How to Select a Solid-State Relay for High-Voltage Operations

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Relay Technology Background and Objectives

Solid-state relays (SSRs) emerged in the 1970s as an evolution of traditional electromechanical relays, offering significant advantages in switching applications. These semiconductor-based devices utilize transistors, thyristors, or triacs to control electrical circuits without moving parts, representing a revolutionary advancement in relay technology. The development trajectory has been marked by continuous improvements in switching speed, reliability, and isolation capabilities.

The fundamental operating principle of SSRs involves three key components: an input circuit that accepts control signals, an isolation mechanism (typically optocouplers) that separates control and load circuits, and an output circuit that handles the switched power. This architecture has evolved significantly over the past five decades, with particular emphasis on enhancing performance in high-voltage applications.

Recent technological advancements have focused on addressing the specific challenges of high-voltage operations, including improved heat dissipation mechanisms, enhanced isolation barriers, and more sophisticated triggering circuits. The integration of microcontroller-based intelligence has further expanded SSR capabilities, enabling features such as zero-crossing detection, fault monitoring, and programmable switching parameters.

The primary objective of modern SSR technology for high-voltage applications is to achieve reliable switching performance while maintaining safety and efficiency. This includes maximizing isolation voltage ratings, minimizing leakage current, optimizing turn-on/turn-off characteristics, and ensuring long-term operational stability under extreme electrical conditions.

Industry standards have evolved alongside the technology, with organizations such as UL, IEC, and IEEE establishing comprehensive guidelines for SSR performance, safety, and testing methodologies. These standards provide crucial benchmarks for evaluating SSR suitability in high-voltage environments and have driven significant innovation in design and manufacturing processes.

The technological trajectory indicates a clear trend toward higher voltage capabilities, with contemporary SSRs now capable of handling several kilovolts in specialized applications. Parallel developments in semiconductor materials, particularly wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), are enabling unprecedented performance improvements in switching speed, power density, and thermal management.

Looking forward, the technology roadmap for high-voltage SSRs points toward further integration with digital control systems, enhanced diagnostic capabilities, and continued miniaturization despite increasing power handling requirements. The convergence with Internet of Things (IoT) technologies is also creating new opportunities for remote monitoring and control of high-voltage switching operations, particularly in critical infrastructure and industrial applications.

The fundamental operating principle of SSRs involves three key components: an input circuit that accepts control signals, an isolation mechanism (typically optocouplers) that separates control and load circuits, and an output circuit that handles the switched power. This architecture has evolved significantly over the past five decades, with particular emphasis on enhancing performance in high-voltage applications.

Recent technological advancements have focused on addressing the specific challenges of high-voltage operations, including improved heat dissipation mechanisms, enhanced isolation barriers, and more sophisticated triggering circuits. The integration of microcontroller-based intelligence has further expanded SSR capabilities, enabling features such as zero-crossing detection, fault monitoring, and programmable switching parameters.

The primary objective of modern SSR technology for high-voltage applications is to achieve reliable switching performance while maintaining safety and efficiency. This includes maximizing isolation voltage ratings, minimizing leakage current, optimizing turn-on/turn-off characteristics, and ensuring long-term operational stability under extreme electrical conditions.

Industry standards have evolved alongside the technology, with organizations such as UL, IEC, and IEEE establishing comprehensive guidelines for SSR performance, safety, and testing methodologies. These standards provide crucial benchmarks for evaluating SSR suitability in high-voltage environments and have driven significant innovation in design and manufacturing processes.

The technological trajectory indicates a clear trend toward higher voltage capabilities, with contemporary SSRs now capable of handling several kilovolts in specialized applications. Parallel developments in semiconductor materials, particularly wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), are enabling unprecedented performance improvements in switching speed, power density, and thermal management.

Looking forward, the technology roadmap for high-voltage SSRs points toward further integration with digital control systems, enhanced diagnostic capabilities, and continued miniaturization despite increasing power handling requirements. The convergence with Internet of Things (IoT) technologies is also creating new opportunities for remote monitoring and control of high-voltage switching operations, particularly in critical infrastructure and industrial applications.

Market Demand Analysis for High-Voltage SSR Applications

The global market for high-voltage solid-state relays (SSRs) has been experiencing robust growth, driven primarily by the increasing adoption of automation across various industries. The market value for high-voltage SSRs reached approximately $1.2 billion in 2022 and is projected to grow at a compound annual growth rate of 6.8% through 2028, according to industry analyses.

Industrial automation represents the largest application segment for high-voltage SSRs, accounting for nearly 40% of the total market demand. Manufacturing facilities are increasingly replacing traditional electromechanical relays with solid-state alternatives due to their superior reliability, longer operational lifespan, and reduced maintenance requirements. The automotive manufacturing sector, in particular, has shown significant demand growth as production lines become more sophisticated and require precise control systems.

Energy management systems constitute another rapidly expanding market segment. With the global push toward renewable energy sources, high-voltage SSRs are finding increased applications in solar inverters, wind turbine control systems, and grid connection equipment. This segment has registered a growth rate of approximately 8.5% annually since 2020, outpacing the overall market average.

Medical equipment manufacturers represent a premium market segment with stringent reliability requirements. High-voltage SSRs are critical components in medical imaging systems, radiation therapy equipment, and diagnostic devices. While this segment accounts for only about 15% of the total market volume, it represents nearly 22% of the market value due to the higher specifications and quality requirements.

Regional analysis indicates that Asia-Pacific currently leads the market with a 38% share, followed by North America (29%) and Europe (24%). China and India are experiencing the fastest growth rates, driven by rapid industrialization and infrastructure development projects. The North American market is primarily driven by technological advancements in industrial automation and healthcare sectors.

Customer requirements are increasingly focused on miniaturization, higher voltage ratings, improved thermal management, and enhanced isolation properties. There is a growing demand for SSRs capable of handling voltages exceeding 1000V while maintaining compact form factors. Additionally, customers are seeking products with integrated diagnostic capabilities and digital interfaces for Industry 4.0 compatibility.

The market is also witnessing a shift toward customized solutions for specific applications rather than general-purpose products. This trend is particularly evident in critical infrastructure projects, renewable energy installations, and specialized industrial equipment where performance parameters must be precisely matched to application requirements.

Industrial automation represents the largest application segment for high-voltage SSRs, accounting for nearly 40% of the total market demand. Manufacturing facilities are increasingly replacing traditional electromechanical relays with solid-state alternatives due to their superior reliability, longer operational lifespan, and reduced maintenance requirements. The automotive manufacturing sector, in particular, has shown significant demand growth as production lines become more sophisticated and require precise control systems.

Energy management systems constitute another rapidly expanding market segment. With the global push toward renewable energy sources, high-voltage SSRs are finding increased applications in solar inverters, wind turbine control systems, and grid connection equipment. This segment has registered a growth rate of approximately 8.5% annually since 2020, outpacing the overall market average.

Medical equipment manufacturers represent a premium market segment with stringent reliability requirements. High-voltage SSRs are critical components in medical imaging systems, radiation therapy equipment, and diagnostic devices. While this segment accounts for only about 15% of the total market volume, it represents nearly 22% of the market value due to the higher specifications and quality requirements.

Regional analysis indicates that Asia-Pacific currently leads the market with a 38% share, followed by North America (29%) and Europe (24%). China and India are experiencing the fastest growth rates, driven by rapid industrialization and infrastructure development projects. The North American market is primarily driven by technological advancements in industrial automation and healthcare sectors.

Customer requirements are increasingly focused on miniaturization, higher voltage ratings, improved thermal management, and enhanced isolation properties. There is a growing demand for SSRs capable of handling voltages exceeding 1000V while maintaining compact form factors. Additionally, customers are seeking products with integrated diagnostic capabilities and digital interfaces for Industry 4.0 compatibility.

The market is also witnessing a shift toward customized solutions for specific applications rather than general-purpose products. This trend is particularly evident in critical infrastructure projects, renewable energy installations, and specialized industrial equipment where performance parameters must be precisely matched to application requirements.

Current SSR Technology Landscape and Challenges

The solid-state relay (SSR) market has experienced significant growth over the past decade, driven by increasing demand for reliable switching solutions in high-voltage applications. Currently, the global SSR market is valued at approximately $1.2 billion and is projected to grow at a CAGR of 6.8% through 2028, with high-voltage segments showing particularly strong momentum.

The contemporary SSR technology landscape is characterized by several dominant technologies. Optically-coupled SSRs remain the most widely deployed solution, utilizing LED-photodiode pairs to achieve electrical isolation between control and load circuits. These devices typically offer isolation voltages up to 4kV, making them suitable for many industrial applications. For higher voltage requirements, transformer-coupled and hybrid coupling technologies have gained traction, with some advanced models achieving isolation ratings of 10kV or more.

Semiconductor materials represent another critical aspect of the current landscape. While traditional silicon-based thyristors and triacs continue to dominate the market, wide-bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) are rapidly gaining market share in high-voltage applications. These materials offer superior thermal performance, faster switching speeds, and higher breakdown voltages compared to conventional silicon alternatives.

Despite technological advancements, several significant challenges persist in high-voltage SSR applications. Thermal management remains a primary concern, as heat dissipation becomes increasingly problematic at higher voltages and currents. Most current solutions employ aluminum heat sinks, but these become impractically large for applications exceeding 10kV, necessitating more advanced cooling strategies.

Leakage current presents another substantial challenge, particularly in medical and precision instrumentation applications. Even state-of-the-art high-voltage SSRs typically exhibit leakage currents in the range of 0.1-5mA, which can be problematic in sensitive circuits. Industry leaders are actively researching novel isolation materials and circuit topologies to address this limitation.

Surge protection capabilities represent a critical gap in current SSR technology. While mechanical relays can inherently withstand substantial voltage transients, solid-state alternatives remain vulnerable to damage from unexpected surges. Most commercial high-voltage SSRs incorporate basic snubber circuits and MOVs, but these offer limited protection against extreme transients exceeding 20kV.

Geographically, SSR technology development is concentrated in several key regions. Japan and Germany lead in precision high-voltage SSR innovation, while the United States dominates in military and aerospace applications. China has emerged as a manufacturing powerhouse for standard SSR products, though high-voltage specialty devices remain primarily produced in developed economies with established semiconductor infrastructure.

The contemporary SSR technology landscape is characterized by several dominant technologies. Optically-coupled SSRs remain the most widely deployed solution, utilizing LED-photodiode pairs to achieve electrical isolation between control and load circuits. These devices typically offer isolation voltages up to 4kV, making them suitable for many industrial applications. For higher voltage requirements, transformer-coupled and hybrid coupling technologies have gained traction, with some advanced models achieving isolation ratings of 10kV or more.

Semiconductor materials represent another critical aspect of the current landscape. While traditional silicon-based thyristors and triacs continue to dominate the market, wide-bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) are rapidly gaining market share in high-voltage applications. These materials offer superior thermal performance, faster switching speeds, and higher breakdown voltages compared to conventional silicon alternatives.

Despite technological advancements, several significant challenges persist in high-voltage SSR applications. Thermal management remains a primary concern, as heat dissipation becomes increasingly problematic at higher voltages and currents. Most current solutions employ aluminum heat sinks, but these become impractically large for applications exceeding 10kV, necessitating more advanced cooling strategies.

Leakage current presents another substantial challenge, particularly in medical and precision instrumentation applications. Even state-of-the-art high-voltage SSRs typically exhibit leakage currents in the range of 0.1-5mA, which can be problematic in sensitive circuits. Industry leaders are actively researching novel isolation materials and circuit topologies to address this limitation.

Surge protection capabilities represent a critical gap in current SSR technology. While mechanical relays can inherently withstand substantial voltage transients, solid-state alternatives remain vulnerable to damage from unexpected surges. Most commercial high-voltage SSRs incorporate basic snubber circuits and MOVs, but these offer limited protection against extreme transients exceeding 20kV.

Geographically, SSR technology development is concentrated in several key regions. Japan and Germany lead in precision high-voltage SSR innovation, while the United States dominates in military and aerospace applications. China has emerged as a manufacturing powerhouse for standard SSR products, though high-voltage specialty devices remain primarily produced in developed economies with established semiconductor infrastructure.

Current Selection Methodologies for High-Voltage SSRs

01 Basic structure and operation of solid-state relays

Solid-state relays (SSRs) are electronic switching devices that use semiconductor components instead of mechanical contacts to switch electrical loads. They typically consist of an input circuit with optical isolation, a semiconductor switching element (such as a TRIAC, MOSFET, or thyristor), and output circuitry. SSRs offer advantages including no moving parts, silent operation, fast switching speeds, and long operational life compared to mechanical relays.- Basic structure and operation of solid-state relays: Solid-state relays (SSRs) are electronic switching devices that use semiconductor components instead of mechanical contacts to switch electrical loads. They typically consist of an input circuit with optical isolation, a semiconductor switching element (such as a TRIAC, MOSFET, or thyristor), and output circuitry. SSRs offer advantages including no moving parts, silent operation, fast switching speeds, and long operational life compared to mechanical relays.

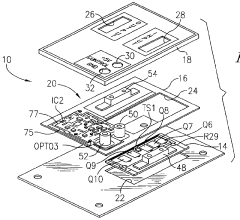

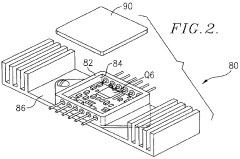

- Thermal management and protection in solid-state relays: Thermal management is critical in solid-state relay design to prevent overheating and ensure reliable operation. Various approaches include heat sink integration, thermal interface materials, improved package designs, and temperature monitoring circuits. Protection features such as over-temperature shutdown, current limiting, and thermal feedback loops are implemented to prevent damage during fault conditions and extend the operational life of the relay.

- Advanced semiconductor technologies for solid-state relays: Modern solid-state relays incorporate advanced semiconductor technologies to improve performance characteristics. These include wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), which offer higher temperature operation, faster switching speeds, and lower on-state resistance. Integration of multiple semiconductor devices and specialized driver circuits enables higher voltage ratings, improved isolation, and enhanced reliability in demanding applications.

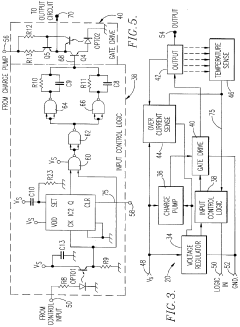

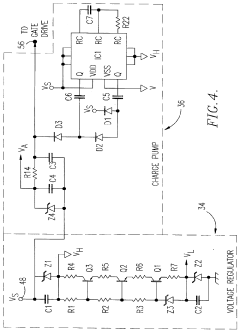

- Control and driving circuits for solid-state relays: Specialized control and driving circuits are essential components of solid-state relays, providing proper gate/base signals to the switching elements. These circuits include optical isolation for safety, gate drivers for proper switching characteristics, timing control for zero-crossing detection, and feedback mechanisms. Advanced designs incorporate microcontroller interfaces, digital control capabilities, and protection features to ensure reliable operation across varying load conditions.

- Application-specific solid-state relay configurations: Solid-state relays are designed with specific configurations to meet the requirements of different applications. These include multi-channel arrays for industrial control systems, high-power designs for motor and heater control, miniaturized versions for space-constrained applications, and specialized versions for automotive and renewable energy systems. Custom configurations may incorporate additional features such as diagnostics, communication interfaces, and application-specific protection mechanisms.

02 Thermal management and protection in solid-state relays

Thermal management is critical in solid-state relay design to prevent overheating and ensure reliable operation. Various techniques are employed including heat sinks, thermal interface materials, improved package designs, and integrated temperature sensors. Protection circuits may include over-temperature shutdown, current limiting features, and thermal feedback systems to prevent damage during fault conditions or overload situations.Expand Specific Solutions03 Integration of solid-state relays in power management systems

Solid-state relays are increasingly integrated into comprehensive power management systems for industrial, automotive, and smart grid applications. These systems may incorporate multiple SSRs with digital control interfaces, monitoring capabilities, and communication protocols. Advanced implementations include programmable switching sequences, load balancing features, and integration with microcontrollers or IoT platforms for remote operation and diagnostics.Expand Specific Solutions04 Semiconductor technologies for solid-state relay switching elements

Various semiconductor technologies are employed as switching elements in solid-state relays, each offering different performance characteristics. These include MOSFETs for low on-resistance and high-frequency applications, IGBTs for higher voltage/current handling, thyristors for AC applications, and GaN or SiC devices for high-temperature operation and improved efficiency. The selection of semiconductor technology impacts switching speed, power handling capability, and thermal performance of the relay.Expand Specific Solutions05 Control and isolation techniques in solid-state relays

Effective control and isolation are essential aspects of solid-state relay design. Optical isolation using LEDs and photodetectors provides electrical separation between input and output circuits, enhancing safety and noise immunity. Advanced control techniques include zero-crossing detection for AC applications to minimize electromagnetic interference, pulse-width modulation for proportional control, and specialized gate drive circuits to optimize switching performance and reduce losses.Expand Specific Solutions

Major Manufacturers and Competitive Analysis

The solid-state relay (SSR) market for high-voltage operations is currently in a growth phase, with increasing adoption across industrial automation, power distribution, and renewable energy sectors. The global market size is estimated to reach approximately $1.8 billion by 2025, driven by demand for reliable switching solutions in high-voltage applications. From a technological maturity perspective, the landscape features established players with diverse capabilities. Companies like Littelfuse, TE Connectivity, and OMRON lead with comprehensive product portfolios and advanced R&D capabilities. Regional manufacturers such as Xiamen Hongfa Electric Appliance and Xiamen Kudom Electronics are gaining market share through cost-effective solutions. Emerging players like Zhejiang Hongzhou New Energy Technology are focusing on specialized applications in renewable energy and electric vehicles, indicating a trend toward application-specific SSR development for high-voltage operations.

Xiamen Hongfa Electric Appliance Co., Ltd.

Technical Solution: Hongfa's approach to high-voltage SSR selection focuses on their HFS series, which utilizes triac output technology optimized for AC switching applications up to 1200V. Their technical solution incorporates optically isolated input-output architecture achieving isolation ratings of 3750V, providing robust protection between control and power circuits. Hongfa implements proprietary semiconductor packaging techniques that enhance thermal conductivity between the switching element and heat sink, improving current handling capability while maintaining compact dimensions. Their high-voltage SSRs feature integrated temperature compensation circuits that adjust gate triggering parameters based on ambient conditions, ensuring consistent switching performance across wide temperature ranges. For applications with challenging load characteristics, Hongfa's SSRs incorporate specialized dv/dt protection circuits that prevent false triggering due to rapid voltage changes, enhancing reliability in electrically noisy environments. The company's selection methodology emphasizes practical application parameters including load type (resistive, inductive, or capacitive), switching frequency, and environmental conditions to guide appropriate relay selection for specific high-voltage operations.

Strengths: Excellent price-performance ratio provides cost-effective solutions for high-volume applications; compact form factors facilitate integration in space-constrained designs; low control power requirements reduce system energy consumption. Weaknesses: More limited voltage range compared to some premium competitors; fewer integrated protection features require additional external components in some applications; less comprehensive technical documentation and application support.

TE Connectivity Corp.

Technical Solution: TE Connectivity's approach to high-voltage SSR selection revolves around their SSRN and SSR-IAC series, which utilize advanced semiconductor switching elements optimized for high-voltage applications. Their technical solution incorporates hybrid technology combining the best attributes of electromechanical relays and solid-state components, achieving isolation voltages up to 4kV while maintaining compact form factors. TE implements proprietary heat sink designs that maximize thermal dissipation through optimized surface area and material composition, enabling higher continuous current ratings in confined spaces. Their high-voltage SSRs feature integrated RC snubber networks precisely calibrated to suppress voltage transients during switching operations, protecting sensitive components in the power circuit. For applications with variable load characteristics, TE's SSRs incorporate adaptive current sensing technology that monitors load conditions and adjusts internal parameters to optimize switching performance. The company's selection methodology emphasizes application-specific parameters including ambient temperature profiles, expected service life, and installation environment factors to ensure appropriate relay selection for high-voltage operations.

Strengths: Excellent thermal management capabilities allow higher current ratings in compact packages; comprehensive certification portfolio simplifies regulatory compliance; wide operating temperature range supports deployment in extreme environments. Weaknesses: More complex configuration requirements compared to simpler relay solutions; higher initial cost than basic mechanical alternatives; limited customization options for specialized applications.

Critical Technical Parameters for High-Voltage SSR Selection

High voltage solid state relay

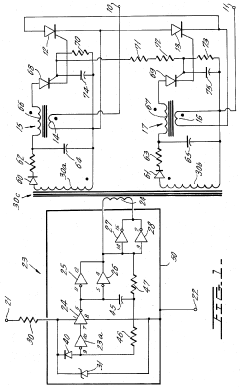

PatentInactiveUS4529888A

Innovation

- A novel solid state relay circuit design separates the power output stage from the input voltage stage, using inductively coupled pilot thyristors that are reverse-biased to ensure turn-on of power devices, with capacitors and gate biases to facilitate conduction and prevent half-waving, allowing the pilot thyristors to operate without full line voltage exposure.

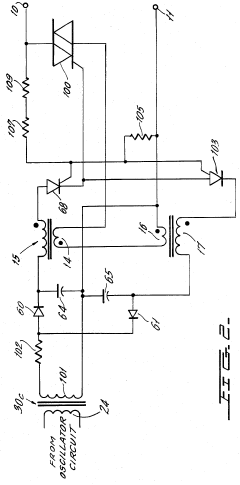

High-current, high-voltage solid state switch

PatentInactiveUS5640293A

Innovation

- A single package integration of solid state switching components with control circuitry, including power field effect transistors, control logic, temperature sense circuitry, and overcurrent circuitry, minimizing sensor I^2R losses and induced noise, and using a coplanar arrangement with a base plate for improved thermal transfer.

Safety Standards and Compliance Requirements

Compliance with safety standards is paramount when selecting solid-state relays (SSRs) for high-voltage operations. Various international and regional regulatory bodies have established comprehensive frameworks to ensure the safe operation of electrical equipment. The International Electrotechnical Commission (IEC) provides several standards directly applicable to SSRs, including IEC 60947-4-3 for AC semiconductor controllers and IEC 61810 for electromechanical relays, which often serve as reference points for SSR requirements.

In North America, Underwriters Laboratories (UL) certification is essential, with UL 508 specifically addressing industrial control equipment including solid-state relays. The Canadian Standards Association (CSA) C22.2 No. 14 provides similar requirements for Canadian markets. European markets require compliance with the Low Voltage Directive (LVD) 2014/35/EU and Electromagnetic Compatibility (EMC) Directive 2014/30/EU, with CE marking indicating conformity.

For high-voltage applications, additional standards become relevant, such as IEC 60664 for insulation coordination and IEC 60950/62368 for information technology equipment safety. These standards define critical parameters including creepage distances, clearance requirements, and insulation specifications that scale with operating voltage levels.

Pollution degree ratings, as defined in IEC 60664-1, must be considered when selecting SSRs for specific environments. These ratings (1-4) describe the expected environmental contamination that could affect insulation properties. High-voltage operations typically require components rated for pollution degree 2 or higher, depending on the installation environment.

Overvoltage category classifications (I-IV per IEC 60664) determine the relay's ability to withstand transient voltages. For high-voltage industrial applications, category III or IV is typically required, necessitating enhanced insulation and clearance specifications.

Safety certifications should be verified through recognized testing laboratories such as UL, TÜV, or VDE. These certifications confirm that the SSR meets specific safety requirements and has undergone rigorous testing protocols. Documentation should include voltage isolation ratings, temperature specifications, and fault condition behaviors.

For applications in specialized industries, additional standards may apply. Medical equipment must comply with IEC 60601, while equipment for hazardous locations must meet standards like ATEX in Europe or Class/Division ratings in North America. The semiconductor industry often requires compliance with SEMI standards, which have specific requirements for high-voltage switching components.

Proper documentation of compliance is essential not only for regulatory approval but also for risk management and liability protection. Manufacturers should provide comprehensive technical documentation demonstrating how their SSRs meet applicable safety standards, including test reports and certification details.

In North America, Underwriters Laboratories (UL) certification is essential, with UL 508 specifically addressing industrial control equipment including solid-state relays. The Canadian Standards Association (CSA) C22.2 No. 14 provides similar requirements for Canadian markets. European markets require compliance with the Low Voltage Directive (LVD) 2014/35/EU and Electromagnetic Compatibility (EMC) Directive 2014/30/EU, with CE marking indicating conformity.

For high-voltage applications, additional standards become relevant, such as IEC 60664 for insulation coordination and IEC 60950/62368 for information technology equipment safety. These standards define critical parameters including creepage distances, clearance requirements, and insulation specifications that scale with operating voltage levels.

Pollution degree ratings, as defined in IEC 60664-1, must be considered when selecting SSRs for specific environments. These ratings (1-4) describe the expected environmental contamination that could affect insulation properties. High-voltage operations typically require components rated for pollution degree 2 or higher, depending on the installation environment.

Overvoltage category classifications (I-IV per IEC 60664) determine the relay's ability to withstand transient voltages. For high-voltage industrial applications, category III or IV is typically required, necessitating enhanced insulation and clearance specifications.

Safety certifications should be verified through recognized testing laboratories such as UL, TÜV, or VDE. These certifications confirm that the SSR meets specific safety requirements and has undergone rigorous testing protocols. Documentation should include voltage isolation ratings, temperature specifications, and fault condition behaviors.

For applications in specialized industries, additional standards may apply. Medical equipment must comply with IEC 60601, while equipment for hazardous locations must meet standards like ATEX in Europe or Class/Division ratings in North America. The semiconductor industry often requires compliance with SEMI standards, which have specific requirements for high-voltage switching components.

Proper documentation of compliance is essential not only for regulatory approval but also for risk management and liability protection. Manufacturers should provide comprehensive technical documentation demonstrating how their SSRs meet applicable safety standards, including test reports and certification details.

Thermal Management Considerations for High-Voltage SSRs

Thermal management is a critical aspect of solid-state relay (SSR) selection for high-voltage operations. When SSRs operate in high-voltage environments, they generate significant heat due to power dissipation across the semiconductor junction. This heat must be effectively managed to prevent thermal runaway, which can lead to premature device failure or catastrophic breakdown.

The primary heat generation in high-voltage SSRs occurs during the on-state, where the semiconductor experiences voltage drop while conducting current. This power dissipation (P = I²R) increases exponentially with current, making thermal considerations particularly important in high-current applications. For every 10°C rise above the rated temperature, the expected lifetime of an SSR typically decreases by approximately 50%.

Proper heat sink selection is fundamental to effective thermal management. Heat sinks must be sized according to the maximum power dissipation expected during operation, with sufficient thermal mass and surface area to maintain junction temperatures within safe operating limits. The thermal resistance pathway from junction to ambient (Rjc + Rcs + Rsa) must be minimized through appropriate material selection and mounting techniques.

Interface materials between the SSR and heat sink significantly impact thermal transfer efficiency. Thermal compounds, pads, or adhesives with high thermal conductivity should be applied correctly to eliminate air gaps that impede heat transfer. The mounting pressure must be carefully controlled to optimize thermal contact without causing mechanical stress to the semiconductor package.

Environmental factors also play a crucial role in thermal management. Ambient temperature, air flow conditions, and proximity to other heat-generating components must be considered during system design. In high-voltage applications, the need for electrical isolation often conflicts with optimal thermal conductivity, requiring careful material selection for insulating thermal interfaces.

Active cooling solutions such as forced-air or liquid cooling may be necessary for high-power applications where passive cooling is insufficient. These systems add complexity but can significantly increase the power handling capability of high-voltage SSRs. Temperature monitoring and protective circuits should be implemented to prevent thermal damage during abnormal operating conditions.

Derating strategies are essential for reliable operation. Manufacturers typically provide derating curves that show the relationship between ambient temperature and maximum allowable load current. Operating SSRs below their maximum ratings provides thermal headroom and extends device lifetime, particularly important in critical high-voltage applications where failure consequences are severe.

The primary heat generation in high-voltage SSRs occurs during the on-state, where the semiconductor experiences voltage drop while conducting current. This power dissipation (P = I²R) increases exponentially with current, making thermal considerations particularly important in high-current applications. For every 10°C rise above the rated temperature, the expected lifetime of an SSR typically decreases by approximately 50%.

Proper heat sink selection is fundamental to effective thermal management. Heat sinks must be sized according to the maximum power dissipation expected during operation, with sufficient thermal mass and surface area to maintain junction temperatures within safe operating limits. The thermal resistance pathway from junction to ambient (Rjc + Rcs + Rsa) must be minimized through appropriate material selection and mounting techniques.

Interface materials between the SSR and heat sink significantly impact thermal transfer efficiency. Thermal compounds, pads, or adhesives with high thermal conductivity should be applied correctly to eliminate air gaps that impede heat transfer. The mounting pressure must be carefully controlled to optimize thermal contact without causing mechanical stress to the semiconductor package.

Environmental factors also play a crucial role in thermal management. Ambient temperature, air flow conditions, and proximity to other heat-generating components must be considered during system design. In high-voltage applications, the need for electrical isolation often conflicts with optimal thermal conductivity, requiring careful material selection for insulating thermal interfaces.

Active cooling solutions such as forced-air or liquid cooling may be necessary for high-power applications where passive cooling is insufficient. These systems add complexity but can significantly increase the power handling capability of high-voltage SSRs. Temperature monitoring and protective circuits should be implemented to prevent thermal damage during abnormal operating conditions.

Derating strategies are essential for reliable operation. Manufacturers typically provide derating curves that show the relationship between ambient temperature and maximum allowable load current. Operating SSRs below their maximum ratings provides thermal headroom and extends device lifetime, particularly important in critical high-voltage applications where failure consequences are severe.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!