Role of green hydrogen in decarbonized cement production processes

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen in Cement Decarbonization: Background & Objectives

The cement industry is one of the largest contributors to global carbon emissions, accounting for approximately 8% of worldwide CO2 emissions. This significant environmental impact stems primarily from the calcination process, where limestone is heated to produce clinker, and from the combustion of fossil fuels to generate the high temperatures required for cement production. As global pressure mounts to address climate change, the cement sector faces increasing scrutiny and regulatory demands to decarbonize its operations.

Green hydrogen, produced through water electrolysis powered by renewable energy sources, has emerged as a promising solution for industrial decarbonization. Unlike grey hydrogen derived from fossil fuels or blue hydrogen that relies on carbon capture technologies, green hydrogen generates zero carbon emissions during both production and utilization. The evolution of hydrogen technology has accelerated significantly over the past decade, with substantial improvements in electrolyzer efficiency and declining costs of renewable energy.

The integration of green hydrogen into cement manufacturing represents a transformative approach to addressing the industry's carbon footprint. Historically, cement production has relied heavily on coal, petroleum coke, and natural gas as thermal energy sources. The technical feasibility of substituting these carbon-intensive fuels with hydrogen has been demonstrated in pilot projects, though widespread commercial implementation remains limited.

Current technological objectives for green hydrogen in cement production focus on several key areas: developing efficient hydrogen combustion systems capable of achieving the 1,450°C temperatures required for clinker formation; optimizing hydrogen storage and transportation infrastructure for cement plants; and integrating hydrogen production facilities with renewable energy sources to ensure truly carbon-neutral operations.

The cement industry's decarbonization trajectory aligns with broader climate goals, including the Paris Agreement's target of limiting global warming to well below 2°C. Several industry roadmaps, such as the Global Cement and Concrete Association's Climate Ambition, have established pathways to carbon neutrality by 2050, with green hydrogen playing an increasingly central role in these strategies.

Research initiatives worldwide are exploring the technical and economic parameters of hydrogen integration in cement production. These efforts aim to address challenges related to flame stability, heat transfer characteristics, equipment modifications, and the economic viability of green hydrogen compared to conventional fuels. The ultimate goal is to develop commercially viable solutions that can be deployed at scale across the global cement industry, contributing significantly to industrial decarbonization efforts.

Green hydrogen, produced through water electrolysis powered by renewable energy sources, has emerged as a promising solution for industrial decarbonization. Unlike grey hydrogen derived from fossil fuels or blue hydrogen that relies on carbon capture technologies, green hydrogen generates zero carbon emissions during both production and utilization. The evolution of hydrogen technology has accelerated significantly over the past decade, with substantial improvements in electrolyzer efficiency and declining costs of renewable energy.

The integration of green hydrogen into cement manufacturing represents a transformative approach to addressing the industry's carbon footprint. Historically, cement production has relied heavily on coal, petroleum coke, and natural gas as thermal energy sources. The technical feasibility of substituting these carbon-intensive fuels with hydrogen has been demonstrated in pilot projects, though widespread commercial implementation remains limited.

Current technological objectives for green hydrogen in cement production focus on several key areas: developing efficient hydrogen combustion systems capable of achieving the 1,450°C temperatures required for clinker formation; optimizing hydrogen storage and transportation infrastructure for cement plants; and integrating hydrogen production facilities with renewable energy sources to ensure truly carbon-neutral operations.

The cement industry's decarbonization trajectory aligns with broader climate goals, including the Paris Agreement's target of limiting global warming to well below 2°C. Several industry roadmaps, such as the Global Cement and Concrete Association's Climate Ambition, have established pathways to carbon neutrality by 2050, with green hydrogen playing an increasingly central role in these strategies.

Research initiatives worldwide are exploring the technical and economic parameters of hydrogen integration in cement production. These efforts aim to address challenges related to flame stability, heat transfer characteristics, equipment modifications, and the economic viability of green hydrogen compared to conventional fuels. The ultimate goal is to develop commercially viable solutions that can be deployed at scale across the global cement industry, contributing significantly to industrial decarbonization efforts.

Market Analysis for Low-Carbon Cement Solutions

The global cement industry is experiencing a significant shift towards low-carbon solutions, driven by increasing environmental regulations and corporate sustainability commitments. Currently, cement production accounts for approximately 8% of global CO2 emissions, making it one of the most carbon-intensive industrial sectors. This has created a substantial market opportunity for decarbonization technologies, with the low-carbon cement market projected to reach $60 billion by 2030, growing at a CAGR of 14.1% from 2023.

Regional market dynamics show varying levels of adoption and demand. Europe leads in regulatory pressure, with the EU Emissions Trading System and Carbon Border Adjustment Mechanism directly impacting cement producers' operations and profitability. The European market for low-carbon cement solutions is expected to grow most rapidly, with countries like Germany, France, and the Nordic region at the forefront of adoption.

North America presents a growing market, particularly as federal infrastructure spending increases and green building certifications gain prominence. The Asia-Pacific region, despite being the largest cement producer globally, shows more varied adoption rates, with China making significant commitments to carbon neutrality while developing economies balance environmental concerns with economic growth imperatives.

Consumer willingness to pay premiums for green cement varies significantly by market segment. Commercial construction and public infrastructure projects demonstrate higher acceptance of price premiums (typically 15-30%) compared to residential construction. This price sensitivity remains a key market barrier, though the gap is narrowing as carbon pricing mechanisms become more widespread.

Market penetration of low-carbon cement technologies remains relatively low, with alternative binding materials and carbon capture solutions collectively representing less than 5% of global cement production. However, growth projections indicate rapid acceleration, with green hydrogen-based solutions expected to capture 10-15% of the decarbonization technology market by 2035.

Key market drivers include tightening emissions regulations, increasing investor pressure for ESG compliance, growing consumer demand for sustainable building materials, and the potential for significant cost reductions through technological innovation and economies of scale. The integration of green hydrogen into cement production processes represents a particularly promising segment, with potential applications in both process heat generation and as a reduction agent in clinker production.

Market barriers include high capital investment requirements, technical challenges in retrofitting existing plants, supply chain constraints for green hydrogen, and the need for supportive policy frameworks to ensure economic viability during the transition period. Despite these challenges, the market trajectory clearly indicates accelerating demand for low-carbon cement solutions, with green hydrogen playing an increasingly central role in the industry's decarbonization pathway.

Regional market dynamics show varying levels of adoption and demand. Europe leads in regulatory pressure, with the EU Emissions Trading System and Carbon Border Adjustment Mechanism directly impacting cement producers' operations and profitability. The European market for low-carbon cement solutions is expected to grow most rapidly, with countries like Germany, France, and the Nordic region at the forefront of adoption.

North America presents a growing market, particularly as federal infrastructure spending increases and green building certifications gain prominence. The Asia-Pacific region, despite being the largest cement producer globally, shows more varied adoption rates, with China making significant commitments to carbon neutrality while developing economies balance environmental concerns with economic growth imperatives.

Consumer willingness to pay premiums for green cement varies significantly by market segment. Commercial construction and public infrastructure projects demonstrate higher acceptance of price premiums (typically 15-30%) compared to residential construction. This price sensitivity remains a key market barrier, though the gap is narrowing as carbon pricing mechanisms become more widespread.

Market penetration of low-carbon cement technologies remains relatively low, with alternative binding materials and carbon capture solutions collectively representing less than 5% of global cement production. However, growth projections indicate rapid acceleration, with green hydrogen-based solutions expected to capture 10-15% of the decarbonization technology market by 2035.

Key market drivers include tightening emissions regulations, increasing investor pressure for ESG compliance, growing consumer demand for sustainable building materials, and the potential for significant cost reductions through technological innovation and economies of scale. The integration of green hydrogen into cement production processes represents a particularly promising segment, with potential applications in both process heat generation and as a reduction agent in clinker production.

Market barriers include high capital investment requirements, technical challenges in retrofitting existing plants, supply chain constraints for green hydrogen, and the need for supportive policy frameworks to ensure economic viability during the transition period. Despite these challenges, the market trajectory clearly indicates accelerating demand for low-carbon cement solutions, with green hydrogen playing an increasingly central role in the industry's decarbonization pathway.

Technical Status and Barriers in Green Hydrogen Cement Production

The global cement industry currently accounts for approximately 7-8% of worldwide CO2 emissions, making it a critical sector for decarbonization efforts. Green hydrogen presents a promising pathway for reducing these emissions, though its implementation faces significant technical challenges. Current technological status shows that hydrogen can contribute to cement decarbonization through multiple pathways: as a fuel substitute in kilns, as a feedstock for alternative cement chemistries, and as an enabler for carbon capture technologies.

Leading cement manufacturers have initiated pilot projects incorporating hydrogen into their production processes. HeidelbergCement's plant in Sweden has successfully tested hydrogen injection in their kilns, achieving up to 30% reduction in fossil fuel usage. Similarly, Cemex and LafargeHolcim have established research partnerships focused on hydrogen integration technologies, though these remain at demonstration scale rather than commercial deployment.

The primary technical barrier to widespread adoption is the combustion technology adaptation. Cement kilns traditionally operate at temperatures exceeding 1450°C, and hydrogen flames exhibit different heat transfer properties compared to conventional fuels. This necessitates significant modifications to burner designs and kiln operation parameters. Current burner technologies can only accommodate hydrogen blends of up to 30-40% without major redesigns.

Infrastructure limitations present another substantial challenge. Green hydrogen production requires substantial renewable electricity and water resources, often not available at cement plant locations. The transportation and storage of hydrogen to cement facilities involves complex safety considerations and significant capital investment in specialized equipment.

Economic barriers remain formidable, with green hydrogen production costs currently ranging from $4-6/kg, significantly higher than natural gas on an energy-equivalent basis. The International Energy Agency estimates that hydrogen costs need to fall below $2/kg to become competitive for cement applications without carbon pricing mechanisms.

Material compatibility issues also pose challenges, as hydrogen embrittlement can affect certain metal components in existing cement plant infrastructure. This necessitates careful materials selection and potential replacement of critical components throughout the production system.

Water requirements for green hydrogen production through electrolysis (approximately 9 kg water per kg H2) create additional sustainability concerns in water-stressed regions where many cement plants operate. Furthermore, the intermittency of renewable energy sources complicates the continuous operation requirements of cement kilns, necessitating either hydrogen storage solutions or hybrid systems.

Despite these barriers, technological advancements in electrolyzer efficiency, renewable energy integration, and specialized hydrogen combustion systems are progressing rapidly, suggesting that green hydrogen's role in cement decarbonization will expand significantly in the coming decade as these technical challenges are systematically addressed.

Leading cement manufacturers have initiated pilot projects incorporating hydrogen into their production processes. HeidelbergCement's plant in Sweden has successfully tested hydrogen injection in their kilns, achieving up to 30% reduction in fossil fuel usage. Similarly, Cemex and LafargeHolcim have established research partnerships focused on hydrogen integration technologies, though these remain at demonstration scale rather than commercial deployment.

The primary technical barrier to widespread adoption is the combustion technology adaptation. Cement kilns traditionally operate at temperatures exceeding 1450°C, and hydrogen flames exhibit different heat transfer properties compared to conventional fuels. This necessitates significant modifications to burner designs and kiln operation parameters. Current burner technologies can only accommodate hydrogen blends of up to 30-40% without major redesigns.

Infrastructure limitations present another substantial challenge. Green hydrogen production requires substantial renewable electricity and water resources, often not available at cement plant locations. The transportation and storage of hydrogen to cement facilities involves complex safety considerations and significant capital investment in specialized equipment.

Economic barriers remain formidable, with green hydrogen production costs currently ranging from $4-6/kg, significantly higher than natural gas on an energy-equivalent basis. The International Energy Agency estimates that hydrogen costs need to fall below $2/kg to become competitive for cement applications without carbon pricing mechanisms.

Material compatibility issues also pose challenges, as hydrogen embrittlement can affect certain metal components in existing cement plant infrastructure. This necessitates careful materials selection and potential replacement of critical components throughout the production system.

Water requirements for green hydrogen production through electrolysis (approximately 9 kg water per kg H2) create additional sustainability concerns in water-stressed regions where many cement plants operate. Furthermore, the intermittency of renewable energy sources complicates the continuous operation requirements of cement kilns, necessitating either hydrogen storage solutions or hybrid systems.

Despite these barriers, technological advancements in electrolyzer efficiency, renewable energy integration, and specialized hydrogen combustion systems are progressing rapidly, suggesting that green hydrogen's role in cement decarbonization will expand significantly in the coming decade as these technical challenges are systematically addressed.

Current Green Hydrogen Integration Methods for Cement Production

01 Hydrogen production methods for decarbonization

Various methods for producing green hydrogen to support decarbonization efforts include electrolysis powered by renewable energy sources, biomass gasification, and advanced water splitting technologies. These processes generate hydrogen without carbon emissions, making them crucial for industrial decarbonization strategies. The technologies focus on maximizing efficiency while minimizing environmental impact, often incorporating catalysts and innovative reactor designs to improve hydrogen yield.- Hydrogen production methods for decarbonization: Various methods for producing green hydrogen are employed to achieve decarbonization goals. These include electrolysis powered by renewable energy sources, which splits water into hydrogen and oxygen without carbon emissions. Advanced technologies such as proton exchange membrane (PEM) electrolyzers and solid oxide electrolysis cells are being developed to improve efficiency and reduce costs. These production methods are crucial for establishing a sustainable hydrogen economy that contributes to global decarbonization efforts.

- Integration of renewable energy with hydrogen systems: The integration of renewable energy sources with hydrogen production systems is essential for green hydrogen decarbonization. Solar, wind, and hydroelectric power can be coupled with electrolyzers to produce hydrogen during periods of excess energy generation. This approach addresses the intermittency issues of renewable energy by using hydrogen as an energy storage medium. Smart grid technologies and advanced control systems optimize the integration process, ensuring efficient energy conversion and storage while maximizing carbon reduction benefits.

- Hydrogen storage and transportation solutions: Effective storage and transportation solutions are critical for the widespread adoption of green hydrogen in decarbonization efforts. Innovations include advanced compression technologies, liquid hydrogen systems, and chemical carriers such as ammonia or liquid organic hydrogen carriers. These solutions address the challenges of hydrogen's low volumetric energy density and enable its distribution across various distances. Pipeline infrastructure adaptations and specialized vessels for maritime transport are also being developed to support the hydrogen supply chain.

- Industrial applications of green hydrogen: Green hydrogen offers significant decarbonization potential across various industrial sectors. It can replace fossil fuels in high-temperature industrial processes such as steel manufacturing, cement production, and chemical synthesis. Hydrogen can also serve as a feedstock for producing green ammonia, methanol, and synthetic fuels. The integration of hydrogen technologies in these hard-to-abate sectors provides pathways for reducing carbon emissions while maintaining industrial productivity and economic viability.

- Hydrogen fuel cells for transportation and power generation: Hydrogen fuel cells represent a key technology for decarbonizing transportation and power generation sectors. These electrochemical devices convert hydrogen into electricity with water as the only byproduct, offering zero-emission operation. Applications include fuel cell electric vehicles, maritime vessels, trains, and stationary power generation systems. Advanced membrane technologies and catalyst developments are improving efficiency and durability while reducing costs. The deployment of hydrogen refueling infrastructure supports the transition to hydrogen-powered transportation systems.

02 Integration of green hydrogen in industrial processes

Green hydrogen can be integrated into existing industrial processes to reduce carbon emissions in hard-to-abate sectors. Applications include steel manufacturing, chemical production, and high-temperature industrial heating. By replacing fossil fuel-based hydrogen or direct fossil fuel use with green hydrogen, industries can significantly reduce their carbon footprint while maintaining production capabilities. These integration strategies often require modifications to existing infrastructure and development of specialized equipment.Expand Specific Solutions03 Storage and transportation solutions for hydrogen

Effective storage and transportation systems are essential for the widespread adoption of green hydrogen in decarbonization efforts. Technologies include compressed gas storage, liquid hydrogen systems, metal hydrides, and chemical carriers like ammonia or liquid organic hydrogen carriers. These solutions address the challenges of hydrogen's low volumetric energy density and potential safety concerns, enabling efficient distribution from production sites to end-users across various distances.Expand Specific Solutions04 Hydrogen utilization in power generation and grid balancing

Green hydrogen offers significant potential for power generation and grid balancing applications in decarbonized energy systems. It can be used in fuel cells, hydrogen turbines, or combined cycle power plants to generate electricity with zero emissions. Additionally, hydrogen production through electrolysis can serve as a flexible load to balance variable renewable energy generation, storing excess electricity during high production periods and releasing it when needed, thus supporting grid stability in systems with high renewable penetration.Expand Specific Solutions05 Economic and policy frameworks for hydrogen deployment

Successful deployment of green hydrogen for decarbonization requires supportive economic models and policy frameworks. This includes carbon pricing mechanisms, subsidies for green hydrogen production, regulatory standards for hydrogen purity and safety, and investment incentives for infrastructure development. International cooperation and standardization efforts are also important to create global markets and supply chains for green hydrogen, reducing costs through economies of scale and facilitating technology transfer across regions.Expand Specific Solutions

Leading Organizations in Green Hydrogen Cement Applications

The green hydrogen market for decarbonized cement production is in its early growth phase, with significant potential as the cement industry seeks to reduce its substantial carbon footprint. Current market size is modest but projected to expand rapidly as technological solutions mature. Leading players include established industrial gas companies like Air Liquide and materials manufacturers such as Mitsubishi Materials and China National Building Material Group, who are developing integrated hydrogen solutions for cement production. Research institutions including MIT, Swiss Federal Institute of Technology, and IIT Guwahati are advancing fundamental technologies, while specialized companies like Tianjin Cement Industry Design & Research Institute and SINOPEC Engineering Group focus on implementation. The competitive landscape features collaboration between traditional cement producers and green technology providers, with varying levels of technological readiness across different decarbonization approaches.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has pioneered a dual-pathway approach to green hydrogen integration in cement manufacturing. Their primary technology involves hydrogen-enriched combustion systems that can be retrofitted to existing cement kilns, allowing for gradual transition without complete infrastructure replacement. CNBM's system utilizes a proprietary hydrogen injection method that optimizes flame characteristics while maintaining thermal efficiency. Additionally, they've developed an innovative process that uses green hydrogen for the direct reduction of calcium carbonate at lower temperatures than conventional methods, potentially reducing energy requirements by 15-20%[2]. Their technology includes smart control systems that automatically adjust hydrogen-to-conventional fuel ratios based on production parameters. CNBM has implemented this technology in several production facilities across China, demonstrating emission reductions of 30-40% compared to conventional operations.

Strengths: Retrofit capability minimizes capital expenditure; dual-pathway approach provides flexibility; extensive implementation experience in world's largest cement market. Weaknesses: Still partially reliant on conventional fuels; requires consistent hydrogen supply infrastructure; technology optimization still ongoing for different cement production configurations.

Air Liquide SA

Technical Solution: Air Liquide has developed a comprehensive green hydrogen ecosystem specifically tailored for cement decarbonization. Their approach centers on large-scale hydrogen production through advanced PEM and alkaline electrolysis technologies, with units capable of producing up to 20MW of hydrogen specifically designed for industrial heat applications. Air Liquide's cement-focused solution includes proprietary hydrogen distribution and injection systems that can be integrated into existing cement kilns with minimal modifications. Their technology addresses the unique challenges of cement production by providing hydrogen burners capable of reaching the extreme temperatures required for clinker formation while maintaining precise flame control. Air Liquide has established partnerships with major cement producers to implement pilot projects demonstrating up to 50% reduction in fossil fuel usage[4]. Additionally, they've developed specialized hydrogen storage solutions to ensure continuous operation despite the intermittent nature of renewable energy sources that power their electrolyzers.

Strengths: Comprehensive end-to-end hydrogen ecosystem from production to utilization; extensive experience in industrial gas applications; established distribution infrastructure. Weaknesses: Requires significant renewable energy capacity; high initial capital investment; technology still being optimized for cement-specific applications.

Key Technologies for Hydrogen-Based Cement Manufacturing

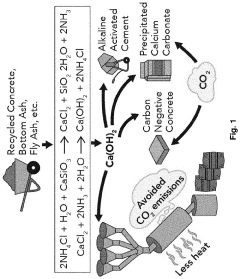

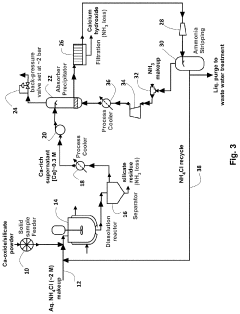

Sustainable calcium hydroxide production for green cement

PatentActiveUS20220081311A1

Innovation

- A novel low-temperature ammonia cycle process is developed to produce calcium hydroxide from calcium-bearing industrial waste streams such as recycled concrete and coal ashes, involving an aqueous solution of ammonium salt to extract calcium ions, followed by reaction with ammonia to precipitate calcium hydroxide, which can be recycled and reused.

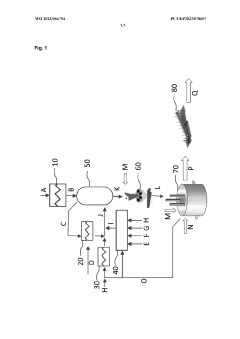

Method for reducing carbon footprint in operating a metallurgical plant for producing pig iron

PatentWO2023066794A1

Innovation

- A method involving pre-heating iron ore fines, partial reduction in fluidized bed reactors using hot reducing gases, and further reduction in submerged arc furnaces with carbonaceous materials, utilizing renewable resources and recycling metallurgical off-gases to minimize carbon dioxide emissions.

Regulatory Framework and Carbon Pricing Implications

The regulatory landscape surrounding cement production is rapidly evolving to address climate change concerns, creating both challenges and opportunities for green hydrogen integration. Carbon pricing mechanisms, including emissions trading systems (ETS) and carbon taxes, are becoming increasingly prevalent across major economies. The European Union's Emissions Trading System has set a precedent by including cement production in its scope, with allowance prices reaching record levels of over €90 per tonne of CO2 in 2023. This pricing trajectory significantly improves the economic case for green hydrogen adoption in cement manufacturing processes.

National and regional regulatory frameworks are also advancing decarbonization mandates specific to hard-to-abate sectors. The European Green Deal and its associated Industrial Decarbonization Strategy explicitly target cement production with stringent emissions reduction targets of 55% by 2030 compared to 1990 levels. Similar regulatory initiatives are emerging in North America, with Canada's Clean Fuel Standard and various state-level programs in the United States creating compliance obligations that favor green hydrogen pathways.

International standards and certification schemes for low-carbon cement are gaining prominence, with organizations like the Global Cement and Concrete Association (GCCA) developing frameworks that recognize hydrogen-based emissions reduction strategies. These standards are increasingly being referenced in public procurement policies, creating market pull for decarbonized cement products and indirectly supporting green hydrogen investments.

Financial incentives specifically targeting industrial hydrogen applications are expanding globally. The US Inflation Reduction Act offers production tax credits of up to $3 per kilogram for green hydrogen, while the EU's Innovation Fund allocates substantial resources to demonstration projects for hydrogen use in cement production. These incentives can significantly offset the capital expenditure required for hydrogen infrastructure at cement plants.

Border carbon adjustment mechanisms, such as the EU's Carbon Border Adjustment Mechanism (CBAM), are creating additional economic pressure by imposing carbon costs on imported cement products. This levels the playing field between jurisdictions with different carbon pricing regimes and prevents carbon leakage, further incentivizing global adoption of green hydrogen technologies in cement production.

The regulatory trajectory indicates a clear direction toward more stringent emissions controls and higher carbon prices over the coming decades. Industry forecasts suggest carbon prices could reach €150-200 per tonne by 2030 in advanced economies, potentially making green hydrogen economically competitive with conventional fossil fuel-based processes even without additional subsidies or incentives.

National and regional regulatory frameworks are also advancing decarbonization mandates specific to hard-to-abate sectors. The European Green Deal and its associated Industrial Decarbonization Strategy explicitly target cement production with stringent emissions reduction targets of 55% by 2030 compared to 1990 levels. Similar regulatory initiatives are emerging in North America, with Canada's Clean Fuel Standard and various state-level programs in the United States creating compliance obligations that favor green hydrogen pathways.

International standards and certification schemes for low-carbon cement are gaining prominence, with organizations like the Global Cement and Concrete Association (GCCA) developing frameworks that recognize hydrogen-based emissions reduction strategies. These standards are increasingly being referenced in public procurement policies, creating market pull for decarbonized cement products and indirectly supporting green hydrogen investments.

Financial incentives specifically targeting industrial hydrogen applications are expanding globally. The US Inflation Reduction Act offers production tax credits of up to $3 per kilogram for green hydrogen, while the EU's Innovation Fund allocates substantial resources to demonstration projects for hydrogen use in cement production. These incentives can significantly offset the capital expenditure required for hydrogen infrastructure at cement plants.

Border carbon adjustment mechanisms, such as the EU's Carbon Border Adjustment Mechanism (CBAM), are creating additional economic pressure by imposing carbon costs on imported cement products. This levels the playing field between jurisdictions with different carbon pricing regimes and prevents carbon leakage, further incentivizing global adoption of green hydrogen technologies in cement production.

The regulatory trajectory indicates a clear direction toward more stringent emissions controls and higher carbon prices over the coming decades. Industry forecasts suggest carbon prices could reach €150-200 per tonne by 2030 in advanced economies, potentially making green hydrogen economically competitive with conventional fossil fuel-based processes even without additional subsidies or incentives.

Economic Feasibility and Implementation Challenges

The economic feasibility of integrating green hydrogen into cement production processes remains a significant challenge despite its environmental benefits. Current production costs of green hydrogen range from $3-8 per kilogram, substantially higher than conventional hydrogen derived from natural gas. This cost differential creates a considerable barrier for cement manufacturers operating in highly competitive markets with thin profit margins. Economic analyses suggest that green hydrogen would need to reach approximately $2 per kilogram to achieve cost parity with traditional cement production methods.

Capital expenditure requirements present another substantial hurdle. Retrofitting existing cement plants to accommodate hydrogen-based heating systems requires significant investment in specialized burners, safety systems, and potentially new kiln designs. Industry estimates indicate conversion costs between $50-100 million for a standard-sized cement plant, with payback periods extending beyond 10 years under current market conditions.

Infrastructure limitations further complicate implementation. Most cement production facilities lack access to hydrogen supply networks, necessitating either on-site production capabilities or dedicated delivery systems. The geographical distribution of cement plants, often in remote locations to minimize transportation costs of raw materials, exacerbates this challenge by increasing connection costs to potential hydrogen supply networks.

Regulatory frameworks and carbon pricing mechanisms significantly influence economic viability. In regions with robust carbon pricing (exceeding €50-60 per ton CO₂), the business case for green hydrogen integration strengthens considerably. However, global regulatory inconsistency creates competitive imbalances, potentially leading to carbon leakage where production shifts to regions with less stringent emissions controls.

Technical implementation challenges compound economic concerns. Hydrogen combustion characteristics differ substantially from conventional fuels, requiring modifications to burner systems and potentially affecting clinker quality. The high flame temperature of hydrogen (approximately 2,100°C) compared to natural gas (1,950°C) necessitates careful thermal management to maintain product consistency and kiln longevity.

Scale-up challenges also persist. While laboratory and pilot demonstrations have shown promising results, full-scale industrial implementation remains limited. The cement industry's conservative approach to technology adoption, driven by high capital costs and long investment cycles, further slows widespread implementation of hydrogen-based solutions in this carbon-intensive sector.

Capital expenditure requirements present another substantial hurdle. Retrofitting existing cement plants to accommodate hydrogen-based heating systems requires significant investment in specialized burners, safety systems, and potentially new kiln designs. Industry estimates indicate conversion costs between $50-100 million for a standard-sized cement plant, with payback periods extending beyond 10 years under current market conditions.

Infrastructure limitations further complicate implementation. Most cement production facilities lack access to hydrogen supply networks, necessitating either on-site production capabilities or dedicated delivery systems. The geographical distribution of cement plants, often in remote locations to minimize transportation costs of raw materials, exacerbates this challenge by increasing connection costs to potential hydrogen supply networks.

Regulatory frameworks and carbon pricing mechanisms significantly influence economic viability. In regions with robust carbon pricing (exceeding €50-60 per ton CO₂), the business case for green hydrogen integration strengthens considerably. However, global regulatory inconsistency creates competitive imbalances, potentially leading to carbon leakage where production shifts to regions with less stringent emissions controls.

Technical implementation challenges compound economic concerns. Hydrogen combustion characteristics differ substantially from conventional fuels, requiring modifications to burner systems and potentially affecting clinker quality. The high flame temperature of hydrogen (approximately 2,100°C) compared to natural gas (1,950°C) necessitates careful thermal management to maintain product consistency and kiln longevity.

Scale-up challenges also persist. While laboratory and pilot demonstrations have shown promising results, full-scale industrial implementation remains limited. The cement industry's conservative approach to technology adoption, driven by high capital costs and long investment cycles, further slows widespread implementation of hydrogen-based solutions in this carbon-intensive sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!