Advancing Structural Ceramics for Sustainable Energy Solutions

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Ceramics Evolution and Energy Transition Goals

Structural ceramics have undergone significant evolution since their initial development in the mid-20th century. Originally designed primarily for high-temperature applications in aerospace and defense sectors, these materials have progressively expanded into broader industrial applications. The technological trajectory has moved from simple oxide ceramics to increasingly complex compositions including silicon nitrides, silicon carbides, and zirconium-based ceramics, each offering enhanced performance characteristics under extreme conditions.

The development timeline reveals three distinct generations of structural ceramics. First-generation materials (1950s-1970s) focused on basic alumina and zirconia compositions with limited toughness. Second-generation ceramics (1980s-2000s) introduced transformation toughening mechanisms and ceramic matrix composites, dramatically improving fracture resistance. Current third-generation advanced ceramics incorporate nano-engineering principles and multi-phase designs that optimize both mechanical and functional properties simultaneously.

Recent technological breakthroughs have positioned structural ceramics as critical materials for sustainable energy transitions. Their exceptional thermal stability, corrosion resistance, and increasingly tailorable properties make them ideal candidates for next-generation energy systems. These include concentrated solar power receivers, solid oxide fuel cells, advanced nuclear reactors, and high-temperature heat exchangers for industrial waste heat recovery.

The energy transition goals driving ceramic innovation include achieving higher operating temperatures in energy conversion systems to improve thermodynamic efficiency, extending component lifespans in corrosive environments, reducing system weight and volume, and enabling new energy technologies that cannot function with conventional materials. Particularly important is the role of ceramics in hydrogen production and utilization infrastructure, where their resistance to hydrogen embrittlement offers significant advantages over metallic alternatives.

Global decarbonization targets have accelerated research into structural ceramics that can withstand increasingly extreme operating conditions. The EU's Green Deal, Japan's carbon neutrality pledge, and similar initiatives worldwide have established ambitious timelines requiring rapid materials innovation. Industry projections suggest that advanced structural ceramics will be essential components in meeting 2030 emissions reduction targets, particularly in hard-to-abate sectors like cement, steel, and chemical processing.

The convergence of materials science advancements with urgent climate imperatives has created unprecedented momentum in structural ceramics research. Computational materials design, additive manufacturing techniques, and novel processing methods are collectively driving an innovation renaissance in this field, with the explicit goal of enabling the clean energy technologies needed for sustainable global development.

The development timeline reveals three distinct generations of structural ceramics. First-generation materials (1950s-1970s) focused on basic alumina and zirconia compositions with limited toughness. Second-generation ceramics (1980s-2000s) introduced transformation toughening mechanisms and ceramic matrix composites, dramatically improving fracture resistance. Current third-generation advanced ceramics incorporate nano-engineering principles and multi-phase designs that optimize both mechanical and functional properties simultaneously.

Recent technological breakthroughs have positioned structural ceramics as critical materials for sustainable energy transitions. Their exceptional thermal stability, corrosion resistance, and increasingly tailorable properties make them ideal candidates for next-generation energy systems. These include concentrated solar power receivers, solid oxide fuel cells, advanced nuclear reactors, and high-temperature heat exchangers for industrial waste heat recovery.

The energy transition goals driving ceramic innovation include achieving higher operating temperatures in energy conversion systems to improve thermodynamic efficiency, extending component lifespans in corrosive environments, reducing system weight and volume, and enabling new energy technologies that cannot function with conventional materials. Particularly important is the role of ceramics in hydrogen production and utilization infrastructure, where their resistance to hydrogen embrittlement offers significant advantages over metallic alternatives.

Global decarbonization targets have accelerated research into structural ceramics that can withstand increasingly extreme operating conditions. The EU's Green Deal, Japan's carbon neutrality pledge, and similar initiatives worldwide have established ambitious timelines requiring rapid materials innovation. Industry projections suggest that advanced structural ceramics will be essential components in meeting 2030 emissions reduction targets, particularly in hard-to-abate sectors like cement, steel, and chemical processing.

The convergence of materials science advancements with urgent climate imperatives has created unprecedented momentum in structural ceramics research. Computational materials design, additive manufacturing techniques, and novel processing methods are collectively driving an innovation renaissance in this field, with the explicit goal of enabling the clean energy technologies needed for sustainable global development.

Market Analysis for Advanced Ceramics in Energy Sector

The global market for advanced structural ceramics in the energy sector is experiencing robust growth, driven by increasing demands for sustainable energy solutions and the unique properties these materials offer. Currently valued at approximately $4.7 billion in 2023, the market is projected to reach $7.2 billion by 2028, representing a compound annual growth rate (CAGR) of 8.9%. This growth trajectory is significantly outpacing traditional materials markets, indicating strong industry momentum.

The energy transition is creating unprecedented demand for materials that can withstand extreme conditions while delivering superior performance. Advanced ceramics, particularly silicon carbide (SiC), silicon nitride (Si3N4), and zirconia (ZrO2), are increasingly being adopted across multiple energy applications due to their exceptional thermal stability, corrosion resistance, and mechanical strength at high temperatures.

Geographically, Asia-Pacific dominates the market with 42% share, led by China and Japan's substantial investments in renewable energy infrastructure and advanced manufacturing capabilities. North America follows at 28%, with particular strength in nuclear energy applications and fuel cell technologies. Europe accounts for 23% of the market, distinguished by its focus on hydrogen technologies and solar energy systems.

By application segment, the most significant growth is observed in fuel cells (11.2% CAGR), followed by concentrated solar power systems (10.5%), and nuclear energy components (8.7%). The gas turbine segment, while more established, continues steady growth at 6.3% annually as efficiency improvements remain a priority for power generation.

Customer segments reveal that utility companies represent the largest end-user group (38%), followed by renewable energy developers (27%), and industrial power generation (21%). Government and research institutions account for 14% of market demand, primarily driving innovation through pilot projects and technology demonstrations.

Key market drivers include increasingly stringent emissions regulations, volatile fossil fuel prices, and government incentives for clean energy technologies. The European Green Deal and similar initiatives in Asia and North America are creating favorable policy environments for advanced materials adoption in energy systems.

Market challenges include high production costs, complex manufacturing processes, and competition from emerging materials such as advanced metal alloys and composites. The average cost premium for ceramic components remains 30-40% higher than conventional alternatives, though this gap is narrowing as production scales increase and manufacturing processes mature.

Future market expansion will likely be catalyzed by breakthroughs in additive manufacturing of ceramics, which could reduce production costs by up to 25% while enabling more complex geometries and customized solutions for specific energy applications.

The energy transition is creating unprecedented demand for materials that can withstand extreme conditions while delivering superior performance. Advanced ceramics, particularly silicon carbide (SiC), silicon nitride (Si3N4), and zirconia (ZrO2), are increasingly being adopted across multiple energy applications due to their exceptional thermal stability, corrosion resistance, and mechanical strength at high temperatures.

Geographically, Asia-Pacific dominates the market with 42% share, led by China and Japan's substantial investments in renewable energy infrastructure and advanced manufacturing capabilities. North America follows at 28%, with particular strength in nuclear energy applications and fuel cell technologies. Europe accounts for 23% of the market, distinguished by its focus on hydrogen technologies and solar energy systems.

By application segment, the most significant growth is observed in fuel cells (11.2% CAGR), followed by concentrated solar power systems (10.5%), and nuclear energy components (8.7%). The gas turbine segment, while more established, continues steady growth at 6.3% annually as efficiency improvements remain a priority for power generation.

Customer segments reveal that utility companies represent the largest end-user group (38%), followed by renewable energy developers (27%), and industrial power generation (21%). Government and research institutions account for 14% of market demand, primarily driving innovation through pilot projects and technology demonstrations.

Key market drivers include increasingly stringent emissions regulations, volatile fossil fuel prices, and government incentives for clean energy technologies. The European Green Deal and similar initiatives in Asia and North America are creating favorable policy environments for advanced materials adoption in energy systems.

Market challenges include high production costs, complex manufacturing processes, and competition from emerging materials such as advanced metal alloys and composites. The average cost premium for ceramic components remains 30-40% higher than conventional alternatives, though this gap is narrowing as production scales increase and manufacturing processes mature.

Future market expansion will likely be catalyzed by breakthroughs in additive manufacturing of ceramics, which could reduce production costs by up to 25% while enabling more complex geometries and customized solutions for specific energy applications.

Global Status and Barriers in Structural Ceramics Development

Structural ceramics have emerged as critical materials for sustainable energy applications, with significant advancements occurring globally at varying rates. Currently, the United States, Japan, Germany, and China lead in structural ceramics research and development, with each country focusing on different application domains. The U.S. excels in aerospace and defense applications, while Japan dominates automotive and electronic ceramic components. Germany has established expertise in industrial machinery ceramics, and China has rapidly expanded its manufacturing capabilities for mass-market ceramic products.

Despite these advancements, several technical barriers impede broader adoption of structural ceramics in energy systems. The inherent brittleness of ceramic materials remains a fundamental challenge, limiting their application in environments requiring mechanical resilience. Current manufacturing processes struggle with dimensional precision for complex geometries, with typical tolerances only reaching ±0.5% compared to ±0.1% for precision metals. This limitation restricts design flexibility for energy system components.

Cost factors present significant barriers to widespread implementation. Production expenses for advanced structural ceramics can be 5-10 times higher than comparable metal components due to complex processing requirements and high-temperature sintering operations. The energy-intensive manufacturing processes ironically undermine the sustainability benefits these materials aim to provide, creating a technological paradox that requires resolution.

Quality control represents another major challenge, as non-destructive testing methods for ceramic components remain less developed than those for metals. Defect detection in ceramic matrices often requires specialized techniques like acoustic microscopy or X-ray tomography, which are not widely available in production environments. This testing limitation increases rejection rates and further drives up costs.

Standardization issues also hinder industry adoption, with insufficient international standards for structural ceramic performance in energy applications. The lack of unified testing protocols and performance metrics creates uncertainty for system designers and slows integration into commercial energy technologies.

Geographically, research capabilities are unevenly distributed, with advanced ceramic processing facilities concentrated in developed economies. This disparity limits global innovation potential and creates supply chain vulnerabilities for critical energy infrastructure components. Developing nations face particular challenges in accessing the specialized knowledge and equipment required for advanced ceramic production.

The knowledge gap between academic research and industrial implementation remains substantial. While laboratory demonstrations have shown promising results for ceramic components in fuel cells, solar receivers, and turbine systems, scaling these innovations to commercial production volumes encounters significant technical and economic hurdles that have yet to be fully addressed.

Despite these advancements, several technical barriers impede broader adoption of structural ceramics in energy systems. The inherent brittleness of ceramic materials remains a fundamental challenge, limiting their application in environments requiring mechanical resilience. Current manufacturing processes struggle with dimensional precision for complex geometries, with typical tolerances only reaching ±0.5% compared to ±0.1% for precision metals. This limitation restricts design flexibility for energy system components.

Cost factors present significant barriers to widespread implementation. Production expenses for advanced structural ceramics can be 5-10 times higher than comparable metal components due to complex processing requirements and high-temperature sintering operations. The energy-intensive manufacturing processes ironically undermine the sustainability benefits these materials aim to provide, creating a technological paradox that requires resolution.

Quality control represents another major challenge, as non-destructive testing methods for ceramic components remain less developed than those for metals. Defect detection in ceramic matrices often requires specialized techniques like acoustic microscopy or X-ray tomography, which are not widely available in production environments. This testing limitation increases rejection rates and further drives up costs.

Standardization issues also hinder industry adoption, with insufficient international standards for structural ceramic performance in energy applications. The lack of unified testing protocols and performance metrics creates uncertainty for system designers and slows integration into commercial energy technologies.

Geographically, research capabilities are unevenly distributed, with advanced ceramic processing facilities concentrated in developed economies. This disparity limits global innovation potential and creates supply chain vulnerabilities for critical energy infrastructure components. Developing nations face particular challenges in accessing the specialized knowledge and equipment required for advanced ceramic production.

The knowledge gap between academic research and industrial implementation remains substantial. While laboratory demonstrations have shown promising results for ceramic components in fuel cells, solar receivers, and turbine systems, scaling these innovations to commercial production volumes encounters significant technical and economic hurdles that have yet to be fully addressed.

Current Engineering Solutions for Energy-Efficient Ceramics

01 Composition and manufacturing of structural ceramics

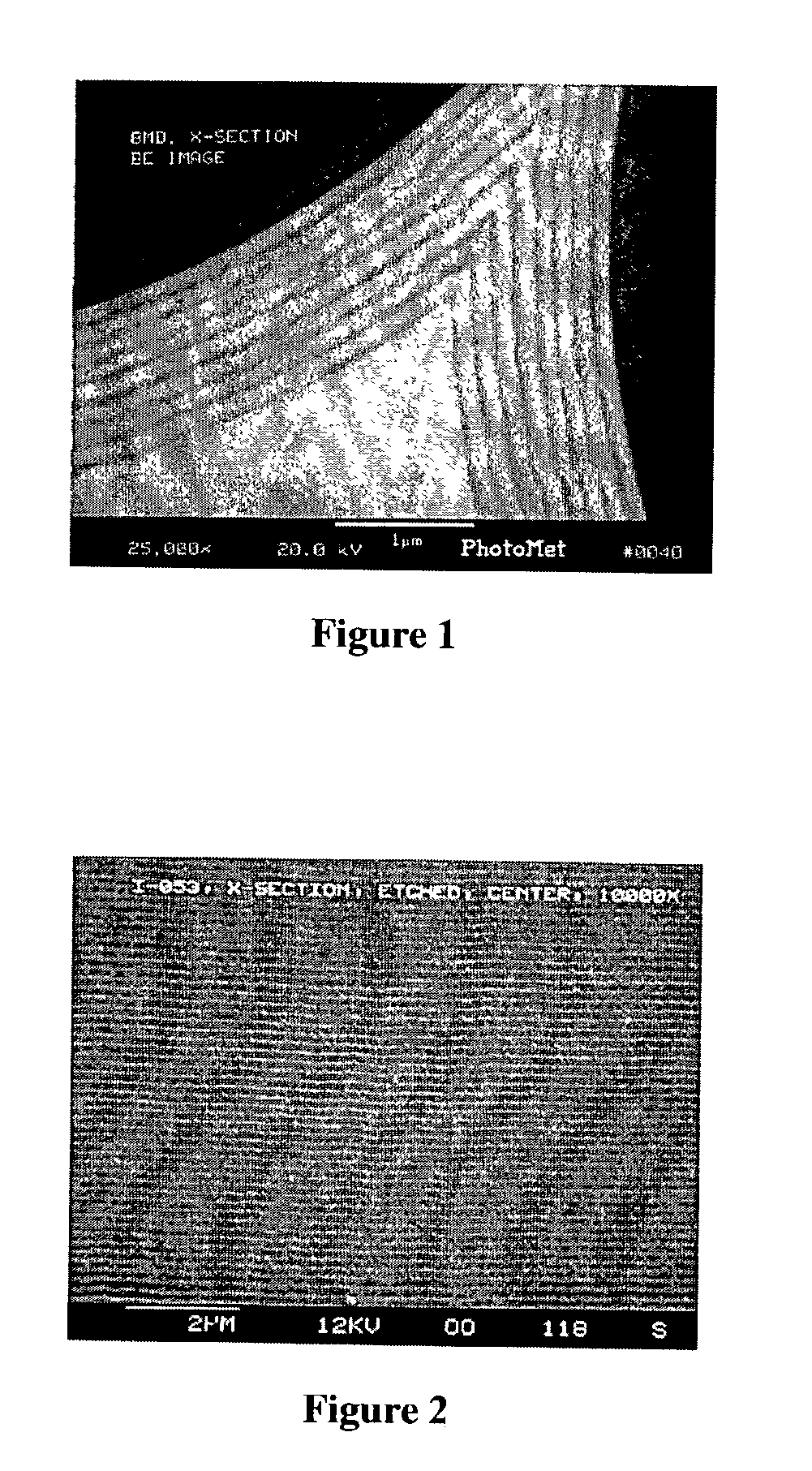

Structural ceramics can be manufactured using various compositions and methods to achieve desired mechanical properties. These ceramics typically incorporate materials such as silicon nitride, silicon carbide, alumina, or zirconia as base materials. The manufacturing process often involves sintering, hot pressing, or other high-temperature consolidation techniques to create dense, strong ceramic components with high hardness, wear resistance, and thermal stability.- Manufacturing methods for structural ceramics: Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These methods include sintering, hot pressing, and chemical vapor deposition. The manufacturing process significantly influences the microstructure and mechanical properties of the final ceramic product. Advanced techniques allow for precise control over porosity, grain size, and phase composition, resulting in ceramics with superior strength, hardness, and thermal stability.

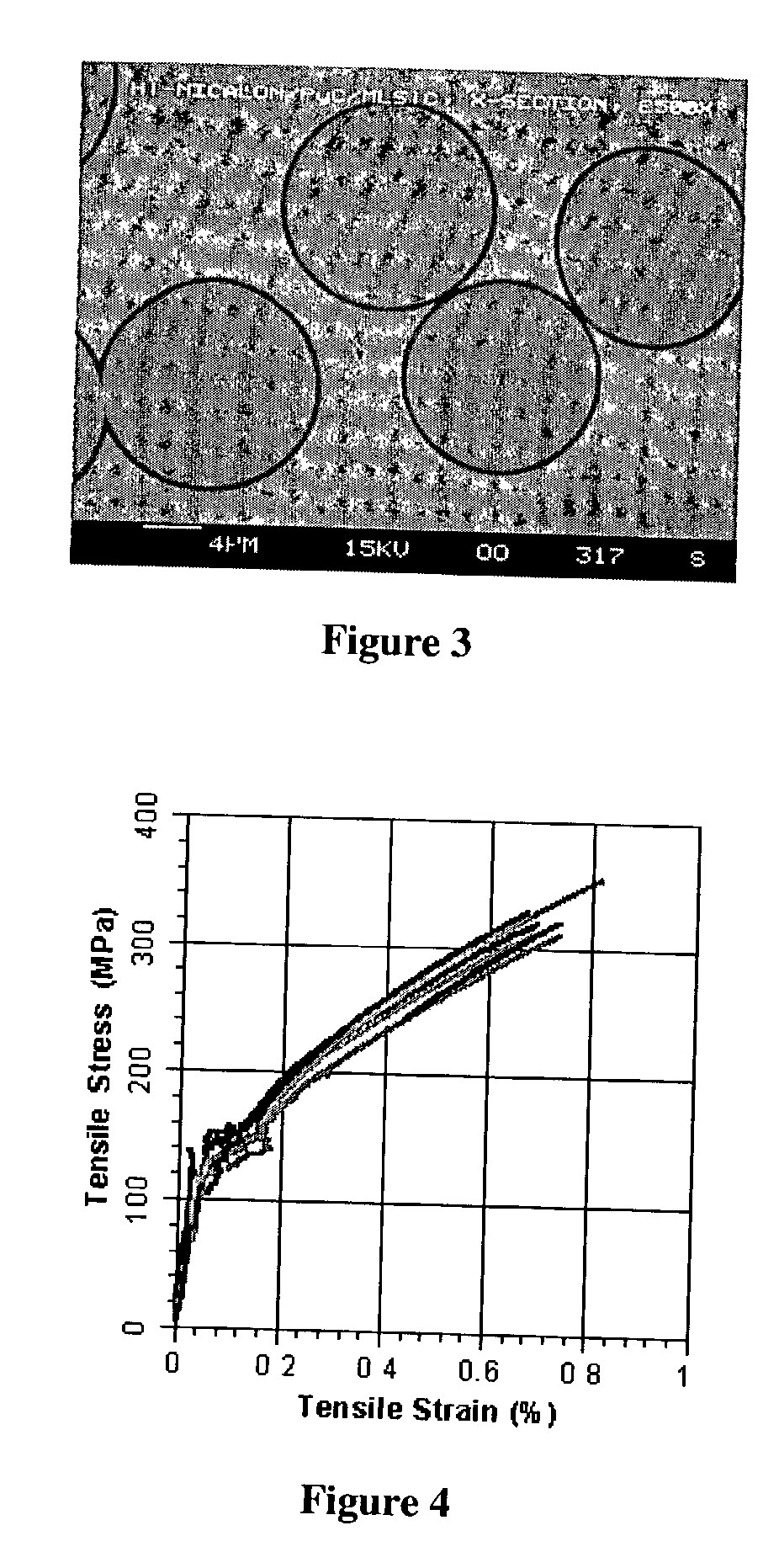

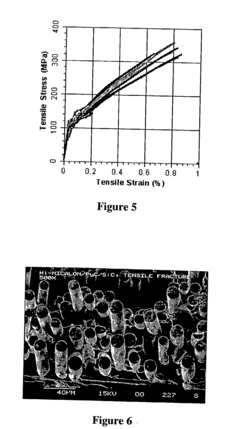

- Composite structural ceramics: Composite structural ceramics combine different ceramic materials or ceramics with metals to achieve improved mechanical properties. These composites often feature reinforcement phases such as fibers, whiskers, or particles embedded in a ceramic matrix. The resulting materials exhibit enhanced fracture toughness, strength, and resistance to thermal shock compared to monolithic ceramics. Ceramic-metal composites (cermets) provide a balance between the hardness of ceramics and the ductility of metals.

- High-temperature applications of structural ceramics: Structural ceramics are widely used in high-temperature applications due to their excellent thermal stability and resistance to oxidation. These materials maintain their mechanical properties at elevated temperatures where metals would fail. Applications include gas turbine components, combustion chamber linings, heat exchangers, and thermal barrier coatings. Silicon nitride, silicon carbide, and zirconia-based ceramics are particularly valued for their performance under extreme thermal conditions.

- Advanced structural ceramic materials: Advanced structural ceramic materials include silicon nitride, silicon carbide, alumina, zirconia, and boron carbide. These materials offer exceptional hardness, wear resistance, and chemical stability. Research focuses on developing ceramics with improved fracture toughness and reliability. Nano-structured ceramics represent a cutting-edge development, featuring grain sizes in the nanometer range that contribute to enhanced mechanical properties and reduced brittleness compared to conventional ceramics.

- Structural ceramics for specialized applications: Structural ceramics are engineered for specialized applications across various industries. In the medical field, bioceramics are used for implants and prosthetics due to their biocompatibility. In electronics, ceramics serve as substrates and insulators. Armor applications utilize ceramics' hardness and lightweight properties for ballistic protection. Cutting tools benefit from ceramics' wear resistance and hardness. Each application requires specific formulations and processing techniques to optimize performance characteristics.

02 Ceramic matrix composites for enhanced mechanical properties

Ceramic matrix composites (CMCs) incorporate reinforcing elements such as fibers, whiskers, or particles within a ceramic matrix to improve toughness and reduce brittleness. These composites combine the high-temperature capabilities of ceramics with improved fracture resistance and damage tolerance. The reinforcement phase can distribute stress and prevent catastrophic failure, making these materials suitable for demanding structural applications in aerospace, defense, and energy sectors.Expand Specific Solutions03 Surface treatments and coatings for structural ceramics

Various surface treatments and coating technologies can be applied to structural ceramics to enhance their performance characteristics. These treatments may include glazing, chemical modification, or the application of protective layers to improve wear resistance, reduce friction, enhance chemical stability, or provide thermal barrier properties. Surface engineering of structural ceramics can significantly extend their service life and expand their application range in harsh environments.Expand Specific Solutions04 Advanced processing techniques for complex ceramic structures

Advanced processing techniques enable the fabrication of complex-shaped structural ceramic components with precise dimensions and controlled microstructures. These techniques include additive manufacturing (3D printing), injection molding, gel casting, and precision machining of pre-sintered bodies. Such methods allow for the creation of intricate geometries, internal channels, and functionally graded structures that would be difficult or impossible to achieve using conventional ceramic processing approaches.Expand Specific Solutions05 Application-specific structural ceramic formulations

Specialized formulations of structural ceramics are developed for specific applications based on the required performance characteristics. These may include high-temperature components for gas turbines, wear-resistant parts for industrial machinery, biocompatible ceramics for medical implants, or electrically insulating components for electronic devices. The composition, microstructure, and processing parameters are tailored to optimize properties such as thermal shock resistance, electrical conductivity, biocompatibility, or chemical inertness depending on the intended use.Expand Specific Solutions

Leading Organizations in Advanced Ceramic Materials Research

The structural ceramics market for sustainable energy solutions is in a growth phase, with increasing demand driven by renewable energy applications and energy efficiency requirements. The market is characterized by established players like NGK Insulators, Kyocera, and Corning dominating with mature technologies in high-temperature applications, while companies such as Siemens Energy, SCHOTT AG, and CeramTec are advancing specialized ceramic solutions for energy systems. Technical maturity varies across applications, with thermal barrier coatings and electrical insulators being well-established, while newer developments in solid oxide fuel cells and energy storage materials are emerging. Academic-industrial collaborations with institutions like Tongji University and Harbin Institute of Technology are accelerating innovation in next-generation ceramic materials with enhanced thermal and electrical properties.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has pioneered advanced structural ceramics for sustainable energy applications, particularly focusing on solid oxide fuel cells (SOFCs) and sodium-sulfur (NAS) batteries. Their proprietary ceramic technology enables the production of high-performance SOFCs that operate at temperatures of 700-1000°C with electrical efficiency exceeding 60%. Their NAS battery systems utilize beta-alumina ceramic electrolytes that facilitate efficient sodium ion transfer between electrodes. NGK has developed specialized manufacturing processes for these ceramics, including tape casting and sintering techniques that ensure uniform microstructure and minimal defects. Their structural ceramics feature exceptional thermal shock resistance, with components capable of withstanding temperature gradients of over 500°C without failure. NGK has also commercialized large-scale energy storage systems using their ceramic technologies, with installations exceeding 4GWh of capacity worldwide.

Strengths: Industry-leading expertise in beta-alumina ceramics for energy storage; proprietary manufacturing processes ensuring high reliability; extensive commercial deployment experience. Weaknesses: High production costs compared to conventional materials; limited flexibility in design modifications due to specialized manufacturing requirements.

Kyocera Corp.

Technical Solution: Kyocera has developed advanced structural ceramic solutions specifically engineered for sustainable energy applications. Their Fine Ceramics division produces silicon nitride and silicon carbide components for solar energy systems, fuel cells, and energy-efficient industrial equipment. Kyocera's proprietary sintering technology enables the production of complex ceramic shapes with exceptional dimensional accuracy (±0.1%) and surface finishes below 0.2μm Ra. Their ceramic components demonstrate superior performance in harsh environments, with operating temperature capabilities exceeding 1400°C and corrosion resistance against aggressive chemicals and gases. For solar applications, Kyocera's ceramic substrates feature thermal conductivity values up to 180 W/m·K while maintaining electrical insulation properties. Their micro-channel ceramic heat exchangers achieve thermal transfer efficiencies up to 95% in waste heat recovery systems, significantly improving overall energy system efficiency.

Strengths: Exceptional material purity control and precision manufacturing capabilities; vertical integration from raw material processing to finished components; extensive application engineering expertise. Weaknesses: Higher initial cost compared to metal alternatives; limited design flexibility for certain complex geometries; longer lead times for customized solutions.

Breakthrough Patents in High-Performance Ceramic Materials

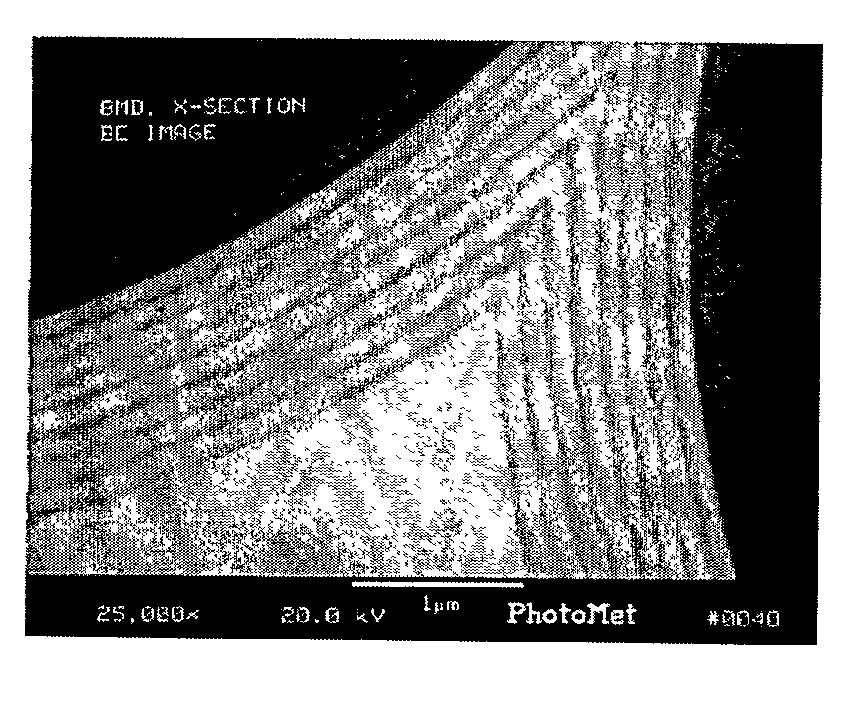

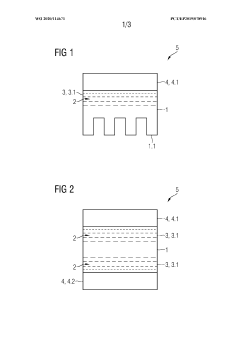

Fiber-reinforced ceramic composite material comprising a matrix with a nanolayered microstructure

PatentInactiveUS20050181192A1

Innovation

- A fiber-reinforced ceramic matrix composite material with a nanolayered ceramic matrix microstructure is developed, where a plurality of thin layers of a primary ceramic phase are interposed by very thin layers of a secondary phase, increasing the matrix cracking strength and toughness by interrupting grain growth and limiting grain size to enhance mechanical properties.

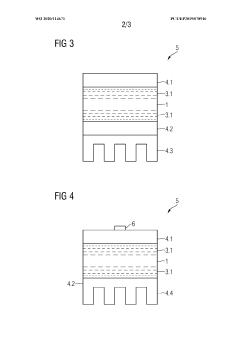

Insulating ceramic for electrical circuits and associated applications

PatentWO2020114671A1

Innovation

- Infiltrating metal, such as copper or aluminum, into ceramic insulating substrates to create a graded concentration gradient that adjusts thermal expansion coefficients and thermal conductivity, allowing for increased metallization thickness and mechanical strength, and reducing thermal stress through adaptive thermal expansion matching.

Environmental Impact Assessment of Ceramic Manufacturing Processes

The manufacturing processes of structural ceramics for sustainable energy applications present significant environmental considerations that must be thoroughly evaluated. Traditional ceramic production methods are energy-intensive, requiring high-temperature firing that consumes substantial fossil fuels and generates considerable greenhouse gas emissions. Current estimates indicate that conventional ceramic manufacturing contributes approximately 2-5% of global industrial carbon emissions, with temperatures often exceeding 1400°C during sintering processes.

Water consumption represents another critical environmental factor, as ceramic processing typically requires substantial amounts for slurry preparation, forming, and cleaning operations. Advanced facilities have begun implementing closed-loop water systems, reducing consumption by up to 70% compared to traditional operations, though implementation remains inconsistent across the industry.

Raw material extraction for ceramic production creates additional environmental burdens through habitat disruption, soil erosion, and potential water contamination. The mining of rare earth elements and specialized minerals for advanced technical ceramics presents particular concerns regarding ecosystem damage and resource depletion. Life cycle assessments indicate that raw material acquisition can account for 15-30% of a ceramic product's total environmental footprint.

Waste generation throughout the manufacturing process includes rejected products, excess materials, and processing byproducts. While some facilities achieve recycling rates of 80-90% for pre-fired ceramic waste, post-fired waste typically ends up in landfills due to limited recycling options. Emerging technologies for ceramic waste valorization show promise but remain in early development stages.

Air quality impacts extend beyond carbon emissions to include particulate matter, volatile organic compounds, and other pollutants released during various production stages. Modern filtration systems can capture up to 99% of particulates, though smaller facilities often operate with less efficient pollution controls.

Recent innovations in manufacturing techniques demonstrate significant potential for environmental improvement. Low-temperature processing methods utilizing microwave sintering, spark plasma sintering, and cold sintering can reduce energy consumption by 30-60% compared to conventional approaches. Additionally, additive manufacturing technologies for ceramics minimize material waste through precise deposition processes.

The transition toward sustainable ceramic manufacturing requires comprehensive assessment frameworks that consider energy efficiency, resource utilization, emissions reduction, and waste minimization across the entire production lifecycle. Standardized environmental impact metrics specific to ceramic manufacturing would enable more effective industry benchmarking and improvement tracking.

Water consumption represents another critical environmental factor, as ceramic processing typically requires substantial amounts for slurry preparation, forming, and cleaning operations. Advanced facilities have begun implementing closed-loop water systems, reducing consumption by up to 70% compared to traditional operations, though implementation remains inconsistent across the industry.

Raw material extraction for ceramic production creates additional environmental burdens through habitat disruption, soil erosion, and potential water contamination. The mining of rare earth elements and specialized minerals for advanced technical ceramics presents particular concerns regarding ecosystem damage and resource depletion. Life cycle assessments indicate that raw material acquisition can account for 15-30% of a ceramic product's total environmental footprint.

Waste generation throughout the manufacturing process includes rejected products, excess materials, and processing byproducts. While some facilities achieve recycling rates of 80-90% for pre-fired ceramic waste, post-fired waste typically ends up in landfills due to limited recycling options. Emerging technologies for ceramic waste valorization show promise but remain in early development stages.

Air quality impacts extend beyond carbon emissions to include particulate matter, volatile organic compounds, and other pollutants released during various production stages. Modern filtration systems can capture up to 99% of particulates, though smaller facilities often operate with less efficient pollution controls.

Recent innovations in manufacturing techniques demonstrate significant potential for environmental improvement. Low-temperature processing methods utilizing microwave sintering, spark plasma sintering, and cold sintering can reduce energy consumption by 30-60% compared to conventional approaches. Additionally, additive manufacturing technologies for ceramics minimize material waste through precise deposition processes.

The transition toward sustainable ceramic manufacturing requires comprehensive assessment frameworks that consider energy efficiency, resource utilization, emissions reduction, and waste minimization across the entire production lifecycle. Standardized environmental impact metrics specific to ceramic manufacturing would enable more effective industry benchmarking and improvement tracking.

Supply Chain Resilience for Critical Ceramic Raw Materials

The global supply chain for critical ceramic raw materials faces significant vulnerabilities that threaten the advancement of structural ceramics for sustainable energy applications. Key materials such as rare earth elements, high-purity silica, alumina, zirconia, and specialized dopants often originate from geopolitically sensitive regions, creating dependency risks for manufacturers. China currently dominates the supply of rare earth elements essential for many advanced ceramic formulations, controlling approximately 85% of global processing capacity.

Climate change impacts further complicate supply chain stability, with extreme weather events disrupting mining operations and transportation networks. The 2021 flooding in major mining regions of Australia demonstrated how quickly raw material availability can be compromised, resulting in price volatility that affected ceramic manufacturers worldwide.

Diversification strategies have emerged as essential approaches to enhance resilience. Leading companies are establishing secondary supplier relationships across multiple geographic regions, with some energy sector manufacturers maintaining at least three separate supply sources for critical materials. Vertical integration has also gained traction, with corporations like Kyocera and Saint-Gobain acquiring mining interests to secure direct access to raw materials.

Recycling and material recovery represent another promising avenue for supply chain resilience. Advanced recycling technologies can now recover up to 90% of certain ceramic materials from end-of-life products, significantly reducing dependency on virgin raw materials. The European Union's Circular Economy Action Plan has accelerated these efforts, establishing targets for material recovery that have spurred innovation in ceramic recycling processes.

Synthetic alternatives and material substitution strategies are also advancing rapidly. Research at institutions like MIT and the Max Planck Institute has yielded promising synthetic pathways for creating ceramic precursors from more abundant elements. These approaches could potentially reduce reliance on geographically concentrated materials by 30-40% within the next decade.

International cooperation frameworks are emerging to address supply vulnerabilities. The International Energy Agency's Critical Materials Alliance now coordinates efforts among 12 major economies to ensure stable supply chains for energy transition materials, including those needed for structural ceramics. Similarly, the EU's European Raw Materials Alliance has established strategic stockpiling programs for critical ceramic precursors, providing a buffer against short-term supply disruptions.

Digital technologies are transforming supply chain management for ceramic materials. AI-powered predictive analytics can now forecast supply disruptions with increasing accuracy, allowing manufacturers to implement mitigation strategies before shortages occur. Blockchain-based tracking systems provide unprecedented transparency throughout the supply chain, helping to verify material origins and ensure compliance with sustainability standards.

Climate change impacts further complicate supply chain stability, with extreme weather events disrupting mining operations and transportation networks. The 2021 flooding in major mining regions of Australia demonstrated how quickly raw material availability can be compromised, resulting in price volatility that affected ceramic manufacturers worldwide.

Diversification strategies have emerged as essential approaches to enhance resilience. Leading companies are establishing secondary supplier relationships across multiple geographic regions, with some energy sector manufacturers maintaining at least three separate supply sources for critical materials. Vertical integration has also gained traction, with corporations like Kyocera and Saint-Gobain acquiring mining interests to secure direct access to raw materials.

Recycling and material recovery represent another promising avenue for supply chain resilience. Advanced recycling technologies can now recover up to 90% of certain ceramic materials from end-of-life products, significantly reducing dependency on virgin raw materials. The European Union's Circular Economy Action Plan has accelerated these efforts, establishing targets for material recovery that have spurred innovation in ceramic recycling processes.

Synthetic alternatives and material substitution strategies are also advancing rapidly. Research at institutions like MIT and the Max Planck Institute has yielded promising synthetic pathways for creating ceramic precursors from more abundant elements. These approaches could potentially reduce reliance on geographically concentrated materials by 30-40% within the next decade.

International cooperation frameworks are emerging to address supply vulnerabilities. The International Energy Agency's Critical Materials Alliance now coordinates efforts among 12 major economies to ensure stable supply chains for energy transition materials, including those needed for structural ceramics. Similarly, the EU's European Raw Materials Alliance has established strategic stockpiling programs for critical ceramic precursors, providing a buffer against short-term supply disruptions.

Digital technologies are transforming supply chain management for ceramic materials. AI-powered predictive analytics can now forecast supply disruptions with increasing accuracy, allowing manufacturers to implement mitigation strategies before shortages occur. Blockchain-based tracking systems provide unprecedented transparency throughout the supply chain, helping to verify material origins and ensure compliance with sustainability standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!