The Regulatory Environment for Structural Ceramics in Construction

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Ceramics Evolution and Regulatory Objectives

Structural ceramics have evolved significantly over the past century, transitioning from traditional clay-based products to advanced engineered materials with superior mechanical and thermal properties. The development trajectory began with conventional bricks and tiles, progressing through refractory ceramics in the mid-20th century, and culminating in today's high-performance structural ceramics that incorporate sophisticated material science principles. This evolution has been driven by increasing demands for building materials that offer enhanced durability, fire resistance, and sustainability in modern construction applications.

The regulatory landscape governing structural ceramics has similarly undergone substantial transformation, reflecting changing priorities in building safety, environmental impact, and performance standards. Early regulations primarily focused on basic dimensional consistency and minimal strength requirements. However, contemporary regulatory frameworks have expanded to encompass comprehensive performance criteria including thermal efficiency, seismic resistance, and lifecycle environmental impact.

Current regulatory objectives for structural ceramics in construction center around four key dimensions: safety, sustainability, performance, and innovation. Safety regulations aim to ensure structural integrity under various loading conditions and extreme events such as fires and earthquakes. These include standards for compressive strength, thermal shock resistance, and failure behavior that minimize catastrophic collapse risks.

Sustainability objectives have gained prominence in recent regulatory developments, with increasing emphasis on embodied carbon, resource efficiency, and end-of-life considerations. Regulations now frequently incorporate requirements for recycled content, energy-efficient manufacturing processes, and potential for material recovery after building decommissioning.

Performance-based regulatory approaches have replaced many prescriptive standards, allowing for greater material innovation while maintaining rigorous verification protocols. These frameworks establish minimum performance thresholds while providing flexibility in how manufacturers achieve compliance, fostering technological advancement in the sector.

Harmonization of international standards represents another significant regulatory objective, with organizations such as ISO, ASTM, and CEN working to align testing methodologies and performance criteria across jurisdictions. This convergence aims to facilitate global trade in structural ceramic products while maintaining consistent safety and quality expectations.

The regulatory environment continues to evolve in response to emerging challenges, including climate adaptation requirements, circular economy principles, and digital verification systems. Future regulatory objectives will likely emphasize predictive performance modeling, real-time monitoring capabilities, and integration with building information management systems to enhance lifecycle management of structural ceramic components.

The regulatory landscape governing structural ceramics has similarly undergone substantial transformation, reflecting changing priorities in building safety, environmental impact, and performance standards. Early regulations primarily focused on basic dimensional consistency and minimal strength requirements. However, contemporary regulatory frameworks have expanded to encompass comprehensive performance criteria including thermal efficiency, seismic resistance, and lifecycle environmental impact.

Current regulatory objectives for structural ceramics in construction center around four key dimensions: safety, sustainability, performance, and innovation. Safety regulations aim to ensure structural integrity under various loading conditions and extreme events such as fires and earthquakes. These include standards for compressive strength, thermal shock resistance, and failure behavior that minimize catastrophic collapse risks.

Sustainability objectives have gained prominence in recent regulatory developments, with increasing emphasis on embodied carbon, resource efficiency, and end-of-life considerations. Regulations now frequently incorporate requirements for recycled content, energy-efficient manufacturing processes, and potential for material recovery after building decommissioning.

Performance-based regulatory approaches have replaced many prescriptive standards, allowing for greater material innovation while maintaining rigorous verification protocols. These frameworks establish minimum performance thresholds while providing flexibility in how manufacturers achieve compliance, fostering technological advancement in the sector.

Harmonization of international standards represents another significant regulatory objective, with organizations such as ISO, ASTM, and CEN working to align testing methodologies and performance criteria across jurisdictions. This convergence aims to facilitate global trade in structural ceramic products while maintaining consistent safety and quality expectations.

The regulatory environment continues to evolve in response to emerging challenges, including climate adaptation requirements, circular economy principles, and digital verification systems. Future regulatory objectives will likely emphasize predictive performance modeling, real-time monitoring capabilities, and integration with building information management systems to enhance lifecycle management of structural ceramic components.

Market Analysis for Structural Ceramics in Construction

The global structural ceramics market in construction is experiencing robust growth, valued at approximately $54.8 billion in 2022 and projected to reach $78.3 billion by 2028, representing a compound annual growth rate (CAGR) of 6.1%. This growth is primarily driven by increasing urbanization, infrastructure development, and the rising demand for sustainable building materials with superior performance characteristics.

Asia-Pacific dominates the market, accounting for over 45% of global consumption, with China leading as both the largest producer and consumer of structural ceramics. The region's rapid industrialization and construction boom continue to fuel demand, particularly in emerging economies like India, Vietnam, and Indonesia where infrastructure spending is accelerating.

North America and Europe represent mature markets with steady growth rates of 4-5%, primarily focused on high-performance and specialized ceramic applications. These regions are increasingly adopting advanced ceramic materials for energy-efficient buildings and specialized infrastructure projects, driven by stringent building codes and sustainability requirements.

Market segmentation reveals that floor and wall tiles constitute the largest application segment (38%), followed by bricks and blocks (27%), roof tiles (18%), and advanced structural components (17%). The advanced structural components segment is witnessing the fastest growth at 8.3% annually, reflecting increasing adoption of engineered ceramic solutions in demanding construction applications.

End-user analysis shows residential construction leading with 52% market share, followed by commercial (28%), industrial (12%), and infrastructure projects (8%). However, the infrastructure segment is projected to grow most rapidly at 7.5% annually through 2028, driven by government investments in transportation, utilities, and public facilities.

Key market drivers include increasing awareness of ceramics' durability and lifecycle cost advantages, growing emphasis on fire safety in building codes, and rising demand for energy-efficient building envelopes. Additionally, technological advancements in manufacturing processes have improved the cost-effectiveness and performance characteristics of structural ceramics, expanding their applicability in construction.

Market challenges include competition from alternative materials like engineered wood, polymers, and composites, as well as the relatively higher initial costs of advanced ceramic systems. Supply chain vulnerabilities exposed during the COVID-19 pandemic continue to influence market dynamics, with increasing emphasis on regional manufacturing capabilities and material sourcing diversification.

The market outlook remains positive, with significant growth opportunities in green building applications, modular construction, and infrastructure rehabilitation projects. Manufacturers focusing on product innovation, sustainability credentials, and integrated building system solutions are best positioned to capture emerging market opportunities.

Asia-Pacific dominates the market, accounting for over 45% of global consumption, with China leading as both the largest producer and consumer of structural ceramics. The region's rapid industrialization and construction boom continue to fuel demand, particularly in emerging economies like India, Vietnam, and Indonesia where infrastructure spending is accelerating.

North America and Europe represent mature markets with steady growth rates of 4-5%, primarily focused on high-performance and specialized ceramic applications. These regions are increasingly adopting advanced ceramic materials for energy-efficient buildings and specialized infrastructure projects, driven by stringent building codes and sustainability requirements.

Market segmentation reveals that floor and wall tiles constitute the largest application segment (38%), followed by bricks and blocks (27%), roof tiles (18%), and advanced structural components (17%). The advanced structural components segment is witnessing the fastest growth at 8.3% annually, reflecting increasing adoption of engineered ceramic solutions in demanding construction applications.

End-user analysis shows residential construction leading with 52% market share, followed by commercial (28%), industrial (12%), and infrastructure projects (8%). However, the infrastructure segment is projected to grow most rapidly at 7.5% annually through 2028, driven by government investments in transportation, utilities, and public facilities.

Key market drivers include increasing awareness of ceramics' durability and lifecycle cost advantages, growing emphasis on fire safety in building codes, and rising demand for energy-efficient building envelopes. Additionally, technological advancements in manufacturing processes have improved the cost-effectiveness and performance characteristics of structural ceramics, expanding their applicability in construction.

Market challenges include competition from alternative materials like engineered wood, polymers, and composites, as well as the relatively higher initial costs of advanced ceramic systems. Supply chain vulnerabilities exposed during the COVID-19 pandemic continue to influence market dynamics, with increasing emphasis on regional manufacturing capabilities and material sourcing diversification.

The market outlook remains positive, with significant growth opportunities in green building applications, modular construction, and infrastructure rehabilitation projects. Manufacturers focusing on product innovation, sustainability credentials, and integrated building system solutions are best positioned to capture emerging market opportunities.

Global Regulatory Landscape and Technical Barriers

The regulatory landscape for structural ceramics in construction varies significantly across different regions, creating a complex environment for manufacturers and construction companies operating globally. In North America, the American Society for Testing and Materials (ASTM) and the American National Standards Institute (ANSI) establish comprehensive standards for ceramic materials used in construction, focusing primarily on mechanical properties, durability, and fire resistance. These standards are generally performance-based rather than prescriptive, allowing for innovation while maintaining safety.

The European Union operates under the Construction Products Regulation (CPR), which mandates CE marking for construction products, including structural ceramics. The European Committee for Standardization (CEN) has developed harmonized standards that specify testing methodologies and performance requirements. The EU's approach tends to be more stringent regarding environmental impact and sustainability metrics compared to other regions, requiring lifecycle assessments and emissions data.

In Asia, regulatory frameworks show significant variation. Japan implements some of the world's most rigorous seismic performance requirements for construction materials, including structural ceramics, through the Building Standard Law. China's rapidly evolving regulatory system has recently strengthened quality control measures through the GB standards (Guobiao standards), though enforcement remains inconsistent across provinces.

Technical barriers to trade represent significant challenges in the structural ceramics sector. Divergent testing methodologies between regions often necessitate redundant certification processes, increasing costs and time-to-market. For instance, fire resistance testing protocols differ substantially between the International Building Code (IBC) used in the US and the Eurocode standards, requiring manufacturers to conduct separate testing campaigns for different markets.

Non-tariff barriers also emerge through localized requirements for environmental performance. Some jurisdictions mandate specific manufacturing processes or raw material sourcing requirements that effectively favor domestic producers. The lack of mutual recognition agreements between major economies further complicates international trade in advanced ceramic construction materials.

Emerging economies present additional regulatory challenges, with many developing nations adopting hybrid regulatory frameworks that combine elements from established systems with local requirements. This creates regulatory uncertainty and increases compliance costs for international suppliers of structural ceramics.

Recent trends indicate movement toward greater international harmonization of standards, particularly regarding testing methodologies for mechanical properties and durability. Organizations such as the International Organization for Standardization (ISO) are working to develop globally recognized standards that could potentially reduce technical barriers, though progress remains slow due to entrenched regional interests and varying safety philosophies.

The European Union operates under the Construction Products Regulation (CPR), which mandates CE marking for construction products, including structural ceramics. The European Committee for Standardization (CEN) has developed harmonized standards that specify testing methodologies and performance requirements. The EU's approach tends to be more stringent regarding environmental impact and sustainability metrics compared to other regions, requiring lifecycle assessments and emissions data.

In Asia, regulatory frameworks show significant variation. Japan implements some of the world's most rigorous seismic performance requirements for construction materials, including structural ceramics, through the Building Standard Law. China's rapidly evolving regulatory system has recently strengthened quality control measures through the GB standards (Guobiao standards), though enforcement remains inconsistent across provinces.

Technical barriers to trade represent significant challenges in the structural ceramics sector. Divergent testing methodologies between regions often necessitate redundant certification processes, increasing costs and time-to-market. For instance, fire resistance testing protocols differ substantially between the International Building Code (IBC) used in the US and the Eurocode standards, requiring manufacturers to conduct separate testing campaigns for different markets.

Non-tariff barriers also emerge through localized requirements for environmental performance. Some jurisdictions mandate specific manufacturing processes or raw material sourcing requirements that effectively favor domestic producers. The lack of mutual recognition agreements between major economies further complicates international trade in advanced ceramic construction materials.

Emerging economies present additional regulatory challenges, with many developing nations adopting hybrid regulatory frameworks that combine elements from established systems with local requirements. This creates regulatory uncertainty and increases compliance costs for international suppliers of structural ceramics.

Recent trends indicate movement toward greater international harmonization of standards, particularly regarding testing methodologies for mechanical properties and durability. Organizations such as the International Organization for Standardization (ISO) are working to develop globally recognized standards that could potentially reduce technical barriers, though progress remains slow due to entrenched regional interests and varying safety philosophies.

Current Compliance Frameworks and Testing Protocols

01 Manufacturing processes for structural ceramics

Various manufacturing processes are employed to produce structural ceramics with enhanced properties. These include sintering, hot pressing, and other specialized techniques that control the microstructure and density of the ceramic materials. These processes can be optimized to improve mechanical strength, thermal resistance, and overall performance of the ceramic components for structural applications.- Manufacturing methods for structural ceramics: Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing, and specialized molding techniques. The manufacturing methods focus on achieving optimal density, microstructure control, and minimizing defects to enhance mechanical properties such as strength and toughness. Advanced processing techniques allow for the creation of complex ceramic shapes while maintaining structural integrity.

- Composition and materials for structural ceramics: Structural ceramics utilize various material compositions to achieve desired properties. Common materials include silicon nitride, silicon carbide, alumina, zirconia, and boron carbide. These materials can be combined with additives and sintering aids to enhance specific properties. The composition directly influences characteristics such as thermal resistance, wear resistance, and mechanical strength, making material selection crucial for specific applications.

- Reinforcement techniques for structural ceramics: Reinforcement techniques are employed to overcome the inherent brittleness of ceramic materials. These include fiber reinforcement, particulate reinforcement, and the development of ceramic matrix composites. By incorporating reinforcing elements, the fracture toughness and damage tolerance of structural ceramics can be significantly improved, expanding their application range in demanding environments where mechanical reliability is critical.

- Surface treatments and coatings for structural ceramics: Surface treatments and coatings are applied to structural ceramics to enhance performance characteristics. These treatments can improve wear resistance, reduce friction, increase chemical stability, or provide thermal barrier properties. Techniques include glazing, chemical vapor deposition, physical vapor deposition, and plasma spraying. Surface modifications allow ceramics to perform better in harsh environments and extend their service life in various applications.

- Applications of structural ceramics: Structural ceramics find applications across numerous industries due to their exceptional properties. They are used in automotive and aerospace components, cutting tools, armor systems, electronic substrates, biomedical implants, and energy systems. Their high temperature resistance, wear resistance, and chemical stability make them suitable for extreme operating conditions where traditional materials would fail. The continuous development of structural ceramics is expanding their application potential in advanced engineering systems.

02 Composite ceramic materials

Composite ceramic materials combine different ceramic components or ceramics with other materials to achieve superior mechanical and thermal properties. These composites often incorporate reinforcing elements such as fibers, whiskers, or particles to enhance toughness and reduce brittleness. The resulting materials offer improved strength, fracture resistance, and durability for demanding structural applications.Expand Specific Solutions03 High-temperature resistant structural ceramics

Specialized structural ceramics designed to withstand extreme temperatures while maintaining their mechanical integrity. These materials typically include silicon nitride, silicon carbide, alumina, and zirconia-based ceramics that exhibit excellent thermal shock resistance and strength at elevated temperatures. Applications include components for gas turbines, aerospace structures, and other high-temperature environments.Expand Specific Solutions04 Ceramic coatings for structural applications

Protective ceramic coatings applied to structural components to enhance surface properties and extend service life. These coatings provide wear resistance, corrosion protection, thermal insulation, and other functional benefits. Various deposition techniques such as plasma spraying, chemical vapor deposition, and sol-gel methods are used to apply these ceramic layers to substrates.Expand Specific Solutions05 Novel structural ceramic formulations

Innovative ceramic compositions developed to achieve specific performance characteristics for structural applications. These formulations may incorporate rare earth elements, specialized dopants, or unique material combinations to enhance properties such as fracture toughness, hardness, or electrical conductivity. Research in this area focuses on tailoring ceramic materials at the molecular level to meet demanding engineering requirements.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The regulatory environment for structural ceramics in construction is evolving within a maturing industry characterized by increasing market adoption and technological refinement. The global market is experiencing steady growth, driven by demands for high-performance building materials with enhanced durability and sustainability properties. Leading companies like NGK Insulators, Corning, and Kyocera have established strong technological foundations, while IBIDEN and Murata Manufacturing are advancing specialized ceramic applications. The competitive landscape features established players from Japan and the US alongside emerging Chinese manufacturers such as Dongguan Wonderful Ceramics and Monalisa Group. Regulatory frameworks are increasingly focusing on performance standards, environmental impact, and safety certifications, creating both compliance challenges and innovation opportunities for industry participants.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has developed a comprehensive regulatory compliance framework for their structural ceramic products in construction applications. Their approach integrates advanced testing methodologies that exceed standard requirements in multiple jurisdictions, particularly focusing on their NAS (NGK Advanced Ceramics) product line. The company has established a dedicated regulatory affairs division that actively participates in international standards development for construction ceramics, including contributions to ISO technical committees. NGK's regulatory strategy includes proactive engagement with building code authorities across different markets to ensure their ceramic products meet or exceed local requirements. Their technical documentation system provides builders and architects with detailed compliance information specific to each regulatory environment, facilitating approval processes. The company has also pioneered environmental impact assessments specifically designed for ceramic construction materials, addressing lifecycle analysis requirements in green building regulations.

Strengths: Strong international regulatory expertise with established relationships with standards bodies; comprehensive testing capabilities that exceed minimum requirements. Weaknesses: Regulatory approach primarily optimized for developed markets with sophisticated building codes; adaptation to rapidly changing regulations in emerging markets can be challenging.

Corning, Inc.

Technical Solution: Corning has developed a sophisticated regulatory engagement strategy for their structural ceramic products in construction applications. Their approach leverages their extensive experience with glass-ceramic materials to address the unique regulatory challenges these hybrid materials face in building codes. Corning maintains a specialized regulatory affairs team that focuses on construction applications, working to establish appropriate testing methodologies that accurately reflect the performance characteristics of their ceramic products. The company has pioneered several industry-first approvals for ceramic materials in structural applications by developing custom testing protocols in collaboration with certification bodies. Their regulatory strategy emphasizes education of building officials about the distinct properties of advanced ceramics compared to traditional construction materials. Corning has also established a comprehensive environmental compliance program that addresses the increasing regulatory focus on sustainability in construction materials, including detailed lifecycle assessments and environmental product declarations that meet requirements across multiple jurisdictions.

Strengths: Strong scientific approach to regulatory challenges with extensive materials science expertise; effective stakeholder education programs that facilitate acceptance of novel ceramic applications. Weaknesses: Regulatory approach sometimes focuses too heavily on technical performance rather than practical implementation concerns; limited experience with certain regional building code systems in developing markets.

Critical Standards and Certification Requirements

Use of polyol for reducing shrinkage of construction chemical compositions

PatentPendingUS20230295043A1

Innovation

- Incorporating a polyol with a functionality of 4 or less and an OH group density of at least 0.033 mol OH per g, such as glycerol or erythritol, into the construction chemical compositions to reduce shrinkage without significantly altering processability or increasing volatile organic compound emissions.

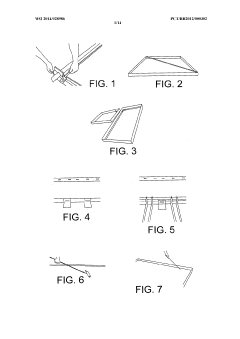

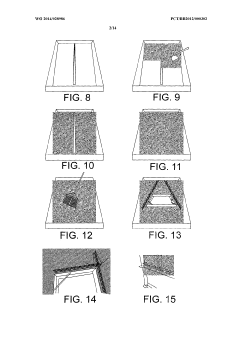

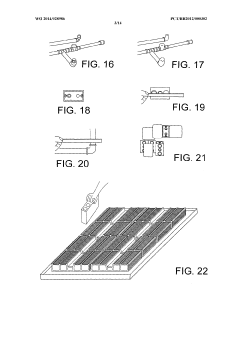

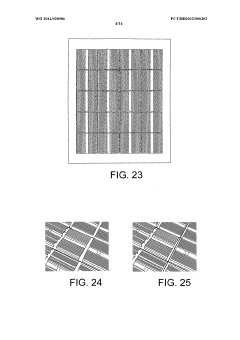

Ceramic panel construction system

PatentWO2014028986A1

Innovation

- A Constructive System of Ceramic Panels that uses non-specialized labor, minimizes waste, and enhances productivity by employing ceramic or styrofoam filling with a modified concreting process, reducing concrete usage and eliminating unnecessary steps, while adhering to market standards like NBR 61 18, utilizing materials such as concrete, iron, and specific internal elements for improved efficiency and quality.

Environmental Impact Assessment and Sustainability Regulations

The regulatory landscape for structural ceramics in construction is increasingly shaped by environmental impact assessment (EIA) requirements and sustainability regulations. These frameworks evaluate the environmental footprint of ceramic materials throughout their lifecycle, from raw material extraction to manufacturing, installation, use, and eventual disposal or recycling.

Life Cycle Assessment (LCA) has become a mandatory component in many jurisdictions, requiring manufacturers to quantify energy consumption, carbon emissions, water usage, and waste generation associated with structural ceramic products. The European Union's Construction Products Regulation (CPR) specifically mandates environmental product declarations (EPDs) that document these impacts, while the LEED and BREEAM certification systems award points for materials with favorable environmental profiles.

Carbon footprint regulations are becoming more stringent, with several countries implementing carbon taxes or cap-and-trade systems that directly affect the ceramic industry. The EU Emissions Trading System (ETS) has placed particular pressure on ceramic manufacturers to reduce emissions from high-temperature firing processes, which traditionally consume significant energy and release substantial CO2.

Water conservation regulations also impact the ceramic industry, which historically has been water-intensive. Regulations in water-stressed regions now mandate closed-loop water systems and treatment of process water before discharge, significantly affecting production costs and facility design requirements.

Waste management directives, such as the EU Waste Framework Directive, have established hierarchies prioritizing waste prevention, reuse, and recycling over disposal. These regulations have spurred innovation in ceramic waste recycling and the development of ceramics incorporating recycled content, including construction and demolition waste.

Chemical safety regulations, including REACH in Europe and similar frameworks globally, restrict hazardous substances in construction materials. This has prompted reformulation of ceramic glazes and additives to eliminate heavy metals and other toxic compounds, particularly important for indoor applications where occupant exposure is a concern.

Emerging regulations increasingly focus on circular economy principles, requiring manufacturers to consider end-of-life scenarios and design products for disassembly, reuse, or recycling. The EU's Circular Economy Action Plan specifically targets construction materials, including ceramics, with requirements for increased durability, repairability, and recyclability.

These environmental and sustainability regulations create both challenges and opportunities for the structural ceramics industry, driving innovation in materials science, manufacturing processes, and business models while establishing new competitive parameters based on environmental performance rather than solely on cost and technical specifications.

Life Cycle Assessment (LCA) has become a mandatory component in many jurisdictions, requiring manufacturers to quantify energy consumption, carbon emissions, water usage, and waste generation associated with structural ceramic products. The European Union's Construction Products Regulation (CPR) specifically mandates environmental product declarations (EPDs) that document these impacts, while the LEED and BREEAM certification systems award points for materials with favorable environmental profiles.

Carbon footprint regulations are becoming more stringent, with several countries implementing carbon taxes or cap-and-trade systems that directly affect the ceramic industry. The EU Emissions Trading System (ETS) has placed particular pressure on ceramic manufacturers to reduce emissions from high-temperature firing processes, which traditionally consume significant energy and release substantial CO2.

Water conservation regulations also impact the ceramic industry, which historically has been water-intensive. Regulations in water-stressed regions now mandate closed-loop water systems and treatment of process water before discharge, significantly affecting production costs and facility design requirements.

Waste management directives, such as the EU Waste Framework Directive, have established hierarchies prioritizing waste prevention, reuse, and recycling over disposal. These regulations have spurred innovation in ceramic waste recycling and the development of ceramics incorporating recycled content, including construction and demolition waste.

Chemical safety regulations, including REACH in Europe and similar frameworks globally, restrict hazardous substances in construction materials. This has prompted reformulation of ceramic glazes and additives to eliminate heavy metals and other toxic compounds, particularly important for indoor applications where occupant exposure is a concern.

Emerging regulations increasingly focus on circular economy principles, requiring manufacturers to consider end-of-life scenarios and design products for disassembly, reuse, or recycling. The EU's Circular Economy Action Plan specifically targets construction materials, including ceramics, with requirements for increased durability, repairability, and recyclability.

These environmental and sustainability regulations create both challenges and opportunities for the structural ceramics industry, driving innovation in materials science, manufacturing processes, and business models while establishing new competitive parameters based on environmental performance rather than solely on cost and technical specifications.

Cross-Border Harmonization of Ceramic Construction Codes

The harmonization of structural ceramic codes across international borders represents a critical challenge and opportunity for the global construction industry. Currently, significant disparities exist between regulatory frameworks in North America, Europe, and Asia, creating barriers to trade and technological innovation in ceramic construction materials. The European Union has made substantial progress through its Construction Products Regulation (CPR), establishing harmonized technical specifications and CE marking requirements that facilitate cross-border commerce within the EU market.

In contrast, North American standards remain fragmented between the United States, Canada, and Mexico, despite NAFTA/USMCA trade agreements. The International Code Council (ICC) has attempted to bridge these gaps through the International Building Code (IBC), but adoption remains inconsistent across jurisdictions, particularly regarding ceramic structural elements.

The Asia-Pacific region presents even greater regulatory diversity, with China's stringent national standards often diverging from Japanese and Korean approaches. This regulatory heterogeneity creates significant compliance costs for manufacturers and limits market access for innovative ceramic construction products.

Recent initiatives by ISO Technical Committee 189 on Ceramic Tiles have demonstrated the potential for global standardization. Their work on ISO 13006 provides a template for how performance-based standards can transcend regional differences while maintaining safety and quality requirements. The World Ceramic Tiles Forum (WCTF) has similarly advocated for regulatory convergence through mutual recognition agreements.

Digital compliance tools are emerging as facilitators of cross-border harmonization. Building Information Modeling (BIM) platforms increasingly incorporate regulatory requirements from multiple jurisdictions, allowing designers and manufacturers to assess compliance across markets simultaneously. These technological solutions may prove more nimble than formal treaty negotiations in addressing regulatory fragmentation.

The economic benefits of harmonization are substantial, with industry analyses suggesting potential cost reductions of 15-20% in certification and testing procedures. More significantly, a harmonized regulatory environment would accelerate the adoption of advanced ceramic technologies, including high-performance structural ceramics that offer superior sustainability profiles compared to traditional construction materials.

Moving forward, a dual-track approach combining formal international standardization efforts with industry-led initiatives appears most promising. The establishment of international technical equivalency tables and performance-based testing protocols would enable regulatory recognition without requiring identical standards across all markets.

In contrast, North American standards remain fragmented between the United States, Canada, and Mexico, despite NAFTA/USMCA trade agreements. The International Code Council (ICC) has attempted to bridge these gaps through the International Building Code (IBC), but adoption remains inconsistent across jurisdictions, particularly regarding ceramic structural elements.

The Asia-Pacific region presents even greater regulatory diversity, with China's stringent national standards often diverging from Japanese and Korean approaches. This regulatory heterogeneity creates significant compliance costs for manufacturers and limits market access for innovative ceramic construction products.

Recent initiatives by ISO Technical Committee 189 on Ceramic Tiles have demonstrated the potential for global standardization. Their work on ISO 13006 provides a template for how performance-based standards can transcend regional differences while maintaining safety and quality requirements. The World Ceramic Tiles Forum (WCTF) has similarly advocated for regulatory convergence through mutual recognition agreements.

Digital compliance tools are emerging as facilitators of cross-border harmonization. Building Information Modeling (BIM) platforms increasingly incorporate regulatory requirements from multiple jurisdictions, allowing designers and manufacturers to assess compliance across markets simultaneously. These technological solutions may prove more nimble than formal treaty negotiations in addressing regulatory fragmentation.

The economic benefits of harmonization are substantial, with industry analyses suggesting potential cost reductions of 15-20% in certification and testing procedures. More significantly, a harmonized regulatory environment would accelerate the adoption of advanced ceramic technologies, including high-performance structural ceramics that offer superior sustainability profiles compared to traditional construction materials.

Moving forward, a dual-track approach combining formal international standardization efforts with industry-led initiatives appears most promising. The establishment of international technical equivalency tables and performance-based testing protocols would enable regulatory recognition without requiring identical standards across all markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!