Anti Fouling Coatings Materials Mechanisms and Marine Applications

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Marine Biofouling Background and Research Objectives

Marine biofouling represents one of the most persistent challenges in maritime industries, characterized by the unwanted accumulation of microorganisms, plants, algae, and animals on submerged structures. This phenomenon dates back to the earliest seafaring civilizations, with historical records showing various attempts to mitigate its effects using materials like lead sheathing, copper, and tar. The economic impact of biofouling is substantial, estimated to cost the global shipping industry over $7 billion annually through increased fuel consumption, maintenance requirements, and operational inefficiencies.

The biological process of fouling typically follows a sequential pattern, beginning with the formation of a conditioning film of organic molecules, followed by bacterial colonization forming a biofilm, and subsequently the attachment of larger organisms such as barnacles, mussels, and algae. This progression creates a complex ecosystem on submerged surfaces that significantly impairs vessel performance and structural integrity.

Current anti-fouling technologies have evolved from highly effective but environmentally harmful tributyltin (TBT) compounds, banned globally since 2008, to copper-based alternatives and newer environmentally acceptable solutions. Despite these advancements, the field continues to face significant challenges in balancing efficacy, environmental sustainability, and economic viability.

The primary objective of this research is to comprehensively analyze the mechanisms underlying anti-fouling coating materials and their applications in marine environments. Specifically, we aim to investigate the chemical, physical, and biological principles that govern fouling prevention, with particular emphasis on novel biomimetic approaches and environmentally sustainable solutions.

Secondary objectives include evaluating the performance metrics of various anti-fouling technologies across different marine conditions, identifying key factors affecting coating longevity and effectiveness, and assessing the environmental impact of emerging anti-fouling solutions. Additionally, this research seeks to establish a framework for predicting coating performance based on material properties and environmental parameters.

The technological trajectory indicates a shift toward multi-functional coatings that combine anti-fouling properties with other desirable characteristics such as corrosion resistance and drag reduction. Biomimetic approaches, inspired by natural anti-fouling mechanisms found in marine organisms, represent a promising frontier in this field, potentially offering solutions that are both effective and environmentally benign.

This research aligns with global maritime sustainability goals and regulatory frameworks, including the International Maritime Organization's (IMO) Biofouling Guidelines and various regional environmental protection initiatives, positioning it at the intersection of technological innovation and environmental stewardship.

The biological process of fouling typically follows a sequential pattern, beginning with the formation of a conditioning film of organic molecules, followed by bacterial colonization forming a biofilm, and subsequently the attachment of larger organisms such as barnacles, mussels, and algae. This progression creates a complex ecosystem on submerged surfaces that significantly impairs vessel performance and structural integrity.

Current anti-fouling technologies have evolved from highly effective but environmentally harmful tributyltin (TBT) compounds, banned globally since 2008, to copper-based alternatives and newer environmentally acceptable solutions. Despite these advancements, the field continues to face significant challenges in balancing efficacy, environmental sustainability, and economic viability.

The primary objective of this research is to comprehensively analyze the mechanisms underlying anti-fouling coating materials and their applications in marine environments. Specifically, we aim to investigate the chemical, physical, and biological principles that govern fouling prevention, with particular emphasis on novel biomimetic approaches and environmentally sustainable solutions.

Secondary objectives include evaluating the performance metrics of various anti-fouling technologies across different marine conditions, identifying key factors affecting coating longevity and effectiveness, and assessing the environmental impact of emerging anti-fouling solutions. Additionally, this research seeks to establish a framework for predicting coating performance based on material properties and environmental parameters.

The technological trajectory indicates a shift toward multi-functional coatings that combine anti-fouling properties with other desirable characteristics such as corrosion resistance and drag reduction. Biomimetic approaches, inspired by natural anti-fouling mechanisms found in marine organisms, represent a promising frontier in this field, potentially offering solutions that are both effective and environmentally benign.

This research aligns with global maritime sustainability goals and regulatory frameworks, including the International Maritime Organization's (IMO) Biofouling Guidelines and various regional environmental protection initiatives, positioning it at the intersection of technological innovation and environmental stewardship.

Market Analysis of Anti-Fouling Coating Industry

The global anti-fouling coating market has demonstrated robust growth, valued at approximately $6.7 billion in 2022 and projected to reach $10.2 billion by 2028, representing a compound annual growth rate (CAGR) of 7.2%. This growth is primarily driven by expanding maritime trade activities, increasing vessel construction, and stringent environmental regulations regarding marine pollution.

The marine segment dominates the anti-fouling coating market, accounting for over 70% of the total market share. This dominance stems from the critical need to prevent biofouling on ship hulls, which can increase fuel consumption by up to 40% and significantly impact operational efficiency. The commercial vessel segment represents the largest application area, followed by offshore structures, naval vessels, and pleasure craft.

Geographically, Asia-Pacific leads the market with approximately 45% share, attributed to the region's robust shipbuilding industry, particularly in China, South Korea, and Japan. Europe follows with around 25% market share, driven by strict environmental regulations and advanced coating technologies. North America accounts for approximately 20% of the market, with growing emphasis on environmentally friendly solutions.

The market is witnessing a significant shift toward environmentally sustainable anti-fouling solutions due to increasing regulatory pressure. Traditional copper and tributyltin (TBT) based coatings are facing restrictions due to their environmental toxicity, creating substantial market opportunities for bio-based and non-toxic alternatives. This regulatory landscape has accelerated innovation in the sector, with silicone-based foul-release coatings gaining significant traction.

Customer preferences are evolving toward solutions offering longer service life, reduced maintenance requirements, and lower environmental impact. The average service life expectancy for premium anti-fouling coatings has increased from 3-5 years to 5-7 years, reflecting technological advancements and changing market demands.

The competitive landscape features both established players and innovative startups. Major companies like PPG Industries, AkzoNobel, Sherwin-Williams, Jotun, and Hempel collectively hold approximately 65% of the market share. These industry leaders are increasingly investing in R&D to develop next-generation anti-fouling technologies that balance performance with environmental sustainability.

Emerging trends include the development of self-polishing copolymer technologies, biomimetic approaches inspired by natural anti-fouling mechanisms, and smart coatings with responsive properties. The integration of nanotechnology in anti-fouling formulations represents a particularly promising growth segment, expected to expand at a CAGR of 9.5% through 2028.

The marine segment dominates the anti-fouling coating market, accounting for over 70% of the total market share. This dominance stems from the critical need to prevent biofouling on ship hulls, which can increase fuel consumption by up to 40% and significantly impact operational efficiency. The commercial vessel segment represents the largest application area, followed by offshore structures, naval vessels, and pleasure craft.

Geographically, Asia-Pacific leads the market with approximately 45% share, attributed to the region's robust shipbuilding industry, particularly in China, South Korea, and Japan. Europe follows with around 25% market share, driven by strict environmental regulations and advanced coating technologies. North America accounts for approximately 20% of the market, with growing emphasis on environmentally friendly solutions.

The market is witnessing a significant shift toward environmentally sustainable anti-fouling solutions due to increasing regulatory pressure. Traditional copper and tributyltin (TBT) based coatings are facing restrictions due to their environmental toxicity, creating substantial market opportunities for bio-based and non-toxic alternatives. This regulatory landscape has accelerated innovation in the sector, with silicone-based foul-release coatings gaining significant traction.

Customer preferences are evolving toward solutions offering longer service life, reduced maintenance requirements, and lower environmental impact. The average service life expectancy for premium anti-fouling coatings has increased from 3-5 years to 5-7 years, reflecting technological advancements and changing market demands.

The competitive landscape features both established players and innovative startups. Major companies like PPG Industries, AkzoNobel, Sherwin-Williams, Jotun, and Hempel collectively hold approximately 65% of the market share. These industry leaders are increasingly investing in R&D to develop next-generation anti-fouling technologies that balance performance with environmental sustainability.

Emerging trends include the development of self-polishing copolymer technologies, biomimetic approaches inspired by natural anti-fouling mechanisms, and smart coatings with responsive properties. The integration of nanotechnology in anti-fouling formulations represents a particularly promising growth segment, expected to expand at a CAGR of 9.5% through 2028.

Current Challenges in Anti-Fouling Technology

Despite significant advancements in anti-fouling technologies over recent decades, the field continues to face substantial challenges that impede the development of ideal solutions. The most pressing issue remains the environmental impact of traditional biocide-based coatings. While tributyltin (TBT) compounds have been globally banned due to their severe ecological damage, even copper-based alternatives exhibit concerning levels of toxicity to non-target marine organisms, particularly in enclosed water bodies and sensitive ecosystems.

Regulatory frameworks worldwide have become increasingly stringent, with the EU's Biocidal Products Regulation and similar legislation in other regions restricting the use of numerous active substances. This regulatory landscape creates a complex compliance environment for manufacturers and limits the available chemical toolbox for effective anti-fouling solutions.

Durability presents another significant challenge, as most current coatings demonstrate effective performance for only 3-5 years before requiring reapplication. This limitation imposes substantial operational costs on vessel operators through increased dry-docking frequency and associated downtime. The performance degradation is particularly problematic for vessels operating in tropical waters or those with variable operational profiles.

The diversity of fouling organisms compounds these challenges, as different species exhibit varying attachment mechanisms and resistance to anti-fouling strategies. While certain coatings may effectively deter barnacles, they might prove ineffective against algae or bacterial biofilms. This biological complexity necessitates multi-mechanism approaches that are difficult to engineer into a single coating system.

Emerging concerns regarding invasive species transport have placed additional demands on anti-fouling technologies. Effective coatings must not only prevent fouling at the vessel's primary operational locations but also minimize the risk of transporting non-native species between different marine environments, a factor not historically prioritized in coating design.

Cost-effectiveness remains a persistent barrier to adoption, particularly for novel environmentally friendly solutions. Biomimetic approaches and advanced surface engineering techniques often involve complex manufacturing processes that significantly increase production costs compared to conventional coatings, limiting their commercial viability despite promising performance characteristics.

Technical integration challenges also exist, as coating performance is heavily influenced by substrate properties, application methods, and operational conditions. The development of universal solutions applicable across diverse vessel types, from leisure craft to commercial ships and offshore structures, continues to elude researchers despite decades of focused effort.

Regulatory frameworks worldwide have become increasingly stringent, with the EU's Biocidal Products Regulation and similar legislation in other regions restricting the use of numerous active substances. This regulatory landscape creates a complex compliance environment for manufacturers and limits the available chemical toolbox for effective anti-fouling solutions.

Durability presents another significant challenge, as most current coatings demonstrate effective performance for only 3-5 years before requiring reapplication. This limitation imposes substantial operational costs on vessel operators through increased dry-docking frequency and associated downtime. The performance degradation is particularly problematic for vessels operating in tropical waters or those with variable operational profiles.

The diversity of fouling organisms compounds these challenges, as different species exhibit varying attachment mechanisms and resistance to anti-fouling strategies. While certain coatings may effectively deter barnacles, they might prove ineffective against algae or bacterial biofilms. This biological complexity necessitates multi-mechanism approaches that are difficult to engineer into a single coating system.

Emerging concerns regarding invasive species transport have placed additional demands on anti-fouling technologies. Effective coatings must not only prevent fouling at the vessel's primary operational locations but also minimize the risk of transporting non-native species between different marine environments, a factor not historically prioritized in coating design.

Cost-effectiveness remains a persistent barrier to adoption, particularly for novel environmentally friendly solutions. Biomimetic approaches and advanced surface engineering techniques often involve complex manufacturing processes that significantly increase production costs compared to conventional coatings, limiting their commercial viability despite promising performance characteristics.

Technical integration challenges also exist, as coating performance is heavily influenced by substrate properties, application methods, and operational conditions. The development of universal solutions applicable across diverse vessel types, from leisure craft to commercial ships and offshore structures, continues to elude researchers despite decades of focused effort.

Current Anti-Fouling Mechanisms and Solutions

01 Biocide-based anti-fouling coatings

These coatings incorporate biocidal compounds that prevent the attachment and growth of marine organisms on surfaces. The biocides are typically released slowly from the coating matrix, creating a toxic environment for fouling organisms. Common biocides include copper compounds, zinc pyrithione, and organic compounds. These formulations are designed to maintain effectiveness over extended periods while minimizing environmental impact through controlled release mechanisms.- Biocide-based antifouling coatings: Biocide-based antifouling coatings incorporate active compounds that prevent the attachment and growth of marine organisms on submerged surfaces. These coatings typically contain compounds that are released slowly over time to create an environment hostile to fouling organisms. The controlled release mechanism ensures long-term effectiveness while minimizing environmental impact. These coatings are particularly effective for marine vessels and structures where biological fouling is a significant concern.

- Polymer-based antifouling technologies: Polymer-based antifouling technologies utilize specialized polymers with properties that resist organism attachment. These coatings may incorporate self-polishing copolymers that gradually erode in water, continuously exposing fresh antifouling surfaces. Some formulations include hydrophobic or hydrophilic polymers that create surfaces unfavorable for biofouling. Advanced polymer systems may also feature controlled degradation rates to optimize performance while reducing environmental impact.

- Environmentally friendly antifouling solutions: Environmentally friendly antifouling solutions focus on developing coatings that provide effective fouling protection while minimizing ecological impact. These formulations often replace traditional toxic biocides with natural compounds or physical deterrents. Some utilize biodegradable materials or biomimetic approaches that replicate natural antifouling mechanisms found in marine organisms. These eco-friendly alternatives aim to meet increasingly stringent environmental regulations while maintaining performance standards.

- Nanoparticle-enhanced antifouling coatings: Nanoparticle-enhanced antifouling coatings incorporate nanoscale materials to improve performance and durability. These formulations may use metal nanoparticles, carbon nanotubes, or silica nanoparticles to create surfaces with enhanced antimicrobial properties or altered surface topography that inhibits organism attachment. The nanomaterials can provide multiple mechanisms of fouling prevention, including physical deterrence and chemical inhibition, while potentially reducing the overall concentration of active ingredients needed.

- Surface modification techniques for fouling prevention: Surface modification techniques focus on altering the physical or chemical properties of surfaces to prevent fouling without relying solely on biocidal compounds. These approaches include creating micro-textured surfaces that reduce organism attachment, applying hydrophobic or hydrophilic coatings that minimize adhesion, or developing slippery liquid-infused porous surfaces. Some technologies combine surface modifications with traditional antifouling compounds to create multi-functional protective systems with enhanced performance and longevity.

02 Environmentally friendly non-toxic anti-fouling solutions

These coatings utilize non-toxic mechanisms to prevent biofouling without harming marine ecosystems. They may incorporate natural compounds, biodegradable polymers, or physical surface modifications that create unfavorable attachment conditions. Some formulations use hydrophobic or hydrophilic properties to prevent organism adhesion, while others employ naturally derived repellents from marine organisms. These solutions address increasing environmental regulations restricting traditional biocide-based coatings.Expand Specific Solutions03 Polymer-based self-polishing coatings

These anti-fouling coatings utilize specialized polymers that gradually erode in water, creating a self-polishing effect that continuously exposes fresh coating material. The controlled erosion prevents the buildup of fouling organisms by maintaining a smooth, renewable surface. These formulations often incorporate hydrolyzable polymers or copolymers that react with seawater, causing controlled degradation of the coating surface while maintaining structural integrity underneath.Expand Specific Solutions04 Silicone and fluoropolymer low-surface-energy coatings

These coatings utilize materials with extremely low surface energy, such as silicones and fluoropolymers, to create surfaces that resist organism attachment. The slippery, non-stick properties make it difficult for fouling organisms to adhere to the treated surface. These coatings often work through physical rather than chemical means, with the smooth, low-friction surface preventing strong attachment of marine organisms and allowing them to be easily removed by water flow or minimal cleaning.Expand Specific Solutions05 Nanoparticle-enhanced anti-fouling coatings

These advanced coatings incorporate nanoparticles to enhance anti-fouling properties through various mechanisms. Nanoparticles such as silver, zinc oxide, or carbon-based materials can provide antimicrobial properties, alter surface topography, or modify release kinetics of active ingredients. The nano-scale features can disrupt organism attachment processes while improving coating durability and performance. These formulations often combine the benefits of traditional anti-fouling approaches with the unique properties of nanomaterials.Expand Specific Solutions

Key Manufacturers and Research Institutions

The anti-fouling coatings market is currently in a mature growth phase with increasing demand driven by expanding marine transportation and offshore industries. The global market size is estimated at approximately $6-8 billion annually with projected CAGR of 5-7% through 2027. Leading players include established manufacturers like Jotun AS, Akzo Nobel Coatings, and Chugoku Marine Paints, who dominate with advanced biocide-based solutions, while Nippon Paint and Kansai Paint Marine are expanding their market share through environmentally compliant innovations. Technical maturity varies significantly, with traditional copper-based coatings being well-established but facing regulatory challenges, while newer silicone-based foul-release technologies from companies like Elkem Silicones and Bluestar Silicones represent the cutting edge. Academic institutions including Dalian Maritime University and Xiamen University are driving fundamental research in novel environmentally sustainable mechanisms, collaborating with industry to address increasing regulatory pressures on biocide-containing products.

Jotun AS

Technical Solution: Jotun has developed SeaQuantum X200, an advanced silyl acrylate self-polishing copolymer (SPC) antifouling coating. This technology utilizes hydrolysis mechanisms where the silyl acrylate polymer reacts with seawater, creating a controlled polishing rate that maintains a smooth hull surface. The coating incorporates copper compounds and organic biocides that are gradually released to prevent marine organism attachment. Jotun's proprietary Hydractive™ technology enables precise control of the polishing rate across varying vessel operational profiles and water conditions. Their research has demonstrated fuel savings of up to 40% compared to conventional coatings through reduced hull roughness and friction. Jotun has also developed SeaStock, a specialized maintenance coating system designed for vessels in challenging tropical waters where biofouling pressure is highest.

Strengths: Superior long-term performance with documented fuel savings and emissions reduction; customizable solutions for different vessel types and operational profiles; global service network providing technical support. Weaknesses: Higher initial cost compared to conventional coatings; performance dependent on vessel operational profile matching coating specifications; contains copper compounds raising environmental concerns in some jurisdictions.

Akzo Nobel Coatings International BV

Technical Solution: Akzo Nobel has pioneered Intersleek®, a revolutionary fouling release coating based on fluoropolymer and silicone technologies. Unlike traditional biocide-based solutions, Intersleek® creates an ultra-smooth, low surface energy coating that prevents organisms from establishing strong bonds with the hull surface. The technology utilizes advanced polymer science to create a surface with significantly reduced friction properties. Their latest generation, Intersleek®1100SR, specifically targets slime fouling through patented amphiphilic surface chemistry that discourages even microscopic biofilm formation. Laboratory and field testing have demonstrated drag reduction of up to 9% compared to standard SPC coatings. The company has documented over 10 million tons of CO₂ emissions prevented through reduced fuel consumption on vessels using their technology. Akzo Nobel has also developed digital tools that can predict coating performance based on vessel operational data and environmental conditions, allowing for optimized maintenance scheduling.

Strengths: Biocide-free formulation meeting stringent environmental regulations; exceptional slime fouling resistance; documented fuel efficiency improvements; suitable for both new builds and conversions. Weaknesses: Requires specific application conditions and skilled application teams; higher initial investment; optimal performance requires minimum vessel speeds; more challenging to repair than conventional coatings.

Critical Patents and Scientific Breakthroughs

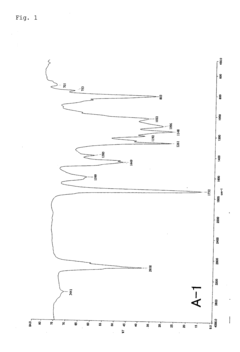

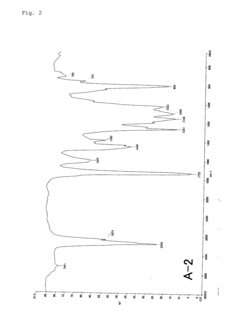

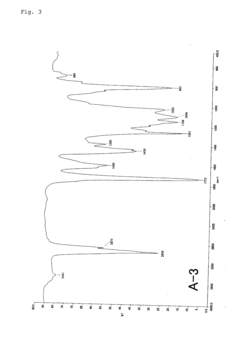

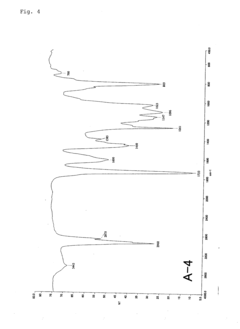

Metal-crosslinked organopolysiloxane-thio block vinyl copolymer and antifouling coating composition containing the metal-crosslinked copolymer

PatentActiveUS20120258321A1

Innovation

- A metal-crosslinked organopolysiloxane-thio block vinyl copolymer with a carboxylic acid-containing vinyl copolymer block and an organopolysiloxane-thio block, crosslinked with a divalent metal, forming a coating composition that maintains antifouling performance without the need for toxic agents like organotin compounds.

Anti-fouling paints and coatings

PatentInactiveUS20210017402A1

Innovation

- A marine coating composition incorporating a proteinaceous molecule with a metal binding sequence, such as those listed in SEQ ID Nos. 204-243 and 250-302, which binds metal ligands to inhibit biofouling by reducing adherence and facilitating easy removal of biofilms, while being reversible and cysteine-free.

Environmental Regulations and Compliance Standards

The regulatory landscape governing anti-fouling coatings has undergone significant transformation over the past two decades, primarily driven by increasing environmental concerns about the ecological impact of biocides. The International Maritime Organization's (IMO) 2001 International Convention on the Control of Harmful Anti-fouling Systems on Ships marked a watershed moment, globally prohibiting the use of tributyltin (TBT)-based coatings due to their devastating effects on marine ecosystems, particularly their endocrine-disrupting properties in mollusks.

This prohibition catalyzed the development of alternative anti-fouling technologies and established a precedent for subsequent regulatory frameworks. Currently, regional regulations exhibit considerable variation in stringency and scope. The European Union's Biocidal Products Regulation (BPR) implements one of the most comprehensive regulatory systems, requiring extensive ecotoxicological data and risk assessments for active substances in anti-fouling products. Similarly, the U.S. Environmental Protection Agency regulates these coatings under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), with specific provisions addressing copper release rates.

Asia-Pacific jurisdictions have implemented increasingly stringent regulations, with countries like Japan, South Korea, and Australia adopting restrictions on copper content and leaching rates. China's recent environmental initiatives have also begun to address marine coating standards as part of broader pollution control efforts. These regional variations create significant compliance challenges for coating manufacturers operating in global markets.

Beyond biocide regulation, emerging compliance standards are addressing broader environmental concerns. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation impacts raw materials selection for coating formulations. Additionally, volatile organic compound (VOC) emissions are regulated under various national and regional frameworks, including the U.S. Clean Air Act and comparable legislation in Europe and Asia.

Certification schemes like the Environmental Product Declaration (EPD) and various eco-labels are gaining prominence, providing market differentiation for environmentally superior products. The shipping industry's decarbonization goals, articulated in the IMO's greenhouse gas reduction strategy, are also influencing coating development, with emphasis on products that reduce hull friction and consequently decrease fuel consumption and emissions.

Compliance with this complex regulatory landscape necessitates sophisticated testing methodologies. Standardized protocols for measuring biocide release rates, ecotoxicity, and coating performance have been developed by organizations such as ASTM International, ISO, and various national standards bodies. These protocols ensure consistent evaluation across different products and jurisdictions, facilitating regulatory compliance and market access.

This prohibition catalyzed the development of alternative anti-fouling technologies and established a precedent for subsequent regulatory frameworks. Currently, regional regulations exhibit considerable variation in stringency and scope. The European Union's Biocidal Products Regulation (BPR) implements one of the most comprehensive regulatory systems, requiring extensive ecotoxicological data and risk assessments for active substances in anti-fouling products. Similarly, the U.S. Environmental Protection Agency regulates these coatings under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), with specific provisions addressing copper release rates.

Asia-Pacific jurisdictions have implemented increasingly stringent regulations, with countries like Japan, South Korea, and Australia adopting restrictions on copper content and leaching rates. China's recent environmental initiatives have also begun to address marine coating standards as part of broader pollution control efforts. These regional variations create significant compliance challenges for coating manufacturers operating in global markets.

Beyond biocide regulation, emerging compliance standards are addressing broader environmental concerns. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation impacts raw materials selection for coating formulations. Additionally, volatile organic compound (VOC) emissions are regulated under various national and regional frameworks, including the U.S. Clean Air Act and comparable legislation in Europe and Asia.

Certification schemes like the Environmental Product Declaration (EPD) and various eco-labels are gaining prominence, providing market differentiation for environmentally superior products. The shipping industry's decarbonization goals, articulated in the IMO's greenhouse gas reduction strategy, are also influencing coating development, with emphasis on products that reduce hull friction and consequently decrease fuel consumption and emissions.

Compliance with this complex regulatory landscape necessitates sophisticated testing methodologies. Standardized protocols for measuring biocide release rates, ecotoxicity, and coating performance have been developed by organizations such as ASTM International, ISO, and various national standards bodies. These protocols ensure consistent evaluation across different products and jurisdictions, facilitating regulatory compliance and market access.

Performance Testing Methodologies and Field Validation

The evaluation of anti-fouling coating performance requires rigorous testing methodologies that simulate real-world marine conditions while providing quantifiable metrics for comparison. Laboratory testing serves as the foundation of performance assessment, with static immersion tests being the most fundamental approach. These tests involve submerging coated panels in seawater tanks for extended periods, typically 1-3 years, with regular inspection intervals to document fouling progression and coating degradation.

Dynamic testing methodologies have evolved to better replicate actual vessel operating conditions. Rotating drum tests simulate water flow across coated surfaces at various speeds, while flow cell systems allow for controlled hydrodynamic conditions that more accurately represent marine environments. These methods provide critical data on coating performance under movement conditions, which static tests cannot adequately capture.

Accelerated aging protocols have been developed to compress testing timelines, exposing coatings to intensified UV radiation, temperature cycling, and concentrated biofouling challenges. While valuable for rapid screening, these methods must be carefully correlated with real-world performance to ensure validity of results. Standardized testing procedures from organizations such as ASTM, ISO, and naval research institutions provide essential frameworks for consistent evaluation across the industry.

Field validation represents the ultimate performance assessment, involving the application of coatings to vessel sections or dedicated test patches on operational ships. These in-service trials track performance across various marine environments, vessel speeds, and operational profiles. Underwater hull inspection protocols typically include photographic documentation, fouling rating systems, and thickness measurements to quantify coating wear rates.

Recent technological advancements have enhanced field validation capabilities through underwater drones equipped with high-resolution cameras and sensors that can monitor coating performance without dry-docking. Data analytics platforms now integrate performance metrics across multiple vessels and coating systems, enabling statistical analysis of performance factors across diverse operating conditions.

The correlation between laboratory testing and field performance remains a significant challenge, with ongoing research focused on developing predictive models that can accurately translate accelerated test results to real-world performance expectations. This includes the development of digital twins and simulation environments that incorporate multiple environmental variables to forecast coating longevity and effectiveness across different marine ecosystems and vessel operational profiles.

Dynamic testing methodologies have evolved to better replicate actual vessel operating conditions. Rotating drum tests simulate water flow across coated surfaces at various speeds, while flow cell systems allow for controlled hydrodynamic conditions that more accurately represent marine environments. These methods provide critical data on coating performance under movement conditions, which static tests cannot adequately capture.

Accelerated aging protocols have been developed to compress testing timelines, exposing coatings to intensified UV radiation, temperature cycling, and concentrated biofouling challenges. While valuable for rapid screening, these methods must be carefully correlated with real-world performance to ensure validity of results. Standardized testing procedures from organizations such as ASTM, ISO, and naval research institutions provide essential frameworks for consistent evaluation across the industry.

Field validation represents the ultimate performance assessment, involving the application of coatings to vessel sections or dedicated test patches on operational ships. These in-service trials track performance across various marine environments, vessel speeds, and operational profiles. Underwater hull inspection protocols typically include photographic documentation, fouling rating systems, and thickness measurements to quantify coating wear rates.

Recent technological advancements have enhanced field validation capabilities through underwater drones equipped with high-resolution cameras and sensors that can monitor coating performance without dry-docking. Data analytics platforms now integrate performance metrics across multiple vessels and coating systems, enabling statistical analysis of performance factors across diverse operating conditions.

The correlation between laboratory testing and field performance remains a significant challenge, with ongoing research focused on developing predictive models that can accurately translate accelerated test results to real-world performance expectations. This includes the development of digital twins and simulation environments that incorporate multiple environmental variables to forecast coating longevity and effectiveness across different marine ecosystems and vessel operational profiles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!