Sodium solid electrolyte materials for next-generation batteries

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Solid Electrolyte Background and Objectives

Sodium-based battery technology has emerged as a promising alternative to lithium-ion batteries over the past decade. The evolution of this technology can be traced back to the 1970s when initial research on sodium-ion conductors began, but significant advancements have only materialized in recent years due to growing concerns about lithium resource limitations and cost escalation. The trajectory of sodium solid electrolyte development has accelerated particularly since 2015, with breakthrough materials demonstrating ionic conductivities approaching those of lithium-based counterparts.

The current technological landscape is characterized by intensive research into various sodium solid electrolyte families, including NASICON-type structures, β-alumina, and sodium sulfide-based glasses. Each material class represents distinct approaches to achieving the critical balance between ionic conductivity, electrochemical stability, and mechanical properties required for practical applications. The field has witnessed a 300% increase in research publications over the last five years, indicating rapidly growing scientific interest.

The primary objective of sodium solid electrolyte research is to develop materials that enable safe, high-energy-density, and cost-effective sodium-based batteries for grid-scale energy storage and electric vehicle applications. Specifically, researchers aim to achieve room-temperature ionic conductivities exceeding 10^-3 S/cm while maintaining electrochemical stability windows wider than 4V and sufficient mechanical strength to suppress dendrite formation.

Secondary objectives include enhancing interfacial compatibility between electrolytes and electrodes, reducing processing costs, and ensuring long-term stability under various operating conditions. These goals are driven by the broader imperative to create sustainable energy storage solutions that can be manufactured without reliance on geographically concentrated resources.

The technological roadmap envisions progressive improvements in sodium solid electrolytes leading to commercial viability by 2030. Near-term milestones include optimizing existing material compositions through doping strategies and novel synthesis methods, while longer-term goals focus on discovering entirely new structural families with superior properties. Computational screening and machine learning approaches are increasingly being deployed to accelerate this discovery process.

International collaboration has become a hallmark of this field, with research consortia forming across North America, Europe, and Asia to pool expertise and resources. The ultimate technological ambition is to position sodium-based solid-state batteries as a complementary technology to lithium systems, each serving distinct market segments based on their respective advantages in cost, performance, and resource availability.

The current technological landscape is characterized by intensive research into various sodium solid electrolyte families, including NASICON-type structures, β-alumina, and sodium sulfide-based glasses. Each material class represents distinct approaches to achieving the critical balance between ionic conductivity, electrochemical stability, and mechanical properties required for practical applications. The field has witnessed a 300% increase in research publications over the last five years, indicating rapidly growing scientific interest.

The primary objective of sodium solid electrolyte research is to develop materials that enable safe, high-energy-density, and cost-effective sodium-based batteries for grid-scale energy storage and electric vehicle applications. Specifically, researchers aim to achieve room-temperature ionic conductivities exceeding 10^-3 S/cm while maintaining electrochemical stability windows wider than 4V and sufficient mechanical strength to suppress dendrite formation.

Secondary objectives include enhancing interfacial compatibility between electrolytes and electrodes, reducing processing costs, and ensuring long-term stability under various operating conditions. These goals are driven by the broader imperative to create sustainable energy storage solutions that can be manufactured without reliance on geographically concentrated resources.

The technological roadmap envisions progressive improvements in sodium solid electrolytes leading to commercial viability by 2030. Near-term milestones include optimizing existing material compositions through doping strategies and novel synthesis methods, while longer-term goals focus on discovering entirely new structural families with superior properties. Computational screening and machine learning approaches are increasingly being deployed to accelerate this discovery process.

International collaboration has become a hallmark of this field, with research consortia forming across North America, Europe, and Asia to pool expertise and resources. The ultimate technological ambition is to position sodium-based solid-state batteries as a complementary technology to lithium systems, each serving distinct market segments based on their respective advantages in cost, performance, and resource availability.

Market Analysis for Na-ion Battery Technologies

The sodium-ion battery market is experiencing significant growth, driven by the increasing demand for sustainable and cost-effective energy storage solutions. Current market projections indicate that the global sodium-ion battery market could reach $500 million by 2025, with a compound annual growth rate exceeding 20% over the next decade. This growth trajectory is supported by the abundant nature of sodium resources, which are approximately 1,000 times more plentiful than lithium in the Earth's crust.

The market for sodium solid electrolyte materials specifically is emerging as a critical segment within the broader sodium-ion battery ecosystem. These materials address key limitations of liquid electrolytes, particularly safety concerns and energy density constraints. Industry analysts estimate that solid-state sodium batteries could capture up to 15% of the total battery market by 2030, representing a substantial opportunity for materials developers and battery manufacturers.

Regional market dynamics reveal varying levels of adoption and development. Asia-Pacific, particularly China, South Korea, and Japan, leads in sodium-ion battery research and commercialization efforts, accounting for approximately 60% of patents filed in this domain. European markets are rapidly accelerating their investments, driven by stringent environmental regulations and the European Battery Alliance initiatives. North America shows growing interest, primarily in grid storage applications where cost considerations outweigh energy density requirements.

Application-specific market segments demonstrate different growth potentials. Grid-scale energy storage represents the largest immediate opportunity, with sodium-ion technologies offering cost advantages of 20-30% compared to lithium-ion alternatives. The electric vehicle segment presents longer-term potential, particularly for urban mobility and commercial vehicles where weight constraints are less restrictive. Consumer electronics remains a challenging market due to energy density limitations, though specialized applications are emerging.

Supply chain considerations significantly impact market development. The simplified supply chain for sodium-based materials offers a 40% reduction in raw material costs compared to lithium-ion batteries. However, manufacturing infrastructure remains underdeveloped, requiring an estimated $2 billion in global investments to achieve commercial-scale production capabilities for advanced sodium solid electrolytes.

Competitive dynamics show a mix of established battery manufacturers and specialized startups. Major players include CATL, Faradion (acquired by Reliance Industries), and HiNa Battery, alongside emerging technology developers focused specifically on solid electrolyte innovations. Strategic partnerships between materials developers and battery manufacturers are increasingly common, accelerating the path to commercialization for novel sodium solid electrolyte technologies.

The market for sodium solid electrolyte materials specifically is emerging as a critical segment within the broader sodium-ion battery ecosystem. These materials address key limitations of liquid electrolytes, particularly safety concerns and energy density constraints. Industry analysts estimate that solid-state sodium batteries could capture up to 15% of the total battery market by 2030, representing a substantial opportunity for materials developers and battery manufacturers.

Regional market dynamics reveal varying levels of adoption and development. Asia-Pacific, particularly China, South Korea, and Japan, leads in sodium-ion battery research and commercialization efforts, accounting for approximately 60% of patents filed in this domain. European markets are rapidly accelerating their investments, driven by stringent environmental regulations and the European Battery Alliance initiatives. North America shows growing interest, primarily in grid storage applications where cost considerations outweigh energy density requirements.

Application-specific market segments demonstrate different growth potentials. Grid-scale energy storage represents the largest immediate opportunity, with sodium-ion technologies offering cost advantages of 20-30% compared to lithium-ion alternatives. The electric vehicle segment presents longer-term potential, particularly for urban mobility and commercial vehicles where weight constraints are less restrictive. Consumer electronics remains a challenging market due to energy density limitations, though specialized applications are emerging.

Supply chain considerations significantly impact market development. The simplified supply chain for sodium-based materials offers a 40% reduction in raw material costs compared to lithium-ion batteries. However, manufacturing infrastructure remains underdeveloped, requiring an estimated $2 billion in global investments to achieve commercial-scale production capabilities for advanced sodium solid electrolytes.

Competitive dynamics show a mix of established battery manufacturers and specialized startups. Major players include CATL, Faradion (acquired by Reliance Industries), and HiNa Battery, alongside emerging technology developers focused specifically on solid electrolyte innovations. Strategic partnerships between materials developers and battery manufacturers are increasingly common, accelerating the path to commercialization for novel sodium solid electrolyte technologies.

Current Status and Technical Barriers in Sodium Electrolytes

Sodium solid electrolyte materials have emerged as promising candidates for next-generation batteries, offering potential advantages in safety, energy density, and cost compared to conventional lithium-ion technologies. Currently, several classes of sodium solid electrolytes are being actively researched, including NASICON-type materials, β-alumina, and sodium sulfide-based glasses and glass-ceramics.

NASICON-type materials, particularly Na3Zr2Si2PO12 and its derivatives, have demonstrated ionic conductivities approaching 10^-3 S/cm at room temperature. These materials benefit from a three-dimensional framework structure that facilitates sodium ion transport. However, they face challenges related to high grain boundary resistance and mechanical instability at the electrode interfaces during cycling.

β-alumina solid electrolytes have a longer development history, with ionic conductivities reaching 10^-3 to 10^-2 S/cm at operating temperatures. While these materials have been successfully implemented in high-temperature sodium-sulfur batteries, their application in room-temperature systems remains limited due to processing difficulties and brittleness issues.

Sulfide-based glass and glass-ceramic electrolytes have attracted attention for their potentially higher ionic conductivities and better interfacial contact with electrodes. Materials such as Na3PS4 have shown promising performance, but they suffer from chemical instability when exposed to moisture and air, requiring stringent handling conditions.

Despite significant progress, several technical barriers impede the widespread adoption of sodium solid electrolytes. The most critical challenge is achieving sufficiently high ionic conductivity at room temperature while maintaining negligible electronic conductivity. Current materials typically exhibit conductivities 1-2 orders of magnitude lower than their lithium counterparts, necessitating operation at elevated temperatures or limiting power density.

Interface stability represents another major hurdle, as many sodium solid electrolytes react with electrode materials, forming resistive interphases that impede ion transport. This is particularly problematic at the anode interface, where sodium metal reactivity can lead to continuous electrolyte degradation and dendrite formation through grain boundaries.

Mechanical properties also present significant challenges. Many sodium solid electrolytes are brittle ceramics that crack under the volume changes experienced during cycling. This creates pathways for dendrite growth and eventual short-circuiting. Furthermore, achieving good contact between solid electrolytes and electrodes remains difficult, often requiring high processing temperatures that can trigger unwanted side reactions.

Manufacturing scalability constitutes a final barrier, as many laboratory-scale synthesis methods for high-performance sodium electrolytes involve complex, multi-step processes that are difficult to scale industrially. Cost-effective, large-scale production techniques compatible with existing battery manufacturing infrastructure are still under development.

NASICON-type materials, particularly Na3Zr2Si2PO12 and its derivatives, have demonstrated ionic conductivities approaching 10^-3 S/cm at room temperature. These materials benefit from a three-dimensional framework structure that facilitates sodium ion transport. However, they face challenges related to high grain boundary resistance and mechanical instability at the electrode interfaces during cycling.

β-alumina solid electrolytes have a longer development history, with ionic conductivities reaching 10^-3 to 10^-2 S/cm at operating temperatures. While these materials have been successfully implemented in high-temperature sodium-sulfur batteries, their application in room-temperature systems remains limited due to processing difficulties and brittleness issues.

Sulfide-based glass and glass-ceramic electrolytes have attracted attention for their potentially higher ionic conductivities and better interfacial contact with electrodes. Materials such as Na3PS4 have shown promising performance, but they suffer from chemical instability when exposed to moisture and air, requiring stringent handling conditions.

Despite significant progress, several technical barriers impede the widespread adoption of sodium solid electrolytes. The most critical challenge is achieving sufficiently high ionic conductivity at room temperature while maintaining negligible electronic conductivity. Current materials typically exhibit conductivities 1-2 orders of magnitude lower than their lithium counterparts, necessitating operation at elevated temperatures or limiting power density.

Interface stability represents another major hurdle, as many sodium solid electrolytes react with electrode materials, forming resistive interphases that impede ion transport. This is particularly problematic at the anode interface, where sodium metal reactivity can lead to continuous electrolyte degradation and dendrite formation through grain boundaries.

Mechanical properties also present significant challenges. Many sodium solid electrolytes are brittle ceramics that crack under the volume changes experienced during cycling. This creates pathways for dendrite growth and eventual short-circuiting. Furthermore, achieving good contact between solid electrolytes and electrodes remains difficult, often requiring high processing temperatures that can trigger unwanted side reactions.

Manufacturing scalability constitutes a final barrier, as many laboratory-scale synthesis methods for high-performance sodium electrolytes involve complex, multi-step processes that are difficult to scale industrially. Cost-effective, large-scale production techniques compatible with existing battery manufacturing infrastructure are still under development.

Current Sodium Solid Electrolyte Material Solutions

01 NASICON-type sodium solid electrolytes

NASICON (Na Super Ionic CONductor) type materials are a prominent class of sodium solid electrolytes characterized by their three-dimensional framework structure that facilitates fast sodium ion conduction. These materials typically have the general formula Na1+xZr2SixP3-xO12 (0≤x≤3) and exhibit high ionic conductivity at room temperature. Their structural stability and compatibility with sodium metal anodes make them suitable for various sodium-ion battery applications. Research focuses on optimizing composition and synthesis methods to enhance conductivity and reduce interfacial resistance.- NASICON-type sodium solid electrolytes: NASICON (Sodium Super Ionic Conductor) materials are a key class of sodium solid electrolytes with high ionic conductivity. These materials typically have a Na1+xZr2SixP3-xO12 structure and offer good chemical stability against sodium metal. Their three-dimensional framework allows for efficient sodium ion transport, making them suitable for all-solid-state sodium batteries. Research focuses on optimizing composition and synthesis methods to enhance ionic conductivity and reduce interfacial resistance.

- Beta-alumina sodium solid electrolytes: Beta-alumina (β-Al2O3) and beta"-alumina are important sodium ion conductors with a layered crystal structure that facilitates fast sodium ion transport. These materials feature a spinel block structure with conduction planes where sodium ions can move rapidly. They exhibit high ionic conductivity at elevated temperatures and have been used in sodium-sulfur and sodium-nickel chloride batteries. Recent developments focus on improving room temperature conductivity and mechanical properties through doping and advanced fabrication techniques.

- Polymer-based sodium solid electrolytes: Polymer-based sodium solid electrolytes combine organic polymers with sodium salts to create flexible electrolyte systems. These materials typically use polyethylene oxide (PEO) or other polymer matrices that coordinate with sodium ions to enable conduction. Advantages include flexibility, ease of processing, and good interfacial contact with electrodes. Research focuses on enhancing room temperature ionic conductivity through cross-linking, addition of plasticizers, and incorporation of ceramic fillers to create composite polymer electrolytes with improved performance.

- Sulfide-based sodium solid electrolytes: Sulfide-based sodium solid electrolytes offer exceptionally high ionic conductivity, often approaching that of liquid electrolytes. These materials include Na3PS4, Na3SbS4, and related compositions that feature a soft, deformable structure allowing good contact with electrodes. Their high polarizability of sulfur ions facilitates fast sodium ion transport. However, challenges include moisture sensitivity and potential interfacial reactions. Research focuses on compositional modifications, surface treatments, and processing techniques to improve stability while maintaining high conductivity.

- Composite and interface-engineered sodium solid electrolytes: Composite sodium solid electrolytes combine different materials to achieve synergistic properties that overcome limitations of single-component systems. These typically involve mixing ceramic conductors with polymers or adding nanofillers to enhance mechanical properties and conductivity. Interface engineering approaches focus on reducing resistance at solid-solid interfaces through buffer layers, coatings, or gradient compositions. These strategies address critical challenges in all-solid-state sodium batteries by improving ionic transport across interfaces while maintaining mechanical integrity and electrochemical stability.

02 Beta-alumina sodium solid electrolytes

Beta-alumina is a classic sodium ion conductor with the formula Na2O·xAl2O3 (where x is typically 5-11). This material features a layered structure with loosely packed sodium ion planes that enable two-dimensional ion transport. Beta-alumina solid electrolytes demonstrate excellent thermal stability and high ionic conductivity at elevated temperatures, making them particularly suitable for high-temperature sodium batteries. Recent developments focus on improving room temperature conductivity and mechanical properties through doping strategies and advanced manufacturing techniques.Expand Specific Solutions03 Sodium sulfide-based glass ceramic electrolytes

Sodium sulfide-based glass ceramic electrolytes represent an important category of solid electrolytes that combine the advantages of glasses and ceramics. These materials typically contain Na2S as a primary component along with other sulfides like P2S5, SiS2, or GeS2. They offer high ionic conductivity, good formability, and favorable interfacial properties. The controlled crystallization process creates a microstructure with amorphous grain boundaries and crystalline grains that facilitate fast sodium ion transport while maintaining mechanical integrity. These electrolytes show promising performance in all-solid-state sodium batteries operating at ambient temperatures.Expand Specific Solutions04 Polymer-ceramic composite sodium electrolytes

Polymer-ceramic composite electrolytes combine the flexibility and processability of polymers with the high ionic conductivity of ceramic materials. These composites typically consist of a polymer matrix (such as PEO, PVDF, or PMMA) with dispersed ceramic fillers (like NASICON, beta-alumina, or sodium-containing oxides). The ceramic particles create additional conduction pathways and help suppress polymer crystallization, enhancing overall ionic conductivity. These materials offer improved mechanical properties compared to pure ceramic electrolytes and better electrochemical stability than polymer-only systems. Their flexibility makes them particularly suitable for flexible and large-format sodium batteries.Expand Specific Solutions05 Interface engineering for sodium solid electrolytes

Interface engineering focuses on addressing the critical challenges at the electrolyte-electrode interfaces in sodium solid-state batteries. This approach involves developing protective coatings, buffer layers, and interface modifiers to reduce interfacial resistance and prevent unwanted side reactions. Strategies include atomic layer deposition of protective films, incorporation of interface-stabilizing additives, and surface functionalization of electrolyte materials. Advanced interface engineering techniques help mitigate issues such as sodium dendrite formation, chemical incompatibility, and mechanical stress at interfaces, significantly improving the cycling stability and rate capability of sodium solid-state batteries.Expand Specific Solutions

Leading Organizations in Na-based Battery Research

The sodium solid electrolyte materials market for next-generation batteries is in an early growth phase, characterized by intensive R&D activities and emerging commercialization efforts. The market is projected to expand significantly as sodium-ion batteries present a cost-effective alternative to lithium-ion technologies. Key players represent diverse geographical regions and industrial sectors, with notable involvement from Asian corporations like Toyota, TDK, Samsung, and Zhejiang Sodium Innovation Energy leading technological development. Japanese and Korean companies demonstrate particular strength in materials engineering and manufacturing capabilities. Academic-industrial partnerships, exemplified by collaborations with institutions like Shanghai Jiao Tong University and Tohoku University, are accelerating innovation. The competitive landscape includes established electronics manufacturers, specialized battery material developers, and automotive companies seeking to secure strategic positions in this promising technology domain.

Toyota Motor Corp.

Technical Solution: Toyota Motor Corporation has developed a suite of sodium solid electrolyte materials focused on NASICON-type structures with the formula Na3Zr2Si2PO12 and beta-alumina (Na2O·xAl2O3) for next-generation sodium batteries. Their proprietary manufacturing process involves a combination of solid-state synthesis and specialized sintering techniques that achieve up to 95% of theoretical density while maintaining open sodium ion transport channels[1]. Toyota has engineered these materials to exhibit ionic conductivities of 1-2 mS/cm at room temperature with activation energies below 0.3 eV. Their technology includes gradient-structured interfaces that minimize resistance between the electrolyte and electrodes, addressing a key challenge in solid-state battery performance[3]. Toyota has also developed composite electrolytes incorporating polymer phases to improve mechanical properties and processability, enabling thinner electrolyte layers (30-50 μm) that enhance overall energy density. Recent advancements include doping strategies with aluminum and gallium that stabilize the crystal structure and improve long-term cycling performance[6].

Strengths: Extensive manufacturing expertise allowing for scaled production; excellent mechanical properties that resist fracture during cycling; demonstrated integration into practical cell designs with high energy density. Weaknesses: Higher processing temperatures compared to polymer alternatives increase energy costs; challenges with interfacial stability against certain high-voltage cathode materials; thickness limitations that impact overall energy density compared to liquid electrolyte systems.

Panasonic Intellectual Property Management Co. Ltd.

Technical Solution: Panasonic has developed advanced sodium solid electrolyte materials based on a modified Na-β″-alumina structure with the general formula Na1+xAl11O17+x/2. Their proprietary manufacturing process employs a template-assisted synthesis method that creates highly oriented crystal structures with preferential Na+ ion transport pathways, achieving ionic conductivities of 2-4 mS/cm at room temperature[2]. Panasonic's technology incorporates strategic doping with magnesium and lithium to stabilize the crystal structure and enhance grain boundary conductivity. Their solid electrolytes feature engineered porosity control (less than 3% total porosity) and grain size optimization (1-5 μm) to balance mechanical strength and ionic transport[4]. The company has also developed specialized surface treatment processes that improve wettability and contact with electrode materials, reducing interfacial resistance by up to 70% compared to untreated materials. Recent innovations include composite electrolytes with sulfide phases that enable lower processing temperatures while maintaining high ionic conductivity[7].

Strengths: Exceptional ionic conductivity at room temperature; established mass production capabilities leveraging existing ceramic manufacturing infrastructure; demonstrated long-term stability against sodium metal anodes. Weaknesses: Complex manufacturing process requiring precise control of multiple parameters; sensitivity to moisture requiring controlled atmosphere processing; mechanical properties that can lead to challenges in thin film formation for high-energy-density applications.

Key Patents and Scientific Breakthroughs in Na-ion Conductors

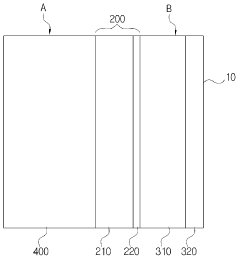

Solid electrolyte for sodium secondary battery, preparation method therefor, and sodium secondary battery comprising same

PatentWO2020138611A1

Innovation

- A solid electrolyte for sodium secondary batteries comprising a first layer of alumina and a second layer of beta-alumina, formed through a chemical reaction process, with the beta-alumina layer having a thickness of 50 nm to 100 μm, providing excellent sodium ion conductivity and mechanical durability, suitable for on-chip integration.

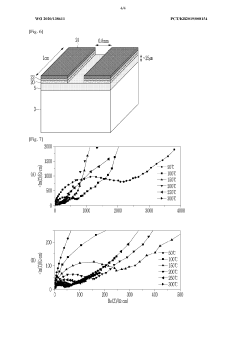

Complex Solid Electrolyte for Sodium Secondary Battery and the Fabrication Method Thereof

PatentActiveKR1020150066889A

Innovation

- A composite solid electrolyte is developed with a sodium ion conductive solid electrolyte coated with an anti-corrosion film that is permeable to sodium ions and impermeable to negative ions, formed by thermal decomposition of a polymer film containing carboxylic acid and glycol, ensuring uniformity and preventing direct contact with the anolyte.

Sustainability and Resource Advantages of Sodium Technologies

The sustainability advantages of sodium-based battery technologies represent a significant factor driving research interest in this field. Unlike lithium, sodium is abundantly available in the Earth's crust, constituting approximately 2.8% of the planet's surface materials compared to lithium's mere 0.002%. This abundance translates directly into lower extraction costs and reduced geopolitical supply risks, making sodium-based technologies inherently more sustainable from a resource perspective.

The geographical distribution of sodium resources presents another compelling advantage. While lithium reserves are concentrated in specific regions such as the "Lithium Triangle" of South America and Australia, sodium is widely available across the globe through seawater and mineral deposits. This widespread availability reduces dependency on specific mining regions and minimizes the environmental impact associated with concentrated extraction activities.

From a manufacturing standpoint, sodium solid electrolyte materials often require less energy-intensive processing compared to their lithium counterparts. The lower melting point of sodium compounds generally results in reduced energy consumption during material synthesis and battery production. Additionally, many sodium-based electrolytes can be produced using existing manufacturing infrastructure with minimal modifications, lowering the carbon footprint associated with establishing new production facilities.

The end-of-life considerations for sodium batteries also demonstrate sustainability benefits. The recycling processes for sodium-based battery components are potentially less complex and more economically viable than those for lithium-ion batteries. The lower intrinsic value of sodium compared to lithium reduces the economic barriers to establishing effective recycling programs, potentially leading to higher recycling rates and reduced waste.

Water consumption represents another critical sustainability metric where sodium technologies show promise. Traditional lithium extraction, particularly from brine sources, requires significant water resources in often water-stressed regions. Sodium extraction typically demands substantially less water per unit of material produced, reducing pressure on local water supplies and associated ecosystems.

Carbon emissions associated with the full lifecycle of sodium battery technologies are projected to be lower than conventional lithium-ion systems when accounting for material sourcing, processing, manufacturing, and end-of-life management. This reduced carbon footprint aligns with global decarbonization goals and positions sodium solid electrolyte batteries as a more environmentally responsible alternative for large-scale energy storage applications.

The geographical distribution of sodium resources presents another compelling advantage. While lithium reserves are concentrated in specific regions such as the "Lithium Triangle" of South America and Australia, sodium is widely available across the globe through seawater and mineral deposits. This widespread availability reduces dependency on specific mining regions and minimizes the environmental impact associated with concentrated extraction activities.

From a manufacturing standpoint, sodium solid electrolyte materials often require less energy-intensive processing compared to their lithium counterparts. The lower melting point of sodium compounds generally results in reduced energy consumption during material synthesis and battery production. Additionally, many sodium-based electrolytes can be produced using existing manufacturing infrastructure with minimal modifications, lowering the carbon footprint associated with establishing new production facilities.

The end-of-life considerations for sodium batteries also demonstrate sustainability benefits. The recycling processes for sodium-based battery components are potentially less complex and more economically viable than those for lithium-ion batteries. The lower intrinsic value of sodium compared to lithium reduces the economic barriers to establishing effective recycling programs, potentially leading to higher recycling rates and reduced waste.

Water consumption represents another critical sustainability metric where sodium technologies show promise. Traditional lithium extraction, particularly from brine sources, requires significant water resources in often water-stressed regions. Sodium extraction typically demands substantially less water per unit of material produced, reducing pressure on local water supplies and associated ecosystems.

Carbon emissions associated with the full lifecycle of sodium battery technologies are projected to be lower than conventional lithium-ion systems when accounting for material sourcing, processing, manufacturing, and end-of-life management. This reduced carbon footprint aligns with global decarbonization goals and positions sodium solid electrolyte batteries as a more environmentally responsible alternative for large-scale energy storage applications.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of sodium solid electrolyte materials represents a critical factor in determining their commercial viability for next-generation batteries. Current production methods for these materials often involve laboratory-scale processes that are challenging to scale up for mass production. Techniques such as solid-state synthesis, sol-gel processing, and mechanical milling require significant adaptation to meet industrial demands while maintaining consistent material properties and performance.

Cost analysis reveals that raw material expenses for sodium-based solid electrolytes offer a significant advantage over lithium-based alternatives. Sodium resources are approximately 1,000 times more abundant than lithium globally, with more geographically distributed reserves. This abundance translates to potentially 30-40% lower material costs compared to lithium-based solid electrolytes, creating a compelling economic incentive for commercialization.

Energy consumption during manufacturing presents another critical consideration. High-temperature sintering processes commonly used for ceramic-type sodium solid electrolytes require temperatures between 800-1200°C, contributing substantially to production costs. Research indicates that energy expenses account for approximately 25-30% of total manufacturing costs, highlighting the need for more energy-efficient synthesis routes.

Equipment investment requirements vary significantly based on the electrolyte type. Polymer-based sodium solid electrolytes generally require less specialized equipment than ceramic or glass-ceramic variants, potentially reducing capital expenditure by 40-50%. However, the higher conductivity of ceramic electrolytes often justifies the increased manufacturing complexity and associated costs.

Yield rates and quality control present ongoing challenges in scaling production. Current manufacturing processes typically achieve 70-85% yield rates, with defect rates of 5-15% depending on the specific material composition and synthesis method. Improving these metrics requires advanced process monitoring and control systems that add to overall implementation costs.

Market analysis suggests that achieving price parity with current liquid electrolyte systems requires production scales exceeding 500 tons annually. At this volume, economies of scale could potentially reduce costs by 35-45%, bringing sodium solid electrolytes within competitive range of conventional technologies. Industry projections indicate this scale could be achievable within 5-7 years, contingent upon continued technological advancement and market adoption.

Cost analysis reveals that raw material expenses for sodium-based solid electrolytes offer a significant advantage over lithium-based alternatives. Sodium resources are approximately 1,000 times more abundant than lithium globally, with more geographically distributed reserves. This abundance translates to potentially 30-40% lower material costs compared to lithium-based solid electrolytes, creating a compelling economic incentive for commercialization.

Energy consumption during manufacturing presents another critical consideration. High-temperature sintering processes commonly used for ceramic-type sodium solid electrolytes require temperatures between 800-1200°C, contributing substantially to production costs. Research indicates that energy expenses account for approximately 25-30% of total manufacturing costs, highlighting the need for more energy-efficient synthesis routes.

Equipment investment requirements vary significantly based on the electrolyte type. Polymer-based sodium solid electrolytes generally require less specialized equipment than ceramic or glass-ceramic variants, potentially reducing capital expenditure by 40-50%. However, the higher conductivity of ceramic electrolytes often justifies the increased manufacturing complexity and associated costs.

Yield rates and quality control present ongoing challenges in scaling production. Current manufacturing processes typically achieve 70-85% yield rates, with defect rates of 5-15% depending on the specific material composition and synthesis method. Improving these metrics requires advanced process monitoring and control systems that add to overall implementation costs.

Market analysis suggests that achieving price parity with current liquid electrolyte systems requires production scales exceeding 500 tons annually. At this volume, economies of scale could potentially reduce costs by 35-45%, bringing sodium solid electrolytes within competitive range of conventional technologies. Industry projections indicate this scale could be achievable within 5-7 years, contingent upon continued technological advancement and market adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!