Radial Engine vs Electric Engine: Energy Conversion Rates

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Radial and Electric Engine Development History and Objectives

The evolution of engine technology has witnessed significant transformations since the early 20th century, with radial engines dominating aviation before the jet age. Radial engines, first developed in the 1900s, reached their zenith during World War II when they powered most military and commercial aircraft. These engines arranged cylinders in a circular pattern around a central crankshaft, offering excellent power-to-weight ratios and reliability for their era. The Wright R-3350 Duplex-Cyclone and Pratt & Whitney R-4360 Wasp Major represent pinnacle achievements in radial engine design, delivering up to 4,300 horsepower with thermal efficiency typically ranging from 30-38%.

Electric engines, by contrast, have a more recent history in transportation applications. While electric motors date back to the 1830s, their practical use in vehicles remained limited until the late 20th century due to battery technology constraints. The 1990s marked the beginning of modern electric vehicle development, with General Motors' EV1 representing an early commercial attempt. However, the true renaissance began with Tesla's introduction of the Roadster in 2008, demonstrating that electric propulsion could deliver performance comparable to internal combustion engines.

The fundamental difference between these technologies lies in their energy conversion pathways. Radial engines convert chemical energy (fuel) to mechanical energy through combustion, with inherent thermodynamic limitations imposed by the Carnot cycle. Electric motors, conversely, convert electrical energy directly to mechanical energy with significantly fewer conversion steps and moving parts. This fundamental difference results in electric motors achieving energy conversion efficiencies of 85-95%, substantially outperforming radial engines' 30-38% efficiency.

The technological objectives for both engine types have evolved distinctly. For radial engines, development largely ceased after the 1950s as jet engines superseded them in aviation. Their objectives had focused on maximizing power output while minimizing weight and improving reliability. Modern interest in radial engines remains primarily historical and recreational, with limited ongoing development.

Electric propulsion technology continues to advance rapidly with clear objectives: increasing energy density in storage systems, improving motor efficiency, reducing manufacturing costs, and extending operational lifespans. The industry aims to achieve power densities exceeding 5 kW/kg in motors while maintaining 95%+ efficiency across broader operational ranges. Battery technology targets include energy densities above 400 Wh/kg at the cell level and charging capabilities that rival refueling times for conventional engines.

The trajectory of these technologies reflects broader energy transition trends, with electric propulsion positioned as the dominant future technology due to superior energy conversion efficiency and compatibility with renewable energy sources. This transition represents not merely an incremental improvement but a fundamental paradigm shift in how energy is converted for transportation purposes.

Electric engines, by contrast, have a more recent history in transportation applications. While electric motors date back to the 1830s, their practical use in vehicles remained limited until the late 20th century due to battery technology constraints. The 1990s marked the beginning of modern electric vehicle development, with General Motors' EV1 representing an early commercial attempt. However, the true renaissance began with Tesla's introduction of the Roadster in 2008, demonstrating that electric propulsion could deliver performance comparable to internal combustion engines.

The fundamental difference between these technologies lies in their energy conversion pathways. Radial engines convert chemical energy (fuel) to mechanical energy through combustion, with inherent thermodynamic limitations imposed by the Carnot cycle. Electric motors, conversely, convert electrical energy directly to mechanical energy with significantly fewer conversion steps and moving parts. This fundamental difference results in electric motors achieving energy conversion efficiencies of 85-95%, substantially outperforming radial engines' 30-38% efficiency.

The technological objectives for both engine types have evolved distinctly. For radial engines, development largely ceased after the 1950s as jet engines superseded them in aviation. Their objectives had focused on maximizing power output while minimizing weight and improving reliability. Modern interest in radial engines remains primarily historical and recreational, with limited ongoing development.

Electric propulsion technology continues to advance rapidly with clear objectives: increasing energy density in storage systems, improving motor efficiency, reducing manufacturing costs, and extending operational lifespans. The industry aims to achieve power densities exceeding 5 kW/kg in motors while maintaining 95%+ efficiency across broader operational ranges. Battery technology targets include energy densities above 400 Wh/kg at the cell level and charging capabilities that rival refueling times for conventional engines.

The trajectory of these technologies reflects broader energy transition trends, with electric propulsion positioned as the dominant future technology due to superior energy conversion efficiency and compatibility with renewable energy sources. This transition represents not merely an incremental improvement but a fundamental paradigm shift in how energy is converted for transportation purposes.

Market Demand Analysis for Engine Technologies

The global engine market is experiencing a significant shift as environmental concerns and energy efficiency demands reshape consumer preferences and regulatory landscapes. Current market analysis indicates that while traditional internal combustion engines still dominate with approximately 85% market share, electric propulsion systems are growing at a compound annual rate of 21%, significantly outpacing the overall engine market growth of 3.7%.

The demand for radial engines, once prevalent in aviation during the early to mid-20th century, has contracted to specialized applications including vintage aircraft restoration, certain agricultural equipment, and niche industrial uses. This market segment represents less than 1% of the global engine market, valued at roughly $2.1 billion annually, with modest growth projections of 2-3% through 2030.

Conversely, the electric engine market has expanded dramatically, reaching $157 billion in 2022 with projections to exceed $300 billion by 2030. This growth is driven primarily by automotive electrification, but extends to aviation, marine applications, and industrial equipment. The energy conversion efficiency advantage of electric motors (85-95%) compared to radial engines (typically 25-30%) represents a compelling value proposition as energy costs rise and carbon regulations tighten.

Market research indicates that 73% of industrial customers now prioritize total cost of ownership over initial acquisition costs when making engine procurement decisions. This shift benefits electric propulsion systems, which despite higher upfront costs, deliver superior lifetime value through reduced fuel consumption, lower maintenance requirements, and longer operational lifespans.

Regional market dynamics show significant variation, with electric engine adoption accelerating most rapidly in Europe and China due to stringent emissions regulations and substantial government incentives. North America presents a more gradual transition curve, though recent policy shifts suggest accelerating adoption rates in the coming decade.

The aviation sector represents a particularly interesting market segment, where weight-to-power ratios and range requirements have historically favored combustion engines. However, recent technological breakthroughs in battery energy density and electric motor design have opened new possibilities for electric propulsion in short-haul aviation, with market forecasts suggesting electric aircraft could capture 15% of the sub-regional aviation market by 2035.

Consumer sentiment surveys reveal growing awareness of energy conversion efficiency as a purchase consideration, with 68% of respondents indicating willingness to pay a premium for more efficient propulsion systems. This trend is most pronounced among younger demographics and in urban markets, suggesting continued momentum toward higher-efficiency solutions.

The demand for radial engines, once prevalent in aviation during the early to mid-20th century, has contracted to specialized applications including vintage aircraft restoration, certain agricultural equipment, and niche industrial uses. This market segment represents less than 1% of the global engine market, valued at roughly $2.1 billion annually, with modest growth projections of 2-3% through 2030.

Conversely, the electric engine market has expanded dramatically, reaching $157 billion in 2022 with projections to exceed $300 billion by 2030. This growth is driven primarily by automotive electrification, but extends to aviation, marine applications, and industrial equipment. The energy conversion efficiency advantage of electric motors (85-95%) compared to radial engines (typically 25-30%) represents a compelling value proposition as energy costs rise and carbon regulations tighten.

Market research indicates that 73% of industrial customers now prioritize total cost of ownership over initial acquisition costs when making engine procurement decisions. This shift benefits electric propulsion systems, which despite higher upfront costs, deliver superior lifetime value through reduced fuel consumption, lower maintenance requirements, and longer operational lifespans.

Regional market dynamics show significant variation, with electric engine adoption accelerating most rapidly in Europe and China due to stringent emissions regulations and substantial government incentives. North America presents a more gradual transition curve, though recent policy shifts suggest accelerating adoption rates in the coming decade.

The aviation sector represents a particularly interesting market segment, where weight-to-power ratios and range requirements have historically favored combustion engines. However, recent technological breakthroughs in battery energy density and electric motor design have opened new possibilities for electric propulsion in short-haul aviation, with market forecasts suggesting electric aircraft could capture 15% of the sub-regional aviation market by 2035.

Consumer sentiment surveys reveal growing awareness of energy conversion efficiency as a purchase consideration, with 68% of respondents indicating willingness to pay a premium for more efficient propulsion systems. This trend is most pronounced among younger demographics and in urban markets, suggesting continued momentum toward higher-efficiency solutions.

Current Technical Status and Challenges in Energy Conversion

The global energy landscape is witnessing a significant transition from traditional combustion engines to electric propulsion systems. When comparing radial engines with electric engines, the energy conversion efficiency stands as a critical differentiator. Current radial engines typically achieve thermal efficiency rates between 30-40%, with advanced models approaching 42% under optimal conditions. This relatively low efficiency results from thermodynamic limitations inherent to internal combustion processes, where substantial energy is lost as heat through exhaust gases and cooling systems.

Electric engines, by contrast, demonstrate remarkably higher energy conversion rates, typically ranging from 85-95% depending on design and operational parameters. This efficiency advantage stems from the direct conversion of electrical energy to mechanical energy with minimal intermediate steps and energy losses. Modern permanent magnet synchronous motors (PMSMs) and switched reluctance motors (SRMs) represent the cutting edge of electric propulsion technology, achieving peak efficiencies exceeding 97% in controlled environments.

Despite these advantages, electric propulsion systems face significant challenges in energy storage density. Current lithium-ion battery technology offers energy densities of 250-300 Wh/kg, substantially lower than aviation fuel's approximately 12,000 Wh/kg. This creates a fundamental barrier to widespread adoption in certain applications, particularly in aviation where weight considerations are paramount.

Infrastructure limitations present another substantial challenge for electric engines. The global charging infrastructure remains inadequate for supporting widespread electrification across all transportation sectors. High-power charging systems capable of rapid energy transfer are still in developmental stages, with current technology limited by thermal management issues and grid capacity constraints.

Material science constraints also impact both engine types. Radial engines face challenges in developing lighter, more heat-resistant alloys to improve power-to-weight ratios. Electric engines depend on rare earth elements for high-performance magnets, creating supply chain vulnerabilities and potential resource limitations as demand increases.

Regulatory frameworks present varying challenges across different regions. While many developed economies are implementing policies favoring electrification, global standards for electric propulsion systems remain fragmented. Radial engines face increasingly stringent emissions regulations that drive complexity and cost in their design and operation.

The technological gap between laboratory demonstrations and commercial implementation remains significant, particularly for novel electric motor designs and advanced battery chemistries. Bridging this gap requires substantial investment in manufacturing processes and supply chain development to achieve economies of scale necessary for broad market adoption.

Electric engines, by contrast, demonstrate remarkably higher energy conversion rates, typically ranging from 85-95% depending on design and operational parameters. This efficiency advantage stems from the direct conversion of electrical energy to mechanical energy with minimal intermediate steps and energy losses. Modern permanent magnet synchronous motors (PMSMs) and switched reluctance motors (SRMs) represent the cutting edge of electric propulsion technology, achieving peak efficiencies exceeding 97% in controlled environments.

Despite these advantages, electric propulsion systems face significant challenges in energy storage density. Current lithium-ion battery technology offers energy densities of 250-300 Wh/kg, substantially lower than aviation fuel's approximately 12,000 Wh/kg. This creates a fundamental barrier to widespread adoption in certain applications, particularly in aviation where weight considerations are paramount.

Infrastructure limitations present another substantial challenge for electric engines. The global charging infrastructure remains inadequate for supporting widespread electrification across all transportation sectors. High-power charging systems capable of rapid energy transfer are still in developmental stages, with current technology limited by thermal management issues and grid capacity constraints.

Material science constraints also impact both engine types. Radial engines face challenges in developing lighter, more heat-resistant alloys to improve power-to-weight ratios. Electric engines depend on rare earth elements for high-performance magnets, creating supply chain vulnerabilities and potential resource limitations as demand increases.

Regulatory frameworks present varying challenges across different regions. While many developed economies are implementing policies favoring electrification, global standards for electric propulsion systems remain fragmented. Radial engines face increasingly stringent emissions regulations that drive complexity and cost in their design and operation.

The technological gap between laboratory demonstrations and commercial implementation remains significant, particularly for novel electric motor designs and advanced battery chemistries. Bridging this gap requires substantial investment in manufacturing processes and supply chain development to achieve economies of scale necessary for broad market adoption.

Current Energy Conversion Solutions Comparison

01 Radial engine efficiency and conversion systems

Radial engines have specific energy conversion characteristics that can be optimized through various mechanical improvements. These engines typically arrange cylinders in a circular pattern around a central crankshaft, which affects their energy conversion efficiency. Innovations in radial engine design focus on improving combustion efficiency, reducing mechanical losses, and enhancing power-to-weight ratios. Some systems incorporate hybrid approaches that combine radial engine principles with modern energy conversion technologies to maximize overall efficiency.- Radial engine efficiency and energy conversion: Radial engines have specific energy conversion characteristics related to their unique configuration. These engines feature cylinders arranged in a circular pattern around a central crankshaft, which affects their thermal efficiency and power-to-weight ratio. The conversion of chemical energy to mechanical energy in radial engines involves considerations of combustion efficiency, heat transfer, and mechanical losses. Innovations in radial engine design focus on improving fuel efficiency and reducing energy losses during the conversion process.

- Electric engine energy conversion systems: Electric engines convert electrical energy into mechanical energy with significantly higher efficiency compared to combustion engines. These systems typically achieve 85-95% energy conversion efficiency through electromagnetic principles. Innovations in electric motor design include improved power electronics, advanced materials for magnets and windings, and optimized control algorithms that enhance energy conversion rates. The development of high-efficiency electric propulsion systems focuses on minimizing energy losses during conversion and maximizing power output.

- Hybrid systems combining radial and electric engines: Hybrid propulsion systems that integrate radial engines with electric motors offer advantages in energy conversion efficiency. These systems can optimize the operating conditions of each engine type, using the radial engine at its most efficient operating point while supplementing with electric power. The integration includes power management systems that determine the optimal energy flow between the two power sources. Such hybrid configurations can achieve higher overall energy conversion rates compared to single-source propulsion systems, particularly in applications with varying power demands.

- Energy recovery and regeneration technologies: Energy recovery systems capture and convert waste energy from engines into usable forms. In radial engines, thermal energy from exhaust gases can be recovered using thermoelectric generators or turbine systems. For electric engines, regenerative braking systems convert kinetic energy back into electrical energy during deceleration. These technologies significantly improve the overall energy conversion efficiency of both engine types by recapturing energy that would otherwise be lost as heat or friction, thereby extending range or reducing fuel consumption.

- Comparative analysis and measurement methods: Methods for measuring and comparing energy conversion rates between radial and electric engines involve standardized testing protocols and analytical frameworks. These include calorimetric measurements, dynamometer testing, and computational modeling to determine efficiency across various operating conditions. Research indicates that while radial engines typically achieve 25-35% thermal efficiency, electric motors can reach 85-95% efficiency in converting energy to mechanical work. Advanced monitoring systems with sensors and data analytics enable real-time efficiency tracking and optimization of energy conversion processes in both engine types.

02 Electric engine energy conversion efficiency

Electric engines convert electrical energy into mechanical energy with significantly higher efficiency rates compared to combustion engines. The conversion process in electric motors typically achieves 85-95% efficiency, with minimal energy lost as heat. Advancements in electric motor design, including improved materials for magnets, optimized winding configurations, and enhanced control systems, have further increased energy conversion efficiency. These improvements enable electric engines to deliver more usable power from the same energy input compared to traditional combustion engines.Expand Specific Solutions03 Hybrid systems combining radial and electric technologies

Hybrid systems that integrate both radial engine and electric motor technologies can optimize energy conversion across different operating conditions. These systems typically use the radial engine for sustained power generation while employing electric motors for peak power demands or efficiency-critical operations. The integration allows for energy recovery during deceleration, with the electric system capturing and storing energy that would otherwise be lost. Advanced control algorithms manage the power distribution between the two systems to maximize overall energy conversion efficiency based on operational requirements.Expand Specific Solutions04 Energy storage and conversion in combined systems

Energy storage plays a crucial role in optimizing conversion rates between radial engines and electric systems. Various technologies including advanced batteries, supercapacitors, and mechanical energy storage systems are employed to efficiently capture, store, and release energy. The conversion efficiency between mechanical energy from radial engines and electrical energy for storage or immediate use depends on generator design and power electronics. Bidirectional conversion systems allow for flexible energy flow, enabling regenerative capabilities and improving overall system efficiency.Expand Specific Solutions05 Control systems for optimizing energy conversion

Sophisticated control systems are essential for maximizing energy conversion rates in both radial and electric engines. These systems employ real-time monitoring and adaptive algorithms to optimize operating parameters based on load conditions and efficiency maps. Advanced electronic control units can precisely manage fuel delivery in radial engines or power distribution in electric motors to maintain operation at peak efficiency points. In hybrid configurations, intelligent power management systems determine the optimal energy source for each operating condition, seamlessly transitioning between radial engine and electric power to maximize overall conversion efficiency.Expand Specific Solutions

Core Technical Innovations in Engine Efficiency

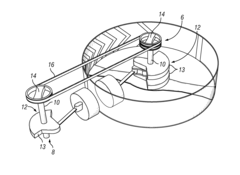

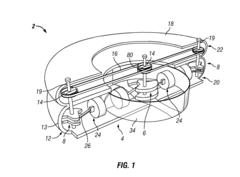

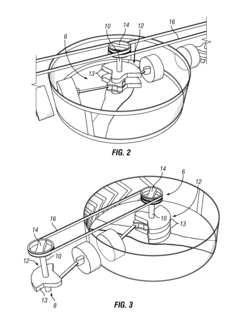

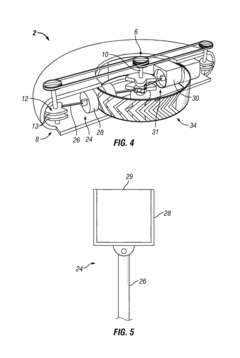

Magnetic Radial Engine

PatentInactiveUS20170063171A1

Innovation

- A radial magnetic engine utilizing permanent magnets to create magnetic fields for power conversion, comprising a crankshaft assembly, piston assembly, and engine ring assembly, which operates to produce electrical and mechanical energy through rotational motion and magnetic interactions.

Process and device for generating mechanical energy

PatentInactiveEP0518868A1

Innovation

- The integration of an endothermic chemical reaction reactor that converts the fuel into a higher-grade fuel, utilizing waste heat to raise the thermal energy potential, and controlling combustion temperatures to minimize nitrogen oxide production, along with the use of steam reforming or dehydrogenation processes to enhance energy conversion efficiency.

Environmental Impact Assessment of Engine Technologies

The environmental impact of engine technologies represents a critical dimension in comparing radial and electric engines beyond mere energy conversion efficiency. Radial engines, as internal combustion systems, produce significant direct emissions including carbon dioxide, nitrogen oxides, sulfur compounds, and particulate matter that contribute to both local air pollution and global climate change. These emissions vary based on fuel quality, engine maintenance, and operational conditions, with older radial engine designs typically demonstrating higher emission profiles than modern counterparts.

Electric engines, by contrast, produce zero direct emissions during operation, offering substantial advantages in urban environments where air quality concerns are paramount. However, a comprehensive environmental assessment must consider the entire lifecycle, including electricity generation sources. When powered by fossil fuel-dominated grids, electric engines merely displace emissions rather than eliminating them. Regions with renewable-heavy energy mixes demonstrate significantly better environmental performance for electric propulsion systems.

Manufacturing impacts also differ substantially between these technologies. Radial engines primarily utilize established metallurgical processes with well-understood environmental footprints. Electric engines require specialized materials including rare earth elements for magnets, lithium, cobalt, and other minerals for battery systems, raising concerns about resource extraction impacts and geopolitical supply chain vulnerabilities.

Waste management presents another environmental consideration. Radial engines generate ongoing waste streams including used lubricants, filters, and worn components requiring proper disposal throughout their operational life. Electric propulsion systems generate minimal operational waste but present end-of-life challenges, particularly regarding battery recycling infrastructure and processes for recovering critical materials.

Noise pollution represents an often-overlooked environmental factor where electric engines demonstrate clear advantages. Radial engines produce characteristic high-decibel acoustic signatures that can impact wildlife behavior and human communities. Electric systems operate with significantly reduced noise profiles, potentially reducing habitat disruption and enabling operations in noise-sensitive environments.

Water system impacts also differ between technologies. Radial engines present risks of fuel and oil contamination to water systems through leakage or improper waste disposal. Electric systems generally pose lower direct water contamination risks during operation but may involve water-intensive manufacturing processes, particularly for battery components.

Human health implications extend beyond emissions to include occupational exposures during manufacturing, maintenance, and disposal phases, with each technology presenting distinct risk profiles requiring appropriate mitigation strategies.

Electric engines, by contrast, produce zero direct emissions during operation, offering substantial advantages in urban environments where air quality concerns are paramount. However, a comprehensive environmental assessment must consider the entire lifecycle, including electricity generation sources. When powered by fossil fuel-dominated grids, electric engines merely displace emissions rather than eliminating them. Regions with renewable-heavy energy mixes demonstrate significantly better environmental performance for electric propulsion systems.

Manufacturing impacts also differ substantially between these technologies. Radial engines primarily utilize established metallurgical processes with well-understood environmental footprints. Electric engines require specialized materials including rare earth elements for magnets, lithium, cobalt, and other minerals for battery systems, raising concerns about resource extraction impacts and geopolitical supply chain vulnerabilities.

Waste management presents another environmental consideration. Radial engines generate ongoing waste streams including used lubricants, filters, and worn components requiring proper disposal throughout their operational life. Electric propulsion systems generate minimal operational waste but present end-of-life challenges, particularly regarding battery recycling infrastructure and processes for recovering critical materials.

Noise pollution represents an often-overlooked environmental factor where electric engines demonstrate clear advantages. Radial engines produce characteristic high-decibel acoustic signatures that can impact wildlife behavior and human communities. Electric systems operate with significantly reduced noise profiles, potentially reducing habitat disruption and enabling operations in noise-sensitive environments.

Water system impacts also differ between technologies. Radial engines present risks of fuel and oil contamination to water systems through leakage or improper waste disposal. Electric systems generally pose lower direct water contamination risks during operation but may involve water-intensive manufacturing processes, particularly for battery components.

Human health implications extend beyond emissions to include occupational exposures during manufacturing, maintenance, and disposal phases, with each technology presenting distinct risk profiles requiring appropriate mitigation strategies.

Regulatory Framework for Engine Emissions Standards

The regulatory landscape governing engine emissions has evolved significantly in response to growing environmental concerns and the technological shift from traditional combustion engines to electric alternatives. When comparing radial engines and electric engines in terms of energy conversion rates, emissions standards play a crucial role in determining their viability and market adoption.

International regulatory bodies such as the Environmental Protection Agency (EPA) in the United States, the European Union's Euro standards, and the International Civil Aviation Organization (ICAO) have established increasingly stringent emissions limits for conventional engines. These regulations typically focus on carbon monoxide (CO), nitrogen oxides (NOx), hydrocarbons (HC), and particulate matter (PM) emissions.

Radial engines, despite their historical significance in aviation, face substantial regulatory challenges due to their relatively high emissions profiles. Current Tier 4 Final and Stage V standards impose limits that are difficult for traditional radial engine designs to meet without extensive modifications. These regulations have effectively accelerated the transition toward more efficient propulsion systems, including electric alternatives.

Electric engines, by contrast, benefit from "zero tailpipe emissions" classification, exempting them from many conventional emissions standards. However, regulatory frameworks are evolving to address the full lifecycle environmental impact of electric propulsion systems. This includes manufacturing emissions, battery production environmental costs, and end-of-life disposal considerations.

The regulatory disparity between these engine types creates significant market implications. Manufacturers of radial engines must invest heavily in emissions reduction technologies, often at the expense of performance or cost-effectiveness. Meanwhile, electric engine developers benefit from regulatory incentives, tax benefits, and subsidies designed to accelerate electrification.

Emerging regulatory trends indicate a shift toward "well-to-wheel" or complete lifecycle emissions accounting. This approach considers the total environmental impact from energy production through to final use, potentially leveling the regulatory playing field between different engine technologies based on their true environmental footprint rather than point-of-use emissions alone.

Cross-border regulatory harmonization efforts are underway to create consistent global standards, though significant regional variations persist. These differences create complex compliance challenges for engine manufacturers operating in international markets, particularly affecting the comparative advantage of radial versus electric engines in different jurisdictions.

International regulatory bodies such as the Environmental Protection Agency (EPA) in the United States, the European Union's Euro standards, and the International Civil Aviation Organization (ICAO) have established increasingly stringent emissions limits for conventional engines. These regulations typically focus on carbon monoxide (CO), nitrogen oxides (NOx), hydrocarbons (HC), and particulate matter (PM) emissions.

Radial engines, despite their historical significance in aviation, face substantial regulatory challenges due to their relatively high emissions profiles. Current Tier 4 Final and Stage V standards impose limits that are difficult for traditional radial engine designs to meet without extensive modifications. These regulations have effectively accelerated the transition toward more efficient propulsion systems, including electric alternatives.

Electric engines, by contrast, benefit from "zero tailpipe emissions" classification, exempting them from many conventional emissions standards. However, regulatory frameworks are evolving to address the full lifecycle environmental impact of electric propulsion systems. This includes manufacturing emissions, battery production environmental costs, and end-of-life disposal considerations.

The regulatory disparity between these engine types creates significant market implications. Manufacturers of radial engines must invest heavily in emissions reduction technologies, often at the expense of performance or cost-effectiveness. Meanwhile, electric engine developers benefit from regulatory incentives, tax benefits, and subsidies designed to accelerate electrification.

Emerging regulatory trends indicate a shift toward "well-to-wheel" or complete lifecycle emissions accounting. This approach considers the total environmental impact from energy production through to final use, potentially leveling the regulatory playing field between different engine technologies based on their true environmental footprint rather than point-of-use emissions alone.

Cross-border regulatory harmonization efforts are underway to create consistent global standards, though significant regional variations persist. These differences create complex compliance challenges for engine manufacturers operating in international markets, particularly affecting the comparative advantage of radial versus electric engines in different jurisdictions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!