Retrofitting Existing Plants with Ultrafiltration Technology: Key Considerations

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ultrafiltration Retrofitting Background and Objectives

Ultrafiltration technology has evolved significantly over the past four decades, transitioning from experimental laboratory applications to becoming a cornerstone of modern water and wastewater treatment systems. Initially developed in the 1960s, ultrafiltration membranes gained commercial traction in the 1980s primarily in specialized industrial applications. The technology has since undergone substantial refinement in membrane materials, module configurations, and operational protocols, enabling broader adoption across municipal and industrial sectors.

The evolution of ultrafiltration has been characterized by several key technological advancements. Membrane materials have progressed from cellulose acetate to more robust polymeric materials such as polysulfone, polyethersulfone, and PVDF (polyvinylidene fluoride), significantly enhancing chemical resistance, mechanical strength, and operational lifespan. Module designs have similarly evolved from plate-and-frame configurations to hollow fiber and spiral-wound formats that optimize surface area to volume ratios and hydraulic performance.

Current market trends indicate accelerating adoption of ultrafiltration technology, driven by increasingly stringent water quality regulations, growing water scarcity concerns, and the need for more efficient treatment processes. The global ultrafiltration market is projected to grow at a CAGR of 15.2% through 2028, with retrofitting existing plants representing a substantial portion of this growth trajectory.

The primary objective of ultrafiltration retrofitting is to enhance existing water and wastewater treatment facilities without necessitating complete system overhauls. This approach aims to leverage the superior filtration capabilities of ultrafiltration membranes—typically removing particles in the 0.01-0.1 micron range—while utilizing existing infrastructure to minimize capital expenditure and operational disruption.

Specific technical goals for ultrafiltration retrofitting include: improving effluent quality to meet more stringent regulatory requirements; increasing treatment capacity within existing footprints; reducing chemical consumption associated with conventional treatment processes; enhancing operational reliability and process stability; and providing an effective barrier against pathogens, particularly in drinking water applications.

The retrofitting approach also addresses emerging contaminants of concern, including microplastics, pharmaceutical residues, and industrial micropollutants, which conventional treatment processes often fail to adequately remove. By integrating ultrafiltration technology into existing treatment trains, facilities can achieve multi-barrier protection while extending the functional lifespan of aging infrastructure.

As water treatment paradigms shift toward resource recovery and circular economy principles, ultrafiltration retrofitting represents a strategic technological bridge, enabling facilities to adapt to evolving requirements while preserving investments in existing infrastructure. This technological trajectory aligns with broader sustainability objectives while addressing immediate operational challenges faced by water treatment operators worldwide.

The evolution of ultrafiltration has been characterized by several key technological advancements. Membrane materials have progressed from cellulose acetate to more robust polymeric materials such as polysulfone, polyethersulfone, and PVDF (polyvinylidene fluoride), significantly enhancing chemical resistance, mechanical strength, and operational lifespan. Module designs have similarly evolved from plate-and-frame configurations to hollow fiber and spiral-wound formats that optimize surface area to volume ratios and hydraulic performance.

Current market trends indicate accelerating adoption of ultrafiltration technology, driven by increasingly stringent water quality regulations, growing water scarcity concerns, and the need for more efficient treatment processes. The global ultrafiltration market is projected to grow at a CAGR of 15.2% through 2028, with retrofitting existing plants representing a substantial portion of this growth trajectory.

The primary objective of ultrafiltration retrofitting is to enhance existing water and wastewater treatment facilities without necessitating complete system overhauls. This approach aims to leverage the superior filtration capabilities of ultrafiltration membranes—typically removing particles in the 0.01-0.1 micron range—while utilizing existing infrastructure to minimize capital expenditure and operational disruption.

Specific technical goals for ultrafiltration retrofitting include: improving effluent quality to meet more stringent regulatory requirements; increasing treatment capacity within existing footprints; reducing chemical consumption associated with conventional treatment processes; enhancing operational reliability and process stability; and providing an effective barrier against pathogens, particularly in drinking water applications.

The retrofitting approach also addresses emerging contaminants of concern, including microplastics, pharmaceutical residues, and industrial micropollutants, which conventional treatment processes often fail to adequately remove. By integrating ultrafiltration technology into existing treatment trains, facilities can achieve multi-barrier protection while extending the functional lifespan of aging infrastructure.

As water treatment paradigms shift toward resource recovery and circular economy principles, ultrafiltration retrofitting represents a strategic technological bridge, enabling facilities to adapt to evolving requirements while preserving investments in existing infrastructure. This technological trajectory aligns with broader sustainability objectives while addressing immediate operational challenges faced by water treatment operators worldwide.

Market Demand Analysis for Plant Ultrafiltration Upgrades

The global market for ultrafiltration technology in industrial plants has experienced significant growth over the past decade, driven by increasingly stringent environmental regulations, water scarcity concerns, and the need for more efficient resource utilization. Current market analysis indicates that the industrial ultrafiltration market is valued at approximately $2.5 billion, with a compound annual growth rate projected between 7-9% through 2028.

Water-intensive industries such as power generation, chemical processing, food and beverage, and pharmaceuticals represent the primary sectors driving demand for ultrafiltration retrofits. These industries face mounting pressure to reduce water consumption, minimize wastewater discharge, and improve overall operational efficiency. The power generation sector alone accounts for nearly 30% of the retrofit market, as aging facilities seek to extend operational lifespans while meeting tightening environmental standards.

Regional analysis reveals varying market dynamics. North America and Europe demonstrate mature markets with demand primarily focused on upgrading existing infrastructure, while Asia-Pacific represents the fastest-growing region with double-digit growth rates. This growth is attributed to rapid industrialization, urbanization, and increasing regulatory pressure in countries like China and India.

Customer needs assessment indicates several key drivers for ultrafiltration retrofits. Process optimization ranks highest, with 68% of surveyed plant operators citing improved operational efficiency as their primary motivation. Environmental compliance follows closely at 62%, while cost reduction through water reuse and reduced chemical consumption was identified by 57% of respondents.

Market segmentation by retrofit type shows membrane replacement projects constitute approximately 45% of the market, complete system upgrades account for 35%, and hybrid solutions combining ultrafiltration with other technologies represent the remaining 20%. The hybrid segment demonstrates the highest growth potential as facilities seek comprehensive water management solutions.

Economic analysis reveals compelling return on investment metrics for ultrafiltration retrofits. Case studies across various industries indicate payback periods ranging from 18-36 months, with water-intensive operations achieving faster returns. Total cost of ownership calculations show 15-25% operational cost reductions over a ten-year period compared to conventional treatment methods.

Future market projections indicate continued strong growth, particularly in developing economies implementing more stringent environmental regulations. Technological advancements in membrane materials and system design are expected to further drive adoption by addressing historical barriers related to fouling, energy consumption, and maintenance requirements.

Water-intensive industries such as power generation, chemical processing, food and beverage, and pharmaceuticals represent the primary sectors driving demand for ultrafiltration retrofits. These industries face mounting pressure to reduce water consumption, minimize wastewater discharge, and improve overall operational efficiency. The power generation sector alone accounts for nearly 30% of the retrofit market, as aging facilities seek to extend operational lifespans while meeting tightening environmental standards.

Regional analysis reveals varying market dynamics. North America and Europe demonstrate mature markets with demand primarily focused on upgrading existing infrastructure, while Asia-Pacific represents the fastest-growing region with double-digit growth rates. This growth is attributed to rapid industrialization, urbanization, and increasing regulatory pressure in countries like China and India.

Customer needs assessment indicates several key drivers for ultrafiltration retrofits. Process optimization ranks highest, with 68% of surveyed plant operators citing improved operational efficiency as their primary motivation. Environmental compliance follows closely at 62%, while cost reduction through water reuse and reduced chemical consumption was identified by 57% of respondents.

Market segmentation by retrofit type shows membrane replacement projects constitute approximately 45% of the market, complete system upgrades account for 35%, and hybrid solutions combining ultrafiltration with other technologies represent the remaining 20%. The hybrid segment demonstrates the highest growth potential as facilities seek comprehensive water management solutions.

Economic analysis reveals compelling return on investment metrics for ultrafiltration retrofits. Case studies across various industries indicate payback periods ranging from 18-36 months, with water-intensive operations achieving faster returns. Total cost of ownership calculations show 15-25% operational cost reductions over a ten-year period compared to conventional treatment methods.

Future market projections indicate continued strong growth, particularly in developing economies implementing more stringent environmental regulations. Technological advancements in membrane materials and system design are expected to further drive adoption by addressing historical barriers related to fouling, energy consumption, and maintenance requirements.

Current Ultrafiltration Technology Landscape and Challenges

Ultrafiltration (UF) technology has evolved significantly over the past three decades, transitioning from a niche separation process to a mainstream water treatment technology. Currently, the global ultrafiltration market is valued at approximately $2.5 billion, with an annual growth rate of 8-10%, driven primarily by increasing water scarcity and stringent water quality regulations worldwide.

The contemporary UF landscape is characterized by membrane modules with varying configurations, including hollow fiber, spiral wound, tubular, and plate-and-frame designs. Hollow fiber configurations dominate the municipal water treatment sector due to their high packing density and backwashing capabilities, while spiral wound modules are prevalent in industrial applications requiring high pressure operation.

Polymeric membranes constitute about 85% of the current market, with polysulfone (PS), polyethersulfone (PES), and polyvinylidene fluoride (PVDF) being the predominant materials. These materials offer different balances of permeability, selectivity, and chemical resistance. Ceramic membranes, though more expensive, are gaining traction in harsh industrial environments due to their superior thermal and chemical stability.

Despite technological advancements, several challenges persist in retrofitting existing plants with UF technology. Foremost is the space constraint, as many older facilities were not designed with membrane systems in mind. Integration with existing infrastructure often requires significant modifications to piping, pumping, and control systems, increasing capital expenditure beyond the cost of the membrane units themselves.

Fouling remains a critical operational challenge, particularly in plants treating water with high organic content or variable quality. Biofouling, organic fouling, and scaling can significantly reduce membrane performance and lifespan, necessitating sophisticated pretreatment and cleaning regimes that may not be easily accommodated in retrofitted systems.

Energy consumption presents another hurdle, as UF systems typically require 0.2-0.5 kWh/m³ of treated water, which can substantially increase operational costs for facilities not originally designed with such energy demands in consideration. This is exacerbated in retrofit scenarios where optimal hydraulic design may be compromised.

Regulatory compliance adds complexity to retrofitting projects, as newer water quality standards often necessitate additional treatment steps beyond UF, such as disinfection or advanced oxidation processes, further complicating integration efforts.

The technological landscape is also marked by regional disparities, with North America and Europe leading in adoption rates and technological innovation, while developing regions in Asia and Africa show the highest growth potential but face significant implementation barriers related to cost and technical expertise.

The contemporary UF landscape is characterized by membrane modules with varying configurations, including hollow fiber, spiral wound, tubular, and plate-and-frame designs. Hollow fiber configurations dominate the municipal water treatment sector due to their high packing density and backwashing capabilities, while spiral wound modules are prevalent in industrial applications requiring high pressure operation.

Polymeric membranes constitute about 85% of the current market, with polysulfone (PS), polyethersulfone (PES), and polyvinylidene fluoride (PVDF) being the predominant materials. These materials offer different balances of permeability, selectivity, and chemical resistance. Ceramic membranes, though more expensive, are gaining traction in harsh industrial environments due to their superior thermal and chemical stability.

Despite technological advancements, several challenges persist in retrofitting existing plants with UF technology. Foremost is the space constraint, as many older facilities were not designed with membrane systems in mind. Integration with existing infrastructure often requires significant modifications to piping, pumping, and control systems, increasing capital expenditure beyond the cost of the membrane units themselves.

Fouling remains a critical operational challenge, particularly in plants treating water with high organic content or variable quality. Biofouling, organic fouling, and scaling can significantly reduce membrane performance and lifespan, necessitating sophisticated pretreatment and cleaning regimes that may not be easily accommodated in retrofitted systems.

Energy consumption presents another hurdle, as UF systems typically require 0.2-0.5 kWh/m³ of treated water, which can substantially increase operational costs for facilities not originally designed with such energy demands in consideration. This is exacerbated in retrofit scenarios where optimal hydraulic design may be compromised.

Regulatory compliance adds complexity to retrofitting projects, as newer water quality standards often necessitate additional treatment steps beyond UF, such as disinfection or advanced oxidation processes, further complicating integration efforts.

The technological landscape is also marked by regional disparities, with North America and Europe leading in adoption rates and technological innovation, while developing regions in Asia and Africa show the highest growth potential but face significant implementation barriers related to cost and technical expertise.

Current Retrofitting Approaches and Implementation Strategies

01 Membrane module retrofitting for existing systems

Retrofitting existing water treatment systems with ultrafiltration membrane modules can significantly improve filtration efficiency and water quality. This approach involves replacing conventional filtration components with advanced membrane modules that offer superior particle removal and reduced footprint. The retrofitting process typically includes assessment of existing infrastructure, modification of piping systems, and integration of membrane modules with minimal disruption to ongoing operations.- Retrofitting existing water treatment systems with ultrafiltration technology: Existing water treatment systems can be upgraded by retrofitting ultrafiltration technology to improve filtration efficiency and water quality. This approach allows facilities to enhance their treatment capabilities without complete system replacement. The retrofitting process typically involves integrating ultrafiltration modules into the existing infrastructure, modifying piping systems, and implementing control systems to manage the new filtration process. This modernization can significantly improve the removal of contaminants, pathogens, and suspended solids.

- Membrane module design and installation for retrofitting applications: Specialized membrane module designs facilitate easier retrofitting of ultrafiltration technology into existing systems. These designs focus on compact arrangements, flexible configurations, and simplified connection points to minimize structural modifications. Key innovations include modular units that can be installed in limited spaces, vertical or horizontal orientation options, and standardized connection interfaces. Advanced membrane materials and configurations enhance filtration performance while reducing the footprint required for installation in retrofit scenarios.

- Control systems and automation for retrofitted ultrafiltration processes: Retrofitting ultrafiltration systems requires sophisticated control and automation technologies to integrate with existing plant operations. These control systems manage membrane cleaning cycles, backwashing sequences, and filtration parameters to optimize performance. Automated monitoring of transmembrane pressure, flow rates, and water quality parameters ensures efficient operation of the retrofitted system. Integration with existing SCADA systems allows for seamless operation and provides operators with comprehensive data for process optimization and maintenance planning.

- Industrial wastewater treatment system retrofits with ultrafiltration: Industrial facilities are increasingly retrofitting their wastewater treatment systems with ultrafiltration technology to meet stricter discharge regulations and enable water reuse. These retrofits are particularly valuable in industries such as textiles, food processing, pharmaceuticals, and chemical manufacturing. The ultrafiltration membranes remove fine particles, colloids, and macromolecules that conventional treatment methods cannot effectively capture. This retrofitting approach improves treatment efficiency, reduces chemical consumption, and creates opportunities for process water recycling within the facility.

- Cost-effective approaches for ultrafiltration retrofitting projects: Various strategies can make ultrafiltration retrofitting more economically viable for existing treatment facilities. These approaches include phased implementation to spread capital costs, utilizing hybrid systems that combine ultrafiltration with existing treatment processes, and implementing energy recovery systems to reduce operational expenses. Innovative financing models, such as performance-based contracts and equipment leasing options, can also help overcome initial investment barriers. Additionally, designing retrofits that minimize civil works and utilize existing infrastructure components significantly reduces project costs while maintaining performance improvements.

02 Energy efficiency improvements in ultrafiltration systems

Energy optimization techniques for ultrafiltration retrofits focus on reducing operational costs while maintaining filtration performance. These include implementing variable frequency drives for pumps, optimizing backwash cycles, introducing energy recovery devices, and improving membrane cleaning protocols. Advanced control systems can monitor and adjust operating parameters in real-time to minimize energy consumption during different filtration stages and water quality conditions.Expand Specific Solutions03 Integration of ultrafiltration with existing treatment processes

Ultrafiltration can be strategically integrated with conventional water treatment processes to enhance overall system performance. This integration may involve positioning ultrafiltration as pre-treatment before reverse osmosis, as replacement for conventional clarification steps, or as polishing treatment after biological processes. The retrofitting approach considers flow patterns, pressure requirements, and chemical compatibility to ensure seamless integration with minimal modifications to existing infrastructure.Expand Specific Solutions04 Automated control systems for retrofitted ultrafiltration

Implementation of advanced automation and control systems is essential for optimizing retrofitted ultrafiltration operations. These systems incorporate real-time monitoring of transmembrane pressure, flow rates, and water quality parameters to automatically adjust operating conditions. Smart control algorithms can optimize backwash frequency, chemical cleaning cycles, and filtration flux based on feed water characteristics, extending membrane life and improving operational efficiency.Expand Specific Solutions05 Industrial wastewater treatment retrofits with ultrafiltration

Retrofitting industrial wastewater treatment systems with ultrafiltration technology enables enhanced contaminant removal and water reuse opportunities. These retrofits are specifically designed to handle challenging industrial effluents containing oils, suspended solids, and complex organic compounds. The implementation includes specialized pre-treatment steps, chemical conditioning protocols, and membrane configurations optimized for specific industrial applications such as textile processing, food production, and manufacturing.Expand Specific Solutions

Leading Ultrafiltration Equipment Manufacturers and Suppliers

The ultrafiltration technology retrofitting market is currently in a growth phase, with increasing adoption across industrial and municipal sectors. The market size is expanding rapidly due to stricter environmental regulations and water scarcity concerns, estimated to reach several billion dollars globally by 2025. From a technological maturity perspective, companies like Siemens AG, Veolia Water Solutions, and WILO SE have established advanced commercial solutions, while academic institutions such as Tianjin University and Harbin Institute of Technology are driving innovation in membrane technology. Regional players like Jiangsu Greenland and Wuxi Taihu Lake Remediation are developing specialized applications for local markets. The competitive landscape shows a mix of global engineering conglomerates (GS Engineering, Fresenius Medical Care) and specialized filtration companies, with increasing focus on energy efficiency and operational cost reduction in retrofit applications.

Daicen Membrane Systems Ltd.

Technical Solution: Daicen Membrane Systems' retrofitting solution for ultrafiltration technology focuses on their proprietary DaiUF™ platform, specifically designed for upgrading existing conventional filtration plants. Their approach employs a unique "filter-to-membrane" conversion methodology that repurposes existing filter vessels by installing ultrafiltration cassettes within the same footprint. The technology utilizes PVDF hollow fiber membranes with asymmetric pore structure, providing enhanced particulate removal while maintaining high permeability. Daicen's implementation strategy includes a phased conversion process that allows facilities to maintain partial treatment capacity throughout the retrofit. Their ultrafiltration modules feature an innovative low-pressure operation design (0.5-1.5 bar), reducing energy consumption by up to 30% compared to conventional pressurized UF systems. The company has developed specialized membrane rack systems that can be customized to fit irregular vessel geometries commonly found in older treatment plants. Their retrofit package includes proprietary membrane preservation technology that extends membrane life by up to 40% in challenging water conditions through optimized chemical cleaning protocols. Daicen's approach typically achieves 99.9% removal of particles larger than 0.1 microns while improving plant throughput by 15-25% compared to conventional filtration.

Strengths: Daicen's solutions offer exceptional adaptability to existing infrastructure, minimizing civil works and reducing capital costs. Their low-pressure operation significantly reduces energy consumption and operational expenses. Weaknesses: The membrane modules require more frequent chemical cleaning in high-turbidity applications, and the system may require additional pre-treatment steps for waters with high organic content.

Siemens AG

Technical Solution: Siemens' retrofitting solution for ultrafiltration technology integration focuses on their Memcor® membrane systems, designed specifically for upgrading existing water treatment facilities. Their approach employs a dual-stage implementation methodology that begins with a comprehensive plant audit to identify integration points and potential constraints. The technology utilizes PVDF (polyvinylidene fluoride) hollow fiber membranes with proprietary coating technology that enhances fouling resistance and extends operational life. Siemens' retrofitting package includes their MemView™ digital monitoring platform that provides real-time performance analytics and predictive maintenance capabilities. Their pressurized ultrafiltration modules operate at 1-3 bar, making them energy-efficient while delivering consistent filtrate quality regardless of feed water variations. The company's retrofit design incorporates intelligent backwash optimization algorithms that adjust cleaning cycles based on actual membrane fouling conditions, reducing water consumption by up to 25% compared to fixed-interval backwashing systems. Siemens typically implements these retrofits using a parallel installation approach that allows for gradual transition from existing filtration systems to the new ultrafiltration technology.

Strengths: Siemens offers comprehensive automation integration with existing SCADA systems, providing seamless operation. Their advanced membrane materials demonstrate superior chemical resistance and longer service life in challenging water conditions. Weaknesses: The systems require more frequent membrane integrity testing compared to some competitors, and retrofitting costs can be significant for smaller facilities due to the sophisticated control systems required.

Key Patents and Innovations in Ultrafiltration Retrofitting

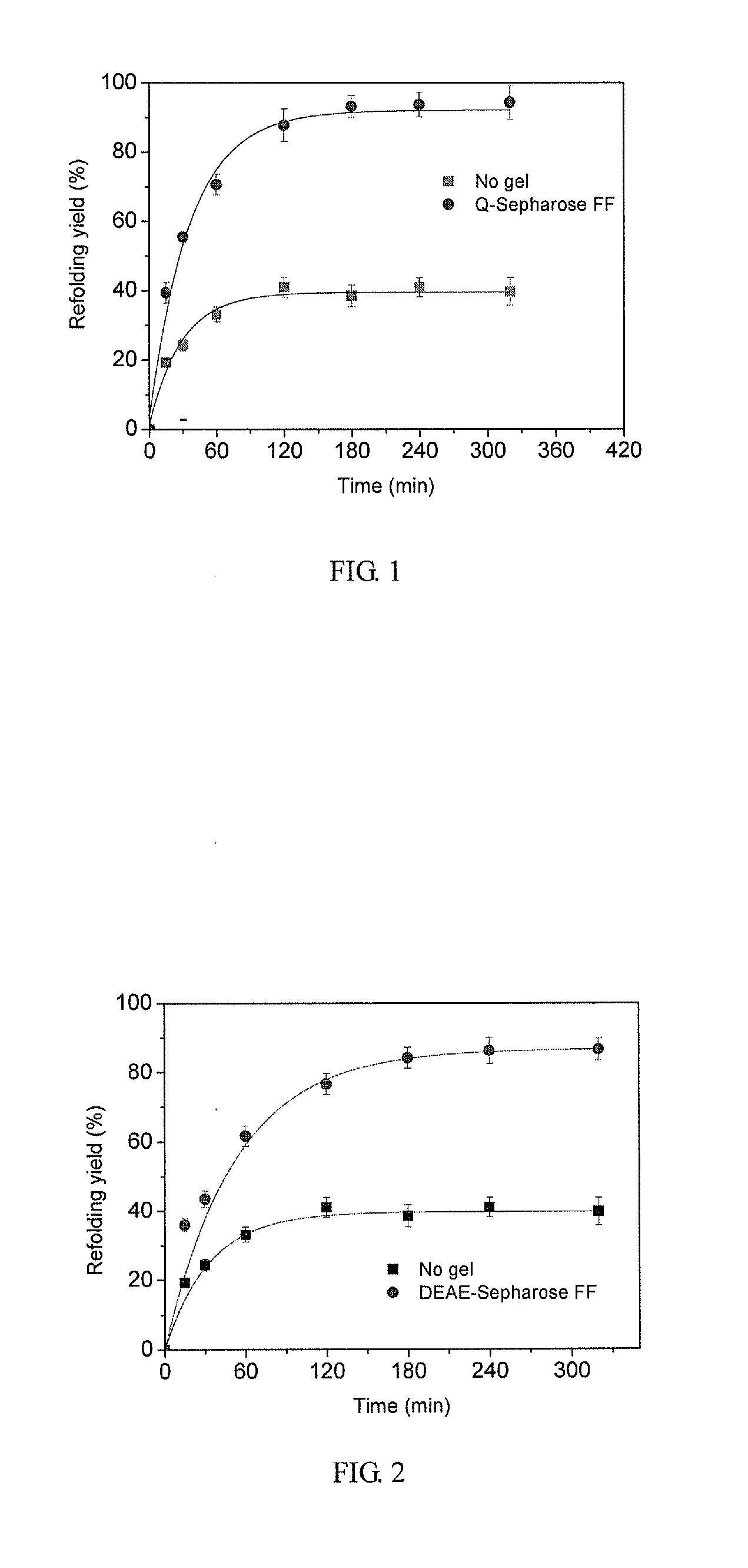

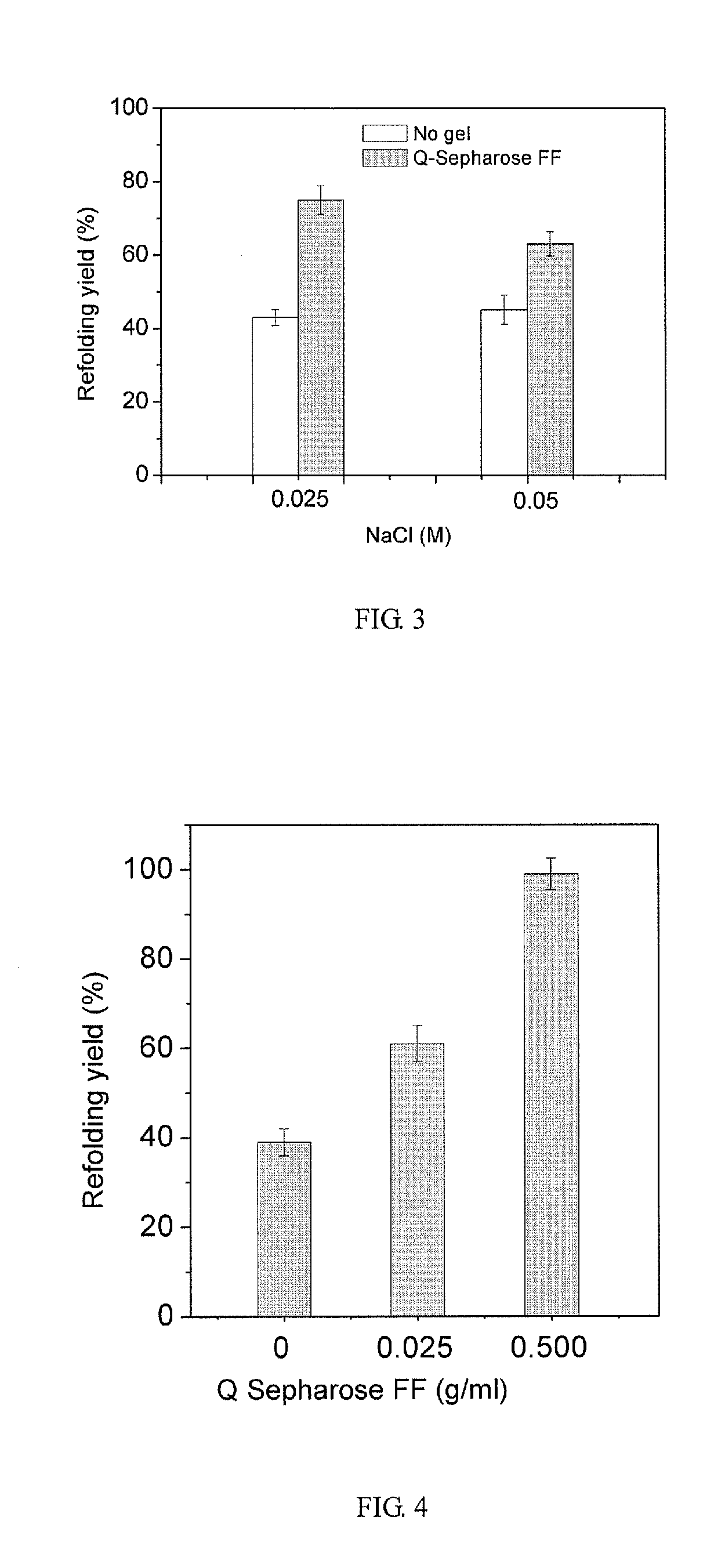

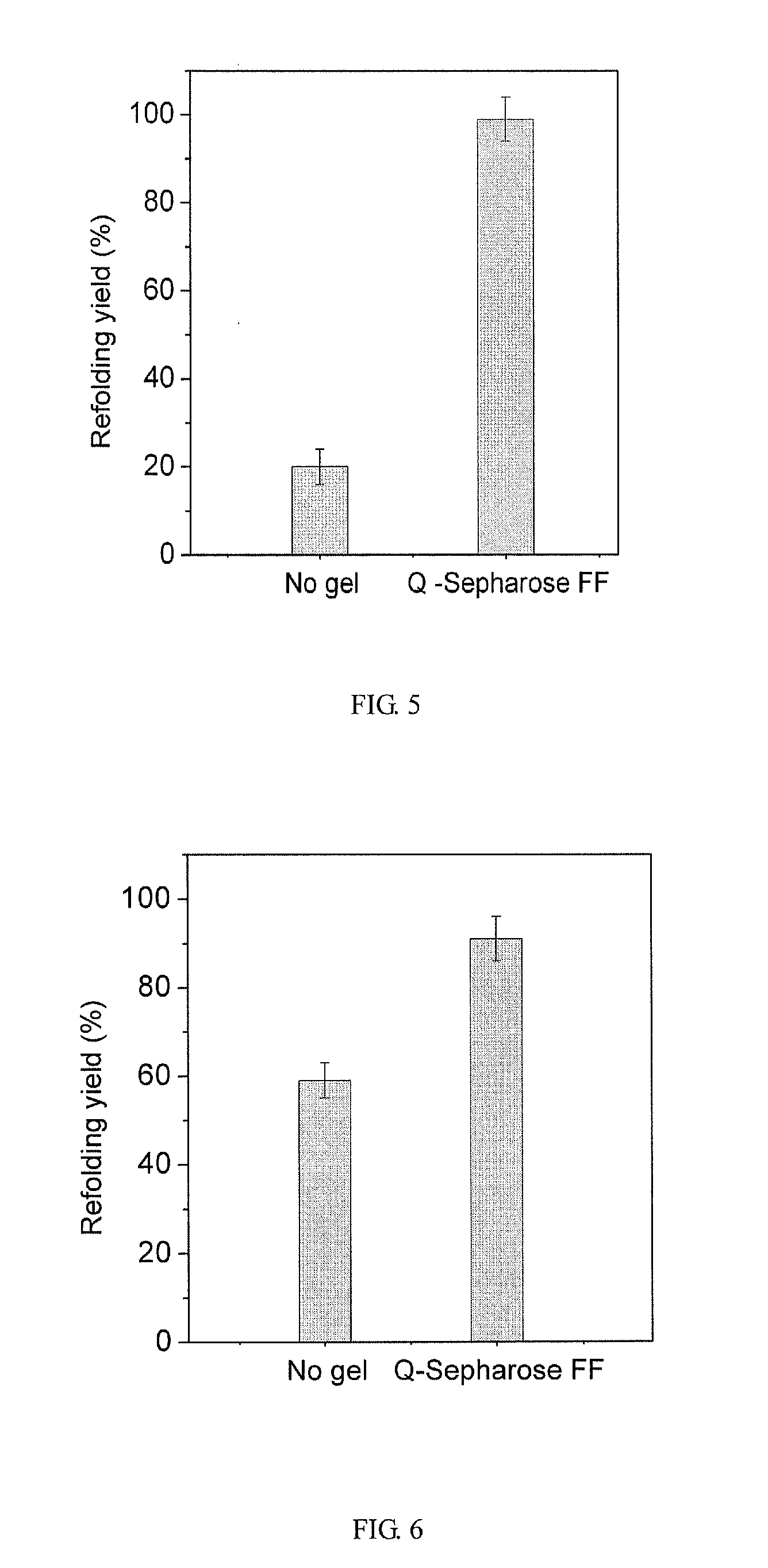

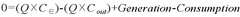

Method of protein refolding with ion exchange resins and the application of the same

PatentActiveUS20130060007A1

Innovation

- The method employs ion exchange resins with like-charged groups to the protein, which are washed and mixed with the refolding buffer to inhibit aggregation through electrostatic repulsion, allowing for efficient protein refolding without the need for chromatographic facilities and enabling resin recycling.

Retrofit construction method for flow-through aquaculture farm and retrofit recirculating aquaculture system using same

PatentWO2024219584A1

Innovation

- A retrofit construction method that assesses existing flow-through fish farms to design and implement a circulation filtration aquaculture system using existing facilities, optimizing space and reducing costs by recycling existing equipment and piping, without the need for pumps or valves, through a step-by-step process involving facility surveys, biological production planning, and detailed design.

Cost-Benefit Analysis of Ultrafiltration Retrofitting Projects

The economic viability of retrofitting existing water treatment plants with ultrafiltration (UF) technology requires comprehensive cost-benefit analysis. Initial capital expenditures for UF retrofitting typically range from $0.5-2 million for small to medium-sized plants, encompassing membrane modules, pumping systems, backwash equipment, and control systems. Installation costs generally account for 30-40% of equipment costs, while engineering and design services add another 15-20%.

Operational expenses include energy consumption (0.1-0.3 kWh/m³), membrane replacement (membranes typically last 5-7 years), chemical cleaning agents, and maintenance labor. These recurring costs must be carefully projected over the expected 15-20 year lifespan of the retrofitted system to establish accurate lifecycle cost assessments.

Benefits quantification reveals multiple value streams. Water quality improvements from UF retrofits typically reduce turbidity by 99% and remove over 99.9% of pathogens, potentially decreasing downstream disinfection chemical usage by 20-30%. This enhanced filtration efficiency can increase plant capacity by 15-25% without physical expansion, effectively reducing the cost per unit volume of treated water.

Regulatory compliance benefits are substantial, as UF technology helps facilities meet increasingly stringent water quality standards like the USEPA's Long Term 2 Enhanced Surface Water Treatment Rule and the EU Drinking Water Directive. Plants with UF retrofits typically experience 40-60% fewer compliance violations, avoiding potential regulatory penalties and public notification requirements.

Return on investment calculations indicate payback periods ranging from 3-7 years depending on plant size, existing infrastructure condition, and local energy costs. Sensitivity analysis reveals that energy prices and membrane replacement schedules are the most significant variables affecting long-term economic performance. Plants in regions with high electricity costs may benefit from incorporating energy recovery devices, potentially reducing energy consumption by 25-30%.

Risk assessment must account for potential membrane fouling issues, which can increase operational costs by 10-15% if not properly managed. However, modern UF systems with advanced cleaning protocols and monitoring systems have demonstrated 95-98% uptime reliability, minimizing production disruptions during the transition period and throughout operational life.

Operational expenses include energy consumption (0.1-0.3 kWh/m³), membrane replacement (membranes typically last 5-7 years), chemical cleaning agents, and maintenance labor. These recurring costs must be carefully projected over the expected 15-20 year lifespan of the retrofitted system to establish accurate lifecycle cost assessments.

Benefits quantification reveals multiple value streams. Water quality improvements from UF retrofits typically reduce turbidity by 99% and remove over 99.9% of pathogens, potentially decreasing downstream disinfection chemical usage by 20-30%. This enhanced filtration efficiency can increase plant capacity by 15-25% without physical expansion, effectively reducing the cost per unit volume of treated water.

Regulatory compliance benefits are substantial, as UF technology helps facilities meet increasingly stringent water quality standards like the USEPA's Long Term 2 Enhanced Surface Water Treatment Rule and the EU Drinking Water Directive. Plants with UF retrofits typically experience 40-60% fewer compliance violations, avoiding potential regulatory penalties and public notification requirements.

Return on investment calculations indicate payback periods ranging from 3-7 years depending on plant size, existing infrastructure condition, and local energy costs. Sensitivity analysis reveals that energy prices and membrane replacement schedules are the most significant variables affecting long-term economic performance. Plants in regions with high electricity costs may benefit from incorporating energy recovery devices, potentially reducing energy consumption by 25-30%.

Risk assessment must account for potential membrane fouling issues, which can increase operational costs by 10-15% if not properly managed. However, modern UF systems with advanced cleaning protocols and monitoring systems have demonstrated 95-98% uptime reliability, minimizing production disruptions during the transition period and throughout operational life.

Environmental Compliance and Regulatory Requirements

Retrofitting existing industrial plants with ultrafiltration technology necessitates thorough compliance with environmental regulations and standards. The regulatory landscape governing water treatment technologies varies significantly across regions and countries, creating a complex framework that facility managers must navigate. In the United States, the Clean Water Act and Safe Drinking Water Act establish fundamental requirements for water quality, while the Environmental Protection Agency (EPA) enforces specific standards for industrial wastewater discharge and treatment processes.

European regulations, particularly the EU Water Framework Directive, impose stringent requirements on water quality and treatment methodologies. These regulations often mandate regular monitoring, reporting, and compliance verification, adding administrative responsibilities to retrofitting projects. Facilities must ensure that ultrafiltration systems not only meet current standards but also possess adaptability to accommodate future regulatory changes, which typically trend toward increasingly stringent requirements.

Permitting processes represent a critical regulatory hurdle in retrofitting projects. Facilities must secure appropriate permits for system modifications, which may include construction permits, operational permits, and specific water treatment authorizations. The permitting timeline can significantly impact project scheduling, with some jurisdictions requiring extensive environmental impact assessments before approval. Early engagement with regulatory authorities can help identify potential compliance issues and streamline the permitting process.

Discharge regulations constitute another crucial consideration, as ultrafiltration systems alter the quality and characteristics of wastewater effluent. Facilities must ensure that treated water meets local discharge standards for parameters such as total suspended solids, biological oxygen demand, and specific contaminants of concern. Some regions implement tiered discharge fee structures based on effluent quality, potentially offering financial incentives for superior treatment performance.

Waste management regulations also apply to ultrafiltration retrofits, particularly regarding the disposal of concentrated waste streams and spent filter materials. These waste streams may contain concentrated contaminants that require specialized handling and disposal methods in accordance with hazardous waste regulations. Developing a comprehensive waste management plan that addresses these regulatory requirements is essential for project success.

Compliance documentation and reporting systems must be integrated into retrofitting plans. Modern ultrafiltration systems typically incorporate automated monitoring capabilities that facilitate regulatory reporting, but facilities must ensure these systems align with specific jurisdictional requirements. Establishing robust record-keeping protocols for system performance, maintenance activities, and water quality parameters provides essential documentation for regulatory inspections and compliance verification.

European regulations, particularly the EU Water Framework Directive, impose stringent requirements on water quality and treatment methodologies. These regulations often mandate regular monitoring, reporting, and compliance verification, adding administrative responsibilities to retrofitting projects. Facilities must ensure that ultrafiltration systems not only meet current standards but also possess adaptability to accommodate future regulatory changes, which typically trend toward increasingly stringent requirements.

Permitting processes represent a critical regulatory hurdle in retrofitting projects. Facilities must secure appropriate permits for system modifications, which may include construction permits, operational permits, and specific water treatment authorizations. The permitting timeline can significantly impact project scheduling, with some jurisdictions requiring extensive environmental impact assessments before approval. Early engagement with regulatory authorities can help identify potential compliance issues and streamline the permitting process.

Discharge regulations constitute another crucial consideration, as ultrafiltration systems alter the quality and characteristics of wastewater effluent. Facilities must ensure that treated water meets local discharge standards for parameters such as total suspended solids, biological oxygen demand, and specific contaminants of concern. Some regions implement tiered discharge fee structures based on effluent quality, potentially offering financial incentives for superior treatment performance.

Waste management regulations also apply to ultrafiltration retrofits, particularly regarding the disposal of concentrated waste streams and spent filter materials. These waste streams may contain concentrated contaminants that require specialized handling and disposal methods in accordance with hazardous waste regulations. Developing a comprehensive waste management plan that addresses these regulatory requirements is essential for project success.

Compliance documentation and reporting systems must be integrated into retrofitting plans. Modern ultrafiltration systems typically incorporate automated monitoring capabilities that facilitate regulatory reporting, but facilities must ensure these systems align with specific jurisdictional requirements. Establishing robust record-keeping protocols for system performance, maintenance activities, and water quality parameters provides essential documentation for regulatory inspections and compliance verification.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!