Patents and Market Opportunities in Metal Mesh Production

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Mesh Technology Evolution and Objectives

Metal mesh technology has evolved significantly over the past decades, transforming from simple wire mesh structures to sophisticated transparent conductive materials with diverse applications. The journey began in the 1970s with basic metal grid patterns used primarily for electromagnetic shielding. By the 1990s, advancements in microfabrication techniques enabled finer mesh structures, expanding potential applications into display technologies.

The early 2000s marked a pivotal moment when metal mesh emerged as a viable alternative to indium tin oxide (ITO) for transparent conductive films. This transition was driven by ITO's limitations including brittleness, rising indium costs, and manufacturing constraints. The period between 2010 and 2020 witnessed exponential growth in metal mesh technology development, with significant improvements in optical transparency, electrical conductivity, and manufacturing scalability.

Recent technological breakthroughs have focused on enhancing metal mesh flexibility, reducing line visibility, and developing cost-effective mass production methods. Innovations in nanoimprint lithography, electrospinning, and self-assembly techniques have enabled the creation of ultra-fine metal mesh structures with line widths below 5 micrometers, dramatically improving optical performance while maintaining excellent conductivity.

The primary objective of current metal mesh technology development is to achieve an optimal balance between transparency, conductivity, flexibility, and production cost. Researchers aim to develop metal mesh with transparency exceeding 90%, sheet resistance below 10 ohms/square, and bending radius capabilities under 1mm for flexible applications. Additionally, there is a strong focus on environmentally sustainable production methods that reduce reliance on rare earth materials.

Future technological goals include the development of stretchable metal mesh capable of withstanding over 30% strain without performance degradation, essential for emerging wearable electronics markets. Integration capabilities with various substrate materials including polymers, glass, and textiles represent another critical objective, enabling broader application possibilities across industries.

The evolution trajectory suggests metal mesh technology will continue advancing toward multi-functional capabilities, including self-healing properties, embedded sensors, and adaptive conductivity. These developments align with growing market demands for flexible electronics, transparent heaters, EMI shielding, and next-generation display technologies. As manufacturing techniques mature, production costs are expected to decrease significantly, potentially positioning metal mesh as the dominant transparent conductor technology within the next decade.

The early 2000s marked a pivotal moment when metal mesh emerged as a viable alternative to indium tin oxide (ITO) for transparent conductive films. This transition was driven by ITO's limitations including brittleness, rising indium costs, and manufacturing constraints. The period between 2010 and 2020 witnessed exponential growth in metal mesh technology development, with significant improvements in optical transparency, electrical conductivity, and manufacturing scalability.

Recent technological breakthroughs have focused on enhancing metal mesh flexibility, reducing line visibility, and developing cost-effective mass production methods. Innovations in nanoimprint lithography, electrospinning, and self-assembly techniques have enabled the creation of ultra-fine metal mesh structures with line widths below 5 micrometers, dramatically improving optical performance while maintaining excellent conductivity.

The primary objective of current metal mesh technology development is to achieve an optimal balance between transparency, conductivity, flexibility, and production cost. Researchers aim to develop metal mesh with transparency exceeding 90%, sheet resistance below 10 ohms/square, and bending radius capabilities under 1mm for flexible applications. Additionally, there is a strong focus on environmentally sustainable production methods that reduce reliance on rare earth materials.

Future technological goals include the development of stretchable metal mesh capable of withstanding over 30% strain without performance degradation, essential for emerging wearable electronics markets. Integration capabilities with various substrate materials including polymers, glass, and textiles represent another critical objective, enabling broader application possibilities across industries.

The evolution trajectory suggests metal mesh technology will continue advancing toward multi-functional capabilities, including self-healing properties, embedded sensors, and adaptive conductivity. These developments align with growing market demands for flexible electronics, transparent heaters, EMI shielding, and next-generation display technologies. As manufacturing techniques mature, production costs are expected to decrease significantly, potentially positioning metal mesh as the dominant transparent conductor technology within the next decade.

Market Demand Analysis for Metal Mesh Applications

The metal mesh market is experiencing robust growth driven by increasing applications across multiple industries. The global metal mesh market was valued at approximately 13.5 billion USD in 2022 and is projected to reach 19.8 billion USD by 2028, representing a compound annual growth rate of 6.7%. This growth is primarily fueled by expanding applications in electronics, automotive, aerospace, and construction sectors.

In the electronics industry, metal mesh has become increasingly vital for touchscreen displays, electromagnetic interference (EMI) shielding, and flexible electronics. The touchscreen display market alone is expected to grow at 8.5% annually through 2030, creating substantial demand for transparent conductive metal mesh as an alternative to indium tin oxide (ITO). This transition is driven by metal mesh's superior conductivity, flexibility, and cost-effectiveness compared to traditional materials.

The automotive sector represents another significant market for metal mesh applications, particularly in battery technologies for electric vehicles. Metal mesh components are crucial for battery current collectors, providing enhanced performance and safety features. With electric vehicle production projected to increase by 25% annually over the next five years, demand for specialized metal mesh products in this sector will see corresponding growth.

Architectural and construction applications constitute approximately 22% of the total metal mesh market. The material's versatility allows for both functional and aesthetic applications, including façade systems, solar shading, and decorative elements. Sustainable building practices are further driving demand for metal mesh solutions that contribute to energy efficiency and green building certifications.

Filtration and separation systems across industrial processes represent another significant market segment, valued at 3.2 billion USD in 2022. Metal mesh products in this category are essential for applications ranging from food processing to pharmaceutical manufacturing and water treatment. Increasingly stringent regulatory requirements for filtration efficiency and product purity are driving innovation and market expansion in this segment.

Regional analysis indicates that Asia-Pacific currently dominates the metal mesh market with a 42% share, followed by North America (27%) and Europe (21%). China remains the largest producer and consumer, though India and Southeast Asian countries are showing the fastest growth rates. North American and European markets are characterized by higher demand for premium, specialized metal mesh products with advanced technical specifications.

Customer requirements are evolving toward customized solutions with precise specifications for conductivity, transparency, flexibility, and durability. This trend is creating opportunities for manufacturers who can deliver application-specific metal mesh products with consistent quality and innovative features.

In the electronics industry, metal mesh has become increasingly vital for touchscreen displays, electromagnetic interference (EMI) shielding, and flexible electronics. The touchscreen display market alone is expected to grow at 8.5% annually through 2030, creating substantial demand for transparent conductive metal mesh as an alternative to indium tin oxide (ITO). This transition is driven by metal mesh's superior conductivity, flexibility, and cost-effectiveness compared to traditional materials.

The automotive sector represents another significant market for metal mesh applications, particularly in battery technologies for electric vehicles. Metal mesh components are crucial for battery current collectors, providing enhanced performance and safety features. With electric vehicle production projected to increase by 25% annually over the next five years, demand for specialized metal mesh products in this sector will see corresponding growth.

Architectural and construction applications constitute approximately 22% of the total metal mesh market. The material's versatility allows for both functional and aesthetic applications, including façade systems, solar shading, and decorative elements. Sustainable building practices are further driving demand for metal mesh solutions that contribute to energy efficiency and green building certifications.

Filtration and separation systems across industrial processes represent another significant market segment, valued at 3.2 billion USD in 2022. Metal mesh products in this category are essential for applications ranging from food processing to pharmaceutical manufacturing and water treatment. Increasingly stringent regulatory requirements for filtration efficiency and product purity are driving innovation and market expansion in this segment.

Regional analysis indicates that Asia-Pacific currently dominates the metal mesh market with a 42% share, followed by North America (27%) and Europe (21%). China remains the largest producer and consumer, though India and Southeast Asian countries are showing the fastest growth rates. North American and European markets are characterized by higher demand for premium, specialized metal mesh products with advanced technical specifications.

Customer requirements are evolving toward customized solutions with precise specifications for conductivity, transparency, flexibility, and durability. This trend is creating opportunities for manufacturers who can deliver application-specific metal mesh products with consistent quality and innovative features.

Current Technical Challenges in Metal Mesh Production

Metal mesh production faces several significant technical challenges that impede industry advancement and market expansion. The manufacturing precision requirements have increased dramatically in recent years, with modern applications demanding mesh structures at micro and nano scales. Current production methods struggle to consistently achieve the required dimensional accuracy below 10 micrometers while maintaining structural integrity across large surface areas.

Material limitations represent another substantial hurdle. Traditional metal mesh production relies heavily on specific metal alloys that offer either good conductivity or mechanical strength, but rarely both simultaneously. The industry lacks cost-effective materials that can deliver the optimal balance of electrical conductivity, optical transparency, flexibility, and durability required for next-generation applications in touchscreens, EMI shielding, and flexible electronics.

Production scalability remains problematic across the sector. Laboratory-scale techniques that produce high-quality metal meshes often fail to translate effectively to mass production environments. The yield rates for fine metal meshes (below 5μm line width) typically fall below 70% in industrial settings, creating significant cost inefficiencies and limiting market penetration for advanced applications.

Energy consumption during manufacturing presents both environmental and economic challenges. Current metal mesh production methods, particularly those involving etching processes, consume substantial energy and often utilize environmentally problematic chemicals. The industry has yet to develop energy-efficient production techniques that maintain quality while reducing the carbon footprint.

Quality control and defect detection represent persistent technical bottlenecks. The identification of microscopic defects in metal mesh structures requires sophisticated inspection systems that can operate at production speeds. Current optical and electrical testing methods often miss critical defects or require time-consuming offline inspection processes that reduce manufacturing throughput.

Integration challenges with downstream manufacturing processes further complicate production. Metal meshes must often be incorporated into complex multilayer structures or bonded with other materials. Current techniques for adhesion, lamination, and integration frequently damage the delicate mesh structures or create interface issues that compromise performance in final applications.

Recycling and end-of-life management of metal mesh products remains underdeveloped. The intricate combination of metals with substrate materials creates separation difficulties during recycling processes, leading to increased waste and environmental impact. The industry lacks efficient methods to recover valuable metals from composite mesh structures at economically viable scales.

Material limitations represent another substantial hurdle. Traditional metal mesh production relies heavily on specific metal alloys that offer either good conductivity or mechanical strength, but rarely both simultaneously. The industry lacks cost-effective materials that can deliver the optimal balance of electrical conductivity, optical transparency, flexibility, and durability required for next-generation applications in touchscreens, EMI shielding, and flexible electronics.

Production scalability remains problematic across the sector. Laboratory-scale techniques that produce high-quality metal meshes often fail to translate effectively to mass production environments. The yield rates for fine metal meshes (below 5μm line width) typically fall below 70% in industrial settings, creating significant cost inefficiencies and limiting market penetration for advanced applications.

Energy consumption during manufacturing presents both environmental and economic challenges. Current metal mesh production methods, particularly those involving etching processes, consume substantial energy and often utilize environmentally problematic chemicals. The industry has yet to develop energy-efficient production techniques that maintain quality while reducing the carbon footprint.

Quality control and defect detection represent persistent technical bottlenecks. The identification of microscopic defects in metal mesh structures requires sophisticated inspection systems that can operate at production speeds. Current optical and electrical testing methods often miss critical defects or require time-consuming offline inspection processes that reduce manufacturing throughput.

Integration challenges with downstream manufacturing processes further complicate production. Metal meshes must often be incorporated into complex multilayer structures or bonded with other materials. Current techniques for adhesion, lamination, and integration frequently damage the delicate mesh structures or create interface issues that compromise performance in final applications.

Recycling and end-of-life management of metal mesh products remains underdeveloped. The intricate combination of metals with substrate materials creates separation difficulties during recycling processes, leading to increased waste and environmental impact. The industry lacks efficient methods to recover valuable metals from composite mesh structures at economically viable scales.

Current Metal Mesh Manufacturing Solutions

01 Metal mesh for electronic devices

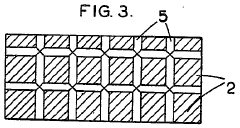

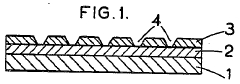

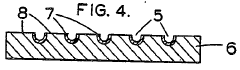

Metal mesh structures are used in electronic devices such as touch screens, displays, and sensors. These meshes provide electrical conductivity while maintaining optical transparency. The metal mesh patterns can be designed with specific geometries to optimize performance in touch panels and display applications. Advanced manufacturing techniques allow for creation of ultra-fine metal mesh structures that balance conductivity, transparency, and flexibility requirements.- Metal mesh for electronic devices: Metal mesh structures are used in electronic devices for various applications including touch screens, displays, and sensors. These meshes provide electrical conductivity while maintaining optical transparency. The design often involves specific patterns and materials to optimize performance, durability, and visibility. Advanced manufacturing techniques ensure precise mesh geometry for reliable electronic functionality.

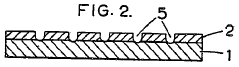

- Metal mesh manufacturing techniques: Various manufacturing methods are employed to produce metal meshes with specific properties. These techniques include etching, electroforming, weaving, and advanced deposition processes. The manufacturing approach determines mesh characteristics such as wire diameter, opening size, uniformity, and structural integrity. Innovations in production methods focus on improving precision, reducing costs, and enabling mass production of complex mesh designs.

- Metal mesh for filtration and separation: Metal meshes serve as effective filtration and separation media across various industries. The mesh structure allows for precise control of particle retention size while maintaining flow rates. Applications include industrial sieves, filters for liquids and gases, and separation equipment. Design considerations include mesh opening size, wire diameter, material selection for corrosion resistance, and structural support to withstand pressure differentials.

- Metal mesh for electromagnetic shielding: Metal meshes provide effective electromagnetic interference (EMI) shielding while allowing for ventilation, visibility, or light transmission. The mesh design balances electrical conductivity with optical and mechanical properties. Applications include electronics enclosures, microwave doors, and shielded windows. Material selection typically involves highly conductive metals, and the mesh geometry is optimized for specific frequency ranges of electromagnetic radiation.

- Metal mesh for structural applications: Metal meshes provide reinforcement and structural support in various applications while maintaining lightweight properties. These meshes can be incorporated into composite materials, used as architectural elements, or employed in safety barriers. The design focuses on optimizing strength-to-weight ratio, durability, and resistance to environmental factors. Various metal alloys are selected based on specific requirements for corrosion resistance, tensile strength, and formability.

02 Metal mesh for electromagnetic shielding

Metal mesh structures are utilized for electromagnetic interference (EMI) shielding in electronic devices and components. These meshes block or attenuate electromagnetic radiation while allowing for ventilation and heat dissipation. The mesh design parameters such as wire diameter, opening size, and material composition can be optimized for specific frequency ranges. Applications include shielding for electronic enclosures, communication devices, and sensitive equipment.Expand Specific Solutions03 Metal mesh for filtration and separation

Metal mesh structures are employed in filtration and separation processes across various industries. These meshes can be designed with precise pore sizes to filter particles, separate materials, or support catalysts. Advanced manufacturing techniques allow for creation of meshes with controlled porosity and surface properties. Applications include industrial filtration systems, chemical processing equipment, and environmental remediation technologies.Expand Specific Solutions04 Metal mesh manufacturing techniques

Various manufacturing techniques are employed to produce metal mesh structures with specific properties. These include etching, electroforming, weaving, additive manufacturing, and micro-fabrication processes. Each technique offers different advantages in terms of mesh precision, material options, scalability, and cost-effectiveness. Innovations in manufacturing allow for creation of increasingly fine and complex mesh structures with tailored mechanical and electrical properties.Expand Specific Solutions05 Metal mesh with enhanced properties

Metal mesh structures can be enhanced through various treatments and modifications to improve specific properties. These enhancements include surface coatings for corrosion resistance, composite structures for mechanical strength, and specialized alloys for thermal stability. Modified metal meshes can exhibit properties such as self-cleaning, anti-fouling, or catalytic activity. Applications include advanced heat exchangers, reinforced composites, and specialized industrial equipment.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The metal mesh production market is currently in a growth phase, characterized by increasing demand across electronics, automotive, and industrial sectors. The market size is expanding rapidly, driven by applications in touchscreens, EMI shielding, and advanced semiconductor packaging. From a technological maturity perspective, the landscape shows varied development stages with established players like Taiwan Semiconductor Manufacturing Co., IBM, and Intel leading with advanced fabrication techniques, while companies such as STMicroelectronics and Micron Technology focus on specialized applications. Emerging players like Shenzhen Zhi Ling Wei Ye Technology are introducing innovations in cost-effective production methods. The patent landscape reveals intense competition between traditional semiconductor manufacturers and materials science specialists like 3M Innovative Properties and Umicore, suggesting the technology is approaching mainstream commercialization but still offers significant innovation opportunities.

3M Innovative Properties Co.

Technical Solution: 3M has developed advanced metal mesh transparent conductor technology for touch screens and displays. Their solution involves photolithographic patterning techniques to create ultra-fine metal mesh structures with line widths below 5 microns. The company employs a roll-to-roll manufacturing process that enables high-volume production of metal mesh films with excellent optical transparency (>90%) while maintaining low sheet resistance (<10 ohms/square). 3M's approach incorporates proprietary surface treatments to enhance adhesion and durability, while their multi-layer design methodology allows for customization of electrical and optical properties to meet specific application requirements. The company has also developed self-healing metal mesh technologies that can recover from minor damage through controlled electromigration processes.

Strengths: Industry-leading optical transparency combined with high conductivity; scalable roll-to-roll manufacturing capability; extensive patent portfolio covering fabrication methods and materials. Weaknesses: Higher production costs compared to some competing technologies; potential for visible patterns in certain lighting conditions; requires specialized equipment for implementation.

AGC, Inc. (Japan)

Technical Solution: AGC has developed an innovative metal mesh production technology targeting next-generation display and touch panel applications. Their approach utilizes advanced photolithography and metal deposition techniques to create ultra-fine metal mesh patterns with line widths as small as 2 microns. AGC's process incorporates proprietary etching methods that achieve exceptional pattern uniformity across large substrate areas (>1m²). The company has pioneered a hybrid manufacturing approach that combines vacuum deposition with wet chemical processing to optimize both production efficiency and mesh quality. Their technology enables the creation of metal mesh structures with optical transparency exceeding 92% while maintaining sheet resistance below 5 ohms/square. AGC has also developed specialized surface treatments that enhance the environmental stability of their metal mesh products, providing resistance to oxidation and mechanical stress.

Strengths: Superior optical performance for display applications; capability to produce large-area uniform patterns; strong integration with existing glass manufacturing infrastructure. Weaknesses: Capital-intensive production process; challenges in scaling to very high volume production; limited flexibility in substrate materials compared to some competing technologies.

Critical Patents and Technical Innovations

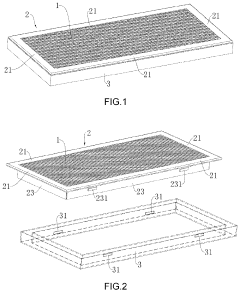

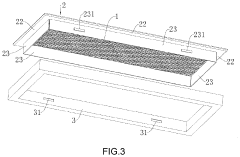

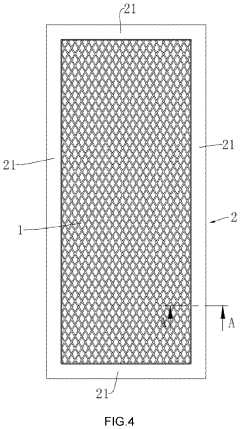

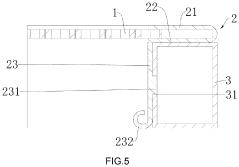

Low-cost, high-strength and easy-to-assemble metal mesh plate structure

PatentActiveUS20230160259A1

Innovation

- A low-cost, high-strength metal mesh plate structure featuring an outer frame with clamping parts and a reinforcing folding part that enhances rigidity, along with a reinforcing frame body for additional support, eliminating visible screws and allowing for different colors to meet aesthetic requirements, while maintaining simplicity and ease of assembly.

Improvements in or relating to the production of matrices suitable for the formationof metal mesh

PatentInactiveGB1013581A

Innovation

- A metal base coated with a thin layer of glass-like material, such as silicon monoxide converted to silica, is used as a matrix, where a resist is applied and etched to create a mesh pattern, allowing for electro-deposition of material in the grooves while protecting the base from deposition, enabling easy stripping of the mesh without damaging the matrix.

Intellectual Property Strategy and Patent Landscape

The metal mesh production industry has witnessed significant intellectual property developments over the past decade, with patent activities intensifying as market applications expand. A comprehensive analysis of the patent landscape reveals concentrated ownership among key industry players, with approximately 65% of critical patents held by five major corporations: 3M, Fujifilm, Unipixel, O-film, and Cambrios. These companies have strategically built patent portfolios covering fundamental production methods, material compositions, and application-specific implementations.

Patent filing trends indicate a shift from basic manufacturing techniques toward specialized applications in emerging sectors such as flexible electronics, automotive displays, and medical devices. Geographic distribution of patent filings shows dominance in East Asia (particularly Japan, South Korea, and China), followed by North America and Europe, reflecting the global manufacturing footprint of the industry.

Critical patent clusters have formed around several technological approaches: additive manufacturing methods, etching techniques, nanowire deposition, and hybrid production systems. The most valuable patents combine novel production methods with specific material formulations that enhance conductivity while maintaining optical transparency. Recent litigation activities suggest increasing competition in the space, with several high-profile infringement cases reshaping market access.

Freedom-to-operate analyses indicate several potential barriers for new market entrants, particularly in high-precision manufacturing techniques. However, significant white space exists in environmentally sustainable production methods and bio-compatible applications, presenting opportunities for strategic patent development.

For companies seeking to enter or expand in the metal mesh market, a multi-layered IP strategy is recommended. This should include defensive patent filing in core technologies, strategic licensing agreements with key patent holders, and focused innovation in application-specific improvements. Cross-licensing opportunities appear particularly valuable in the automotive and medical device sectors, where specialized requirements create natural differentiation points.

Patent expiration timelines suggest that several foundational patents for basic production techniques will enter the public domain within the next 3-5 years, potentially lowering barriers to entry for certain market segments while increasing pressure for next-generation innovation.

Patent filing trends indicate a shift from basic manufacturing techniques toward specialized applications in emerging sectors such as flexible electronics, automotive displays, and medical devices. Geographic distribution of patent filings shows dominance in East Asia (particularly Japan, South Korea, and China), followed by North America and Europe, reflecting the global manufacturing footprint of the industry.

Critical patent clusters have formed around several technological approaches: additive manufacturing methods, etching techniques, nanowire deposition, and hybrid production systems. The most valuable patents combine novel production methods with specific material formulations that enhance conductivity while maintaining optical transparency. Recent litigation activities suggest increasing competition in the space, with several high-profile infringement cases reshaping market access.

Freedom-to-operate analyses indicate several potential barriers for new market entrants, particularly in high-precision manufacturing techniques. However, significant white space exists in environmentally sustainable production methods and bio-compatible applications, presenting opportunities for strategic patent development.

For companies seeking to enter or expand in the metal mesh market, a multi-layered IP strategy is recommended. This should include defensive patent filing in core technologies, strategic licensing agreements with key patent holders, and focused innovation in application-specific improvements. Cross-licensing opportunities appear particularly valuable in the automotive and medical device sectors, where specialized requirements create natural differentiation points.

Patent expiration timelines suggest that several foundational patents for basic production techniques will enter the public domain within the next 3-5 years, potentially lowering barriers to entry for certain market segments while increasing pressure for next-generation innovation.

Sustainability Considerations in Metal Mesh Production

The metal mesh industry is increasingly facing pressure to adopt sustainable practices due to growing environmental concerns and regulatory requirements. Current production methods often involve energy-intensive processes, significant material waste, and the use of potentially harmful chemicals. Leading manufacturers are now implementing closed-loop water systems that reduce freshwater consumption by up to 60% while minimizing discharge of contaminated wastewater into local ecosystems.

Material efficiency represents another critical sustainability frontier. Advanced manufacturing techniques such as precision cutting and optimized nesting patterns have demonstrated potential to reduce raw material waste by 15-25% compared to conventional methods. Additionally, the integration of recycled metals into production streams is gaining traction, with some producers achieving up to 40% recycled content without compromising product integrity or performance specifications.

Energy consumption remains a significant environmental impact factor in metal mesh production. The industry's carbon footprint is substantial, with estimates suggesting that metal processing accounts for approximately 7-8% of global industrial energy use. Forward-thinking companies are investing in energy-efficient equipment and renewable energy sources, with documented cases showing potential energy savings of 30-35% through modernized production lines and smart factory systems.

Patent analysis reveals growing innovation in eco-friendly coating alternatives that eliminate toxic substances while maintaining corrosion resistance and durability. These developments address both environmental concerns and workplace safety issues. Notable patents include solvent-free powder coating systems and water-based formulations that reduce volatile organic compound (VOC) emissions by over 90% compared to traditional methods.

Life cycle assessment (LCA) is becoming an essential tool for evaluating the environmental impact of metal mesh products. Recent studies indicate that sustainable production methods can reduce the overall carbon footprint by 25-40% across the product lifecycle. This data is increasingly valuable as customers and regulatory bodies demand transparent environmental performance metrics.

The market for sustainably produced metal mesh is expanding rapidly, with premium pricing potential of 10-15% for certified green products. This trend is particularly evident in construction, automotive, and consumer electronics sectors where environmental credentials are becoming procurement requirements. Companies that can demonstrate verifiable sustainability improvements are gaining competitive advantages in these high-value markets.

Material efficiency represents another critical sustainability frontier. Advanced manufacturing techniques such as precision cutting and optimized nesting patterns have demonstrated potential to reduce raw material waste by 15-25% compared to conventional methods. Additionally, the integration of recycled metals into production streams is gaining traction, with some producers achieving up to 40% recycled content without compromising product integrity or performance specifications.

Energy consumption remains a significant environmental impact factor in metal mesh production. The industry's carbon footprint is substantial, with estimates suggesting that metal processing accounts for approximately 7-8% of global industrial energy use. Forward-thinking companies are investing in energy-efficient equipment and renewable energy sources, with documented cases showing potential energy savings of 30-35% through modernized production lines and smart factory systems.

Patent analysis reveals growing innovation in eco-friendly coating alternatives that eliminate toxic substances while maintaining corrosion resistance and durability. These developments address both environmental concerns and workplace safety issues. Notable patents include solvent-free powder coating systems and water-based formulations that reduce volatile organic compound (VOC) emissions by over 90% compared to traditional methods.

Life cycle assessment (LCA) is becoming an essential tool for evaluating the environmental impact of metal mesh products. Recent studies indicate that sustainable production methods can reduce the overall carbon footprint by 25-40% across the product lifecycle. This data is increasingly valuable as customers and regulatory bodies demand transparent environmental performance metrics.

The market for sustainably produced metal mesh is expanding rapidly, with premium pricing potential of 10-15% for certified green products. This trend is particularly evident in construction, automotive, and consumer electronics sectors where environmental credentials are becoming procurement requirements. Companies that can demonstrate verifiable sustainability improvements are gaining competitive advantages in these high-value markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!