conductivity of metals with the flexibility of nanomaterials; excellent mechanical durability; redundant conductive pathways improve reliability; solution-processable manufacturing components. Weaknesses: More complex multi-step fabrication process; higher material costs than single-technology approaches; potential challenges in scaling to large-area production; optimization required for specific applications.

Critical Patents and Research in Conductive Materials

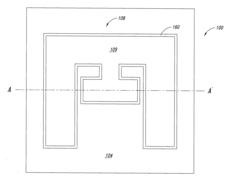

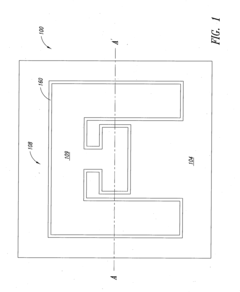

Metal grid sensor with low reflection and low haze and preparation process thereof

PatentActiveCN113215555A

Innovation

- The process of combining colored photoresist and catalyst layer is used to form a low-reflective metal grid through exposure, development, copper plating and blackening. The blackening liquid is used to reduce the reflectivity of the metal grid surface, and the high water solubility is used to reduce the reflectivity of the metal grid. The molecules prevent the photoresist layer from absorbing water and ensure the exposure effect.

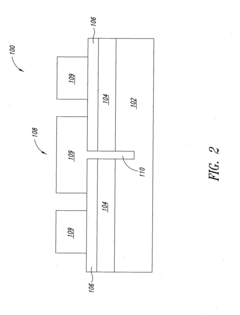

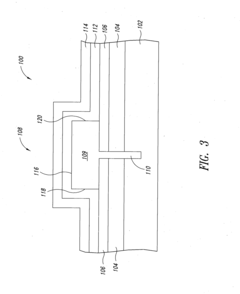

Surface alloy process for MEMS and nems

PatentActiveUS20120161573A1

Innovation

- A microstructure is formed with a moveable component made of a silicon-based material, where a metallic silicide layer with more electropositive elements is deposited on its surfaces to enhance protection and prevent sticking, using a self-aligning process that includes annealing to form a silicide layer, which is then partially released after removing the sacrificial layer.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of metal mesh technology has reached significant maturity in recent years, with established production methods including photolithography, gravure printing, and laser patterning. These processes enable high-volume production with consistent quality control, making metal mesh commercially viable for large-scale electronics applications. Current manufacturing capabilities allow for production of metal mesh transparent conductors with sheet resistances below 10 ohms/square and optical transmittance exceeding 85%, meeting industry requirements for touchscreens and displays.

Cost analysis reveals that metal mesh production benefits from utilizing abundant materials like copper, silver, and aluminum, which are significantly less expensive than rare elements required for certain nanomaterials. The initial capital investment for metal mesh manufacturing facilities ranges from $5-20 million depending on production capacity, with per-unit costs decreasing substantially at higher volumes. Industry reports indicate production costs of $8-15 per square meter for high-quality metal mesh, representing a 30-40% cost advantage over comparable ITO solutions.

In contrast, nanomaterial manufacturing for electronics faces considerable scalability challenges. Carbon nanotubes and graphene production methods such as chemical vapor deposition and solution processing struggle with consistency issues when scaled beyond laboratory settings. Current industrial nanomaterial production yields inconsistent quality with defect rates often exceeding 15%, significantly higher than the 3-5% typically observed in mature metal mesh production lines.

The economic barriers for nanomaterial manufacturing remain substantial, with production costs for high-purity carbon nanotubes ranging from $100-500 per gram and graphene production costs between $50-200 per square meter for electronics-grade material. These high costs stem from complex purification processes, specialized equipment requirements, and low yields. Additionally, nanomaterial production often requires rare catalysts and energy-intensive processes, further increasing costs.

Environmental and regulatory considerations also impact manufacturing scalability. Metal mesh production utilizes established chemical processes with well-understood environmental controls, while nanomaterial production faces evolving regulatory scrutiny regarding potential health impacts of nanoparticles. This regulatory uncertainty adds risk to large-scale investment in nanomaterial manufacturing infrastructure.

Looking forward, metal mesh manufacturing costs are projected to decrease by 15-20% over the next five years through process optimization and automation. Meanwhile, nanomaterial production costs may decrease more dramatically (potentially 30-50%) but from a much higher baseline, suggesting metal mesh will maintain its cost advantage in the near term while offering superior manufacturing scalability for immediate commercial applications.

Cost analysis reveals that metal mesh production benefits from utilizing abundant materials like copper, silver, and aluminum, which are significantly less expensive than rare elements required for certain nanomaterials. The initial capital investment for metal mesh manufacturing facilities ranges from $5-20 million depending on production capacity, with per-unit costs decreasing substantially at higher volumes. Industry reports indicate production costs of $8-15 per square meter for high-quality metal mesh, representing a 30-40% cost advantage over comparable ITO solutions.

In contrast, nanomaterial manufacturing for electronics faces considerable scalability challenges. Carbon nanotubes and graphene production methods such as chemical vapor deposition and solution processing struggle with consistency issues when scaled beyond laboratory settings. Current industrial nanomaterial production yields inconsistent quality with defect rates often exceeding 15%, significantly higher than the 3-5% typically observed in mature metal mesh production lines.

The economic barriers for nanomaterial manufacturing remain substantial, with production costs for high-purity carbon nanotubes ranging from $100-500 per gram and graphene production costs between $50-200 per square meter for electronics-grade material. These high costs stem from complex purification processes, specialized equipment requirements, and low yields. Additionally, nanomaterial production often requires rare catalysts and energy-intensive processes, further increasing costs.

Environmental and regulatory considerations also impact manufacturing scalability. Metal mesh production utilizes established chemical processes with well-understood environmental controls, while nanomaterial production faces evolving regulatory scrutiny regarding potential health impacts of nanoparticles. This regulatory uncertainty adds risk to large-scale investment in nanomaterial manufacturing infrastructure.

Looking forward, metal mesh manufacturing costs are projected to decrease by 15-20% over the next five years through process optimization and automation. Meanwhile, nanomaterial production costs may decrease more dramatically (potentially 30-50%) but from a much higher baseline, suggesting metal mesh will maintain its cost advantage in the near term while offering superior manufacturing scalability for immediate commercial applications.

Environmental Impact and Sustainability Considerations

The environmental impact of electronic materials has become a critical consideration in technology development as the industry faces increasing pressure to adopt sustainable practices. Metal mesh and nanomaterials present distinctly different environmental profiles throughout their lifecycle. Metal mesh technologies typically utilize conventional metals like copper, silver, and aluminum, which have established recycling infrastructures. These materials can be recovered at rates exceeding 90% in proper recycling facilities, significantly reducing their environmental footprint compared to materials with limited recyclability.

In contrast, nanomaterials such as carbon nanotubes, graphene, and metal nanoparticles present unique environmental challenges. Their production often requires energy-intensive processes and specialized chemicals, resulting in higher carbon emissions per unit of material produced. A comparative lifecycle assessment reveals that metal mesh fabrication typically generates 30-45% less carbon dioxide equivalent emissions than comparable nanomaterial production processes.

Water usage represents another significant environmental factor. Nanomaterial synthesis frequently demands ultra-pure water and generates wastewater containing potentially harmful nanoparticles. Current filtration technologies struggle to completely remove these particles before discharge, creating potential ecological risks. Metal mesh manufacturing, while not without water impacts, generally operates within more established water treatment frameworks with proven effectiveness.

The toxicity profiles of these materials also differ substantially. Certain nanomaterials have demonstrated potential cytotoxicity and genotoxicity in laboratory studies, raising concerns about their environmental release during manufacturing, product use, or disposal. Metal mesh components, composed of well-characterized metals, present more predictable environmental interactions, though issues like metal leaching must still be managed appropriately.

From a resource perspective, many nanomaterials incorporate rare elements with limited global supplies and geopolitically concentrated sources. This raises questions about long-term sustainability and supply chain resilience. Metal mesh technologies predominantly utilize more abundant metals, though silver-based systems do incorporate a precious metal with its own sustainability considerations.

End-of-life management represents perhaps the most significant sustainability difference between these technologies. While metal mesh can be processed through conventional e-waste recycling, nanomaterials often lack specific recovery protocols in current recycling systems. This gap results in potential material loss and environmental contamination when nanomaterial-based electronics reach end-of-life.

Looking forward, both technologies are evolving toward greater sustainability. Innovations in metal mesh include reduced-thickness designs that maintain performance while decreasing material requirements. Similarly, nanomaterial researchers are developing greener synthesis methods and exploring biodegradable nanomaterial variants that could address current environmental concerns.

In contrast, nanomaterials such as carbon nanotubes, graphene, and metal nanoparticles present unique environmental challenges. Their production often requires energy-intensive processes and specialized chemicals, resulting in higher carbon emissions per unit of material produced. A comparative lifecycle assessment reveals that metal mesh fabrication typically generates 30-45% less carbon dioxide equivalent emissions than comparable nanomaterial production processes.

Water usage represents another significant environmental factor. Nanomaterial synthesis frequently demands ultra-pure water and generates wastewater containing potentially harmful nanoparticles. Current filtration technologies struggle to completely remove these particles before discharge, creating potential ecological risks. Metal mesh manufacturing, while not without water impacts, generally operates within more established water treatment frameworks with proven effectiveness.

The toxicity profiles of these materials also differ substantially. Certain nanomaterials have demonstrated potential cytotoxicity and genotoxicity in laboratory studies, raising concerns about their environmental release during manufacturing, product use, or disposal. Metal mesh components, composed of well-characterized metals, present more predictable environmental interactions, though issues like metal leaching must still be managed appropriately.

From a resource perspective, many nanomaterials incorporate rare elements with limited global supplies and geopolitically concentrated sources. This raises questions about long-term sustainability and supply chain resilience. Metal mesh technologies predominantly utilize more abundant metals, though silver-based systems do incorporate a precious metal with its own sustainability considerations.

End-of-life management represents perhaps the most significant sustainability difference between these technologies. While metal mesh can be processed through conventional e-waste recycling, nanomaterials often lack specific recovery protocols in current recycling systems. This gap results in potential material loss and environmental contamination when nanomaterial-based electronics reach end-of-life.

Looking forward, both technologies are evolving toward greater sustainability. Innovations in metal mesh include reduced-thickness designs that maintain performance while decreasing material requirements. Similarly, nanomaterial researchers are developing greener synthesis methods and exploring biodegradable nanomaterial variants that could address current environmental concerns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!