Anti Fouling Coatings Balancing Durability and Eco Safety

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Antifouling Coating Evolution and Objectives

Antifouling coatings have evolved significantly since their inception in the early 18th century when copper sheathing was first applied to wooden ship hulls. The modern era of antifouling technology began in the mid-20th century with the development of tributyltin (TBT) self-polishing copolymer paints, which revolutionized the industry due to their exceptional effectiveness against marine biofouling. However, the environmental devastation caused by TBT, including shell deformations in oysters and imposex in gastropods, led to its global ban by the International Maritime Organization in 2008.

This regulatory shift catalyzed a new wave of innovation in antifouling technologies, focusing on balancing performance with environmental sustainability. The industry has since moved through several technological generations, from copper-based alternatives to silicone foul-release coatings, and more recently toward biomimetic approaches and natural product-based solutions.

Current technological trajectories show a clear trend toward multi-functional coating systems that combine physical and chemical deterrents while minimizing environmental impact. Research is increasingly focused on developing coatings that maintain effectiveness throughout a vessel's operational lifecycle (typically 3-5 years) without releasing harmful biocides into marine ecosystems.

The primary technical objective in this field is to develop antifouling coatings that achieve the seemingly contradictory goals of long-term durability and ecological safety. This requires innovations in polymer science, surface engineering, and controlled-release technologies. Specifically, researchers aim to create coatings that can withstand harsh marine conditions while maintaining their functional properties, yet degrade into non-toxic components at end-of-life.

Secondary objectives include reducing the carbon footprint of coating production and application processes, decreasing vessel maintenance requirements, and improving fuel efficiency through reduced hull friction. These goals align with broader maritime industry sustainability initiatives and increasingly stringent international regulations on marine pollution.

The evolution of this technology is now entering a critical phase where advanced materials science, including nanotechnology and smart polymers, is being leveraged to create self-healing, responsive coating systems. These next-generation solutions aim to adapt to changing environmental conditions and biofouling pressures without relying on traditional biocidal mechanisms.

Success in this field will require interdisciplinary collaboration between marine biologists, polymer chemists, materials scientists, and environmental toxicologists to develop comprehensive solutions that address the complex challenges of marine biofouling while meeting increasingly stringent ecological standards and performance requirements.

This regulatory shift catalyzed a new wave of innovation in antifouling technologies, focusing on balancing performance with environmental sustainability. The industry has since moved through several technological generations, from copper-based alternatives to silicone foul-release coatings, and more recently toward biomimetic approaches and natural product-based solutions.

Current technological trajectories show a clear trend toward multi-functional coating systems that combine physical and chemical deterrents while minimizing environmental impact. Research is increasingly focused on developing coatings that maintain effectiveness throughout a vessel's operational lifecycle (typically 3-5 years) without releasing harmful biocides into marine ecosystems.

The primary technical objective in this field is to develop antifouling coatings that achieve the seemingly contradictory goals of long-term durability and ecological safety. This requires innovations in polymer science, surface engineering, and controlled-release technologies. Specifically, researchers aim to create coatings that can withstand harsh marine conditions while maintaining their functional properties, yet degrade into non-toxic components at end-of-life.

Secondary objectives include reducing the carbon footprint of coating production and application processes, decreasing vessel maintenance requirements, and improving fuel efficiency through reduced hull friction. These goals align with broader maritime industry sustainability initiatives and increasingly stringent international regulations on marine pollution.

The evolution of this technology is now entering a critical phase where advanced materials science, including nanotechnology and smart polymers, is being leveraged to create self-healing, responsive coating systems. These next-generation solutions aim to adapt to changing environmental conditions and biofouling pressures without relying on traditional biocidal mechanisms.

Success in this field will require interdisciplinary collaboration between marine biologists, polymer chemists, materials scientists, and environmental toxicologists to develop comprehensive solutions that address the complex challenges of marine biofouling while meeting increasingly stringent ecological standards and performance requirements.

Market Analysis for Sustainable Marine Coatings

The global market for sustainable marine coatings is experiencing significant growth, driven by increasing environmental regulations and a growing awareness of ecological impacts. The anti-fouling coatings segment, valued at approximately 6.5 billion USD in 2022, is projected to reach 10.2 billion USD by 2028, with a compound annual growth rate of 7.8%. This growth trajectory reflects the maritime industry's urgent need for solutions that balance performance with environmental responsibility.

Demand for eco-friendly anti-fouling technologies is particularly strong in regions with strict environmental regulations, such as the European Union, North America, and increasingly in Asia-Pacific markets. The EU's Biocidal Products Regulation and the International Maritime Organization's guidelines have created substantial market pressure for alternatives to traditional copper and TBT-based coatings, which have been linked to marine ecosystem damage.

Commercial shipping represents the largest market segment, accounting for approximately 45% of the total anti-fouling coatings market. This sector's demand is primarily driven by fuel efficiency concerns, as biofouling can increase fuel consumption by up to 40%. The leisure marine segment follows at 30%, with offshore structures and naval vessels comprising the remaining market share.

Customer preferences are evolving toward solutions that offer extended service life while meeting environmental standards. Market research indicates that shipping companies are willing to pay a premium of 15-20% for coatings that can demonstrate both superior durability and minimal environmental impact, as the total cost of ownership is reduced through less frequent dry-docking and maintenance.

Regional market analysis reveals that Asia-Pacific dominates with 38% market share, followed by Europe (27%) and North America (22%). China and South Korea, as major shipbuilding nations, represent particularly high-growth markets for advanced anti-fouling technologies. The Middle East and Latin America are emerging markets showing increased adoption rates as environmental regulations tighten globally.

The sustainable marine coatings market is characterized by a growing preference for silicone-based foul-release coatings and biocide-free alternatives. These products currently command approximately 25% of the market but are expected to reach 40% by 2030 as performance improves and costs decrease. Hybrid solutions that combine different technologies to achieve both durability and eco-safety are gaining traction, particularly in premium market segments.

Market challenges include the higher initial cost of sustainable alternatives compared to traditional biocide-based products and the technical complexity of developing solutions that perform effectively across diverse marine environments and vessel operational profiles. Despite these challenges, the regulatory landscape continues to drive innovation and market expansion for environmentally responsible anti-fouling technologies.

Demand for eco-friendly anti-fouling technologies is particularly strong in regions with strict environmental regulations, such as the European Union, North America, and increasingly in Asia-Pacific markets. The EU's Biocidal Products Regulation and the International Maritime Organization's guidelines have created substantial market pressure for alternatives to traditional copper and TBT-based coatings, which have been linked to marine ecosystem damage.

Commercial shipping represents the largest market segment, accounting for approximately 45% of the total anti-fouling coatings market. This sector's demand is primarily driven by fuel efficiency concerns, as biofouling can increase fuel consumption by up to 40%. The leisure marine segment follows at 30%, with offshore structures and naval vessels comprising the remaining market share.

Customer preferences are evolving toward solutions that offer extended service life while meeting environmental standards. Market research indicates that shipping companies are willing to pay a premium of 15-20% for coatings that can demonstrate both superior durability and minimal environmental impact, as the total cost of ownership is reduced through less frequent dry-docking and maintenance.

Regional market analysis reveals that Asia-Pacific dominates with 38% market share, followed by Europe (27%) and North America (22%). China and South Korea, as major shipbuilding nations, represent particularly high-growth markets for advanced anti-fouling technologies. The Middle East and Latin America are emerging markets showing increased adoption rates as environmental regulations tighten globally.

The sustainable marine coatings market is characterized by a growing preference for silicone-based foul-release coatings and biocide-free alternatives. These products currently command approximately 25% of the market but are expected to reach 40% by 2030 as performance improves and costs decrease. Hybrid solutions that combine different technologies to achieve both durability and eco-safety are gaining traction, particularly in premium market segments.

Market challenges include the higher initial cost of sustainable alternatives compared to traditional biocide-based products and the technical complexity of developing solutions that perform effectively across diverse marine environments and vessel operational profiles. Despite these challenges, the regulatory landscape continues to drive innovation and market expansion for environmentally responsible anti-fouling technologies.

Current Challenges in Eco-friendly Antifouling Technologies

The current landscape of antifouling technologies faces significant challenges in balancing performance with environmental sustainability. Traditional antifouling coatings, particularly those containing tributyltin (TBT), have demonstrated exceptional durability and effectiveness but have been globally restricted due to their devastating ecological impacts, including endocrine disruption in marine organisms and bioaccumulation in food chains.

The primary technical challenge lies in developing alternatives that match the 5+ year service life of TBT-based systems while eliminating ecotoxicity. Copper-based coatings, the most common replacement, still pose environmental concerns due to copper accumulation in sediments and non-target species sensitivity, despite their reduced toxicity compared to TBT.

Biocide-free technologies represent a promising direction but face significant performance limitations. Silicone-based foul-release coatings, which prevent organism attachment through low surface energy, demonstrate inadequate durability in static conditions and are vulnerable to mechanical damage. Additionally, their effectiveness diminishes significantly at vessel speeds below 15 knots, limiting their application range.

Natural product-based solutions derived from marine organisms show promising antifouling properties but struggle with scalability, extraction efficiency, and stability issues. The complex molecular structures of these compounds make industrial-scale synthesis economically challenging, while their environmental persistence profiles remain inadequately characterized.

Engineered surface topographies mimicking natural antifouling surfaces (like shark skin) face manufacturing consistency challenges across large surface areas and demonstrate rapid performance degradation as biofilms develop in the microstructures. The precision required for these surfaces significantly increases production costs compared to conventional coating applications.

Regulatory frameworks present another significant hurdle, with inconsistent global standards creating market fragmentation. The EU's Biocidal Products Regulation, for instance, has more stringent requirements than regulations in Asia-Pacific regions, forcing manufacturers to develop region-specific formulations and complicating global deployment strategies.

The economic challenge of balancing increased research and development costs with market competitiveness cannot be overlooked. Eco-friendly alternatives typically command a 30-40% price premium over conventional solutions, limiting their market penetration, particularly in cost-sensitive shipping segments.

The technical community also faces a knowledge gap in standardized testing methodologies that accurately predict long-term performance in diverse marine environments. Laboratory tests often fail to replicate the complex interactions between coatings and the dynamic marine environment, leading to performance discrepancies between controlled testing and real-world applications.

The primary technical challenge lies in developing alternatives that match the 5+ year service life of TBT-based systems while eliminating ecotoxicity. Copper-based coatings, the most common replacement, still pose environmental concerns due to copper accumulation in sediments and non-target species sensitivity, despite their reduced toxicity compared to TBT.

Biocide-free technologies represent a promising direction but face significant performance limitations. Silicone-based foul-release coatings, which prevent organism attachment through low surface energy, demonstrate inadequate durability in static conditions and are vulnerable to mechanical damage. Additionally, their effectiveness diminishes significantly at vessel speeds below 15 knots, limiting their application range.

Natural product-based solutions derived from marine organisms show promising antifouling properties but struggle with scalability, extraction efficiency, and stability issues. The complex molecular structures of these compounds make industrial-scale synthesis economically challenging, while their environmental persistence profiles remain inadequately characterized.

Engineered surface topographies mimicking natural antifouling surfaces (like shark skin) face manufacturing consistency challenges across large surface areas and demonstrate rapid performance degradation as biofilms develop in the microstructures. The precision required for these surfaces significantly increases production costs compared to conventional coating applications.

Regulatory frameworks present another significant hurdle, with inconsistent global standards creating market fragmentation. The EU's Biocidal Products Regulation, for instance, has more stringent requirements than regulations in Asia-Pacific regions, forcing manufacturers to develop region-specific formulations and complicating global deployment strategies.

The economic challenge of balancing increased research and development costs with market competitiveness cannot be overlooked. Eco-friendly alternatives typically command a 30-40% price premium over conventional solutions, limiting their market penetration, particularly in cost-sensitive shipping segments.

The technical community also faces a knowledge gap in standardized testing methodologies that accurately predict long-term performance in diverse marine environments. Laboratory tests often fail to replicate the complex interactions between coatings and the dynamic marine environment, leading to performance discrepancies between controlled testing and real-world applications.

Contemporary Antifouling Formulation Approaches

01 Environmentally friendly anti-fouling coatings

Development of eco-friendly anti-fouling coatings that minimize environmental impact while maintaining effectiveness. These coatings utilize biodegradable materials and non-toxic compounds that prevent marine organism attachment without releasing harmful substances into water bodies. The formulations often incorporate natural biocides or physical deterrent mechanisms rather than traditional toxic compounds, ensuring compliance with increasingly stringent environmental regulations.- Environmentally friendly anti-fouling coatings: These coatings are designed to prevent marine growth while minimizing environmental impact. They utilize biodegradable materials and non-toxic compounds that effectively inhibit biofouling without releasing harmful substances into aquatic ecosystems. These eco-friendly alternatives replace traditional copper and tin-based coatings that have been shown to harm marine life. The formulations often incorporate natural biocides or surface modification techniques that discourage organism attachment.

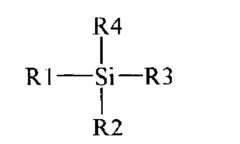

- Silicone-based anti-fouling technologies: Silicone-based coatings provide effective anti-fouling properties through their low surface energy characteristics. These formulations create a slippery surface that prevents marine organisms from firmly attaching to the substrate. The silicone polymers can be modified with additives to enhance durability and performance in various marine environments. These coatings typically offer longer service life compared to conventional biocide-based systems and maintain their effectiveness even after extended water exposure.

- Nanoparticle-enhanced anti-fouling coatings: Incorporating nanoparticles into anti-fouling formulations significantly improves coating performance and longevity. These nanomaterials can include zinc oxide, silver, or carbon-based particles that provide antimicrobial properties while enhancing the mechanical strength of the coating. The nanostructured surfaces disrupt the attachment mechanisms of fouling organisms and can be engineered to release anti-fouling agents in a controlled manner. This technology allows for reduced biocide content while maintaining or improving effectiveness.

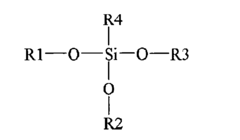

- Self-polishing copolymer anti-fouling systems: Self-polishing copolymer systems gradually wear away through controlled hydrolysis, continuously exposing fresh biocide and maintaining anti-fouling effectiveness. These coatings are engineered to erode at a predictable rate in marine environments, providing consistent protection throughout their service life. The polymer matrix can be modified to optimize release rates and extend durability under various operating conditions. Advanced formulations incorporate environmentally acceptable active ingredients that degrade into harmless compounds after release.

- Hybrid organic-inorganic anti-fouling coatings: Hybrid coatings combine organic polymers with inorganic components to create durable anti-fouling systems with enhanced mechanical properties. These formulations typically feature cross-linked networks that resist abrasion and weathering while maintaining anti-fouling functionality. The inorganic components often include silica, ceramic materials, or metal oxides that improve hardness and adhesion to substrates. These hybrid systems can be designed to work through multiple anti-fouling mechanisms simultaneously, providing robust protection even in challenging marine environments.

02 Silicone-based anti-fouling technologies

Silicone-based coatings that provide durable anti-fouling properties through their low surface energy characteristics. These coatings create a slippery surface that prevents organisms from firmly attaching to treated surfaces. The silicone formulations often incorporate additional components to enhance durability and performance in various marine environments, offering long-term protection without the environmental concerns associated with traditional biocide-releasing coatings.Expand Specific Solutions03 Copper-free anti-fouling solutions

Anti-fouling coating technologies that eliminate or significantly reduce copper content while maintaining effective fouling prevention. These innovative formulations address environmental concerns related to copper accumulation in marine ecosystems while providing durable protection against biofouling. Alternative active ingredients and mechanisms are employed to achieve comparable or superior performance to traditional copper-based systems, meeting both durability requirements and ecological safety standards.Expand Specific Solutions04 Nanotechnology in anti-fouling applications

Integration of nanomaterials and nanotechnology in anti-fouling coating systems to enhance performance and durability. These advanced coatings utilize nanoparticles or nanostructured surfaces to create physical barriers against fouling organisms or to enable controlled release of active ingredients. The nanoscale features provide improved adhesion, mechanical strength, and longevity while allowing for reduced concentrations of active ingredients, thereby improving the ecological profile of the coatings.Expand Specific Solutions05 Self-polishing copolymer technologies

Self-polishing copolymer systems that gradually wear away in controlled manner, continuously exposing fresh anti-fouling surfaces. These coatings maintain effectiveness throughout their service life by controlled erosion mechanisms that prevent biofilm formation while extending the functional lifetime of the coating. Advanced polymer chemistry enables precise control of erosion rates and release profiles, balancing long-term performance with environmental considerations for various marine applications.Expand Specific Solutions

Industry Leaders in Marine Coating Innovation

The anti-fouling coatings market is currently in a growth phase, balancing the increasing demand for durable marine protection with environmental sustainability concerns. The global market size is estimated to exceed $10 billion, driven by expanding maritime trade and stricter environmental regulations. Leading players like AkzoNobel, Jotun, Hempel, and Chugoku Marine Paints dominate with advanced R&D capabilities, while Japanese companies including Nippon Paint and Nitto Kasei focus on eco-friendly innovations. Chinese entities such as Marine Chemical Research Institute and Sunrui Ship Coating are rapidly gaining market share. Technology maturity varies significantly, with traditional copper-based solutions being replaced by more sustainable silicone and biocide-free alternatives developed by research institutions like Naval Research Laboratory and universities collaborating with industry partners.

Akzo Nobel Coatings International BV

Technical Solution: Akzo Nobel has developed Intersleek, a biocide-free fouling control coating based on fluoropolymer technology. This innovative solution creates an ultra-smooth, low friction surface that prevents organisms from adhering to the hull. Their technology utilizes advanced polymer chemistry to create a surface with extremely low surface energy, making it difficult for marine organisms to establish strong bonds. The company has also introduced self-polishing copolymer (SPC) technology that gradually wears away, continuously exposing fresh biocide and maintaining effectiveness throughout the coating's lifespan. Recent advancements include the integration of hydrophilic and hydrophobic components that work synergistically to prevent both hard and soft fouling organisms. Their research has demonstrated fuel savings of up to 9% compared to traditional biocidal antifouling coatings, with corresponding reductions in CO2 emissions.

Strengths: Superior fouling prevention without relying on biocides, reducing environmental impact while maintaining performance. The technology offers significant fuel savings and emissions reductions. Weaknesses: Higher initial application costs compared to conventional coatings, and performance may be affected in certain water conditions or when vessels remain stationary for extended periods.

Chugoku Marine Paints, Ltd.

Technical Solution: Chugoku Marine Paints has pioneered the SEAFLO NEO series, which utilizes a hybrid technology combining silyl polymer and hydrolysis technology. This approach creates a self-polishing effect that controls the release rate of active ingredients while maintaining a smooth surface throughout the coating's lifetime. Their proprietary "Selektope" technology incorporates a non-metal organic biocide that specifically targets barnacle larvae at extremely low concentrations (0.1% w/w), significantly reducing overall biocide content while maintaining effectiveness. The company has also developed nano-engineered surface structures that physically deter organism attachment without chemical action. Their latest innovation includes a dual-action mechanism where the coating surface undergoes controlled hydrolysis in seawater, creating a constantly renewing interface that prevents fouling organism adhesion while minimizing environmental impact. Field tests have shown their coatings maintain effectiveness for up to 90 months in various marine environments, substantially extending dry-docking intervals.

Strengths: Exceptional longevity and performance in diverse marine conditions with reduced environmental impact through targeted biocide use and controlled release mechanisms. Weaknesses: The complex formulation requires precise application conditions and may have compatibility issues with certain substrate materials or previous coating systems.

Key Patents in Environmentally Safe Antifouling Technology

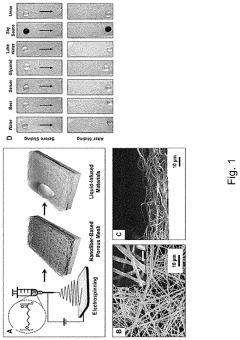

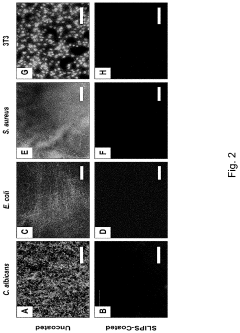

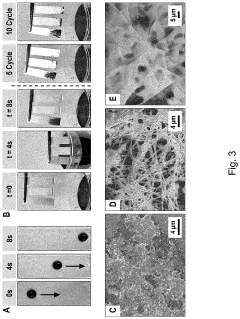

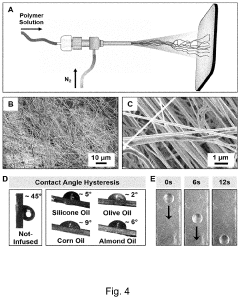

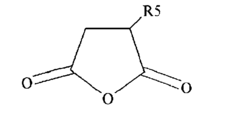

Slippery and Anti-Fouling Liquid-Infused Coatings Fabricated from Biodegradable and Biocompatible Components

PatentPendingUS20230303861A1

Innovation

- Development of biocompatible and degradable SLIPS and slippery nanoemulsion-infused porous surfaces (SNIPS) using degradable polymers and lubricating liquids or emulsions, such as vegetable oils, infused into nanofiber-based porous matrices, which allow for controlled release of molecules and improved anti-fouling properties.

Marine antifouling paint composition

PatentInactiveEP1788042A2

Innovation

- A coating composition comprising 25-60% alcohol and paraffin, 2-10% epoxy resin, and 5-70% organosilicon compounds, synthesized through the sol-gel process, forming a porous nanocomposite that inhibits fouling through hydrolysis and condensation reactions, creating a covalently bonded, durable, and low-density surface with additives like nanozinc oxide and peroxide for enhanced adhesion and bactericidal properties.

Regulatory Framework for Marine Coating Applications

The regulatory landscape for marine anti-fouling coatings has evolved significantly over the past decades, primarily driven by increasing environmental concerns and scientific evidence of ecological damage. The International Maritime Organization (IMO) established a pivotal framework through the International Convention on the Control of Harmful Anti-fouling Systems on Ships (AFS Convention), which came into force in 2008. This convention explicitly prohibits the use of organotin compounds, particularly tributyltin (TBT), which were once widely used but proven to cause severe endocrine disruption in marine organisms.

Regional regulatory frameworks have further shaped the industry, with the European Union's Biocidal Products Regulation (BPR) imposing stringent requirements for active substance approval and product authorization. The BPR mandates comprehensive environmental risk assessments and efficacy data before anti-fouling products can enter the market. Similarly, the United States Environmental Protection Agency regulates anti-fouling coatings under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), requiring registration of biocidal compounds and compliance with specific environmental standards.

The regulatory trend clearly indicates a progressive tightening of restrictions on biocidal components. Copper-based formulations, while currently permitted, face increasing scrutiny due to accumulation concerns in harbor sediments. Several jurisdictions, including Washington State and California, have already implemented copper leaching rate limitations, signaling potential future restrictions at national and international levels.

Compliance certification processes have become increasingly complex, requiring manufacturers to conduct extensive ecotoxicological testing, leaching rate studies, and environmental fate modeling. These requirements create significant market entry barriers but also drive innovation toward more sustainable solutions. The regulatory framework now explicitly encourages the development of non-biocidal alternatives through expedited approval pathways and research incentives in many jurisdictions.

Global harmonization efforts are underway through initiatives like the Global Harmonized System (GHS) for classification and labeling of chemicals, though significant regional variations in implementation persist. This regulatory fragmentation presents challenges for coating manufacturers operating in global markets, necessitating tailored formulation strategies for different regions.

Future regulatory developments are likely to focus on microplastic emissions from coating degradation, nanomaterial incorporation safety, and comprehensive life-cycle assessment requirements. Industry stakeholders must maintain proactive regulatory intelligence capabilities to navigate this evolving landscape while balancing performance requirements with increasingly stringent environmental compliance standards.

Regional regulatory frameworks have further shaped the industry, with the European Union's Biocidal Products Regulation (BPR) imposing stringent requirements for active substance approval and product authorization. The BPR mandates comprehensive environmental risk assessments and efficacy data before anti-fouling products can enter the market. Similarly, the United States Environmental Protection Agency regulates anti-fouling coatings under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), requiring registration of biocidal compounds and compliance with specific environmental standards.

The regulatory trend clearly indicates a progressive tightening of restrictions on biocidal components. Copper-based formulations, while currently permitted, face increasing scrutiny due to accumulation concerns in harbor sediments. Several jurisdictions, including Washington State and California, have already implemented copper leaching rate limitations, signaling potential future restrictions at national and international levels.

Compliance certification processes have become increasingly complex, requiring manufacturers to conduct extensive ecotoxicological testing, leaching rate studies, and environmental fate modeling. These requirements create significant market entry barriers but also drive innovation toward more sustainable solutions. The regulatory framework now explicitly encourages the development of non-biocidal alternatives through expedited approval pathways and research incentives in many jurisdictions.

Global harmonization efforts are underway through initiatives like the Global Harmonized System (GHS) for classification and labeling of chemicals, though significant regional variations in implementation persist. This regulatory fragmentation presents challenges for coating manufacturers operating in global markets, necessitating tailored formulation strategies for different regions.

Future regulatory developments are likely to focus on microplastic emissions from coating degradation, nanomaterial incorporation safety, and comprehensive life-cycle assessment requirements. Industry stakeholders must maintain proactive regulatory intelligence capabilities to navigate this evolving landscape while balancing performance requirements with increasingly stringent environmental compliance standards.

Life Cycle Assessment of Antifouling Systems

Life Cycle Assessment (LCA) of antifouling systems provides a comprehensive framework for evaluating the environmental impacts of these coatings throughout their entire existence - from raw material extraction to disposal. When balancing durability and ecological safety, LCA becomes an essential tool for quantifying trade-offs between long-lasting performance and environmental consequences.

Traditional copper-based and biocide-containing antifouling systems typically demonstrate superior durability, often lasting 3-5 years before requiring reapplication. However, LCA studies reveal significant environmental burdens during their use phase, including marine ecotoxicity, bioaccumulation in food chains, and negative impacts on non-target organisms. The manufacturing phase also contributes substantially to their environmental footprint through energy-intensive production processes and toxic chemical handling.

In contrast, newer eco-friendly alternatives such as silicone-based foul-release coatings and biomimetic surfaces show reduced environmental impacts during use but may require more frequent reapplication or maintenance. Their LCA profiles indicate lower ecotoxicity but potentially higher carbon footprints due to manufacturing complexity and shorter service lives.

Recent comparative LCA studies have highlighted the importance of regional factors in determining overall environmental performance. For instance, in areas with sensitive marine ecosystems, the ecological benefits of non-toxic coatings outweigh their durability limitations. Conversely, in commercial shipping applications where frequent dry-docking creates substantial economic and environmental costs, the extended service life of more durable coatings may represent a better overall environmental choice when considering the full life cycle.

The disposal phase presents another critical consideration in LCA evaluations. End-of-life management of antifouling coatings often involves hazardous waste handling for traditional biocide-containing products, while some newer formulations offer improved recyclability or biodegradability. This factor becomes increasingly important as regulatory frameworks worldwide strengthen their focus on circular economy principles.

Methodological challenges in conducting comprehensive LCAs for antifouling systems include quantifying long-term marine ecosystem impacts, accounting for varying performance under different operating conditions, and addressing data gaps in emerging technologies. Despite these limitations, LCA provides valuable insights for manufacturers, regulators, and end-users seeking to optimize the balance between coating durability and environmental safety.

Traditional copper-based and biocide-containing antifouling systems typically demonstrate superior durability, often lasting 3-5 years before requiring reapplication. However, LCA studies reveal significant environmental burdens during their use phase, including marine ecotoxicity, bioaccumulation in food chains, and negative impacts on non-target organisms. The manufacturing phase also contributes substantially to their environmental footprint through energy-intensive production processes and toxic chemical handling.

In contrast, newer eco-friendly alternatives such as silicone-based foul-release coatings and biomimetic surfaces show reduced environmental impacts during use but may require more frequent reapplication or maintenance. Their LCA profiles indicate lower ecotoxicity but potentially higher carbon footprints due to manufacturing complexity and shorter service lives.

Recent comparative LCA studies have highlighted the importance of regional factors in determining overall environmental performance. For instance, in areas with sensitive marine ecosystems, the ecological benefits of non-toxic coatings outweigh their durability limitations. Conversely, in commercial shipping applications where frequent dry-docking creates substantial economic and environmental costs, the extended service life of more durable coatings may represent a better overall environmental choice when considering the full life cycle.

The disposal phase presents another critical consideration in LCA evaluations. End-of-life management of antifouling coatings often involves hazardous waste handling for traditional biocide-containing products, while some newer formulations offer improved recyclability or biodegradability. This factor becomes increasingly important as regulatory frameworks worldwide strengthen their focus on circular economy principles.

Methodological challenges in conducting comprehensive LCAs for antifouling systems include quantifying long-term marine ecosystem impacts, accounting for varying performance under different operating conditions, and addressing data gaps in emerging technologies. Despite these limitations, LCA provides valuable insights for manufacturers, regulators, and end-users seeking to optimize the balance between coating durability and environmental safety.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!