Hydrogen-powered direct reduction in green steelmaking technologies

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Steelmaking Evolution and Objectives

Steel production has historically been one of the most carbon-intensive industrial processes, accounting for approximately 7-9% of global CO2 emissions. Traditional steelmaking relies heavily on coal-based blast furnaces and basic oxygen furnaces (BF-BOF), which emit approximately 1.8-2 tons of CO2 per ton of steel produced. The evolution of hydrogen-powered direct reduction represents a paradigm shift in steelmaking technology, offering a pathway to significantly reduce carbon emissions in this critical industry.

The concept of direct reduction in steelmaking dates back to the 1960s with the development of natural gas-based direct reduced iron (DRI) processes. However, the use of hydrogen as a reducing agent has gained momentum only in the past decade as climate concerns intensified and hydrogen production technologies advanced. The transition from natural gas to hydrogen in DRI processes marks a critical evolutionary step, as hydrogen can potentially eliminate carbon emissions from the reduction process itself.

Early hydrogen-based direct reduction experiments in the 1990s demonstrated technical feasibility but were economically unviable due to high hydrogen production costs. The 2010s witnessed significant breakthroughs with pilot plants in Sweden (HYBRIT), Germany (H2Steel), and Austria (H2FUTURE) demonstrating the scalability of hydrogen-based steelmaking. These initiatives have progressively increased in scale, moving from laboratory tests to industrial demonstrations producing several tons of green steel per day.

The primary objective of hydrogen-powered direct reduction technology is to achieve carbon-neutral steelmaking while maintaining or improving product quality and economic viability. Specific technical goals include developing reduction processes that can operate with variable hydrogen concentrations, optimizing energy efficiency, and designing furnaces capable of handling hydrogen's unique properties. The technology aims to reduce emissions by over 95% compared to conventional methods.

Secondary objectives include establishing integrated hydrogen infrastructure for steel plants, developing hydrogen storage solutions to manage intermittent renewable energy supply, and creating standardized methodologies for calculating and verifying emissions reductions in hydrogen steelmaking. The technology roadmap typically targets commercial-scale implementation by 2030-2035, with full industry transformation envisioned by 2050.

The evolution of hydrogen steelmaking is closely aligned with broader decarbonization efforts and renewable energy expansion, as green hydrogen production requires substantial clean electricity. This technological trajectory represents not merely an incremental improvement but a fundamental reimagining of the steelmaking process that has remained largely unchanged for centuries.

The concept of direct reduction in steelmaking dates back to the 1960s with the development of natural gas-based direct reduced iron (DRI) processes. However, the use of hydrogen as a reducing agent has gained momentum only in the past decade as climate concerns intensified and hydrogen production technologies advanced. The transition from natural gas to hydrogen in DRI processes marks a critical evolutionary step, as hydrogen can potentially eliminate carbon emissions from the reduction process itself.

Early hydrogen-based direct reduction experiments in the 1990s demonstrated technical feasibility but were economically unviable due to high hydrogen production costs. The 2010s witnessed significant breakthroughs with pilot plants in Sweden (HYBRIT), Germany (H2Steel), and Austria (H2FUTURE) demonstrating the scalability of hydrogen-based steelmaking. These initiatives have progressively increased in scale, moving from laboratory tests to industrial demonstrations producing several tons of green steel per day.

The primary objective of hydrogen-powered direct reduction technology is to achieve carbon-neutral steelmaking while maintaining or improving product quality and economic viability. Specific technical goals include developing reduction processes that can operate with variable hydrogen concentrations, optimizing energy efficiency, and designing furnaces capable of handling hydrogen's unique properties. The technology aims to reduce emissions by over 95% compared to conventional methods.

Secondary objectives include establishing integrated hydrogen infrastructure for steel plants, developing hydrogen storage solutions to manage intermittent renewable energy supply, and creating standardized methodologies for calculating and verifying emissions reductions in hydrogen steelmaking. The technology roadmap typically targets commercial-scale implementation by 2030-2035, with full industry transformation envisioned by 2050.

The evolution of hydrogen steelmaking is closely aligned with broader decarbonization efforts and renewable energy expansion, as green hydrogen production requires substantial clean electricity. This technological trajectory represents not merely an incremental improvement but a fundamental reimagining of the steelmaking process that has remained largely unchanged for centuries.

Green Steel Market Demand Analysis

The global steel industry is experiencing a significant shift towards greener production methods, driven by increasing environmental regulations and growing consumer demand for sustainable products. Steel production currently accounts for approximately 7-9% of global CO2 emissions, making it one of the most carbon-intensive industrial sectors. This environmental impact has created substantial market pressure for decarbonization solutions, with hydrogen-powered direct reduction emerging as a leading technology pathway.

Market analysis indicates that the demand for green steel is accelerating across multiple sectors. The construction industry, which consumes roughly 50% of global steel production, is increasingly adopting green building standards that favor low-carbon materials. Similarly, the automotive sector is pursuing carbon neutrality goals, with major manufacturers committing to reduce emissions across their supply chains, including steel procurement.

Consumer goods companies are also driving demand through sustainability commitments, responding to growing consumer awareness about carbon footprints. A recent survey revealed that 68% of consumers are willing to pay a premium for products with verified environmental benefits, including those made with green steel. This willingness to pay premium prices is creating economic incentives for steel producers to invest in hydrogen-based reduction technologies.

Policy frameworks are further stimulating market demand through carbon pricing mechanisms, emissions trading schemes, and green procurement policies. The European Union's Carbon Border Adjustment Mechanism (CBAM) represents a significant market driver, as it will impose carbon costs on imported steel that doesn't meet EU emissions standards. Similar policies are being considered in other major economies, creating a global regulatory environment that favors green steel production.

Investment trends reflect this growing market demand, with venture capital and corporate investments in green steelmaking technologies reaching record levels. Several major steel producers have announced pilot projects and commercial-scale plants utilizing hydrogen-powered direct reduction, with planned capacities ranging from demonstration scale to multi-million ton production facilities.

Market forecasts project that green steel could capture 30% of the global steel market by 2050, representing a substantial commercial opportunity. The premium for green steel is currently estimated at 10-30% above conventional steel prices, though this is expected to decrease as technologies mature and economies of scale are realized. Early adopters of hydrogen-based direct reduction technology are positioned to gain competitive advantages in markets where environmental performance is increasingly valued.

Market analysis indicates that the demand for green steel is accelerating across multiple sectors. The construction industry, which consumes roughly 50% of global steel production, is increasingly adopting green building standards that favor low-carbon materials. Similarly, the automotive sector is pursuing carbon neutrality goals, with major manufacturers committing to reduce emissions across their supply chains, including steel procurement.

Consumer goods companies are also driving demand through sustainability commitments, responding to growing consumer awareness about carbon footprints. A recent survey revealed that 68% of consumers are willing to pay a premium for products with verified environmental benefits, including those made with green steel. This willingness to pay premium prices is creating economic incentives for steel producers to invest in hydrogen-based reduction technologies.

Policy frameworks are further stimulating market demand through carbon pricing mechanisms, emissions trading schemes, and green procurement policies. The European Union's Carbon Border Adjustment Mechanism (CBAM) represents a significant market driver, as it will impose carbon costs on imported steel that doesn't meet EU emissions standards. Similar policies are being considered in other major economies, creating a global regulatory environment that favors green steel production.

Investment trends reflect this growing market demand, with venture capital and corporate investments in green steelmaking technologies reaching record levels. Several major steel producers have announced pilot projects and commercial-scale plants utilizing hydrogen-powered direct reduction, with planned capacities ranging from demonstration scale to multi-million ton production facilities.

Market forecasts project that green steel could capture 30% of the global steel market by 2050, representing a substantial commercial opportunity. The premium for green steel is currently estimated at 10-30% above conventional steel prices, though this is expected to decrease as technologies mature and economies of scale are realized. Early adopters of hydrogen-based direct reduction technology are positioned to gain competitive advantages in markets where environmental performance is increasingly valued.

Current Hydrogen Reduction Technologies and Barriers

Currently, several hydrogen-based direct reduction technologies are being developed and implemented in the green steelmaking industry. The most mature technology is the H2-based direct reduction of iron (DRI), which uses hydrogen as a reducing agent instead of carbon monoxide derived from natural gas or coal. Leading examples include MIDREX H2, HYBRIT, and SALCOS processes, which have demonstrated the technical feasibility of using up to 100% hydrogen for iron ore reduction.

The MIDREX Hydrogen process has been adapted from the conventional MIDREX technology and can operate with varying hydrogen concentrations, offering flexibility during the transition period. The HYBRIT process, developed by SSAB, LKAB, and Vattenfall, focuses exclusively on hydrogen-based reduction and has successfully produced pilot-scale fossil-free steel. ThyssenKrupp's SALCOS concept integrates hydrogen-based direct reduction with existing blast furnace operations.

Despite these advancements, significant barriers impede widespread adoption. The primary challenge is hydrogen availability and cost. Green hydrogen production via electrolysis requires substantial renewable electricity, with current production costs ranging from $4-6/kg, significantly higher than natural gas-based alternatives. The steel industry would require massive hydrogen volumes, necessitating unprecedented scaling of electrolyzer capacity.

Infrastructure limitations present another major obstacle. Most steel plants lack access to hydrogen pipeline networks, and building such infrastructure requires enormous capital investment. Additionally, hydrogen storage remains challenging due to its low volumetric energy density, requiring compression or liquefaction for efficient storage.

Technical barriers also persist. Current direct reduction furnaces require modifications to operate with pure hydrogen, as hydrogen reduction kinetics differ from carbon monoxide reduction. The process demands precise temperature control, as hydrogen reduction is endothermic and can cause cooling effects within the furnace. Material handling issues arise as hydrogen-reduced DRI is more reactive and prone to re-oxidation than conventional DRI.

Economic viability remains questionable without supportive policies. The capital expenditure for retrofitting existing plants or building new hydrogen-based facilities is estimated at 30-50% higher than conventional routes. Operating costs are dominated by hydrogen prices, making the technology uncompetitive against conventional steelmaking without carbon pricing mechanisms or subsidies.

Regulatory frameworks and standards for hydrogen-based steelmaking are still evolving, creating uncertainty for investors and slowing technology deployment across the industry.

The MIDREX Hydrogen process has been adapted from the conventional MIDREX technology and can operate with varying hydrogen concentrations, offering flexibility during the transition period. The HYBRIT process, developed by SSAB, LKAB, and Vattenfall, focuses exclusively on hydrogen-based reduction and has successfully produced pilot-scale fossil-free steel. ThyssenKrupp's SALCOS concept integrates hydrogen-based direct reduction with existing blast furnace operations.

Despite these advancements, significant barriers impede widespread adoption. The primary challenge is hydrogen availability and cost. Green hydrogen production via electrolysis requires substantial renewable electricity, with current production costs ranging from $4-6/kg, significantly higher than natural gas-based alternatives. The steel industry would require massive hydrogen volumes, necessitating unprecedented scaling of electrolyzer capacity.

Infrastructure limitations present another major obstacle. Most steel plants lack access to hydrogen pipeline networks, and building such infrastructure requires enormous capital investment. Additionally, hydrogen storage remains challenging due to its low volumetric energy density, requiring compression or liquefaction for efficient storage.

Technical barriers also persist. Current direct reduction furnaces require modifications to operate with pure hydrogen, as hydrogen reduction kinetics differ from carbon monoxide reduction. The process demands precise temperature control, as hydrogen reduction is endothermic and can cause cooling effects within the furnace. Material handling issues arise as hydrogen-reduced DRI is more reactive and prone to re-oxidation than conventional DRI.

Economic viability remains questionable without supportive policies. The capital expenditure for retrofitting existing plants or building new hydrogen-based facilities is estimated at 30-50% higher than conventional routes. Operating costs are dominated by hydrogen prices, making the technology uncompetitive against conventional steelmaking without carbon pricing mechanisms or subsidies.

Regulatory frameworks and standards for hydrogen-based steelmaking are still evolving, creating uncertainty for investors and slowing technology deployment across the industry.

Hydrogen-Based DRI Process Solutions

01 Hydrogen-based direct reduction processes for iron production

Hydrogen can be used as a reducing agent in direct reduction processes for iron production, replacing traditional carbon-based reducing agents like coal or coke. This approach significantly reduces carbon emissions since the main byproduct is water vapor rather than CO2. The process involves using hydrogen to remove oxygen from iron ore at temperatures below the melting point of iron, resulting in direct reduced iron (DRI) that can be further processed in electric arc furnaces.- Hydrogen-based direct reduction processes for iron production: Hydrogen can be used as a reducing agent in direct reduction processes for iron production, replacing traditional carbon-based reducing agents like coal or coke. This approach significantly reduces carbon emissions as the main byproduct is water vapor rather than CO2. The process involves using hydrogen to remove oxygen from iron ore, producing direct reduced iron (DRI) that can be further processed in electric arc furnaces. This method represents a key pathway toward decarbonizing the steel industry.

- Integration of renewable energy sources with hydrogen production: Renewable energy sources can be integrated with hydrogen production systems to create green hydrogen for use in direct reduction processes. This involves using electricity from solar, wind, or hydroelectric sources to power electrolyzers that split water into hydrogen and oxygen. The resulting green hydrogen provides a carbon-neutral reducing agent for metallurgical processes, further decreasing the carbon footprint of metal production. These integrated systems often include energy storage solutions to manage intermittency issues associated with renewable energy sources.

- Advanced reactor designs for hydrogen-based direct reduction: Specialized reactor designs have been developed to optimize hydrogen-based direct reduction processes. These reactors feature improved gas distribution systems, enhanced heat recovery mechanisms, and optimized reaction chambers that maximize the contact between hydrogen and iron ore. Some designs incorporate fluidized bed technology, while others use shaft furnaces with modified gas flow patterns. These advanced reactors improve process efficiency, reduce energy consumption, and minimize carbon emissions compared to conventional reduction methods.

- Carbon capture and utilization systems for residual emissions: Even in hydrogen-based direct reduction processes, some carbon emissions may still occur from auxiliary operations or when using hydrogen derived from fossil fuels. Carbon capture technologies can be integrated to collect these residual CO2 emissions. The captured carbon can then be utilized in various applications such as synthetic fuel production, chemical manufacturing, or permanently sequestered underground. These systems help achieve near-zero emission operations in metallurgical processes that cannot completely eliminate carbon usage.

- Hybrid reduction systems combining hydrogen with other reducing agents: Hybrid reduction systems combine hydrogen with other reducing agents like natural gas or biogas to optimize process economics and technical performance during the transition to fully hydrogen-based operations. These systems allow for flexible operation depending on hydrogen availability and cost. The proportion of hydrogen can be gradually increased as infrastructure develops, enabling a phased approach to decarbonization. Some hybrid systems also incorporate plasma technology or electrical heating to enhance reduction efficiency and further reduce carbon emissions compared to conventional methods.

02 Integration of renewable energy sources with hydrogen production

Renewable energy sources such as wind, solar, and hydroelectric power can be integrated with hydrogen production systems to create green hydrogen for use in direct reduction processes. This integration allows for the production of hydrogen through electrolysis powered by renewable electricity, creating a carbon-neutral pathway for steel production. Such systems often include energy storage solutions to manage intermittency issues associated with renewable energy sources.Expand Specific Solutions03 Carbon capture and utilization technologies in hydrogen-powered reduction

Carbon capture technologies can be integrated with hydrogen-powered direct reduction processes to capture any residual CO2 emissions. These captured emissions can then be utilized in various applications or sequestered. Some systems combine partial hydrogen usage with carbon capture to create a transitional approach toward zero-emission steel production, allowing for gradual implementation while infrastructure for full hydrogen-based reduction develops.Expand Specific Solutions04 Hybrid reduction systems using both hydrogen and natural gas

Hybrid reduction systems utilize a combination of hydrogen and natural gas as reducing agents, allowing for a flexible transition toward lower carbon emissions. These systems can adjust the ratio of hydrogen to natural gas based on availability and economic factors, providing a practical pathway for existing facilities to reduce carbon emissions incrementally. The technology often includes specialized burners and control systems that can handle varying gas compositions.Expand Specific Solutions05 Process optimization and reactor design for hydrogen-based reduction

Specialized reactor designs and process optimizations are essential for efficient hydrogen-based direct reduction of iron ore. These innovations include fluidized bed reactors, shaft furnaces with modified gas distribution systems, and advanced control systems that optimize hydrogen utilization. Improved heat recovery systems and catalyst technologies enhance the efficiency of the reduction process, further reducing the overall carbon footprint of steel production.Expand Specific Solutions

Leading Companies in Green Steelmaking

Hydrogen-powered direct reduction in green steelmaking is currently in an early growth phase, with increasing market adoption driven by decarbonization goals. The global market is expanding rapidly, projected to reach significant scale as steel producers commit to carbon neutrality targets. Technologically, the field shows varying maturity levels, with companies like ArcelorMittal, Midrex Technologies, and voestalpine leading innovation through pilot projects and commercial implementations. Air Liquide and HBIS Group are advancing hydrogen production and integration capabilities, while equipment manufacturers such as Danieli, Paul Wurth, and Tenova are developing specialized furnace technologies. Academic institutions like University of Science & Technology Beijing and Northeastern University are contributing fundamental research to overcome remaining technical challenges in scaling hydrogen-based reduction processes for widespread industrial adoption.

ArcelorMittal SA

Technical Solution: ArcelorMittal has developed the XCarb® hydrogen-based direct reduction technology as part of their decarbonization strategy. Their approach involves replacing natural gas with hydrogen in the direct reduction process, enabling carbon-free reduction of iron ore. The company has implemented this technology in their Hamburg plant as a demonstration project, where they've achieved up to 100% hydrogen utilization in the shaft furnace for short periods. ArcelorMittal is also developing their "Smart Carbon" route which combines hydrogen-based reduction with carbon capture technologies. They've committed €1.7 billion to reduce CO2 emissions by 35% in Europe by 2030, with hydrogen-based DRI plants planned in Bremen, Dunkirk, and Eisenhüttenstadt. Their technology allows for flexible operation, transitioning gradually from natural gas to increasing hydrogen percentages as green hydrogen becomes more available and economical.

Strengths: Flexible implementation allowing gradual transition from natural gas to hydrogen; significant financial commitment to scaling the technology; proven operation with 100% hydrogen in demonstration projects. Weaknesses: Still dependent on large-scale green hydrogen availability; requires substantial infrastructure investment; technology remains in demonstration phase for full-scale implementation.

HYL Technologies SA de CV

Technical Solution: HYL Technologies (part of Tenova Group) has developed the ENERGIRON ZR process, one of the most advanced hydrogen-based direct reduction technologies for green steelmaking. Their system can operate with hydrogen concentrations ranging from 0-100%, offering exceptional flexibility. The ENERGIRON ZR process features a unique zero reformer design that eliminates the need for an external reformer, reducing capital costs and simplifying operations. The technology includes a proprietary CO2 removal system that captures and purifies carbon dioxide for commercial use or sequestration. HYL has successfully implemented this technology in over 40 modules worldwide, processing various iron ore types including pellets, lump ore, and concentrates. Their process achieves metallization rates above 94% and carbon contents between 1.5-4%, depending on operational parameters. The system's energy efficiency is optimized through heat recovery systems that utilize waste heat from the process gas.

Strengths: Proven flexibility with hydrogen concentrations from 0-100%; proprietary CO2 capture system; extensive commercial implementation experience; ability to process various iron ore types. Weaknesses: Higher capital costs compared to conventional blast furnace routes; dependence on reliable hydrogen supply infrastructure; requires high-quality iron ore feed for optimal performance.

Key Patents in Hydrogen Reduction Technology

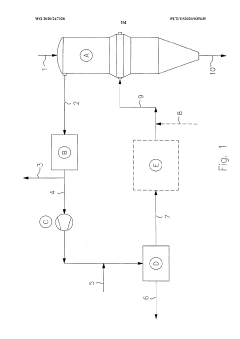

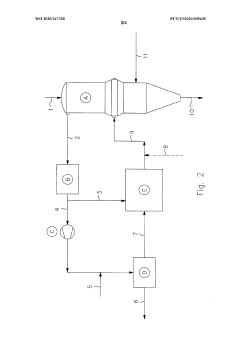

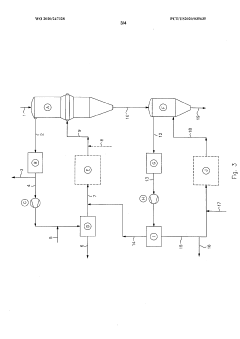

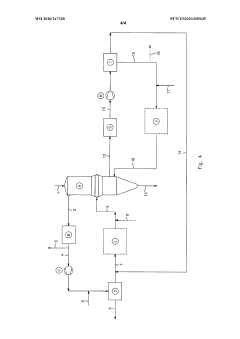

Direct reduction process utilizing hydrogen

PatentWO2020247328A1

Innovation

- The process integrates hydrogen production within the main gas loop using a solid oxide electrolyzer to recycle spent reducing gas, eliminating the need for externally supplied fuel and minimizing heat loss, while allowing for direct carbon control through carburizing gas injection, either within the shaft furnace or in a separate vessel.

Carbon Policy Impact on Steel Industry

Carbon policies worldwide are increasingly reshaping the steel industry landscape, creating both challenges and opportunities for manufacturers. The European Union's Carbon Border Adjustment Mechanism (CBAM) and Emissions Trading System (ETS) have established precedents for carbon pricing that directly impact steel production costs. These mechanisms effectively place a premium on carbon-intensive production methods, creating economic incentives for decarbonization technologies like hydrogen-powered direct reduction.

In the United States, the Inflation Reduction Act has allocated substantial funding for clean hydrogen production and industrial decarbonization projects, providing financial support for steel manufacturers pursuing green technologies. Similarly, China's national emissions trading scheme, though currently limited in scope, signals a gradual shift toward carbon constraints in the world's largest steel-producing nation.

The steel industry faces particular scrutiny under these policies due to its carbon-intensive nature, with conventional blast furnace operations emitting approximately 1.8 tons of CO2 per ton of steel produced. This regulatory pressure has accelerated interest in hydrogen-powered direct reduction as a viable pathway to compliance while maintaining production capacity.

Carbon pricing mechanisms are proving to be powerful drivers for technological transformation. Analysis indicates that carbon prices exceeding €50-70 per ton create economic conditions where hydrogen-based direct reduction becomes competitive with conventional blast furnace routes, particularly when coupled with renewable electricity for hydrogen production.

Industry response has been strategic and varied. Major steel producers like ArcelorMittal, Thyssenkrupp, and SSAB have announced significant investments in hydrogen-based steelmaking pilots and demonstrations, directly citing carbon policy compliance as a primary motivation. These investments represent a fundamental shift in the industry's technological trajectory.

The policy landscape continues to evolve, with increasing coordination between national carbon policies and international trade agreements. The G7's proposed "climate club" concept suggests potential harmonization of carbon pricing across major economies, which would further strengthen the business case for hydrogen-based direct reduction technologies by creating more predictable regulatory environments for long-term investments.

For steel manufacturers, the transition timeline imposed by carbon policies presents significant challenges, particularly regarding capital investment cycles and asset depreciation schedules. However, early adopters of hydrogen-powered direct reduction may gain competitive advantages through carbon cost avoidance and potential access to premium green steel markets.

In the United States, the Inflation Reduction Act has allocated substantial funding for clean hydrogen production and industrial decarbonization projects, providing financial support for steel manufacturers pursuing green technologies. Similarly, China's national emissions trading scheme, though currently limited in scope, signals a gradual shift toward carbon constraints in the world's largest steel-producing nation.

The steel industry faces particular scrutiny under these policies due to its carbon-intensive nature, with conventional blast furnace operations emitting approximately 1.8 tons of CO2 per ton of steel produced. This regulatory pressure has accelerated interest in hydrogen-powered direct reduction as a viable pathway to compliance while maintaining production capacity.

Carbon pricing mechanisms are proving to be powerful drivers for technological transformation. Analysis indicates that carbon prices exceeding €50-70 per ton create economic conditions where hydrogen-based direct reduction becomes competitive with conventional blast furnace routes, particularly when coupled with renewable electricity for hydrogen production.

Industry response has been strategic and varied. Major steel producers like ArcelorMittal, Thyssenkrupp, and SSAB have announced significant investments in hydrogen-based steelmaking pilots and demonstrations, directly citing carbon policy compliance as a primary motivation. These investments represent a fundamental shift in the industry's technological trajectory.

The policy landscape continues to evolve, with increasing coordination between national carbon policies and international trade agreements. The G7's proposed "climate club" concept suggests potential harmonization of carbon pricing across major economies, which would further strengthen the business case for hydrogen-based direct reduction technologies by creating more predictable regulatory environments for long-term investments.

For steel manufacturers, the transition timeline imposed by carbon policies presents significant challenges, particularly regarding capital investment cycles and asset depreciation schedules. However, early adopters of hydrogen-powered direct reduction may gain competitive advantages through carbon cost avoidance and potential access to premium green steel markets.

Economic Viability of Hydrogen Steelmaking

The economic viability of hydrogen steelmaking represents a critical factor in the broader adoption of green steelmaking technologies. Current cost analyses indicate that hydrogen-based direct reduction processes remain 20-40% more expensive than conventional blast furnace routes, primarily due to high capital expenditure requirements and the cost of green hydrogen production.

Energy costs constitute the most significant economic barrier, with green hydrogen production currently ranging from $3-6/kg depending on regional electricity prices and electrolyzer technologies. For economic parity with conventional methods, hydrogen costs need to decrease to approximately $1.5-2/kg, requiring substantial reductions in renewable electricity costs and improvements in electrolyzer efficiency.

Capital investments present another major challenge, as retrofitting existing steel plants or building new hydrogen-ready facilities demands investments of $500-1,000 per ton of annual capacity. These substantial upfront costs create significant barriers to entry, particularly for smaller steel producers operating with thin profit margins in a highly competitive global market.

Production economics are further complicated by operational considerations. Hydrogen-based direct reduction typically achieves 90-95% metallization rates compared to nearly 100% in conventional blast furnaces, potentially affecting product quality and downstream processing requirements. Additionally, the intermittent nature of renewable energy sources used for hydrogen production may impact continuous steelmaking operations without adequate storage infrastructure.

Market mechanisms such as carbon pricing significantly influence economic viability. Analysis suggests that carbon prices of €50-100 per ton CO2 would be necessary to make hydrogen steelmaking competitive with conventional routes without additional subsidies. Several regions, including the EU with its Carbon Border Adjustment Mechanism, are implementing such frameworks to level the economic playing field.

Government incentives are emerging as crucial enablers for early adoption. Programs like the EU Innovation Fund, Germany's H2Global, and various green steel procurement policies are creating economic pathways for first movers. These initiatives help offset the "green premium" that currently exists for hydrogen-based steel products.

Long-term economic projections suggest hydrogen steelmaking could achieve cost parity with conventional methods by 2030-2035, driven by declining renewable electricity costs, economies of scale in electrolyzer manufacturing, and increasingly stringent carbon regulations. This timeline aligns with many steel producers' decarbonization roadmaps, suggesting a coordinated industry transition is economically feasible within the next decade.

Energy costs constitute the most significant economic barrier, with green hydrogen production currently ranging from $3-6/kg depending on regional electricity prices and electrolyzer technologies. For economic parity with conventional methods, hydrogen costs need to decrease to approximately $1.5-2/kg, requiring substantial reductions in renewable electricity costs and improvements in electrolyzer efficiency.

Capital investments present another major challenge, as retrofitting existing steel plants or building new hydrogen-ready facilities demands investments of $500-1,000 per ton of annual capacity. These substantial upfront costs create significant barriers to entry, particularly for smaller steel producers operating with thin profit margins in a highly competitive global market.

Production economics are further complicated by operational considerations. Hydrogen-based direct reduction typically achieves 90-95% metallization rates compared to nearly 100% in conventional blast furnaces, potentially affecting product quality and downstream processing requirements. Additionally, the intermittent nature of renewable energy sources used for hydrogen production may impact continuous steelmaking operations without adequate storage infrastructure.

Market mechanisms such as carbon pricing significantly influence economic viability. Analysis suggests that carbon prices of €50-100 per ton CO2 would be necessary to make hydrogen steelmaking competitive with conventional routes without additional subsidies. Several regions, including the EU with its Carbon Border Adjustment Mechanism, are implementing such frameworks to level the economic playing field.

Government incentives are emerging as crucial enablers for early adoption. Programs like the EU Innovation Fund, Germany's H2Global, and various green steel procurement policies are creating economic pathways for first movers. These initiatives help offset the "green premium" that currently exists for hydrogen-based steel products.

Long-term economic projections suggest hydrogen steelmaking could achieve cost parity with conventional methods by 2030-2035, driven by declining renewable electricity costs, economies of scale in electrolyzer manufacturing, and increasingly stringent carbon regulations. This timeline aligns with many steel producers' decarbonization roadmaps, suggesting a coordinated industry transition is economically feasible within the next decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!