Self Polishing Anti Fouling Paints Formulation Advances

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Polishing Antifouling Technology Background and Objectives

Self-polishing antifouling (SPA) technology represents a significant advancement in marine coatings, evolving from early biocide-based solutions to sophisticated controlled-release systems. The development trajectory began in the 1970s with tributyltin (TBT) self-polishing copolymers, which revolutionized ship hull protection but were later banned due to severe environmental impacts. This catalyzed intensive research into alternative technologies that balance efficacy with environmental sustainability.

The technical evolution of SPA coatings has progressed through distinct phases: first-generation TBT-based systems, second-generation copper-based alternatives, and current third-generation formulations incorporating novel biocides and polymer technologies. Each iteration has aimed to enhance performance while reducing ecological footprint, reflecting the industry's response to increasingly stringent regulatory frameworks worldwide.

Current research focuses on optimizing the hydrolysis mechanisms that enable the controlled erosion of the coating surface, releasing biocides at a predetermined rate while maintaining a smooth hull profile. This self-polishing effect is critical for long-term performance, as it prevents biofilm accumulation and reduces hydrodynamic drag, directly impacting vessel fuel efficiency and operational costs.

The primary technical objective in SPA formulation advancement is developing systems that provide effective protection for extended periods (ideally 60+ months) while minimizing environmental impact. This involves sophisticated polymer chemistry to control erosion rates, biocide encapsulation technologies for targeted release, and surface engineering to create physical deterrents to organism settlement.

Market drivers have significantly influenced technical development paths, with international maritime regulations like the International Maritime Organization's (IMO) Biofouling Guidelines and regional restrictions on biocide use shaping research priorities. The industry is witnessing a paradigm shift toward "green" antifouling solutions, spurring innovation in biomimetic approaches and non-toxic alternatives.

Emerging trends include hybrid systems combining traditional biocides with novel mechanisms such as surface topography modification, hydrophobic/hydrophilic balancing, and enzyme-based technologies. These approaches aim to disrupt the biological processes involved in marine biofouling rather than simply killing settling organisms.

The technological trajectory points toward multi-functional coating systems that not only prevent fouling but also contribute to vessel performance through reduced friction, self-healing capabilities, and smart responsive features that adapt to changing environmental conditions. This holistic approach represents the future direction of SPA technology, where coating performance is measured not just by antifouling efficacy but by overall contribution to maritime sustainability goals.

The technical evolution of SPA coatings has progressed through distinct phases: first-generation TBT-based systems, second-generation copper-based alternatives, and current third-generation formulations incorporating novel biocides and polymer technologies. Each iteration has aimed to enhance performance while reducing ecological footprint, reflecting the industry's response to increasingly stringent regulatory frameworks worldwide.

Current research focuses on optimizing the hydrolysis mechanisms that enable the controlled erosion of the coating surface, releasing biocides at a predetermined rate while maintaining a smooth hull profile. This self-polishing effect is critical for long-term performance, as it prevents biofilm accumulation and reduces hydrodynamic drag, directly impacting vessel fuel efficiency and operational costs.

The primary technical objective in SPA formulation advancement is developing systems that provide effective protection for extended periods (ideally 60+ months) while minimizing environmental impact. This involves sophisticated polymer chemistry to control erosion rates, biocide encapsulation technologies for targeted release, and surface engineering to create physical deterrents to organism settlement.

Market drivers have significantly influenced technical development paths, with international maritime regulations like the International Maritime Organization's (IMO) Biofouling Guidelines and regional restrictions on biocide use shaping research priorities. The industry is witnessing a paradigm shift toward "green" antifouling solutions, spurring innovation in biomimetic approaches and non-toxic alternatives.

Emerging trends include hybrid systems combining traditional biocides with novel mechanisms such as surface topography modification, hydrophobic/hydrophilic balancing, and enzyme-based technologies. These approaches aim to disrupt the biological processes involved in marine biofouling rather than simply killing settling organisms.

The technological trajectory points toward multi-functional coating systems that not only prevent fouling but also contribute to vessel performance through reduced friction, self-healing capabilities, and smart responsive features that adapt to changing environmental conditions. This holistic approach represents the future direction of SPA technology, where coating performance is measured not just by antifouling efficacy but by overall contribution to maritime sustainability goals.

Marine Industry Demand Analysis for Advanced Antifouling Solutions

The global marine industry faces significant challenges related to biofouling, which occurs when marine organisms attach to submerged surfaces like ship hulls. This phenomenon increases drag, fuel consumption, and operational costs while facilitating the spread of invasive species across marine ecosystems. According to recent industry reports, biofouling can increase fuel consumption by up to 40% and maintenance costs by millions of dollars annually for large commercial vessels.

The demand for advanced antifouling solutions has intensified due to stricter environmental regulations, particularly the International Maritime Organization's (IMO) ban on tributyltin (TBT) compounds and increasing restrictions on copper-based alternatives. The global shipping industry, representing over 80% of world trade by volume, requires sustainable solutions that maintain vessel efficiency while complying with evolving environmental standards.

Commercial shipping operators seek antifouling technologies that can extend dry-docking intervals beyond the current industry standard of 3-5 years, potentially saving significant operational costs. The global market for marine coatings was valued at approximately $3.9 billion in 2022, with antifouling coatings representing the fastest-growing segment, projected to expand at a CAGR of 8.2% through 2030.

Offshore energy infrastructure presents another significant market segment, with oil and gas platforms, wind turbines, and tidal energy systems requiring specialized antifouling solutions for stationary marine structures. These applications demand coatings with different performance characteristics than those used for mobile vessels, creating opportunities for tailored formulation approaches.

Recreational boating represents a substantial market segment, particularly in North America and Europe, where environmental consciousness among consumers drives demand for eco-friendly antifouling solutions. This sector values ease of application and maintenance alongside environmental compliance.

Aquaculture, one of the fastest-growing food production sectors globally, faces significant challenges from biofouling on nets, cages, and other infrastructure. The industry requires specialized antifouling solutions that ensure no contamination of farmed species while maintaining operational efficiency.

The naval defense sector constitutes a premium market segment with specific requirements for long-lasting performance, acoustic properties, and resistance to detection technologies. This sector often drives innovation in high-performance coating systems that eventually transfer to commercial applications.

Market analysis indicates growing demand for self-polishing copolymer (SPC) technologies that can deliver controlled biocide release without harmful environmental impacts. Silicone-based foul-release coatings are gaining market share, particularly in premium vessel segments where fuel efficiency justifies higher initial investment in advanced coating systems.

The demand for advanced antifouling solutions has intensified due to stricter environmental regulations, particularly the International Maritime Organization's (IMO) ban on tributyltin (TBT) compounds and increasing restrictions on copper-based alternatives. The global shipping industry, representing over 80% of world trade by volume, requires sustainable solutions that maintain vessel efficiency while complying with evolving environmental standards.

Commercial shipping operators seek antifouling technologies that can extend dry-docking intervals beyond the current industry standard of 3-5 years, potentially saving significant operational costs. The global market for marine coatings was valued at approximately $3.9 billion in 2022, with antifouling coatings representing the fastest-growing segment, projected to expand at a CAGR of 8.2% through 2030.

Offshore energy infrastructure presents another significant market segment, with oil and gas platforms, wind turbines, and tidal energy systems requiring specialized antifouling solutions for stationary marine structures. These applications demand coatings with different performance characteristics than those used for mobile vessels, creating opportunities for tailored formulation approaches.

Recreational boating represents a substantial market segment, particularly in North America and Europe, where environmental consciousness among consumers drives demand for eco-friendly antifouling solutions. This sector values ease of application and maintenance alongside environmental compliance.

Aquaculture, one of the fastest-growing food production sectors globally, faces significant challenges from biofouling on nets, cages, and other infrastructure. The industry requires specialized antifouling solutions that ensure no contamination of farmed species while maintaining operational efficiency.

The naval defense sector constitutes a premium market segment with specific requirements for long-lasting performance, acoustic properties, and resistance to detection technologies. This sector often drives innovation in high-performance coating systems that eventually transfer to commercial applications.

Market analysis indicates growing demand for self-polishing copolymer (SPC) technologies that can deliver controlled biocide release without harmful environmental impacts. Silicone-based foul-release coatings are gaining market share, particularly in premium vessel segments where fuel efficiency justifies higher initial investment in advanced coating systems.

Current Antifouling Paint Technologies and Challenges

The antifouling paint industry currently faces significant technical challenges despite considerable advancements in recent decades. Traditional biocide-based antifouling paints, which dominated the market for years, have increasingly come under regulatory scrutiny due to their environmental impact. Tributyltin (TBT)-based formulations, once the industry standard, have been globally banned since 2008 due to their devastating effects on marine ecosystems, including shell deformations in mollusks and endocrine disruption in various marine species.

Current commercial self-polishing antifouling paints primarily rely on copper-based biocides, typically copper oxide or copper pyrithione, supplemented with booster biocides to enhance efficacy against copper-resistant organisms. However, these formulations face mounting challenges as copper compounds are increasingly restricted in many jurisdictions due to accumulation in harbor sediments and toxicity to non-target organisms.

The technical formulation of self-polishing copolymer (SPC) systems presents significant challenges in achieving optimal erosion rates. The hydrolysis mechanism that enables controlled biocide release must be precisely engineered to maintain effectiveness throughout the coating's service life, typically 3-5 years. Achieving consistent polishing rates across varying hydrodynamic conditions remains problematic, with premature biocide depletion in high-flow areas and insufficient release in static conditions.

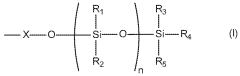

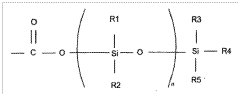

Polymer matrix development represents another critical challenge. Current acrylic and methacrylic copolymers with hydrolyzable side chains require careful balancing of hydrophobic and hydrophilic properties to achieve desired polishing rates without compromising mechanical stability. The incorporation of biocides into these matrices without affecting the hydrolysis mechanism demands sophisticated encapsulation techniques and surface chemistry modifications.

Emerging regulatory frameworks worldwide are progressively restricting traditional biocides, creating urgent demand for alternative technologies. The EU Biocidal Products Regulation and similar legislation in Asia-Pacific markets have accelerated the phase-out timeline for copper-based formulations, forcing manufacturers to invest in novel approaches with uncertain commercial viability.

Performance consistency across diverse marine environments presents additional challenges. Antifouling paints must withstand varying salinity, temperature, pH levels, and biological pressures from different fouling organisms. Current formulations often demonstrate regional performance variations, necessitating market-specific product development that increases manufacturing complexity and costs.

The industry also struggles with application and adhesion issues. Self-polishing coatings must adhere effectively to various substrates while maintaining their controlled erosion properties. Balancing these contradictory requirements—strong initial adhesion versus programmed degradation—remains technically challenging, particularly for applications on aluminum hulls and composite materials increasingly used in modern vessel construction.

Current commercial self-polishing antifouling paints primarily rely on copper-based biocides, typically copper oxide or copper pyrithione, supplemented with booster biocides to enhance efficacy against copper-resistant organisms. However, these formulations face mounting challenges as copper compounds are increasingly restricted in many jurisdictions due to accumulation in harbor sediments and toxicity to non-target organisms.

The technical formulation of self-polishing copolymer (SPC) systems presents significant challenges in achieving optimal erosion rates. The hydrolysis mechanism that enables controlled biocide release must be precisely engineered to maintain effectiveness throughout the coating's service life, typically 3-5 years. Achieving consistent polishing rates across varying hydrodynamic conditions remains problematic, with premature biocide depletion in high-flow areas and insufficient release in static conditions.

Polymer matrix development represents another critical challenge. Current acrylic and methacrylic copolymers with hydrolyzable side chains require careful balancing of hydrophobic and hydrophilic properties to achieve desired polishing rates without compromising mechanical stability. The incorporation of biocides into these matrices without affecting the hydrolysis mechanism demands sophisticated encapsulation techniques and surface chemistry modifications.

Emerging regulatory frameworks worldwide are progressively restricting traditional biocides, creating urgent demand for alternative technologies. The EU Biocidal Products Regulation and similar legislation in Asia-Pacific markets have accelerated the phase-out timeline for copper-based formulations, forcing manufacturers to invest in novel approaches with uncertain commercial viability.

Performance consistency across diverse marine environments presents additional challenges. Antifouling paints must withstand varying salinity, temperature, pH levels, and biological pressures from different fouling organisms. Current formulations often demonstrate regional performance variations, necessitating market-specific product development that increases manufacturing complexity and costs.

The industry also struggles with application and adhesion issues. Self-polishing coatings must adhere effectively to various substrates while maintaining their controlled erosion properties. Balancing these contradictory requirements—strong initial adhesion versus programmed degradation—remains technically challenging, particularly for applications on aluminum hulls and composite materials increasingly used in modern vessel construction.

Current Formulation Approaches for Self-Polishing Antifouling Paints

01 Polymer-based self-polishing systems

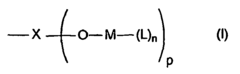

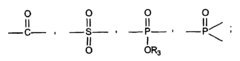

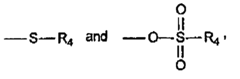

Self-polishing antifouling paints often utilize specialized polymers that hydrolyze in seawater, creating a controlled erosion mechanism. These formulations typically include acrylic or methacrylic polymers with hydrolyzable groups that gradually break down in marine environments, continuously exposing fresh biocide layers. This controlled erosion maintains an active surface and provides long-term antifouling performance while minimizing biocide leaching rates.- Polymer-based self-polishing systems: Self-polishing antifouling paints can be formulated using specific polymers that undergo controlled hydrolysis in seawater. These polymers, often acrylates or methacrylates with hydrolyzable groups, gradually erode in water, creating a constantly renewed surface that releases biocides at a controlled rate. This mechanism ensures long-term effectiveness by maintaining a fresh active layer and reducing biofouling accumulation on ship hulls and marine structures.

- Biocide incorporation and release mechanisms: Effective antifouling paints incorporate various biocides that are released in a controlled manner to prevent marine organism attachment. These formulations typically contain copper compounds as primary biocides, often supplemented with organic co-biocides for enhanced effectiveness against a broader spectrum of fouling organisms. The release rate of these active ingredients is carefully engineered through the paint matrix composition to provide optimal protection while minimizing environmental impact and extending the coating's service life.

- Environmentally friendly formulations: Modern self-polishing antifouling paints are increasingly formulated with environmentally friendly components to reduce marine ecosystem impact. These formulations replace traditional toxic biocides with biodegradable alternatives, natural compounds, or biomimetic approaches. Some utilize silicone-based or fluoropolymer technologies that create ultra-smooth, low surface energy coatings that prevent organism attachment through physical rather than chemical means, offering effective fouling protection while meeting stringent environmental regulations.

- Rosin-based formulations: Rosin-based compounds remain important components in self-polishing antifouling paint formulations. Derived from pine tree resin, rosin provides natural water solubility and contributes to the controlled erosion mechanism of the coating. These formulations typically combine rosin with various polymers and additives to optimize the polishing rate, mechanical properties, and biocide release characteristics. The natural origin of rosin also offers some environmental advantages compared to fully synthetic alternatives while maintaining effective antifouling performance.

- Additives for enhanced performance: Various additives are incorporated into self-polishing antifouling paint formulations to enhance their performance characteristics. These include rheology modifiers to improve application properties, pigments for visibility and UV protection, plasticizers for flexibility, and reinforcing agents for mechanical strength. Specialized additives such as copper scavengers, adhesion promoters, and anti-settling agents are also used to address specific performance requirements. The careful selection and balance of these additives significantly impact the coating's durability, effectiveness, and application characteristics.

02 Biocide incorporation techniques

Effective antifouling formulations incorporate various biocides that are strategically released to prevent marine organism attachment. These biocides include copper compounds, zinc pyrithione, and organic alternatives that are less harmful to the environment. The formulation must balance biocide release rates with paint durability, often using controlled-release technologies to maintain effectiveness throughout the coating's service life while minimizing environmental impact.Expand Specific Solutions03 Environmentally friendly formulation approaches

Modern self-polishing antifouling paints increasingly focus on environmentally sustainable formulations that reduce ecological impact. These approaches include biodegradable polymers, natural product-derived biocides, and silicone-based foul-release coatings that prevent organism attachment through physical rather than chemical means. These formulations aim to maintain effective antifouling performance while complying with increasingly stringent environmental regulations.Expand Specific Solutions04 Hydrolysis rate control mechanisms

Controlling the hydrolysis rate of self-polishing antifouling paints is crucial for optimal performance. Formulations incorporate pH buffers, hydrolysis inhibitors, or accelerators to fine-tune the erosion rate according to specific marine conditions. The paint matrix composition, including the selection of co-binders, plasticizers, and fillers, significantly influences the hydrolysis kinetics and ultimately determines the coating's service life and effectiveness in different water temperatures and flow conditions.Expand Specific Solutions05 Reinforcement and adhesion enhancement

Self-polishing antifouling paint formulations require excellent adhesion to substrates and mechanical durability to withstand harsh marine conditions. Formulations incorporate specialized adhesion promoters, cross-linking agents, and reinforcing materials to improve coating integrity. These components help prevent premature failure through delamination or mechanical damage while maintaining the controlled polishing mechanism. Proper surface preparation protocols and primer systems are also essential components of the complete antifouling system.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Antifouling Coatings

The self-polishing anti-fouling paints market is currently in a mature growth phase, with an estimated global market size exceeding $5 billion and projected CAGR of 6-8% through 2028. The competitive landscape features established marine coating specialists like Jotun AS, Hempel A/S, and Chugoku Marine Paints dominating with advanced copper-free formulations, alongside emerging players such as CNOOC Changzhou and Xiamen Sunrui developing environmentally compliant alternatives. Technical maturity varies significantly, with industry leaders (AkzoNobel, PPG) investing heavily in silyl acrylate and metal-free technologies, while research institutions (Ocean University of China, Technical University of Denmark) focus on biocide-free innovations. The regulatory shift toward eco-friendly formulations is accelerating R&D collaboration between commercial entities and academic institutions to meet IMO's increasingly stringent environmental standards.

Hempel A/S

Technical Solution: Hempel has developed the GLOBIC and HEMPAGUARD series of self-polishing anti-fouling paints based on their patented ActiGuard technology. This innovative approach combines hydrolysing silyl acrylate polymers with controlled biocide release mechanisms to provide extended protection periods of up to 90 months. Their formulations incorporate specially engineered microfibers that strengthen the paint matrix while maintaining optimal polishing rates. Hempel's research has focused on developing binder systems that maintain consistent performance across varying vessel operational profiles, from high-speed container ships to slow-steaming bulk carriers. Their HEMPAGUARD X7 product combines silicone-hydrogel technology with biocide enhancement, creating a smooth surface with extremely low friction properties. Independent testing has verified fuel savings of up to 8% compared to conventional anti-fouling coatings. Hempel has also pioneered digital monitoring systems that track coating performance in real-time, allowing for data-driven maintenance decisions.

Strengths: Strong focus on innovation with significant R&D investment; excellent long-term performance data; comprehensive technical support and application guidance. Weaknesses: Premium pricing positions products at the higher end of the market; some formulations require specialized application equipment; performance benefits may be less noticeable for vessels with irregular operational patterns.

Chugoku Marine Paints, Ltd.

Technical Solution: Chugoku Marine Paints has developed the SEA GRANDPRIX series, featuring advanced hydrolysis-type self-polishing copolymer technology. Their proprietary zinc acrylate polymer system provides controlled release of biocides through a unique reaction with seawater that maintains a consistently active surface. CMP's formulations incorporate specialized rheology modifiers that enhance application properties while ensuring optimal polishing rates under various operating conditions. Their research has demonstrated that their hydrophilic surface technology reduces the initial attachment of marine organisms by creating an unfavorable settlement environment. CMP has also pioneered low-friction coating technologies that combine anti-fouling properties with drag reduction capabilities, achieving documented fuel savings of 4-8% compared to conventional anti-fouling systems. Recent innovations include the development of nano-capsule technology that enables more precise control of biocide release rates, extending effective service life while reducing overall environmental impact.

Strengths: Strong presence in Asian markets with extensive shipyard relationships; specialized formulations for different water temperatures and vessel types; excellent technical support network. Weaknesses: Limited market penetration in some Western markets; some formulations have shorter effective lifespans compared to premium competitors; higher sensitivity to improper application techniques.

Key Patents and Innovations in Biocide Release Mechanisms

Self-polishing marine antifouling paint composition comprising fibres and metal-containing co-polymers

PatentInactiveEP1299482B1

Innovation

- Incorporation of specific fibres into a self-polishing marine antifouling paint composition with a binder co-polymer containing terminal metal ester bonds, which enhances mechanical strength and resistance to blistering, as demonstrated by improved performance in the Blister Box Test.

A self-polishing antifouling paint composition comprising solid particles of entrapped or encapsulated rosin constituents

PatentWO2013034158A1

Innovation

- Incorporating solid particles of entrapped or encapsulated rosin constituents into the paint composition, which replace a portion of the pigment phase, allowing for reduced or eliminated use of Cu20 and ZnO while maintaining self-polishing properties by gradually dissolving in seawater.

Environmental Regulations Impact on Antifouling Paint Development

Environmental regulations have become a pivotal force shaping the development trajectory of antifouling paint technologies, particularly self-polishing systems. The landmark International Maritime Organization (IMO) ban on tributyltin (TBT) compounds in 2008 represented a watershed moment, compelling manufacturers to radically reformulate their products. This regulatory shift stemmed from extensive research documenting TBT's severe ecological impacts, including endocrine disruption in marine organisms and bioaccumulation throughout food chains.

In response to these restrictions, the industry has witnessed an accelerated transition toward copper-based alternatives and copper-free formulations. However, these solutions face increasingly stringent regulatory scrutiny themselves. The European Union's Biocidal Products Regulation (BPR) and similar frameworks in North America have established comprehensive approval processes for active substances, requiring extensive ecotoxicological data and environmental fate assessments.

Regional variations in regulatory approaches create significant complexity for global manufacturers. While the EU has implemented some of the most stringent controls on copper release rates and biocide registration, other maritime regions maintain different standards. This regulatory fragmentation necessitates tailored formulation strategies for different markets, increasing research and development costs substantially.

The regulatory landscape continues to evolve toward more comprehensive lifecycle assessments. Modern regulations increasingly consider not only the toxicity of active ingredients but also their degradation products, leaching rates, and potential for bioaccumulation. This holistic approach has driven innovation in controlled-release technologies and biodegradable polymer matrices that optimize biocide efficiency while minimizing environmental loading.

Anticipatory regulatory compliance has emerged as a competitive advantage in the industry. Forward-thinking manufacturers are investing in green chemistry approaches that align with predicted regulatory trajectories, including biomimetic technologies and naturally-derived antifouling compounds. These initiatives often receive preferential treatment under regulatory frameworks that incentivize environmentally preferable alternatives.

The economic implications of regulatory compliance have reshaped market dynamics significantly. Higher barriers to entry created by extensive testing requirements have consolidated the industry around larger players with substantial R&D resources. Simultaneously, this has created niche opportunities for specialized firms focused exclusively on regulatory-compliant innovation in specific application domains.

Looking ahead, the regulatory horizon suggests continued pressure toward zero-harm formulations. Emerging regulations are likely to further restrict copper content, driving research into novel biocide-free technologies. This regulatory pressure, while challenging, continues to serve as a powerful catalyst for technological advancement in self-polishing antifouling systems.

In response to these restrictions, the industry has witnessed an accelerated transition toward copper-based alternatives and copper-free formulations. However, these solutions face increasingly stringent regulatory scrutiny themselves. The European Union's Biocidal Products Regulation (BPR) and similar frameworks in North America have established comprehensive approval processes for active substances, requiring extensive ecotoxicological data and environmental fate assessments.

Regional variations in regulatory approaches create significant complexity for global manufacturers. While the EU has implemented some of the most stringent controls on copper release rates and biocide registration, other maritime regions maintain different standards. This regulatory fragmentation necessitates tailored formulation strategies for different markets, increasing research and development costs substantially.

The regulatory landscape continues to evolve toward more comprehensive lifecycle assessments. Modern regulations increasingly consider not only the toxicity of active ingredients but also their degradation products, leaching rates, and potential for bioaccumulation. This holistic approach has driven innovation in controlled-release technologies and biodegradable polymer matrices that optimize biocide efficiency while minimizing environmental loading.

Anticipatory regulatory compliance has emerged as a competitive advantage in the industry. Forward-thinking manufacturers are investing in green chemistry approaches that align with predicted regulatory trajectories, including biomimetic technologies and naturally-derived antifouling compounds. These initiatives often receive preferential treatment under regulatory frameworks that incentivize environmentally preferable alternatives.

The economic implications of regulatory compliance have reshaped market dynamics significantly. Higher barriers to entry created by extensive testing requirements have consolidated the industry around larger players with substantial R&D resources. Simultaneously, this has created niche opportunities for specialized firms focused exclusively on regulatory-compliant innovation in specific application domains.

Looking ahead, the regulatory horizon suggests continued pressure toward zero-harm formulations. Emerging regulations are likely to further restrict copper content, driving research into novel biocide-free technologies. This regulatory pressure, while challenging, continues to serve as a powerful catalyst for technological advancement in self-polishing antifouling systems.

Performance Testing and Validation Methodologies

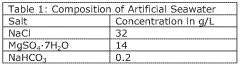

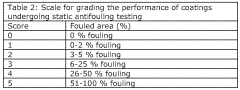

The validation of self-polishing antifouling (SPA) paint formulations requires rigorous testing methodologies to ensure their effectiveness in real-world marine environments. Standard laboratory tests include static immersion panels, where coated panels are submerged in seawater tanks with controlled conditions to monitor biofouling accumulation rates. These tests typically run for 3-6 months and provide preliminary data on coating performance under controlled conditions.

Rotary drum testing represents a more dynamic approach, simulating vessel movement through water. Coated cylinders rotate at various speeds in seawater tanks, allowing researchers to evaluate the self-polishing mechanisms and erosion rates under different hydrodynamic conditions. This methodology is particularly valuable for understanding how water flow affects the release rates of biocides and the physical polishing characteristics of the coating.

Field testing remains the gold standard for comprehensive validation. This involves applying experimental formulations to vessel hulls or dedicated test patches on commercial ships, followed by periodic inspection during dry-docking. Advanced underwater inspection techniques using ROVs (Remotely Operated Vehicles) equipped with high-resolution cameras now allow for interim assessments without removing vessels from service, significantly reducing evaluation costs and timeframes.

Analytical chemistry plays a crucial role in performance validation through leaching rate studies. Techniques such as high-performance liquid chromatography (HPLC) and inductively coupled plasma mass spectrometry (ICP-MS) enable precise measurement of biocide release rates over time. These measurements help establish the coating's effective lifespan and compliance with environmental regulations regarding biocide discharge.

Surface analysis techniques including scanning electron microscopy (SEM), atomic force microscopy (AFM), and X-ray photoelectron spectroscopy (XPS) provide detailed characterization of coating surface changes during polishing. These methods reveal microscopic erosion patterns, hydration layers, and chemical composition changes that directly influence antifouling performance.

Accelerated aging tests have been developed to compress testing timeframes, exposing coatings to elevated temperatures, UV radiation, and artificial seawater conditions that simulate years of service in months. While valuable for rapid screening, these methods require careful correlation with real-world performance data to ensure validity.

Computational fluid dynamics (CFD) modeling has emerged as a complementary validation tool, allowing researchers to predict hydrodynamic effects on coating performance across different vessel types and operating conditions. These simulations, when calibrated with experimental data, help optimize formulations for specific applications without extensive physical testing.

Rotary drum testing represents a more dynamic approach, simulating vessel movement through water. Coated cylinders rotate at various speeds in seawater tanks, allowing researchers to evaluate the self-polishing mechanisms and erosion rates under different hydrodynamic conditions. This methodology is particularly valuable for understanding how water flow affects the release rates of biocides and the physical polishing characteristics of the coating.

Field testing remains the gold standard for comprehensive validation. This involves applying experimental formulations to vessel hulls or dedicated test patches on commercial ships, followed by periodic inspection during dry-docking. Advanced underwater inspection techniques using ROVs (Remotely Operated Vehicles) equipped with high-resolution cameras now allow for interim assessments without removing vessels from service, significantly reducing evaluation costs and timeframes.

Analytical chemistry plays a crucial role in performance validation through leaching rate studies. Techniques such as high-performance liquid chromatography (HPLC) and inductively coupled plasma mass spectrometry (ICP-MS) enable precise measurement of biocide release rates over time. These measurements help establish the coating's effective lifespan and compliance with environmental regulations regarding biocide discharge.

Surface analysis techniques including scanning electron microscopy (SEM), atomic force microscopy (AFM), and X-ray photoelectron spectroscopy (XPS) provide detailed characterization of coating surface changes during polishing. These methods reveal microscopic erosion patterns, hydration layers, and chemical composition changes that directly influence antifouling performance.

Accelerated aging tests have been developed to compress testing timeframes, exposing coatings to elevated temperatures, UV radiation, and artificial seawater conditions that simulate years of service in months. While valuable for rapid screening, these methods require careful correlation with real-world performance data to ensure validity.

Computational fluid dynamics (CFD) modeling has emerged as a complementary validation tool, allowing researchers to predict hydrodynamic effects on coating performance across different vessel types and operating conditions. These simulations, when calibrated with experimental data, help optimize formulations for specific applications without extensive physical testing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!