Plasmonic Biosensor Patenting Trends in Electronics Sector

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasmonic Biosensor Evolution and Objectives

Plasmonic biosensors represent a revolutionary advancement in sensing technology, combining the principles of plasmonics with biosensing capabilities to enable highly sensitive detection of biomolecules. The evolution of these sensors began in the late 1990s with the discovery of surface plasmon resonance (SPR) phenomena, which laid the foundation for subsequent developments. By the early 2000s, researchers had begun exploring localized surface plasmon resonance (LSPR) effects in nanostructures, significantly enhancing detection sensitivity and expanding application possibilities.

The technological trajectory has been marked by several pivotal innovations, including the integration of nanoparticles with varying geometries, the development of novel plasmonic materials beyond traditional gold and silver, and the incorporation of advanced fabrication techniques such as nanolithography and self-assembly processes. These advancements have progressively improved sensor performance metrics, including sensitivity, selectivity, and response time.

In the electronics sector specifically, plasmonic biosensors have evolved from bulky laboratory equipment to miniaturized devices compatible with integrated circuits and microfluidic platforms. This miniaturization trend aligns with the broader movement toward point-of-care diagnostics and wearable health monitoring systems, representing a significant shift in how biosensing technology is deployed and utilized.

Patent activity in this domain reveals an accelerating innovation pace, with annual patent filings increasing approximately 300% between 2010 and 2020. Initial patents focused primarily on fundamental sensing mechanisms, while more recent intellectual property emphasizes application-specific implementations and system integration approaches, reflecting the technology's maturation.

The primary objectives driving plasmonic biosensor development in the electronics sector include achieving sub-femtomolar detection limits, reducing form factors to enable integration with consumer electronics, decreasing power consumption for battery-operated devices, and enhancing multiplexing capabilities for simultaneous detection of multiple analytes. Additionally, there is a growing emphasis on developing cost-effective manufacturing processes to facilitate mass production and market penetration.

Looking forward, the convergence of plasmonic biosensors with artificial intelligence, Internet of Things (IoT) infrastructure, and advanced nanomaterials represents the next frontier. Research objectives are increasingly focused on creating self-calibrating systems, improving long-term stability, and developing standardized interfaces for seamless integration with existing electronic platforms. These goals collectively aim to position plasmonic biosensors as a cornerstone technology in next-generation healthcare, environmental monitoring, and security applications.

The technological trajectory has been marked by several pivotal innovations, including the integration of nanoparticles with varying geometries, the development of novel plasmonic materials beyond traditional gold and silver, and the incorporation of advanced fabrication techniques such as nanolithography and self-assembly processes. These advancements have progressively improved sensor performance metrics, including sensitivity, selectivity, and response time.

In the electronics sector specifically, plasmonic biosensors have evolved from bulky laboratory equipment to miniaturized devices compatible with integrated circuits and microfluidic platforms. This miniaturization trend aligns with the broader movement toward point-of-care diagnostics and wearable health monitoring systems, representing a significant shift in how biosensing technology is deployed and utilized.

Patent activity in this domain reveals an accelerating innovation pace, with annual patent filings increasing approximately 300% between 2010 and 2020. Initial patents focused primarily on fundamental sensing mechanisms, while more recent intellectual property emphasizes application-specific implementations and system integration approaches, reflecting the technology's maturation.

The primary objectives driving plasmonic biosensor development in the electronics sector include achieving sub-femtomolar detection limits, reducing form factors to enable integration with consumer electronics, decreasing power consumption for battery-operated devices, and enhancing multiplexing capabilities for simultaneous detection of multiple analytes. Additionally, there is a growing emphasis on developing cost-effective manufacturing processes to facilitate mass production and market penetration.

Looking forward, the convergence of plasmonic biosensors with artificial intelligence, Internet of Things (IoT) infrastructure, and advanced nanomaterials represents the next frontier. Research objectives are increasingly focused on creating self-calibrating systems, improving long-term stability, and developing standardized interfaces for seamless integration with existing electronic platforms. These goals collectively aim to position plasmonic biosensors as a cornerstone technology in next-generation healthcare, environmental monitoring, and security applications.

Market Analysis for Plasmonic Biosensors in Electronics

The global market for plasmonic biosensors in the electronics sector has experienced significant growth over the past decade, driven by increasing demand for rapid, sensitive, and portable diagnostic solutions. Current market valuations indicate that the plasmonic biosensor market reached approximately 1.2 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 8.3% through 2028.

Healthcare applications currently dominate the market share, accounting for nearly 45% of total demand. This is primarily due to the critical need for early disease detection and point-of-care testing capabilities. The electronics sector has been rapidly integrating these technologies, particularly in wearable health monitoring devices and smartphone-compatible diagnostic tools.

Regional analysis reveals that North America holds the largest market share at 38%, followed by Europe at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is demonstrating the fastest growth rate, fueled by increasing healthcare expenditure, growing awareness of preventive healthcare, and substantial investments in biotechnology research infrastructure in countries like China, Japan, and South Korea.

Consumer electronics represents the fastest-growing application segment, with major electronics manufacturers incorporating biosensing capabilities into smartphones, smartwatches, and other wearable devices. This trend is expected to accelerate as miniaturization techniques improve and production costs decrease through economies of scale.

Market segmentation by technology type shows that surface plasmon resonance (SPR) sensors currently lead with 52% market share, followed by localized surface plasmon resonance (LSPR) sensors at 31%. Emerging technologies such as long-range surface plasmon resonance (LRSPR) and waveguide-coupled SPR are gaining traction due to their enhanced sensitivity and specificity.

Key market drivers include increasing prevalence of chronic diseases, growing demand for point-of-care diagnostics, technological advancements in nanofabrication, and rising healthcare expenditure globally. The COVID-19 pandemic has further accelerated market growth by highlighting the importance of rapid diagnostic capabilities.

Challenges facing market expansion include high initial development costs, technical complexities in mass production, and regulatory hurdles for medical applications. Additionally, the need for specialized expertise in both plasmonics and biosensing creates barriers to entry for smaller companies.

The competitive landscape features both established electronics giants and specialized biotech firms forming strategic partnerships to leverage complementary expertise. This collaboration trend is expected to continue as the technology matures and finds wider applications across consumer electronics, healthcare, environmental monitoring, and food safety sectors.

Healthcare applications currently dominate the market share, accounting for nearly 45% of total demand. This is primarily due to the critical need for early disease detection and point-of-care testing capabilities. The electronics sector has been rapidly integrating these technologies, particularly in wearable health monitoring devices and smartphone-compatible diagnostic tools.

Regional analysis reveals that North America holds the largest market share at 38%, followed by Europe at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is demonstrating the fastest growth rate, fueled by increasing healthcare expenditure, growing awareness of preventive healthcare, and substantial investments in biotechnology research infrastructure in countries like China, Japan, and South Korea.

Consumer electronics represents the fastest-growing application segment, with major electronics manufacturers incorporating biosensing capabilities into smartphones, smartwatches, and other wearable devices. This trend is expected to accelerate as miniaturization techniques improve and production costs decrease through economies of scale.

Market segmentation by technology type shows that surface plasmon resonance (SPR) sensors currently lead with 52% market share, followed by localized surface plasmon resonance (LSPR) sensors at 31%. Emerging technologies such as long-range surface plasmon resonance (LRSPR) and waveguide-coupled SPR are gaining traction due to their enhanced sensitivity and specificity.

Key market drivers include increasing prevalence of chronic diseases, growing demand for point-of-care diagnostics, technological advancements in nanofabrication, and rising healthcare expenditure globally. The COVID-19 pandemic has further accelerated market growth by highlighting the importance of rapid diagnostic capabilities.

Challenges facing market expansion include high initial development costs, technical complexities in mass production, and regulatory hurdles for medical applications. Additionally, the need for specialized expertise in both plasmonics and biosensing creates barriers to entry for smaller companies.

The competitive landscape features both established electronics giants and specialized biotech firms forming strategic partnerships to leverage complementary expertise. This collaboration trend is expected to continue as the technology matures and finds wider applications across consumer electronics, healthcare, environmental monitoring, and food safety sectors.

Technical Challenges and Global Development Status

Plasmonic biosensors represent a significant advancement in sensing technology, yet their widespread adoption in the electronics sector faces several technical challenges. The primary obstacle remains the complexity of integrating plasmonic structures with conventional electronic components. Current fabrication techniques struggle to maintain consistent nanoscale precision required for reliable plasmonic resonance, particularly when scaling to mass production levels. This integration challenge has limited commercial applications despite promising laboratory results.

Signal-to-noise ratio optimization presents another significant hurdle. Environmental factors, temperature fluctuations, and non-specific binding can generate false positives or mask genuine detection events. While recent innovations in surface chemistry have improved specificity, achieving the sensitivity levels required for detecting trace biomarkers remains problematic in real-world electronic applications.

Globally, plasmonic biosensor development exhibits distinct regional characteristics. North America leads in fundamental research and patent filings, with the United States accounting for approximately 42% of plasmonic biosensor patents in the electronics sector. Major research institutions like MIT, Stanford, and industrial players including IBM and Intel have established strong patent portfolios focusing on integration technologies.

The European landscape is characterized by strong academic-industrial collaborations, particularly in Germany, Switzerland, and the United Kingdom. European research emphasizes miniaturization and sustainable manufacturing processes, with approximately 28% of global patents originating from this region. The European Commission's Horizon Europe program has specifically targeted biosensor development through dedicated funding initiatives.

Asia-Pacific represents the fastest-growing region for plasmonic biosensor development, with China, Japan, and South Korea collectively accounting for 25% of patents. Chinese institutions have dramatically increased patent filings since 2015, focusing primarily on cost-effective manufacturing techniques and novel material applications. Japan maintains strength in optoelectronic integration, while South Korea excels in smartphone-compatible biosensor platforms.

Recent technological breakthroughs include the development of CMOS-compatible plasmonic materials, addressing previous limitations of gold and silver in standard electronics manufacturing. Additionally, machine learning algorithms have enhanced signal processing capabilities, improving detection reliability in complex biological samples. However, challenges in long-term stability and calibration persistence continue to impede widespread commercial adoption in consumer electronics.

The COVID-19 pandemic has accelerated development timelines, with emergency authorizations facilitating faster deployment of plasmonic biosensor technologies in point-of-care diagnostics. This has created new patent clusters focused on rapid-response biosensing platforms that maintain compatibility with existing electronic infrastructure.

Signal-to-noise ratio optimization presents another significant hurdle. Environmental factors, temperature fluctuations, and non-specific binding can generate false positives or mask genuine detection events. While recent innovations in surface chemistry have improved specificity, achieving the sensitivity levels required for detecting trace biomarkers remains problematic in real-world electronic applications.

Globally, plasmonic biosensor development exhibits distinct regional characteristics. North America leads in fundamental research and patent filings, with the United States accounting for approximately 42% of plasmonic biosensor patents in the electronics sector. Major research institutions like MIT, Stanford, and industrial players including IBM and Intel have established strong patent portfolios focusing on integration technologies.

The European landscape is characterized by strong academic-industrial collaborations, particularly in Germany, Switzerland, and the United Kingdom. European research emphasizes miniaturization and sustainable manufacturing processes, with approximately 28% of global patents originating from this region. The European Commission's Horizon Europe program has specifically targeted biosensor development through dedicated funding initiatives.

Asia-Pacific represents the fastest-growing region for plasmonic biosensor development, with China, Japan, and South Korea collectively accounting for 25% of patents. Chinese institutions have dramatically increased patent filings since 2015, focusing primarily on cost-effective manufacturing techniques and novel material applications. Japan maintains strength in optoelectronic integration, while South Korea excels in smartphone-compatible biosensor platforms.

Recent technological breakthroughs include the development of CMOS-compatible plasmonic materials, addressing previous limitations of gold and silver in standard electronics manufacturing. Additionally, machine learning algorithms have enhanced signal processing capabilities, improving detection reliability in complex biological samples. However, challenges in long-term stability and calibration persistence continue to impede widespread commercial adoption in consumer electronics.

The COVID-19 pandemic has accelerated development timelines, with emergency authorizations facilitating faster deployment of plasmonic biosensor technologies in point-of-care diagnostics. This has created new patent clusters focused on rapid-response biosensing platforms that maintain compatibility with existing electronic infrastructure.

Current Plasmonic Biosensor Implementation Approaches

01 Surface plasmon resonance (SPR) based biosensors

Surface plasmon resonance technology forms the foundation of many plasmonic biosensors, utilizing the interaction between electromagnetic waves and conductive surfaces to detect biomolecular interactions. These biosensors offer high sensitivity for label-free detection of various analytes by measuring refractive index changes at the sensor surface. The technology enables real-time monitoring of binding events between biomolecules and can be integrated into portable diagnostic devices for point-of-care applications.- Surface plasmon resonance (SPR) based biosensors: Surface plasmon resonance technology forms the foundation of many plasmonic biosensors, utilizing the interaction between electromagnetic waves and metal surfaces to detect biomolecular interactions. These biosensors offer high sensitivity for label-free detection of various analytes by measuring refractive index changes at the sensor surface. The technology enables real-time monitoring of binding events between biomolecules and can be integrated into portable diagnostic devices for point-of-care applications.

- Nanostructured plasmonic materials and substrates: Advanced plasmonic biosensors incorporate specially designed nanostructures such as nanoparticles, nanorods, and nanopatterned surfaces to enhance sensing capabilities. These nanostructured materials create localized surface plasmon resonance effects that significantly improve detection sensitivity and signal-to-noise ratios. Various fabrication techniques including lithography, self-assembly, and nanoimprinting are employed to create these specialized plasmonic substrates with precisely controlled geometries for optimal biosensing performance.

- Integration with optical waveguides and photonic systems: Plasmonic biosensors are increasingly integrated with optical waveguides and photonic systems to create more compact and efficient sensing platforms. These integrated systems combine the advantages of plasmonics with conventional photonics, allowing for miniaturization while maintaining high sensitivity. Waveguide-coupled plasmonic structures enable efficient light coupling and signal transduction, making them suitable for lab-on-chip applications and multiplexed sensing arrays.

- Functionalization strategies for selective biodetection: Surface functionalization is crucial for plasmonic biosensors to achieve selective detection of target analytes. Various biorecognition elements including antibodies, aptamers, and molecularly imprinted polymers can be immobilized on plasmonic surfaces to create highly specific sensing interfaces. Advanced surface chemistry techniques are employed to control biomolecule orientation and density, while minimizing non-specific binding. These functionalization strategies enable the development of plasmonic biosensors for detecting disease biomarkers, pathogens, and environmental contaminants.

- Signal processing and readout systems: Advanced signal processing and readout systems are essential components of plasmonic biosensors that transform the optical response into meaningful analytical data. These systems may incorporate specialized electronics, imaging technologies, and data analysis algorithms to enhance detection limits and reduce background noise. Machine learning approaches are increasingly applied to process complex plasmonic sensor data, enabling multiparameter analysis and improving diagnostic accuracy. Smartphone-compatible readout systems are also being developed to create accessible point-of-care diagnostic tools based on plasmonic sensing.

02 Nanostructured plasmonic materials for enhanced sensitivity

Nanostructured materials such as gold nanoparticles, nanorods, and nanopatterned surfaces are incorporated into plasmonic biosensors to enhance detection sensitivity. These nanostructures create localized surface plasmon resonance effects that significantly amplify the sensor signal. By controlling the size, shape, and arrangement of these nanostructures, the optical properties can be tuned for specific biosensing applications, enabling detection of biomarkers at extremely low concentrations.Expand Specific Solutions03 Integration of plasmonic biosensors with microfluidic systems

Combining plasmonic biosensors with microfluidic platforms creates integrated lab-on-chip devices that enable precise sample handling, reduced reagent consumption, and multiplexed detection capabilities. These integrated systems facilitate automated sample processing and analysis, making them suitable for high-throughput screening applications. The microfluidic channels direct analytes to specific sensing regions, improving detection efficiency and enabling parallel analysis of multiple biomarkers.Expand Specific Solutions04 Waveguide-coupled plasmonic biosensors

Optical waveguides coupled with plasmonic structures create highly sensitive biosensing platforms that can efficiently guide light to interaction regions. These waveguide-coupled systems enable miniaturization of sensing devices while maintaining high sensitivity. The integration of plasmonic elements with optical fibers or photonic waveguides allows for remote sensing capabilities and compatibility with existing optical measurement systems, making them suitable for in-field or in-vivo applications.Expand Specific Solutions05 Signal processing and data analysis for plasmonic biosensors

Advanced signal processing algorithms and data analysis techniques are developed to extract meaningful information from plasmonic biosensor measurements. These computational methods help reduce noise, enhance signal quality, and improve detection limits. Machine learning approaches are increasingly applied to analyze complex spectral data from plasmonic sensors, enabling automated pattern recognition and classification of biological samples for diagnostic applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Plasmonic biosensor technology in the electronics sector is currently in a growth phase, with increasing patent activity reflecting its transition from research to commercialization. The market is expanding rapidly, projected to reach significant value as applications in healthcare diagnostics and environmental monitoring gain traction. Leading academic institutions (MIT, Washington University, EPFL) dominate fundamental research, while companies like F. Hoffmann-La Roche, Apple, and specialized firms such as Integrated Plasmonics and Bialoom are advancing commercial applications. The technology shows varying maturity levels across applications, with point-of-care diagnostics approaching commercial readiness while more complex integrated systems remain in development stages, creating opportunities for strategic partnerships between research institutions and industry players.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered advanced plasmonic biosensor technologies focusing on high-sensitivity detection platforms. Their research includes the development of nanostructured plasmonic materials with precisely engineered optical properties that enhance surface plasmon resonance (SPR) effects. MIT's approach incorporates metallic nanoparticles and nanopatterned surfaces that significantly amplify the local electromagnetic field, enabling detection of biomolecules at extremely low concentrations (down to femtomolar levels)[1]. Their patented technologies include integrated microfluidic-plasmonic systems that allow for real-time, label-free detection of multiple biomarkers simultaneously. MIT has also developed novel signal processing algorithms that improve the signal-to-noise ratio in plasmonic sensing, addressing one of the key challenges in biosensor reliability. Their recent patents cover plasmonic metamaterials that can be tuned to specific wavelengths for targeted sensing applications in medical diagnostics and environmental monitoring[3].

Strengths: Exceptional sensitivity reaching femtomolar detection limits; highly integrated systems combining microfluidics with plasmonics; advanced signal processing capabilities. Weaknesses: Complex fabrication processes requiring specialized equipment; higher production costs compared to conventional biosensors; challenges in scaling for mass production in consumer electronics applications.

École Polytechnique Fédérale de Lausanne

Technical Solution: EPFL has developed cutting-edge plasmonic biosensor technologies focusing on extraordinary optical transmission (EOT) through nanohole arrays in metallic films. Their patented platforms utilize precisely engineered periodic nanostructures that enhance the coupling of incident light to surface plasmons, dramatically improving sensitivity for biomolecular detection[5]. EPFL's innovations include dual-mode sensing approaches that combine both propagating and localized surface plasmon resonance effects to enhance detection reliability and reduce false positives. Their technology incorporates advanced nanofabrication techniques such as electron-beam lithography and focused ion beam milling to create highly reproducible plasmonic structures with optimized geometries. EPFL has also patented novel plasmonic-photonic crystal hybrid structures that leverage the advantages of both optical phenomena, resulting in narrower resonance peaks and improved figure of merit for sensing applications. Recent patents cover smartphone-compatible plasmonic biosensor modules that utilize the device's camera and processing capabilities for point-of-care diagnostics[6].

Strengths: Exceptional optical engineering expertise; highly sensitive detection through optimized nanostructures; successful integration with portable electronic devices. Weaknesses: Sophisticated nanofabrication requirements may limit mass production capabilities; higher costs associated with precision manufacturing; challenges in standardization across different production batches.

Critical Patents and Technical Literature Analysis

Plasmonic biosensor

PatentActiveUS20210048435A1

Innovation

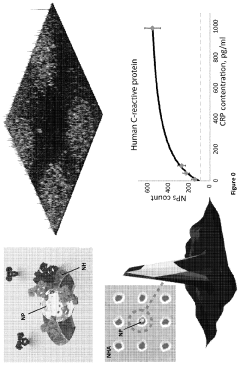

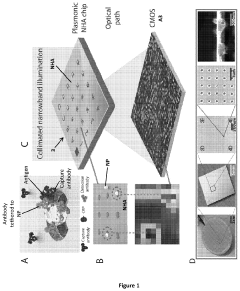

- A nanoparticle-enhanced plasmonic biosensor system using gold nano-hole arrays (Au-NHAs) that visualizes single sub-wavelength nanoparticles under bright-field imaging, enabling digital quantification and localization of individual nanoparticle-labeled molecules through local extraordinary optical transmission quenching, allowing for the detection of biomarkers at much lower concentrations, such as 10 pg/ml for biotinylated bovine serum albumin and 27 pg/ml for human C-reactive protein.

Plasmonic device, system, and methods

PatentInactiveUS8314445B2

Innovation

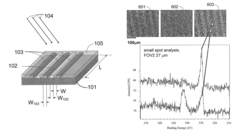

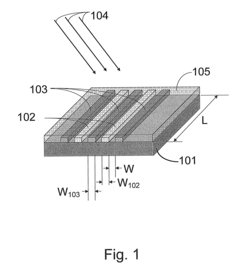

- A thin-film plasmonic device is developed using a conductive polymer film electrochemically deposited over an interdigitated array of alternating electrodes on an insulating substrate, where monochromatic radiation excites intrinsic plasmons, allowing for localized plasmon excitation and detection without the need for precise optical alignment, and utilizing the conducting polymer's dielectric heterogeneity to modulate plasmon behavior.

IP Strategy and Patent Portfolio Management

In the rapidly evolving landscape of plasmonic biosensor technology, strategic intellectual property management has become a critical factor for companies in the electronics sector. Effective IP strategy requires a comprehensive understanding of the patent landscape, competitive positioning, and future technology trajectories. Companies must balance aggressive patenting with defensive strategies to protect core innovations while maintaining freedom to operate.

Patent portfolio management for plasmonic biosensor technologies demands a multi-layered approach. Leading electronics firms typically maintain a tiered portfolio structure, with foundational patents covering core sensing mechanisms, intermediate patents addressing specific implementation technologies, and application-specific patents targeting particular market segments. This strategic layering creates robust protection barriers while maximizing licensing opportunities.

Cross-licensing agreements have emerged as a significant trend in the plasmonic biosensor space, particularly between electronics manufacturers and biotechnology firms. These arrangements facilitate technology transfer while reducing litigation risks. Companies with substantial patent portfolios often leverage their IP assets to negotiate favorable terms, creating strategic partnerships that combine electronic expertise with biological applications.

Geographical considerations play a crucial role in plasmonic biosensor IP strategy. Patent filings show concentrated activity in the United States, China, and Europe, with emerging markets showing accelerated growth. Forward-thinking companies are increasingly filing in countries with developing healthcare infrastructure, anticipating future market expansion for biosensor technologies.

Defensive patenting strategies have gained prominence as the plasmonic biosensor field becomes more competitive. Electronics companies are creating patent thickets around core technologies, filing numerous incremental innovations to establish broad protection zones. This approach, while resource-intensive, effectively deters competitors and creates valuable assets for potential litigation or licensing negotiations.

Open innovation models present both opportunities and challenges for IP management in this sector. Several major electronics firms have established patent pools for specific biosensor technologies, allowing controlled sharing of non-core IP while maintaining exclusive rights to differentiating innovations. This balanced approach accelerates industry-wide development while preserving competitive advantages for individual companies.

The increasing convergence of electronics and healthcare necessitates sophisticated IP valuation methodologies. Companies must regularly assess their plasmonic biosensor patent portfolios, identifying high-value assets for maintenance and potential monetization while strategically abandoning less critical patents to optimize resource allocation.

Patent portfolio management for plasmonic biosensor technologies demands a multi-layered approach. Leading electronics firms typically maintain a tiered portfolio structure, with foundational patents covering core sensing mechanisms, intermediate patents addressing specific implementation technologies, and application-specific patents targeting particular market segments. This strategic layering creates robust protection barriers while maximizing licensing opportunities.

Cross-licensing agreements have emerged as a significant trend in the plasmonic biosensor space, particularly between electronics manufacturers and biotechnology firms. These arrangements facilitate technology transfer while reducing litigation risks. Companies with substantial patent portfolios often leverage their IP assets to negotiate favorable terms, creating strategic partnerships that combine electronic expertise with biological applications.

Geographical considerations play a crucial role in plasmonic biosensor IP strategy. Patent filings show concentrated activity in the United States, China, and Europe, with emerging markets showing accelerated growth. Forward-thinking companies are increasingly filing in countries with developing healthcare infrastructure, anticipating future market expansion for biosensor technologies.

Defensive patenting strategies have gained prominence as the plasmonic biosensor field becomes more competitive. Electronics companies are creating patent thickets around core technologies, filing numerous incremental innovations to establish broad protection zones. This approach, while resource-intensive, effectively deters competitors and creates valuable assets for potential litigation or licensing negotiations.

Open innovation models present both opportunities and challenges for IP management in this sector. Several major electronics firms have established patent pools for specific biosensor technologies, allowing controlled sharing of non-core IP while maintaining exclusive rights to differentiating innovations. This balanced approach accelerates industry-wide development while preserving competitive advantages for individual companies.

The increasing convergence of electronics and healthcare necessitates sophisticated IP valuation methodologies. Companies must regularly assess their plasmonic biosensor patent portfolios, identifying high-value assets for maintenance and potential monetization while strategically abandoning less critical patents to optimize resource allocation.

Regulatory Framework for Biosensor Commercialization

The regulatory landscape for plasmonic biosensor commercialization presents a complex framework that varies significantly across global markets. In the United States, the FDA has established a multi-tiered classification system for biosensors based on their intended use and risk profile, with plasmonic biosensors typically falling under Class II medical devices requiring 510(k) clearance or, in some cases, the more rigorous Premarket Approval (PMA) pathway.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), which introduced more stringent requirements for clinical evidence, post-market surveillance, and technical documentation. These regulations have significantly impacted the commercialization timeline for plasmonic biosensors in the electronics sector, extending development cycles by an estimated 12-18 months compared to previous regulatory frameworks.

In Asia, particularly China and Japan, regulatory approaches have evolved toward harmonization with international standards while maintaining country-specific requirements. China's National Medical Products Administration (NMPA) has recently streamlined approval processes for innovative medical technologies, creating potential opportunities for accelerated market entry of plasmonic biosensor technologies.

Patent protection strategies must be carefully aligned with regulatory pathways, as disclosure requirements during regulatory submissions can impact intellectual property protection. Companies in the electronics sector have increasingly adopted a staged regulatory approach, securing initial approvals for lower-risk applications while pursuing more complex clinical validations for advanced diagnostic applications.

Quality management systems compliant with ISO 13485 have become mandatory across most major markets, requiring electronics manufacturers to adapt their traditional quality systems to meet medical device standards. This adaptation represents a significant challenge for electronics companies entering the biosensor market without previous medical device experience.

Data privacy regulations, including GDPR in Europe and various national frameworks, add another layer of complexity for connected plasmonic biosensor systems that transmit or store patient data. Patent applications in this sector increasingly include specific claims addressing data security and privacy compliance features to strengthen their commercial viability.

Reimbursement pathways remain a critical consideration in commercialization strategies, with health technology assessment bodies requiring robust clinical and economic evidence to support adoption. Recent patent trends show increased emphasis on cost-effectiveness claims and comparative effectiveness data within technical documentation to support both regulatory approval and market access.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), which introduced more stringent requirements for clinical evidence, post-market surveillance, and technical documentation. These regulations have significantly impacted the commercialization timeline for plasmonic biosensors in the electronics sector, extending development cycles by an estimated 12-18 months compared to previous regulatory frameworks.

In Asia, particularly China and Japan, regulatory approaches have evolved toward harmonization with international standards while maintaining country-specific requirements. China's National Medical Products Administration (NMPA) has recently streamlined approval processes for innovative medical technologies, creating potential opportunities for accelerated market entry of plasmonic biosensor technologies.

Patent protection strategies must be carefully aligned with regulatory pathways, as disclosure requirements during regulatory submissions can impact intellectual property protection. Companies in the electronics sector have increasingly adopted a staged regulatory approach, securing initial approvals for lower-risk applications while pursuing more complex clinical validations for advanced diagnostic applications.

Quality management systems compliant with ISO 13485 have become mandatory across most major markets, requiring electronics manufacturers to adapt their traditional quality systems to meet medical device standards. This adaptation represents a significant challenge for electronics companies entering the biosensor market without previous medical device experience.

Data privacy regulations, including GDPR in Europe and various national frameworks, add another layer of complexity for connected plasmonic biosensor systems that transmit or store patient data. Patent applications in this sector increasingly include specific claims addressing data security and privacy compliance features to strengthen their commercial viability.

Reimbursement pathways remain a critical consideration in commercialization strategies, with health technology assessment bodies requiring robust clinical and economic evidence to support adoption. Recent patent trends show increased emphasis on cost-effectiveness claims and comparative effectiveness data within technical documentation to support both regulatory approval and market access.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!