Why SERS Substrates Are Integral in Biosensor Technology

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SERS Substrate Evolution and Research Objectives

Surface-Enhanced Raman Spectroscopy (SERS) has evolved significantly since its discovery in the 1970s, transforming from a curious spectroscopic phenomenon to a cornerstone technology in advanced biosensing applications. The journey began with the observation of enhanced Raman signals from pyridine molecules adsorbed on roughened silver electrodes by Fleischmann, Hendra, and McQuillan in 1974, followed by the theoretical explanations proposed by Jeanmaire and Van Duyne in 1977, which laid the foundation for understanding the electromagnetic enhancement mechanism.

The evolution of SERS substrates has been marked by several pivotal technological advancements. Early substrates consisted primarily of electrochemically roughened metal surfaces, which provided limited enhancement factors and poor reproducibility. The 1990s witnessed the emergence of colloidal nanoparticles as SERS substrates, offering improved sensitivity but still suffering from aggregation issues and signal inconsistency.

A significant breakthrough occurred in the early 2000s with the development of lithographically fabricated substrates, enabling precise control over nanostructure geometry and spacing. This period also saw the introduction of novel substrate materials beyond traditional gold and silver, including copper, aluminum, and various hybrid materials, expanding the application spectrum of SERS technology.

The past decade has been characterized by the integration of SERS substrates with microfluidic platforms, creating lab-on-a-chip devices capable of rapid, multiplexed bioanalysis. Additionally, the incorporation of machine learning algorithms for spectral analysis has dramatically improved the sensitivity and specificity of SERS-based biosensors, enabling detection limits approaching single-molecule levels.

Current research objectives in SERS substrate development are multifaceted and ambitious. Primary goals include enhancing substrate stability under diverse environmental conditions, improving batch-to-batch reproducibility for commercial applications, and developing cost-effective fabrication methods suitable for mass production without compromising performance.

Another critical research direction involves the creation of "smart" SERS substrates with stimuli-responsive properties, capable of adapting to different analytes or concentrations. These advanced substrates aim to overcome current limitations in selectivity by incorporating molecular recognition elements such as aptamers or antibodies directly into the substrate architecture.

Furthermore, researchers are actively pursuing the development of flexible and wearable SERS substrates for continuous, non-invasive biomonitoring applications. This includes exploring novel substrate materials compatible with biological tissues and designing form factors suitable for integration into wearable devices.

The ultimate objective remains the creation of universal SERS platforms capable of detecting multiple biomarkers simultaneously with high sensitivity and specificity, thereby enabling early disease diagnosis, therapeutic monitoring, and personalized medicine approaches. This ambitious goal drives ongoing innovation in substrate design, fabrication techniques, and integration strategies across the global research community.

The evolution of SERS substrates has been marked by several pivotal technological advancements. Early substrates consisted primarily of electrochemically roughened metal surfaces, which provided limited enhancement factors and poor reproducibility. The 1990s witnessed the emergence of colloidal nanoparticles as SERS substrates, offering improved sensitivity but still suffering from aggregation issues and signal inconsistency.

A significant breakthrough occurred in the early 2000s with the development of lithographically fabricated substrates, enabling precise control over nanostructure geometry and spacing. This period also saw the introduction of novel substrate materials beyond traditional gold and silver, including copper, aluminum, and various hybrid materials, expanding the application spectrum of SERS technology.

The past decade has been characterized by the integration of SERS substrates with microfluidic platforms, creating lab-on-a-chip devices capable of rapid, multiplexed bioanalysis. Additionally, the incorporation of machine learning algorithms for spectral analysis has dramatically improved the sensitivity and specificity of SERS-based biosensors, enabling detection limits approaching single-molecule levels.

Current research objectives in SERS substrate development are multifaceted and ambitious. Primary goals include enhancing substrate stability under diverse environmental conditions, improving batch-to-batch reproducibility for commercial applications, and developing cost-effective fabrication methods suitable for mass production without compromising performance.

Another critical research direction involves the creation of "smart" SERS substrates with stimuli-responsive properties, capable of adapting to different analytes or concentrations. These advanced substrates aim to overcome current limitations in selectivity by incorporating molecular recognition elements such as aptamers or antibodies directly into the substrate architecture.

Furthermore, researchers are actively pursuing the development of flexible and wearable SERS substrates for continuous, non-invasive biomonitoring applications. This includes exploring novel substrate materials compatible with biological tissues and designing form factors suitable for integration into wearable devices.

The ultimate objective remains the creation of universal SERS platforms capable of detecting multiple biomarkers simultaneously with high sensitivity and specificity, thereby enabling early disease diagnosis, therapeutic monitoring, and personalized medicine approaches. This ambitious goal drives ongoing innovation in substrate design, fabrication techniques, and integration strategies across the global research community.

Market Analysis for SERS-Based Biosensors

The global market for SERS-based biosensors is experiencing robust growth, driven by increasing demand for rapid, sensitive, and portable diagnostic solutions across healthcare, environmental monitoring, and food safety sectors. Current market valuations place the SERS biosensor segment at approximately 1.2 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 14.7% through 2030, potentially reaching 3.5 billion USD by the end of the forecast period.

Healthcare applications dominate the market landscape, accounting for nearly 65% of total market share. This is primarily attributed to the rising incidence of chronic diseases, growing emphasis on early disease detection, and the shift toward personalized medicine. Point-of-care testing represents the fastest-growing application segment, as healthcare systems worldwide seek cost-effective diagnostic solutions that reduce hospital visits and enable remote patient monitoring.

Regionally, North America currently leads the market with approximately 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the highest growth rate over the next five years, driven by increasing healthcare expenditure, expanding research infrastructure, and growing awareness about advanced diagnostic technologies in countries like China, Japan, and India.

Key market drivers include technological advancements in nanofabrication techniques that have significantly improved the sensitivity and reproducibility of SERS substrates, growing investment in healthcare infrastructure, and increasing prevalence of infectious diseases necessitating rapid diagnostic solutions. The COVID-19 pandemic has further accelerated market growth by highlighting the importance of rapid, accurate diagnostic technologies.

Despite positive growth indicators, several challenges constrain market expansion. High development and production costs of SERS substrates remain a significant barrier, particularly for widespread adoption in resource-limited settings. Additionally, the lack of standardization in SERS measurement protocols and substrate fabrication creates inconsistencies that hinder commercial scalability.

Competitive analysis reveals a fragmented market landscape with a mix of established analytical instrument manufacturers and emerging specialized companies. Major players include Thermo Fisher Scientific, Horiba, Renishaw, Ocean Insight, and Metrohm, alongside innovative startups like Silmeco, Hamamatsu Photonics, and AnteoTech. Strategic collaborations between technology developers and healthcare providers are becoming increasingly common, aimed at accelerating commercialization pathways and expanding application domains.

Healthcare applications dominate the market landscape, accounting for nearly 65% of total market share. This is primarily attributed to the rising incidence of chronic diseases, growing emphasis on early disease detection, and the shift toward personalized medicine. Point-of-care testing represents the fastest-growing application segment, as healthcare systems worldwide seek cost-effective diagnostic solutions that reduce hospital visits and enable remote patient monitoring.

Regionally, North America currently leads the market with approximately 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the highest growth rate over the next five years, driven by increasing healthcare expenditure, expanding research infrastructure, and growing awareness about advanced diagnostic technologies in countries like China, Japan, and India.

Key market drivers include technological advancements in nanofabrication techniques that have significantly improved the sensitivity and reproducibility of SERS substrates, growing investment in healthcare infrastructure, and increasing prevalence of infectious diseases necessitating rapid diagnostic solutions. The COVID-19 pandemic has further accelerated market growth by highlighting the importance of rapid, accurate diagnostic technologies.

Despite positive growth indicators, several challenges constrain market expansion. High development and production costs of SERS substrates remain a significant barrier, particularly for widespread adoption in resource-limited settings. Additionally, the lack of standardization in SERS measurement protocols and substrate fabrication creates inconsistencies that hinder commercial scalability.

Competitive analysis reveals a fragmented market landscape with a mix of established analytical instrument manufacturers and emerging specialized companies. Major players include Thermo Fisher Scientific, Horiba, Renishaw, Ocean Insight, and Metrohm, alongside innovative startups like Silmeco, Hamamatsu Photonics, and AnteoTech. Strategic collaborations between technology developers and healthcare providers are becoming increasingly common, aimed at accelerating commercialization pathways and expanding application domains.

Current SERS Substrate Technologies and Limitations

Surface-Enhanced Raman Spectroscopy (SERS) substrates currently employ several key technologies, each with distinct advantages and limitations. Metal nanoparticle-based substrates, particularly those utilizing gold and silver, remain the most widely implemented. These substrates offer significant enhancement factors (10^6-10^8) through localized surface plasmon resonance effects. However, they frequently suffer from reproducibility issues, batch-to-batch variation, and limited shelf life due to oxidation, especially with silver nanoparticles.

Nanopatterned solid substrates represent another prominent approach, including nanopillar arrays, nanoholes, and nanogratings fabricated through lithographic techniques. While these offer improved reproducibility and stability compared to colloidal systems, they typically provide lower enhancement factors and involve complex, expensive fabrication processes that limit scalability for commercial biosensor applications.

Hybrid SERS substrates combining metallic nanostructures with supporting materials like graphene, polymers, or metal-organic frameworks have emerged to address specific limitations. These designs aim to improve stability, biocompatibility, and molecular capture efficiency, but often introduce additional complexity in fabrication and characterization.

A significant limitation across current SERS substrate technologies is the "hot spot" distribution challenge. Enhancement factors vary dramatically across substrate surfaces, with only a small percentage of the surface (typically <1%) providing the strongest signal enhancement. This spatial heterogeneity complicates quantitative analysis and reduces detection reliability in biosensing applications.

Stability issues present another major hurdle, particularly for in vivo or continuous monitoring biosensors. Many high-performance SERS substrates degrade when exposed to biological fluids, high salt concentrations, or varying pH environments, limiting their practical application in complex biological systems.

Cost-effectiveness remains a persistent challenge, with high-performance substrates often requiring expensive nanofabrication techniques. This creates a significant barrier to widespread adoption in point-of-care diagnostics and resource-limited settings where biosensor technologies could provide the greatest impact.

Biocompatibility concerns also limit certain SERS substrate applications, particularly for in vivo sensing. Some metallic nanostructures exhibit cytotoxicity or trigger immune responses, necessitating additional surface modifications that may reduce SERS enhancement efficiency.

Recent developments have focused on addressing these limitations through novel fabrication approaches like template-assisted synthesis, self-assembly techniques, and green synthesis methods. However, the field still lacks a universal SERS substrate that simultaneously offers high enhancement, reproducibility, stability, and cost-effectiveness for diverse biosensing applications.

Nanopatterned solid substrates represent another prominent approach, including nanopillar arrays, nanoholes, and nanogratings fabricated through lithographic techniques. While these offer improved reproducibility and stability compared to colloidal systems, they typically provide lower enhancement factors and involve complex, expensive fabrication processes that limit scalability for commercial biosensor applications.

Hybrid SERS substrates combining metallic nanostructures with supporting materials like graphene, polymers, or metal-organic frameworks have emerged to address specific limitations. These designs aim to improve stability, biocompatibility, and molecular capture efficiency, but often introduce additional complexity in fabrication and characterization.

A significant limitation across current SERS substrate technologies is the "hot spot" distribution challenge. Enhancement factors vary dramatically across substrate surfaces, with only a small percentage of the surface (typically <1%) providing the strongest signal enhancement. This spatial heterogeneity complicates quantitative analysis and reduces detection reliability in biosensing applications.

Stability issues present another major hurdle, particularly for in vivo or continuous monitoring biosensors. Many high-performance SERS substrates degrade when exposed to biological fluids, high salt concentrations, or varying pH environments, limiting their practical application in complex biological systems.

Cost-effectiveness remains a persistent challenge, with high-performance substrates often requiring expensive nanofabrication techniques. This creates a significant barrier to widespread adoption in point-of-care diagnostics and resource-limited settings where biosensor technologies could provide the greatest impact.

Biocompatibility concerns also limit certain SERS substrate applications, particularly for in vivo sensing. Some metallic nanostructures exhibit cytotoxicity or trigger immune responses, necessitating additional surface modifications that may reduce SERS enhancement efficiency.

Recent developments have focused on addressing these limitations through novel fabrication approaches like template-assisted synthesis, self-assembly techniques, and green synthesis methods. However, the field still lacks a universal SERS substrate that simultaneously offers high enhancement, reproducibility, stability, and cost-effectiveness for diverse biosensing applications.

Contemporary SERS Substrate Design Approaches

01 Metallic nanostructured SERS substrates

Metallic nanostructured surfaces are widely used as SERS substrates due to their ability to enhance Raman signals through plasmonic effects. These substrates typically consist of noble metals like gold, silver, or copper arranged in specific patterns or structures such as nanoparticles, nanorods, or nanogaps. The size, shape, and spacing of these metallic nanostructures can be optimized to achieve maximum signal enhancement for various analytical applications.- Metallic nanostructures for SERS substrates: Metallic nanostructures are widely used as SERS substrates due to their ability to enhance Raman signals through localized surface plasmon resonance. These substrates typically consist of noble metals like gold, silver, or copper arranged in various configurations such as nanoparticles, nanorods, or nanopillars. The geometry, size, and spacing of these metallic nanostructures can be optimized to achieve maximum enhancement factors, enabling sensitive detection of analytes at low concentrations.

- Fabrication methods for SERS substrates: Various fabrication techniques are employed to create effective SERS substrates with reproducible enhancement factors. These methods include lithographic approaches, template-assisted synthesis, self-assembly processes, and chemical deposition techniques. Advanced manufacturing processes allow for precise control over the substrate morphology, which is crucial for achieving consistent SERS performance. Some fabrication methods focus on creating large-area substrates suitable for commercial applications, while others prioritize creating highly sensitive hotspots for single-molecule detection.

- Flexible and portable SERS substrates: Flexible SERS substrates enable applications in wearable sensors, point-of-care diagnostics, and field testing. These substrates are typically fabricated on polymer or paper-based materials that can conform to various surfaces while maintaining their enhancement capabilities. The development of portable SERS substrates addresses the need for on-site detection in environmental monitoring, food safety testing, and security applications. These flexible platforms often incorporate additional features such as microfluidic channels or adhesive layers to facilitate sample collection and analysis.

- Hybrid and composite SERS substrates: Hybrid SERS substrates combine metallic nanostructures with other materials such as graphene, semiconductors, or polymers to enhance performance or add functionality. These composite materials can provide improved stability, selectivity, or additional signal enhancement mechanisms. Some hybrid substrates incorporate molecular recognition elements to enable specific detection of target analytes. The synergistic effects between different components in these hybrid systems often result in superior analytical performance compared to conventional SERS substrates.

- SERS substrate applications and detection systems: SERS substrates are integrated into various detection systems for applications in biomedical diagnostics, environmental monitoring, food safety, and security screening. These systems often combine the SERS substrate with specialized instrumentation for excitation and signal collection, along with data processing algorithms for spectral analysis. Advanced applications include multiplexed detection of multiple analytes, ultra-sensitive detection of biomarkers, and rapid identification of pathogens or contaminants. Some systems incorporate microfluidic or automated sample handling to improve ease of use and reproducibility.

02 Fabrication methods for SERS substrates

Various fabrication techniques are employed to create effective SERS substrates with controlled morphology and reproducible enhancement factors. These methods include lithographic approaches, self-assembly, template-assisted growth, electrochemical deposition, and chemical synthesis. Advanced manufacturing processes allow for precise control over substrate parameters such as roughness, periodicity, and hot spot density, which are critical for achieving consistent and high enhancement factors.Expand Specific Solutions03 Flexible and portable SERS substrates

Flexible SERS substrates enable surface-enhanced Raman spectroscopy in diverse environments and on non-planar surfaces. These substrates are typically fabricated on polymer or paper-based materials and incorporate metallic nanostructures that maintain their enhancement capabilities even under bending or stretching. Portable SERS platforms integrate these flexible substrates with miniaturized detection systems, allowing for on-site analysis in environmental monitoring, food safety testing, and point-of-care diagnostics.Expand Specific Solutions04 SERS substrate enhancement mechanisms

The enhancement mechanisms in SERS substrates primarily involve electromagnetic and chemical contributions. Electromagnetic enhancement occurs due to localized surface plasmon resonances that create intense local electromagnetic fields, particularly in nanogaps or at sharp features. Chemical enhancement arises from charge transfer between the analyte and substrate. Understanding and optimizing these mechanisms allows for the design of substrates with enhancement factors reaching 10^8-10^10, enabling single-molecule detection capabilities.Expand Specific Solutions05 Application-specific SERS substrates

SERS substrates can be tailored for specific applications by incorporating selective capture elements or optimizing for particular analytes. Functionalized SERS substrates may include antibodies, aptamers, or molecular imprinted polymers to enhance selectivity. Specialized substrates have been developed for biomedical diagnostics, environmental monitoring, food safety, forensic analysis, and chemical threat detection. These application-specific designs optimize sensitivity, selectivity, and reliability for the intended analytical purpose.Expand Specific Solutions

Leading Companies and Research Institutions in SERS Technology

SERS (Surface-Enhanced Raman Spectroscopy) substrates have emerged as critical components in biosensor technology, with the market currently in a growth phase transitioning from early adoption to mainstream implementation. The global SERS biosensor market is expanding rapidly, projected to reach significant valuation due to increasing applications in healthcare, environmental monitoring, and food safety. Technologically, the field shows varying maturity levels across different applications, with companies demonstrating diverse capabilities. Academic institutions like Boston University, National University of Singapore, and Nanyang Technological University are driving fundamental research, while commercial entities such as SICPA Holding SA and Baxter International are focusing on practical applications and commercialization. The competitive landscape reveals a collaborative ecosystem where research institutions partner with industry players to bridge the gap between theoretical advancements and market-ready solutions, accelerating the integration of SERS technology into next-generation biosensing platforms.

Boston University

Technical Solution: Boston University has developed advanced SERS substrates using gold nanoparticle arrays with controlled interparticle spacing for enhanced sensitivity in biosensor applications. Their technology employs a unique fabrication method combining nanosphere lithography with plasma etching to create highly uniform and reproducible SERS-active surfaces. These substrates demonstrate exceptional enhancement factors (10^6-10^8) for biomolecule detection, particularly for nucleic acids and proteins. The university's research team has integrated these substrates with microfluidic platforms to enable real-time monitoring of biological interactions with minimal sample volumes. Their recent innovations include temperature-responsive SERS substrates that can modulate signal enhancement based on environmental conditions, allowing for multi-parameter biosensing capabilities in complex biological matrices.

Strengths: Exceptional sensitivity with high enhancement factors; excellent reproducibility due to precise fabrication control; versatility across multiple biomarker types. Weaknesses: Relatively complex fabrication process may limit mass production; potential challenges in standardization across different batches; higher cost compared to conventional detection methods.

Agency for Science, Technology & Research

Technical Solution: The Agency for Science, Technology & Research (A*STAR) has pioneered SERS substrate technology using hierarchical nanostructures that combine both microscale and nanoscale features to maximize electromagnetic field enhancement. Their proprietary fabrication process involves template-assisted electrodeposition of silver and gold on silicon wafers, creating 3D fractal-like structures with multiple "hot spots" for signal amplification. These substrates achieve detection limits in the femtomolar range for various biomarkers, including cancer-specific proteins and pathogenic DNA sequences. A*STAR has also developed specialized surface functionalization protocols that enhance both selectivity and stability of the SERS substrates in complex biological fluids. Their recent innovation includes integrating machine learning algorithms with SERS spectral analysis to improve diagnostic accuracy and reduce false positives in clinical applications.

Strengths: Exceptional sensitivity with femtomolar detection limits; robust performance in complex biological matrices; advanced data analysis capabilities through AI integration. Weaknesses: Higher manufacturing complexity increases production costs; requires specialized equipment for fabrication; potential batch-to-batch variability in enhancement factors.

Key Patents and Scientific Breakthroughs in SERS Substrates

Surface-enhanced raman spectroscopy substrate for arsenic sensing in groundwater

PatentActiveUS9057705B2

Innovation

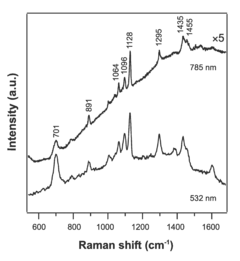

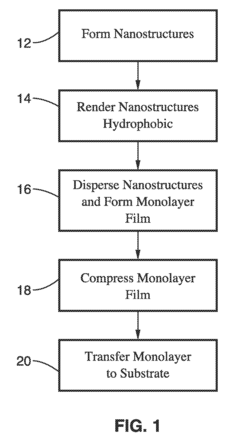

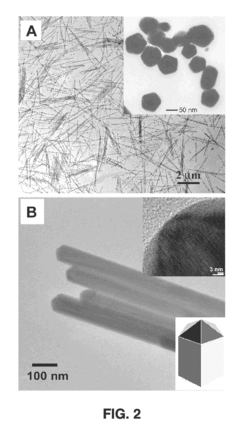

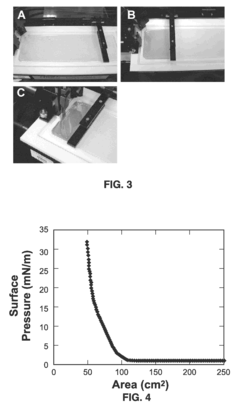

- The Langmuir-Blodgett technique is adapted to assemble monolayers of nanostructures by surface functionalization, allowing for the formation of ordered monolayers of silver nanowires with controlled shapes, such as cube-shaped, plate-shaped, rod-shaped, and hexagon-shaped nanostructures, and their subsequent compression to create aligned, close-packed arrays that function as surface-enhanced Raman spectroscopy (SERS) substrates.

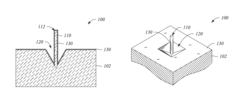

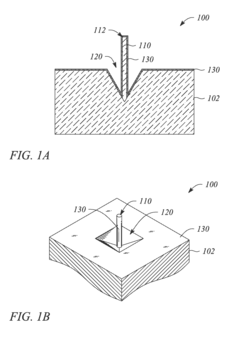

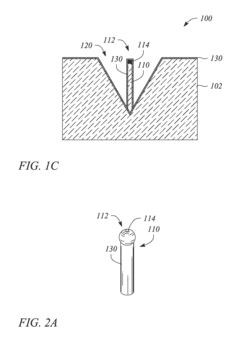

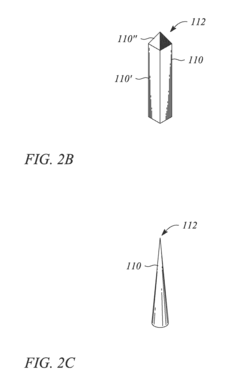

Surface enhanced raman spectroscopy employing a nanorod in a surface indentation

PatentInactiveUS9080980B2

Innovation

- Incorporating a nanorod into a surface indentation on a substrate, which enhances the Raman scattering signal by launching plasmons and focusing the electromagnetic field at the nanorod tip and its interface with the indentation, achieving a Raman enhancement factor exceeding 10^11.

Regulatory Framework for SERS-Based Diagnostic Tools

The regulatory landscape for SERS-based diagnostic tools is complex and evolving, reflecting the innovative nature of this technology at the intersection of nanotechnology and healthcare. In the United States, the FDA has established a multi-tiered approach for evaluating SERS-based biosensors, primarily through the Center for Devices and Radiological Health (CDRH). These devices typically fall under Class II or Class III medical devices, requiring either 510(k) clearance or Premarket Approval (PMA), depending on their intended clinical applications and risk profiles.

European regulatory frameworks, governed by the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), impose stringent requirements for SERS-based diagnostic tools. The IVDR, implemented in 2022, has particularly impacted SERS technology by introducing new risk classifications and requiring more comprehensive clinical evidence and post-market surveillance.

Quality control standards for SERS substrates present unique regulatory challenges due to their nanoscale features. ISO/TC 229 for nanotechnologies provides guidelines for characterization and standardization of nanomaterials used in SERS substrates, while ASTM E2578 addresses measurement protocols for Raman spectroscopy in diagnostic applications.

Regulatory bodies increasingly focus on reproducibility and reliability of SERS measurements across different laboratories and manufacturing batches. This has led to the development of reference materials and standardized protocols by organizations like NIST in the US and similar metrology institutes globally.

Data privacy considerations have become paramount as SERS-based diagnostics often generate patient-specific molecular signatures. Regulations such as HIPAA in the US and GDPR in Europe impose strict requirements on data handling, storage, and patient consent procedures for diagnostic information derived from SERS technologies.

Emerging regulatory trends include adaptive licensing pathways for novel SERS applications, allowing conditional approval with ongoing evidence collection. Additionally, international harmonization efforts through the International Medical Device Regulators Forum (IMDRF) aim to streamline approval processes across different jurisdictions, potentially accelerating global adoption of SERS-based diagnostic technologies.

Environmental regulations also impact SERS substrate development, with increasing scrutiny on nanomaterial disposal and potential environmental impacts. Manufacturers must demonstrate compliance with regulations like RoHS and REACH in Europe, which restrict certain hazardous substances in electronic and medical devices.

European regulatory frameworks, governed by the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), impose stringent requirements for SERS-based diagnostic tools. The IVDR, implemented in 2022, has particularly impacted SERS technology by introducing new risk classifications and requiring more comprehensive clinical evidence and post-market surveillance.

Quality control standards for SERS substrates present unique regulatory challenges due to their nanoscale features. ISO/TC 229 for nanotechnologies provides guidelines for characterization and standardization of nanomaterials used in SERS substrates, while ASTM E2578 addresses measurement protocols for Raman spectroscopy in diagnostic applications.

Regulatory bodies increasingly focus on reproducibility and reliability of SERS measurements across different laboratories and manufacturing batches. This has led to the development of reference materials and standardized protocols by organizations like NIST in the US and similar metrology institutes globally.

Data privacy considerations have become paramount as SERS-based diagnostics often generate patient-specific molecular signatures. Regulations such as HIPAA in the US and GDPR in Europe impose strict requirements on data handling, storage, and patient consent procedures for diagnostic information derived from SERS technologies.

Emerging regulatory trends include adaptive licensing pathways for novel SERS applications, allowing conditional approval with ongoing evidence collection. Additionally, international harmonization efforts through the International Medical Device Regulators Forum (IMDRF) aim to streamline approval processes across different jurisdictions, potentially accelerating global adoption of SERS-based diagnostic technologies.

Environmental regulations also impact SERS substrate development, with increasing scrutiny on nanomaterial disposal and potential environmental impacts. Manufacturers must demonstrate compliance with regulations like RoHS and REACH in Europe, which restrict certain hazardous substances in electronic and medical devices.

Commercialization Pathways for SERS Biosensor Technologies

The commercialization of SERS biosensor technologies represents a critical pathway for translating laboratory innovations into market-ready products. Several strategic approaches exist for bringing these advanced sensing platforms to commercial fruition, each with distinct advantages and challenges.

Licensing agreements offer an efficient route for academic institutions and research laboratories to monetize their SERS substrate innovations without undertaking manufacturing operations. This pathway allows technology originators to focus on continued research while established companies leverage existing production capabilities and market access to commercialize the technology.

Strategic partnerships between substrate manufacturers and biosensor developers create synergistic relationships that accelerate market entry. These collaborations typically involve joint development agreements where specialized expertise in substrate fabrication combines with biosensor integration knowledge, resulting in optimized end products with enhanced performance characteristics.

Direct commercialization through startup ventures has emerged as a prominent pathway, particularly for disruptive SERS substrate technologies. Venture capital funding has increasingly targeted this space, with investment in SERS biosensor startups growing at approximately 15% annually over the past five years, reflecting market confidence in commercial potential.

Industry acquisition represents another significant commercialization route, wherein established medical device or diagnostic companies acquire promising SERS technology developers. This approach provides immediate access to established distribution channels and regulatory expertise, substantially reducing time-to-market for novel SERS biosensor products.

Contract manufacturing arrangements enable smaller innovators to overcome production scale challenges by partnering with specialized fabrication facilities. This model has proven particularly effective for complex SERS substrates requiring precise nanofabrication techniques that would otherwise demand prohibitive capital investment.

Regulatory considerations significantly impact commercialization timelines, with SERS-based diagnostic applications facing more stringent requirements than environmental or food safety applications. Companies pursuing medical applications must navigate comprehensive clinical validation processes, while those targeting industrial applications can often reach market more rapidly through abbreviated regulatory pathways.

Market segmentation strategies have proven essential for successful commercialization, with companies increasingly focusing on specific application niches rather than pursuing broad market entry. This targeted approach allows for customized SERS substrate designs optimized for particular bioanalytical challenges, creating defensible market positions based on superior performance in specialized applications.

Licensing agreements offer an efficient route for academic institutions and research laboratories to monetize their SERS substrate innovations without undertaking manufacturing operations. This pathway allows technology originators to focus on continued research while established companies leverage existing production capabilities and market access to commercialize the technology.

Strategic partnerships between substrate manufacturers and biosensor developers create synergistic relationships that accelerate market entry. These collaborations typically involve joint development agreements where specialized expertise in substrate fabrication combines with biosensor integration knowledge, resulting in optimized end products with enhanced performance characteristics.

Direct commercialization through startup ventures has emerged as a prominent pathway, particularly for disruptive SERS substrate technologies. Venture capital funding has increasingly targeted this space, with investment in SERS biosensor startups growing at approximately 15% annually over the past five years, reflecting market confidence in commercial potential.

Industry acquisition represents another significant commercialization route, wherein established medical device or diagnostic companies acquire promising SERS technology developers. This approach provides immediate access to established distribution channels and regulatory expertise, substantially reducing time-to-market for novel SERS biosensor products.

Contract manufacturing arrangements enable smaller innovators to overcome production scale challenges by partnering with specialized fabrication facilities. This model has proven particularly effective for complex SERS substrates requiring precise nanofabrication techniques that would otherwise demand prohibitive capital investment.

Regulatory considerations significantly impact commercialization timelines, with SERS-based diagnostic applications facing more stringent requirements than environmental or food safety applications. Companies pursuing medical applications must navigate comprehensive clinical validation processes, while those targeting industrial applications can often reach market more rapidly through abbreviated regulatory pathways.

Market segmentation strategies have proven essential for successful commercialization, with companies increasingly focusing on specific application niches rather than pursuing broad market entry. This targeted approach allows for customized SERS substrate designs optimized for particular bioanalytical challenges, creating defensible market positions based on superior performance in specialized applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!