Ultrafiltration vs Activated Carbon Filtration: Impact on Taste and Odor

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Water Filtration Technology Evolution and Objectives

Water filtration technology has evolved significantly over the past century, transitioning from basic sand filtration methods to sophisticated membrane and adsorption technologies. The 1960s marked a pivotal moment with the commercial introduction of activated carbon filtration, which revolutionized taste and odor control in drinking water. By the 1980s, ultrafiltration emerged as a promising technology, initially for industrial applications before gradually entering the residential market in the early 2000s.

The evolution of these technologies has been driven by increasing water quality concerns, stricter regulatory standards, and growing consumer awareness about water contaminants. Activated carbon filtration, utilizing the principle of adsorption, has been the gold standard for taste and odor improvement for decades. Meanwhile, ultrafiltration, operating on size exclusion principles through semi-permeable membranes, has gained prominence for its ability to remove particulates and microorganisms.

Recent technological advancements have focused on enhancing the efficiency and effectiveness of both filtration methods. For activated carbon, innovations include improved carbon formulations with higher adsorption capacities and specialized treatments to target specific contaminants. Ultrafiltration has seen developments in membrane materials, increasing durability while reducing fouling issues that historically limited its widespread adoption.

The convergence of environmental challenges, including emerging contaminants like pharmaceuticals and microplastics, has accelerated research in these filtration technologies. Climate change impacts on water sources have further emphasized the need for robust filtration solutions capable of addressing variable water quality conditions.

The primary objective of current research in this field is to determine the comparative effectiveness of ultrafiltration versus activated carbon filtration specifically for taste and odor control. While activated carbon has traditionally excelled in this area through its adsorption mechanisms, ultrafiltration's potential to remove the physical sources of taste and odor compounds presents an alternative approach worth investigating.

Secondary objectives include evaluating the cost-effectiveness, maintenance requirements, and long-term performance stability of both technologies. Additionally, research aims to explore potential synergistic effects when these technologies are combined in series or hybrid systems, potentially offering superior taste and odor control compared to either technology alone.

The ultimate goal is to develop evidence-based recommendations for water treatment facilities and residential filtration system manufacturers regarding optimal technology selection for taste and odor management across different water source conditions and consumer preferences.

The evolution of these technologies has been driven by increasing water quality concerns, stricter regulatory standards, and growing consumer awareness about water contaminants. Activated carbon filtration, utilizing the principle of adsorption, has been the gold standard for taste and odor improvement for decades. Meanwhile, ultrafiltration, operating on size exclusion principles through semi-permeable membranes, has gained prominence for its ability to remove particulates and microorganisms.

Recent technological advancements have focused on enhancing the efficiency and effectiveness of both filtration methods. For activated carbon, innovations include improved carbon formulations with higher adsorption capacities and specialized treatments to target specific contaminants. Ultrafiltration has seen developments in membrane materials, increasing durability while reducing fouling issues that historically limited its widespread adoption.

The convergence of environmental challenges, including emerging contaminants like pharmaceuticals and microplastics, has accelerated research in these filtration technologies. Climate change impacts on water sources have further emphasized the need for robust filtration solutions capable of addressing variable water quality conditions.

The primary objective of current research in this field is to determine the comparative effectiveness of ultrafiltration versus activated carbon filtration specifically for taste and odor control. While activated carbon has traditionally excelled in this area through its adsorption mechanisms, ultrafiltration's potential to remove the physical sources of taste and odor compounds presents an alternative approach worth investigating.

Secondary objectives include evaluating the cost-effectiveness, maintenance requirements, and long-term performance stability of both technologies. Additionally, research aims to explore potential synergistic effects when these technologies are combined in series or hybrid systems, potentially offering superior taste and odor control compared to either technology alone.

The ultimate goal is to develop evidence-based recommendations for water treatment facilities and residential filtration system manufacturers regarding optimal technology selection for taste and odor management across different water source conditions and consumer preferences.

Market Analysis of Taste and Odor Removal Solutions

The global market for taste and odor removal solutions in water treatment has experienced significant growth, driven by increasing consumer awareness about water quality and stricter regulations on drinking water standards. Currently valued at approximately $7.2 billion, this market segment is projected to grow at a compound annual growth rate of 6.8% through 2028, according to recent industry analyses.

Consumer demand for better-tasting water represents the primary market driver, with surveys indicating that over 75% of consumers cite taste and odor as their main concerns regarding tap water quality. This perception has fueled both residential filtration system sales and municipal treatment upgrades, creating a dual-market dynamic that benefits solution providers across multiple sectors.

The municipal water treatment sector constitutes roughly 58% of the total market share, with utilities increasingly investing in advanced filtration technologies to address consumer complaints about chlorine taste, earthy/musty odors, and other organoleptic issues. North America and Europe currently lead market consumption, though the Asia-Pacific region shows the fastest growth trajectory with 9.3% annual expansion, primarily driven by rapid urbanization and increasing middle-class concerns about water quality.

Within the residential segment, point-of-use systems have gained substantial traction, growing at 7.5% annually. This growth reflects consumer preference for immediate solutions at the tap rather than whole-house systems. Activated carbon filtration dominates this segment with approximately 65% market share due to its cost-effectiveness and established consumer trust.

The commercial sector, including hospitality, food service, and institutional applications, represents a growing market segment with particular emphasis on consistent water quality for beverage production and food preparation. This sector increasingly demands hybrid solutions that combine multiple filtration technologies to address both taste/odor concerns and other contaminants simultaneously.

Market analysis reveals a significant price sensitivity differential between segments. While municipal buyers prioritize long-term operational costs and effectiveness, residential consumers demonstrate greater sensitivity to initial purchase price, creating distinct marketing and product development requirements for manufacturers targeting different segments.

Competition in this market features both specialized water treatment companies and diversified industrial conglomerates. Recent merger and acquisition activity has increased market consolidation, with five major players now controlling approximately 43% of global market share. This consolidation trend is expected to continue as companies seek to offer comprehensive water quality solutions rather than single-technology approaches.

Consumer demand for better-tasting water represents the primary market driver, with surveys indicating that over 75% of consumers cite taste and odor as their main concerns regarding tap water quality. This perception has fueled both residential filtration system sales and municipal treatment upgrades, creating a dual-market dynamic that benefits solution providers across multiple sectors.

The municipal water treatment sector constitutes roughly 58% of the total market share, with utilities increasingly investing in advanced filtration technologies to address consumer complaints about chlorine taste, earthy/musty odors, and other organoleptic issues. North America and Europe currently lead market consumption, though the Asia-Pacific region shows the fastest growth trajectory with 9.3% annual expansion, primarily driven by rapid urbanization and increasing middle-class concerns about water quality.

Within the residential segment, point-of-use systems have gained substantial traction, growing at 7.5% annually. This growth reflects consumer preference for immediate solutions at the tap rather than whole-house systems. Activated carbon filtration dominates this segment with approximately 65% market share due to its cost-effectiveness and established consumer trust.

The commercial sector, including hospitality, food service, and institutional applications, represents a growing market segment with particular emphasis on consistent water quality for beverage production and food preparation. This sector increasingly demands hybrid solutions that combine multiple filtration technologies to address both taste/odor concerns and other contaminants simultaneously.

Market analysis reveals a significant price sensitivity differential between segments. While municipal buyers prioritize long-term operational costs and effectiveness, residential consumers demonstrate greater sensitivity to initial purchase price, creating distinct marketing and product development requirements for manufacturers targeting different segments.

Competition in this market features both specialized water treatment companies and diversified industrial conglomerates. Recent merger and acquisition activity has increased market consolidation, with five major players now controlling approximately 43% of global market share. This consolidation trend is expected to continue as companies seek to offer comprehensive water quality solutions rather than single-technology approaches.

Current Challenges in Water Filtration Technologies

Water filtration technologies face significant challenges in effectively addressing taste and odor issues while maintaining operational efficiency. The primary contaminants affecting organoleptic properties include geosmin and 2-methylisoborneol (MIB), which impart earthy and musty flavors even at concentrations as low as 10 ng/L. These compounds, primarily produced by cyanobacteria and actinomycetes, represent persistent challenges for conventional treatment systems.

Ultrafiltration (UF) systems, while excellent at removing particulates and microorganisms through size exclusion mechanisms, demonstrate limited effectiveness against dissolved organic compounds responsible for taste and odor issues. The typical pore size of UF membranes (0.01-0.1 μm) exceeds the molecular dimensions of taste and odor compounds, allowing these contaminants to pass through. This fundamental limitation necessitates additional treatment steps when taste and odor control is a priority.

Activated carbon filtration, conversely, excels at adsorbing organic compounds but faces challenges related to capacity exhaustion and regeneration requirements. The adsorption efficiency varies significantly based on carbon type, contact time, and competing substances in the water matrix. Granular activated carbon (GAC) systems require substantial maintenance and regular media replacement, while powdered activated carbon (PAC) dosing presents challenges in achieving consistent application rates and subsequent removal of carbon particles.

Hybrid systems combining both technologies attempt to leverage complementary strengths but introduce complexity in operation and maintenance. The integration of these systems requires sophisticated monitoring and control mechanisms to optimize performance across varying water quality conditions. Additionally, the capital and operational costs of combined systems can be prohibitive for smaller water utilities.

Seasonal variations in source water quality present another significant challenge, as algal blooms can cause sudden spikes in taste and odor compounds that overwhelm treatment capacity. Climate change exacerbates this issue by increasing the frequency and intensity of these events, requiring more robust and adaptable treatment solutions.

Regulatory frameworks add another layer of complexity, as they typically focus on health-based contaminants rather than aesthetic water quality parameters. This creates a disconnect between compliance requirements and consumer expectations, often leaving utilities to balance regulatory mandates against customer satisfaction metrics.

Emerging contaminants of concern, including pharmaceuticals and personal care products, further complicate treatment strategies as these compounds may contribute to taste and odor issues while requiring specialized removal approaches. The increasing diversity of potential contaminants necessitates more sophisticated multi-barrier treatment approaches that can address both traditional and emerging water quality challenges.

Ultrafiltration (UF) systems, while excellent at removing particulates and microorganisms through size exclusion mechanisms, demonstrate limited effectiveness against dissolved organic compounds responsible for taste and odor issues. The typical pore size of UF membranes (0.01-0.1 μm) exceeds the molecular dimensions of taste and odor compounds, allowing these contaminants to pass through. This fundamental limitation necessitates additional treatment steps when taste and odor control is a priority.

Activated carbon filtration, conversely, excels at adsorbing organic compounds but faces challenges related to capacity exhaustion and regeneration requirements. The adsorption efficiency varies significantly based on carbon type, contact time, and competing substances in the water matrix. Granular activated carbon (GAC) systems require substantial maintenance and regular media replacement, while powdered activated carbon (PAC) dosing presents challenges in achieving consistent application rates and subsequent removal of carbon particles.

Hybrid systems combining both technologies attempt to leverage complementary strengths but introduce complexity in operation and maintenance. The integration of these systems requires sophisticated monitoring and control mechanisms to optimize performance across varying water quality conditions. Additionally, the capital and operational costs of combined systems can be prohibitive for smaller water utilities.

Seasonal variations in source water quality present another significant challenge, as algal blooms can cause sudden spikes in taste and odor compounds that overwhelm treatment capacity. Climate change exacerbates this issue by increasing the frequency and intensity of these events, requiring more robust and adaptable treatment solutions.

Regulatory frameworks add another layer of complexity, as they typically focus on health-based contaminants rather than aesthetic water quality parameters. This creates a disconnect between compliance requirements and consumer expectations, often leaving utilities to balance regulatory mandates against customer satisfaction metrics.

Emerging contaminants of concern, including pharmaceuticals and personal care products, further complicate treatment strategies as these compounds may contribute to taste and odor issues while requiring specialized removal approaches. The increasing diversity of potential contaminants necessitates more sophisticated multi-barrier treatment approaches that can address both traditional and emerging water quality challenges.

Comparative Analysis of UF and AC Filtration Systems

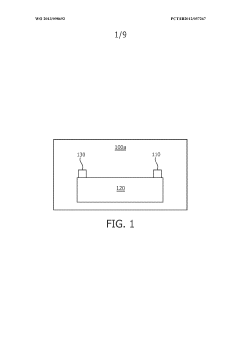

01 Combined ultrafiltration and activated carbon systems for taste and odor removal

Systems that integrate both ultrafiltration and activated carbon filtration technologies provide comprehensive treatment for taste and odor issues in water. The ultrafiltration membrane removes particulates and microorganisms, while the activated carbon adsorbs organic compounds responsible for unpleasant tastes and odors. This combination ensures more effective removal of contaminants than either technology alone, resulting in improved water quality and palatability.- Combined ultrafiltration and activated carbon systems for taste and odor removal: Systems that integrate both ultrafiltration and activated carbon filtration technologies provide comprehensive treatment for taste and odor issues in water. The ultrafiltration membrane removes particulates and microorganisms, while the activated carbon adsorbs organic compounds responsible for unpleasant tastes and odors. This combination offers superior performance compared to single-technology approaches, ensuring effective removal of a wide range of contaminants.

- Activated carbon filtration mechanisms for taste and odor control: Activated carbon filtration works through adsorption processes to remove taste and odor-causing compounds from water. The porous structure of activated carbon provides a large surface area that effectively captures organic molecules, chlorine, and other substances that contribute to unpleasant tastes and odors. Different forms of activated carbon, including granular and block types, can be utilized depending on the specific contaminants targeted and the desired flow rate.

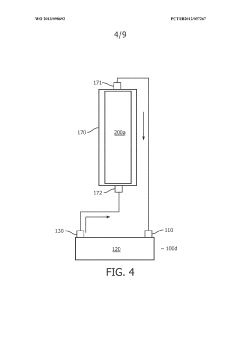

- Ultrafiltration membrane technology for water purification: Ultrafiltration membranes employ a physical barrier with pore sizes typically ranging from 0.01 to 0.1 microns to remove suspended solids, bacteria, and some viruses from water. This technology helps eliminate turbidity and microorganisms that can contribute to taste and odor problems. The membrane filtration process operates under low pressure and can be designed for various flow capacities, making it suitable for both residential and industrial applications.

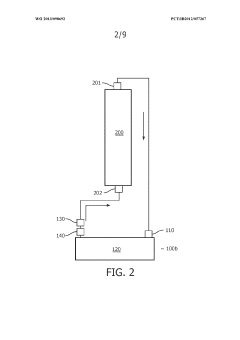

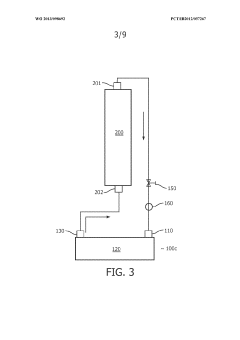

- Multi-stage filtration systems incorporating pre-treatment and post-treatment processes: Advanced water treatment systems often employ multiple filtration stages to address taste and odor issues comprehensively. These systems may include pre-treatment processes such as sediment filtration or coagulation before ultrafiltration, and post-treatment with activated carbon to remove residual tastes and odors. This sequential approach ensures optimal performance of each filtration component and extends the service life of the more expensive filtration elements.

- Specialized activated carbon materials for enhanced taste and odor removal: Various specialized activated carbon materials have been developed to target specific taste and odor compounds in water. These include coconut shell-based carbon, coal-based carbon, and chemically modified carbons with enhanced adsorption capabilities for particular contaminants. The selection of appropriate activated carbon material depends on the source water quality and the specific taste and odor compounds present, allowing for customized treatment solutions.

02 Granular activated carbon filtration for organic compound removal

Granular activated carbon (GAC) filtration systems are specifically designed to target and remove organic compounds that cause taste and odor problems in water. The porous structure of activated carbon provides a large surface area for adsorption of contaminants such as chlorine, pesticides, and volatile organic compounds. These systems can be optimized with different carbon types and contact times to enhance the removal efficiency of specific taste and odor-causing compounds.Expand Specific Solutions03 Ultrafiltration membrane technology for particulate and microbial removal

Ultrafiltration membrane systems utilize semi-permeable membranes with pore sizes typically between 0.01 and 0.1 micrometers to physically separate suspended solids, bacteria, and some viruses from water. While primarily focused on particulate removal, these systems also contribute to taste and odor improvement by removing microorganisms that can produce taste and odor compounds. The membrane configuration and material selection significantly impact filtration efficiency and operational performance.Expand Specific Solutions04 Multi-stage filtration systems with pre and post-treatment

Multi-stage water treatment systems incorporate sequential filtration processes including pre-filtration, ultrafiltration, activated carbon treatment, and post-treatment stages. Pre-treatment removes larger particles to protect downstream components, while post-treatment may include disinfection or pH adjustment. This comprehensive approach ensures optimal performance of both ultrafiltration and activated carbon components, extending their operational life while maximizing taste and odor removal efficiency.Expand Specific Solutions05 Specialized activated carbon materials for enhanced adsorption

Advanced activated carbon materials with modified surface properties or impregnated with specific chemicals can provide enhanced adsorption capabilities for particular taste and odor compounds. These specialized carbons may be derived from different source materials (coconut shell, coal, wood) or undergo various activation processes to optimize their performance for specific contaminants. The selection of appropriate carbon material based on water quality analysis can significantly improve taste and odor treatment outcomes.Expand Specific Solutions

Leading Manufacturers and Market Competition

The water filtration market is experiencing robust growth, currently in a mature expansion phase with increasing consumer awareness of water quality issues. The global market for ultrafiltration and activated carbon filtration technologies is estimated to exceed $15 billion, driven by rising concerns about taste and odor in drinking water. Technologically, activated carbon filtration represents a more established solution with widespread adoption, while ultrafiltration is gaining momentum as a premium alternative. Leading players include Procter & Gamble and LG Electronics offering consumer-focused solutions, MANN+HUMMEL and Sciessent developing specialized filtration technologies, and research institutions like Penn State Research Foundation advancing next-generation solutions. Companies such as Coway, BSH Hausgeräte, and Sharp are integrating these technologies into comprehensive water treatment systems, indicating a trend toward multifunctional filtration solutions addressing both taste/odor concerns and contaminant removal.

Procter & Gamble Co.

Technical Solution: Procter & Gamble has developed sophisticated water filtration technologies addressing taste and odor concerns through both ultrafiltration and activated carbon approaches. Their ultrafiltration systems employ semi-permeable membranes with precisely controlled pore sizes (typically 0.01-0.02 microns) that operate under low pressure (30-50 psi) to remove particulates, bacteria, and some viruses while preserving beneficial minerals. P&G's activated carbon filtration technology utilizes proprietary carbon formulations with enhanced adsorption capacity, specifically targeting chlorine, volatile organic compounds (VOCs), and other taste/odor-causing compounds. Their carbon media undergoes specialized treatment processes to create optimal pore size distribution and surface chemistry for maximum contaminant binding. P&G has conducted extensive sensory testing showing that their activated carbon systems can reduce chlorine taste by over 95% and improve overall taste perception scores by 40-60% compared to untreated water, while their ultrafiltration systems excel at removing particulate-based turbidity that affects visual appeal.

Strengths: P&G's consumer research-driven approach has optimized their filtration technologies specifically for taste and odor concerns that matter most to end users. Their activated carbon formulations demonstrate superior chlorine and VOC removal with longer filter life than many competitors. Weaknesses: Their ultrafiltration systems require more frequent membrane replacement in high-sediment applications and have higher initial costs compared to basic carbon filtration, potentially limiting adoption in cost-sensitive markets.

MANN+HUMMEL GmbH

Technical Solution: MANN+HUMMEL has developed advanced filtration solutions comparing ultrafiltration and activated carbon technologies for taste and odor control. Their ultrafiltration systems utilize hollow fiber membranes with pore sizes of 0.01-0.1 microns that physically block contaminants based on size exclusion principles. This technology effectively removes bacteria (>99.99%), viruses, and particulates while preserving essential minerals. Their activated carbon filtration employs specially engineered carbon media with optimized surface area (typically 500-1500 m²/g) and controlled pore size distribution to maximize adsorption of organic compounds, chlorine, and volatile organic compounds (VOCs) that cause taste and odor issues. MANN+HUMMEL's hybrid systems combine both technologies in sequence, with activated carbon removing chlorine and organics first to protect membranes from degradation, followed by ultrafiltration to remove remaining particulates and microorganisms.

Strengths: Their hybrid approach maximizes the benefits of both technologies, providing comprehensive contaminant removal while maintaining essential mineral content. The company's extensive R&D in pore structure optimization has resulted in longer filter life and reduced maintenance costs. Weaknesses: Their ultrafiltration systems require higher initial investment and energy consumption compared to standalone activated carbon solutions, and may experience membrane fouling in applications with high organic loads.

Key Patents and Research in Taste/Odor Removal

Apparatus, system and method for disinfecting objects

PatentWO2013098692A1

Innovation

- An off-line disinfection apparatus and method that circulates a disinfectant through the filter when it is not in use, using a pressurizer to break down larger particles, a pressure valve to control disinfectant flow, and a sensor to manage disinfectant concentration, allowing for effective disinfection without introducing disinfectants into water or air.

Textiles having antimicrobial properties

PatentInactiveEP3795741A1

Innovation

- A textile material is treated with an exhaust process using a liquor containing antimicrobial agents, followed by heat treatment to ensure strong bonding and durability, allowing it to act as a disinfectant and filter without leaching, and a water purification system using gravity-based filtration with antimicrobial filters.

Environmental Impact and Sustainability Considerations

The environmental footprint of water filtration technologies has become increasingly important as organizations and consumers seek sustainable solutions. When comparing ultrafiltration (UF) and activated carbon filtration (ACF) systems, several key environmental considerations emerge beyond their effectiveness in taste and odor removal.

Ultrafiltration systems generally demonstrate superior environmental performance in terms of operational lifespan. UF membranes typically last 3-5 years before replacement, significantly reducing waste generation compared to activated carbon filters that require more frequent changes—typically every 2-6 months depending on usage patterns and water quality. This difference translates to substantially less solid waste entering landfills over a system's lifetime.

Energy consumption presents another critical sustainability factor. UF systems require pumping pressure to force water through membranes, consuming approximately 0.1-0.3 kWh per cubic meter of treated water. In contrast, gravity-fed activated carbon systems consume minimal operational energy but may require more energy during the manufacturing and regeneration processes. The carbon activation process is particularly energy-intensive, requiring temperatures of 600-900°C during production.

The carbon footprint of manufacturing these filtration technologies differs significantly. Activated carbon production generates considerable greenhouse gas emissions during the high-temperature activation process. Additionally, virgin activated carbon often derives from coal, wood, or coconut shells, raising resource depletion concerns. UF membrane production, while also resource-intensive, typically utilizes synthetic polymers with different environmental impact profiles.

Waste management considerations favor ultrafiltration in many scenarios. Spent activated carbon may contain concentrated contaminants requiring special disposal procedures, whereas UF membranes generally pose fewer hazardous waste concerns. However, end-of-life recycling options remain limited for both technologies, presenting an ongoing sustainability challenge.

Water efficiency metrics also differ between these systems. Ultrafiltration typically requires periodic backwashing that consumes 5-10% of filtered water, while activated carbon systems generally operate without this water loss. This difference becomes particularly significant in water-scarce regions where conservation is paramount.

Chemical usage presents another environmental consideration. UF membranes often require periodic chemical cleaning with agents like sodium hypochlorite or citric acid to maintain performance. Activated carbon typically requires fewer maintenance chemicals but may need periodic sanitization depending on the application context.

Ultrafiltration systems generally demonstrate superior environmental performance in terms of operational lifespan. UF membranes typically last 3-5 years before replacement, significantly reducing waste generation compared to activated carbon filters that require more frequent changes—typically every 2-6 months depending on usage patterns and water quality. This difference translates to substantially less solid waste entering landfills over a system's lifetime.

Energy consumption presents another critical sustainability factor. UF systems require pumping pressure to force water through membranes, consuming approximately 0.1-0.3 kWh per cubic meter of treated water. In contrast, gravity-fed activated carbon systems consume minimal operational energy but may require more energy during the manufacturing and regeneration processes. The carbon activation process is particularly energy-intensive, requiring temperatures of 600-900°C during production.

The carbon footprint of manufacturing these filtration technologies differs significantly. Activated carbon production generates considerable greenhouse gas emissions during the high-temperature activation process. Additionally, virgin activated carbon often derives from coal, wood, or coconut shells, raising resource depletion concerns. UF membrane production, while also resource-intensive, typically utilizes synthetic polymers with different environmental impact profiles.

Waste management considerations favor ultrafiltration in many scenarios. Spent activated carbon may contain concentrated contaminants requiring special disposal procedures, whereas UF membranes generally pose fewer hazardous waste concerns. However, end-of-life recycling options remain limited for both technologies, presenting an ongoing sustainability challenge.

Water efficiency metrics also differ between these systems. Ultrafiltration typically requires periodic backwashing that consumes 5-10% of filtered water, while activated carbon systems generally operate without this water loss. This difference becomes particularly significant in water-scarce regions where conservation is paramount.

Chemical usage presents another environmental consideration. UF membranes often require periodic chemical cleaning with agents like sodium hypochlorite or citric acid to maintain performance. Activated carbon typically requires fewer maintenance chemicals but may need periodic sanitization depending on the application context.

Regulatory Standards for Drinking Water Quality

Regulatory standards for drinking water quality play a crucial role in evaluating water treatment technologies such as Ultrafiltration (UF) and Activated Carbon Filtration (ACF), particularly regarding their effectiveness in addressing taste and odor concerns. These standards vary globally but generally establish minimum requirements for aesthetic water quality parameters alongside health-based contaminant limits.

The United States Environmental Protection Agency (EPA) has established Secondary Maximum Contaminant Levels (SMCLs) that specifically address taste, odor, and appearance factors in drinking water. While these are non-enforceable guidelines, they provide important benchmarks for water utilities to maintain consumer satisfaction. For taste and odor specifically, parameters include threshold odor number (TON) and flavor profile analysis (FPA) methodologies.

The European Union's Drinking Water Directive (98/83/EC, updated in 2020) similarly includes parameters related to organoleptic properties, requiring that drinking water be "acceptable to consumers and with no abnormal change" in taste and odor. These qualitative standards recognize the importance of consumer perception in water quality assessment.

The World Health Organization's Guidelines for Drinking-water Quality emphasize that while taste and odor compounds may not pose direct health risks, they significantly impact consumer acceptance and confidence in water supplies. WHO recommends monitoring for geosmin and 2-methylisoborneol (2-MIB), common compounds causing earthy-musty tastes, with detection thresholds as low as 4-10 ng/L.

In Asia, Japan's Ministry of Health, Labour and Welfare has established some of the most stringent standards for taste and odor compounds, with specific numerical limits for geosmin and 2-MIB at 10 ng/L. China's national standards (GB 5749-2006) similarly address these aesthetic parameters with quantitative limits.

Regulatory frameworks increasingly recognize the importance of addressing disinfection byproducts (DBPs) that can impart chlorinous tastes. The Stage 2 Disinfectants and Disinfection Byproducts Rule in the US establishes maximum contaminant levels for trihalomethanes and haloacetic acids, compounds that can affect taste while also posing health concerns.

When comparing UF and ACF technologies, regulatory compliance must consider both technologies' capabilities against these standards. ACF typically excels at removing specific organic compounds responsible for taste and odor issues, while UF may require complementary treatment steps to achieve similar aesthetic quality results, despite its superior performance in pathogen removal.

Recent regulatory trends indicate a move toward more comprehensive and quantitative standards for taste and odor compounds, reflecting growing consumer expectations for drinking water that is not only safe but also aesthetically pleasing.

The United States Environmental Protection Agency (EPA) has established Secondary Maximum Contaminant Levels (SMCLs) that specifically address taste, odor, and appearance factors in drinking water. While these are non-enforceable guidelines, they provide important benchmarks for water utilities to maintain consumer satisfaction. For taste and odor specifically, parameters include threshold odor number (TON) and flavor profile analysis (FPA) methodologies.

The European Union's Drinking Water Directive (98/83/EC, updated in 2020) similarly includes parameters related to organoleptic properties, requiring that drinking water be "acceptable to consumers and with no abnormal change" in taste and odor. These qualitative standards recognize the importance of consumer perception in water quality assessment.

The World Health Organization's Guidelines for Drinking-water Quality emphasize that while taste and odor compounds may not pose direct health risks, they significantly impact consumer acceptance and confidence in water supplies. WHO recommends monitoring for geosmin and 2-methylisoborneol (2-MIB), common compounds causing earthy-musty tastes, with detection thresholds as low as 4-10 ng/L.

In Asia, Japan's Ministry of Health, Labour and Welfare has established some of the most stringent standards for taste and odor compounds, with specific numerical limits for geosmin and 2-MIB at 10 ng/L. China's national standards (GB 5749-2006) similarly address these aesthetic parameters with quantitative limits.

Regulatory frameworks increasingly recognize the importance of addressing disinfection byproducts (DBPs) that can impart chlorinous tastes. The Stage 2 Disinfectants and Disinfection Byproducts Rule in the US establishes maximum contaminant levels for trihalomethanes and haloacetic acids, compounds that can affect taste while also posing health concerns.

When comparing UF and ACF technologies, regulatory compliance must consider both technologies' capabilities against these standards. ACF typically excels at removing specific organic compounds responsible for taste and odor issues, while UF may require complementary treatment steps to achieve similar aesthetic quality results, despite its superior performance in pathogen removal.

Recent regulatory trends indicate a move toward more comprehensive and quantitative standards for taste and odor compounds, reflecting growing consumer expectations for drinking water that is not only safe but also aesthetically pleasing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!