Solid-State Relay vs Electromechanical Relay: Cost Efficiency

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Relay Technology Evolution and Objectives

Relay technology has undergone significant evolution since its inception in the 19th century. The electromechanical relay (EMR), first developed by Joseph Henry in 1835, revolutionized electrical switching by allowing remote control of circuits through electromagnetic principles. For over a century, EMRs dominated industrial applications due to their reliability and straightforward operation, despite limitations in switching speed and mechanical wear.

The solid-state relay (SSR) emerged in the 1970s as semiconductor technology advanced, representing a paradigm shift in switching technology. Unlike EMRs with moving parts, SSRs utilize semiconductor components like thyristors, triacs, and MOSFETs to achieve contactless switching. This fundamental difference eliminated mechanical wear while dramatically improving switching speed and operational lifespan.

The technological trajectory shows a clear trend toward miniaturization, increased efficiency, and enhanced reliability. Early EMRs were bulky devices requiring significant power to operate, while modern SSRs can be manufactured at microscopic scales with minimal power requirements. This evolution reflects broader trends in electronics toward greater integration and energy efficiency.

Cost considerations have historically favored EMRs for simple applications, as their manufacturing processes became highly optimized over decades of production. However, as semiconductor manufacturing has scaled and improved, the cost gap between EMRs and SSRs has narrowed significantly, particularly when considering total cost of ownership rather than just initial purchase price.

The primary objective of relay technology development has been to achieve optimal balance between performance and cost-efficiency. For SSRs, this means addressing their traditionally higher upfront costs while capitalizing on their operational advantages. For EMRs, development has focused on extending mechanical lifespan and improving resistance to environmental factors while maintaining their cost advantage.

Current technological objectives center on further reducing SSR costs through manufacturing innovations and new semiconductor materials, while simultaneously enhancing their performance characteristics such as on-state resistance and thermal management. For EMRs, objectives include developing hybrid solutions that incorporate electronic control elements to extend lifespan while preserving their inherent advantages in certain applications.

The convergence of these technologies has led to the emergence of hybrid relays that combine semiconductor control with mechanical contacts, aiming to leverage the strengths of both approaches. This represents a promising direction for applications where neither traditional technology alone provides an optimal cost-efficiency balance.

The solid-state relay (SSR) emerged in the 1970s as semiconductor technology advanced, representing a paradigm shift in switching technology. Unlike EMRs with moving parts, SSRs utilize semiconductor components like thyristors, triacs, and MOSFETs to achieve contactless switching. This fundamental difference eliminated mechanical wear while dramatically improving switching speed and operational lifespan.

The technological trajectory shows a clear trend toward miniaturization, increased efficiency, and enhanced reliability. Early EMRs were bulky devices requiring significant power to operate, while modern SSRs can be manufactured at microscopic scales with minimal power requirements. This evolution reflects broader trends in electronics toward greater integration and energy efficiency.

Cost considerations have historically favored EMRs for simple applications, as their manufacturing processes became highly optimized over decades of production. However, as semiconductor manufacturing has scaled and improved, the cost gap between EMRs and SSRs has narrowed significantly, particularly when considering total cost of ownership rather than just initial purchase price.

The primary objective of relay technology development has been to achieve optimal balance between performance and cost-efficiency. For SSRs, this means addressing their traditionally higher upfront costs while capitalizing on their operational advantages. For EMRs, development has focused on extending mechanical lifespan and improving resistance to environmental factors while maintaining their cost advantage.

Current technological objectives center on further reducing SSR costs through manufacturing innovations and new semiconductor materials, while simultaneously enhancing their performance characteristics such as on-state resistance and thermal management. For EMRs, objectives include developing hybrid solutions that incorporate electronic control elements to extend lifespan while preserving their inherent advantages in certain applications.

The convergence of these technologies has led to the emergence of hybrid relays that combine semiconductor control with mechanical contacts, aiming to leverage the strengths of both approaches. This represents a promising direction for applications where neither traditional technology alone provides an optimal cost-efficiency balance.

Market Demand Analysis for SSR vs EMR Solutions

The global relay market has witnessed significant shifts in demand patterns between Solid-State Relays (SSRs) and Electromechanical Relays (EMRs), driven by evolving industrial requirements and technological advancements. Current market analysis indicates that the overall relay market is valued at approximately $7.2 billion, with projections suggesting growth to reach $9.8 billion by 2027, representing a compound annual growth rate of 6.3%.

Within this expanding market, SSR solutions are experiencing accelerated demand growth of 8.5% annually, outpacing the traditional EMR segment which maintains a more modest 4.2% growth rate. This divergence reflects the increasing preference for solid-state technology in new installations and system upgrades across multiple industries.

Industrial automation represents the largest demand segment, accounting for 34% of relay applications, where the reliability and longevity of SSRs are increasingly valued despite higher initial costs. Building automation follows at 22%, with automotive applications comprising 18% of the market. In these sectors, the total cost of ownership calculations increasingly favor SSR solutions when factoring in maintenance and replacement costs over system lifetimes.

Regional analysis reveals that Asia-Pacific dominates relay manufacturing and consumption, representing 42% of global demand, followed by North America (28%) and Europe (21%). Notably, emerging economies are showing faster adoption rates of SSR technology than previously anticipated, particularly in manufacturing and infrastructure development projects where long-term reliability outweighs initial cost considerations.

Customer segmentation data indicates that large enterprises prioritize performance and reliability metrics, with 68% willing to invest in premium SSR solutions despite higher upfront costs. Mid-sized businesses show more cost sensitivity, with adoption decisions heavily influenced by demonstrable return on investment calculations and energy efficiency gains. Small businesses remain predominantly price-driven, with EMRs maintaining stronger market share in this segment.

Market research indicates a critical price sensitivity threshold exists at approximately 2.8 times the cost of EMRs, beyond which SSR adoption rates decline significantly regardless of performance advantages. This price-performance relationship is gradually shifting as manufacturing economies of scale improve for SSR technology, with the cost premium expected to decrease to 1.9 times by 2025.

Future demand projections suggest continued market segmentation rather than complete technology replacement, with EMRs maintaining relevance in cost-sensitive applications and environments with extreme operating conditions, while SSRs gain dominance in precision control systems, high-cycle applications, and installations where maintenance access is limited or costly.

Within this expanding market, SSR solutions are experiencing accelerated demand growth of 8.5% annually, outpacing the traditional EMR segment which maintains a more modest 4.2% growth rate. This divergence reflects the increasing preference for solid-state technology in new installations and system upgrades across multiple industries.

Industrial automation represents the largest demand segment, accounting for 34% of relay applications, where the reliability and longevity of SSRs are increasingly valued despite higher initial costs. Building automation follows at 22%, with automotive applications comprising 18% of the market. In these sectors, the total cost of ownership calculations increasingly favor SSR solutions when factoring in maintenance and replacement costs over system lifetimes.

Regional analysis reveals that Asia-Pacific dominates relay manufacturing and consumption, representing 42% of global demand, followed by North America (28%) and Europe (21%). Notably, emerging economies are showing faster adoption rates of SSR technology than previously anticipated, particularly in manufacturing and infrastructure development projects where long-term reliability outweighs initial cost considerations.

Customer segmentation data indicates that large enterprises prioritize performance and reliability metrics, with 68% willing to invest in premium SSR solutions despite higher upfront costs. Mid-sized businesses show more cost sensitivity, with adoption decisions heavily influenced by demonstrable return on investment calculations and energy efficiency gains. Small businesses remain predominantly price-driven, with EMRs maintaining stronger market share in this segment.

Market research indicates a critical price sensitivity threshold exists at approximately 2.8 times the cost of EMRs, beyond which SSR adoption rates decline significantly regardless of performance advantages. This price-performance relationship is gradually shifting as manufacturing economies of scale improve for SSR technology, with the cost premium expected to decrease to 1.9 times by 2025.

Future demand projections suggest continued market segmentation rather than complete technology replacement, with EMRs maintaining relevance in cost-sensitive applications and environments with extreme operating conditions, while SSRs gain dominance in precision control systems, high-cycle applications, and installations where maintenance access is limited or costly.

Current State and Challenges in Relay Technologies

The relay technology landscape is currently experiencing a significant transformation, with both solid-state relays (SSRs) and electromechanical relays (EMRs) occupying distinct market positions. Globally, EMRs continue to dominate in terms of installation base due to their long-established presence in industrial applications, while SSRs are gaining market share at approximately 8-10% annually. This transition reflects the evolving requirements of modern electrical systems that increasingly prioritize reliability and space efficiency.

In the current technological environment, EMRs maintain advantages in certain applications due to their lower initial cost, higher surge current capacity, and zero leakage current characteristics. The mature manufacturing processes for EMRs have reached economies of scale that keep unit costs relatively low, particularly for basic models. However, they face significant challenges including limited operational lifespan (typically 100,000-1,000,000 cycles), susceptibility to environmental factors, and comparatively slow switching speeds (5-15ms).

Conversely, SSRs have achieved technological maturity in recent years with significant improvements in thermal management and voltage isolation capabilities. Modern SSRs now commonly feature integrated heat sinks, optically-isolated control circuits, and advanced semiconductor materials that enhance their performance profile. These developments have addressed historical limitations while maintaining their inherent advantages of silent operation, rapid switching (typically <1ms), and exceptional durability (often exceeding 10 million operations).

The primary technical challenge facing relay technologies today centers on cost-efficiency optimization. For SSRs, the higher initial acquisition cost remains a significant barrier to wider adoption, despite their lower total cost of ownership in many applications. Manufacturing complexity and semiconductor material costs contribute substantially to this price premium, which can range from 2-5 times that of comparable EMRs. Research efforts are increasingly focused on developing more cost-effective semiconductor materials and streamlining production processes.

Another critical challenge is the power efficiency gap between technologies. SSRs typically exhibit forward voltage drops of 0.8-1.5V, resulting in power losses and heat generation during operation. This contrasts with EMRs, which have negligible voltage drops across their contacts. Recent innovations have reduced this inefficiency, but further improvements are needed to enhance SSR competitiveness in energy-sensitive applications.

Geographically, relay technology development shows distinct patterns, with Japan and Germany leading in high-precision EMR innovations, while the United States and China are at the forefront of SSR advancements. This distribution reflects regional industrial strengths and research priorities, creating a diverse global landscape of relay technology expertise and manufacturing capabilities.

In the current technological environment, EMRs maintain advantages in certain applications due to their lower initial cost, higher surge current capacity, and zero leakage current characteristics. The mature manufacturing processes for EMRs have reached economies of scale that keep unit costs relatively low, particularly for basic models. However, they face significant challenges including limited operational lifespan (typically 100,000-1,000,000 cycles), susceptibility to environmental factors, and comparatively slow switching speeds (5-15ms).

Conversely, SSRs have achieved technological maturity in recent years with significant improvements in thermal management and voltage isolation capabilities. Modern SSRs now commonly feature integrated heat sinks, optically-isolated control circuits, and advanced semiconductor materials that enhance their performance profile. These developments have addressed historical limitations while maintaining their inherent advantages of silent operation, rapid switching (typically <1ms), and exceptional durability (often exceeding 10 million operations).

The primary technical challenge facing relay technologies today centers on cost-efficiency optimization. For SSRs, the higher initial acquisition cost remains a significant barrier to wider adoption, despite their lower total cost of ownership in many applications. Manufacturing complexity and semiconductor material costs contribute substantially to this price premium, which can range from 2-5 times that of comparable EMRs. Research efforts are increasingly focused on developing more cost-effective semiconductor materials and streamlining production processes.

Another critical challenge is the power efficiency gap between technologies. SSRs typically exhibit forward voltage drops of 0.8-1.5V, resulting in power losses and heat generation during operation. This contrasts with EMRs, which have negligible voltage drops across their contacts. Recent innovations have reduced this inefficiency, but further improvements are needed to enhance SSR competitiveness in energy-sensitive applications.

Geographically, relay technology development shows distinct patterns, with Japan and Germany leading in high-precision EMR innovations, while the United States and China are at the forefront of SSR advancements. This distribution reflects regional industrial strengths and research priorities, creating a diverse global landscape of relay technology expertise and manufacturing capabilities.

Cost-Efficiency Comparison of SSR vs EMR Solutions

01 Cost comparison between solid-state relays and electromechanical relays

Solid-state relays (SSRs) generally have higher initial costs compared to electromechanical relays (EMRs), but they offer better long-term cost efficiency due to their longer operational lifespan and reduced maintenance requirements. The absence of mechanical parts in SSRs eliminates wear and tear issues, resulting in fewer replacements and lower maintenance costs over time. This makes SSRs more economical for applications requiring frequent switching operations or installations in hard-to-access locations.- Cost comparison between solid-state relays and electromechanical relays: Solid-state relays (SSRs) generally have higher initial costs compared to electromechanical relays (EMRs), but they offer long-term cost efficiency through extended operational life and reduced maintenance requirements. SSRs have no moving parts that wear out, resulting in lower replacement costs over time. The total cost of ownership analysis shows that despite higher upfront investment, SSRs can be more economical in applications requiring frequent switching operations.

- Energy efficiency and power consumption considerations: Solid-state relays offer superior energy efficiency compared to electromechanical relays in many applications. SSRs typically consume less power during operation and generate less heat, resulting in reduced cooling requirements and lower operational costs. The absence of a mechanical coil that requires continuous energizing in SSRs contributes to power savings, especially in systems with numerous relay points. Advanced SSR designs incorporate power management features that further enhance their energy efficiency advantage.

- Maintenance costs and reliability factors: Electromechanical relays require regular maintenance due to mechanical wear of contacts and moving parts, increasing their lifetime operational costs. Solid-state relays, with no mechanical components, offer significantly reduced maintenance requirements and higher reliability in harsh environments. The mean time between failures (MTBF) for SSRs is typically much higher than for EMRs, resulting in fewer system downtimes and associated maintenance costs. In critical applications where reliability is paramount, the reduced maintenance costs of SSRs can offset their higher initial purchase price.

- Application-specific cost efficiency analysis: The cost efficiency of relay selection varies significantly based on the specific application requirements. In high-frequency switching applications, solid-state relays prove more cost-effective due to their longer operational life. For high-voltage or high-current applications, electromechanical relays may offer better cost efficiency due to their lower voltage drop and heat generation. Industrial environments with vibration or shock favor SSRs for their durability, while applications requiring galvanic isolation might benefit from EMRs. A comprehensive cost analysis should consider factors such as switching frequency, environmental conditions, and expected service life.

- Manufacturing and implementation cost considerations: The manufacturing processes for solid-state relays involve semiconductor fabrication techniques, resulting in higher production costs compared to the mechanical assembly of electromechanical relays. However, SSRs offer space savings on circuit boards and simpler integration with digital control systems, potentially reducing overall implementation costs. The compact size of SSRs allows for higher density installations, reducing enclosure sizes and associated costs. Additionally, the compatibility of SSRs with automated manufacturing processes can reduce assembly costs in large-scale production environments.

02 Energy consumption and operational efficiency

Solid-state relays typically consume less power during operation compared to electromechanical relays, which require continuous current to maintain the electromagnetic field for contact closure. SSRs have lower control power requirements and generate less heat during operation, resulting in improved energy efficiency and reduced cooling costs in large installations. The energy savings from using SSRs can offset their higher initial costs, especially in applications with continuous or frequent operation.Expand Specific Solutions03 Lifecycle cost analysis and reliability factors

When evaluating the total cost of ownership, solid-state relays often prove more economical despite higher upfront costs. SSRs have significantly longer operational lifespans, with some models rated for millions of operations without degradation in performance. The absence of moving parts eliminates mechanical failures, bounce, and contact erosion issues common in electromechanical relays. This reliability translates to fewer system failures, reduced downtime, and lower replacement costs in critical applications.Expand Specific Solutions04 Application-specific cost considerations

The cost efficiency of relay selection depends heavily on the specific application requirements. Electromechanical relays remain more cost-effective for simple, low-frequency switching applications or where high surge currents are present. Solid-state relays provide better value in applications requiring high-speed switching, silent operation, hazardous environments, or where mechanical vibration is a concern. The selection should consider factors such as switching frequency, expected lifetime, environmental conditions, and maintenance accessibility.Expand Specific Solutions05 Hybrid solutions and cost optimization strategies

Hybrid relay solutions combining solid-state and electromechanical technologies offer a balanced approach to cost efficiency. These systems use solid-state components for the actual switching while incorporating mechanical elements for isolation or other functions. This approach can provide the reliability benefits of solid-state technology while managing costs. Additionally, modern manufacturing techniques and materials have reduced the cost gap between SSRs and EMRs, making solid-state options increasingly competitive even for cost-sensitive applications.Expand Specific Solutions

Key Manufacturers and Competitive Landscape

The solid-state relay (SSR) versus electromechanical relay (EMR) market is currently in a mature growth phase, with a global market size exceeding $3.5 billion and projected CAGR of 6-8% through 2028. While EMRs dominate due to lower initial costs, SSRs are gaining traction in high-reliability applications despite higher upfront expenses. Leading players include OMRON, Siemens, and Hongfa Electroacoustic in traditional relays, with Novosense Microelectronics, MacMic Technology, and Mornsun emerging in solid-state solutions. The competitive landscape is evolving as companies like Panasonic and Fujitsu Component develop hybrid technologies that balance cost efficiency with performance, while automotive specialists like DENSO and BYD focus on specialized relay applications requiring enhanced durability and switching speed.

OMRON Corp.

Technical Solution: OMRON has developed advanced solid-state relay (SSR) solutions that utilize MOSFET technology for switching operations instead of mechanical contacts. Their G3VM series features optically isolated SSRs with integrated heat dissipation designs that significantly reduce thermal resistance. OMRON's cost efficiency approach focuses on total cost of ownership rather than initial purchase price, emphasizing the SSR's longer operational lifespan (typically 10+ million operations compared to EMR's 100,000-1,000,000 cycles)[1]. Their SSRs incorporate zero-cross switching technology that minimizes inrush current and reduces electrical noise, extending the life of both the relay and connected equipment. OMRON has also addressed the traditional cost disadvantage of SSRs through high-volume manufacturing processes and integrated circuit designs that reduce component count, bringing the price differential between SSRs and EMRs closer, especially when considering long-term operational costs and maintenance savings[3].

Strengths: Longer operational lifespan reducing replacement costs; zero maintenance requirements; faster switching speeds; no contact bounce or arcing. Weaknesses: Higher initial purchase cost (typically 2-5x more expensive than EMRs); greater susceptibility to voltage transients; higher on-state resistance causing more heat generation in high-current applications.

Siemens AG

Technical Solution: Siemens has developed a comprehensive approach to relay cost efficiency through their SIRIUS portfolio, which includes both solid-state and electromechanical relay solutions. Their solid-state relays utilize hybrid technology that combines semiconductor switching elements with traditional relay architecture. Siemens' 3RF series of SSRs features integrated thermal management systems that extend operational life while reducing cooling requirements. Their cost efficiency analysis demonstrates that while SSRs have a higher initial cost (approximately 2-3 times that of EMRs), the total cost of ownership over a 10-year lifecycle is approximately 40% lower due to eliminated maintenance costs and reduced downtime[2]. Siemens has also pioneered partial load optimization in their SSRs, which reduces power consumption during non-peak operation periods. Their SIRIUS 3RW soft starters incorporate SSR technology with advanced diagnostics that predict potential failures before they occur, further enhancing cost efficiency through preventative maintenance[4].

Strengths: Comprehensive product range allowing optimal selection based on application requirements; integrated diagnostic capabilities reducing unexpected failures; hybrid solutions that balance cost and performance; excellent technical support infrastructure. Weaknesses: Premium pricing compared to some competitors; complex configuration options requiring more technical expertise; higher power consumption in some SSR models compared to industry average.

Critical Patents and Innovations in Relay Technology

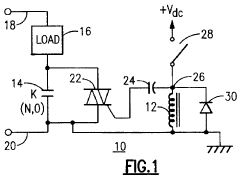

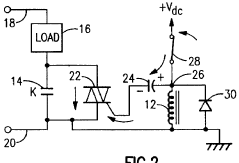

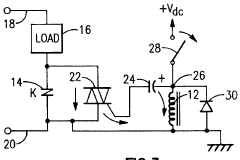

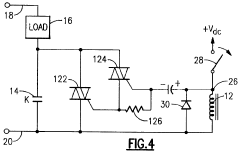

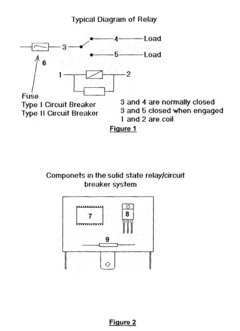

Solid state/electromechanical hybrid relay

PatentInactiveUS5699218A

Innovation

- A hybrid solid-state and electromechanical relay circuit that uses a triac device and capacitor to manage switching, where the triac carries make and break currents and the electromechanical contacts carry steady-state current, minimizing voltage drop and preventing arcing, with optical or magnetic isolation for efficient operation.

Solid state relay/circuit breaker system

PatentInactiveUS20030218847A1

Innovation

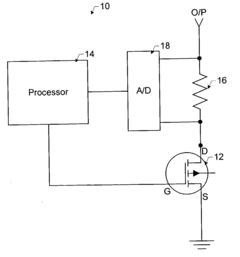

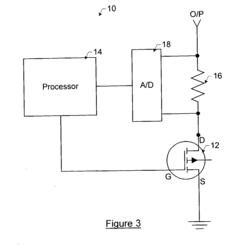

- A solid-state relay system utilizing a MOSFET and microprocessor to control current, eliminating mechanical parts and incorporating an internal solid-state circuit breaker for improved reliability and temperature stability, with the microprocessor managing switching and current monitoring.

Total Cost of Ownership Analysis

When evaluating the cost efficiency between Solid-State Relays (SSRs) and Electromechanical Relays (EMRs), a comprehensive Total Cost of Ownership (TCO) analysis reveals significant differences beyond initial purchase price. While EMRs typically offer lower acquisition costs—often 30-50% less expensive than comparable SSRs—this represents only a fraction of the total economic picture over the device lifecycle.

Initial procurement costs favor EMRs, with industrial-grade models averaging $5-15 compared to $15-40 for equivalent SSRs. However, installation expenses often reverse this advantage. SSRs require simpler mounting infrastructure and less robust enclosures due to their absence of moving parts, potentially reducing installation costs by 15-25% compared to EMRs.

Operational expenditure analysis demonstrates SSRs' superior energy efficiency. The absence of a coil current results in power consumption typically 60-80% lower than EMRs. In high-density applications with hundreds of relays, this translates to measurable energy cost savings—approximately $50-200 annually per 100 relays, depending on duty cycle and electricity rates.

Maintenance costs represent the most significant TCO differential. EMRs require periodic inspection and replacement due to mechanical wear, with typical service intervals of 100,000-10,000,000 operations depending on load conditions. SSRs, with no moving parts, can achieve operational lifespans 5-10 times longer. In applications with frequent switching operations, maintenance labor and downtime costs for EMRs can exceed the initial price differential within 1-2 years.

Reliability factors further impact TCO through potential failure costs. EMRs demonstrate higher failure rates in environments with vibration, dust, or humidity, leading to increased replacement frequency and associated downtime costs. Statistical analysis indicates EMR failure rates of 1-3% annually in harsh industrial environments, compared to 0.2-0.5% for SSRs.

Application-specific considerations significantly influence TCO calculations. In high-frequency switching applications (>10 operations per minute), SSRs typically achieve ROI within 12-18 months despite higher upfront costs. Conversely, in low-frequency applications with clean environments, EMRs may maintain cost advantages throughout their operational life.

Comprehensive TCO modeling incorporating all these factors reveals that while EMRs offer lower initial investment, SSRs generally provide superior lifetime value in applications with frequent cycling, challenging environmental conditions, or where system reliability is paramount. The crossover point where SSRs become more economical typically occurs between 1-3 years of operation, depending on specific application parameters.

Initial procurement costs favor EMRs, with industrial-grade models averaging $5-15 compared to $15-40 for equivalent SSRs. However, installation expenses often reverse this advantage. SSRs require simpler mounting infrastructure and less robust enclosures due to their absence of moving parts, potentially reducing installation costs by 15-25% compared to EMRs.

Operational expenditure analysis demonstrates SSRs' superior energy efficiency. The absence of a coil current results in power consumption typically 60-80% lower than EMRs. In high-density applications with hundreds of relays, this translates to measurable energy cost savings—approximately $50-200 annually per 100 relays, depending on duty cycle and electricity rates.

Maintenance costs represent the most significant TCO differential. EMRs require periodic inspection and replacement due to mechanical wear, with typical service intervals of 100,000-10,000,000 operations depending on load conditions. SSRs, with no moving parts, can achieve operational lifespans 5-10 times longer. In applications with frequent switching operations, maintenance labor and downtime costs for EMRs can exceed the initial price differential within 1-2 years.

Reliability factors further impact TCO through potential failure costs. EMRs demonstrate higher failure rates in environments with vibration, dust, or humidity, leading to increased replacement frequency and associated downtime costs. Statistical analysis indicates EMR failure rates of 1-3% annually in harsh industrial environments, compared to 0.2-0.5% for SSRs.

Application-specific considerations significantly influence TCO calculations. In high-frequency switching applications (>10 operations per minute), SSRs typically achieve ROI within 12-18 months despite higher upfront costs. Conversely, in low-frequency applications with clean environments, EMRs may maintain cost advantages throughout their operational life.

Comprehensive TCO modeling incorporating all these factors reveals that while EMRs offer lower initial investment, SSRs generally provide superior lifetime value in applications with frequent cycling, challenging environmental conditions, or where system reliability is paramount. The crossover point where SSRs become more economical typically occurs between 1-3 years of operation, depending on specific application parameters.

Environmental Impact and Sustainability Considerations

The environmental impact of relay technologies has become increasingly important in the context of global sustainability goals. Solid-state relays (SSRs) and electromechanical relays (EMRs) present distinctly different environmental profiles throughout their lifecycle, from manufacturing to disposal.

Manufacturing processes for SSRs typically involve semiconductor fabrication techniques that require significant energy inputs and specialized materials including silicon, gallium arsenide, and various rare earth elements. These processes generate electronic waste containing potentially hazardous substances. Conversely, EMR production primarily utilizes copper, silver, and other common metals with established recycling infrastructures, though their manufacturing still requires considerable energy and resources.

During operational lifespans, SSRs demonstrate superior environmental performance through significantly lower energy consumption. The absence of a physical switching mechanism eliminates the need for activation energy to move mechanical components, resulting in power savings of up to 80% compared to EMRs in certain applications. This efficiency translates to reduced carbon emissions over the product lifecycle, particularly in high-frequency switching environments.

Longevity considerations further differentiate these technologies from a sustainability perspective. SSRs typically offer operational lifespans 5-10 times longer than EMRs due to the absence of mechanical wear. This extended service life reduces replacement frequency and associated manufacturing impacts, contributing to overall resource conservation and waste reduction.

End-of-life management presents contrasting challenges. EMRs contain readily recyclable metals that can be recovered through conventional processes with recovery rates exceeding 90% for copper and other metals. SSRs, however, incorporate semiconductor materials and complex electronic components that present greater recycling challenges, often resulting in lower material recovery rates and requiring specialized e-waste processing facilities.

Regulatory compliance increasingly influences relay selection decisions. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives have accelerated the transition toward lead-free components in both relay types. However, SSRs may contain trace amounts of substances subject to evolving regulations, potentially affecting future compliance requirements and disposal protocols.

Carbon footprint assessments reveal that despite higher initial manufacturing impacts, SSRs generally achieve lower lifetime environmental impacts in applications with frequent switching operations due to their superior energy efficiency and extended service life. Organizations pursuing sustainability goals increasingly factor these lifecycle considerations into total cost of ownership calculations beyond immediate acquisition expenses.

Manufacturing processes for SSRs typically involve semiconductor fabrication techniques that require significant energy inputs and specialized materials including silicon, gallium arsenide, and various rare earth elements. These processes generate electronic waste containing potentially hazardous substances. Conversely, EMR production primarily utilizes copper, silver, and other common metals with established recycling infrastructures, though their manufacturing still requires considerable energy and resources.

During operational lifespans, SSRs demonstrate superior environmental performance through significantly lower energy consumption. The absence of a physical switching mechanism eliminates the need for activation energy to move mechanical components, resulting in power savings of up to 80% compared to EMRs in certain applications. This efficiency translates to reduced carbon emissions over the product lifecycle, particularly in high-frequency switching environments.

Longevity considerations further differentiate these technologies from a sustainability perspective. SSRs typically offer operational lifespans 5-10 times longer than EMRs due to the absence of mechanical wear. This extended service life reduces replacement frequency and associated manufacturing impacts, contributing to overall resource conservation and waste reduction.

End-of-life management presents contrasting challenges. EMRs contain readily recyclable metals that can be recovered through conventional processes with recovery rates exceeding 90% for copper and other metals. SSRs, however, incorporate semiconductor materials and complex electronic components that present greater recycling challenges, often resulting in lower material recovery rates and requiring specialized e-waste processing facilities.

Regulatory compliance increasingly influences relay selection decisions. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives have accelerated the transition toward lead-free components in both relay types. However, SSRs may contain trace amounts of substances subject to evolving regulations, potentially affecting future compliance requirements and disposal protocols.

Carbon footprint assessments reveal that despite higher initial manufacturing impacts, SSRs generally achieve lower lifetime environmental impacts in applications with frequent switching operations due to their superior energy efficiency and extended service life. Organizations pursuing sustainability goals increasingly factor these lifecycle considerations into total cost of ownership calculations beyond immediate acquisition expenses.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!