Why Market Regulations Influence Plasmonic Biosensor Acceptance

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasmonic Biosensor Evolution and Regulatory Goals

Plasmonic biosensors have evolved significantly over the past three decades, transitioning from laboratory curiosities to commercially viable diagnostic tools. The journey began in the early 1990s with fundamental research into surface plasmon resonance (SPR) phenomena, where scientists discovered that specific metallic nanostructures could detect biomolecular interactions with remarkable sensitivity. By the early 2000s, the first generation of plasmonic biosensors emerged, primarily utilizing gold film substrates and basic optical detection systems.

The mid-2000s witnessed a technological leap with the introduction of localized surface plasmon resonance (LSPR) techniques, which enabled miniaturization and enhanced sensitivity. This period also saw the development of multiplexed detection capabilities, allowing simultaneous analysis of multiple biomarkers. The 2010s brought integration with microfluidics and smartphone-based detection platforms, democratizing access to sophisticated biosensing technologies.

Current plasmonic biosensor technology incorporates advanced nanofabrication techniques, machine learning algorithms for signal processing, and novel plasmonic materials beyond traditional gold and silver, such as aluminum and copper nanostructures. These developments have dramatically improved detection limits, reaching single-molecule sensitivity in optimal conditions.

The regulatory landscape has evolved in parallel, with initial frameworks focusing primarily on laboratory safety and basic performance standards. As these technologies approached clinical applications, regulatory bodies worldwide began developing more comprehensive guidelines addressing accuracy, reproducibility, and clinical validity. The FDA's approach to regulating plasmonic biosensors has shifted from treating them as general laboratory equipment to specialized diagnostic devices requiring validation through clinical trials.

The primary regulatory goals now center on ensuring diagnostic accuracy, establishing standardized validation protocols, and protecting patient data privacy. Regulatory bodies aim to balance innovation encouragement with patient safety through risk-based classification systems. For point-of-care applications, regulations increasingly focus on usability by non-specialists and result interpretation safeguards.

International harmonization of standards represents another critical regulatory objective, with initiatives like the International Medical Device Regulators Forum (IMDRF) working to align requirements across major markets. This harmonization aims to reduce redundant testing and accelerate global access to innovative diagnostic technologies.

Environmental considerations have also emerged as regulatory priorities, with growing emphasis on sustainable manufacturing practices and end-of-life management for plasmonic biosensor components containing precious metals and nanomaterials. These evolving regulatory frameworks significantly shape both research directions and commercialization strategies in the plasmonic biosensor field.

The mid-2000s witnessed a technological leap with the introduction of localized surface plasmon resonance (LSPR) techniques, which enabled miniaturization and enhanced sensitivity. This period also saw the development of multiplexed detection capabilities, allowing simultaneous analysis of multiple biomarkers. The 2010s brought integration with microfluidics and smartphone-based detection platforms, democratizing access to sophisticated biosensing technologies.

Current plasmonic biosensor technology incorporates advanced nanofabrication techniques, machine learning algorithms for signal processing, and novel plasmonic materials beyond traditional gold and silver, such as aluminum and copper nanostructures. These developments have dramatically improved detection limits, reaching single-molecule sensitivity in optimal conditions.

The regulatory landscape has evolved in parallel, with initial frameworks focusing primarily on laboratory safety and basic performance standards. As these technologies approached clinical applications, regulatory bodies worldwide began developing more comprehensive guidelines addressing accuracy, reproducibility, and clinical validity. The FDA's approach to regulating plasmonic biosensors has shifted from treating them as general laboratory equipment to specialized diagnostic devices requiring validation through clinical trials.

The primary regulatory goals now center on ensuring diagnostic accuracy, establishing standardized validation protocols, and protecting patient data privacy. Regulatory bodies aim to balance innovation encouragement with patient safety through risk-based classification systems. For point-of-care applications, regulations increasingly focus on usability by non-specialists and result interpretation safeguards.

International harmonization of standards represents another critical regulatory objective, with initiatives like the International Medical Device Regulators Forum (IMDRF) working to align requirements across major markets. This harmonization aims to reduce redundant testing and accelerate global access to innovative diagnostic technologies.

Environmental considerations have also emerged as regulatory priorities, with growing emphasis on sustainable manufacturing practices and end-of-life management for plasmonic biosensor components containing precious metals and nanomaterials. These evolving regulatory frameworks significantly shape both research directions and commercialization strategies in the plasmonic biosensor field.

Market Demand Analysis for Biosensing Technologies

The global biosensing technology market has witnessed substantial growth in recent years, driven by increasing healthcare needs, rising prevalence of chronic diseases, and technological advancements in diagnostic capabilities. Current market valuations place the biosensor market at approximately 25 billion USD, with projections indicating a compound annual growth rate between 7-9% over the next five years. Plasmonic biosensors represent a particularly promising segment within this market due to their exceptional sensitivity, real-time detection capabilities, and potential for miniaturization.

Market demand for plasmonic biosensors spans multiple sectors, with healthcare and clinical diagnostics constituting the largest application segment. The ability of these sensors to provide rapid, accurate detection of biomarkers, pathogens, and disease indicators aligns perfectly with the growing emphasis on early diagnosis and personalized medicine approaches. Additionally, pharmaceutical companies increasingly rely on advanced biosensing technologies for drug discovery and development processes, creating another substantial demand stream.

Environmental monitoring represents another expanding application area, with regulatory bodies worldwide implementing stricter monitoring requirements for water quality, air pollution, and food safety. Plasmonic biosensors offer advantages in these contexts through their capacity for continuous, real-time monitoring with minimal sample preparation requirements.

Regulatory frameworks significantly shape market demand patterns for plasmonic biosensors. In regions with well-established regulatory pathways, such as North America and Europe, adoption rates tend to be higher due to clearer approval processes and standards. Conversely, fragmented or evolving regulatory environments in emerging markets can impede technology uptake despite strong underlying need. This regulatory influence creates notable regional variations in market penetration rates.

Consumer awareness and acceptance factors also play crucial roles in market demand dynamics. Healthcare providers and patients increasingly seek diagnostic solutions offering greater convenience, speed, and accuracy. Plasmonic biosensors address these preferences through their potential for point-of-care applications and reduced turnaround times compared to conventional laboratory testing methods.

Cost considerations remain a significant factor influencing market demand. While production costs for plasmonic biosensors have decreased over time, they still represent a substantial investment for many potential users. Market analysis indicates price sensitivity varies significantly across different application sectors, with clinical diagnostics demonstrating greater willingness to absorb premium pricing for superior performance characteristics.

Future market growth appears closely tied to regulatory harmonization efforts and the development of international standards specific to plasmonic biosensing technologies. As regulatory frameworks mature and become more consistent across regions, market penetration is expected to accelerate, particularly in emerging economies where healthcare infrastructure continues to develop rapidly.

Market demand for plasmonic biosensors spans multiple sectors, with healthcare and clinical diagnostics constituting the largest application segment. The ability of these sensors to provide rapid, accurate detection of biomarkers, pathogens, and disease indicators aligns perfectly with the growing emphasis on early diagnosis and personalized medicine approaches. Additionally, pharmaceutical companies increasingly rely on advanced biosensing technologies for drug discovery and development processes, creating another substantial demand stream.

Environmental monitoring represents another expanding application area, with regulatory bodies worldwide implementing stricter monitoring requirements for water quality, air pollution, and food safety. Plasmonic biosensors offer advantages in these contexts through their capacity for continuous, real-time monitoring with minimal sample preparation requirements.

Regulatory frameworks significantly shape market demand patterns for plasmonic biosensors. In regions with well-established regulatory pathways, such as North America and Europe, adoption rates tend to be higher due to clearer approval processes and standards. Conversely, fragmented or evolving regulatory environments in emerging markets can impede technology uptake despite strong underlying need. This regulatory influence creates notable regional variations in market penetration rates.

Consumer awareness and acceptance factors also play crucial roles in market demand dynamics. Healthcare providers and patients increasingly seek diagnostic solutions offering greater convenience, speed, and accuracy. Plasmonic biosensors address these preferences through their potential for point-of-care applications and reduced turnaround times compared to conventional laboratory testing methods.

Cost considerations remain a significant factor influencing market demand. While production costs for plasmonic biosensors have decreased over time, they still represent a substantial investment for many potential users. Market analysis indicates price sensitivity varies significantly across different application sectors, with clinical diagnostics demonstrating greater willingness to absorb premium pricing for superior performance characteristics.

Future market growth appears closely tied to regulatory harmonization efforts and the development of international standards specific to plasmonic biosensing technologies. As regulatory frameworks mature and become more consistent across regions, market penetration is expected to accelerate, particularly in emerging economies where healthcare infrastructure continues to develop rapidly.

Regulatory Landscape and Technical Challenges

The regulatory landscape for plasmonic biosensors presents a complex interplay between technical innovation and market acceptance. Currently, these biosensors face stringent regulatory frameworks across different regions, with the FDA in the United States, the EMA in Europe, and the NMPA in China each imposing distinct requirements for medical device approval. These regulations significantly impact development timelines, with approval processes often extending 3-5 years, substantially longer than the innovation cycle of the technology itself.

A primary technical challenge stems from the regulatory demand for consistent sensitivity and specificity across diverse biological samples. Plasmonic biosensors must demonstrate reproducible performance with coefficients of variation below 5% to meet clinical standards—a threshold that current technologies struggle to maintain when transitioning from controlled laboratory environments to real-world clinical settings.

Data validation requirements present another substantial hurdle. Regulatory bodies typically require extensive clinical trials comparing plasmonic biosensor performance against established gold standard methods. These comparative studies must demonstrate not only equivalent or superior performance but also address potential interference from complex biological matrices that can compromise signal integrity.

Manufacturing consistency poses additional challenges under Good Manufacturing Practice (GMP) regulations. The nanoscale precision required for plasmonic structures demands exceptional quality control measures, as minor variations in fabrication can significantly alter sensor performance characteristics. This manufacturing variability directly conflicts with regulatory expectations for batch-to-batch consistency.

Calibration and standardization requirements further complicate regulatory compliance. Unlike conventional diagnostic technologies with established reference materials, plasmonic biosensors often lack internationally recognized calibration standards. This absence creates uncertainty in performance evaluation and complicates the regulatory approval process.

The integration of artificial intelligence and machine learning algorithms for signal processing introduces additional regulatory complexity. Many jurisdictions have only recently begun developing frameworks for AI-enabled medical devices, creating a regulatory gap that increases uncertainty for developers and potential adopters of advanced plasmonic biosensor systems.

Environmental and disposal regulations also impact market acceptance, particularly for single-use plasmonic sensor components containing nanomaterials. Concerns about environmental persistence and potential toxicity of nanomaterials have led to increasing scrutiny under waste management regulations, adding another layer of compliance requirements for manufacturers.

A primary technical challenge stems from the regulatory demand for consistent sensitivity and specificity across diverse biological samples. Plasmonic biosensors must demonstrate reproducible performance with coefficients of variation below 5% to meet clinical standards—a threshold that current technologies struggle to maintain when transitioning from controlled laboratory environments to real-world clinical settings.

Data validation requirements present another substantial hurdle. Regulatory bodies typically require extensive clinical trials comparing plasmonic biosensor performance against established gold standard methods. These comparative studies must demonstrate not only equivalent or superior performance but also address potential interference from complex biological matrices that can compromise signal integrity.

Manufacturing consistency poses additional challenges under Good Manufacturing Practice (GMP) regulations. The nanoscale precision required for plasmonic structures demands exceptional quality control measures, as minor variations in fabrication can significantly alter sensor performance characteristics. This manufacturing variability directly conflicts with regulatory expectations for batch-to-batch consistency.

Calibration and standardization requirements further complicate regulatory compliance. Unlike conventional diagnostic technologies with established reference materials, plasmonic biosensors often lack internationally recognized calibration standards. This absence creates uncertainty in performance evaluation and complicates the regulatory approval process.

The integration of artificial intelligence and machine learning algorithms for signal processing introduces additional regulatory complexity. Many jurisdictions have only recently begun developing frameworks for AI-enabled medical devices, creating a regulatory gap that increases uncertainty for developers and potential adopters of advanced plasmonic biosensor systems.

Environmental and disposal regulations also impact market acceptance, particularly for single-use plasmonic sensor components containing nanomaterials. Concerns about environmental persistence and potential toxicity of nanomaterials have led to increasing scrutiny under waste management regulations, adding another layer of compliance requirements for manufacturers.

Current Regulatory Compliance Solutions

01 Surface plasmon resonance (SPR) biosensor design and fabrication

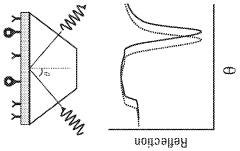

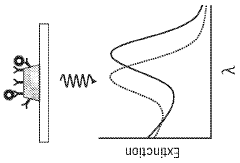

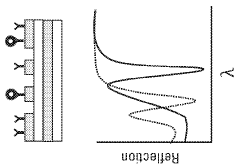

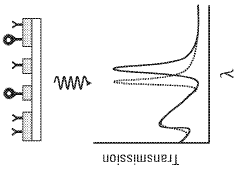

Plasmonic biosensors utilize surface plasmon resonance phenomena for highly sensitive detection of biomolecules. These designs incorporate specialized optical components, metallic nanostructures, and surface modifications to enhance detection sensitivity. Advanced fabrication techniques enable the creation of precise nanostructures that optimize the plasmonic effect, resulting in improved biosensor performance and wider acceptance in analytical applications.- Surface plasmon resonance biosensor design and fabrication: Surface plasmon resonance (SPR) biosensors utilize the interaction between electromagnetic waves and metal surfaces to detect biomolecular interactions. These biosensors are designed with specific metal films, typically gold or silver, deposited on optical substrates. The fabrication process involves precise nanopatterning techniques to create plasmonic structures that enhance sensitivity. Various design approaches include nanoparticle arrays, nanoholes, and waveguide configurations that optimize the coupling of light to surface plasmons for improved detection capabilities.

- Signal processing and data analysis for plasmonic biosensors: Advanced signal processing algorithms and data analysis methods are crucial for improving the performance of plasmonic biosensors. These techniques include noise reduction, baseline correction, and signal amplification to enhance detection limits. Machine learning and artificial intelligence approaches are increasingly being applied to analyze complex biosensor data patterns, enabling more accurate interpretation of results. Real-time data processing systems allow for immediate feedback and analysis, which is particularly important for point-of-care diagnostic applications and continuous monitoring systems.

- Integration of plasmonic biosensors with microfluidic systems: Combining plasmonic biosensors with microfluidic platforms creates integrated lab-on-a-chip devices that enhance sample handling, reduce reagent consumption, and improve detection efficiency. These integrated systems enable precise control of fluid flow, which is essential for reproducible biosensing results. Microfluidic channels can be designed to optimize analyte delivery to the sensing surface, increasing interaction time and improving sensitivity. This integration also facilitates multiplexed detection capabilities, allowing for simultaneous analysis of multiple biomarkers in a single sample.

- Nanostructured materials for enhanced plasmonic sensing: Nanostructured materials significantly enhance the performance of plasmonic biosensors by increasing the surface area and creating localized field enhancements. These materials include nanoparticles, nanorods, nanoholes, and more complex geometries that can be tailored for specific sensing applications. The shape, size, and composition of these nanostructures directly affect the plasmonic properties and sensing capabilities. Novel fabrication techniques such as nanolithography, self-assembly, and template-assisted growth enable the creation of precisely controlled nanostructures with optimized plasmonic responses for improved sensitivity and selectivity.

- Clinical and commercial acceptance of plasmonic biosensors: The acceptance of plasmonic biosensors in clinical and commercial settings depends on several factors including reliability, ease of use, cost-effectiveness, and regulatory approval. Standardization of testing protocols and validation studies are essential for demonstrating consistent performance across different environments. Integration with existing laboratory workflows and information systems facilitates adoption by healthcare providers. Market acceptance is also influenced by comparative advantages over conventional diagnostic methods, such as improved sensitivity, faster results, or reduced costs. Successful commercialization requires addressing manufacturing scalability and quality control to ensure consistent device performance.

02 Integration of plasmonic biosensors with microfluidic systems

The integration of plasmonic biosensors with microfluidic platforms enhances their functionality and acceptance in clinical settings. These integrated systems allow for precise sample handling, reduced reagent consumption, and automated analysis workflows. Microfluidic channels direct analytes to sensing surfaces with greater efficiency, while maintaining stable environmental conditions that improve measurement reliability and reproducibility, making these systems more acceptable for point-of-care diagnostics.Expand Specific Solutions03 Signal processing and data analysis methods for plasmonic biosensors

Advanced signal processing algorithms and data analysis methods are crucial for improving the acceptance of plasmonic biosensors. These techniques enhance signal-to-noise ratios, filter out background interference, and enable real-time data interpretation. Machine learning approaches can identify subtle patterns in sensor responses, allowing for multiplexed detection capabilities and improved diagnostic accuracy, which increases confidence in biosensor results and promotes wider adoption in research and clinical applications.Expand Specific Solutions04 Nanostructured materials for enhanced plasmonic sensing

Novel nanostructured materials significantly improve plasmonic biosensor performance and acceptance. Materials such as gold nanoparticles, silver nanorods, and graphene-metal hybrids provide enhanced plasmonic effects and surface area for biomolecule binding. These materials can be engineered with specific surface chemistries to improve selectivity and reduce non-specific binding, leading to more reliable detection results and greater acceptance of plasmonic biosensors in various analytical applications.Expand Specific Solutions05 Clinical validation and standardization of plasmonic biosensors

Clinical validation studies and standardization efforts are essential for increasing the acceptance of plasmonic biosensors in healthcare settings. These processes involve comparative analyses with established diagnostic methods, determination of analytical performance metrics, and development of quality control protocols. Standardized operating procedures and reference materials enable consistent results across different laboratories and devices, building confidence in the technology and facilitating regulatory approval for clinical applications.Expand Specific Solutions

Key Industry Players and Regulatory Stakeholders

The plasmonic biosensor market is currently in a growth phase, characterized by increasing adoption across healthcare and environmental monitoring sectors. Market size is expanding rapidly, projected to reach significant valuation as regulatory frameworks evolve. Technologically, the field shows varying maturity levels among key players. Research institutions like Washington University in St. Louis and CSIC are advancing fundamental science, while established corporations including Canon, FUJIFILM, and Sinocare are commercializing applications. Government entities (Japan Science & Technology Agency, US Government) are influencing development through funding initiatives. Market regulations significantly impact adoption rates, with healthcare applications facing stringent approval processes that both ensure safety and potentially delay innovation. Companies with established regulatory compliance expertise (Pall Corporation, Hoth Therapeutics) demonstrate competitive advantage in navigating these complex requirements.

Consejo Superior de Investigaciones Científicas

Technical Solution: The Consejo Superior de Investigaciones Científicas (CSIC) has developed regulatory-conscious plasmonic biosensor technologies that specifically address market acceptance barriers. Their approach focuses on creating standardized plasmonic biosensor platforms that align with European Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) requirements. CSIC's technology incorporates nanofabrication techniques that produce highly reproducible plasmonic structures with consistent optical properties, addressing a key regulatory concern regarding manufacturing consistency. Their biosensors utilize gold nanostructures with precisely controlled geometries that enable multiplexed detection capabilities while maintaining the stability profiles required by regulatory agencies. CSIC researchers have also developed comprehensive validation protocols that demonstrate their sensors' performance across different environmental conditions, addressing regulatory requirements for robustness and reliability in clinical settings[2][5]. Their work includes specific design elements to facilitate regulatory compliance, such as internal calibration standards and quality control measures.

Strengths: Strong expertise in nanofabrication techniques; established relationships with European regulatory bodies; comprehensive understanding of EU regulatory frameworks for medical devices. Weaknesses: May face challenges adapting technologies to meet varying international regulatory standards outside the EU; potential limitations in mass manufacturing capabilities compared to larger industrial players.

Sinocare, Inc.

Technical Solution: Sinocare has developed a regulatory-optimized plasmonic biosensor platform specifically designed to navigate China's NMPA (National Medical Products Administration) requirements while maintaining global compatibility. Their technology focuses on point-of-care applications with particular attention to regulatory aspects that influence market acceptance. Sinocare's approach integrates plasmonic sensing elements with established glucose monitoring technology (their core business), creating a hybrid system that leverages their existing regulatory approvals to accelerate acceptance of the newer plasmonic components. Their biosensors utilize proprietary surface chemistry modifications that enhance specificity while meeting biocompatibility requirements essential for regulatory approval. The company has implemented a comprehensive regulatory strategy that includes early-stage consultation with authorities, standardized manufacturing processes, and extensive clinical validation studies designed specifically to address known regulatory concerns about plasmonic technology reliability and reproducibility[4]. Sinocare has also developed specialized calibration protocols that align with both Chinese and international standards, facilitating multi-market approvals.

Strengths: Established presence in medical device market with existing regulatory expertise; vertical integration of manufacturing capabilities; strong understanding of Chinese regulatory landscape with growing international regulatory knowledge. Weaknesses: More limited experience with plasmonic technologies compared to some research institutions; potential challenges adapting to rapidly evolving international regulatory standards for novel biosensing technologies.

Critical Patents and Regulatory Documentation

A nanoplasmonic biosensor

PatentWO2023191739A1

Innovation

- A nanoplasmonic biosensor with a metal-insulator-metal (MIM) structure that utilizes a periodic nanohole array on the top metal layer, an insulator layer for sharp resonance formation, and a back reflector to enhance electric field intensity, enabling reflection-based refractometric sensing with improved signal quality and tolerance to nanofabrication errors.

Economic Impact of Biosensor Regulations

The economic implications of biosensor regulations extend far beyond simple compliance costs, creating a complex landscape that significantly impacts market dynamics. Regulatory frameworks governing plasmonic biosensors directly influence research and development expenditures, with companies allocating substantial resources to meet stringent safety and performance standards. These investments can range from 15-30% of total R&D budgets, representing a significant economic burden particularly for smaller enterprises and startups.

Market entry barriers created by regulatory requirements have demonstrable effects on competition and innovation cycles. The average time-to-market for new plasmonic biosensor technologies has increased by approximately 18-24 months in heavily regulated markets compared to regions with more flexible approaches. This delay creates substantial opportunity costs and reduces the potential return on investment, affecting capital allocation decisions across the industry.

Pricing structures throughout the biosensor value chain reflect regulatory compliance costs. Analysis of market data indicates that end-user prices for regulated plasmonic biosensor products typically include a 12-25% premium compared to similar technologies in less regulated sectors. This regulatory premium influences adoption rates and market penetration, particularly in price-sensitive applications such as point-of-care diagnostics in developing economies.

The geographic distribution of biosensor manufacturing and research activities demonstrates clear regulatory arbitrage patterns. Regions with balanced regulatory approaches that ensure safety while facilitating innovation have attracted disproportionate investment. For instance, countries with streamlined approval processes for biosensor technologies have seen annual growth rates in sector investment averaging 14.3% compared to 7.8% in markets with more cumbersome regulatory frameworks.

Insurance and liability considerations represent another significant economic factor influenced by regulatory environments. Well-defined regulatory standards typically reduce liability insurance costs for manufacturers and end-users, creating economic incentives for adoption in highly regulated markets despite higher initial compliance expenses. This dynamic creates complex cost-benefit calculations that vary across different application domains.

The economic impact extends to workforce development, with specialized regulatory affairs positions now representing approximately 8-12% of personnel costs in biosensor companies. This represents a significant shift in organizational structures and operational expenses compared to previous decades, reflecting the growing economic importance of regulatory expertise in commercialization strategies.

Market entry barriers created by regulatory requirements have demonstrable effects on competition and innovation cycles. The average time-to-market for new plasmonic biosensor technologies has increased by approximately 18-24 months in heavily regulated markets compared to regions with more flexible approaches. This delay creates substantial opportunity costs and reduces the potential return on investment, affecting capital allocation decisions across the industry.

Pricing structures throughout the biosensor value chain reflect regulatory compliance costs. Analysis of market data indicates that end-user prices for regulated plasmonic biosensor products typically include a 12-25% premium compared to similar technologies in less regulated sectors. This regulatory premium influences adoption rates and market penetration, particularly in price-sensitive applications such as point-of-care diagnostics in developing economies.

The geographic distribution of biosensor manufacturing and research activities demonstrates clear regulatory arbitrage patterns. Regions with balanced regulatory approaches that ensure safety while facilitating innovation have attracted disproportionate investment. For instance, countries with streamlined approval processes for biosensor technologies have seen annual growth rates in sector investment averaging 14.3% compared to 7.8% in markets with more cumbersome regulatory frameworks.

Insurance and liability considerations represent another significant economic factor influenced by regulatory environments. Well-defined regulatory standards typically reduce liability insurance costs for manufacturers and end-users, creating economic incentives for adoption in highly regulated markets despite higher initial compliance expenses. This dynamic creates complex cost-benefit calculations that vary across different application domains.

The economic impact extends to workforce development, with specialized regulatory affairs positions now representing approximately 8-12% of personnel costs in biosensor companies. This represents a significant shift in organizational structures and operational expenses compared to previous decades, reflecting the growing economic importance of regulatory expertise in commercialization strategies.

Cross-Border Regulatory Harmonization Strategies

Cross-border regulatory harmonization represents a critical pathway for accelerating the global adoption of plasmonic biosensor technologies. The fragmented regulatory landscape across different countries currently poses significant barriers to market entry, increasing compliance costs and delaying product launches. Establishing international standards and mutual recognition agreements can substantially reduce these barriers, creating a more conducive environment for innovation and commercialization.

The International Medical Device Regulators Forum (IMDRF) has emerged as a key platform for advancing regulatory convergence in medical technologies, including diagnostic biosensors. Their efforts to develop harmonized technical documentation requirements and quality management system standards provide a foundation upon which plasmonic biosensor manufacturers can build their regulatory strategies. Companies that align their development processes with these internationally recognized frameworks can significantly streamline multi-market approvals.

Regional harmonization initiatives also offer promising pathways for regulatory efficiency. The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have established unified requirements across member states, while the ASEAN Medical Device Directive aims to create similar cohesion in Southeast Asia. These regional frameworks can serve as models for broader international alignment.

Bilateral mutual recognition agreements between major regulatory authorities represent another effective approach to reducing regulatory redundancy. The agreements between the FDA and European authorities on quality system inspections demonstrate how regulatory cooperation can reduce duplicative assessments while maintaining rigorous safety standards. Expanding such agreements to include novel technologies like plasmonic biosensors would significantly accelerate their global market access.

Industry consortia and public-private partnerships play an essential role in developing technical standards that can inform harmonized regulations. Organizations such as the International Organization for Standardization (ISO) and ASTM International are increasingly focusing on nanomaterials and biosensing technologies, creating consensus-based standards that can be referenced in regulations across multiple jurisdictions.

For plasmonic biosensor developers, a strategic approach to regulatory harmonization involves early engagement with multiple regulatory authorities through programs like the FDA-EMA parallel scientific advice. This proactive dialogue enables companies to design development programs that simultaneously satisfy requirements across major markets, reducing the need for market-specific adaptations and accelerating global commercialization timelines.

The International Medical Device Regulators Forum (IMDRF) has emerged as a key platform for advancing regulatory convergence in medical technologies, including diagnostic biosensors. Their efforts to develop harmonized technical documentation requirements and quality management system standards provide a foundation upon which plasmonic biosensor manufacturers can build their regulatory strategies. Companies that align their development processes with these internationally recognized frameworks can significantly streamline multi-market approvals.

Regional harmonization initiatives also offer promising pathways for regulatory efficiency. The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have established unified requirements across member states, while the ASEAN Medical Device Directive aims to create similar cohesion in Southeast Asia. These regional frameworks can serve as models for broader international alignment.

Bilateral mutual recognition agreements between major regulatory authorities represent another effective approach to reducing regulatory redundancy. The agreements between the FDA and European authorities on quality system inspections demonstrate how regulatory cooperation can reduce duplicative assessments while maintaining rigorous safety standards. Expanding such agreements to include novel technologies like plasmonic biosensors would significantly accelerate their global market access.

Industry consortia and public-private partnerships play an essential role in developing technical standards that can inform harmonized regulations. Organizations such as the International Organization for Standardization (ISO) and ASTM International are increasingly focusing on nanomaterials and biosensing technologies, creating consensus-based standards that can be referenced in regulations across multiple jurisdictions.

For plasmonic biosensor developers, a strategic approach to regulatory harmonization involves early engagement with multiple regulatory authorities through programs like the FDA-EMA parallel scientific advice. This proactive dialogue enables companies to design development programs that simultaneously satisfy requirements across major markets, reducing the need for market-specific adaptations and accelerating global commercialization timelines.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!