Transient Electronics in Smart Packaging Solutions.

SEP 4, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transient Electronics Background and Objectives

Transient electronics represents a revolutionary paradigm shift in electronic device design, focusing on systems that can physically disappear or degrade in a controlled manner after serving their intended functions. This emerging field has evolved from traditional permanent electronics to address growing concerns about electronic waste, data security, and specialized applications requiring temporary functionality. The concept originated in the early 2010s with pioneering work at universities like the University of Illinois and Northwestern University, where researchers demonstrated silicon-based circuits that could dissolve in water.

The evolution of transient electronics has been accelerated by advancements in material science, particularly biodegradable polymers, water-soluble metals, and environmentally friendly semiconductors. These developments have enabled the creation of electronic components that can decompose through various mechanisms including dissolution, mechanical disintegration, and thermal degradation, with controllable lifespans ranging from minutes to months.

In the context of smart packaging solutions, transient electronics presents unprecedented opportunities to revolutionize product tracking, authentication, and consumer engagement. The integration of these self-destructing electronic systems into packaging materials enables advanced functionalities such as real-time monitoring of product conditions, tamper evidence, and enhanced supply chain visibility, while ensuring that the electronic components do not contribute to long-term waste streams.

The primary technical objectives for transient electronics in smart packaging applications include developing materials and components that maintain reliable performance during their operational lifetime while ensuring complete degradation afterward. This requires precise control over degradation triggers and rates, which may be activated by environmental factors such as moisture, temperature, light exposure, or specific chemical reactions.

Another critical objective involves achieving cost-effective manufacturing processes that can be scaled for mass production, as smart packaging applications typically require high-volume, low-cost solutions. This necessitates innovations in printing technologies, roll-to-roll processing, and other additive manufacturing techniques compatible with transient materials.

Energy management represents a significant challenge, as transient electronic systems in packaging must operate with minimal or self-generated power. Research goals include developing transient batteries, energy harvesting systems, and ultra-low-power circuits specifically designed for packaging environments.

The field aims to establish comprehensive design methodologies that balance functionality, reliability, environmental impact, and controlled degradability. This includes creating simulation tools and testing protocols that can accurately predict and verify the performance and degradation characteristics of transient electronic systems in various packaging scenarios and environmental conditions.

The evolution of transient electronics has been accelerated by advancements in material science, particularly biodegradable polymers, water-soluble metals, and environmentally friendly semiconductors. These developments have enabled the creation of electronic components that can decompose through various mechanisms including dissolution, mechanical disintegration, and thermal degradation, with controllable lifespans ranging from minutes to months.

In the context of smart packaging solutions, transient electronics presents unprecedented opportunities to revolutionize product tracking, authentication, and consumer engagement. The integration of these self-destructing electronic systems into packaging materials enables advanced functionalities such as real-time monitoring of product conditions, tamper evidence, and enhanced supply chain visibility, while ensuring that the electronic components do not contribute to long-term waste streams.

The primary technical objectives for transient electronics in smart packaging applications include developing materials and components that maintain reliable performance during their operational lifetime while ensuring complete degradation afterward. This requires precise control over degradation triggers and rates, which may be activated by environmental factors such as moisture, temperature, light exposure, or specific chemical reactions.

Another critical objective involves achieving cost-effective manufacturing processes that can be scaled for mass production, as smart packaging applications typically require high-volume, low-cost solutions. This necessitates innovations in printing technologies, roll-to-roll processing, and other additive manufacturing techniques compatible with transient materials.

Energy management represents a significant challenge, as transient electronic systems in packaging must operate with minimal or self-generated power. Research goals include developing transient batteries, energy harvesting systems, and ultra-low-power circuits specifically designed for packaging environments.

The field aims to establish comprehensive design methodologies that balance functionality, reliability, environmental impact, and controlled degradability. This includes creating simulation tools and testing protocols that can accurately predict and verify the performance and degradation characteristics of transient electronic systems in various packaging scenarios and environmental conditions.

Smart Packaging Market Demand Analysis

The smart packaging market is experiencing unprecedented growth driven by the convergence of consumer demands for enhanced product experiences, sustainability concerns, and technological advancements. Current market analysis indicates that the global smart packaging sector is expanding at a compound annual growth rate of approximately 5-6%, with projections suggesting acceleration to 8-10% growth by 2025 as transient electronics integration becomes more mainstream.

Consumer behavior research demonstrates increasing willingness to pay premium prices for packaging that offers additional functionality beyond basic containment and protection. This trend is particularly evident in high-value sectors such as pharmaceuticals, luxury consumer goods, and perishable foods, where product authentication, freshness monitoring, and enhanced user experiences justify the added cost of smart packaging solutions.

The pharmaceutical industry represents one of the most promising markets for transient electronics in packaging, with demand driven by medication adherence concerns, anti-counterfeiting needs, and cold chain monitoring requirements. Healthcare providers and insurers increasingly recognize the potential cost savings from improved patient compliance facilitated by smart packaging, creating a strong economic incentive for adoption.

Food and beverage sectors show robust demand growth, particularly for solutions that can monitor freshness, extend shelf life, and reduce waste. With global food waste valued at over $1 trillion annually, packaging that can accurately indicate product condition offers significant economic and environmental benefits. Retailers report increased consumer trust and brand loyalty when implementing smart packaging solutions that provide transparency about product origins and condition.

Regional market analysis reveals varying adoption rates, with North America and Europe leading in premium smart packaging implementation, while Asia-Pacific markets show the fastest growth trajectory due to expanding middle-class populations and increasing focus on product authenticity verification. The integration of transient electronics specifically addresses concerns in emerging markets regarding electronic waste management.

Supply chain stakeholders express growing interest in smart packaging that enables improved inventory management, reduced shrinkage, and enhanced logistics efficiency. The ability of transient electronics to provide real-time monitoring without creating permanent electronic waste aligns with corporate sustainability initiatives, further driving market demand.

Consumer surveys indicate that 68% of shoppers have increased interest in packaging that provides information about product freshness, while 72% express concern about electronic waste from conventional smart devices. This dual consumer preference creates an ideal market opportunity for transient electronics in packaging applications that deliver functionality without permanent environmental impact.

Consumer behavior research demonstrates increasing willingness to pay premium prices for packaging that offers additional functionality beyond basic containment and protection. This trend is particularly evident in high-value sectors such as pharmaceuticals, luxury consumer goods, and perishable foods, where product authentication, freshness monitoring, and enhanced user experiences justify the added cost of smart packaging solutions.

The pharmaceutical industry represents one of the most promising markets for transient electronics in packaging, with demand driven by medication adherence concerns, anti-counterfeiting needs, and cold chain monitoring requirements. Healthcare providers and insurers increasingly recognize the potential cost savings from improved patient compliance facilitated by smart packaging, creating a strong economic incentive for adoption.

Food and beverage sectors show robust demand growth, particularly for solutions that can monitor freshness, extend shelf life, and reduce waste. With global food waste valued at over $1 trillion annually, packaging that can accurately indicate product condition offers significant economic and environmental benefits. Retailers report increased consumer trust and brand loyalty when implementing smart packaging solutions that provide transparency about product origins and condition.

Regional market analysis reveals varying adoption rates, with North America and Europe leading in premium smart packaging implementation, while Asia-Pacific markets show the fastest growth trajectory due to expanding middle-class populations and increasing focus on product authenticity verification. The integration of transient electronics specifically addresses concerns in emerging markets regarding electronic waste management.

Supply chain stakeholders express growing interest in smart packaging that enables improved inventory management, reduced shrinkage, and enhanced logistics efficiency. The ability of transient electronics to provide real-time monitoring without creating permanent electronic waste aligns with corporate sustainability initiatives, further driving market demand.

Consumer surveys indicate that 68% of shoppers have increased interest in packaging that provides information about product freshness, while 72% express concern about electronic waste from conventional smart devices. This dual consumer preference creates an ideal market opportunity for transient electronics in packaging applications that deliver functionality without permanent environmental impact.

Current State and Challenges in Transient Electronics

Transient electronics represents a revolutionary approach in the field of smart packaging, with significant advancements achieved globally over the past decade. Currently, the technology has evolved from laboratory concepts to functional prototypes, with several commercial applications beginning to emerge in food safety monitoring and pharmaceutical packaging. Leading research institutions in the United States, South Korea, and Europe have demonstrated transient electronic systems capable of dissolving in controlled environments within timeframes ranging from minutes to several weeks.

Despite these advancements, the field faces substantial technical challenges that limit widespread adoption. Material stability remains a primary concern, as many transient materials exhibit inconsistent degradation rates when exposed to varying environmental conditions such as humidity, temperature fluctuations, and pH levels. This unpredictability poses significant reliability issues for commercial applications where precise dissolution timing is critical.

Manufacturing scalability presents another major obstacle. Current fabrication techniques for transient electronics largely rely on laboratory-scale processes that are difficult to translate to mass production environments. The integration of these components into existing packaging production lines requires substantial retooling and process adaptation, creating economic barriers to industry adoption.

Power supply limitations further constrain the functionality of transient electronic systems in packaging applications. While progress has been made in biodegradable batteries and energy harvesting technologies, these solutions typically provide insufficient power density for extended monitoring applications or fail to degrade at rates compatible with the electronic components they power.

The geographic distribution of transient electronics research shows concentration in specific regions. North America leads in fundamental research and patent filings, with approximately 45% of published research originating from institutions in the United States. East Asia, particularly South Korea and Japan, demonstrates strength in materials science innovations related to transient electronics, while European research clusters focus predominantly on environmental impact assessment and regulatory frameworks.

Regulatory uncertainty compounds technical challenges, as standards for biodegradable electronics remain underdeveloped in most jurisdictions. The novel nature of these materials creates classification difficulties for waste management systems and raises questions about potential environmental impacts of degradation byproducts, even as the technology aims to reduce electronic waste.

Cost factors present perhaps the most immediate barrier to commercialization, with current transient electronic components costing 8-15 times more than their conventional counterparts. This premium significantly limits market penetration to high-value applications where the benefits of transience justify the increased expense.

Despite these advancements, the field faces substantial technical challenges that limit widespread adoption. Material stability remains a primary concern, as many transient materials exhibit inconsistent degradation rates when exposed to varying environmental conditions such as humidity, temperature fluctuations, and pH levels. This unpredictability poses significant reliability issues for commercial applications where precise dissolution timing is critical.

Manufacturing scalability presents another major obstacle. Current fabrication techniques for transient electronics largely rely on laboratory-scale processes that are difficult to translate to mass production environments. The integration of these components into existing packaging production lines requires substantial retooling and process adaptation, creating economic barriers to industry adoption.

Power supply limitations further constrain the functionality of transient electronic systems in packaging applications. While progress has been made in biodegradable batteries and energy harvesting technologies, these solutions typically provide insufficient power density for extended monitoring applications or fail to degrade at rates compatible with the electronic components they power.

The geographic distribution of transient electronics research shows concentration in specific regions. North America leads in fundamental research and patent filings, with approximately 45% of published research originating from institutions in the United States. East Asia, particularly South Korea and Japan, demonstrates strength in materials science innovations related to transient electronics, while European research clusters focus predominantly on environmental impact assessment and regulatory frameworks.

Regulatory uncertainty compounds technical challenges, as standards for biodegradable electronics remain underdeveloped in most jurisdictions. The novel nature of these materials creates classification difficulties for waste management systems and raises questions about potential environmental impacts of degradation byproducts, even as the technology aims to reduce electronic waste.

Cost factors present perhaps the most immediate barrier to commercialization, with current transient electronic components costing 8-15 times more than their conventional counterparts. This premium significantly limits market penetration to high-value applications where the benefits of transience justify the increased expense.

Current Transient Electronics Implementation Approaches

01 Biodegradable and dissolvable electronic systems

Transient electronics that are designed to dissolve or degrade after a predetermined period or under specific environmental conditions. These systems utilize biodegradable substrates and conductive materials that can safely break down in the body or environment. Applications include implantable medical devices that don't require surgical removal and environmentally friendly consumer electronics that reduce e-waste.- Biodegradable and dissolvable electronic systems: Transient electronics that are designed to dissolve or degrade after a predetermined period or under specific environmental conditions. These systems utilize biodegradable substrates and conductive materials that can safely break down in the body or environment. Applications include implantable medical devices that don't require surgical removal and environmentally friendly consumer electronics that reduce e-waste.

- Thermal management in transient electronic devices: Advanced cooling and heat dissipation techniques specifically designed for transient electronic systems. These solutions address the unique thermal challenges of temporary electronic devices, including efficient heat transfer mechanisms, thermal interface materials, and cooling structures that maintain functionality during the device's intended lifespan while not impeding its transient nature.

- Security and self-destruction mechanisms: Electronic systems designed with intentional transience for security applications. These devices incorporate mechanisms that can trigger rapid degradation or complete destruction of sensitive components when activated by specific stimuli or after a predetermined time. Applications include secure data storage, military electronics, and devices that prevent unauthorized access to sensitive information.

- Power management for temporary electronic systems: Specialized power supply and energy management solutions for transient electronic devices. These include temporary batteries, energy harvesting systems, and power conditioning circuits designed to provide reliable operation during the intended functional period of the device while supporting its transient characteristics afterward.

- Flexible and stretchable transient electronics: Transient electronic systems built on flexible or stretchable substrates that can conform to irregular surfaces while maintaining their temporary nature. These devices combine mechanical flexibility with controlled degradability, enabling applications such as wearable health monitors, conformable sensors, and soft bioelectronics that can be applied to the skin or integrated with biological tissues.

02 Thermal management in transient electronic devices

Advanced cooling and heat dissipation techniques specifically designed for transient electronic systems. These solutions address the unique thermal challenges of temporary electronic devices, including efficient heat transfer mechanisms, thermal interface materials, and cooling structures that maintain functionality during the device's intended lifespan while not impeding its eventual degradation or dissolution.Expand Specific Solutions03 Power supply systems for transient electronics

Specialized power sources designed for transient electronic applications, including biodegradable batteries, energy harvesting systems, and temporary power storage solutions. These power systems are engineered to provide sufficient energy during the functional lifetime of the device while also being capable of degradation or dissolution along with the rest of the electronic components.Expand Specific Solutions04 Security applications of transient electronics

Implementation of transient electronic systems for security and data protection purposes. These include self-destructing data storage devices, tamper-evident electronics, and hardware security modules that can be triggered to degrade or become inoperable when unauthorized access is detected, protecting sensitive information from falling into the wrong hands.Expand Specific Solutions05 Fabrication techniques for transient electronic components

Manufacturing methods specifically developed for creating transient electronic devices, including specialized thin-film deposition, water-soluble circuit printing, and integration of dissolvable conductive materials. These techniques enable the production of electronic components with controlled lifespans and degradation profiles while maintaining necessary performance characteristics during their operational period.Expand Specific Solutions

Key Industry Players in Smart Packaging Solutions

The transient electronics market in smart packaging is in its early growth phase, characterized by increasing R&D activities and emerging commercial applications. The global market is projected to expand significantly as sustainability concerns drive demand for biodegradable electronics. Leading academic institutions (University of Illinois, Tufts College, Vanderbilt University) are pioneering fundamental research, while established semiconductor companies (Intel, Micron Technology, Infineon) are developing commercial applications. Technology startups like Transient Electronics, Inc. are focusing on specialized solutions, while packaging innovators (Sapal SA, Georg Utz Holding, Wanfried-Druck Kalden) are integrating these technologies into smart packaging systems. The ecosystem is evolving through strategic partnerships between research institutions and industry players to overcome technical challenges in scalability, reliability, and cost-effectiveness.

The Board of Trustees of the University of Illinois

Technical Solution: The University of Illinois has pioneered transient electronics for smart packaging through their groundbreaking work on silicon-based systems that can dissolve in water or biofluids. Their technology utilizes ultrathin silicon membranes (down to 20 nm thickness) combined with magnesium conductors and silk protein encapsulation to create fully functional electronic systems with programmable lifespans. For smart packaging applications, they've developed integrated sensor platforms that can monitor temperature, humidity, and mechanical stress while being thin enough (less than 100 μm total thickness) to integrate seamlessly into standard packaging materials. Their system incorporates near-field communication capabilities that allow data transmission to smartphones for authentication and condition verification[7]. A key innovation is their development of transient batteries using non-toxic metals that can power these systems for precise durations before dissolving completely. The technology has been demonstrated in pharmaceutical packaging applications where it can verify cold chain compliance and product authenticity while leaving no electronic waste after disposal[8]. Recent advancements include the integration of simple microprocessors capable of running authentication algorithms directly on the package.

Strengths: Extremely thin profile enables seamless integration into conventional packaging; precisely controllable dissolution rates from minutes to months; comprehensive intellectual property portfolio with extensive published research validation. Weaknesses: Higher manufacturing complexity compared to conventional packaging; limited computational capabilities due to material constraints; potential cost barriers for widespread adoption in lower-value consumer goods.

Micron Technology, Inc.

Technical Solution: Micron Technology has developed a sophisticated transient memory platform specifically optimized for smart packaging applications. Their technology leverages modified NAND flash memory architectures built on water-soluble substrates that maintain data integrity until triggered to decompose. For smart packaging solutions, Micron has created ultra-low-power memory modules capable of storing product authentication codes, supply chain data, and environmental exposure records that can be accessed via NFC or RFID interfaces. The company's proprietary encapsulation technology allows precise control over dissolution timing, with options ranging from immediate dissolution upon package opening to gradual degradation over several weeks[9]. Their smart packaging platform incorporates secure encryption capabilities to prevent counterfeiting while consuming minimal power - less than 10 μW during standby operation. Micron has demonstrated integration with temperature and humidity sensors to create complete package monitoring systems that can store weeks of environmental data before transmitting it during authentication checks. The technology has been successfully implemented in luxury goods packaging to verify authenticity and in pharmaceutical applications to ensure proper handling throughout distribution[10].

Strengths: Industry-leading data storage capacity enables complex authentication and monitoring capabilities; established manufacturing infrastructure provides pathway to scale; secure encryption prevents counterfeiting. Weaknesses: Higher implementation cost compared to simple visual authentication methods; requires specialized reading equipment for full functionality; more complex integration process compared to conventional packaging technologies.

Core Patents and Technical Literature Analysis

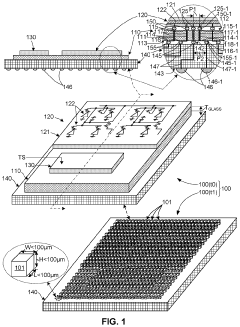

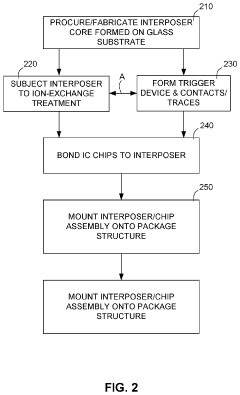

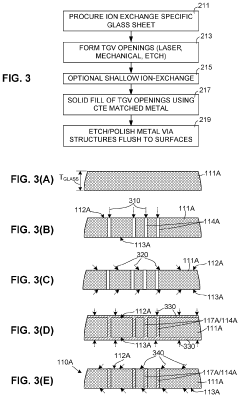

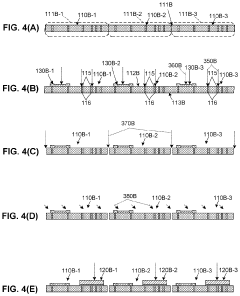

Transient electronic device with ion-exchanged glass treated interposer

PatentActiveUS20200027847A1

Innovation

- A transient electronic device using a glass-based interposer with an ion-exchange treated substrate that fractures upon a trigger signal, causing the IC die to powderize simultaneously, providing rapid and complete destruction compatible with existing IC fabrication techniques.

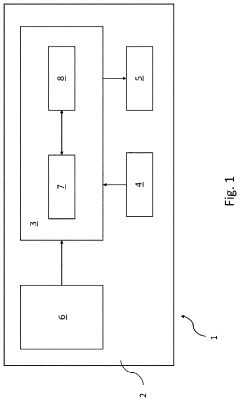

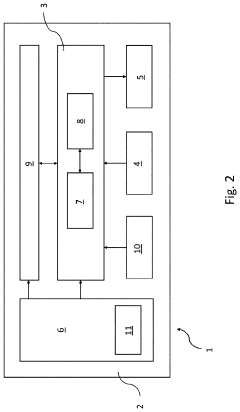

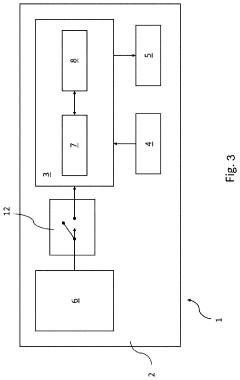

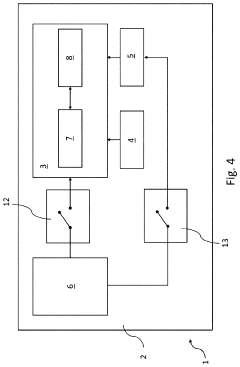

Smart label device which is applicable to a packaging for providing an information representative of the residual period of life of a perishable product inside the packaging

PatentPendingUS20230419867A1

Innovation

- A flexible smart label device with a polymer or plastic substrate, printed electronics, and integrated sensors and control units that can be applied to packaging without external components, providing information on the residual life of perishable products while being cost-effective and easily recyclable.

Environmental Impact and Sustainability Considerations

The environmental impact of transient electronics in smart packaging represents a critical consideration as this technology advances toward commercial implementation. Traditional electronics contribute significantly to e-waste, with approximately 50 million tons generated annually worldwide. Transient electronics offer a promising alternative by utilizing biodegradable substrates, water-soluble conductors, and environmentally benign semiconductors that naturally decompose after their intended use period.

Material selection plays a fundamental role in determining the environmental footprint of these systems. Silicon-based transient electronics typically employ ultra-thin silicon membranes that can dissolve in biofluids or water, while organic alternatives utilize biodegradable polymers such as polylactic acid (PLA) or cellulose derivatives. These materials demonstrate varying degradation rates and environmental impacts, with some completely decomposing within weeks while others may require specific environmental conditions to trigger dissolution.

Life cycle assessment (LCA) studies indicate that transient electronics in smart packaging can reduce environmental impact by up to 60% compared to conventional electronics when properly designed. However, these benefits are contingent upon appropriate end-of-life management and the absence of potentially harmful degradation byproducts. Current research focuses on ensuring that decomposition processes yield only environmentally safe compounds.

Energy considerations present another dimension of sustainability. Smart packaging applications typically require low-power operation, making transient electronics particularly suitable when combined with energy harvesting technologies such as photovoltaics or radio frequency harvesting. This combination can eliminate the need for batteries, further reducing environmental impact while extending functional lifetimes.

Manufacturing processes for transient electronics are evolving toward more sustainable approaches. Additive manufacturing techniques like inkjet printing of conductive materials on biodegradable substrates consume significantly fewer resources than traditional semiconductor fabrication. However, challenges remain in scaling these processes while maintaining environmental benefits.

Regulatory frameworks worldwide are beginning to acknowledge and incorporate provisions for transient electronics. The European Union's Waste Electrical and Electronic Equipment (WEEE) Directive is considering special classifications for self-degrading electronic components, potentially creating incentives for their adoption in consumer packaging applications. Similar regulatory developments are emerging in North America and parts of Asia, though harmonization remains incomplete.

The integration of transient electronics into circular economy models represents perhaps their greatest sustainability potential. By designing these systems to safely return to the biological cycle after use, manufacturers can create truly closed-loop packaging solutions that align with zero-waste initiatives while delivering enhanced functionality.

Material selection plays a fundamental role in determining the environmental footprint of these systems. Silicon-based transient electronics typically employ ultra-thin silicon membranes that can dissolve in biofluids or water, while organic alternatives utilize biodegradable polymers such as polylactic acid (PLA) or cellulose derivatives. These materials demonstrate varying degradation rates and environmental impacts, with some completely decomposing within weeks while others may require specific environmental conditions to trigger dissolution.

Life cycle assessment (LCA) studies indicate that transient electronics in smart packaging can reduce environmental impact by up to 60% compared to conventional electronics when properly designed. However, these benefits are contingent upon appropriate end-of-life management and the absence of potentially harmful degradation byproducts. Current research focuses on ensuring that decomposition processes yield only environmentally safe compounds.

Energy considerations present another dimension of sustainability. Smart packaging applications typically require low-power operation, making transient electronics particularly suitable when combined with energy harvesting technologies such as photovoltaics or radio frequency harvesting. This combination can eliminate the need for batteries, further reducing environmental impact while extending functional lifetimes.

Manufacturing processes for transient electronics are evolving toward more sustainable approaches. Additive manufacturing techniques like inkjet printing of conductive materials on biodegradable substrates consume significantly fewer resources than traditional semiconductor fabrication. However, challenges remain in scaling these processes while maintaining environmental benefits.

Regulatory frameworks worldwide are beginning to acknowledge and incorporate provisions for transient electronics. The European Union's Waste Electrical and Electronic Equipment (WEEE) Directive is considering special classifications for self-degrading electronic components, potentially creating incentives for their adoption in consumer packaging applications. Similar regulatory developments are emerging in North America and parts of Asia, though harmonization remains incomplete.

The integration of transient electronics into circular economy models represents perhaps their greatest sustainability potential. By designing these systems to safely return to the biological cycle after use, manufacturers can create truly closed-loop packaging solutions that align with zero-waste initiatives while delivering enhanced functionality.

Regulatory Framework for Food-Contact Electronics

The regulatory landscape for food-contact electronics represents a critical framework governing the implementation of transient electronics in smart packaging solutions. Currently, regulatory bodies worldwide are developing specific guidelines to address the unique challenges posed by electronics that directly interface with food products. The U.S. Food and Drug Administration (FDA) has established preliminary guidelines under the Food Contact Substance Notification Program, requiring manufacturers to demonstrate that transient electronic components do not migrate harmful substances into food products during their functional lifetime.

In the European Union, the European Food Safety Authority (EFSA) has implemented more stringent regulations through the EU Regulation No. 1935/2004, which mandates comprehensive safety assessments for all materials intended to contact food. For transient electronics, this includes evaluation of all component materials, degradation products, and potential migration pathways. Additionally, the EU's Restriction of Hazardous Substances (RoHS) directive imposes limitations on certain hazardous materials commonly used in electronics manufacturing, necessitating alternative material selection for transient electronics in food packaging.

Japan's Ministry of Health, Labour and Welfare has established the Positive List System for food contact materials, which specifically addresses electronic components in proximity to food products. This system requires pre-market approval for novel materials and technologies, including transient electronics applications in smart packaging. Similarly, China's National Food Safety Standard GB 9685 regulates additives for food contact materials and is currently being updated to address emerging technologies like transient electronics.

International standards organizations, including ISO and IEC, are developing harmonized testing protocols specifically for transient electronics in food packaging. ISO/TC 122 (Packaging) is currently drafting standards for smart packaging that incorporate electronic components, focusing on safety, functionality, and environmental impact throughout the product lifecycle.

Compliance challenges for manufacturers include the varying regulatory requirements across different markets, necessitating multiple certification processes. The rapid evolution of transient electronics technology often outpaces regulatory frameworks, creating uncertainty regarding compliance pathways. Furthermore, the novel degradation mechanisms of transient electronics present unique challenges for traditional toxicological assessment methods, requiring new approaches to safety evaluation.

Looking forward, regulatory trends indicate movement toward a more harmonized global approach, with increased focus on lifecycle assessment and end-of-life considerations for transient electronics. Regulatory bodies are increasingly adopting risk-based approaches that consider both the intended functionality and potential hazards of smart packaging technologies, balancing innovation with consumer safety.

In the European Union, the European Food Safety Authority (EFSA) has implemented more stringent regulations through the EU Regulation No. 1935/2004, which mandates comprehensive safety assessments for all materials intended to contact food. For transient electronics, this includes evaluation of all component materials, degradation products, and potential migration pathways. Additionally, the EU's Restriction of Hazardous Substances (RoHS) directive imposes limitations on certain hazardous materials commonly used in electronics manufacturing, necessitating alternative material selection for transient electronics in food packaging.

Japan's Ministry of Health, Labour and Welfare has established the Positive List System for food contact materials, which specifically addresses electronic components in proximity to food products. This system requires pre-market approval for novel materials and technologies, including transient electronics applications in smart packaging. Similarly, China's National Food Safety Standard GB 9685 regulates additives for food contact materials and is currently being updated to address emerging technologies like transient electronics.

International standards organizations, including ISO and IEC, are developing harmonized testing protocols specifically for transient electronics in food packaging. ISO/TC 122 (Packaging) is currently drafting standards for smart packaging that incorporate electronic components, focusing on safety, functionality, and environmental impact throughout the product lifecycle.

Compliance challenges for manufacturers include the varying regulatory requirements across different markets, necessitating multiple certification processes. The rapid evolution of transient electronics technology often outpaces regulatory frameworks, creating uncertainty regarding compliance pathways. Furthermore, the novel degradation mechanisms of transient electronics present unique challenges for traditional toxicological assessment methods, requiring new approaches to safety evaluation.

Looking forward, regulatory trends indicate movement toward a more harmonized global approach, with increased focus on lifecycle assessment and end-of-life considerations for transient electronics. Regulatory bodies are increasingly adopting risk-based approaches that consider both the intended functionality and potential hazards of smart packaging technologies, balancing innovation with consumer safety.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!