Anti Fouling Coatings for Heat Exchanger Applications

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heat Exchanger Fouling Background and Objectives

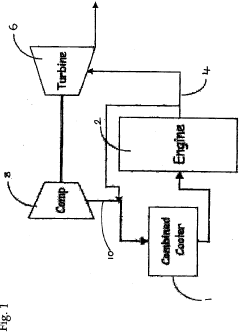

Heat exchanger fouling represents a significant challenge across numerous industrial applications, including power generation, chemical processing, food production, and HVAC systems. This phenomenon occurs when unwanted materials accumulate on heat transfer surfaces, forming deposits that impede thermal efficiency and increase operational costs. Historically, fouling has been addressed through mechanical cleaning, chemical treatments, and periodic maintenance, but these approaches often require system downtime and can be costly over equipment lifespans.

The evolution of heat exchanger technology has seen remarkable advancements in design and materials, yet fouling remains a persistent obstacle to optimal performance. Industry data suggests that fouling-related issues account for approximately 2-3% of global carbon emissions due to decreased energy efficiency, highlighting the environmental impact beyond mere operational concerns. Recent technological trends indicate a shift toward preventative solutions rather than reactive maintenance, with anti-fouling coatings emerging as a promising frontier.

Current objectives in anti-fouling coating research focus on developing surfaces that can maintain clean heat transfer interfaces for extended periods without intervention. These objectives include creating coatings with enhanced durability under extreme temperature and pressure conditions, minimizing adhesion of particulates and biological matter, and ensuring compatibility with various heat exchanger materials including metals, alloys, and polymers.

The technical goals extend to developing coatings that are environmentally sustainable, moving away from traditional biocide-releasing systems toward more passive physical and chemical deterrents. Research aims to achieve coating lifespans exceeding five years in industrial applications, representing a significant improvement over current solutions that may require replacement or regeneration annually.

Another critical objective involves understanding the fundamental mechanisms of fouling at the molecular and surface interaction levels. This knowledge is essential for designing next-generation coatings that can selectively repel specific foulants based on their chemical or physical properties. Advanced characterization techniques and computational modeling are increasingly employed to predict fouling behavior and optimize coating formulations.

The industry also seeks standardized testing protocols and performance metrics for anti-fouling coatings, as current evaluation methods vary widely across sectors. Establishing universal benchmarks would accelerate adoption and enable meaningful comparisons between competing technologies, ultimately driving innovation through transparent competition.

The evolution of heat exchanger technology has seen remarkable advancements in design and materials, yet fouling remains a persistent obstacle to optimal performance. Industry data suggests that fouling-related issues account for approximately 2-3% of global carbon emissions due to decreased energy efficiency, highlighting the environmental impact beyond mere operational concerns. Recent technological trends indicate a shift toward preventative solutions rather than reactive maintenance, with anti-fouling coatings emerging as a promising frontier.

Current objectives in anti-fouling coating research focus on developing surfaces that can maintain clean heat transfer interfaces for extended periods without intervention. These objectives include creating coatings with enhanced durability under extreme temperature and pressure conditions, minimizing adhesion of particulates and biological matter, and ensuring compatibility with various heat exchanger materials including metals, alloys, and polymers.

The technical goals extend to developing coatings that are environmentally sustainable, moving away from traditional biocide-releasing systems toward more passive physical and chemical deterrents. Research aims to achieve coating lifespans exceeding five years in industrial applications, representing a significant improvement over current solutions that may require replacement or regeneration annually.

Another critical objective involves understanding the fundamental mechanisms of fouling at the molecular and surface interaction levels. This knowledge is essential for designing next-generation coatings that can selectively repel specific foulants based on their chemical or physical properties. Advanced characterization techniques and computational modeling are increasingly employed to predict fouling behavior and optimize coating formulations.

The industry also seeks standardized testing protocols and performance metrics for anti-fouling coatings, as current evaluation methods vary widely across sectors. Establishing universal benchmarks would accelerate adoption and enable meaningful comparisons between competing technologies, ultimately driving innovation through transparent competition.

Market Demand Analysis for Anti-Fouling Solutions

The global market for anti-fouling solutions in heat exchanger applications has been experiencing robust growth, driven primarily by increasing industrialization and the critical need for energy efficiency across various sectors. Current market assessments value the heat exchanger anti-fouling coatings sector at approximately $2.1 billion, with projections indicating a compound annual growth rate of 5.7% through 2028.

Industries such as oil and gas, chemical processing, power generation, and food processing represent the largest demand segments for anti-fouling technologies. These sectors collectively account for over 65% of the total market share, with the oil and gas industry being the predominant consumer due to the severe fouling challenges encountered in their operations.

The economic impact of fouling in heat exchangers is substantial, with global costs estimated to exceed $30 billion annually when considering energy losses, maintenance expenses, production downtime, and equipment replacement. Studies indicate that fouling can reduce heat transfer efficiency by 20-50%, significantly increasing operational costs and carbon emissions.

Regional analysis reveals that North America and Europe currently dominate the market with approximately 60% combined share, attributed to stringent environmental regulations and higher adoption rates of advanced technologies. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the expansion due to rapid industrialization and increasing awareness about energy conservation.

Customer demand is increasingly focused on sustainable and environmentally friendly anti-fouling solutions. The market is witnessing a significant shift away from traditional biocide-based coatings toward non-toxic alternatives, driven by tightening environmental regulations and corporate sustainability initiatives. This trend is particularly pronounced in the marine and food processing sectors, where environmental impact and product contamination concerns are paramount.

Recent market surveys indicate that end-users prioritize long-term performance and reduced maintenance requirements over initial investment costs. Approximately 78% of industrial customers expressed willingness to pay premium prices for anti-fouling solutions that demonstrably extend operational periods between cleaning cycles and reduce overall lifecycle costs.

The water treatment sector represents an emerging market opportunity, with municipal water systems and desalination plants increasingly seeking effective anti-fouling technologies to improve operational efficiency and reduce maintenance costs. This segment is projected to grow at 7.2% annually, outpacing the overall market growth rate.

Digital monitoring solutions integrated with anti-fouling technologies are gaining traction, with the smart coatings market segment expanding rapidly. These integrated systems offer real-time fouling detection and performance optimization capabilities, addressing the growing demand for predictive maintenance approaches in industrial operations.

Industries such as oil and gas, chemical processing, power generation, and food processing represent the largest demand segments for anti-fouling technologies. These sectors collectively account for over 65% of the total market share, with the oil and gas industry being the predominant consumer due to the severe fouling challenges encountered in their operations.

The economic impact of fouling in heat exchangers is substantial, with global costs estimated to exceed $30 billion annually when considering energy losses, maintenance expenses, production downtime, and equipment replacement. Studies indicate that fouling can reduce heat transfer efficiency by 20-50%, significantly increasing operational costs and carbon emissions.

Regional analysis reveals that North America and Europe currently dominate the market with approximately 60% combined share, attributed to stringent environmental regulations and higher adoption rates of advanced technologies. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the expansion due to rapid industrialization and increasing awareness about energy conservation.

Customer demand is increasingly focused on sustainable and environmentally friendly anti-fouling solutions. The market is witnessing a significant shift away from traditional biocide-based coatings toward non-toxic alternatives, driven by tightening environmental regulations and corporate sustainability initiatives. This trend is particularly pronounced in the marine and food processing sectors, where environmental impact and product contamination concerns are paramount.

Recent market surveys indicate that end-users prioritize long-term performance and reduced maintenance requirements over initial investment costs. Approximately 78% of industrial customers expressed willingness to pay premium prices for anti-fouling solutions that demonstrably extend operational periods between cleaning cycles and reduce overall lifecycle costs.

The water treatment sector represents an emerging market opportunity, with municipal water systems and desalination plants increasingly seeking effective anti-fouling technologies to improve operational efficiency and reduce maintenance costs. This segment is projected to grow at 7.2% annually, outpacing the overall market growth rate.

Digital monitoring solutions integrated with anti-fouling technologies are gaining traction, with the smart coatings market segment expanding rapidly. These integrated systems offer real-time fouling detection and performance optimization capabilities, addressing the growing demand for predictive maintenance approaches in industrial operations.

Current Anti-Fouling Technologies and Challenges

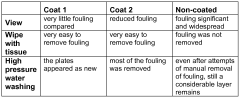

The global heat exchanger market faces significant challenges due to fouling, which reduces thermal efficiency, increases maintenance costs, and shortens equipment lifespan. Current anti-fouling technologies for heat exchangers can be categorized into three main approaches: surface modifications, chemical treatments, and mechanical solutions.

Surface modification technologies represent the most advanced approach, with hydrophobic and superhydrophobic coatings leading the field. These coatings create low surface energy interfaces that minimize adhesion of foulants. PTFE (polytetrafluoroethylene), silicone-based, and fluoropolymer coatings have demonstrated effectiveness in industrial applications, though their durability under high-temperature and high-flow conditions remains challenging.

Antimicrobial coatings incorporating silver, copper, or zinc nanoparticles have shown promise in preventing biofouling, particularly in water-cooling systems. However, concerns about nanoparticle leaching and environmental impact have limited widespread adoption. Sol-gel derived ceramic coatings offer excellent thermal stability and chemical resistance but often lack the necessary mechanical properties for long-term operation.

Chemical treatment approaches include antiscalants, dispersants, and biocides that prevent fouling formation. Phosphonates and polycarboxylates are widely used as scale inhibitors, while oxidizing biocides like chlorine and non-oxidizing alternatives like quaternary ammonium compounds target biological fouling. The environmental impact of these chemicals has driven research toward greener alternatives, though efficacy often remains lower than conventional options.

Mechanical solutions such as automatic brush systems, ultrasonic cleaning devices, and flow reversal mechanisms provide physical means to remove fouling. These systems are effective but add complexity and cost to heat exchanger designs. Emerging technologies like pulsed electric fields show promise but remain in early development stages.

The primary challenges facing current anti-fouling technologies include durability limitations, with most coatings degrading under harsh operating conditions within 1-3 years. Cost-effectiveness remains problematic, as high-performance coatings often require complex application processes and expensive materials. Environmental regulations increasingly restrict chemical treatments, particularly in water discharge applications, forcing industry to seek alternatives.

Application-specific performance presents another significant challenge, as no universal solution exists across all heat exchanger types and operating environments. A coating effective in cooling water systems may fail completely in oil processing applications. Additionally, the integration of anti-fouling technologies with existing heat exchanger designs often requires significant engineering modifications.

Recent research focuses on developing multi-functional coatings that combine hydrophobicity, antimicrobial properties, and mechanical durability. Biomimetic approaches inspired by natural anti-fouling surfaces like lotus leaves and shark skin represent promising directions, though commercial-scale manufacturing remains challenging.

Surface modification technologies represent the most advanced approach, with hydrophobic and superhydrophobic coatings leading the field. These coatings create low surface energy interfaces that minimize adhesion of foulants. PTFE (polytetrafluoroethylene), silicone-based, and fluoropolymer coatings have demonstrated effectiveness in industrial applications, though their durability under high-temperature and high-flow conditions remains challenging.

Antimicrobial coatings incorporating silver, copper, or zinc nanoparticles have shown promise in preventing biofouling, particularly in water-cooling systems. However, concerns about nanoparticle leaching and environmental impact have limited widespread adoption. Sol-gel derived ceramic coatings offer excellent thermal stability and chemical resistance but often lack the necessary mechanical properties for long-term operation.

Chemical treatment approaches include antiscalants, dispersants, and biocides that prevent fouling formation. Phosphonates and polycarboxylates are widely used as scale inhibitors, while oxidizing biocides like chlorine and non-oxidizing alternatives like quaternary ammonium compounds target biological fouling. The environmental impact of these chemicals has driven research toward greener alternatives, though efficacy often remains lower than conventional options.

Mechanical solutions such as automatic brush systems, ultrasonic cleaning devices, and flow reversal mechanisms provide physical means to remove fouling. These systems are effective but add complexity and cost to heat exchanger designs. Emerging technologies like pulsed electric fields show promise but remain in early development stages.

The primary challenges facing current anti-fouling technologies include durability limitations, with most coatings degrading under harsh operating conditions within 1-3 years. Cost-effectiveness remains problematic, as high-performance coatings often require complex application processes and expensive materials. Environmental regulations increasingly restrict chemical treatments, particularly in water discharge applications, forcing industry to seek alternatives.

Application-specific performance presents another significant challenge, as no universal solution exists across all heat exchanger types and operating environments. A coating effective in cooling water systems may fail completely in oil processing applications. Additionally, the integration of anti-fouling technologies with existing heat exchanger designs often requires significant engineering modifications.

Recent research focuses on developing multi-functional coatings that combine hydrophobicity, antimicrobial properties, and mechanical durability. Biomimetic approaches inspired by natural anti-fouling surfaces like lotus leaves and shark skin represent promising directions, though commercial-scale manufacturing remains challenging.

Current Anti-Fouling Coating Solutions

01 Silicone-based anti-fouling coatings

Silicone-based coatings provide excellent anti-fouling properties due to their low surface energy which prevents organisms from adhering to surfaces. These coatings create a smooth, slippery surface that marine organisms have difficulty attaching to. The silicone polymers can be combined with other compounds to enhance durability and fouling resistance, making them particularly effective for marine vessels and underwater structures.- Silicone-based anti-fouling coatings: Silicone-based coatings provide effective anti-fouling properties due to their low surface energy which prevents organisms from adhering to surfaces. These coatings create a smooth, slippery surface that marine organisms have difficulty attaching to. The formulations often include silicone polymers combined with specific additives that enhance the release properties of the coating, making it difficult for biofouling organisms to establish a strong attachment. These coatings are particularly effective for marine vessels and underwater structures.

- Copper-based anti-fouling systems: Copper and copper compounds are widely used in anti-fouling coatings due to their biocidal properties. These formulations typically contain copper oxide or copper-based biocides that slowly release into the surrounding water, creating an environment hostile to fouling organisms. The controlled release mechanism ensures long-term protection against biofouling while minimizing environmental impact. These systems are commonly applied to ship hulls and marine structures to prevent the attachment and growth of barnacles, algae, and other marine organisms.

- Environmentally friendly anti-fouling technologies: Environmentally friendly anti-fouling technologies utilize non-toxic or low-toxicity compounds to prevent biofouling. These formulations incorporate natural biocides, biodegradable polymers, or biomimetic approaches that mimic natural anti-fouling mechanisms found in marine organisms. Some technologies use surface modification techniques to create micro-textured surfaces that inhibit organism attachment without releasing harmful substances into the environment. These eco-friendly alternatives are becoming increasingly important as regulations on traditional biocides become more stringent.

- Nanoparticle-enhanced anti-fouling coatings: Nanoparticle-enhanced anti-fouling coatings incorporate various types of nanoparticles to improve fouling resistance. These nanoparticles, such as silver, zinc oxide, or titanium dioxide, can provide antimicrobial properties or modify the surface characteristics of the coating. The small size of nanoparticles allows for better dispersion within the coating matrix, resulting in more uniform protection. Additionally, some nanoparticles can create photocatalytic effects that break down organic matter on the surface, further enhancing the anti-fouling performance.

- Self-polishing copolymer anti-fouling systems: Self-polishing copolymer systems provide controlled release of biocides through a hydrolysis mechanism that gradually erodes the coating surface. As the outer layer of the coating is worn away by water movement, a fresh layer with active biocides is exposed, ensuring continuous anti-fouling protection. These systems typically consist of acrylic or methacrylic copolymers with hydrolyzable groups that determine the erosion rate. The controlled erosion process helps maintain a smooth hull surface, which can reduce drag and improve fuel efficiency for marine vessels.

02 Copper-based biocidal anti-fouling systems

Copper compounds are widely used in anti-fouling coatings due to their biocidal properties that prevent the growth of marine organisms. These systems typically incorporate copper oxide or copper-based compounds that slowly release active ingredients to create an environment hostile to fouling organisms. The controlled release mechanism ensures long-term protection while minimizing environmental impact compared to traditional toxic anti-fouling paints.Expand Specific Solutions03 Nanostructured and textured anti-fouling surfaces

Nanostructured surfaces mimic natural anti-fouling mechanisms found in organisms like shark skin or lotus leaves. These coatings utilize precisely engineered surface textures at the nano or micro scale to disrupt the settlement patterns of fouling organisms. The specialized surface topography creates unfavorable conditions for organism attachment without relying solely on chemical biocides, offering an environmentally friendly approach to fouling prevention.Expand Specific Solutions04 Polymer-based fouling-release coatings

Polymer-based fouling-release coatings work by creating surfaces with low adhesion strength, allowing fouling organisms to be easily removed by water flow or minimal cleaning. These coatings typically incorporate specialized polymers that resist initial attachment of organisms and facilitate their removal through hydrodynamic forces. Unlike traditional biocidal coatings, these systems rely on physical properties rather than toxic effects, making them more environmentally sustainable for long-term use.Expand Specific Solutions05 Self-cleaning and active anti-fouling systems

Self-cleaning anti-fouling systems incorporate mechanisms that actively prevent or remove fouling without manual intervention. These include coatings with responsive properties that change under different environmental conditions, systems that generate repulsive forces against organisms, or surfaces that periodically shed their outer layer. Some advanced systems utilize electrical currents, ultrasonic vibrations, or mechanical movements to disrupt biofilm formation and prevent organism attachment.Expand Specific Solutions

Key Industry Players in Anti-Fouling Coatings

The anti-fouling coatings for heat exchanger applications market is currently in a growth phase, driven by increasing energy efficiency demands across industries. The global market size is estimated to exceed $1.2 billion, with projected annual growth of 5-7% through 2028. Technologically, the field shows moderate maturity with ongoing innovation focused on environmentally sustainable solutions. Key players represent diverse technological approaches: ExxonMobil and Saudi Aramco lead in petroleum-based coatings; Alfa Laval and Carrier dominate in commercial heat exchanger applications; while specialty coating innovators like SilcoTek and SiOx ApS offer advanced thin-film solutions. Asian manufacturers including Midea Group, Samsung, and Mitsubishi Electric are rapidly expanding market share through integration of anti-fouling technologies in consumer and industrial systems, particularly in high-growth regions.

Alfa Laval Corporate AB

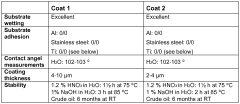

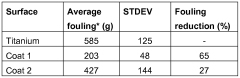

Technical Solution: Alfa Laval has developed advanced anti-fouling coatings specifically designed for plate heat exchangers in demanding environments. Their technology utilizes a proprietary hydrophobic polymer matrix combined with embedded nanoparticles that create a smooth, low-surface-energy barrier. This coating system employs a dual-action mechanism: physical fouling prevention through reduced surface adhesion and chemical resistance to scaling compounds. The company's AlfaGuard technology incorporates silver ions for antimicrobial properties, particularly effective in food processing and pharmaceutical applications. Their latest generation coatings feature self-healing capabilities that can repair minor scratches through thermally-activated polymer reorientation. Alfa Laval's coatings are applied using a specialized plasma-enhanced chemical vapor deposition process that ensures uniform coverage even on complex geometries of heat exchanger plates.

Strengths: Exceptional durability in high-temperature and corrosive environments; significantly extends maintenance intervals; compatible with a wide range of heat transfer fluids. Weaknesses: Higher initial implementation cost compared to conventional coatings; requires specialized application equipment; performance may degrade in extremely acidic conditions.

SiOx ApS

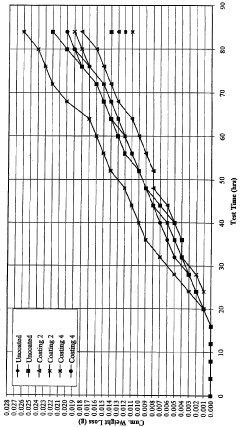

Technical Solution: SiOx has developed an innovative anti-fouling coating technology based on their proprietary silicon oxide matrix with embedded functional nanoparticles. Their coating system creates an ultra-smooth, hydrophilic surface that prevents initial adhesion of fouling agents through a combination of physical and chemical mechanisms. The company's technology utilizes a sol-gel application process that forms a nanoporous structure allowing controlled release of biocidal compounds while maintaining a smooth surface profile. SiOx's coatings incorporate photocatalytic titanium dioxide nanoparticles that, when exposed to light, generate reactive oxygen species that break down organic foulants. This self-cleaning mechanism is particularly effective for heat exchangers in water treatment and food processing applications. The coating's silica-based matrix provides excellent thermal stability and chemical resistance while maintaining high thermal conductivity. Independent testing has demonstrated fouling reduction rates of over 85% compared to uncoated surfaces in marine water cooling systems, with coating durability exceeding 5 years in field applications.

Strengths: Excellent biofilm resistance; environmentally friendly formulation without heavy metals; maintains effectiveness across wide temperature ranges. Weaknesses: Photocatalytic components require periodic light exposure for optimal performance; higher cost compared to conventional coatings; may require specialized application equipment.

Core Anti-Fouling Mechanisms and Patents

Heat exchanger plates with Anti-fouling properties

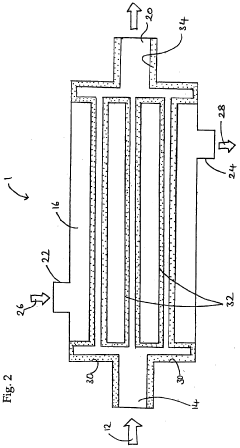

PatentWO2012018296A1

Innovation

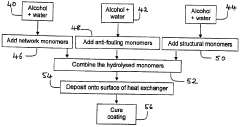

- A sol-gel composition with organosilicon compounds is applied to the heat exchanger plates, reducing surface free energy and roughness, and providing a durable, flexible non-stick coating that resists wear and cracking, facilitating easy cleaning and maintaining heat transfer efficiency.

Anti-fouling coating

PatentInactiveGB2428604A

Innovation

- A siloxane-based coating with silicon, oxygen, and fluorinated alkyl groups forms a continuous, inert, and self-regenerating layer on heat exchanger surfaces, reducing fouling through low surface energy and even fluorination distribution, allowing chemical bonding without mechanical substrate preparation, and maintaining anti-fouling properties even when worn.

Environmental Impact and Regulations

The environmental impact of anti-fouling coatings for heat exchangers has become a critical consideration in recent years, driven by increasing regulatory scrutiny and growing sustainability concerns. Traditional anti-fouling solutions, particularly those containing heavy metals like copper and tributyltin (TBT), have been linked to significant ecological damage in aquatic environments. These substances can leach into water systems, causing bioaccumulation in marine organisms and disrupting aquatic ecosystems even at low concentrations.

Regulatory frameworks governing anti-fouling coatings have evolved substantially over the past two decades. The International Maritime Organization's (IMO) ban on TBT-based coatings through the Anti-Fouling Systems Convention of 2001, fully implemented by 2008, marked a watershed moment for the industry. This regulation has been followed by increasingly stringent regional and national legislation, including the European Union's Biocidal Products Regulation (BPR) and the U.S. Environmental Protection Agency's Vessel General Permit requirements.

Current regulatory trends indicate a clear movement toward zero-discharge policies and life-cycle assessment approaches. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation has placed additional pressure on manufacturers to develop environmentally benign alternatives by requiring comprehensive toxicity data and environmental impact assessments for chemical substances used in coatings.

The industrial heat exchanger sector faces unique regulatory challenges compared to marine applications, with additional considerations related to drinking water safety standards, food processing regulations, and industrial wastewater discharge limits. These regulations vary significantly across jurisdictions, creating a complex compliance landscape for multinational operations and technology developers.

Emerging environmental metrics for anti-fouling coatings now include biodegradability, bioaccumulation potential, toxicity thresholds, and carbon footprint calculations. The industry is increasingly adopting Environmental Product Declarations (EPDs) and Life Cycle Assessments (LCAs) to quantify and communicate the environmental performance of coating systems throughout their entire life cycle.

Forward-looking regulations are expected to focus on microplastic release from polymer-based coatings, volatile organic compound (VOC) emissions during application and curing processes, and end-of-life disposal considerations. These evolving requirements are driving innovation toward biomimetic approaches, naturally-derived compounds, and smart-release technologies that minimize environmental impact while maintaining effective anti-fouling performance.

Regulatory frameworks governing anti-fouling coatings have evolved substantially over the past two decades. The International Maritime Organization's (IMO) ban on TBT-based coatings through the Anti-Fouling Systems Convention of 2001, fully implemented by 2008, marked a watershed moment for the industry. This regulation has been followed by increasingly stringent regional and national legislation, including the European Union's Biocidal Products Regulation (BPR) and the U.S. Environmental Protection Agency's Vessel General Permit requirements.

Current regulatory trends indicate a clear movement toward zero-discharge policies and life-cycle assessment approaches. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation has placed additional pressure on manufacturers to develop environmentally benign alternatives by requiring comprehensive toxicity data and environmental impact assessments for chemical substances used in coatings.

The industrial heat exchanger sector faces unique regulatory challenges compared to marine applications, with additional considerations related to drinking water safety standards, food processing regulations, and industrial wastewater discharge limits. These regulations vary significantly across jurisdictions, creating a complex compliance landscape for multinational operations and technology developers.

Emerging environmental metrics for anti-fouling coatings now include biodegradability, bioaccumulation potential, toxicity thresholds, and carbon footprint calculations. The industry is increasingly adopting Environmental Product Declarations (EPDs) and Life Cycle Assessments (LCAs) to quantify and communicate the environmental performance of coating systems throughout their entire life cycle.

Forward-looking regulations are expected to focus on microplastic release from polymer-based coatings, volatile organic compound (VOC) emissions during application and curing processes, and end-of-life disposal considerations. These evolving requirements are driving innovation toward biomimetic approaches, naturally-derived compounds, and smart-release technologies that minimize environmental impact while maintaining effective anti-fouling performance.

Cost-Benefit Analysis of Anti-Fouling Technologies

The implementation of anti-fouling technologies for heat exchangers requires careful economic evaluation to justify investment decisions. When conducting a comprehensive cost-benefit analysis, organizations must consider both direct and indirect financial implications across the entire lifecycle of these systems.

Initial acquisition costs represent a significant consideration, with advanced anti-fouling coatings typically commanding premium prices compared to conventional materials. For instance, specialized polymer-based coatings may cost 30-50% more than standard epoxy coatings, while cutting-edge nanocomposite solutions can be 2-3 times more expensive. However, these higher upfront expenditures must be weighed against long-term operational benefits.

Operational savings constitute the primary economic advantage of anti-fouling technologies. Studies indicate that effective anti-fouling measures can reduce cleaning frequency by 40-60%, translating to substantial maintenance cost reductions. Furthermore, by maintaining optimal heat transfer efficiency, these technologies typically deliver energy savings of 15-25% compared to untreated systems, with corresponding reductions in utility expenses.

Extended equipment lifespan represents another significant economic benefit. Heat exchangers protected by quality anti-fouling coatings demonstrate 30-50% longer operational lives before requiring replacement, deferring capital expenditures and improving return on investment calculations. This longevity factor is particularly valuable in industries where equipment replacement involves significant production disruptions.

Productivity improvements further enhance the economic case for anti-fouling technologies. Reduced downtime for cleaning and maintenance can increase overall system availability by 10-20%, directly impacting production capacity and revenue generation potential. In process-intensive industries like petrochemicals or food processing, these availability improvements can translate to millions in additional annual revenue.

Environmental compliance considerations also factor into the economic equation. As regulatory frameworks become increasingly stringent regarding chemical treatments and waste disposal, anti-fouling technologies that reduce chemical usage or eliminate toxic compounds can significantly reduce compliance costs and potential liability exposure.

Payback period analysis typically reveals that despite higher initial investments, most anti-fouling technologies achieve break-even within 12-24 months of implementation, with subsequent years delivering substantial positive returns. However, these calculations vary considerably based on specific operating conditions, fouling severity, and energy costs in different regions and industries.

Initial acquisition costs represent a significant consideration, with advanced anti-fouling coatings typically commanding premium prices compared to conventional materials. For instance, specialized polymer-based coatings may cost 30-50% more than standard epoxy coatings, while cutting-edge nanocomposite solutions can be 2-3 times more expensive. However, these higher upfront expenditures must be weighed against long-term operational benefits.

Operational savings constitute the primary economic advantage of anti-fouling technologies. Studies indicate that effective anti-fouling measures can reduce cleaning frequency by 40-60%, translating to substantial maintenance cost reductions. Furthermore, by maintaining optimal heat transfer efficiency, these technologies typically deliver energy savings of 15-25% compared to untreated systems, with corresponding reductions in utility expenses.

Extended equipment lifespan represents another significant economic benefit. Heat exchangers protected by quality anti-fouling coatings demonstrate 30-50% longer operational lives before requiring replacement, deferring capital expenditures and improving return on investment calculations. This longevity factor is particularly valuable in industries where equipment replacement involves significant production disruptions.

Productivity improvements further enhance the economic case for anti-fouling technologies. Reduced downtime for cleaning and maintenance can increase overall system availability by 10-20%, directly impacting production capacity and revenue generation potential. In process-intensive industries like petrochemicals or food processing, these availability improvements can translate to millions in additional annual revenue.

Environmental compliance considerations also factor into the economic equation. As regulatory frameworks become increasingly stringent regarding chemical treatments and waste disposal, anti-fouling technologies that reduce chemical usage or eliminate toxic compounds can significantly reduce compliance costs and potential liability exposure.

Payback period analysis typically reveals that despite higher initial investments, most anti-fouling technologies achieve break-even within 12-24 months of implementation, with subsequent years delivering substantial positive returns. However, these calculations vary considerably based on specific operating conditions, fouling severity, and energy costs in different regions and industries.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!