Optimizing NMC Battery Active Materials for Power Retention

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

NMC Battery Evolution and Performance Targets

Lithium-ion batteries with NMC (Nickel Manganese Cobalt) cathode materials have undergone significant evolution since their commercial introduction in the early 2000s. The initial NMC formulations (NMC111) contained equal parts nickel, manganese, and cobalt, offering balanced performance characteristics. As market demands shifted toward higher energy density, the industry progressively increased nickel content while reducing cobalt, leading to the development of NMC532, NMC622, and most recently NMC811 compositions.

This evolution has been driven by several factors: the need for greater energy density to support longer-range electric vehicles, cost reduction through minimizing expensive cobalt content, and addressing supply chain concerns related to cobalt mining. Each generation of NMC materials has demonstrated incremental improvements in specific capacity, from approximately 160 mAh/g for NMC111 to over 200 mAh/g for NMC811 when cycled within standard voltage windows.

However, this pursuit of higher energy density has often come at the expense of power retention capabilities. Higher nickel content, while beneficial for energy density, typically results in accelerated capacity fade during high-rate cycling and reduced thermal stability. This trade-off represents a critical challenge for applications requiring both high energy density and sustained power delivery, such as electric vehicles that must maintain performance during rapid acceleration events throughout their service life.

Current performance targets for advanced NMC materials focus on achieving a delicate balance between multiple parameters. Industry benchmarks now demand specific capacities exceeding 220 mAh/g while maintaining 80% capacity retention after 1000 cycles at 1C discharge rates. Additionally, power retention metrics specify that batteries should maintain at least 80% of their initial power capability after 500 cycles under high-rate (3C) discharge conditions.

Thermal stability requirements have also become more stringent, with expectations that NMC materials demonstrate onset temperatures for exothermic reactions above 200°C in fully charged states. This is particularly crucial for safety considerations in large-format batteries used in transportation applications.

The path forward for NMC optimization involves addressing several interconnected challenges: stabilizing the crystal structure during repeated lithiation/delithiation cycles, mitigating surface reactivity with electrolytes, and enhancing electronic/ionic conductivity networks within electrode structures. Recent research indicates that gradient concentration cathodes, advanced surface coatings, and dopant strategies represent promising approaches to enhance power retention without sacrificing energy density.

This evolution has been driven by several factors: the need for greater energy density to support longer-range electric vehicles, cost reduction through minimizing expensive cobalt content, and addressing supply chain concerns related to cobalt mining. Each generation of NMC materials has demonstrated incremental improvements in specific capacity, from approximately 160 mAh/g for NMC111 to over 200 mAh/g for NMC811 when cycled within standard voltage windows.

However, this pursuit of higher energy density has often come at the expense of power retention capabilities. Higher nickel content, while beneficial for energy density, typically results in accelerated capacity fade during high-rate cycling and reduced thermal stability. This trade-off represents a critical challenge for applications requiring both high energy density and sustained power delivery, such as electric vehicles that must maintain performance during rapid acceleration events throughout their service life.

Current performance targets for advanced NMC materials focus on achieving a delicate balance between multiple parameters. Industry benchmarks now demand specific capacities exceeding 220 mAh/g while maintaining 80% capacity retention after 1000 cycles at 1C discharge rates. Additionally, power retention metrics specify that batteries should maintain at least 80% of their initial power capability after 500 cycles under high-rate (3C) discharge conditions.

Thermal stability requirements have also become more stringent, with expectations that NMC materials demonstrate onset temperatures for exothermic reactions above 200°C in fully charged states. This is particularly crucial for safety considerations in large-format batteries used in transportation applications.

The path forward for NMC optimization involves addressing several interconnected challenges: stabilizing the crystal structure during repeated lithiation/delithiation cycles, mitigating surface reactivity with electrolytes, and enhancing electronic/ionic conductivity networks within electrode structures. Recent research indicates that gradient concentration cathodes, advanced surface coatings, and dopant strategies represent promising approaches to enhance power retention without sacrificing energy density.

Market Analysis for High-Power NMC Batteries

The global market for high-power NMC (Nickel Manganese Cobalt) batteries has experienced significant growth in recent years, driven primarily by the expanding electric vehicle (EV) sector and increasing demand for high-performance energy storage solutions. Current market valuations place the high-power NMC battery segment at approximately $25 billion, with projections indicating a compound annual growth rate of 18-20% through 2030.

The automotive sector represents the largest application market for high-power NMC batteries, accounting for nearly 65% of total demand. This dominance stems from the superior power density characteristics of NMC chemistry, which enables faster charging capabilities and higher discharge rates crucial for performance-oriented EVs. Premium and performance-oriented electric vehicle manufacturers have shown particular interest in advanced NMC formulations optimized for power retention.

Industrial applications constitute the second-largest market segment at 22%, where high-power NMC batteries are increasingly deployed in material handling equipment, power tools, and industrial automation systems requiring rapid charge-discharge cycles. The consumer electronics sector, while smaller at 8% of market share, is showing accelerated adoption rates as manufacturers seek batteries capable of supporting fast-charging technologies.

Geographically, Asia-Pacific dominates the high-power NMC battery market with 58% share, led by China, South Korea, and Japan, where major battery manufacturers and automotive OEMs have established significant production capacities. North America and Europe follow with 22% and 17% market shares respectively, with both regions experiencing rapid growth driven by electric vehicle adoption and renewable energy integration policies.

Market research indicates that power retention characteristics represent a critical purchasing factor for 78% of commercial battery buyers across sectors. The ability to maintain consistent power delivery throughout the battery lifecycle directly impacts operational efficiency and total cost of ownership calculations. Industry surveys reveal customers are willing to pay a 15-30% premium for NMC batteries demonstrating superior power retention metrics compared to standard formulations.

Competition in this market segment is intensifying, with established battery manufacturers facing challenges from new entrants leveraging innovative material science approaches. The market currently features over 25 significant players, with the top five controlling approximately 62% of global production capacity. Strategic partnerships between material suppliers, battery manufacturers, and end-users are becoming increasingly common as the industry seeks to accelerate commercialization of advanced NMC formulations.

Regulatory factors are also shaping market dynamics, with several jurisdictions implementing performance standards that specifically address power retention requirements. These regulations are expected to further drive demand for optimized NMC active materials capable of maintaining consistent power delivery characteristics throughout extended operational lifespans.

The automotive sector represents the largest application market for high-power NMC batteries, accounting for nearly 65% of total demand. This dominance stems from the superior power density characteristics of NMC chemistry, which enables faster charging capabilities and higher discharge rates crucial for performance-oriented EVs. Premium and performance-oriented electric vehicle manufacturers have shown particular interest in advanced NMC formulations optimized for power retention.

Industrial applications constitute the second-largest market segment at 22%, where high-power NMC batteries are increasingly deployed in material handling equipment, power tools, and industrial automation systems requiring rapid charge-discharge cycles. The consumer electronics sector, while smaller at 8% of market share, is showing accelerated adoption rates as manufacturers seek batteries capable of supporting fast-charging technologies.

Geographically, Asia-Pacific dominates the high-power NMC battery market with 58% share, led by China, South Korea, and Japan, where major battery manufacturers and automotive OEMs have established significant production capacities. North America and Europe follow with 22% and 17% market shares respectively, with both regions experiencing rapid growth driven by electric vehicle adoption and renewable energy integration policies.

Market research indicates that power retention characteristics represent a critical purchasing factor for 78% of commercial battery buyers across sectors. The ability to maintain consistent power delivery throughout the battery lifecycle directly impacts operational efficiency and total cost of ownership calculations. Industry surveys reveal customers are willing to pay a 15-30% premium for NMC batteries demonstrating superior power retention metrics compared to standard formulations.

Competition in this market segment is intensifying, with established battery manufacturers facing challenges from new entrants leveraging innovative material science approaches. The market currently features over 25 significant players, with the top five controlling approximately 62% of global production capacity. Strategic partnerships between material suppliers, battery manufacturers, and end-users are becoming increasingly common as the industry seeks to accelerate commercialization of advanced NMC formulations.

Regulatory factors are also shaping market dynamics, with several jurisdictions implementing performance standards that specifically address power retention requirements. These regulations are expected to further drive demand for optimized NMC active materials capable of maintaining consistent power delivery characteristics throughout extended operational lifespans.

Current Challenges in NMC Active Materials

Despite significant advancements in NMC (Nickel Manganese Cobalt) battery technology, several critical challenges persist in optimizing active materials for enhanced power retention. The primary issue lies in the structural instability of high-nickel NMC materials during cycling. As manufacturers push toward higher nickel content (NMC811, NMC90) to increase energy density, these materials exhibit accelerated capacity fading and reduced cycle life due to increased lattice distortion and oxygen release at high states of charge.

Surface reactivity presents another significant challenge, as NMC particles readily react with electrolytes, forming resistive surface films that impede lithium-ion transport. This surface degradation is particularly pronounced at elevated temperatures and high voltage operations, leading to impedance growth and power fade over time. The reactive nature of nickel-rich surfaces catalyzes electrolyte decomposition, creating a negative feedback loop of degradation.

Particle morphology optimization remains problematic, with current synthesis methods struggling to produce ideal microstructures that balance surface area, porosity, and mechanical integrity. Conventional NMC particles often crack during cycling due to anisotropic volume changes, creating new reactive surfaces and disconnected active material. The trade-off between particle size (affecting power capability) and stability (affecting cycle life) continues to challenge material scientists.

Transition metal dissolution, particularly of manganese and nickel, occurs during cycling and storage, especially at elevated temperatures. These dissolved metal ions can migrate to the anode, contaminating the SEI layer and causing irreversible capacity loss. This phenomenon is exacerbated in high-voltage applications where the cathode-electrolyte interface becomes increasingly unstable.

Lithium/nickel cation mixing represents another fundamental challenge, where nickel ions (particularly Ni²⁺) occupy lithium sites in the crystal structure, blocking lithium diffusion pathways. This disorder increases with cycling and higher nickel content, directly impacting rate capability and power retention. Current synthesis and doping strategies have only partially mitigated this issue.

The manufacturing consistency of NMC materials at industrial scale presents additional challenges. Variations in precursor quality, synthesis conditions, and post-processing treatments lead to inconsistent electrochemical performance across production batches. The sensitivity of high-nickel NMC materials to moisture and air exposure during processing further complicates quality control efforts.

Finally, the industry faces significant challenges in reducing cobalt content while maintaining performance, as cobalt plays a crucial role in structural stabilization. Alternative dopants and gradient compositions show promise but often compromise power capability or introduce new degradation mechanisms that ultimately affect long-term power retention.

Surface reactivity presents another significant challenge, as NMC particles readily react with electrolytes, forming resistive surface films that impede lithium-ion transport. This surface degradation is particularly pronounced at elevated temperatures and high voltage operations, leading to impedance growth and power fade over time. The reactive nature of nickel-rich surfaces catalyzes electrolyte decomposition, creating a negative feedback loop of degradation.

Particle morphology optimization remains problematic, with current synthesis methods struggling to produce ideal microstructures that balance surface area, porosity, and mechanical integrity. Conventional NMC particles often crack during cycling due to anisotropic volume changes, creating new reactive surfaces and disconnected active material. The trade-off between particle size (affecting power capability) and stability (affecting cycle life) continues to challenge material scientists.

Transition metal dissolution, particularly of manganese and nickel, occurs during cycling and storage, especially at elevated temperatures. These dissolved metal ions can migrate to the anode, contaminating the SEI layer and causing irreversible capacity loss. This phenomenon is exacerbated in high-voltage applications where the cathode-electrolyte interface becomes increasingly unstable.

Lithium/nickel cation mixing represents another fundamental challenge, where nickel ions (particularly Ni²⁺) occupy lithium sites in the crystal structure, blocking lithium diffusion pathways. This disorder increases with cycling and higher nickel content, directly impacting rate capability and power retention. Current synthesis and doping strategies have only partially mitigated this issue.

The manufacturing consistency of NMC materials at industrial scale presents additional challenges. Variations in precursor quality, synthesis conditions, and post-processing treatments lead to inconsistent electrochemical performance across production batches. The sensitivity of high-nickel NMC materials to moisture and air exposure during processing further complicates quality control efforts.

Finally, the industry faces significant challenges in reducing cobalt content while maintaining performance, as cobalt plays a crucial role in structural stabilization. Alternative dopants and gradient compositions show promise but often compromise power capability or introduce new degradation mechanisms that ultimately affect long-term power retention.

Current Approaches to Power Retention Optimization

01 Cathode material composition for improved power retention

NMC (Nickel Manganese Cobalt) battery cathode materials can be optimized through specific compositional formulations to enhance power retention. These formulations typically involve precise ratios of nickel, manganese, and cobalt, along with dopants or substitutional elements that stabilize the crystal structure during cycling. By controlling the elemental composition, researchers can minimize structural degradation and maintain electronic conductivity, resulting in batteries that retain their power capacity over extended cycling.- Cathode material composition for improved power retention: NMC (Nickel Manganese Cobalt) battery cathode materials can be optimized through specific compositional modifications to enhance power retention. These modifications include adjusting the ratios of nickel, manganese, and cobalt, as well as incorporating dopants such as aluminum, magnesium, or zirconium. The optimized composition helps maintain structural stability during charge-discharge cycles, reducing capacity fade and improving long-term power retention performance.

- Surface coating and modification techniques: Surface treatments and coatings on NMC active materials can significantly improve power retention by creating protective layers that prevent direct contact between the cathode material and the electrolyte. These modifications include applying metal oxide coatings (such as Al2O3, ZrO2, or TiO2), carbon-based coatings, or surface fluorination. These protective layers reduce unwanted side reactions, minimize dissolution of transition metals, and maintain the structural integrity of the cathode material during cycling.

- Particle morphology and size control: The morphology, size distribution, and microstructure of NMC particles play crucial roles in battery power retention. Controlling these parameters through advanced synthesis methods can create particles with optimized electron and ion transport pathways. Techniques such as co-precipitation, sol-gel processing, and spray pyrolysis can produce particles with specific shapes (spherical, plate-like, or hierarchical structures) and sizes that minimize diffusion distances and enhance structural stability during cycling.

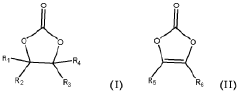

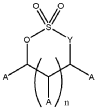

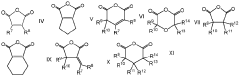

- Electrolyte additives and interface engineering: The interface between NMC active materials and the electrolyte can be engineered to improve power retention through specialized additives and interface modifications. Functional electrolyte additives form stable solid-electrolyte interphase (SEI) layers that prevent continuous electrolyte decomposition and cathode degradation. These additives can include fluorinated compounds, boron-based materials, or phosphorus-containing substances that promote the formation of protective films on the cathode surface.

- Advanced doping strategies: Strategic doping of NMC materials with various elements can enhance structural stability and improve power retention. Doping elements such as aluminum, magnesium, zirconium, titanium, or lanthanides can be incorporated into the crystal structure to stabilize the layered structure during cycling, suppress phase transitions, and reduce oxygen release at high states of charge. These dopants can occupy specific lattice sites or grain boundaries to mitigate structural degradation mechanisms.

02 Surface coating and modification techniques

Surface treatments and coatings on NMC active materials significantly improve power retention by creating protective barriers against electrolyte reactions. These modifications include applying thin layers of metal oxides, fluorides, or phosphates to the particle surfaces, which prevent unwanted side reactions while maintaining good ionic conductivity. Surface-modified NMC materials show reduced capacity fading and improved cycling stability, particularly at high voltages and elevated temperatures where degradation typically accelerates.Expand Specific Solutions03 Particle morphology and size control

The physical characteristics of NMC particles, including their size, shape, and microstructure, play crucial roles in power retention. Controlling particle morphology through advanced synthesis methods can create materials with optimized ion diffusion pathways and reduced internal strain during cycling. Hierarchical structures, core-shell architectures, and nano-sized particles with specific crystallographic orientations have demonstrated superior power retention by facilitating lithium-ion transport and accommodating volume changes during charge-discharge cycles.Expand Specific Solutions04 Electrolyte compatibility and interface engineering

The interaction between NMC active materials and the electrolyte significantly impacts power retention. Engineering stable solid-electrolyte interfaces (SEI) through electrolyte additives or surface treatments can prevent continuous electrolyte decomposition and cathode dissolution. Specialized electrolyte formulations that form protective films on the NMC surface while maintaining good ionic conductivity help preserve the electrochemical performance of the battery over extended cycling, resulting in improved power retention.Expand Specific Solutions05 Structural stabilization through doping

Introducing dopant elements into the NMC crystal structure enhances structural stability during repeated charge-discharge cycles. Common dopants include aluminum, magnesium, zirconium, and various lanthanides, which occupy specific lattice sites and strengthen the oxygen framework. These dopants can suppress phase transitions, reduce oxygen release, and mitigate cation mixing, all of which are degradation mechanisms that reduce power retention. Optimized doping strategies result in NMC materials that maintain their capacity and rate capability over extended cycling.Expand Specific Solutions

Leading NMC Battery Material Manufacturers

The NMC battery active materials market for power retention optimization is in a growth phase, with increasing demand driven by electric vehicle adoption and energy storage applications. The market size is expanding rapidly, projected to reach significant scale by 2030. Technologically, the field is in mid-maturity, with established players like CATL, LG Energy Solution, and Samsung SDI leading commercial deployment while continuing R&D efforts. Toyota, BYD, and Northvolt are advancing proprietary NMC formulations to enhance power retention characteristics. Research institutions like Trinity College Dublin and Argonne National Laboratory collaborate with industry leaders to overcome technical challenges in cycle stability and high-temperature performance. Companies like Murata, Umicore, and POSCO Future M are focusing on material innovations to extend battery lifespan while maintaining power density.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a multi-gradient NMC cathode structure with optimized lithium-nickel-manganese-cobalt ratios to enhance power retention. Their approach involves precise control of primary particle size distribution and secondary particle morphology to minimize structural degradation during cycling. The company employs single-crystal NMC materials with reduced grain boundaries to limit electrolyte penetration and mitigate surface-related degradation mechanisms. CATL's technology incorporates nano-scale surface coatings (primarily Al2O3 and ZrO2) that act as protective barriers against HF attack while maintaining efficient lithium-ion transport. Their manufacturing process includes carefully controlled synthesis parameters and post-treatment protocols to ensure optimal crystallinity and reduced cation mixing, which significantly improves the structural stability during high-rate charging and discharging cycles.

Strengths: Superior cycle life with >90% capacity retention after 1000 cycles at 1C rate; excellent rate capability maintaining 80% capacity at 5C discharge; reduced capacity fading at elevated temperatures. Weaknesses: Higher manufacturing costs due to complex synthesis requirements; potential supply chain constraints for certain coating materials; slightly lower initial energy density compared to non-optimized NMC materials.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has pioneered a comprehensive approach to NMC battery optimization focusing on power retention through their "Power+Tech" platform. Their technology employs concentration-gradient cathodes where nickel content gradually decreases from core to surface while manganese increases, creating a more stable outer layer while maintaining high energy density. The company utilizes proprietary dopants (including aluminum, zirconium, and tungsten) at specific lattice sites to stabilize the crystal structure during repeated lithiation/delithiation. Their manufacturing process incorporates precise control of synthesis atmosphere and temperature profiles to minimize oxygen release during high-voltage operation. LG Energy Solution has also developed specialized electrolyte additives that form stable cathode-electrolyte interphases, significantly reducing transition metal dissolution which is a primary cause of power fade in NMC batteries.

Strengths: Excellent voltage stability during cycling with minimal impedance increase; superior thermal stability reducing risk of thermal runaway; compatible with existing manufacturing infrastructure allowing cost-effective scaling. Weaknesses: Complex quality control requirements for gradient materials; performance advantages diminish at extremely low temperatures; requires precise electrolyte formulation that may limit compatibility with some cell designs.

Key Patents in NMC Active Material Engineering

Positive electrode active material for lithium secondary battery, method for producing same, and lithium secondary battery

PatentWO2020149244A1

Innovation

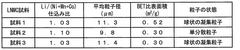

- A positive electrode active material comprising a mixture of high nickel lithium nickel manganese cobalt composite oxide particles and inorganic fluoride particles, specifically MgF2 and/or AlF3, is used, with a manufacturing method involving dry or wet mixing followed by heat treatment to enhance performance.

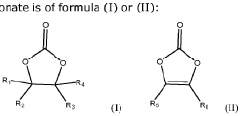

A Ni BASED LITHIUM-ION SECONDARY BATTERY COMPRISING A FLUORINATED ELECTROLYTE

PatentWO2019211357A1

Innovation

- A specific electrolyte composition comprising cyclic carbonates, fluorinated acyclic carboxylic acid esters, electrolyte salts, lithium compounds, cyclic sulfur compounds, and cyclic carboxylic acid anhydrides, optimized for use with lithium transition metal-based oxide powders, enhances the performance of high Ni-excess NMC cathode materials by improving reversible capacity, cycle stability, and thermal stability.

Environmental Impact of NMC Battery Production

The production of NMC (Nickel Manganese Cobalt) batteries carries significant environmental implications across their entire lifecycle. Raw material extraction represents the first major environmental challenge, with mining operations for nickel, manganese, and especially cobalt causing habitat destruction, soil degradation, and water pollution. Cobalt mining in the Democratic Republic of Congo has been particularly scrutinized for both environmental damage and human rights concerns, including child labor and unsafe working conditions.

Manufacturing processes for NMC cathode materials require substantial energy inputs, contributing to greenhouse gas emissions when powered by fossil fuels. The production phase involves energy-intensive processes such as calcination at temperatures exceeding 800°C, which demands considerable thermal energy. Chemical processing also generates hazardous waste streams containing heavy metals and toxic solvents that require specialized treatment and disposal protocols.

Water usage presents another critical environmental concern, with estimates suggesting that producing one ton of lithium-ion batteries requires between 170,000-510,000 liters of water, primarily in the extraction and processing of raw materials. This places significant pressure on water resources, particularly in arid regions where mining operations are often located.

Recent life cycle assessments indicate that NMC battery production generates approximately 73-200 kg CO2-equivalent per kWh of battery capacity, with variations depending on specific manufacturing processes and energy sources. The carbon footprint is heavily influenced by the electricity mix used during production, with facilities powered by renewable energy showing significantly lower emissions profiles.

Efforts to mitigate these environmental impacts are gaining momentum across the industry. Closed-loop manufacturing systems are being implemented to recover and recycle process water, reducing freshwater consumption by up to 60%. Advanced hydrometallurgical recycling technologies now enable recovery rates exceeding 95% for nickel and cobalt from spent batteries, significantly reducing the need for virgin material extraction.

Manufacturers are increasingly adopting dry electrode coating processes that eliminate NMP (N-Methyl-2-pyrrolidone) solvent usage, addressing a major source of toxic emissions. Additionally, direct recycling methods that preserve the crystal structure of cathode materials are showing promise for reducing the energy requirements of battery material recovery by approximately 70% compared to conventional pyrometallurgical approaches.

These environmental considerations are becoming increasingly important as optimization efforts for power retention in NMC batteries must balance performance improvements against sustainability metrics to ensure truly viable long-term solutions for energy storage applications.

Manufacturing processes for NMC cathode materials require substantial energy inputs, contributing to greenhouse gas emissions when powered by fossil fuels. The production phase involves energy-intensive processes such as calcination at temperatures exceeding 800°C, which demands considerable thermal energy. Chemical processing also generates hazardous waste streams containing heavy metals and toxic solvents that require specialized treatment and disposal protocols.

Water usage presents another critical environmental concern, with estimates suggesting that producing one ton of lithium-ion batteries requires between 170,000-510,000 liters of water, primarily in the extraction and processing of raw materials. This places significant pressure on water resources, particularly in arid regions where mining operations are often located.

Recent life cycle assessments indicate that NMC battery production generates approximately 73-200 kg CO2-equivalent per kWh of battery capacity, with variations depending on specific manufacturing processes and energy sources. The carbon footprint is heavily influenced by the electricity mix used during production, with facilities powered by renewable energy showing significantly lower emissions profiles.

Efforts to mitigate these environmental impacts are gaining momentum across the industry. Closed-loop manufacturing systems are being implemented to recover and recycle process water, reducing freshwater consumption by up to 60%. Advanced hydrometallurgical recycling technologies now enable recovery rates exceeding 95% for nickel and cobalt from spent batteries, significantly reducing the need for virgin material extraction.

Manufacturers are increasingly adopting dry electrode coating processes that eliminate NMP (N-Methyl-2-pyrrolidone) solvent usage, addressing a major source of toxic emissions. Additionally, direct recycling methods that preserve the crystal structure of cathode materials are showing promise for reducing the energy requirements of battery material recovery by approximately 70% compared to conventional pyrometallurgical approaches.

These environmental considerations are becoming increasingly important as optimization efforts for power retention in NMC batteries must balance performance improvements against sustainability metrics to ensure truly viable long-term solutions for energy storage applications.

Supply Chain Considerations for Critical Materials

The supply chain for NMC (Nickel-Manganese-Cobalt) battery active materials presents significant challenges that directly impact power retention optimization efforts. Critical materials including nickel, manganese, cobalt, and lithium face varying degrees of supply constraints, with cobalt being particularly problematic due to its limited geographical availability and ethical concerns surrounding mining practices in the Democratic Republic of Congo, which supplies approximately 70% of global cobalt.

Price volatility of these raw materials significantly affects manufacturing economics and research investment decisions. Historical data shows that cobalt prices have fluctuated by over 400% in the past decade, while nickel has seen variations exceeding 200%. These fluctuations create uncertainty in long-term planning for battery material optimization programs and can redirect research toward more abundant substitute materials.

Geopolitical factors further complicate the supply landscape. China controls significant portions of the processing capacity for these materials, creating potential bottlenecks and strategic vulnerabilities. Recent trade tensions and national security concerns have accelerated efforts to develop alternative supply chains in North America, Europe, and Australia, though these initiatives remain in early development stages.

Processing requirements for high-purity battery-grade materials introduce additional complexity. The refinement of nickel and cobalt to battery-grade specifications requires sophisticated processes that are energy-intensive and environmentally challenging. Innovations in hydrometallurgical and direct recycling processes show promise for reducing these impacts but remain commercially limited.

Recycling infrastructure represents both a challenge and opportunity for NMC battery materials. Current recycling rates for lithium-ion batteries remain below 5% globally, though the theoretical recovery rates for nickel and cobalt can exceed 90% with advanced processes. Developing closed-loop systems for these materials could significantly improve supply security and reduce environmental impacts while potentially enhancing power retention through more consistent material quality.

Emerging alternative chemistries, such as lithium iron phosphate (LFP) and sodium-ion technologies, are gaining traction partly in response to these supply chain challenges. However, these alternatives typically offer lower energy density, highlighting the continued importance of optimizing NMC materials despite supply challenges. Strategic partnerships between battery manufacturers, mining companies, and material processors are becoming increasingly common to secure stable material supplies for advanced NMC formulations.

Price volatility of these raw materials significantly affects manufacturing economics and research investment decisions. Historical data shows that cobalt prices have fluctuated by over 400% in the past decade, while nickel has seen variations exceeding 200%. These fluctuations create uncertainty in long-term planning for battery material optimization programs and can redirect research toward more abundant substitute materials.

Geopolitical factors further complicate the supply landscape. China controls significant portions of the processing capacity for these materials, creating potential bottlenecks and strategic vulnerabilities. Recent trade tensions and national security concerns have accelerated efforts to develop alternative supply chains in North America, Europe, and Australia, though these initiatives remain in early development stages.

Processing requirements for high-purity battery-grade materials introduce additional complexity. The refinement of nickel and cobalt to battery-grade specifications requires sophisticated processes that are energy-intensive and environmentally challenging. Innovations in hydrometallurgical and direct recycling processes show promise for reducing these impacts but remain commercially limited.

Recycling infrastructure represents both a challenge and opportunity for NMC battery materials. Current recycling rates for lithium-ion batteries remain below 5% globally, though the theoretical recovery rates for nickel and cobalt can exceed 90% with advanced processes. Developing closed-loop systems for these materials could significantly improve supply security and reduce environmental impacts while potentially enhancing power retention through more consistent material quality.

Emerging alternative chemistries, such as lithium iron phosphate (LFP) and sodium-ion technologies, are gaining traction partly in response to these supply chain challenges. However, these alternatives typically offer lower energy density, highlighting the continued importance of optimizing NMC materials despite supply challenges. Strategic partnerships between battery manufacturers, mining companies, and material processors are becoming increasingly common to secure stable material supplies for advanced NMC formulations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!