Structural Ceramics in Military Defense Systems: An Analysis

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Military Ceramic Evolution and Objectives

Structural ceramics have evolved significantly in military defense applications over the past seven decades, transforming from basic refractory materials to sophisticated engineered components with exceptional mechanical and ballistic properties. The development trajectory began in the 1960s with rudimentary alumina ceramics used primarily for heat shielding, followed by the introduction of silicon carbide and boron carbide in the 1970s that revolutionized personal armor systems.

The 1980s marked a pivotal shift with the integration of ceramic composite materials in vehicle armor, significantly enhancing protection capabilities while reducing weight compared to traditional steel armor. By the 1990s, advancements in processing techniques enabled the production of more complex geometries and multi-hit capable ceramic armor systems, expanding their application across various military platforms.

The early 2000s witnessed the emergence of nano-engineered ceramics with improved fracture toughness and impact resistance, addressing the historical brittleness limitations of ceramic materials. This period also saw increased focus on cost-effective manufacturing methods to enable broader deployment across military assets.

Current military ceramic technology encompasses a diverse range of materials including aluminum oxide, silicon carbide, boron carbide, and silicon nitride, each optimized for specific defense applications ranging from personal body armor to aircraft protection systems and missile components. These advanced ceramics offer superior ballistic performance at significantly reduced weight compared to metallic alternatives.

The primary objectives driving military ceramic evolution include enhancing protection levels against increasingly sophisticated threats, reducing system weight to improve mobility and operational range, and developing multi-functional ceramics that can simultaneously provide ballistic protection, electromagnetic shielding, and structural support. Cost reduction remains a critical goal, as widespread implementation across defense systems requires economically viable production methods.

Future development aims to achieve ceramics with self-healing capabilities to maintain structural integrity after initial impact, improved edge and corner performance to address current vulnerability points, and adaptive ceramic systems that can respond dynamically to different threat levels. Research is also focused on developing ceramic-matrix composites with enhanced toughness and reliability under extreme conditions.

The evolution of military ceramics represents a continuous response to evolving battlefield threats, with each advancement addressing specific operational requirements and performance limitations of previous generations. This technological progression has fundamentally transformed modern defense capabilities, enabling unprecedented levels of protection while maintaining tactical mobility and operational effectiveness.

The 1980s marked a pivotal shift with the integration of ceramic composite materials in vehicle armor, significantly enhancing protection capabilities while reducing weight compared to traditional steel armor. By the 1990s, advancements in processing techniques enabled the production of more complex geometries and multi-hit capable ceramic armor systems, expanding their application across various military platforms.

The early 2000s witnessed the emergence of nano-engineered ceramics with improved fracture toughness and impact resistance, addressing the historical brittleness limitations of ceramic materials. This period also saw increased focus on cost-effective manufacturing methods to enable broader deployment across military assets.

Current military ceramic technology encompasses a diverse range of materials including aluminum oxide, silicon carbide, boron carbide, and silicon nitride, each optimized for specific defense applications ranging from personal body armor to aircraft protection systems and missile components. These advanced ceramics offer superior ballistic performance at significantly reduced weight compared to metallic alternatives.

The primary objectives driving military ceramic evolution include enhancing protection levels against increasingly sophisticated threats, reducing system weight to improve mobility and operational range, and developing multi-functional ceramics that can simultaneously provide ballistic protection, electromagnetic shielding, and structural support. Cost reduction remains a critical goal, as widespread implementation across defense systems requires economically viable production methods.

Future development aims to achieve ceramics with self-healing capabilities to maintain structural integrity after initial impact, improved edge and corner performance to address current vulnerability points, and adaptive ceramic systems that can respond dynamically to different threat levels. Research is also focused on developing ceramic-matrix composites with enhanced toughness and reliability under extreme conditions.

The evolution of military ceramics represents a continuous response to evolving battlefield threats, with each advancement addressing specific operational requirements and performance limitations of previous generations. This technological progression has fundamentally transformed modern defense capabilities, enabling unprecedented levels of protection while maintaining tactical mobility and operational effectiveness.

Defense Market Requirements Analysis

The global defense market demonstrates a growing demand for advanced structural ceramics, driven primarily by the increasing need for lightweight yet highly protective armor systems. Military organizations worldwide are seeking solutions that can withstand high-velocity projectiles, explosive fragments, and emerging threats while reducing the overall weight burden on personnel and vehicles. Current requirements specify that next-generation ceramic armor must achieve at least 30% weight reduction compared to traditional steel armor while maintaining equivalent or superior protection levels.

Defense contractors face stringent performance specifications, with ceramic components expected to withstand multiple hits and extreme environmental conditions ranging from -40°C to +70°C without significant degradation in protective capabilities. The market particularly values multi-hit capability, as modern combat scenarios often involve repeated impacts to the same general area of protective equipment.

Market analysis reveals that ground vehicle protection represents the largest segment for structural ceramics in defense applications, accounting for approximately 45% of the total market value. Personal body armor follows at 30%, with aircraft protection systems and naval applications comprising the remaining 25%. The compound annual growth rate for ceramic armor systems is projected at 7.8% through 2028, outpacing the overall defense market growth of 3.5%.

Cost considerations remain a significant factor influencing procurement decisions. Defense departments worldwide operate under tight budget constraints, requiring manufacturers to demonstrate clear cost-performance advantages. The current acceptable price premium for ceramic-based solutions over traditional materials ranges between 15-20%, provided that weight savings of at least 25% can be achieved alongside enhanced protection.

Durability requirements have intensified, with military specifications now demanding ceramic armor systems capable of maintaining structural integrity throughout a minimum 10-year service life under combat conditions. This includes resistance to thermal cycling, moisture exposure, and mechanical vibration typical in military operations.

Emerging requirements focus on multi-functionality, with defense agencies increasingly seeking ceramic components that serve dual purposes. Examples include armor tiles that also function as electromagnetic shields, thermal management systems, or structural elements. This trend toward integrated solutions reflects the military's emphasis on space and weight optimization in next-generation defense platforms.

Customization capabilities represent another critical market requirement, as different military branches and mission profiles necessitate tailored protection solutions. Manufacturers able to provide modular ceramic systems that can be rapidly adapted to specific threat levels and operational environments gain significant competitive advantage in the global defense marketplace.

Defense contractors face stringent performance specifications, with ceramic components expected to withstand multiple hits and extreme environmental conditions ranging from -40°C to +70°C without significant degradation in protective capabilities. The market particularly values multi-hit capability, as modern combat scenarios often involve repeated impacts to the same general area of protective equipment.

Market analysis reveals that ground vehicle protection represents the largest segment for structural ceramics in defense applications, accounting for approximately 45% of the total market value. Personal body armor follows at 30%, with aircraft protection systems and naval applications comprising the remaining 25%. The compound annual growth rate for ceramic armor systems is projected at 7.8% through 2028, outpacing the overall defense market growth of 3.5%.

Cost considerations remain a significant factor influencing procurement decisions. Defense departments worldwide operate under tight budget constraints, requiring manufacturers to demonstrate clear cost-performance advantages. The current acceptable price premium for ceramic-based solutions over traditional materials ranges between 15-20%, provided that weight savings of at least 25% can be achieved alongside enhanced protection.

Durability requirements have intensified, with military specifications now demanding ceramic armor systems capable of maintaining structural integrity throughout a minimum 10-year service life under combat conditions. This includes resistance to thermal cycling, moisture exposure, and mechanical vibration typical in military operations.

Emerging requirements focus on multi-functionality, with defense agencies increasingly seeking ceramic components that serve dual purposes. Examples include armor tiles that also function as electromagnetic shields, thermal management systems, or structural elements. This trend toward integrated solutions reflects the military's emphasis on space and weight optimization in next-generation defense platforms.

Customization capabilities represent another critical market requirement, as different military branches and mission profiles necessitate tailored protection solutions. Manufacturers able to provide modular ceramic systems that can be rapidly adapted to specific threat levels and operational environments gain significant competitive advantage in the global defense marketplace.

Global Ceramic Technology Assessment

The global ceramic technology landscape has undergone significant transformation over the past decade, with structural ceramics emerging as a critical component in advanced military defense systems. Current assessment indicates that the global market for technical ceramics reached approximately $8.3 billion in 2022, with a projected compound annual growth rate of 6.2% through 2030, driven largely by defense applications.

In the military sector, structural ceramics have revolutionized ballistic protection systems, with silicon carbide (SiC) and boron carbide (B4C) ceramics demonstrating superior performance in armor applications. These materials offer exceptional hardness (9+ on the Mohs scale) while maintaining significantly lower weight profiles compared to traditional metal armor systems, enabling enhanced mobility without compromising protection.

Geographically, the United States, China, Russia, and European Union dominate ceramic technology development for defense applications. The U.S. maintains leadership in advanced ceramic composites through substantial Department of Defense funding, while China has rapidly expanded its manufacturing capabilities, particularly in silicon carbide production. Russia continues to leverage its historical expertise in ceramic materials science, focusing on specialized applications for extreme environments.

Recent technological breakthroughs include the development of transparent ceramic armor with optical clarity approaching that of glass while providing superior ballistic protection. Additionally, ceramic matrix composites (CMCs) have advanced significantly, now capable of withstanding temperatures exceeding 1600°C while maintaining structural integrity, making them ideal for hypersonic vehicle applications.

Key challenges facing the industry include high production costs, with advanced ceramic components often costing 5-10 times more than metal alternatives, and manufacturing scalability limitations. Current production methods struggle with consistent quality in large-format ceramic plates, with rejection rates sometimes exceeding 30% for complex geometries.

Emerging technologies showing promise include additive manufacturing of ceramics, which has demonstrated potential for creating complex geometries previously impossible with traditional manufacturing methods. Cold sintering processes are also gaining attention, potentially reducing energy requirements by 60-70% compared to conventional sintering while enabling novel material combinations.

The integration of structural ceramics with sensor technologies represents another frontier, with piezoelectric ceramics enabling self-monitoring armor systems capable of damage assessment and performance validation in field conditions, addressing a critical need for real-time battlefield intelligence on equipment integrity.

In the military sector, structural ceramics have revolutionized ballistic protection systems, with silicon carbide (SiC) and boron carbide (B4C) ceramics demonstrating superior performance in armor applications. These materials offer exceptional hardness (9+ on the Mohs scale) while maintaining significantly lower weight profiles compared to traditional metal armor systems, enabling enhanced mobility without compromising protection.

Geographically, the United States, China, Russia, and European Union dominate ceramic technology development for defense applications. The U.S. maintains leadership in advanced ceramic composites through substantial Department of Defense funding, while China has rapidly expanded its manufacturing capabilities, particularly in silicon carbide production. Russia continues to leverage its historical expertise in ceramic materials science, focusing on specialized applications for extreme environments.

Recent technological breakthroughs include the development of transparent ceramic armor with optical clarity approaching that of glass while providing superior ballistic protection. Additionally, ceramic matrix composites (CMCs) have advanced significantly, now capable of withstanding temperatures exceeding 1600°C while maintaining structural integrity, making them ideal for hypersonic vehicle applications.

Key challenges facing the industry include high production costs, with advanced ceramic components often costing 5-10 times more than metal alternatives, and manufacturing scalability limitations. Current production methods struggle with consistent quality in large-format ceramic plates, with rejection rates sometimes exceeding 30% for complex geometries.

Emerging technologies showing promise include additive manufacturing of ceramics, which has demonstrated potential for creating complex geometries previously impossible with traditional manufacturing methods. Cold sintering processes are also gaining attention, potentially reducing energy requirements by 60-70% compared to conventional sintering while enabling novel material combinations.

The integration of structural ceramics with sensor technologies represents another frontier, with piezoelectric ceramics enabling self-monitoring armor systems capable of damage assessment and performance validation in field conditions, addressing a critical need for real-time battlefield intelligence on equipment integrity.

Current Ballistic Protection Solutions

01 Manufacturing methods for structural ceramics

Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing, and specialized molding techniques. The manufacturing methods focus on achieving optimal density, microstructure control, and minimizing defects to enhance mechanical properties such as strength and toughness. Advanced processing techniques allow for the creation of complex ceramic shapes while maintaining structural integrity.- Manufacturing methods for structural ceramics: Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing, and specialized molding techniques. These methods can control the microstructure and density of the ceramic materials, which directly affects their mechanical properties such as strength, hardness, and fracture toughness. Advanced manufacturing techniques allow for the creation of complex shapes while maintaining the structural integrity of the ceramic components.

- Composition and material design of structural ceramics: The composition of structural ceramics plays a crucial role in determining their performance characteristics. Materials commonly used include silicon carbide, silicon nitride, alumina, and zirconia, often with various additives to enhance specific properties. Multi-component ceramic systems and ceramic matrix composites are designed to achieve optimal combinations of strength, toughness, and thermal resistance. The careful selection and proportioning of raw materials can significantly influence the final properties of the structural ceramic products.

- Surface treatments and coatings for structural ceramics: Surface treatments and coatings are applied to structural ceramics to enhance their performance in specific applications. These treatments can improve wear resistance, reduce friction, increase chemical stability, or provide thermal barrier properties. Techniques include glazing, chemical vapor deposition, physical vapor deposition, and plasma spraying. Surface modifications can significantly extend the service life of ceramic components in harsh operating environments by protecting the base material from degradation.

- Applications of structural ceramics in high-temperature environments: Structural ceramics are widely used in high-temperature applications due to their excellent thermal stability and resistance to oxidation. They are employed in components for gas turbines, combustion engines, heat exchangers, and furnace linings. Their ability to maintain mechanical properties at elevated temperatures makes them superior to metals in many extreme environment applications. The development of specialized ceramic formulations has enabled their use in increasingly demanding thermal conditions, expanding their application range in aerospace, energy, and industrial sectors.

- Reinforcement techniques for improving mechanical properties: Various reinforcement techniques are employed to overcome the inherent brittleness of structural ceramics and improve their mechanical properties. These include fiber reinforcement, particle reinforcement, and the development of ceramic matrix composites. The incorporation of secondary phases or the creation of engineered microstructures can significantly enhance fracture toughness, impact resistance, and reliability. These reinforcement strategies enable structural ceramics to be used in applications requiring both high strength and damage tolerance.

02 Composition and materials for structural ceramics

Structural ceramics utilize various material compositions to achieve desired properties. Common materials include silicon nitride, silicon carbide, alumina, zirconia, and their composites. These compositions are engineered to provide high temperature resistance, wear resistance, and mechanical strength. The selection of raw materials and their proportions significantly impacts the final ceramic properties, with additives and dopants used to enhance specific characteristics such as fracture toughness or thermal shock resistance.Expand Specific Solutions03 Reinforcement techniques for structural ceramics

Various reinforcement techniques are employed to overcome the inherent brittleness of ceramic materials. These include fiber reinforcement, particulate reinforcement, and the development of ceramic matrix composites. Reinforcement methods improve fracture toughness, impact resistance, and overall mechanical reliability. Advanced designs incorporate multiple reinforcement mechanisms to create ceramics with superior damage tolerance and reliability under extreme conditions.Expand Specific Solutions04 Surface treatments and coatings for structural ceramics

Surface treatments and coatings are applied to structural ceramics to enhance performance characteristics. These treatments include glazing, chemical modification, and the application of protective layers. Surface engineering techniques improve wear resistance, corrosion protection, and thermal barrier properties. Specialized coatings can also enhance functionality by providing electrical conductivity, catalytic activity, or biocompatibility depending on the application requirements.Expand Specific Solutions05 Applications of structural ceramics

Structural ceramics find applications across various industries due to their exceptional properties. They are used in high-temperature environments such as gas turbines, automotive components, cutting tools, armor systems, and biomedical implants. The combination of hardness, wear resistance, and thermal stability makes structural ceramics ideal for demanding applications where metals and polymers would fail. Emerging applications include electronics substrates, energy systems, and advanced aerospace components.Expand Specific Solutions

Defense Industry Ceramic Manufacturers

The structural ceramics market in military defense systems is currently in a growth phase, characterized by increasing demand for lightweight, high-performance materials with superior ballistic protection capabilities. The global market size is expanding steadily, driven by rising defense budgets and growing emphasis on personnel protection. Technologically, the field shows varying maturity levels across applications, with significant innovations emerging from key players. Naval Research Laboratory and Rafael Advanced Defense Systems lead in advanced ceramic armor development, while companies like NP Aerospace and COI Ceramics have established strong positions in specialized applications. Academic institutions including Xi'an Jiaotong University and Harbin Institute of Technology are advancing fundamental research, while industrial giants Boeing and Corning provide manufacturing scale and integration expertise. The competitive landscape features increasing collaboration between defense contractors, research institutions, and materials specialists to develop next-generation ceramic solutions.

Corning, Inc.

Technical Solution: Corning has developed specialized structural ceramic solutions for military defense systems, leveraging their extensive expertise in glass and ceramic technologies. Their defense portfolio includes advanced ceramic materials engineered for ballistic protection, electromagnetic shielding, and thermal management in military applications. Corning utilizes proprietary glass-ceramic manufacturing processes that create materials with controlled crystallization, offering unique combinations of hardness, toughness, and thermal stability. Their ceramic solutions include transparent armor systems that provide ballistic protection while maintaining optical clarity for vehicle windows and aircraft canopies. Corning has pioneered ceramic matrix composites (CMCs) that combine ceramic fibers within a ceramic matrix, creating lightweight materials with exceptional heat resistance for jet engine components and missile structures. Their manufacturing capabilities include precision forming techniques for complex geometries and large-format ceramic components that maintain tight dimensional tolerances. Corning's ceramic technologies also address specialized military requirements such as radar-transparent materials for radome applications and high-temperature ceramics for hypersonic vehicle thermal protection systems.

Strengths: World-class materials science expertise and R&D capabilities; established manufacturing infrastructure with precision quality control; ability to produce large-format ceramic components; extensive experience with transparent ceramics. Weaknesses: Primary focus on commercial markets rather than defense; higher cost structure compared to defense-specialized manufacturers; less experience with battlefield deployment and field maintenance requirements.

NP Aerospace Ltd.

Technical Solution: NP Aerospace has developed a comprehensive structural ceramics portfolio for defense applications, focusing on advanced ceramic composite armor systems. Their technology combines silicon carbide and alumina ceramics with proprietary composite backing materials to create lightweight yet highly effective protection systems. NP Aerospace utilizes a unique pressing and sintering process that optimizes ceramic microstructure for maximum ballistic efficiency. Their CAMAC® (Ceramic Armor Multi-hit Advanced Capability) technology incorporates specially designed ceramic tile arrangements with advanced bonding techniques to distribute impact energy and prevent crack propagation between tiles. This enables superior multi-hit capability compared to conventional ceramic armor. The company has also pioneered integration methods for vehicle protection, creating modular ceramic armor packages that can be rapidly installed or replaced in field conditions. Their ceramic solutions protect against threats ranging from small arms fire to high-explosive anti-tank rounds.

Strengths: Exceptional weight-to-performance ratio allowing for increased mobility; proven field performance in multiple conflict zones; modular design enabling quick replacement of damaged sections; established manufacturing capacity for large-scale production. Weaknesses: Higher initial cost compared to steel armor solutions; requires specialized maintenance protocols; performance degradation in extreme environmental conditions.

Advanced Ceramic Materials Research

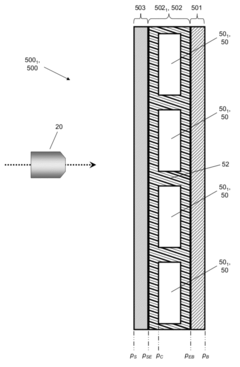

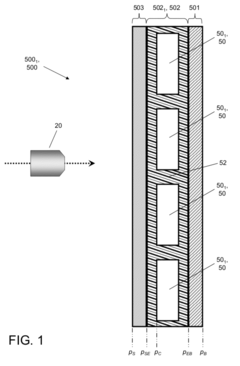

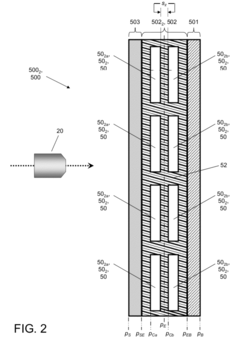

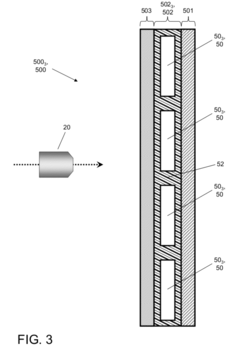

Method for designing and making a plural-layer composite armor system

PatentActiveUS8226873B1

Innovation

- A composite armor system utilizing low-density ceramic materials, such as aluminosilicate porcelain, embedded in an elastomeric matrix material, which provides a lighter-weight and more economical alternative to traditional ceramic armor systems by adjusting the density and configuration of ceramic elements to match the areal density of conventional systems.

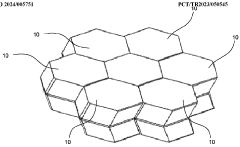

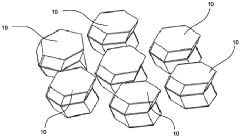

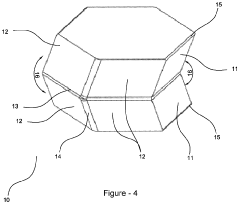

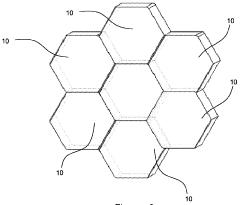

Ballistic ceramic structuring

PatentWO2024005751A1

Innovation

- The use of ceramic tiles with angled, interlocking convex and concave surfaces that interconnect to eliminate ceramic-free areas, support junction points, and guide ammunition, enhancing energy absorption and distribution while allowing for seamless adhesion and reduced weight.

Supply Chain Security Considerations

The security of supply chains for structural ceramics in military defense systems represents a critical vulnerability that requires comprehensive management strategies. The global nature of advanced ceramic production creates inherent risks, as key raw materials often originate from politically sensitive regions. Specifically, rare earth elements and specialized minerals essential for high-performance ceramics frequently come from countries with complex geopolitical relationships with Western military powers. This geographic concentration creates potential single points of failure that could be exploited during international conflicts or trade disputes.

Manufacturing capabilities for military-grade structural ceramics are similarly concentrated among a limited number of specialized facilities worldwide. This concentration increases vulnerability to disruption through natural disasters, political instability, or targeted actions by adversarial entities. The sophisticated nature of these production facilities means that alternative sources cannot be rapidly developed in response to supply chain disruptions, creating potential bottlenecks in defense system production.

Quality assurance represents another significant security consideration. The performance of structural ceramics in defense applications depends on precise material composition and manufacturing processes. Counterfeit or substandard materials introduced into the supply chain could compromise the integrity of critical defense systems. This necessitates rigorous verification protocols throughout the entire supply chain, from raw material sourcing to final component integration.

Intellectual property protection presents additional challenges in maintaining supply chain security. Advanced ceramic formulations and manufacturing techniques often represent proprietary knowledge with significant military value. Protecting this intellectual property from theft or unauthorized transfer requires sophisticated cybersecurity measures and careful management of international partnerships and technology transfers.

Climate change and environmental regulations increasingly impact ceramic supply chains. Extraction of raw materials and energy-intensive manufacturing processes face growing regulatory scrutiny and potential restrictions. Defense organizations must anticipate these challenges by developing more sustainable sourcing and production methods that maintain compliance while ensuring supply continuity.

Diversification strategies have become essential for mitigating supply chain risks. These include developing multiple sourcing options for critical materials, investing in domestic production capabilities, maintaining strategic reserves of essential components, and exploring material substitutions that could reduce dependence on vulnerable supply chains. Such approaches require significant investment but are increasingly viewed as necessary components of national security strategy.

Manufacturing capabilities for military-grade structural ceramics are similarly concentrated among a limited number of specialized facilities worldwide. This concentration increases vulnerability to disruption through natural disasters, political instability, or targeted actions by adversarial entities. The sophisticated nature of these production facilities means that alternative sources cannot be rapidly developed in response to supply chain disruptions, creating potential bottlenecks in defense system production.

Quality assurance represents another significant security consideration. The performance of structural ceramics in defense applications depends on precise material composition and manufacturing processes. Counterfeit or substandard materials introduced into the supply chain could compromise the integrity of critical defense systems. This necessitates rigorous verification protocols throughout the entire supply chain, from raw material sourcing to final component integration.

Intellectual property protection presents additional challenges in maintaining supply chain security. Advanced ceramic formulations and manufacturing techniques often represent proprietary knowledge with significant military value. Protecting this intellectual property from theft or unauthorized transfer requires sophisticated cybersecurity measures and careful management of international partnerships and technology transfers.

Climate change and environmental regulations increasingly impact ceramic supply chains. Extraction of raw materials and energy-intensive manufacturing processes face growing regulatory scrutiny and potential restrictions. Defense organizations must anticipate these challenges by developing more sustainable sourcing and production methods that maintain compliance while ensuring supply continuity.

Diversification strategies have become essential for mitigating supply chain risks. These include developing multiple sourcing options for critical materials, investing in domestic production capabilities, maintaining strategic reserves of essential components, and exploring material substitutions that could reduce dependence on vulnerable supply chains. Such approaches require significant investment but are increasingly viewed as necessary components of national security strategy.

Environmental Impact of Ceramic Production

The production of structural ceramics for military defense systems carries significant environmental implications throughout its lifecycle. Raw material extraction represents the first major environmental concern, as mining operations for alumina, silicon carbide, and boron carbide disrupt local ecosystems and generate substantial waste material. These extraction processes often involve extensive land use changes, potentially leading to habitat destruction and biodiversity loss in mining regions.

Energy consumption during ceramic manufacturing constitutes another critical environmental factor. The production of advanced structural ceramics requires extremely high firing temperatures, typically ranging from 1400°C to 2000°C, resulting in substantial carbon emissions. Current industry estimates suggest that producing one ton of advanced ceramic materials generates approximately 4.5-6.5 tons of CO2 equivalent, significantly higher than conventional construction materials.

Water usage presents additional environmental challenges, particularly in regions facing water scarcity. The ceramic production process requires substantial quantities of water for mixing, forming, and cleaning operations. Furthermore, wastewater from ceramic manufacturing often contains heavy metals and other contaminants that require specialized treatment before discharge to prevent groundwater and surface water contamination.

Chemical processing during ceramic production introduces environmental risks through the use of various binders, sintering aids, and surface treatments. Many of these compounds contain potentially hazardous substances that require careful handling and disposal. Emissions of volatile organic compounds (VOCs) and particulate matter during processing can contribute to air quality degradation in manufacturing zones.

Recent technological advancements have begun addressing these environmental concerns. Closed-loop water systems have reduced freshwater consumption by up to 60% in modern ceramic manufacturing facilities. Additionally, alternative energy sources and more efficient kilns have demonstrated potential to reduce carbon emissions by 25-30% compared to conventional methods.

Waste management represents both a challenge and opportunity in ceramic production. While manufacturing generates substantial waste material, recent innovations have enabled the recycling of ceramic production scrap into secondary products. Some military contractors have implemented programs that repurpose up to 40% of ceramic waste materials, significantly reducing landfill contributions.

As military applications increasingly demand advanced ceramic materials, balancing performance requirements with environmental sustainability will become increasingly important for defense contractors and materials scientists developing next-generation protective systems.

Energy consumption during ceramic manufacturing constitutes another critical environmental factor. The production of advanced structural ceramics requires extremely high firing temperatures, typically ranging from 1400°C to 2000°C, resulting in substantial carbon emissions. Current industry estimates suggest that producing one ton of advanced ceramic materials generates approximately 4.5-6.5 tons of CO2 equivalent, significantly higher than conventional construction materials.

Water usage presents additional environmental challenges, particularly in regions facing water scarcity. The ceramic production process requires substantial quantities of water for mixing, forming, and cleaning operations. Furthermore, wastewater from ceramic manufacturing often contains heavy metals and other contaminants that require specialized treatment before discharge to prevent groundwater and surface water contamination.

Chemical processing during ceramic production introduces environmental risks through the use of various binders, sintering aids, and surface treatments. Many of these compounds contain potentially hazardous substances that require careful handling and disposal. Emissions of volatile organic compounds (VOCs) and particulate matter during processing can contribute to air quality degradation in manufacturing zones.

Recent technological advancements have begun addressing these environmental concerns. Closed-loop water systems have reduced freshwater consumption by up to 60% in modern ceramic manufacturing facilities. Additionally, alternative energy sources and more efficient kilns have demonstrated potential to reduce carbon emissions by 25-30% compared to conventional methods.

Waste management represents both a challenge and opportunity in ceramic production. While manufacturing generates substantial waste material, recent innovations have enabled the recycling of ceramic production scrap into secondary products. Some military contractors have implemented programs that repurpose up to 40% of ceramic waste materials, significantly reducing landfill contributions.

As military applications increasingly demand advanced ceramic materials, balancing performance requirements with environmental sustainability will become increasingly important for defense contractors and materials scientists developing next-generation protective systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!