The Impact of Structural Ceramics on Advanced Transportation Systems

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Ceramics Evolution and Transportation Goals

Structural ceramics have undergone significant evolution since their initial development in the mid-20th century. Early applications were limited to simple components due to manufacturing constraints and material brittleness. The 1970s marked a turning point with the introduction of transformation-toughened zirconia, which dramatically improved fracture toughness and reliability. This advancement catalyzed research into ceramic matrix composites (CMCs) and other advanced ceramic systems specifically designed for transportation applications.

The evolution trajectory has been driven by increasing demands for fuel efficiency, reduced emissions, and enhanced performance in transportation systems. Traditional metallic components face limitations in extreme operating environments, particularly at high temperatures where mechanical properties degrade significantly. Structural ceramics offer superior high-temperature stability, wear resistance, and chemical inertness, making them ideal candidates for next-generation transportation technologies.

Current development goals focus on addressing the remaining challenges in ceramic implementation. These include improving manufacturing scalability, reducing production costs, enhancing reliability through defect minimization, and developing standardized testing methodologies specific to transportation applications. The integration of computational modeling with experimental validation has accelerated this development process, allowing for more rapid iteration and optimization of ceramic components.

In the automotive sector, structural ceramics aim to enable more efficient internal combustion engines through higher operating temperatures and reduced cooling requirements. For electric vehicles, ceramics offer potential weight reduction and enhanced thermal management capabilities critical for battery systems and power electronics. The aerospace industry seeks ceramic solutions for turbine components, thermal protection systems, and hypersonic vehicle applications where traditional materials cannot withstand the extreme conditions.

The railway industry is exploring ceramic-based brake systems and bearing components to improve safety and reduce maintenance requirements. Maritime transportation is investigating ceramic coatings and components for corrosion resistance in harsh saltwater environments and improved propulsion efficiency.

The convergence of advanced manufacturing techniques, including additive manufacturing and precision machining, with novel ceramic formulations is creating unprecedented opportunities for structural ceramic implementation. The ultimate goal is to develop transportation systems with significantly improved efficiency, durability, and environmental performance through the strategic application of ceramic technologies.

Looking forward, the integration of smart functionalities into structural ceramics represents an emerging frontier, potentially enabling self-monitoring components that can predict failure and optimize performance in real-time across various transportation platforms.

The evolution trajectory has been driven by increasing demands for fuel efficiency, reduced emissions, and enhanced performance in transportation systems. Traditional metallic components face limitations in extreme operating environments, particularly at high temperatures where mechanical properties degrade significantly. Structural ceramics offer superior high-temperature stability, wear resistance, and chemical inertness, making them ideal candidates for next-generation transportation technologies.

Current development goals focus on addressing the remaining challenges in ceramic implementation. These include improving manufacturing scalability, reducing production costs, enhancing reliability through defect minimization, and developing standardized testing methodologies specific to transportation applications. The integration of computational modeling with experimental validation has accelerated this development process, allowing for more rapid iteration and optimization of ceramic components.

In the automotive sector, structural ceramics aim to enable more efficient internal combustion engines through higher operating temperatures and reduced cooling requirements. For electric vehicles, ceramics offer potential weight reduction and enhanced thermal management capabilities critical for battery systems and power electronics. The aerospace industry seeks ceramic solutions for turbine components, thermal protection systems, and hypersonic vehicle applications where traditional materials cannot withstand the extreme conditions.

The railway industry is exploring ceramic-based brake systems and bearing components to improve safety and reduce maintenance requirements. Maritime transportation is investigating ceramic coatings and components for corrosion resistance in harsh saltwater environments and improved propulsion efficiency.

The convergence of advanced manufacturing techniques, including additive manufacturing and precision machining, with novel ceramic formulations is creating unprecedented opportunities for structural ceramic implementation. The ultimate goal is to develop transportation systems with significantly improved efficiency, durability, and environmental performance through the strategic application of ceramic technologies.

Looking forward, the integration of smart functionalities into structural ceramics represents an emerging frontier, potentially enabling self-monitoring components that can predict failure and optimize performance in real-time across various transportation platforms.

Market Demand Analysis for Advanced Transportation Materials

The global market for advanced transportation materials, particularly structural ceramics, is experiencing significant growth driven by increasing demands for fuel efficiency, emissions reduction, and enhanced performance across various transportation sectors. Current market analysis indicates that the structural ceramics segment within transportation materials is projected to grow at a compound annual growth rate of 7.2% through 2030, reaching a market valuation of approximately 12.3 billion USD.

Automotive industry represents the largest demand sector, with manufacturers increasingly incorporating ceramic components in engine systems, brake assemblies, and exhaust systems. This shift is primarily motivated by stringent emissions regulations in major markets including Europe, North America, and Asia. The automotive ceramic components market alone is expected to expand by 8.5% annually as vehicle manufacturers pursue lightweight solutions that can withstand extreme operating conditions.

Aerospace applications constitute another rapidly growing segment, with demand for ceramic matrix composites (CMCs) rising substantially. These materials offer critical weight reduction while maintaining structural integrity at high temperatures, enabling next-generation aircraft engines to achieve 15-20% better fuel efficiency compared to conventional metal alloys. Major aerospace manufacturers have increased their procurement budgets for advanced ceramics by an average of 12% annually since 2020.

The railway transportation sector is also emerging as a significant consumer of structural ceramics, particularly for high-speed rail systems where thermal management and weight considerations are paramount. Market research indicates that high-speed rail projects across Asia and Europe will drive approximately 5.8% annual growth in ceramic component demand through 2028.

Consumer preferences are increasingly aligned with sustainability objectives, creating market pull for transportation solutions with reduced environmental footprints. Survey data shows that 68% of consumers in developed markets consider environmental impact when making transportation-related purchasing decisions, indirectly boosting demand for vehicles incorporating advanced ceramic technologies.

Regional analysis reveals that Asia-Pacific currently dominates the market with 42% share, followed by North America (27%) and Europe (23%). China specifically has emerged as both the largest consumer and producer of structural ceramics for transportation applications, supported by government initiatives promoting new energy vehicles and advanced manufacturing capabilities.

Supply chain considerations are becoming increasingly important, with recent disruptions highlighting vulnerabilities in the advanced materials sector. Transportation manufacturers are consequently developing more robust procurement strategies, including vertical integration and long-term supplier partnerships, further stabilizing market demand for structural ceramics.

Automotive industry represents the largest demand sector, with manufacturers increasingly incorporating ceramic components in engine systems, brake assemblies, and exhaust systems. This shift is primarily motivated by stringent emissions regulations in major markets including Europe, North America, and Asia. The automotive ceramic components market alone is expected to expand by 8.5% annually as vehicle manufacturers pursue lightweight solutions that can withstand extreme operating conditions.

Aerospace applications constitute another rapidly growing segment, with demand for ceramic matrix composites (CMCs) rising substantially. These materials offer critical weight reduction while maintaining structural integrity at high temperatures, enabling next-generation aircraft engines to achieve 15-20% better fuel efficiency compared to conventional metal alloys. Major aerospace manufacturers have increased their procurement budgets for advanced ceramics by an average of 12% annually since 2020.

The railway transportation sector is also emerging as a significant consumer of structural ceramics, particularly for high-speed rail systems where thermal management and weight considerations are paramount. Market research indicates that high-speed rail projects across Asia and Europe will drive approximately 5.8% annual growth in ceramic component demand through 2028.

Consumer preferences are increasingly aligned with sustainability objectives, creating market pull for transportation solutions with reduced environmental footprints. Survey data shows that 68% of consumers in developed markets consider environmental impact when making transportation-related purchasing decisions, indirectly boosting demand for vehicles incorporating advanced ceramic technologies.

Regional analysis reveals that Asia-Pacific currently dominates the market with 42% share, followed by North America (27%) and Europe (23%). China specifically has emerged as both the largest consumer and producer of structural ceramics for transportation applications, supported by government initiatives promoting new energy vehicles and advanced manufacturing capabilities.

Supply chain considerations are becoming increasingly important, with recent disruptions highlighting vulnerabilities in the advanced materials sector. Transportation manufacturers are consequently developing more robust procurement strategies, including vertical integration and long-term supplier partnerships, further stabilizing market demand for structural ceramics.

Current State and Challenges of Structural Ceramics

Structural ceramics have emerged as critical materials in advanced transportation systems, with significant developments observed across global research institutions and industries. Currently, these materials are primarily utilized in aerospace, automotive, and railway sectors due to their exceptional thermal resistance, mechanical strength, and lightweight properties. The global market for structural ceramics in transportation applications reached approximately $4.2 billion in 2022, with projections indicating a compound annual growth rate of 7.8% through 2030.

Despite their promising attributes, several technical challenges impede the widespread adoption of structural ceramics in transportation systems. The inherent brittleness of ceramic materials remains a primary concern, limiting their application in components subjected to impact or vibration. Manufacturing complexities present another significant hurdle, as the production of complex geometries with consistent properties requires sophisticated processing techniques that are often cost-prohibitive for mass production.

The reliability and predictability of ceramic components under diverse operational conditions pose additional challenges. Current testing methodologies struggle to accurately predict long-term performance and failure mechanisms, particularly under combined thermal, mechanical, and environmental stresses typical in transportation applications. This uncertainty necessitates conservative design approaches, potentially undermining the weight and efficiency advantages these materials offer.

Joining and integration issues represent another technical barrier. Conventional joining methods for ceramics to metals or composites often create weak points in the structure, compromising overall system integrity. Research into novel joining technologies shows promise but remains in early developmental stages at institutions like Fraunhofer Institute and Tokyo Institute of Technology.

Geographically, structural ceramics research and development demonstrates distinct patterns. Japan and Germany lead in automotive applications, with companies like NGK and CeramTec pioneering advanced silicon nitride and aluminum oxide components. The United States dominates aerospace applications through entities like NASA and defense contractors developing ultra-high temperature ceramic composites. China has rapidly expanded its capabilities, particularly in silicon carbide production for electric vehicle applications.

Cost factors continue to constrain broader implementation, with structural ceramic components typically costing 3-5 times more than their metal counterparts. This economic barrier is gradually diminishing through process innovations and economies of scale, but remains significant for mass-market transportation applications.

Environmental considerations present both challenges and opportunities. While ceramic production processes can be energy-intensive, their potential to enable more efficient transportation systems offers promising lifecycle benefits. Recent research indicates that advanced ceramic components in next-generation aircraft engines could reduce fuel consumption by up to 8%, representing a significant environmental advantage despite higher initial production impacts.

Despite their promising attributes, several technical challenges impede the widespread adoption of structural ceramics in transportation systems. The inherent brittleness of ceramic materials remains a primary concern, limiting their application in components subjected to impact or vibration. Manufacturing complexities present another significant hurdle, as the production of complex geometries with consistent properties requires sophisticated processing techniques that are often cost-prohibitive for mass production.

The reliability and predictability of ceramic components under diverse operational conditions pose additional challenges. Current testing methodologies struggle to accurately predict long-term performance and failure mechanisms, particularly under combined thermal, mechanical, and environmental stresses typical in transportation applications. This uncertainty necessitates conservative design approaches, potentially undermining the weight and efficiency advantages these materials offer.

Joining and integration issues represent another technical barrier. Conventional joining methods for ceramics to metals or composites often create weak points in the structure, compromising overall system integrity. Research into novel joining technologies shows promise but remains in early developmental stages at institutions like Fraunhofer Institute and Tokyo Institute of Technology.

Geographically, structural ceramics research and development demonstrates distinct patterns. Japan and Germany lead in automotive applications, with companies like NGK and CeramTec pioneering advanced silicon nitride and aluminum oxide components. The United States dominates aerospace applications through entities like NASA and defense contractors developing ultra-high temperature ceramic composites. China has rapidly expanded its capabilities, particularly in silicon carbide production for electric vehicle applications.

Cost factors continue to constrain broader implementation, with structural ceramic components typically costing 3-5 times more than their metal counterparts. This economic barrier is gradually diminishing through process innovations and economies of scale, but remains significant for mass-market transportation applications.

Environmental considerations present both challenges and opportunities. While ceramic production processes can be energy-intensive, their potential to enable more efficient transportation systems offers promising lifecycle benefits. Recent research indicates that advanced ceramic components in next-generation aircraft engines could reduce fuel consumption by up to 8%, representing a significant environmental advantage despite higher initial production impacts.

Current Technical Solutions for Transportation Applications

01 Manufacturing methods for structural ceramics

Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing techniques, and chemical vapor deposition. These methods can be optimized to control grain size, porosity, and phase composition, which directly influence the mechanical and thermal properties of the final ceramic components. Advanced processing techniques allow for the creation of complex shapes and microstructures tailored for specific applications.- Manufacturing methods for structural ceramics: Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing techniques, and chemical vapor deposition. These methods can control the microstructure and density of the ceramic materials, which directly affects their mechanical properties such as strength, hardness, and fracture toughness. Advanced manufacturing techniques allow for the production of complex shapes and near-net-form components, reducing the need for expensive machining operations.

- Composition and materials for structural ceramics: Structural ceramics are composed of various materials including silicon nitride, silicon carbide, alumina, zirconia, and boron carbide. These materials can be combined with additives and sintering aids to enhance specific properties. The composition directly influences the ceramic's performance characteristics such as thermal stability, chemical resistance, and mechanical strength. Advanced ceramic composites may incorporate reinforcing phases like fibers, whiskers, or particles to improve toughness and prevent catastrophic failure.

- Applications of structural ceramics: Structural ceramics find applications in various high-performance environments due to their exceptional properties. They are used in aerospace components, automotive parts (particularly engine components), cutting tools, armor systems, and electronic substrates. Their high temperature stability makes them suitable for thermal barrier coatings and furnace components. Additionally, their biocompatibility allows for applications in medical implants and prosthetics. The wear resistance of structural ceramics makes them ideal for bearings and valve components in harsh environments.

- Properties and characterization of structural ceramics: Structural ceramics exhibit distinctive properties including high hardness, wear resistance, thermal stability, and chemical inertness. They typically have high compressive strength but lower tensile strength and fracture toughness compared to metals. Various characterization techniques are employed to evaluate these properties, including X-ray diffraction, electron microscopy, mechanical testing, and thermal analysis. Understanding the relationship between microstructure and properties is crucial for optimizing ceramic performance in specific applications.

- Surface treatments and coatings for structural ceramics: Surface treatments and coatings can significantly enhance the performance of structural ceramics. These include glazing, polishing, chemical treatments, and the application of protective coatings. Such treatments can improve surface finish, reduce friction, enhance chemical resistance, and seal surface porosity. Multilayer coatings can provide additional functionality such as thermal insulation, electrical conductivity, or biocompatibility. Advanced coating techniques like physical vapor deposition and plasma spraying allow for precise control of surface properties.

02 Composition and materials for high-performance ceramics

Structural ceramics can be formulated using various materials including silicon nitride, silicon carbide, alumina, zirconia, and boron carbide. These base materials can be combined with additives and sintering aids to enhance specific properties. The composition directly affects characteristics such as strength, hardness, thermal shock resistance, and chemical stability. Advanced ceramic composites may incorporate reinforcing phases like fibers, whiskers, or particles to improve toughness and prevent catastrophic failure.Expand Specific Solutions03 Ceramic-metal composites and joining techniques

Ceramic-metal composites (cermets) combine the hardness and heat resistance of ceramics with the toughness and electrical conductivity of metals. These materials are particularly valuable in applications requiring both thermal stability and mechanical durability. Various joining techniques have been developed to integrate ceramics with metals or other ceramics, including brazing, diffusion bonding, and the use of specialized interlayers. These joining methods are critical for creating complex components and systems that utilize structural ceramics.Expand Specific Solutions04 Applications of structural ceramics in extreme environments

Structural ceramics are utilized in applications requiring resistance to extreme conditions such as high temperatures, corrosive environments, and high mechanical stresses. These applications include components for gas turbines, cutting tools, armor systems, heat exchangers, and aerospace components. The exceptional hardness, wear resistance, and thermal stability of structural ceramics make them ideal for these demanding environments where traditional materials would fail. Recent developments have expanded their use in energy systems, electronics, and biomedical applications.Expand Specific Solutions05 Surface treatments and coatings for ceramic components

Various surface treatments and coating technologies are applied to structural ceramics to enhance their performance characteristics. These include glazing, polishing, chemical treatments, and the application of thin films or protective layers. Surface modifications can improve wear resistance, reduce friction, enhance chemical stability, or provide specialized functionality. Advanced coating techniques such as physical vapor deposition and plasma spraying allow for the creation of multi-layered systems that combine the beneficial properties of different materials.Expand Specific Solutions

Key Industry Players in Structural Ceramics

The structural ceramics market in advanced transportation systems is currently in a growth phase, characterized by increasing adoption across automotive, aerospace, and rail sectors. The global market size is estimated to reach $8-10 billion by 2025, driven by demand for lightweight, high-performance components. Technologically, the field shows varying maturity levels, with companies like NGK Insulators and Kyocera leading in automotive applications, while aerospace implementations by Boeing and Northrop Grumman represent cutting-edge development. CeramTec, Corning, and Siemens Energy are advancing thermal management solutions, while IBIDEN and Robert Bosch focus on electronic ceramic substrates. Hyperloop Technologies represents the frontier application, utilizing advanced ceramics for next-generation transportation systems requiring extreme thermal and structural properties.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has developed advanced ceramic technologies specifically targeting transportation applications, with their proprietary silicon nitride and cordierite materials leading the industry. Their ceramic honeycomb substrates form the core of automotive catalytic converters and diesel particulate filters, demonstrating exceptional thermal shock resistance (withstanding temperature changes of over 800°C) and durability in harsh operating environments. NGK's silicon nitride components for turbochargers and engine parts exhibit superior heat resistance (operating continuously at temperatures up to 1200°C) and wear resistance (50-70% better than metal alternatives). The company has pioneered manufacturing techniques that allow for complex geometries while maintaining tight tolerances and structural integrity. Their NAS® battery technology, utilizing beta-alumina ceramic electrolytes, offers energy storage solutions for transportation infrastructure with demonstrated cycle life exceeding 4,500 cycles at 80% depth of discharge. NGK has also developed ceramic-to-metal joining technologies that overcome traditional integration challenges, enabling hybrid components that maximize performance benefits.

Strengths: Exceptional thermal stability and shock resistance; superior chemical inertness in corrosive environments; excellent mechanical properties at high temperatures; proven long-term durability with some components exceeding 200,000 miles of service. Weaknesses: Higher production costs compared to traditional materials; manufacturing complexity for certain geometries; potential for catastrophic failure without proper design considerations for brittle behavior.

The Boeing Co.

Technical Solution: Boeing has developed advanced ceramic matrix composites (CMCs) for aerospace transportation applications, focusing on silicon carbide (SiC) fiber reinforced ceramic matrices. Their proprietary CMC technology demonstrates exceptional high-temperature performance, maintaining structural integrity at temperatures exceeding 1200°C while weighing approximately 30% less than nickel superalloys. Boeing's ceramic thermal protection systems for hypersonic vehicles utilize oxide-based ceramics capable of withstanding extreme aerodynamic heating during atmospheric re-entry. The company has pioneered manufacturing techniques for large-scale ceramic components with complex geometries, including advanced 3D weaving of ceramic fibers and chemical vapor infiltration processes that ensure uniform material properties. Boeing's ceramic bearing systems for aircraft control surfaces demonstrate 40-60% reduced friction compared to traditional bearings, significantly improving fuel efficiency and component lifespan. Their ceramic-based acoustic liners for jet engines reduce noise levels by 15-20 decibels while withstanding the extreme thermal and mechanical stresses of the engine environment.

Strengths: Exceptional strength-to-weight ratio (up to 3 times better than traditional aerospace alloys); superior high-temperature performance enabling more efficient engine operation; excellent resistance to thermal cycling and shock; reduced maintenance requirements due to enhanced durability. Weaknesses: Significantly higher production costs compared to conventional materials; complex manufacturing processes limiting production scale; challenges in non-destructive evaluation and quality assurance; limited repairability in field conditions.

Core Patents and Research in Structural Ceramics

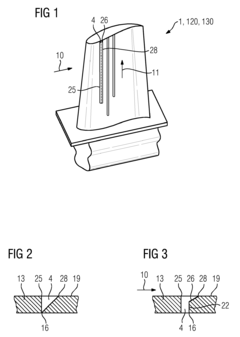

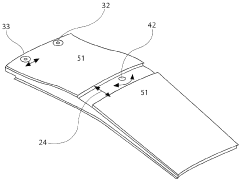

Surface with specially formed depressions and component

PatentInactiveEP2586985A1

Innovation

- The introduction of elongated depressions on the surface of ceramic and metal components, angled at 90° ± 20° to the flow direction, which widen from the bottom to the surface and have a constant cross-section transverse to their longitudinal direction, improving chipping resistance and aerodynamics, and can be created during the coating process or using laser techniques.

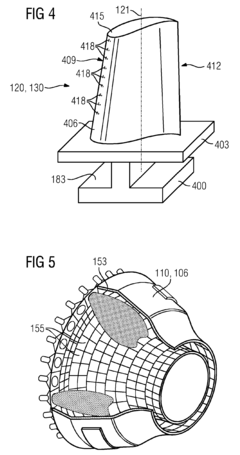

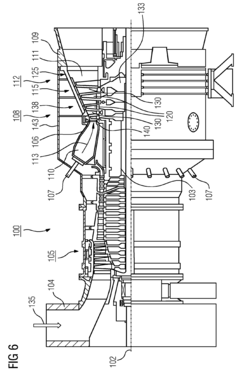

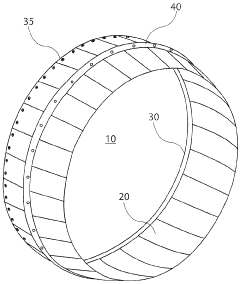

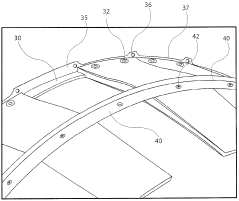

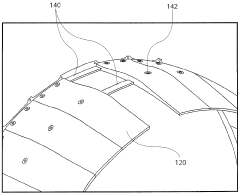

Stave and ring CMC nozzle

PatentWO2009102528A1

Innovation

- A CMC/metallic nozzle structure comprising a plurality of CMC staves attached to metal support rings, allowing for relative movement and thermal expansion accommodation, with a seal between staves to prevent gas flow, and the ability to replace individual staves for repair and cost reduction.

Environmental Impact and Sustainability Considerations

The integration of structural ceramics into advanced transportation systems presents significant environmental implications that warrant careful consideration. These materials offer substantial environmental benefits through their contribution to vehicle weight reduction, which directly translates to improved fuel efficiency and reduced emissions. Studies indicate that ceramic components in aerospace applications can reduce fuel consumption by 8-12% compared to traditional metal counterparts, representing a meaningful contribution to transportation sustainability goals.

The production processes for structural ceramics have evolved considerably, with modern manufacturing techniques reducing energy consumption by approximately 30% over the past decade. However, these processes still require high-temperature sintering (typically 1400-1700°C), resulting in considerable energy demands. The carbon footprint of advanced ceramic production remains a challenge, with estimates suggesting that manufacturing one kilogram of silicon nitride ceramic components generates 15-20 kg of CO2 equivalent emissions.

Raw material extraction for structural ceramics presents another environmental consideration. While ceramics utilize abundant materials like silicon, aluminum, and zirconium, mining operations can cause habitat disruption and water pollution. Positively, these materials typically require less environmentally damaging extraction processes than rare earth metals used in alternative technologies, offering a comparative advantage in resource sustainability.

Lifecycle assessment studies demonstrate that the environmental benefits of structural ceramics in transportation systems generally outweigh their production impacts when considering full product lifecycles. The extended service life of ceramic components—often 2-3 times longer than conventional materials—reduces replacement frequency and associated resource consumption. Additionally, their resistance to extreme conditions minimizes the need for environmentally harmful lubricants and coolants.

End-of-life management represents both a challenge and opportunity. Current recycling technologies for structural ceramics remain limited, with only 15-20% of ceramic waste effectively reclaimed. However, promising developments in ceramic recycling include novel crushing techniques that allow recovered materials to serve as aggregates in construction applications, potentially creating circular economy pathways.

Water conservation presents another sustainability advantage, as ceramic manufacturing typically consumes 40-60% less water than comparable metal processing. This aspect becomes increasingly significant as transportation industries face growing pressure to reduce their water footprint in manufacturing operations.

The production processes for structural ceramics have evolved considerably, with modern manufacturing techniques reducing energy consumption by approximately 30% over the past decade. However, these processes still require high-temperature sintering (typically 1400-1700°C), resulting in considerable energy demands. The carbon footprint of advanced ceramic production remains a challenge, with estimates suggesting that manufacturing one kilogram of silicon nitride ceramic components generates 15-20 kg of CO2 equivalent emissions.

Raw material extraction for structural ceramics presents another environmental consideration. While ceramics utilize abundant materials like silicon, aluminum, and zirconium, mining operations can cause habitat disruption and water pollution. Positively, these materials typically require less environmentally damaging extraction processes than rare earth metals used in alternative technologies, offering a comparative advantage in resource sustainability.

Lifecycle assessment studies demonstrate that the environmental benefits of structural ceramics in transportation systems generally outweigh their production impacts when considering full product lifecycles. The extended service life of ceramic components—often 2-3 times longer than conventional materials—reduces replacement frequency and associated resource consumption. Additionally, their resistance to extreme conditions minimizes the need for environmentally harmful lubricants and coolants.

End-of-life management represents both a challenge and opportunity. Current recycling technologies for structural ceramics remain limited, with only 15-20% of ceramic waste effectively reclaimed. However, promising developments in ceramic recycling include novel crushing techniques that allow recovered materials to serve as aggregates in construction applications, potentially creating circular economy pathways.

Water conservation presents another sustainability advantage, as ceramic manufacturing typically consumes 40-60% less water than comparable metal processing. This aspect becomes increasingly significant as transportation industries face growing pressure to reduce their water footprint in manufacturing operations.

Regulatory Framework for Advanced Materials in Transportation

The regulatory landscape governing structural ceramics in transportation systems has evolved significantly in response to technological advancements and safety concerns. International bodies such as the International Organization for Standardization (ISO) and the American Society for Testing and Materials (ASTM) have established comprehensive standards for ceramic materials used in critical transportation components. These standards address mechanical properties, thermal resistance, and long-term durability requirements that structural ceramics must meet before implementation in vehicles, aircraft, or rail systems.

In the automotive sector, regulations like the Federal Motor Vehicle Safety Standards (FMVSS) in the United States and the United Nations Economic Commission for Europe (UNECE) regulations have begun incorporating specific provisions for advanced ceramic materials. These frameworks focus particularly on crash safety performance, emissions reduction capabilities, and the structural integrity of ceramic components under extreme conditions.

The aerospace industry operates under even more stringent regulatory oversight, with authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) requiring extensive certification processes for ceramic components. These include rigorous testing protocols for thermal shock resistance, fatigue behavior, and failure mode analysis, reflecting the critical safety implications of material performance in aerospace applications.

Environmental regulations also significantly impact the adoption of structural ceramics in transportation. Legislation such as the European Union's End-of-Life Vehicle (ELV) Directive and similar frameworks in other regions mandate recyclability and environmental impact considerations for all vehicle materials, including advanced ceramics. Manufacturers must demonstrate compliance with these requirements throughout the product lifecycle.

Emerging regulatory trends indicate a shift toward performance-based standards rather than prescriptive requirements, allowing for greater innovation in ceramic material development. This approach enables manufacturers to utilize novel ceramic compositions and manufacturing techniques, provided they can demonstrate equivalent or superior performance compared to conventional materials.

Regulatory harmonization efforts across different regions remain incomplete, creating challenges for global manufacturers implementing ceramic solutions in transportation systems. Disparities in testing methodologies, safety thresholds, and certification requirements between North American, European, and Asian markets necessitate multiple validation processes for the same ceramic components, increasing development costs and time-to-market.

Recent regulatory developments have begun addressing the unique characteristics of ceramic-metal hybrid components and ceramic matrix composites, recognizing their growing importance in next-generation transportation systems. These updated frameworks aim to balance innovation enablement with rigorous safety assurance for these relatively novel material systems.

In the automotive sector, regulations like the Federal Motor Vehicle Safety Standards (FMVSS) in the United States and the United Nations Economic Commission for Europe (UNECE) regulations have begun incorporating specific provisions for advanced ceramic materials. These frameworks focus particularly on crash safety performance, emissions reduction capabilities, and the structural integrity of ceramic components under extreme conditions.

The aerospace industry operates under even more stringent regulatory oversight, with authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) requiring extensive certification processes for ceramic components. These include rigorous testing protocols for thermal shock resistance, fatigue behavior, and failure mode analysis, reflecting the critical safety implications of material performance in aerospace applications.

Environmental regulations also significantly impact the adoption of structural ceramics in transportation. Legislation such as the European Union's End-of-Life Vehicle (ELV) Directive and similar frameworks in other regions mandate recyclability and environmental impact considerations for all vehicle materials, including advanced ceramics. Manufacturers must demonstrate compliance with these requirements throughout the product lifecycle.

Emerging regulatory trends indicate a shift toward performance-based standards rather than prescriptive requirements, allowing for greater innovation in ceramic material development. This approach enables manufacturers to utilize novel ceramic compositions and manufacturing techniques, provided they can demonstrate equivalent or superior performance compared to conventional materials.

Regulatory harmonization efforts across different regions remain incomplete, creating challenges for global manufacturers implementing ceramic solutions in transportation systems. Disparities in testing methodologies, safety thresholds, and certification requirements between North American, European, and Asian markets necessitate multiple validation processes for the same ceramic components, increasing development costs and time-to-market.

Recent regulatory developments have begun addressing the unique characteristics of ceramic-metal hybrid components and ceramic matrix composites, recognizing their growing importance in next-generation transportation systems. These updated frameworks aim to balance innovation enablement with rigorous safety assurance for these relatively novel material systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!