New Regulatory Patents in Plasmonic Biosensor Development

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasmonic Biosensor Regulatory Background and Objectives

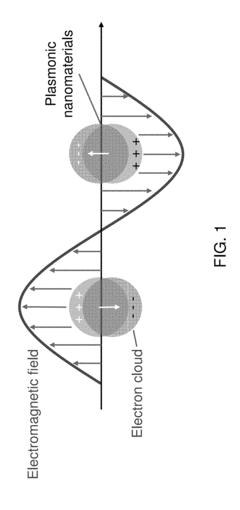

Plasmonic biosensors have emerged as a revolutionary technology in the field of diagnostics and biomedical research over the past two decades. These sensors leverage the unique optical properties of surface plasmon resonance (SPR) to detect biomolecular interactions with exceptional sensitivity and in real-time. The evolution of this technology has been marked by significant advancements in nanofabrication techniques, optical instrumentation, and surface chemistry, enabling increasingly sophisticated applications in healthcare, environmental monitoring, and food safety.

The regulatory landscape governing plasmonic biosensors has undergone substantial transformation, reflecting the growing recognition of their potential impact on public health and safety. Initially, these devices faced minimal regulatory scrutiny as they were primarily confined to research laboratories. However, as their clinical applications expanded, regulatory bodies worldwide began developing specific frameworks to ensure their safety, efficacy, and reliability.

In the United States, the FDA has established a tiered regulatory approach for plasmonic biosensors based on their intended use and risk classification. Devices intended for diagnostic purposes are subject to more stringent requirements compared to those designed for research use only. Similarly, the European Union has implemented the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), which impose comprehensive requirements for performance evaluation, clinical evidence, and post-market surveillance.

Patent activity in the plasmonic biosensor domain has accelerated dramatically, with a notable shift from fundamental technology patents to application-specific and regulatory-compliant innovations. Recent patent filings increasingly address regulatory considerations such as standardization protocols, quality control mechanisms, and validation methodologies that align with regulatory requirements across different jurisdictions.

The primary objective of current regulatory patents is to bridge the gap between laboratory prototypes and commercially viable, regulatory-compliant products. This includes developing standardized calibration methods, establishing reference materials, and creating robust validation protocols that can withstand regulatory scrutiny. Additionally, patents focusing on manufacturing processes that ensure consistency and reproducibility have gained prominence.

Looking forward, the technical goals in this field include developing integrated quality management systems specifically tailored for plasmonic biosensor production, creating adaptive regulatory compliance frameworks that can accommodate rapid technological advancements, and establishing international harmonization of standards to facilitate global market access. These objectives reflect the industry's recognition that regulatory compliance is not merely a hurdle to overcome but a critical component of product development that must be addressed from the earliest stages of innovation.

The regulatory landscape governing plasmonic biosensors has undergone substantial transformation, reflecting the growing recognition of their potential impact on public health and safety. Initially, these devices faced minimal regulatory scrutiny as they were primarily confined to research laboratories. However, as their clinical applications expanded, regulatory bodies worldwide began developing specific frameworks to ensure their safety, efficacy, and reliability.

In the United States, the FDA has established a tiered regulatory approach for plasmonic biosensors based on their intended use and risk classification. Devices intended for diagnostic purposes are subject to more stringent requirements compared to those designed for research use only. Similarly, the European Union has implemented the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), which impose comprehensive requirements for performance evaluation, clinical evidence, and post-market surveillance.

Patent activity in the plasmonic biosensor domain has accelerated dramatically, with a notable shift from fundamental technology patents to application-specific and regulatory-compliant innovations. Recent patent filings increasingly address regulatory considerations such as standardization protocols, quality control mechanisms, and validation methodologies that align with regulatory requirements across different jurisdictions.

The primary objective of current regulatory patents is to bridge the gap between laboratory prototypes and commercially viable, regulatory-compliant products. This includes developing standardized calibration methods, establishing reference materials, and creating robust validation protocols that can withstand regulatory scrutiny. Additionally, patents focusing on manufacturing processes that ensure consistency and reproducibility have gained prominence.

Looking forward, the technical goals in this field include developing integrated quality management systems specifically tailored for plasmonic biosensor production, creating adaptive regulatory compliance frameworks that can accommodate rapid technological advancements, and establishing international harmonization of standards to facilitate global market access. These objectives reflect the industry's recognition that regulatory compliance is not merely a hurdle to overcome but a critical component of product development that must be addressed from the earliest stages of innovation.

Market Analysis for Plasmonic Biosensor Applications

The global market for plasmonic biosensors is experiencing robust growth, driven by increasing demand for rapid, sensitive, and portable diagnostic solutions across multiple sectors. Current market valuations place the plasmonic biosensor segment at approximately $1.2 billion, with projections indicating a compound annual growth rate of 8.3% through 2028, potentially reaching $1.9 billion by that time.

Healthcare applications represent the largest market segment, accounting for nearly 45% of current plasmonic biosensor deployments. Within this sector, point-of-care diagnostics and infectious disease detection are witnessing particularly strong demand, accelerated by recent global health challenges. The pharmaceutical industry constitutes the second-largest application area, where plasmonic biosensors are increasingly utilized for drug discovery processes and therapeutic monitoring.

Environmental monitoring applications are emerging as a high-growth segment, with regulatory bodies worldwide implementing stricter monitoring requirements for water quality, air pollution, and food safety. This regulatory push has created a substantial market opportunity for plasmonic biosensor technologies that offer real-time detection capabilities for environmental contaminants.

Geographically, North America dominates the market with approximately 38% share, followed by Europe at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is demonstrating the fastest growth trajectory, with China and India making significant investments in biosensor technologies for healthcare infrastructure and environmental monitoring systems.

Consumer demand patterns reveal a clear preference for miniaturized, user-friendly devices with smartphone connectivity and cloud-based data management capabilities. This trend is particularly evident in the rapidly expanding home diagnostics segment, where plasmonic biosensor technologies are being integrated into consumer health monitoring devices.

The competitive landscape is characterized by a mix of established medical device manufacturers and innovative startups. Market entry barriers remain relatively high due to regulatory requirements and intellectual property considerations, particularly in light of recent patent developments in the field.

Price sensitivity varies significantly across application segments, with healthcare providers demonstrating greater willingness to invest in premium solutions that offer enhanced sensitivity and specificity. Conversely, environmental monitoring applications tend to be more cost-conscious, prioritizing durability and ease of deployment over cutting-edge performance metrics.

Healthcare applications represent the largest market segment, accounting for nearly 45% of current plasmonic biosensor deployments. Within this sector, point-of-care diagnostics and infectious disease detection are witnessing particularly strong demand, accelerated by recent global health challenges. The pharmaceutical industry constitutes the second-largest application area, where plasmonic biosensors are increasingly utilized for drug discovery processes and therapeutic monitoring.

Environmental monitoring applications are emerging as a high-growth segment, with regulatory bodies worldwide implementing stricter monitoring requirements for water quality, air pollution, and food safety. This regulatory push has created a substantial market opportunity for plasmonic biosensor technologies that offer real-time detection capabilities for environmental contaminants.

Geographically, North America dominates the market with approximately 38% share, followed by Europe at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is demonstrating the fastest growth trajectory, with China and India making significant investments in biosensor technologies for healthcare infrastructure and environmental monitoring systems.

Consumer demand patterns reveal a clear preference for miniaturized, user-friendly devices with smartphone connectivity and cloud-based data management capabilities. This trend is particularly evident in the rapidly expanding home diagnostics segment, where plasmonic biosensor technologies are being integrated into consumer health monitoring devices.

The competitive landscape is characterized by a mix of established medical device manufacturers and innovative startups. Market entry barriers remain relatively high due to regulatory requirements and intellectual property considerations, particularly in light of recent patent developments in the field.

Price sensitivity varies significantly across application segments, with healthcare providers demonstrating greater willingness to invest in premium solutions that offer enhanced sensitivity and specificity. Conversely, environmental monitoring applications tend to be more cost-conscious, prioritizing durability and ease of deployment over cutting-edge performance metrics.

Current Challenges in Plasmonic Biosensor Development

Despite significant advancements in plasmonic biosensor technology, several critical challenges continue to impede widespread commercial adoption and regulatory approval. The primary technical hurdle remains sensitivity optimization in complex biological matrices. While plasmonic biosensors demonstrate excellent performance in controlled laboratory environments, their efficacy diminishes considerably when exposed to real-world biological samples containing numerous interfering compounds, leading to reduced signal-to-noise ratios and compromised detection limits.

Miniaturization presents another significant challenge, particularly for point-of-care applications. Current plasmonic biosensor systems often require sophisticated optical components and precise alignment mechanisms that are difficult to integrate into compact, portable devices without sacrificing performance. This limitation directly impacts their utility in resource-limited settings where such diagnostic capabilities are most needed.

Reproducibility and standardization issues persist across the field. The fabrication of plasmonic nanostructures with consistent optical properties remains problematic at scale, resulting in device-to-device variations that complicate regulatory approval processes. This manufacturing inconsistency creates significant barriers for companies seeking to commercialize these technologies under stringent regulatory frameworks such as FDA or EMA guidelines.

Biofouling represents a persistent challenge that affects long-term stability and reliability. Non-specific adsorption of biomolecules onto sensor surfaces can mask specific binding events and generate false signals. Current surface modification strategies provide only partial solutions and often compromise sensor performance or increase production complexity.

From a regulatory perspective, the novel nature of plasmonic biosensors creates uncertainty in classification and approval pathways. Regulatory bodies struggle to establish appropriate validation protocols for these hybrid technologies that combine elements of traditional diagnostic devices with nanotechnology. The lack of standardized performance metrics specifically designed for plasmonic biosensors further complicates the regulatory landscape.

Cost-effectiveness remains a significant barrier to widespread adoption. Current fabrication methods for high-performance plasmonic substrates often involve expensive nanolithography techniques or specialized equipment, resulting in prohibitively high production costs for mass-market applications. This economic challenge is particularly acute for disposable diagnostic applications where unit costs must be minimized.

Addressing these multifaceted challenges requires interdisciplinary approaches combining advances in materials science, nanofabrication, surface chemistry, and regulatory science. Recent patent activities suggest emerging solutions, but significant work remains to overcome these barriers to realize the full potential of plasmonic biosensor technology in clinical and point-of-care settings.

Miniaturization presents another significant challenge, particularly for point-of-care applications. Current plasmonic biosensor systems often require sophisticated optical components and precise alignment mechanisms that are difficult to integrate into compact, portable devices without sacrificing performance. This limitation directly impacts their utility in resource-limited settings where such diagnostic capabilities are most needed.

Reproducibility and standardization issues persist across the field. The fabrication of plasmonic nanostructures with consistent optical properties remains problematic at scale, resulting in device-to-device variations that complicate regulatory approval processes. This manufacturing inconsistency creates significant barriers for companies seeking to commercialize these technologies under stringent regulatory frameworks such as FDA or EMA guidelines.

Biofouling represents a persistent challenge that affects long-term stability and reliability. Non-specific adsorption of biomolecules onto sensor surfaces can mask specific binding events and generate false signals. Current surface modification strategies provide only partial solutions and often compromise sensor performance or increase production complexity.

From a regulatory perspective, the novel nature of plasmonic biosensors creates uncertainty in classification and approval pathways. Regulatory bodies struggle to establish appropriate validation protocols for these hybrid technologies that combine elements of traditional diagnostic devices with nanotechnology. The lack of standardized performance metrics specifically designed for plasmonic biosensors further complicates the regulatory landscape.

Cost-effectiveness remains a significant barrier to widespread adoption. Current fabrication methods for high-performance plasmonic substrates often involve expensive nanolithography techniques or specialized equipment, resulting in prohibitively high production costs for mass-market applications. This economic challenge is particularly acute for disposable diagnostic applications where unit costs must be minimized.

Addressing these multifaceted challenges requires interdisciplinary approaches combining advances in materials science, nanofabrication, surface chemistry, and regulatory science. Recent patent activities suggest emerging solutions, but significant work remains to overcome these barriers to realize the full potential of plasmonic biosensor technology in clinical and point-of-care settings.

Current Regulatory Compliance Solutions

01 Plasmonic biosensor design and fabrication

This category covers patents related to the design and fabrication of plasmonic biosensors. These patents describe various structures and manufacturing methods for creating biosensors that utilize surface plasmon resonance for detection. The designs include specific nanostructures, substrate materials, and fabrication techniques that enhance sensitivity and specificity for biological analyte detection.- Plasmonic biosensor detection methods and systems: Various detection methods and systems for plasmonic biosensors that enhance sensitivity and specificity for biological analyte detection. These systems utilize surface plasmon resonance (SPR) phenomena to detect biomolecular interactions at metal-dielectric interfaces, enabling real-time, label-free detection of biomarkers, pathogens, and other biological targets. The technologies include advanced optical configurations, signal processing algorithms, and integration with microfluidic platforms to improve detection limits and reliability.

- Regulatory compliance and standardization for biosensor devices: Patents addressing regulatory frameworks, validation protocols, and standardization methods specific to plasmonic biosensor technologies. These innovations focus on ensuring compliance with healthcare regulations, establishing quality control parameters, and developing reference standards for calibration and performance verification. The technologies enable consistent performance across different manufacturing batches and laboratory settings, facilitating regulatory approval processes for clinical and point-of-care applications.

- Nanostructured materials for enhanced plasmonic sensing: Advanced nanostructured materials designed specifically for plasmonic biosensing applications. These materials include engineered metallic nanoparticles, nanoarrays, and composite structures that exhibit enhanced plasmonic properties. The innovations focus on improving sensitivity through optimized surface plasmon coupling, localized field enhancement, and controlled nanostructure geometry. These materials enable detection of lower analyte concentrations and provide platforms for multiplexed sensing applications.

- Integration of plasmonic biosensors with electronic systems: Technologies that integrate plasmonic biosensing elements with electronic components and systems for improved functionality and portability. These innovations include sensor-on-chip designs, integrated signal processing circuits, and wireless communication capabilities. The integration enables miniaturization of sensing platforms, real-time data analysis, and connectivity with healthcare information systems, facilitating point-of-care diagnostics and remote monitoring applications.

- Optical waveguide configurations for plasmonic biosensing: Specialized optical waveguide designs and configurations that enhance the performance of plasmonic biosensors. These innovations include novel fiber optic structures, integrated photonic waveguides, and optical coupling mechanisms that efficiently excite surface plasmons. The technologies focus on improving light-plasmon coupling efficiency, reducing background noise, and enabling multiplexed sensing through waveguide arrays, resulting in higher sensitivity and detection specificity.

02 Regulatory compliance and standardization for biosensor devices

Patents in this category focus on methods and systems for ensuring regulatory compliance of plasmonic biosensor devices. These include quality control processes, validation protocols, and standardization approaches that meet requirements set by regulatory bodies. The patents cover techniques for demonstrating reliability, reproducibility, and safety of biosensor devices for clinical and commercial applications.Expand Specific Solutions03 Signal processing and data analysis for plasmonic biosensors

This category encompasses patents related to signal processing algorithms and data analysis methods specifically designed for plasmonic biosensor applications. These patents describe techniques for enhancing signal-to-noise ratios, filtering interference, and extracting meaningful biological information from sensor readings. Advanced computational methods including machine learning approaches for interpreting biosensor data are also covered.Expand Specific Solutions04 Integration of plasmonic biosensors with other technologies

Patents in this category focus on the integration of plasmonic biosensors with complementary technologies to create more comprehensive diagnostic or analytical systems. These include combinations with microfluidics, optical systems, electronic readout mechanisms, and wireless communication technologies. The patents describe methods for creating multi-modal sensing platforms that leverage the advantages of plasmonic detection alongside other detection modalities.Expand Specific Solutions05 Plasmonic biosensor applications in regulated industries

This category covers patents specifically addressing applications of plasmonic biosensors in highly regulated industries such as healthcare, pharmaceuticals, food safety, and environmental monitoring. These patents describe specialized biosensor designs and protocols that meet industry-specific regulatory requirements. They include methods for detecting specific biomarkers, pathogens, or contaminants that are subject to regulatory oversight.Expand Specific Solutions

Key Industry Players and Patent Holders

The plasmonic biosensor development field is currently in a growth phase, characterized by increasing regulatory patent activity across academic institutions and industry players. The market is expanding rapidly, driven by applications in healthcare diagnostics, environmental monitoring, and biomedical research. Key players include established research universities (Washington University, MIT, Boston University) collaborating with industry leaders like F. Hoffmann-La Roche and Philips. Technological maturity varies significantly, with academic institutions (EPFL, Industrial Technology Research Institute) focusing on fundamental research while companies like Lenano Diagnostics and Onechip Bioelectronics are commercializing applications. The competitive landscape shows a balance between traditional medical device manufacturers and emerging specialized biosensor companies, with increasing cross-sector partnerships accelerating innovation and regulatory approval processes.

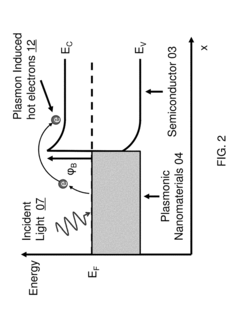

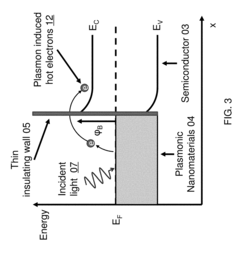

The Regents of the University of California

Technical Solution: The University of California has developed advanced plasmonic biosensor technologies that utilize surface plasmon resonance (SPR) for highly sensitive detection of biomolecules. Their patented approach incorporates nanostructured metal films with precisely engineered geometries to enhance local electromagnetic fields, significantly improving detection sensitivity. The university's research teams have pioneered the integration of microfluidic systems with plasmonic sensing platforms, allowing for automated sample handling and real-time analysis capabilities. Their regulatory patents cover novel fabrication methods for creating reproducible nanostructured surfaces with consistent optical properties, addressing a critical challenge in commercialization of plasmonic biosensors. Additionally, they have developed proprietary surface chemistry protocols for selective immobilization of bioreceptors on plasmonic surfaces, enhancing specificity while minimizing non-specific binding that can compromise sensor performance[1][3]. Recent innovations include multiplexed sensing arrays capable of simultaneous detection of multiple biomarkers from complex biological samples.

Strengths: Exceptional sensitivity reaching sub-picomolar detection limits for various biomarkers; robust intellectual property portfolio covering fabrication, surface chemistry, and system integration; strong academic-industry partnerships accelerating commercialization. Weaknesses: Higher manufacturing costs compared to conventional biosensors; some designs require specialized equipment for readout; challenges in scaling production while maintaining nanoscale precision.

F. Hoffmann-La Roche Ltd.

Technical Solution: F. Hoffmann-La Roche has developed proprietary plasmonic biosensor technology focused on point-of-care diagnostic applications with regulatory compliance built into the design process. Their patented approach combines traditional surface plasmon resonance with innovative nanoparticle-enhanced sensing mechanisms, creating highly sensitive detection platforms for clinical biomarkers. Roche's technology incorporates specialized surface chemistry modifications that enable selective detection of disease markers in complex biological fluids with minimal sample preparation. Their patents cover novel sensor chip designs with integrated reference channels for real-time background correction, addressing a key regulatory requirement for clinical diagnostic devices. The company has pioneered automated calibration systems that ensure consistent performance across different manufacturing batches, a critical factor for regulatory approval[2]. Roche's plasmonic biosensor platform includes proprietary data analysis algorithms that translate optical signals into clinically relevant quantitative results, with built-in quality control metrics that align with FDA and European regulatory frameworks for in vitro diagnostic devices. Their recent patents focus on system miniaturization and integration with existing clinical laboratory workflows to facilitate adoption in regulated healthcare environments.

Strengths: Comprehensive regulatory expertise and established pathways for medical device approval; extensive clinical validation data supporting performance claims; robust manufacturing capabilities ensuring product consistency; global distribution network for commercialization. Weaknesses: Higher cost structure compared to academic solutions; technology primarily optimized for clinical settings rather than environmental or food safety applications; proprietary system architecture limits third-party development opportunities.

Critical Patent Analysis for Plasmonic Biosensors

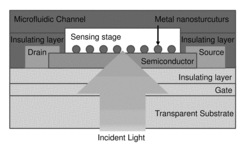

Portable plasmonic system for disease detection

PatentActiveUS20180217138A1

Innovation

- A portable biosensing system utilizing a plasmonic field effect transistor or photoconductor platform with a microfluidic control unit, back illumination, and a lock-in amplifier to directly convert plasmonic energy into an electrical signal, enabling real-time measurement and multiplexing capabilities.

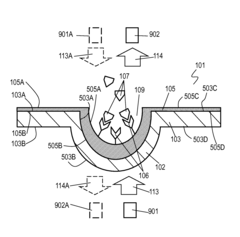

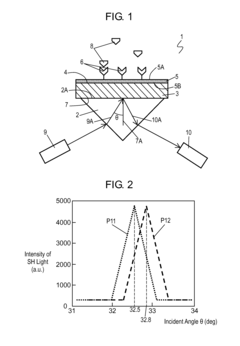

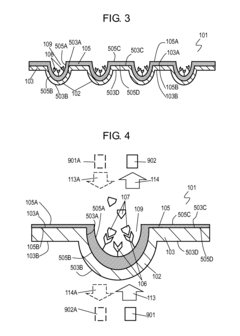

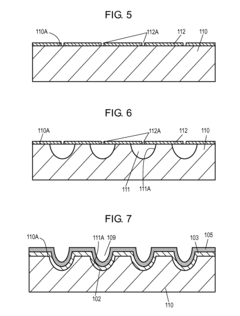

Surface plasmon resonance sensor, localized plasmon resonance sensor, and method for manufacturing same

PatentActiveUS8699032B2

Innovation

- A surface plasmon resonance sensor is designed with a substrate and a dielectric film having a nonlinear optical effect, where the surface plasmon resonance is detected by measuring changes in the second-order harmonic component of reflected light, enhancing sensitivity through the use of lead zirconate titanate (PZT) or non-lead inorganic nonlinear optical materials.

Global Regulatory Framework Comparison

The regulatory landscape for plasmonic biosensor development varies significantly across major global regions, creating a complex environment for innovators and manufacturers. In the United States, the FDA has established a risk-based classification system for biosensors, with plasmonic devices typically falling under Class II medical devices requiring 510(k) clearance. The FDA's recent Digital Health Innovation Action Plan has created pathways for expedited review of novel biosensor technologies, though patent protection remains subject to heightened scrutiny following the Mayo and Myriad Supreme Court decisions that limit patentability of diagnostic methods.

The European Union operates under the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), which implemented stricter requirements for clinical evidence and post-market surveillance in 2022. The European Patent Office generally maintains a more permissive approach to diagnostic method patents than the US, creating opportunities for strategic patent filing. Notably, the EU's IVDR has established specific performance requirements for biosensors, including sensitivity and specificity thresholds that directly impact plasmonic technology development.

In Asia, regulatory frameworks show significant variation. Japan's PMDA has implemented the SAKIGAKE designation system to accelerate innovative medical technologies, including advanced biosensors. China has rapidly evolved its regulatory system through the National Medical Products Administration (NMPA), which now includes special review pathways for innovative medical devices while strengthening intellectual property protection for domestic innovations in plasmonic technology.

Recent comparative analysis reveals that harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have begun standardizing technical documentation requirements across regions, though significant differences persist in clinical evidence standards and patent enforcement. The Medical Device Single Audit Program (MDSAP) has reduced regulatory burden in participating countries by allowing a single regulatory audit to satisfy requirements across multiple jurisdictions.

Patent protection strategies must now account for these regulatory divergences, with successful companies adopting jurisdiction-specific approaches. For example, method-of-treatment claims may be more viable in Europe and Asia than diagnostic method claims in the US. Recent regulatory patents show increasing focus on system-level integration claims that combine hardware and software elements to overcome subject matter eligibility challenges, particularly for AI-enhanced plasmonic biosensor systems.

The global trend toward real-world evidence (RWE) acceptance is creating new opportunities for plasmonic biosensor validation, potentially reducing development costs while creating new patentable improvements based on post-market data analysis and algorithm refinement.

The European Union operates under the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), which implemented stricter requirements for clinical evidence and post-market surveillance in 2022. The European Patent Office generally maintains a more permissive approach to diagnostic method patents than the US, creating opportunities for strategic patent filing. Notably, the EU's IVDR has established specific performance requirements for biosensors, including sensitivity and specificity thresholds that directly impact plasmonic technology development.

In Asia, regulatory frameworks show significant variation. Japan's PMDA has implemented the SAKIGAKE designation system to accelerate innovative medical technologies, including advanced biosensors. China has rapidly evolved its regulatory system through the National Medical Products Administration (NMPA), which now includes special review pathways for innovative medical devices while strengthening intellectual property protection for domestic innovations in plasmonic technology.

Recent comparative analysis reveals that harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have begun standardizing technical documentation requirements across regions, though significant differences persist in clinical evidence standards and patent enforcement. The Medical Device Single Audit Program (MDSAP) has reduced regulatory burden in participating countries by allowing a single regulatory audit to satisfy requirements across multiple jurisdictions.

Patent protection strategies must now account for these regulatory divergences, with successful companies adopting jurisdiction-specific approaches. For example, method-of-treatment claims may be more viable in Europe and Asia than diagnostic method claims in the US. Recent regulatory patents show increasing focus on system-level integration claims that combine hardware and software elements to overcome subject matter eligibility challenges, particularly for AI-enhanced plasmonic biosensor systems.

The global trend toward real-world evidence (RWE) acceptance is creating new opportunities for plasmonic biosensor validation, potentially reducing development costs while creating new patentable improvements based on post-market data analysis and algorithm refinement.

Commercialization Barriers and Strategies

Despite the promising potential of plasmonic biosensors, several significant barriers impede their successful commercialization. Regulatory challenges represent a primary obstacle, as new patents in this field must navigate complex approval processes across different jurisdictions. The FDA in the United States, the EMA in Europe, and NMPA in China each maintain distinct requirements for medical diagnostic devices, creating a fragmented regulatory landscape that increases compliance costs and extends time-to-market.

Manufacturing scalability presents another substantial barrier. Current fabrication techniques for plasmonic nanostructures often involve sophisticated nanolithography processes that are difficult to scale economically. The precision required for consistent sensor performance demands specialized equipment and clean room facilities, significantly increasing production costs and limiting mass manufacturing capabilities.

Quality control and standardization issues further complicate commercialization efforts. The performance of plasmonic biosensors depends critically on the precise dimensions and optical properties of metallic nanostructures, making batch-to-batch consistency challenging to achieve. Without established industry standards for performance metrics, companies struggle to validate their technologies against recognized benchmarks.

Market education and adoption represent additional hurdles. Healthcare providers and clinical laboratories often resist adopting novel diagnostic platforms without substantial evidence of superiority over established methods. The initial capital investment required for new sensing platforms further discourages adoption, particularly when existing technologies are perceived as adequate.

Effective commercialization strategies must address these barriers through multi-faceted approaches. Regulatory navigation can be optimized by engaging with authorities early through pre-submission consultations and pursuing expedited review pathways for novel technologies addressing unmet medical needs. Strategic partnerships with established medical device manufacturers can provide access to regulatory expertise and established distribution channels.

Manufacturing challenges can be addressed through design-for-manufacturing approaches that prioritize production feasibility alongside performance. Investment in automated quality control systems utilizing machine learning algorithms can help ensure consistent sensor performance while reducing labor costs. Modular design approaches that separate the sensor element from the detection instrumentation may allow for disposable sensor components while maintaining more sophisticated reusable detection systems.

Market penetration strategies should focus initially on high-value applications where conventional methods are inadequate, establishing beachhead markets before expanding to broader applications. Demonstrating clear economic benefits through health economics studies can help overcome adoption resistance by quantifying the value proposition in terms healthcare systems understand.

Manufacturing scalability presents another substantial barrier. Current fabrication techniques for plasmonic nanostructures often involve sophisticated nanolithography processes that are difficult to scale economically. The precision required for consistent sensor performance demands specialized equipment and clean room facilities, significantly increasing production costs and limiting mass manufacturing capabilities.

Quality control and standardization issues further complicate commercialization efforts. The performance of plasmonic biosensors depends critically on the precise dimensions and optical properties of metallic nanostructures, making batch-to-batch consistency challenging to achieve. Without established industry standards for performance metrics, companies struggle to validate their technologies against recognized benchmarks.

Market education and adoption represent additional hurdles. Healthcare providers and clinical laboratories often resist adopting novel diagnostic platforms without substantial evidence of superiority over established methods. The initial capital investment required for new sensing platforms further discourages adoption, particularly when existing technologies are perceived as adequate.

Effective commercialization strategies must address these barriers through multi-faceted approaches. Regulatory navigation can be optimized by engaging with authorities early through pre-submission consultations and pursuing expedited review pathways for novel technologies addressing unmet medical needs. Strategic partnerships with established medical device manufacturers can provide access to regulatory expertise and established distribution channels.

Manufacturing challenges can be addressed through design-for-manufacturing approaches that prioritize production feasibility alongside performance. Investment in automated quality control systems utilizing machine learning algorithms can help ensure consistent sensor performance while reducing labor costs. Modular design approaches that separate the sensor element from the detection instrumentation may allow for disposable sensor components while maintaining more sophisticated reusable detection systems.

Market penetration strategies should focus initially on high-value applications where conventional methods are inadequate, establishing beachhead markets before expanding to broader applications. Demonstrating clear economic benefits through health economics studies can help overcome adoption resistance by quantifying the value proposition in terms healthcare systems understand.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!