How To Improve Tungsten Sourcing And Sustainability?

Tungsten Industry Overview

Tungsten, also known as wolfram, is a rare metal with unique properties that make it indispensable in various industries. The global tungsten market has experienced significant fluctuations in recent years, driven by supply constraints, geopolitical factors, and evolving demand patterns. China dominates the tungsten industry, accounting for over 80% of global production and reserves. This concentration has led to concerns about supply chain resilience and sustainability.

The tungsten industry is characterized by a complex value chain, from mining and processing to the production of intermediate products and end-use applications. Primary tungsten is extracted from wolframite and scheelite ores, with China, Vietnam, and Russia being the top producers. Secondary tungsten, derived from recycling, is becoming increasingly important as a sustainable source.

Key end-use sectors for tungsten include automotive, aerospace, mining, and electronics. The metal's high melting point, density, and hardness make it crucial for applications such as cutting tools, wear-resistant components, and high-temperature alloys. The growing demand for electric vehicles and renewable energy technologies is expected to drive further growth in tungsten consumption.

Sustainability challenges in the tungsten industry are multifaceted. Environmental concerns include habitat destruction, water pollution, and energy-intensive processing. Social issues involve labor conditions in mining regions and potential conflicts in sourcing areas. Economic sustainability is challenged by price volatility and the need for significant capital investments in new mining projects.

Efforts to improve tungsten sourcing and sustainability are gaining momentum. These include developing more efficient extraction technologies, increasing recycling rates, and exploring alternative sources such as mine tailings and industrial by-products. Initiatives like the Responsible Minerals Initiative (RMI) are promoting responsible sourcing practices and supply chain transparency.

The tungsten market is influenced by global economic trends, technological advancements, and regulatory frameworks. Trade tensions and export restrictions have highlighted the need for diversified supply chains and strategic stockpiling by major consumers. Emerging applications in additive manufacturing, energy storage, and advanced materials are expected to create new opportunities and challenges for the industry.

As the world transitions towards a more sustainable and circular economy, the tungsten industry faces both opportunities and pressures to adapt. Innovations in recycling technologies, material substitution, and more sustainable mining practices are likely to shape the future of tungsten sourcing and utilization.

Global Demand Analysis

The global demand for tungsten has been steadily increasing due to its unique properties and wide range of applications across various industries. Tungsten's high melting point, density, and strength make it indispensable in sectors such as aerospace, automotive, mining, and electronics. The growing industrialization and technological advancements in emerging economies have further fueled the demand for tungsten-based products.

In the aerospace industry, tungsten alloys are crucial for manufacturing turbine blades, rocket nozzles, and heat shields. The expansion of commercial aviation and space exploration programs has led to a surge in demand for these high-performance materials. Similarly, the automotive sector relies heavily on tungsten for producing wear-resistant components, such as engine valves and turbocharger rotors, driving the need for sustainable sourcing solutions.

The electronics industry represents another significant market for tungsten, particularly in the production of integrated circuits and LED lighting. As consumer electronics become more sophisticated and energy-efficient, the demand for tungsten in this sector continues to grow. Additionally, the ongoing transition to renewable energy sources has increased the use of tungsten in wind turbines and solar panels, further straining the global supply chain.

Mining and construction industries also contribute substantially to the global tungsten demand. Tungsten carbide tools are essential for drilling, cutting, and excavation operations, with their durability and performance driving continued adoption. The expansion of infrastructure projects in developing countries has amplified this demand, necessitating improved sourcing strategies to meet the growing needs.

The medical sector has emerged as a promising market for tungsten applications, particularly in radiation shielding and medical imaging equipment. As healthcare systems worldwide invest in advanced diagnostic technologies, the demand for tungsten in this field is expected to rise significantly in the coming years.

However, the concentration of tungsten production in a few countries, primarily China, has raised concerns about supply chain vulnerabilities and geopolitical risks. This situation has prompted many industries and governments to seek alternative sources and develop more sustainable extraction and recycling methods. The push for circular economy principles and the increasing focus on environmental sustainability have also influenced the tungsten market, driving innovations in recycling technologies and the development of more efficient mining practices.

To address these challenges and meet the growing global demand, stakeholders across the tungsten value chain must collaborate to improve sourcing strategies, invest in sustainable production methods, and explore new deposits in geopolitically stable regions. Additionally, advancing recycling technologies and promoting the use of tungsten scrap can help alleviate supply pressures and reduce the environmental impact of tungsten production.

Sourcing Challenges

Tungsten sourcing faces significant challenges due to its limited geographical distribution and complex geopolitical factors. The majority of tungsten reserves are concentrated in China, which accounts for over 80% of global production. This concentration creates supply chain vulnerabilities and potential price volatility for industries relying on tungsten.

Environmental concerns pose another major challenge in tungsten sourcing. Traditional mining methods can lead to soil erosion, water pollution, and habitat destruction. The energy-intensive nature of tungsten extraction and processing also contributes to a substantial carbon footprint, raising sustainability issues in an era of increasing environmental awareness.

The scarcity of tungsten deposits outside China has led to increased exploration efforts in other regions, but developing new mines is a time-consuming and capital-intensive process. This situation is further complicated by stringent environmental regulations in many countries, which can delay or prevent the opening of new mining operations.

Recycling tungsten presents its own set of challenges. While recycling is a more sustainable option, the process can be technically complex and economically challenging. The diverse applications of tungsten in various alloys and compounds make it difficult to recover and separate from other materials efficiently.

Geopolitical tensions and trade disputes also impact tungsten sourcing. Export restrictions, tariffs, and changing trade policies can disrupt supply chains and create uncertainty in the global tungsten market. This instability can lead to price fluctuations and supply shortages, affecting industries that rely heavily on tungsten.

The tungsten industry also faces challenges related to social responsibility and ethical sourcing. Concerns about labor practices, conflict minerals, and the social impact of mining operations in certain regions have led to increased scrutiny and demand for transparency in the supply chain.

Technological limitations in exploration and extraction methods present another hurdle. Developing more efficient and environmentally friendly mining techniques is crucial for improving tungsten sourcing sustainability, but requires significant investment in research and development.

Lastly, the cyclical nature of demand in key industries that use tungsten, such as automotive and aerospace, can lead to unpredictable market conditions. This volatility makes it challenging for mining companies to plan long-term investments and maintain stable production levels, further complicating the sourcing landscape.

Current Sourcing Methods

01 Sustainable sourcing of tungsten

Implementing sustainable practices in tungsten sourcing involves responsible mining techniques, recycling initiatives, and ethical supply chain management. This approach aims to minimize environmental impact, ensure fair labor practices, and promote long-term resource availability.- Sustainable sourcing of tungsten: Implementing sustainable practices in tungsten sourcing involves responsible mining techniques, recycling initiatives, and ethical supply chain management. This approach aims to minimize environmental impact, ensure fair labor practices, and promote long-term resource availability.

- Tungsten recycling and circular economy: Developing efficient recycling processes for tungsten-containing products and implementing circular economy principles can significantly reduce the need for primary tungsten extraction. This includes recovering tungsten from industrial waste, used products, and manufacturing scrap.

- Traceability and supply chain transparency: Utilizing blockchain technology and advanced tracking systems to enhance the traceability of tungsten from mine to end-product. This ensures compliance with ethical sourcing standards and helps identify and eliminate conflict minerals from the supply chain.

- Alternative materials and substitutes: Researching and developing alternative materials or substitutes for tungsten in various applications to reduce dependence on primary tungsten sources. This includes exploring new alloys, composites, or entirely different materials that can provide similar properties to tungsten.

- Energy-efficient tungsten processing: Implementing energy-efficient technologies and processes in tungsten mining, refining, and manufacturing to reduce the overall environmental footprint of tungsten production. This includes optimizing extraction methods, improving ore processing techniques, and utilizing renewable energy sources in production facilities.

02 Tungsten recycling and circular economy

Developing efficient recycling processes for tungsten-containing products and implementing circular economy principles in the tungsten industry. This includes recovering tungsten from scrap materials, improving recycling technologies, and creating closed-loop systems to reduce reliance on primary mining.Expand Specific Solutions03 Traceability and supply chain transparency

Utilizing blockchain technology and advanced tracking systems to enhance the traceability of tungsten from mine to end-product. This ensures compliance with ethical sourcing standards, reduces the risk of conflict minerals, and improves overall supply chain transparency.Expand Specific Solutions04 Alternative materials and substitutes

Researching and developing alternative materials or substitutes for tungsten in various applications to reduce dependence on primary tungsten sources. This includes exploring new alloys, composite materials, or entirely different elements that can provide similar properties to tungsten in specific use cases.Expand Specific Solutions05 Energy-efficient tungsten processing

Developing and implementing energy-efficient technologies and processes for tungsten extraction, refining, and manufacturing. This includes optimizing ore processing techniques, reducing energy consumption in smelting operations, and improving overall resource efficiency in the tungsten production chain.Expand Specific Solutions

Key Industry Players

The tungsten sourcing and sustainability landscape is in a mature yet evolving phase, with a global market size expected to reach $5.7 billion by 2027. The industry is characterized by a mix of established players and emerging innovators. Companies like Xiamen Tungsten Co., Ltd. and CMOC Group Ltd. are leading in sustainable mining practices, while Sumitomo Electric Industries Ltd. and Mitsubishi Materials Corp. focus on advanced recycling technologies. Research institutions such as Central South University and Jiangxi University of Science & Technology are driving innovation in extraction methods and material efficiency. The competitive landscape is shifting towards more sustainable practices, with companies like Kennametal, Inc. and Toshiba Corp. investing in circular economy initiatives to address growing environmental concerns and resource scarcity.

Xiamen Tungsten Co., Ltd.

Chongyi Zhangyuan Tungsten Co., Ltd.

Sustainable Practices

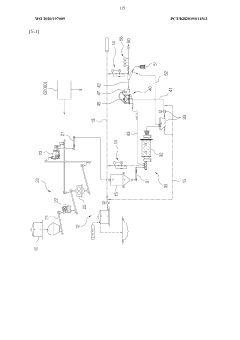

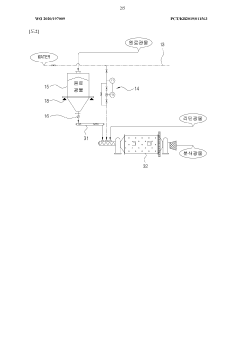

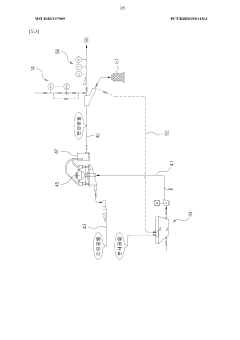

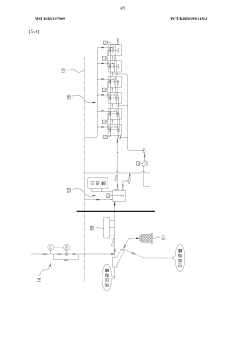

- A continuous process tungsten concentrate extraction system that modularizes crushing, grinding, and beneficiation, incorporating a storage system, crushing and grinding units with variable speed control, a cyclone classifier for particle size adjustment, and a control system with a microcomputer circuit for real-time monitoring and control of the entire process.

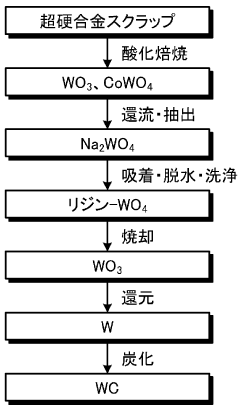

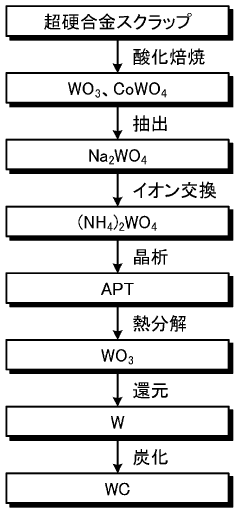

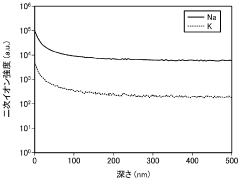

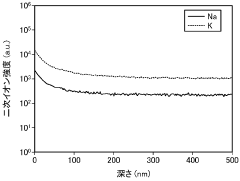

- The development of a tungsten oxide powder with a higher sodium concentration than potassium throughout its depth direction, which enhances the reaction promoting effect in hydrogen reduction treatment, allowing for efficient production of metallic tungsten and subsequently tungsten carbide by maintaining sodium in a molten state and suppressing potassium volatilization, thereby facilitating grain growth at lower energy levels.

Regulatory Framework

The regulatory framework surrounding tungsten sourcing and sustainability has become increasingly complex and stringent in recent years, reflecting growing global concerns about environmental impact, labor practices, and conflict minerals. At the international level, the Organization for Economic Co-operation and Development (OECD) has established Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, which includes specific provisions for tungsten. This guidance serves as a benchmark for many national and regional regulations.

In the United States, the Dodd-Frank Wall Street Reform and Consumer Protection Act, specifically Section 1502, requires companies to disclose their use of conflict minerals, including tungsten, from the Democratic Republic of Congo and adjoining countries. The European Union has implemented similar legislation with the Conflict Minerals Regulation, which came into full effect in January 2021. This regulation applies to EU importers of tungsten, tin, tantalum, and gold, requiring them to conduct due diligence on their supply chains.

China, as the world's largest tungsten producer, has implemented its own set of regulations to address environmental concerns and resource conservation. The Chinese government has introduced production quotas, export restrictions, and environmental standards for tungsten mining and processing. These measures aim to consolidate the industry, reduce environmental impact, and ensure long-term sustainability of tungsten resources.

Several countries with significant tungsten deposits, such as Vietnam, Rwanda, and Bolivia, have also developed national regulations to govern tungsten extraction and trade. These regulations often focus on licensing requirements, environmental protection, and local community engagement. Additionally, industry-led initiatives like the Tungsten Industry-Conflict Minerals Council (TI-CMC) have established frameworks for responsible sourcing and supply chain due diligence.

The regulatory landscape is further complicated by the intersection of tungsten sourcing with broader sustainability goals, such as the United Nations Sustainable Development Goals (SDGs). Companies are increasingly expected to align their tungsten sourcing practices with these global objectives, addressing issues like clean water and sanitation, decent work, and climate action.

As regulations continue to evolve, companies involved in tungsten sourcing must stay informed and adapt their practices accordingly. This may involve implementing robust supply chain tracking systems, conducting regular audits, and engaging in multi-stakeholder initiatives to ensure compliance and promote sustainability. The regulatory framework serves as both a challenge and an opportunity for improving tungsten sourcing practices globally.

Recycling Technologies

Recycling technologies play a crucial role in improving tungsten sourcing and sustainability. The increasing demand for tungsten, coupled with its limited natural reserves, has led to the development of various recycling methods to recover this valuable metal from end-of-life products and industrial waste.

One of the primary recycling technologies for tungsten is the hydrometallurgical process. This method involves dissolving tungsten-containing materials in chemical solutions, followed by selective precipitation or solvent extraction to recover pure tungsten compounds. The process is highly efficient and can handle a wide range of tungsten-bearing materials, including carbide tools, alloys, and electronic components.

Another significant recycling technology is pyrometallurgy, which utilizes high temperatures to extract tungsten from scrap materials. This method is particularly effective for processing tungsten carbide tools and other high-temperature alloys. The process typically involves oxidation of the scrap material, followed by reduction to recover metallic tungsten or its compounds.

Advanced physical separation techniques have also been developed to recycle tungsten-containing materials. These include magnetic separation, electrostatic separation, and density-based sorting. These methods are often used as pre-treatment steps to concentrate tungsten-bearing fractions before further processing.

In recent years, innovative recycling technologies have emerged to address specific challenges in tungsten recovery. For instance, bioleaching processes using microorganisms have shown promise in extracting tungsten from low-grade ores and complex waste materials. This environmentally friendly approach offers potential advantages in terms of energy efficiency and reduced chemical usage.

Plasma technology is another cutting-edge method being explored for tungsten recycling. This process uses high-temperature plasma to break down tungsten-containing materials into their elemental components, allowing for efficient recovery of pure tungsten. While still in the developmental stage, plasma recycling shows potential for handling complex tungsten alloys and composites.

The implementation of these recycling technologies not only improves the sustainability of tungsten sourcing but also offers significant economic benefits. By reducing dependence on primary mining, recycling helps to stabilize tungsten supply chains and mitigate price volatility. Furthermore, it contributes to reducing the environmental impact associated with tungsten extraction and processing.

As research and development in this field continue, we can expect further advancements in tungsten recycling technologies. These innovations will likely focus on improving process efficiency, reducing energy consumption, and expanding the range of recyclable tungsten-containing materials.